Professional Documents

Culture Documents

Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

Regd. Off. : Lati Bazar, Joravarnagar - 363 020. Dist.

Su rendranagar (Gujarat)

E-mail : patidarbuildconltd@rocketmail.com CIN No. L99999GJl 989PTC058691

Mo. 98253 55961

Ref No. .

Dt:

To, Date:14.02.2O1.7

Gen. Manager [DCS)

BSE Limited.

PI Towers, Dalal Street,

Fort, Mumbai-400001

Sub: Compliance of Rigulation 33 of Securities and Exchange Board of India (Listing

Obligations and Disclosures Requirements) Regulatipns. 2015 for M/s. Patidar Buildcon

Limited.

Reft Conipany Code BSE: 524031

Dear Sir,

With regard to captioned subject, the Board of directors at its meeting held on 14*, February,2017

has considered and approved the unaudited [provisional) financial results for the Quarter and nine

month ended on 31't December, 2016. The said financial results were subject to Limited review

conducted by the statutory auditor of the company.

Kindly find enclosed herewith the copy of unaudited (provisional) Financial Statements for the

quarter and nine month ended on 31't December, 2016 along with the Limited review Report of

Auditors of the Company in compliance of Regulation 33 of Securities and Exchange Board of India

[Listing Obligations and Disclosures Requirements) Regulations, 20L5.

You are requested to take the same on record.

Thanking you.

Yours sincerely,

FoT, PATIDAR BUITDCON LIMITED

MR. RAJNIKANT PATEL

MANAGING DIRECTOR

(DrN- 01218436)

Regd. Off. : Lati Bazar, Joravarnagar - 363 020. Dist. Surendranagar (Gujarat)

E-mail : patidarbuildconltd@rocketmail.corrr CIN No. L99999GJ 1 989PTCo58691

Mo. 98253 55961

IPART- I

rurernenr ot Jtanqalone unauclleo Kesur6 Ior ure Quarter ano IoI

the Period Ended on 31st December, 2O16 lRs in lakhs)

Quarter ended on Forthe Perriod Ended fear Ended on

Particulars 31-12-16 30-09-16 3t-tz-15 3l-12-16 3t-12-15 3t-03-20L6

Unaudited Unaudited Unaudited Unaudited Unaur Audited

1 Income from Operations

al Net Sales/ Income from ODeration 55.95 7.79 32.54 65.50 70,09 75.55

b) Other operating income 8.38 6.55 3.65 21.45 10.65

Total lncome from Operations 64.33 8.34 36.19 86,9s 40.74 75.55

Expenses

al Cost ofMaterial Consumed

r') Purchase ofstock in trade 0.40 4.93 2.67 1.44 13.00 723.6t

ncreasel/ Decrease in Stock in Trade &Work in Progress 43.29 -2.72 25.34 47.49 46.96 -53.0i

) Employee Cost 1.75 1.50 LZA 4.55 3.32 4.44

el Depreciation & amortization 0.20 0.15 0.04 0.39 0.11 0.15

0 Power and Fuel 0.06 0.05 0.13 0.22 o.27 0.34

gJ Other Expenditure (Any item exceedin$ 10% ofthe total

expenses relatingto continuing operations to be shown 0.37 0.65 0.72 2.39 1.80 2.4(

senaratelvl

ROC Fees Exp. 0.03 0.01 0.04

Listins Fees Exp, ala 2.25 2.24

Rent Exp. 0.45 0.45 0.45 1.35 0.45 0.90

Pofit/Loss of Commodities 7.54 1..54

t/Loss ofShares 4.55 4.55

Printing Exps. t.02 0.01 1.05 0.tz 0.12

lrofessional Fees 0.86 0.77 0.63 7.60 1.18 a 2)

Revocation Fees Exp z,/5 2.75

lotal Expenses 50.1( 7.35 3,-.27 69.96 75.55 89.63

Prolit/(Loss) from operation before other lncome, Iinance

:osts and exceptional Items (1-2 1 1-4.1 0.99 4.98 16.99 5.19 -1 4. Ofl

Ither income 1.51 7.76 3.63 6.3i 9.8: 44.82

Profit / (Loss) from ordinary activities before finance costs

and exceptional items (3 + 4)

15.6t 2.75 8.61 23.3C 15.02 30.74

6 Finance Cost

Profit / (Loss) from ordinary activities after linance costs

but before exceptional items (5 + 6) 15.68 2.75 8.61 23.36 Ls,02

Exceptional ltems

Profit / floss) from ordinarv activities before tax [7 + B] 15.68 2.75 a.6t 23.36 t5.o2 30.74

10 Iax expense 9.75

t1 Net Prolit / (Loss) from ordinary activities after tax [9 a.10) 15.68 2.75 8.61 23.36 ts.o2 20.99

t2 Extraordinarv items fnet of tax ' exDense

t3 Net Prolit / (Loss) for the period (tL + l2'l 15.68 2.7! 8.61 23.36 15.O2 20.99

L4 Share ofProfit / flossl ofassociates *

15 N4inority Interest*

Net Profit / (Loss) after taxes, minority interest and share ol

t6 profit / floss) ofassociates (13 + 14 + 15) * 15.68 2.75 8.61 23.36 11 ni 20.99

t7 Paid up equity share capital (indicate the Face value) 551.53 551.53 551.53 551.53 551.53 551.5:

Reserre excluding Revaluation Reserves as per balance sheel

18 of previous accountins vear 36.46 36.46 Ls.47 ?6-46 15.4? 36.5!

Earnings Per Share (before extraordinary items) (of'

19 ti) /- eachl fnot annualisedl: o.2a 0.0s 0.16 o,42 o.27 0.38

a) Baslc o.2a 0.05 0.16 o.42 0.27 0.38

b) Diluted

Earnings Per Share (after extraordinary items) (of ' _/-

19 (iil eachl [not annualised]:

a) Basic 0.28 0.05 o.16 o.42 o.27 0.3t

b) Diluted o.28 0.05 o.16 o.42 o.27 0.3t

NOTES

1. The above unaudited financial results have been reviewed by Audit Committee and taken on record by the Board of Directors at their respective

meeting held on 14th February 2017,

2. The company do not have any multiple segmenL

For, Patidar Buildcon Limited

PLACE: Ahmedabad.

DATE:L4-02-2OL7

Rainikant R. Patel

Managing Director

(DIN:01218436)

ftr in-t*#!ry *' t t t !'"!D r t?fi 1

"{"#" e,}dde S ;{-***cuke*

ffi.*"#s*d:&*c***teut&"

. Ann*xure V

Limited *eviBw fteport *n $tandxhn* Financial R*sults uf Fatidar Buildc*n Limited

Reviers Report t* PATIDAR BUILDCON LIMITED

We have reviewecl tlre accompanying statement of unaudrted financlal results of Patidar

Suilde*n Limlt*4 f*r th* per"iod *nded 3t$t secerfih*r, 2ff1s, Ttris statenrent ie the

r*sponsibitity cf ih* C*yf:a.ny.s .L1lanagemenl and has b*en approved by th* Board of

Dir*ctsrs our reapcnsr*llrty ls to ,s*ue a rep*rt sn th*se finanrial statenrents based sn our

review

W* c*nducted *ur review in accordxnce with the $tandard on Review Engag*nr*nt ($Rfi)

?400, F6gngs.]isi)fs /o Reurclv Fi*arrciaf $fafsmenl* i*sued by the lnetitutc tf Chartered

Aeccurrtaits of India This standard reqr"rir*s thal w* plan and perf*rn'r ths revislrr to obtain

ffi*derstr assllrnnce as to whether th* financial statemrsnts arr {ree *f mat*rial mlsstatement.

A revievu, iE limii*S prirnar'iiy to inquiri*s of company personnel and analyticai procedur*s

applied to financiat d*i* and thus provide less as$urance than art audii- We have not

p*rformed an *udit and acc*rdingly, we do not *Xplsss arr audit opinirn.

Bas*d on oLJr r*vi*iry cgnclu*t*d as abovs, nothing hag come to our attentlon that causes us to

believe $rat th* **s*illpailying statem*nt uf r..rnaudited fin*ncial results prepared in scc*rdance

policies

with *ppticable am*unting slandards and other recogniaed accountrng practices and

nas nai di*ctssed th* inforrnalion required to be ,liscl*sed in t*rms af Regulatian 33 ol ihe

SEBt {Listing *bligations ancl Disclosure R*quirements) Regulaticn*, 2015 including the

rrlannt"in lvhiah it is to b* r{is*losed" *r that it cilnt*in$ any ntaterial nrisstatement.

Fsr X" C- Farll*trr & &ssu*iates

gir6slgy*S &c ntants, '" r*'''1,:

"--*.;+t -\

.

FRf,l: X,07 ,, o').e.,- .;ih . *.,i

'i".#S*lit

$r;s:ll;l*+jlf1

&A.

i

lUI. S*slti

Farfn*r

M" N*.: 1182S8

uale: Jaflilaryll lurl

Fiace, Ahme**bad,

ffi*H*nks, f,. s. fi*arl, &ht**rlaha*-s8il {is$.

Ptr": +$'1"?$ 3*S1 ?44'tr,4SSq 8$S1 [ mt!l: u]rir,tsn$kepsrikh"tstn

s"'*n""1'****'" {tr{ nn't *L . ni]^]{r} C*'-;t" l,*d^.;|.r"fi4e,.:l ^-*"

1.! 11 ' C t "l a'1n *)*J Ul"*+ !tS"** 6tdtl hf' X{:l'* i1;**"** "':AnSl

You might also like

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Half Year Financial Results 30 Sept 2022Document11 pagesHalf Year Financial Results 30 Sept 2022Ashwin staffNo ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document4 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Rmu'L ,: Regd. Off.:11/2, Usha Ganj, Lndore 4246092Document4 pagesRmu'L ,: Regd. Off.:11/2, Usha Ganj, Lndore 4246092Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Lnril: Fort - of Held 11 ToDocument11 pagesLnril: Fort - of Held 11 Tomd zafarNo ratings yet

- A Summer Project Report OnDocument17 pagesA Summer Project Report OnHarsh MidhaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Result Update Aug 02 02082023123958Document7 pagesFinancial Result Update Aug 02 02082023123958Surajit DasNo ratings yet

- Common Size Analysis: Hul Profit and Loss StatementDocument7 pagesCommon Size Analysis: Hul Profit and Loss Statementamlan dasNo ratings yet

- Tata Motors PLDocument2 pagesTata Motors PLSravani BotchaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Published Results 31 March 2010Document2 pagesPublished Results 31 March 2010Ravi ChaturvediNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Book 2Document18 pagesBook 2Aishwarya DaymaNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- PN L Oldest 5 YrsDocument2 pagesPN L Oldest 5 YrsAryan BagdekarNo ratings yet

- Dabur 5Document1 pageDabur 5faheem.ashrafNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Raymond P&LDocument2 pagesRaymond P&LSJNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Revised Financial Results For December 31, 2016 (Result)Document4 pagesRevised Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Moneycontrol. P&L BataDocument2 pagesMoneycontrol. P&L BataSanket BhondageNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Zydus Wellness Standalone Yearly Results Vanaspati & Oils Standalone Yearly Results of Zydus Wellness - BSE 531335, NSE ZYDUSWELLDocument2 pagesZydus Wellness Standalone Yearly Results Vanaspati & Oils Standalone Yearly Results of Zydus Wellness - BSE 531335, NSE ZYDUSWELLRozy SinghNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Escort P&LDocument2 pagesEscort P&LSagar JainNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Company Info - Print Financials2Document2 pagesCompany Info - Print Financials2rojaNo ratings yet

- Al Fajar Ply Board Factory OrgDocument22 pagesAl Fajar Ply Board Factory OrgFINAC GROUPNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Falcon QTR Sep 09Document1 pageFalcon QTR Sep 09shettypavanNo ratings yet

- Tarmat Script: The by The The On L4ttDocument5 pagesTarmat Script: The by The The On L4ttShyam SunderNo ratings yet

- Moneycontrol P&LDocument2 pagesMoneycontrol P&Lveda sai kiranmayee rasagna somaraju AP22322130023No ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Sl. Particulars Total No. 1 Vehicle B. SLX (Mahindra) 6.87 6.87Document17 pagesSl. Particulars Total No. 1 Vehicle B. SLX (Mahindra) 6.87 6.87Amit SoniNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- Eicher Motors Profit and Loss AccountDocument2 pagesEicher Motors Profit and Loss AccountVaishnav Sunil100% (1)

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Jamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanaDocument4 pagesJamna Auto Industries Limited: Registered Office: Jai Spring Road, Industrial Area, Yamunanagar-135001, HaryanapoloNo ratings yet

- MindtreeDocument18 pagesMindtreeAkash DidhariaNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Bollinger BandsDocument34 pagesBollinger BandsKiran Kudtarkar50% (2)

- C3PO StrategyDocument6 pagesC3PO Strategyartus14No ratings yet

- Curated Interview With Marty Schwartz From Market Wizards - Curated AlphaDocument5 pagesCurated Interview With Marty Schwartz From Market Wizards - Curated Alphaietram12100% (1)

- FINANCIAL INSTRUMENTS MCQNDocument3 pagesFINANCIAL INSTRUMENTS MCQNJoelo De Vera100% (1)

- Master of Business AdministrationDocument71 pagesMaster of Business AdministrationsunithagsNo ratings yet

- Don UcspDocument25 pagesDon UcspBianca RelosNo ratings yet

- Platt 2018Document15 pagesPlatt 2018Haseen AslamNo ratings yet

- Dalal StreetDocument108 pagesDalal StreetMayank ChandrakarNo ratings yet

- India Trade ProfileDocument31 pagesIndia Trade ProfileSreekanth ReddyNo ratings yet

- Statement of Evidence To The Royal Commission On Indian Currency - Dr. B.R.ambedkarDocument9 pagesStatement of Evidence To The Royal Commission On Indian Currency - Dr. B.R.ambedkarVeeramani ManiNo ratings yet

- (Ohama B., Bowman M.) Patterns That Detect StockDocument10 pages(Ohama B., Bowman M.) Patterns That Detect Stockmindrust8No ratings yet

- SGX SICOM Rubber Factsheet 201801-English PDFDocument6 pagesSGX SICOM Rubber Factsheet 201801-English PDFKien TrungNo ratings yet

- An Analysis of Financial PerformanceDocument76 pagesAn Analysis of Financial PerformanceShah Kamal100% (8)

- 2009 Level - II - Mock - Exam - Afternoon PDFDocument37 pages2009 Level - II - Mock - Exam - Afternoon PDFShivam KapoorNo ratings yet

- Multiplan FR 20081126 EngDocument1 pageMultiplan FR 20081126 EngMultiplan RINo ratings yet

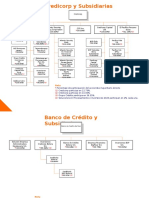

- Organigrama CredicorpDocument7 pagesOrganigrama CredicorpCarlos RamosNo ratings yet

- On The Pricing of European SwaptionsDocument6 pagesOn The Pricing of European SwaptionsThomas GustafssonNo ratings yet

- Inter Nation La FinanceDocument243 pagesInter Nation La FinanceMpho Peloewtse Tau100% (1)

- Paul Tudor JonesDocument11 pagesPaul Tudor JonesPalanisamy BalasubramaniNo ratings yet

- OMSEC Morning Note 13 09 2022Document6 pagesOMSEC Morning Note 13 09 2022Ropafadzo KwarambaNo ratings yet

- Competition HSBCDocument3 pagesCompetition HSBCPREKSHA KARDAM100% (1)

- Questions and CompilationDocument15 pagesQuestions and CompilationJude Thaddeus DamianNo ratings yet

- Real Feel Test 1Document50 pagesReal Feel Test 1Pragati Yadav100% (2)

- Esma Guidelines Ucits Etfs and Structured UcitsDocument40 pagesEsma Guidelines Ucits Etfs and Structured UcitsMarketsWikiNo ratings yet

- Whats New in The Technical AnalysisDocument48 pagesWhats New in The Technical AnalysisSiddha ReddyNo ratings yet

- Accounting Standards Board (ASB) in 1977Document15 pagesAccounting Standards Board (ASB) in 1977Viswanathan SrkNo ratings yet

- Millionaire TeacherDocument15 pagesMillionaire TeacherArnab0% (1)

- The Tipster1901, From "Wall Street Stories" by Lefevre, EdwinDocument20 pagesThe Tipster1901, From "Wall Street Stories" by Lefevre, EdwinGutenberg.orgNo ratings yet

- CPT Markets Liquidity GuidelinesDocument3 pagesCPT Markets Liquidity GuidelinesAdnantNo ratings yet