Professional Documents

Culture Documents

Zodius Capital II Fund Launch 070414

Uploaded by

avendusCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Zodius Capital II Fund Launch 070414

Uploaded by

avendusCopyright:

Available Formats

Avendus and Zodius partner to create a multi-stage technology fund to invest in India-

centric Digital and SMAC Businesses

Partnership plans to invest $400-500 million in late-stage and pre-IPO companies in the next 3-4 years

Mumbai, April 7, 2014

Avendus Capital, a leading India-based financial services firm, through its Alternate Asset Management

subsidiary and Zodius Capital, an investor-operator of India-centric technology companies, have decided

to partner and invest $400-500 million in emerging leaders in high growth Digital and SMAC (Social,

Mobile, Analytics and Cloud) based Business Services.

The targeted Digital Business investments would cover both Internet and Mobile, and areas such as

Media, Commerce and Consumer Services. Business Services investments would be focused primarily

on SMAC driven IT/BPO opportunities to build new disrupters, or restructure and redirect existing

companies toward new high growth market segments. .

The fund Zodius Capital II is a follow-up to the previous fund Zodius Capital I, which focused on

accelerated early-stage investments and build-outs in the technology sector. Zodius Capital II will invest

primarily in late-stage and pre-IPO companies, filling a critical gap in the technology investment

landscape with a differentiated investment strategy which includes:

Sharp focus on the technology sector

Shorter investment period of 1+1 years as investors will see pre-identified and cultivated deals and

commit funds in three tranches to portfolios of $100-150 million each, making it unique amongst the

typical blind pool (post fund raise) strategy followed by most growth funds

Shorter investment cycle and investor lock-in of 5+2 years as compared with typical growth fund lock-

ins of 10+2 years, enabled by the funds sharp focus on investing in exitable assets and a well-

defined built-to-list program to support the portfolio companies

Speaking about the partnership and Zodius Capital II, Mr. Neeraj Bhargava, Founder and Senior

Managing Director of Zodius said My partners, Gautam Patel, Shilpa Kulkarni and I are delighted to

partner with Avendus. Both Avendus and Zodius have unparalleled track records, expertise and network

to generate deal flow, develop companies and work with them to a planned exit either through an IPO or

a strategic sale. Collectively we are well placed to explore the tremendous opportunity in India centric

digital and SMAC businesses.

Mr. Ranu Vohra, Co-founder, MD & CEO of Avendus Capital added, We have joined hands at a time

when digital and SMAC businesses across the world are eliciting exceptional and rightly deserved

NEWSRELEASE

AvendusCapital

ReleaseDate:April7,2014

Mumbai,Delhi,Bangalore,NewYork,London

Contact:ShvetaSingh

+912266480020shveta.singh@avendus.com

investment interest. The IPO surge for digital India centric businesses is just beginning and we expect it

to create a very high growth environment in this sector. We are excited about our partnership with Zodius

and are sure that given our insights, research and track record in this sector we will be meaningful in this

eco system and will be able to give investors access to some promising companies. Avendus also has a

strong wealth management business and some of our family office clients have shown strong interest in

this product.

As per Bloomberg, Avendus is the leading banker in the Technology and Internet space for the last 5

years, with the largest number of transactions and 19% market share by deal value(1st April 2009 to 31st

March 2014). Some of its recent deals include Kinneviks investment in Quickr (March 2014), Naspers

acquisition of redBus (October 2013) and TA Associates investment in Fractal (June 2013).

Zodius is an experienced investor-cum-operator of India-centric businesses. It has raised and

successfully operated a stand-alone fund, Zodius Capital I since 2011. Zodius typically develops one

company every six months and works intensively with portfolio company teams to speed up and shape

up for exceptional growth and profitability, with its current portfolio companies include Group FMG, ZyFin,

Antuit and Enki Professional (backed and helped develop the True School of Music).

About Avendus Capital:

Avendus Capital is a leading financial services firm which provides customised solutions in the areas of

financial advisory, equity capital markets, alternative asset management and wealth management. The

firm relies on its extensive track record, in-depth domain understanding and knowledge of the economic

and regulatory environment, to offer research based solutions to its clients that include institutional

investors, corporations and high net worth individuals/families. In recent years, Avendus Capital has

consistently been ranked among the leading corporate finance advisors in India and has emerged as the

advisor of choice for cross-border M&A deals, having closed around 38 cross-border transactions in the

past 5 years. Avendus PE Investment Advisors manages funds raised from its investors by investing in

public markets, while Avendus Wealth Management caters to investment advisory and portfolio

management needs of Family offices and Ultra High Networth Individuals / families, spanning all asset

classes. Headquartered in Mumbai, the firm has offices in New Delhi and Bangalore.

Avendus Capital, Inc (US) and Avendus Capital (UK) Pvt. Ltd. located in New York and London

respectively are wholly owned subsidiaries offering M&A and Private Equity syndication services to clients

in the respective regions. Avendus Capital, Inc (US) also provides wealth management services to clients

in select jurisdictions in USA. For more information, please visit www.avendus.com

About Zodius:

Zodius invests in and builds exceptional market-defining businesses in new and high growth areas where

an exciting new market is emerging and there is no leader in place to drive the market. Operational since

2011, Zodius works intensively with its portfolio company teams to speed up and shape up for

exceptional growth and profitability. Zodius portfolio includes Group FMG (digital marketing and

commerce-enablement services), ZyFin (ETF and asset management products driven by proprietary

financial and economic research), Antuit (Big Data & Analytics services), Culture Machines (online video

multi-channel network), Enki Professional Holdings (vocational education centers and online education)

and BookAdda.com (academic books and educational products e-commerce). For more information,

please visit www.zodius.com

You might also like

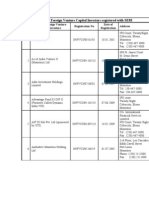

- List of VCFsDocument3 pagesList of VCFspoddar_ruchitaNo ratings yet

- List of VCFsDocument3 pagesList of VCFspoddar_ruchitaNo ratings yet

- Avendus Capital Advises Lenskart On Its Fundraising From Premji InvestDocument2 pagesAvendus Capital Advises Lenskart On Its Fundraising From Premji InvestavendusNo ratings yet

- VCs in IndiaDocument25 pagesVCs in IndiaBreejNo ratings yet

- MeetFounders UK EU August 2021 HandoutDocument13 pagesMeetFounders UK EU August 2021 HandoutAndrew BottNo ratings yet

- Europes Most Active Business Angels 2018.compressedDocument100 pagesEuropes Most Active Business Angels 2018.compressedEnrique SobriniNo ratings yet

- Fintech VC Panels & Pitches HandoutDocument7 pagesFintech VC Panels & Pitches HandoutAndrew BottNo ratings yet

- Ecommerce & Marketplace VC Panels & Pitches HandoutDocument6 pagesEcommerce & Marketplace VC Panels & Pitches HandoutAndrew BottNo ratings yet

- VC Funding Survey, 3Q 2015Document11 pagesVC Funding Survey, 3Q 2015BayAreaNewsGroupNo ratings yet

- Guide-to-Venture-Capital IVA PDFDocument90 pagesGuide-to-Venture-Capital IVA PDFNaveen AwasthiNo ratings yet

- MeetFounders UK-EU MARCH 2021 HandoutDocument21 pagesMeetFounders UK-EU MARCH 2021 HandoutAndrew BottNo ratings yet

- 2Q 15 VcsurveyDocument11 pages2Q 15 VcsurveyBayAreaNewsGroupNo ratings yet

- 2Q 15 Vcsurvey PDFDocument11 pages2Q 15 Vcsurvey PDFBayAreaNewsGroupNo ratings yet

- Accelerators: List of Start-Up Incubators and AcceleratorsDocument2 pagesAccelerators: List of Start-Up Incubators and AcceleratorsnamanNo ratings yet

- List of Merchant BankersDocument10 pagesList of Merchant Bankersnikee patelNo ratings yet

- 140 Active Angel Investor Seed Fund Profiles in IndiaDocument110 pages140 Active Angel Investor Seed Fund Profiles in IndiabhavikNo ratings yet

- Initial Report of SIPDocument32 pagesInitial Report of SIPbhuaryanNo ratings yet

- Corporate Governance and Finance Department: List of Investment Companies/Mutual Funds (71) As of June 30 2019Document3 pagesCorporate Governance and Finance Department: List of Investment Companies/Mutual Funds (71) As of June 30 2019Sui KixNo ratings yet

- Aibi Summit 2016Document48 pagesAibi Summit 2016Anonymous KRErbYM7No ratings yet

- San Diego Venture Capital FirmsDocument4 pagesSan Diego Venture Capital FirmsJoseph KymmNo ratings yet

- Accelerator / Incubator Website CountryDocument561 pagesAccelerator / Incubator Website CountryАсхат ЖанабайNo ratings yet

- Consulting Hy uPE I - Bank VC ListDocument41 pagesConsulting Hy uPE I - Bank VC ListsandeepntcNo ratings yet

- IVCA PE & VC Report - 2023-7158010123170753609Document37 pagesIVCA PE & VC Report - 2023-7158010123170753609Neelaj MaityNo ratings yet

- Healthcare FundDocument2 pagesHealthcare Fundluvisfact7616No ratings yet

- Investors ContactsDocument5 pagesInvestors ContactsGoli Vamshi KrishnaNo ratings yet

- A-List of Foreign Venture Capital Investors Registered With SEBIDocument24 pagesA-List of Foreign Venture Capital Investors Registered With SEBIVipul ParekhNo ratings yet

- Flo Biz - Sample DeckDocument8 pagesFlo Biz - Sample DeckRishivanth ThulasiramanNo ratings yet

- Venture ListsDocument8 pagesVenture ListsRavi Singh BishtNo ratings yet

- PE Final)Document30 pagesPE Final)Satbir SinghNo ratings yet

- Name of Institiution Office Address: Fimmda Member ListDocument5 pagesName of Institiution Office Address: Fimmda Member ListAbhishek BiswasNo ratings yet

- Dokumen - Tips - Middle East Venture Capital Private Equity DirectoryDocument15 pagesDokumen - Tips - Middle East Venture Capital Private Equity DirectorySadeq ObaidNo ratings yet

- Venture Capital List - SEBIDocument40 pagesVenture Capital List - SEBImitalisorthi100% (1)

- Which Australian Companies Are Thriving in ThailandDocument56 pagesWhich Australian Companies Are Thriving in ThailandRaj ParekhNo ratings yet

- Venture CapitalDocument62 pagesVenture CapitalNikhil Thakur0% (1)

- Top 300 PEIDocument8 pagesTop 300 PEIJerome OngNo ratings yet

- Venture Capital Q2 2016Document1 pageVenture Capital Q2 2016BayAreaNewsGroup100% (2)

- FDI Investors in India Top10 CountriesDocument11 pagesFDI Investors in India Top10 CountriesJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- List of Financial Institutions in Kse XleDocument13 pagesList of Financial Institutions in Kse XleMahmood KhanNo ratings yet

- Cancelled NBFCDocument336 pagesCancelled NBFCAANo ratings yet

- Venture Capital in IndiaDocument17 pagesVenture Capital in Indiamaheshtech76No ratings yet

- IVCA Members - Alphabetical ListingDocument5 pagesIVCA Members - Alphabetical ListingRajesh PaniNo ratings yet

- Indian Investors in AfricaDocument3 pagesIndian Investors in Africajoenathan ebenezerNo ratings yet

- Top Consultancy ListDocument1 pageTop Consultancy ListKannanNo ratings yet

- List of Registered Venture Capital FundsDocument25 pagesList of Registered Venture Capital FundsjvreddiNo ratings yet

- Ferrero's Marketing StrategiesDocument33 pagesFerrero's Marketing StrategiesGopal Mahajan100% (1)

- Gaju HumairaDocument431 pagesGaju Humairagaju619No ratings yet

- Europe Hedge FundsDocument126 pagesEurope Hedge Fundsheedi0No ratings yet

- List of Foreign Venture Capital Investors Registered With SEBISDocument19 pagesList of Foreign Venture Capital Investors Registered With SEBISDisha NagraniNo ratings yet

- Venture Capital Funds in IndiaDocument17 pagesVenture Capital Funds in IndialipsaNo ratings yet

- JMC Project FinanceDocument26 pagesJMC Project FinancebharatNo ratings yet

- List of Malaysia Investors in Timor-LesteDocument6 pagesList of Malaysia Investors in Timor-LesteHernanio MoratoNo ratings yet

- Startup India - State Report - KeralaDocument24 pagesStartup India - State Report - Keralabalamuralivv8391No ratings yet

- LABF - Fund of FundsDocument6 pagesLABF - Fund of FundsdavidsirotaNo ratings yet

- Mercom India Cleantech Report Jul2023Document13 pagesMercom India Cleantech Report Jul2023aakashNo ratings yet

- Funding Opportunities For Agricultural Technology: About UsDocument7 pagesFunding Opportunities For Agricultural Technology: About UsTomi Risley AnumoNo ratings yet

- VC ListDocument4 pagesVC ListSaaf suthraNo ratings yet

- Venture CapitalDocument20 pagesVenture CapitalAshika Khanna 1911165No ratings yet

- Techstars Investors Europe tcm213-234388 PDFDocument1 pageTechstars Investors Europe tcm213-234388 PDFIrina LaninaNo ratings yet

- Communications Platform as a Service cPaaS A Complete GuideFrom EverandCommunications Platform as a Service cPaaS A Complete GuideNo ratings yet

- Nile River VP Guide For StartupsDocument78 pagesNile River VP Guide For StartupsAbhilaksh LalwaniNo ratings yet

- Avendus Capital Forms Strategic PartnDocument2 pagesAvendus Capital Forms Strategic PartnavendusNo ratings yet

- Avendus Ocean Dial FinalDocument3 pagesAvendus Ocean Dial FinalavendusNo ratings yet

- Avendus Capital Appoints Alok Vajpeyi As Chairman of Its Public Markets Alternative Strategies BusinessDocument3 pagesAvendus Capital Appoints Alok Vajpeyi As Chairman of Its Public Markets Alternative Strategies BusinessavendusNo ratings yet

- Avendus Wealth Management Appoints Sudeepto Deb To Head The Equities PortfolioDocument2 pagesAvendus Wealth Management Appoints Sudeepto Deb To Head The Equities PortfolioavendusNo ratings yet

- Avendus Structured Credit Fund Final-V2Document2 pagesAvendus Structured Credit Fund Final-V2avendusNo ratings yet

- Avendus Wealth Launches Phoenix Fund FinalDocument2 pagesAvendus Wealth Launches Phoenix Fund FinalavendusNo ratings yet

- Avendus Capital Raises A New Round of Capital From KKR, Gaja Capital and Yogesh MahansariaDocument2 pagesAvendus Capital Raises A New Round of Capital From KKR, Gaja Capital and Yogesh MahansariaavendusNo ratings yet

- Avendus Deal SVG April 2017Document2 pagesAvendus Deal SVG April 2017avendusNo ratings yet

- Corpus Acquires Itellix SoftwareDocument2 pagesCorpus Acquires Itellix SoftwareavendusNo ratings yet

- Corpus Acquires Itellix SoftwareDocument2 pagesCorpus Acquires Itellix SoftwareavendusNo ratings yet

- Sameer Kamath Appointment 10 July 2017Document2 pagesSameer Kamath Appointment 10 July 2017avendusNo ratings yet

- Avendus Deal MSL Jan 2016Document2 pagesAvendus Deal MSL Jan 2016avendusNo ratings yet

- Avendus Wealth Management Advises Iimjobs - Com On Its Series A Fundraise From India Quotient, Tracxn Labs and Others.Document2 pagesAvendus Wealth Management Advises Iimjobs - Com On Its Series A Fundraise From India Quotient, Tracxn Labs and Others.avendusNo ratings yet

- Avendus Capital AdvisedDocument2 pagesAvendus Capital AdvisedavendusNo ratings yet

- Avendus Deal Jabong PDFDocument2 pagesAvendus Deal Jabong PDFavendusNo ratings yet

- Avendus Wealth Management Places Equity of NDTV's Maiden Ecommerce Venture, IndianRoots - Com, With Its Private Wealth Clients.Document2 pagesAvendus Wealth Management Places Equity of NDTV's Maiden Ecommerce Venture, IndianRoots - Com, With Its Private Wealth Clients.avendusNo ratings yet

- Avendus Deal Jabong PDFDocument2 pagesAvendus Deal Jabong PDFavendusNo ratings yet

- Avendus Capital Advises Byju's On Its Fund Raise From Chan Zuckerberg Initiative and Existing InvestorsDocument3 pagesAvendus Capital Advises Byju's On Its Fund Raise From Chan Zuckerberg Initiative and Existing InvestorsavendusNo ratings yet

- Avendus Capital Appoints Deepak Bhandari As Head - EuropeDocument2 pagesAvendus Capital Appoints Deepak Bhandari As Head - EuropeavendusNo ratings yet

- Avendus Wealth Management AdvisesDocument2 pagesAvendus Wealth Management AdvisesavendusNo ratings yet

- Avendus Capital Appoints Deepak Bhandari As Head - EuropeDocument2 pagesAvendus Capital Appoints Deepak Bhandari As Head - EuropeavendusNo ratings yet

- KKR Invests in Avendus CapitalDocument2 pagesKKR Invests in Avendus CapitalavendusNo ratings yet

- Avendus Wealth ManagementDocument2 pagesAvendus Wealth ManagementavendusNo ratings yet

- 40 Under 40 Report 2023 1Document72 pages40 Under 40 Report 2023 1Samibrata GhoshNo ratings yet

- The Single Family Office BookDocument289 pagesThe Single Family Office BookCode Cloud100% (2)

- Final JMF Annual Report 12-13 - WebDocument134 pagesFinal JMF Annual Report 12-13 - WebRichard JonesNo ratings yet

- PMS AdityaDocument39 pagesPMS AdityaAditya SinghNo ratings yet

- 2020 Global Finance Business Management Analyst Program - IIMDocument4 pages2020 Global Finance Business Management Analyst Program - IIMrishabhaaaNo ratings yet

- Vault Career Guide To Private Wealth Management (2007)Document248 pagesVault Career Guide To Private Wealth Management (2007)Christopher KingNo ratings yet

- OMS Chartbook Morgan-Stanley PDFDocument253 pagesOMS Chartbook Morgan-Stanley PDFantics20No ratings yet

- Bank of America 4Document18 pagesBank of America 4Akshay PilaniNo ratings yet

- DocumentDocument1 pageDocumentAdminAli100% (1)

- Wall Street Letter Aug 11 - Aug 17 2011Document16 pagesWall Street Letter Aug 11 - Aug 17 2011Jim WolfeNo ratings yet

- Companies Involved in Online TradingDocument10 pagesCompanies Involved in Online TradingAzaruddin Shaik B PositiveNo ratings yet

- Study and Strategy of Customer Acquisition Process in Wealth ManagementDocument7 pagesStudy and Strategy of Customer Acquisition Process in Wealth Managementsubhayan_svnitNo ratings yet

- Case Study MISDocument3 pagesCase Study MISFaizan HaiderNo ratings yet

- Nitin ResumeDocument3 pagesNitin ResumevrvgopalNo ratings yet

- Latin Family OfficeDocument43 pagesLatin Family OfficeEduardo VianaNo ratings yet

- Bridgecreek Investment Management Firm Tops $1 Billion in Assets Under ManagementDocument3 pagesBridgecreek Investment Management Firm Tops $1 Billion in Assets Under ManagementPR.comNo ratings yet

- Strategic Human Resources Management Australian Private BankingDocument16 pagesStrategic Human Resources Management Australian Private BankingMichael YuleNo ratings yet

- Chief Operating Officer CFO in New York City Resume Mark YoungDocument3 pagesChief Operating Officer CFO in New York City Resume Mark YoungMarkYoungNo ratings yet

- Barclays Wealth InsightsDocument32 pagesBarclays Wealth Insightsnarayan.mitNo ratings yet

- Credit Suisse - Financial 3rd Quarter 2017Document178 pagesCredit Suisse - Financial 3rd Quarter 2017StansfieldNo ratings yet

- (中期結算) 2015各MT人工調查Document46 pages(中期結算) 2015各MT人工調查Ariely0% (1)

- India 2019 RM Headcount League Table - Asian Private Banker PDFDocument3 pagesIndia 2019 RM Headcount League Table - Asian Private Banker PDFvjNo ratings yet

- WMDocument151 pagesWMKomal Bagrodia100% (1)

- Emkay SharesDocument30 pagesEmkay Sharesnkr225No ratings yet

- Marketing MadnessDocument44 pagesMarketing MadnessSuzanne StevensNo ratings yet

- Deutsche Bank Annual Report 2010 EntireDocument498 pagesDeutsche Bank Annual Report 2010 Entirekpmgtaxshelter_kpmg tax shelter-kpmg tax shelterNo ratings yet

- Wealth Management - D&B Program OutlineDocument4 pagesWealth Management - D&B Program OutlineParijat ChoudhuryNo ratings yet

- HSBC Holdings PLCDocument9 pagesHSBC Holdings PLCAnonymous P73cUg73LNo ratings yet

- Maximizing Performance in A Competitive Market: Citigroup Global Wealth ManagementDocument58 pagesMaximizing Performance in A Competitive Market: Citigroup Global Wealth ManagementRITUSINGH2010No ratings yet

- Ey Family Office Guide Single FinalDocument64 pagesEy Family Office Guide Single Finalleogonzal100% (3)