Professional Documents

Culture Documents

Federal Insurance Contributions Act

Uploaded by

MaryCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Federal Insurance Contributions Act

Uploaded by

MaryCopyright:

Available Formats

Federal Insurance Contributions Act (FICA)

Social Security (S.S.) and Medicare (Med or HI)

Year 2012 2012 2011 2011 2010 2010 2009 2009 Type of (FICA) Social Security Tax Medicare Social Security Tax Medicare Social Security Tax Medicare Social Security Tax Medicare Maximum Taxable Earnings $110,100.00 unlimited $106,800.00 unlimited $106,800.00 unlimited $106,800.00 unlimited Rates 6.2% each for employer and employee 1.45% 6.2% each for employer and 4.2% employee 1.45% 6.2% each for employer and employee 1.45% 6.2% each for employer and employee 1.45%

Social Security Rate as part of the FICA (SS or OASDI) tax is at 6.2% of a base of $106,800 for the year of 2010. For this subsection of the chapter, students should use the maximum taxable earnings of $106,800 unless otherwise directed by their instructor. Any earnings in excess of the cap of $106,800 are not taxable.

A careful record of each employees earnings must be maintained every year so that the employer will know when the federal income tax cap has been reached and when the employees earnings are about to reach the cap. Very often part of a paycheck during the year will become non-taxable while part of it is still below the cap and still taxable. Employees have taxes taking out of every paycheck for FICASS so the student should only calculate the taxes for the current paycheck and not the entire year unless stated in the instructions of the problem. The payroll system is a pay as you go system in the United States where the employee pays taxes on their gross pay for each paycheck during the year.

FICA Social Security (S.S.) EXAMPLES

No Employee 1 2 3 Carl Clay Charlie

Cumulative earnings before this pay period $100,000 $105,000 $125,000

Pay amount this period $4,308 $4,038 $5,306

Taxable Salary $4,308 $1,800 $0

SS Tax

$267.10 $111.60 $0

MJC Revised 12/2011

Page 1

Federal Insurance Contributions Act (FICA)

In case number 1-Carl paid taxes on his cumulative earnings of $100,000 to date so, his earnings are below the cap of $106,000. Case 1.

Even with the current paycheck Carls cumulative earnings has not yet reached the cap for the year so all of his current paycheck is taxable. In case number 2-Clay cumulative earnings are $105,000, which is just below the cap. If you take the cap of $106,800 minus his current cumulative earnings of $105,000 then only $1,800 of his current paycheck is below the cap and therefore taxable.

In case number 3 Charlies cumulative earnings of $125,000 is already well above the cap of $106,000 therefore none of his current paycheck is taxable. Once an employees cumulative earnings go over the cap then the rest of the years paychecks are no taxable income.

MJC Revised 12/2011

Page 2

Federal Insurance Contributions Act (FICA)

Medicare rate for the part of FICA (Med. or HI) Tax rate is 1.45% on the entire amount of the employees income. There is not a cap on the Medicare portion of the FICA taxes. The percentage rate for Medicare has not changes since it began. FICA Medicare Examples Cumulative earnings Pay amount before this pay period this period $100,000 $4,308 $105,000 $4,038 $125,000 $5,306

No. 1 2 3

Employee Carl Clay Charlie

Taxable Wages $4,308 $4,038 $5,306

Med. Tax $62.47 $58.55 $76.94

Cash 1 Carls Med. Tax is $62.47. The calculation is: $4,308 X .0145 = $62.47 Case 2 Clays Med. Tax is $58.55. The calculation is: $4,038 X .0145 = $58.55 Case 3 Charlies Med. Tax is $76.94. The calculation is: $5,306 X .0145 = $76.94 *Note: these final totals for med. tax are rounded to the nearest hundredth (cent).

MJC Revised 12/2011

Page 3

You might also like

- Individual Inc Tax Exam 1 Study GuideDocument20 pagesIndividual Inc Tax Exam 1 Study GuideMary Tol100% (1)

- Analysis of Financial Statements RatiosDocument2 pagesAnalysis of Financial Statements RatiosMaryNo ratings yet

- Instructions For A Cash Flows Statement Direct MethodDocument5 pagesInstructions For A Cash Flows Statement Direct MethodMary100% (8)

- Adjusting Entries For Bank ReconciliationDocument1 pageAdjusting Entries For Bank ReconciliationMaryNo ratings yet

- Final Exam - 2020Document10 pagesFinal Exam - 2020mshan lee100% (1)

- Account ClassificationDocument3 pagesAccount ClassificationUsama MukhtarNo ratings yet

- Client Bookkeeping Solution TutorialDocument304 pagesClient Bookkeeping Solution Tutorialburhan_qureshiNo ratings yet

- Financial Statements SampleDocument32 pagesFinancial Statements Sampleraymodo_philipNo ratings yet

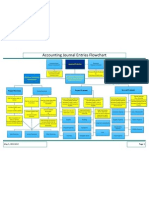

- Accounting Journal Entries Flowchart PDFDocument1 pageAccounting Journal Entries Flowchart PDFMary75% (4)

- Basic AccountsDocument51 pagesBasic AccountsNilesh Indikar100% (1)

- Aries Computer Repair SolutionsDocument9 pagesAries Computer Repair SolutionsedalzurcNo ratings yet

- Managerial EconomicsDocument3 pagesManagerial EconomicsGuruKPONo ratings yet

- Cash Flows Statement Indirect MethodDocument2 pagesCash Flows Statement Indirect MethodMary100% (1)

- Accounting and Bookkeeping Business PlanDocument33 pagesAccounting and Bookkeeping Business PlanNissa Hosten-JamesNo ratings yet

- Basic Impact of Everyday Journal Entries On The Income StatementDocument2 pagesBasic Impact of Everyday Journal Entries On The Income StatementMary100% (1)

- Payroll Accounting 2015 1st Edition Landin Solutions Manual DownloadDocument42 pagesPayroll Accounting 2015 1st Edition Landin Solutions Manual DownloadTommie Clemens100% (21)

- Module 2 Introducting Financial Statements - 6th EditionDocument7 pagesModule 2 Introducting Financial Statements - 6th EditionjoshNo ratings yet

- Journal Entry Format PDFDocument1 pageJournal Entry Format PDFMaryNo ratings yet

- Journal Entries For Long Lived AssetsDocument2 pagesJournal Entries For Long Lived AssetsMary100% (20)

- Job Order Costing: Patrick Louie E. Reyes, CTT, Micb, Rca, CpaDocument45 pagesJob Order Costing: Patrick Louie E. Reyes, CTT, Micb, Rca, CpaClaudette Clemente100% (1)

- BVA CheatsheetDocument3 pagesBVA CheatsheetMina ChangNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsMary100% (4)

- Petty Cash FundDocument1 pagePetty Cash FundMary100% (2)

- The Financial Accounting Cycle PDFDocument219 pagesThe Financial Accounting Cycle PDFQuadjo Opoku Sarkodie100% (1)

- Bean Counter's Essential Accounting Cheat SheetDocument7 pagesBean Counter's Essential Accounting Cheat SheetdbistaNo ratings yet

- Kathy Davis - Dancing Tango - Passionate Encounters in A Globalizing World-New York University Press (2015)Document236 pagesKathy Davis - Dancing Tango - Passionate Encounters in A Globalizing World-New York University Press (2015)Csongor KicsiNo ratings yet

- Comprehensive Problem Accounting 101Document2 pagesComprehensive Problem Accounting 101Heidi Norris Dawson25% (4)

- Terms of SaleDocument6 pagesTerms of SaleMary100% (1)

- Concepts: Introduction To Financial AccountingDocument30 pagesConcepts: Introduction To Financial Accountingbmurali37No ratings yet

- Longman ESOL Skills For Life - ShoppingDocument4 pagesLongman ESOL Skills For Life - ShoppingAstri Natalia Permatasari83% (6)

- Prac Res Q2 Module 1Document14 pagesPrac Res Q2 Module 1oea aoueoNo ratings yet

- Horizontal Analysis of A Balance SheetDocument3 pagesHorizontal Analysis of A Balance SheetMary100% (6)

- SUTA and FUTA CalculationsDocument2 pagesSUTA and FUTA CalculationsMary83% (12)

- FIT-Percentage Method ChartsDocument4 pagesFIT-Percentage Method ChartsMary67% (3)

- Partial PaymentsDocument1 pagePartial PaymentsMaryNo ratings yet

- Basic Instructions On How To Create A Sum-of-the-Years'-Digits Depreciation ScheduleDocument4 pagesBasic Instructions On How To Create A Sum-of-the-Years'-Digits Depreciation ScheduleMary100% (1)

- Basic Instructions For LIFO Inventory MethodDocument4 pagesBasic Instructions For LIFO Inventory MethodMary100% (4)

- Unit Costs Under Traditional Costing MethodDocument2 pagesUnit Costs Under Traditional Costing MethodMary67% (3)

- Calendars For Sales TermsDocument2 pagesCalendars For Sales TermsMaryNo ratings yet

- Instructions On How To Create A MACRS Depreciation ScheduleDocument4 pagesInstructions On How To Create A MACRS Depreciation ScheduleMary100% (2)

- Labor Variance FormulasDocument2 pagesLabor Variance FormulasMaryNo ratings yet

- Owners Equity Statement Form InstructionsDocument2 pagesOwners Equity Statement Form InstructionsMary100% (4)

- How To Create A WorksheetDocument3 pagesHow To Create A WorksheetMary100% (2)

- Analyzes of A Business TransactionDocument13 pagesAnalyzes of A Business TransactionMary100% (1)

- Gross Pay CalculationsDocument2 pagesGross Pay CalculationsMary100% (3)

- Cost Sheet FormatDocument2 pagesCost Sheet FormatAMIN BUHARI ABDUL KHADERNo ratings yet

- Basic Instructions For A Cash Budget StatementDocument4 pagesBasic Instructions For A Cash Budget StatementMary100% (6)

- Instructions On How To Create A Units of Production Depreciation ScheduleDocument2 pagesInstructions On How To Create A Units of Production Depreciation ScheduleMary100% (3)

- Materials Variance FormulasDocument2 pagesMaterials Variance FormulasMary100% (1)

- Transaction AnalysisDocument14 pagesTransaction AnalysisMaryNo ratings yet

- Periodic Inventory Valuation MethodsDocument10 pagesPeriodic Inventory Valuation MethodsMary100% (1)

- Cash DiscountsDocument1 pageCash DiscountsMaryNo ratings yet

- Ratio CalculationDocument8 pagesRatio CalculationSohel MahmudNo ratings yet

- Stop DepreciationDocument8 pagesStop DepreciationDeepak GhugardareNo ratings yet

- Basic Instructions For Retained Earnings StatementDocument1 pageBasic Instructions For Retained Earnings StatementMary100% (5)

- Unit Cost Under ABC Costing MethodDocument4 pagesUnit Cost Under ABC Costing MethodMary100% (5)

- Perpetual Inventory System MethodsDocument13 pagesPerpetual Inventory System MethodsMary100% (10)

- Closing Journal Entries-Sole ProprietorshipDocument1 pageClosing Journal Entries-Sole ProprietorshipMary100% (3)

- End of The Year Adjustment For Allowance For Doubtful AccountsDocument1 pageEnd of The Year Adjustment For Allowance For Doubtful AccountsMary100% (1)

- How To Create Corporation WorksheetDocument4 pagesHow To Create Corporation WorksheetMaryNo ratings yet

- CFI Team 05072022 - Income StatementDocument8 pagesCFI Team 05072022 - Income StatementDR WONDERS PIBOWEINo ratings yet

- Continue or Eliminate AnalysisDocument3 pagesContinue or Eliminate AnalysisMaryNo ratings yet

- Accounting Entry (FI)Document9 pagesAccounting Entry (FI)Manoj PradhanNo ratings yet

- Trade DiscountsDocument4 pagesTrade DiscountsMary100% (2)

- Chapter 3 Double Entry BookkeepingDocument16 pagesChapter 3 Double Entry BookkeepingNgoni Mukuku100% (2)

- US CMA PPT 3 Investments in DebtDocument11 pagesUS CMA PPT 3 Investments in DebtmohammedNo ratings yet

- Partial Income Statement For Manufacturing CompanyDocument1 pagePartial Income Statement For Manufacturing CompanyMary50% (2)

- Accounts Payable QuizDocument4 pagesAccounts Payable Quiz5variaraNo ratings yet

- Flash Card SlidesDocument29 pagesFlash Card SlidesMary100% (2)

- 6 Completion of Accounting Cycle UDDocument28 pages6 Completion of Accounting Cycle UDERICK MLINGWANo ratings yet

- FI User Manual Cross ChargesDocument25 pagesFI User Manual Cross ChargesJose Luis Becerril BurgosNo ratings yet

- US Rule For Partial PaymentsDocument2 pagesUS Rule For Partial PaymentsMary100% (3)

- Document 1944 2629Document63 pagesDocument 1944 2629caninerawboned.2rfl40No ratings yet

- ACC 111 Chapter 7 Lecture NotesDocument5 pagesACC 111 Chapter 7 Lecture NotesLoriNo ratings yet

- Diagram of Accounting EquationDocument1 pageDiagram of Accounting EquationMary100% (3)

- Basic Everyday Journal Entries Retained Earnings and Stockholders EquityDocument2 pagesBasic Everyday Journal Entries Retained Earnings and Stockholders EquityMary100% (2)

- Make or Buy AnalysisDocument4 pagesMake or Buy AnalysisMaryNo ratings yet

- End of The Year Adjustment For Allowance For Doubtful AccountsDocument1 pageEnd of The Year Adjustment For Allowance For Doubtful AccountsMary100% (1)

- Special Order AnalysisDocument2 pagesSpecial Order AnalysisMaryNo ratings yet

- Kirkpatrick + ModelDocument1 pageKirkpatrick + ModelMaryNo ratings yet

- Product Cost AnalysisDocument10 pagesProduct Cost AnalysisMaryNo ratings yet

- Scaffolding MethodDocument1 pageScaffolding MethodMaryNo ratings yet

- Continue or Eliminate AnalysisDocument3 pagesContinue or Eliminate AnalysisMaryNo ratings yet

- Chunking Method DiagramDocument1 pageChunking Method DiagramMaryNo ratings yet

- ARCS Method of MotivationDocument1 pageARCS Method of MotivationMaryNo ratings yet

- Current Assets, Liabilities, and Stockholders' Equity Normal BalancesDocument1 pageCurrent Assets, Liabilities, and Stockholders' Equity Normal BalancesMaryNo ratings yet

- Circle of LifeDocument1 pageCircle of LifeMaryNo ratings yet

- Table Factors For Present and Future Value of One DollarDocument6 pagesTable Factors For Present and Future Value of One DollarMaryNo ratings yet

- Partial Income Statement For Manufacturing CompanyDocument1 pagePartial Income Statement For Manufacturing CompanyMary50% (2)

- Simplified Charts - Percentage Method Income Tax Withholding 2012Document4 pagesSimplified Charts - Percentage Method Income Tax Withholding 2012MaryNo ratings yet

- Labor Variance FormulasDocument2 pagesLabor Variance FormulasMaryNo ratings yet

- Calendars For Sales TermsDocument2 pagesCalendars For Sales TermsMaryNo ratings yet

- Materials Variance FormulasDocument2 pagesMaterials Variance FormulasMary100% (1)

- Transaction Analyzes For A CorporationDocument2 pagesTransaction Analyzes For A CorporationMaryNo ratings yet

- Simplified Charts-Percentage Method Income Tax Withholding 2008Document4 pagesSimplified Charts-Percentage Method Income Tax Withholding 2008MaryNo ratings yet

- Gross Profit Section of Income Statement-Periodic SystemDocument3 pagesGross Profit Section of Income Statement-Periodic SystemMary67% (3)

- CENG 5503 Intro to Steel & Timber StructuresDocument37 pagesCENG 5503 Intro to Steel & Timber StructuresBern Moses DuachNo ratings yet

- An Introduction To Ecology and The BiosphereDocument54 pagesAn Introduction To Ecology and The BiosphereAndrei VerdeanuNo ratings yet

- EC GATE 2017 Set I Key SolutionDocument21 pagesEC GATE 2017 Set I Key SolutionJeevan Sai MaddiNo ratings yet

- Cover Letter PDFDocument1 pageCover Letter PDFAli EjazNo ratings yet

- Test Bank For Fundamental Financial Accounting Concepts 10th by EdmondsDocument18 pagesTest Bank For Fundamental Financial Accounting Concepts 10th by Edmondsooezoapunitory.xkgyo4100% (47)

- Dermatology Study Guide 2023-IvDocument7 pagesDermatology Study Guide 2023-IvUnknown ManNo ratings yet

- Alignment of Railway Track Nptel PDFDocument18 pagesAlignment of Railway Track Nptel PDFAshutosh MauryaNo ratings yet

- Ultra Slimpak G448-0002: Bridge Input Field Configurable IsolatorDocument4 pagesUltra Slimpak G448-0002: Bridge Input Field Configurable IsolatorVladimirNo ratings yet

- Nagina Cotton Mills Annual Report 2007Document44 pagesNagina Cotton Mills Annual Report 2007Sonia MukhtarNo ratings yet

- What's Wrong With American Taiwan Policy: Andrew J. NathanDocument14 pagesWhat's Wrong With American Taiwan Policy: Andrew J. NathanWu GuifengNo ratings yet

- Jesd8 15aDocument22 pagesJesd8 15aSridhar PonnurangamNo ratings yet

- Prasads Pine Perks - Gift CardsDocument10 pagesPrasads Pine Perks - Gift CardsSusanth Kumar100% (1)

- Shouldice Hospital Ltd.Document5 pagesShouldice Hospital Ltd.Martín Gómez CortésNo ratings yet

- Ofper 1 Application For Seagoing AppointmentDocument4 pagesOfper 1 Application For Seagoing AppointmentNarayana ReddyNo ratings yet

- Sinclair User 1 Apr 1982Document68 pagesSinclair User 1 Apr 1982JasonWhite99No ratings yet

- PEDs and InterferenceDocument28 pagesPEDs and Interferencezakool21No ratings yet

- Chapter 19 - 20 Continuous Change - Transorganizational ChangeDocument12 pagesChapter 19 - 20 Continuous Change - Transorganizational ChangeGreen AvatarNo ratings yet

- AD Chemicals - Freeze-Flash PointDocument4 pagesAD Chemicals - Freeze-Flash Pointyb3yonnayNo ratings yet

- MA1201 Calculus and Basic Linear Algebra II Solution of Problem Set 4Document10 pagesMA1201 Calculus and Basic Linear Algebra II Solution of Problem Set 4Sit LucasNo ratings yet

- 1st SemDocument3 pages1st SemARUPARNA MAITYNo ratings yet

- Evil Days of Luckless JohnDocument5 pagesEvil Days of Luckless JohnadikressNo ratings yet

- Pasadena Nursery Roses Inventory ReportDocument2 pagesPasadena Nursery Roses Inventory ReportHeng SrunNo ratings yet

- Precision Machine Components: NSK Linear Guides Ball Screws MonocarriersDocument564 pagesPrecision Machine Components: NSK Linear Guides Ball Screws MonocarriersDorian Cristian VatavuNo ratings yet

- DOE Tank Safety Workshop Presentation on Hydrogen Tank TestingDocument36 pagesDOE Tank Safety Workshop Presentation on Hydrogen Tank TestingAlex AbakumovNo ratings yet