Professional Documents

Culture Documents

Lecture 08 PDF

Uploaded by

Chintan ManekOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture 08 PDF

Uploaded by

Chintan ManekCopyright:

Available Formats

UNIT IV

INFLATION, DEFLATION AND

LESSON 8:

UNEMPLOYMENT

INFLATION , DEFLATION AND

REFLATION

Hello students now lets take a look at a very interesting topic the value of money. It also adversely affects the course

BUSINESS ECONOMY II

that is Inflation of economic planning and programming both at macro and

micro levels.

Objective of the module

In short, most of such harmful effects are indirectly by the

Meaning and Explanation

menace of , inflation and deflation. Inflation implies declining

Demand and cost Inflation value of money: Deflation implies rising value of money. We

Introduction shall therefore, discuss these topics in details in this chapter.

If money is to serve its good purpose its value must remain Meaning of Inflation

stable. Changes in value of money lead to harmful conse- Inflation is commonly understood as a situation of substantial

quences in the economy at large. and rapid general increase in the level of prices and consequent

Some broad effects of changes in value of money are traced deterioration in the value of money over a period of time.

below: The behaviour of general prices is measured through price

1. Price fluctuations implies that the value of money is indices. The trend of price indices reveals the course of inflation

unstable. This adversely affect the confidence in money fails or deflation in the economy. As Lerner says, a price rise which is

to serve as a good store of value. unforeseen and uncorrected is inflationary.

2. Even as a means of payments it looses its growth. It may Thus, inflation is statistically measured in terms of percentage

also become a source of peril and confusion. Since prices of increase in the price index, as a rate per cent per unit of time -

all goods do not change in the same order, the relative price usually a year or a month.

structure is distorted. When prices of necessaries tend to Usually, the wholesale price index (WPI) numbers are used to

rise while those of luxuries may be falling, there is regressive measure inflation. Alternatively, the consumer price index (CPI)

effect, as the poor consumers suffer, while the rich are or the cost of living index number can be adopted in measuring

benefited while spending their money. the rate of inflation.

3. Price variations in product and factor markets are not A Few Definitions

uniform. Thus, thecost-functions and revenues in different Inflation is like an elephant to the blind men. Different

categories of production differ. As a result, profitability of economists have defined inflation differently. We may, thus,

firms and industry tend to differ. Marginal productivity of enlist a few important definitions of inflation as under which

different factors in different uses never tend to identical would give us a comprehensive idea about this intricate

when the value of money fluctuates in segregated manner. problem.

This obstructs the optimal utilisation of resources. This

Harry Johnson defines inflation as a substained rise in prices.

may also cause maladjustment and wastefulness in the

eXploitation of countrys productive resources. Crowther, similarly defines inflation as a state in which the

value of money is falling, i.e., prices are rising.2

4. When value of money changes incoherently in different

types of real and financial assets, assets portfolio The common feature of inflation is a price rise, the degree of

management becomes a difficult task. It also distorts the which may be measured by price indices.

pattern of wealth distribution and position of the wealth Edward Shapiro, puts it thus: Recognising the ambiguities our

holders. Say, for instance, when share prices fall but real words contain, we will define inflation simply as a persistent

estate prices rises,then person who has invested in shares is and appreciable rise in the general level of prices.3

a looser while person occupying a real estate of the same Prof. Samuelson puts it thus: Inflation occurs when the

amount is a gainer. general level of price and costs is rising.Authors like Throp and

Such changes in different values of wealth due to unstable value Quandt, however, opine that it is of great help to defme

of money distorts the pattern of income distribution. Conse- inflation in terms of observable phenomenon and for this

quently, savings and investment may be adversely affected. It reason the process of rising prices should be considered as

also disturb business expectations and business planning. inflationary.

Business risks would be high when value of money in not There are, at least, two distinct views on the concept of

stable. inflation. To some economists, inflation is a pure monetary

5. Effects of rising prices in general- inflation effects - are also phenomenon, while to others, it is a postfull employment

different from the effects of falling prices in general - the phenomenon.

deflation effects. Especially, tempo of growth process and

economic development is disturbed -due to instability in

Copy Right: Rai University

48 11.251

Inflation As A Pure Monetary Phenomenon operating in the economy or because the economy has already

BUSINESS ECONOMY II

Monetarists, in general, regard inflation as a purely monetary reached the full employment level.

phenomenon. It is held that when money supply exceeds the In Keynes view, thus, rising prices in all situations cannot be

normal absorbing capacity of the economy, it leads to persis- termed as inflation. In a condition of under-employment,

tently rising prices. In other words, when there is overexpansion when an increase in money supply and rising prices are accompa-

of money supply and too much money chasing too few goods, nied by the expansion of output and employment, but

inflation occurs. Milton Friedman, puts thus, Inflation is when1here are bottlenecks in the economy, an increase in money

always and everywhere a monetary phenomenon. supply may cause cost and prices to rise more than the expan-

Goldenweiser goes on to state that Inflation occurs when the sion of output and employment. This may be termed as

volume of money activity bidding forr goods and services semi-inflation or reflation till the ceiling of full employ-

increases faster than the available supply of goods, when the ment is reached. Once full employment level is reached, the

growth of national income in money units is greater than its entire increase in money supply is reflected simply by the rising

growth in physical units. prices - the real inflation.

The monetarists view, in fact, is a corollary to the quantity Incidentally, Keynes mentions the following four related terms

theory of money. Other things being equal, if money supply while discussing the concept of inflation:

increases, there is inflation or a rise in prices.

1. Reflation,

This evidently follows from the Fisherian equation:

2. Inflation,

MV =P T

3. Disinflation, and

Assuming

4. Deflation.

V and T to be constant,

Using a trade cycle model (as in Figure 1) we may clarify these

P rises directly in proportion to the increase in money supply terms as under:

(M).

1. Reflation. It is a situation of rising prices, deliberately

Economists such as Milton Friedman, Hawtrey and undertaken to relieve a depression. With rising prices,

Goldenweiser who looked upon inflation as a purely monetary employment, output and income also increase till the

phenomenon, firmly believed in the quantity theory of money. economy reaches the full employment ceiling.

But the theory failed to explain the phenomenon of hyper-

In the below diagram, the FF line represents the full employ-

inflation, where the rise in the prices may cause an increase in the

ment ceiling and represents the normal path. In the beginning

money supply which, in turn, may cause a further rise in prices.

when the economy is at a point of below full employment

In fact, the phenomenon of money and prices chasing each

equilibrium, an increase in money supply leads the economy to

other in a vicious spiral is so indivisible that it is not very easy to

move on the path ofAB. However, till the economy reaches the

determine which is the cause and which is the effect in the

pointB, price rise is accompanied by the expansion of employ-

dynamic process of inflation. Moreover, the quantity theory is

ment and output. The situation is, thus, described as

quite misleading and confusing if one were to analyse a

semi-inflation or reflation.

situation of depression, in which the government resorts to the

usual fiscal and monetary techniques to counteract the evils of

depression, and the result is both an increase in money supply

and a rise in prices.

Inflation As A Post-full Employment Phenomenon

Although inflation by its nature is commonly conceived as a

monetary phenomenon, a group of economists, including

Pigou and Keynes, regarded inflation as a phenomenon of full

employment. In particular, the Keynesian theory of inflation is

based on the concept of full employment. In the Keynesian

view, rising prices in all situations cannot be termed inflation. In

a situation of underemployment, when an increase in money fig. 1: The Model of a Trade Cycle

supply and rising prices are accompanied by an expansion of Inflation. It occurs when prices rise after the stage of full

output and employment, inflation does not occur. Sometimes, employment is reached in the economy, with no corresponding

due to bottlenecks in the economy, an increase in money supply rise in employment and output. The following are the main

may cause costs and prices to rise more than the expansion of characteristics of inflation:

output and employment. This is known as semi-inflation or

Inflation is a long-term operating dynamic process.

bottleneck inflation. Once full-employment level is reached, the

entire increase in money supply is reflected by rising prices-a case Inflation is a process of persistently ris.ing price level.

of a true inflation. Inflationary price rise is persistent and is irreversible within a

Inflation occurs in a situation where there is an increase in short time; thus, it should be distinguished from a price

demand expressed through more money spending but no rise which may occur temporarily, due to short-term scarcity

corresponding increase in production either due to bottlenecks or during a cyclical upswing.

Copy Right: Rai University

11.251 49

A cyclical movement is not inflation. Inflation is a rising ployment and stagnation in the rate of growth. To describe this

BUSINESS ECONOMY II

trend in the price level. situation, Professor Samuelson has coined a new term,

Inflation is endogenous to the economic system. stagflation. As Samuelson says, Stagflation involves inflation-

ary rises in prices and wages at the same time so that people are

Inflation is fostered by the interaction of a multitude of

unable to find jobs and firms are unable to find customers for

economic factors. (g) Inflation, in a real sense, is a post-full

what their plants can produce.In short, stagflation refers to a

employment phenomenon. (h) By and large, inflation is also a

situation of recession and rising unemployment accompanied

monetary phenomenon. It is usually characterised by an

by a rising price level.flats, etc. are much high and fascinating

overflow of money and credit. In fact, the root causeof

than the rate of returns on shares, and bonds in an inflationary

inflation is the expansion of money supply beyond the normal

economy.

absorbing capacity of the economy.

9. Interest rates in the unaccounted and unorganised sectors

In Figure 1, the economys path up to BC is inflationary,

tend to be higher than the organised sectors of the money

Disinflation. When prices are falling due to anti-inflationary

market.

measures adopted by the authorities, with no corresponding

decline in the existing level of employment, output and 10. Labour unrest, strikes, lock-outs, etc. are common.

income, the result is disinflation. Organised labour force successfully resists any reduction in

real wages and pushes up the money-wages, thereby

When acute inflation afflicts the community, disinflation is

accelerating the process of cost-plish inflation.

adopted as a cure. Disinflation is said to take place when

deliberate attempts are made to curtail expenditure of all sorts 11. In an inflationary economy, the government is trapped in

to lower prices and money incomes for the benefit of the the cob-web of ever increasing public expenditure, larger

community. budgets, higher taxes, larger public debts, huge deficit

financing and a large number of controls, which, in turn,

In Figure 1, the path CD represents disinflation.

encourage black money and dual accounting system,

Deflation: It is a condition of falling prices accompanied by a blackmarketing, smuggling and other antisocial activities on

decreasing level of employment, outpUt and income. Deflation account of the deterioration of the communitys morals in

is just the opposite of inflation. Deflation occurs when the total general caused by the inflationary impact.

expenditure of the community is not equal to the existing

In short, an economy is inflationary because it is inflationary.

prices. Consequently, the value of money goes up and prices

There tends tobe a vicious circle of inflation when it is curbed

fall. However, each and every fall in price cannot be called

immediately. In the long period, the state of unchecked

deflation. The process of reversing inflation without either

inflation becomes a built-in feature of the economy and people

creating unemployment or reducing output is called

expect the rate of inflation to accelerate further.

disinflation and not deflation.Deflation is an under-

employment phenomenon. In Fig. I, the path DEG shows Students now lets try to understand inflation in a different way

deflation. Meaning of Inflations

Contemporary Views on Inflation Different economists have offered different definitions of the

For all practical purposes, Emile James defined inflation as a term inflation. In fact, there is a plethora of defInitions on the

self-perpetuatingand irreversible upward movement of prices, subject. Inflation in the popular mind is generally associated

caused by an excess of demand over capacity to supply. Here, with rapidly rising prices which cause a decline in the purchasing

Prof. James points ab oUt that excess demand may be demand power of money. Prof. Hawtrey defines inflation as the issue

for investment as well as for consumer goods. The phrase of too much currency. Prof. Kemmerer has defined inflation as

capacity to supply in the definition stresses that any increase in too much currency in relation to the physical volume of

demand, at a given moment, constitutes a call for an increase in business being done. Prof. Coulbourn has defined inflation as

production. If the productive apparatus can meet the challenge, too much money. chasing too few goods. These definitions

there will be no inflation. Inflation can come aboUt only if given by Hawtrey, Kemmerer, and Coulbourn belong to the

expansion in production or supply is held back by some same category. They seek to establish cause and effect relation-

obstacle, such as full employment of resources or occasionally, ship between supply of money and the price level. According to

by some constraints, and market imperfections. In this sense, these definitions, the rise in the pricelevel is caused by an

the term inflation is also applicable to an economy when a increase in the supply of money. The increase in the supply of

rise in the price level may not lead to increased output beyond a money is the cause, the rise in the price-level is the effect.

certain stage due to the existence of bottlenecks, even. though But the above cause and effect relationship between supply of

the stage of full employment is not attained. Briefly then, apart money and the price-level was reversed in Germany after the

from price rise, the existence of excess demand is regarded as an First World War. The rise in the price-level, instead of being the

essential characteristic of inflation. result, was actually the cause of the expansion of money supply

It is generally believed that inflation is accompanied by growth in Germany in .the post-war period. In other words, it was the

in employment. rise in prices which caused the expansion of money supply in

Germany. It is in this context that Prof. Einzig has drawn a

However, in recent years, the world has been experiencing a

distinction between money inflation and price inflation.

situation in which the price level has been continuously rising

but simultaneously there has been a rise in the rate of unem-

Copy Right: Rai University

50 11.251

-According to him, money inflation is the first stage of inflation during the war, or during the planning period, or during a

BUSINESS ECONOMY II

in which the excess of money supply over business require- period of technological improvements.

ments pushes up the price-level. Price inflation is the second There is, however, no fundamental difference between the two

stage of inflation when the rising price-level necessitates a rapid approaches. The excess demand can become effective only

expansion of the supply of money. During price inflation, the through an increased supply of money. The increased supply of

prices rise with such rapidity that even the money supply cannot money is thus the causal factor of inflation. Ultimately, there is

keep pace with them. The stage of inflation is referred to as no basic difference between the quantity theory of money

hyper-inflation. To our mind, Einzigs definition of inflation approach and the excess demand approach. The excess demand

appears to be the best because it fully explains the phenomenon approach is, however, more popular than the quantity theory of

of inflation. In the words of Einzig, Inflation is that state of money approach.

disequilibrium in which an expansion of purchasing power

The above explanation of excess demand approach highlights

tends to cause or is the effect of an increase in the price-leveL

the various factors that cause the emergence of excess demand

An analysis of this definition reveals the fact that the rise in the

in the economy. The emergence of excess demand in the

price-level is not only the result but also the cause of the

economy can be attributed to two main factors:

expansion of money supply.

i. Increase in the demand for goods and services, and

But recently, Prof. Keynes has linked up the concept of inflation

with the phenomenon of full employment. According to ii. Decrease in the supply of goods and services. The factors

Keynes, an inflationary rise in the price-level cannot take place causing an increase in demand include increase in public

before the point of full employment. An expansion of money expenditure, increase in private expenditure, increase in

supply will not lead to a rise in the price-level so long as there exports, reduction in taxation and repayment of past

are unemployed resources in the economy. The price-level will internal debts. The factors causing a decrease in supply

rise only after the point of full employment has been reached. include such things as shortage of supplies of factors of

According to Keynes, the rise in the price-level after the point of production, hoarding by traders and consumers, etc.

full employment is true inflation. Demand Inflation and Cost Inflation

Approaches to the Theory of Inflation Broadly speaking, there are two main causes of inflation: (I) an

There are two main approaches to the theory of inflation: increase in effective demand, and (ii) an increase in production

cost. The former gives rise to demand inflation while the latter

i. The Quantity Theory of Money Approach, and

leads to cost inflation.

ii. The Excess Demand Approach.

Demand-Pull Inflation

i. The Quantity Theory of Money Approach Demand-pull inflation is caused by an increase in the aggregate

According to this approach, it is the increase in the quantity of effective demand for goods and services in the economy. The

money which causes an inflationary rise in the price-level. This effective demand increases due to increased money incomes of

approach looks upon inflation as a purely monetary phenom- the factors of production consequent upon increased invest-

enon. It has been subjected to criticism in recent years: ment in the economy. This demand inflation is marked by a

a. This approach does not adequately explain the considerable rise in commodity and factor prices in the

phenomenon of hyper-inflation which took place in economy. This type of inflation generally arises in thePost-war

Germany in the post-war period. It was the rise in the price- period when people rush up to give vent to their pent-up

level which caused an increase in the supply of money there. demand for goods and services. The demand inflation can be

b. This approach is not applicable to an economy which tackled by the government by curtailing unnecessary demand

suffers from depression and unemployment. through the adoption of monetary and fiscal measures.

An expansion of money in such an economy may not necessar- Cost-Push Inflation

ily result in an inflationary rise in the price-level. An expansion The cost-push inflation is caused by an increase in production

of money supply in such an economy, instead of raising the costs. It is generally caused by two factors: (a) an increase in

price-level, will go to increase output and employment. wages, and (b) an increase in the profit-margins of the

entrepreneurs. The increase in wages may be caused by a

ii. Thee Excess Demand Approach

monopolistic labour union through pressure tactics. This

This approach has been developed in recent years by the

attempt on the part of the trade unions to push up wages

Cambridge economists, particularly Keynes. According to them,

invariably causes cost inflation in the economy. Cost inflation is

Just as the price of any good is determined by the demand for

also caused by an organized attempt on the part of the

and the supply of it, so also the general price-level is determined

industrialists to push up their profit margins. But the profits-

by the total demand for and total supply of the group of

push elements are not so important in causing inflation as the

goods concerned. Thus, according to this approach, inflation is

wage-push elements are. Powerful trade unions get the wages

that situation in which the total demand for goods exceeds the

pushed up even without an equivalent increase in the productiv-

total supply of goods at current prices. The sole cause of

ity of the workers. Under these circumstances, the increase in

inflation, according to this approach, is the existence of a

wages cannot but result in an increase in prices. When cost

persistent excess demand in the economy. This phenomenon

inflation arises in one particular industry, it soon spreads to the

of excess demand can arise in a number of situations, such as,

other factors of economy as well, the reason being that the

Copy Right: Rai University

11.251 51

various sectors of the economy are closely linked with each deftnition depends upon the net disposable income of the

BUSINESS ECONOMY II

other. community. The net disposable income of the community, in

It should be noted that demand inflation and cost inflation are its own turn, is arrived at by subtracting taxation and saving out

not mutually exclusive concepts. Demand inflation, when it of the total money income. Net disposable income = total

once starts, may soon land the economy into cost inflation. An money income taxation saving. Anticipated total expenditure of

increase in the prices of consumer goods is invariably accompa- the community is determined by tbe aggregate consumption,

nied by the demand for higher wages on the part of the investment and government outlays. Thus,total anticipated

workers. The prices of raw materials may also. register a rise expenditure = C + I + G (where, C represents consumption

under the impact of demand inflation. An increase in wages expenditure, I denotes investment expenditure, and G shows

and the prices of raw materials will naturally lead to the government outlays on goods and services).

emergence of cost inflation in, the economy. It is, thus, difficult The real output, on the other hand, is determined by the

to demarcate the line between demand inflation and cost conditions of employment, plus the technological basis of the

inflation. Of the two types of inflations, cost inflation is much economy. The inflationary gap is a situation where the antici-

more difficult to control than demand inflation.. Demand pated expenditure (i.e., the demand for output) exceeds the

inflation can be tackled by adopting various types of monetary available output at pre-inflation prices. It is measured by the

and fiscal measures to mop up surplus purchasing power from difference between the net disposable income on the one hand

the hands of the public, but cost inflation cannot be so easily and the available output on the other.

controlled through monetary and ftscal measures. Any attempt The inflationary gap may develop in the economy like this. To

to cut down wages by the authorities will be met by stiff start with, there is an increase either in private investment or in

resistance on the part of the workers. government outlays. This has the result of raising the money

Students in some lessons I have introduced exercise for practice income of the community to higher levels, but the real output

to enable you to answer in a structural manner.I hope it will of goods and services does not increase because the economy is

help you all. already operating at the point of full employment. The failure

of the economy to raise its output in response to the increase in

Exercise for Practice

the money income results in the emergence of the inflationary

Ex. 1. gap. The inflationary gap is, thus, the result of excess demand

Distinguish between cost-push and demand-pull inflation. in the economy. In other words, the inflationary gap is equal to

Why is it difficult to separate the one from the other? net disposable income minus real output of goods and

services. The inflationary gap has been explained in the Table

Hints:

below which represents the state of affairs in an imaginary

you may point out that it is often difftcult to separate demand-

wartime economy

pull inflation from cost-push inflation. Demand-pull inflation,

when it starts, soon lands the economy into cost-push infla- TABLE (In croses of Rupees)

tion. Demand inflation results in a steep rise in the prices of

Demand side Supply Side

consumer goods. The workers agitate and through concerted

Total Money Income .300 Gross National Product

action get their wages raised. This soon results in increases in

production costs or in cost-push inflation. For a detailed Minus Taxes 50 (at per inflation prices) .270

treatment of this aspect,.} Total Disposal Income ..250 Minus War Expenditure .90

the Keynesian Theory of Inflationary Gap. Minus Saving 50 Available Output for

Inflationary Gap arises when money expands more than in Net Disposable Income 250 Civilian Consumption

proportion to income-earning activity. Explain and suggest the (at pre-inflation prices) .180

necessary measures to bridge any such gap in a developing Hence,Inflationary Gap =200-180 = Rs. 20 crore

economy.

The above Table relates to a wartime economy. There is a clear

Inflationary Gap inflationary gap of Rs. 20 crore in the economy. So long as this

Real inflation, according to Keynes, comes into being only if inflationary gap continues to exist, the price-level shall go on

monetary expansion continues even beyond the point of full rising upwards. But if somehow this inflationary gap of Rs. 20

employment. Then every additional expansion of money Crore is wiped out, there shall be no inflation at all. The

supply shall exert its full effect on prices, raising them to higher government can reduce a part of this inflationary gap by cutting

and higher levels. Keynes tried to explain the phenomenon of down disposable income through taxes. The whole of the gap

inflation in terms of his well-known concept of inflationary gap cannot be wiped out through taxation, because in that case there

in his famous pamphlet entitled How to Pay for the War? The is bound to be tax:resistance and popular unrest. So it is

Keynesian concept of inflationary gap represents the technique advisable to remove the inflationaryc-gap through taxes as well

of statistically measuring the pressure of inflation in the as induced savings. Yet another way to reduce or narrow down

economy. The inflationary gap for the economy, as a whole, may the inflationary gap is to increase the supply of consumer

be deftned in the words of Prof. Kurihara, as an excess of goods. But in wartime, the scope for increasing the supply of

anticipated expenditure over available output at base prices. consumer goods for civilians is rather limited. So the only

The anticipated total expenditure referred to in the above methods available for narrowing down the inflationary gap

Copy Right: Rai University

52 11.251

during wartime are taxes and public borrowings. It should,

BUSINESS ECONOMY II

however, be remembered that the inflationary gap cannot be

completely wiped out during wartime.

Hence, the possibility of inflation is always there in a wartime

economy. The inflationary gap can also arise in a planned

economy where the anticipated expenditure may exceed the total

output of goods and services. Thus, whenever the amount of

disposable income exceeds the volume of output available, an

inflationary gap is bound to arise in the economy. If, on the

contrary, the volume of output exceeds the disposable money

income, then a deflationary gap is bound to emerge, giving rise

to a falling price-level in the economy.higher and higher levels.

Since the economy is already operating at the point of full

employment, the supply of money income increases more

rapidly than the output of goods and services in the economy.

With the expenditure increasing faster than the output of

goods and services, the prices will naturally rise to equate the

increased expenditure with the money value of output at a

higher price-level. The inflationary gap may, therefore, be

defined as the amount by which the monetary demand exceeds

the value of current output at existing .prices. In order to keep

prices constant, the output should be increased by an amount

that is sufficient to absorb the excess demand caused by the

increased government expenditure. The price-level can remain

constant only if the output of goods and services increases

from OMI to OM2. This amount of output is equal to the

excess demand P1N1 caused by the increased government

expenditure. The inflationary gap of P1N1-in the diagram can be

wiped out only if the output of goods and services increases by

M1M2

The concept of inflationary gap is a very useful concept in

economic analysis. It not only measures statistically the pres-

sures of inflation in the economy, it also highlights the nature

and the extent of anti-inflationary measures, both fiscal and

monetary, which the government can adopt to cure the

economy of the malady of inflation. /

The Shrinking Dollar

Inflation: definition

A rise in the general price level

Note that this does not mean that all prices are rising.

Deflation, the opposite of inflation, is a decrease in the

general price level.

Notes -

Copy Right: Rai University

11.251 53

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- SoffoDocument1 pageSoffoChintan ManekNo ratings yet

- Sing Sing Bhujiya Best GujiyaDocument1 pageSing Sing Bhujiya Best GujiyaChintan ManekNo ratings yet

- Lp2005 Full BWDocument24 pagesLp2005 Full BWChintan ManekNo ratings yet

- Java Packages: Packages, A Method of Subdividing A Java Program and Grouping ClassesDocument13 pagesJava Packages: Packages, A Method of Subdividing A Java Program and Grouping ClassesChintan ManekNo ratings yet

- Lecture 23 PDFDocument7 pagesLecture 23 PDFChintan ManekNo ratings yet

- Java Packages: Packages, A Method of Subdividing A Java Program and Grouping ClassesDocument13 pagesJava Packages: Packages, A Method of Subdividing A Java Program and Grouping ClassesChintan ManekNo ratings yet

- Amateurs GMAT Notes 2006Document45 pagesAmateurs GMAT Notes 2006Madhavan SriramNo ratings yet

- Chhiki Chiki Jhangiyo Chiki JahhangiyoDocument1 pageChhiki Chiki Jhangiyo Chiki JahhangiyoChintan ManekNo ratings yet

- New Lit ReviewDocument2 pagesNew Lit ReviewChintan ManekNo ratings yet

- Unix Commands PDFDocument50 pagesUnix Commands PDFChintan ManekNo ratings yet

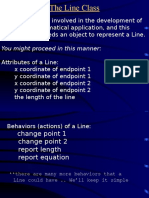

- You Might Proceed in This MannerDocument17 pagesYou Might Proceed in This MannerChintan ManekNo ratings yet

- Object CodeDocument18 pagesObject CodeChintan ManekNo ratings yet

- StringsDocument15 pagesStringsChintan ManekNo ratings yet

- Car Class Constants MPGDocument15 pagesCar Class Constants MPGChintan ManekNo ratings yet

- Inheritance in Java - Understanding Subclassing and PolymorphismDocument6 pagesInheritance in Java - Understanding Subclassing and PolymorphismChintan ManekNo ratings yet

- 06 - Exception HandlingDocument4 pages06 - Exception HandlingChintan ManekNo ratings yet

- 11 Creating ClassesDocument86 pages11 Creating ClassesChintan ManekNo ratings yet

- Designing Multi Designing Multi Designing Multi Designing Multi - Class Programs Class Programs Class Programs Class ProgramsDocument3 pagesDesigning Multi Designing Multi Designing Multi Designing Multi - Class Programs Class Programs Class Programs Class ProgramsChintan ManekNo ratings yet

- If Statement: If (Amount Balance) Balance Balance - AmountDocument39 pagesIf Statement: If (Amount Balance) Balance Balance - AmountChintan ManekNo ratings yet

- ToyotaDocument16 pagesToyotaChintan ManekNo ratings yet

- Amrita (Ob)Document19 pagesAmrita (Ob)Chintan ManekNo ratings yet

- Certificate Course in C.exciseDocument180 pagesCertificate Course in C.exciseKrishna CheediNo ratings yet

- Company/Finance/Balance Sheet Consolidated/4764/Jsw SteelDocument1 pageCompany/Finance/Balance Sheet Consolidated/4764/Jsw SteelChintan ManekNo ratings yet

- FinalDocument53 pagesFinalChintan ManekNo ratings yet

- JSW Steel's Bankers as of 02/02/2010Document1 pageJSW Steel's Bankers as of 02/02/2010Chintan ManekNo ratings yet

- IB2 GRPB L6 Advertising and Promotions - Shandy PohDocument20 pagesIB2 GRPB L6 Advertising and Promotions - Shandy PohChintan ManekNo ratings yet

- Sebi TocDocument33 pagesSebi TocChintan ManekNo ratings yet

- Company/Finance/Balance Sheet Agg./4764/Jsw SteelDocument1 pageCompany/Finance/Balance Sheet Agg./4764/Jsw SteelChintan ManekNo ratings yet

- Application of Marketing Strategies To Re - Launch The ProductDocument39 pagesApplication of Marketing Strategies To Re - Launch The ProductChintan ManekNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial AdministrationDocument322 pagesFinancial AdministrationAbhijit Jadhav91% (57)

- Azra Eco104Document4 pagesAzra Eco104Ashraful Islam Shawon 1813325630No ratings yet

- ReedLawrence W When Money Goes BadDocument107 pagesReedLawrence W When Money Goes BadIo PanNo ratings yet

- Prabhat Patnaik - Global CrisisDocument6 pagesPrabhat Patnaik - Global CrisisJournalism TuitionNo ratings yet

- The Best Strategies For Inflationary TimesDocument32 pagesThe Best Strategies For Inflationary TimesRafael Checa FernándezNo ratings yet

- Group 2 - Group Assignment ECO121Document11 pagesGroup 2 - Group Assignment ECO121Vũ Nhi An100% (2)

- Inflationary & Deflationary GapDocument52 pagesInflationary & Deflationary GapAli Saima100% (2)

- Peronomics, Populism and MMTDocument16 pagesPeronomics, Populism and MMTSkeletorNo ratings yet

- Deloitte - HR Projections Report 2023Document27 pagesDeloitte - HR Projections Report 2023Honey Gupta100% (1)

- Banking SystemDocument108 pagesBanking SystemsbNo ratings yet

- 930c6c98-1b8b-4d29-9b03-e10a3fc5a30bDocument390 pages930c6c98-1b8b-4d29-9b03-e10a3fc5a30bRemigiusz DąbrowskiNo ratings yet

- IRDA Annual Report 2005Document228 pagesIRDA Annual Report 2005Yajur KapoorNo ratings yet

- 1935510212+tofig Dadashov+International FinanceDocument22 pages1935510212+tofig Dadashov+International FinanceTofiq DadashovNo ratings yet

- Macro Economic Policy InstrumentsDocument11 pagesMacro Economic Policy InstrumentsThankachan CJNo ratings yet

- Determinants of Inflation in EthiopiaDocument65 pagesDeterminants of Inflation in Ethiopiagodislove1111100% (1)

- Any Need For Naira Re Denomination NowDocument10 pagesAny Need For Naira Re Denomination NowUtri DianniarNo ratings yet

- AP Macro 2019Document104 pagesAP Macro 2019Bo Zhang100% (2)

- Bm111 (Unit3) NotesDocument14 pagesBm111 (Unit3) NotesMohd asimNo ratings yet

- Inflationary & Deflationary GapDocument6 pagesInflationary & Deflationary GaprosheelNo ratings yet

- s5 Economics - InflationDocument18 pagess5 Economics - InflationHasifa KonsoNo ratings yet

- Vision: All India General Studies Prelims Test Series 2022Document29 pagesVision: All India General Studies Prelims Test Series 2022R EnterprisesNo ratings yet

- Financial Times UK November 25 2022Document27 pagesFinancial Times UK November 25 2022Main DoNo ratings yet

- Case Study On InflationDocument8 pagesCase Study On InflationDrGarima Nitin Sharma50% (2)

- Madura Chapter 5 PDFDocument41 pagesMadura Chapter 5 PDFMahmoud AbdullahNo ratings yet

- Macroeconomics Final ProjectDocument10 pagesMacroeconomics Final ProjectNihanNo ratings yet

- Unit 03Document37 pagesUnit 03Shah Maqsumul Masrur TanviNo ratings yet

- Money The Greatest Hoax On EarthDocument261 pagesMoney The Greatest Hoax On EarthGreg Raven100% (1)

- Redmon James Sarah 1974 Bahamas PDFDocument12 pagesRedmon James Sarah 1974 Bahamas PDFthe missions networkNo ratings yet

- 21 Rev Der PR51Document7 pages21 Rev Der PR51takoNo ratings yet

- UNIT-1 Conceptual FrameworkDocument17 pagesUNIT-1 Conceptual FrameworkKusum JaiswalNo ratings yet