Professional Documents

Culture Documents

Pension Calculation Sheet Sample-Signed

Uploaded by

Thirukumaran VenugopalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pension Calculation Sheet Sample-Signed

Uploaded by

Thirukumaran VenugopalCopyright:

Available Formats

www.ednnet.blogspot.

com

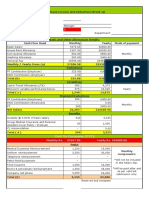

Pension Calculation - Sample Sheet

( G.O. 788 Fin 13.05.1986, 134179 / 91-1 Fin 27.12.1991, 140549/92-4 Fin 02.07.1993 )

(814 Fin 30.09.1994)

1 Name ABC

2 Designation of post from which retired XYZ

3 Department/Office last served PQR

4 Date of Birth 20.09.1942

5 Date of Commencement of service 10.04.1965

Date of Superannuation/ retirements 30.09.2000

6 Rules under which pensionary benefits T.N. Pension Rules

were settled

7 Qualifying Service (See para 3.9 Part III) 30.09.2000

-- 10.04.1965 D M Y

20.05.35

1. Addition to Qualifying Service Nil

2. Period of Service not Qualifying for pension

With reasons not Qualifying Nil

20.05.35

8 Emoluments drawn during the last 10 Scale of pay Rs.4500--125--7000

months and Scale of pay preceding 01.07.1999 Rs.5875+SplPay50+PP50

retirement/superannuation(Pay, Special 01.07.2000 Rs.6000+ " 50+ " 50

pay, D.P.Allowance,Personal pay, D .Pay,

Interim relief)

9 Computation of Average emoluments on 5975 X7 = 41825

which pension is fixed 6100 X3 = 18300

60125

Average Emoluments Rs.6012.50

Pay Last drawn Rs.6100

Pay last drawn being advantageous it has to be adopted Rs.6100

10 i) Total amount of Pension 6100 X 50 / 100 = Rs.3050

ii) Family Pension Admissible

a) Ordinary rate of Family Pension: Pay last 6100 X 30% = Rs.1830

drawn X 30% subject to Min.1275 Max

6570

b) Enhanced rate of Family Pension 50% of pay last drawn and not Nil

exceeding pension admissible on date of retirement Min.1275

Max.6570

11 Details of Commutation of Pension

www.ednnet.blogspot.com

i) Percentage amount of monthly pension commuted 40%

ii) Amount of Commuted value of pension {3050 X 40 / 100} X 10.46 X 12 =

(Age Next birthday 59 years 10.46 Yrs Rs.1,53,135

purchase)

12 Computation of D.C.R.Gratuity Actual Service 35 years

(Emoluments=PAY+D.A) 5 months restricted to

33 years for Gratuity Pay 6100,

D.A.@41%(as on 1.7.2000)

2501=8601

8601 X 16 1/2 = Rs.1,41,917

13 Amount of D.C.R.Gratuity Rs.1,41,917

14 Remarks

You might also like

- Intermediate Acctg 2 - MillanDocument6 pagesIntermediate Acctg 2 - MillanJuliana Ipo100% (1)

- (Answers) 20200915172413prl3 - v1 - 0 - Exercise - Year - End - Federal - 2017 - 0120Document13 pages(Answers) 20200915172413prl3 - v1 - 0 - Exercise - Year - End - Federal - 2017 - 0120Arslan Hafeez100% (1)

- Harrison FA IFRS 11e CH09 SMDocument106 pagesHarrison FA IFRS 11e CH09 SMShako GrdzelidzeNo ratings yet

- Questions & Answers: 2 SalariesDocument26 pagesQuestions & Answers: 2 SalariesSabyasachi Ghosh67% (3)

- E-Payslip SummaryDocument1 pageE-Payslip SummaryRonald MwewaNo ratings yet

- NC-III Bookkeeping Reviewer NC-III Bookkeeping ReviewerDocument34 pagesNC-III Bookkeeping Reviewer NC-III Bookkeeping ReviewerSheila Mae Lira100% (2)

- Kareen Leon, Cpa Page No: - 1 - General JournalDocument4 pagesKareen Leon, Cpa Page No: - 1 - General JournalTayaban Van Gih100% (2)

- How To Calculate PensionDocument5 pagesHow To Calculate PensionEddie GeinNo ratings yet

- PAS 19R Employee Benefits PlansDocument20 pagesPAS 19R Employee Benefits PlansKezNo ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- Calculating Income from Salary and House PropertyDocument9 pagesCalculating Income from Salary and House PropertyArpita Artani100% (1)

- Format PensionDocument4 pagesFormat Pensionsne1971No ratings yet

- Financial and Managerial Accounting 14th Edition Warren Solutions ManualDocument45 pagesFinancial and Managerial Accounting 14th Edition Warren Solutions Manualhildabacvvz100% (25)

- Answer - Alex Rodriguez CaseDocument8 pagesAnswer - Alex Rodriguez CaseNice Dela RocaNo ratings yet

- Solution Manual For Accounting 9th Edition by Charles T Horngren Walter T Harrison JR M Suzanne OliverDocument39 pagesSolution Manual For Accounting 9th Edition by Charles T Horngren Walter T Harrison JR M Suzanne OliverPatriciaCooleyMDkrws100% (33)

- Salary Structure CalculatorDocument7 pagesSalary Structure CalculatorMakesh Gopalakrishnan0% (1)

- Compound Financial Instrument PDFDocument4 pagesCompound Financial Instrument PDFidontcaree123312100% (1)

- M 14 IPCC Taxation Guideline AnswersDocument14 pagesM 14 IPCC Taxation Guideline Answerssantosh barkiNo ratings yet

- Mr. X's taxable income calculation for AY 2020-21Document5 pagesMr. X's taxable income calculation for AY 2020-21Shraddha TiwariNo ratings yet

- Sample Structure 100lpa XII PassDocument1 pageSample Structure 100lpa XII PassKiran IconNo ratings yet

- Monetisation ExerciseDocument3 pagesMonetisation ExerciseMariam Fatima BurhanNo ratings yet

- Pension Calculation-UpdatedDocument3 pagesPension Calculation-UpdatedgcrajasekaranNo ratings yet

- Page Smu/Faculty of Accounting and FinanceDocument11 pagesPage Smu/Faculty of Accounting and Financeሔርሞን ይድነቃቸውNo ratings yet

- NelsonDocument2 pagesNelsonAbid AliNo ratings yet

- CTC Statement Vikram VermaDocument1 pageCTC Statement Vikram VermaVikram VerNo ratings yet

- SCDL - PGDBA - Finance - Sem 4 - TaxationDocument23 pagesSCDL - PGDBA - Finance - Sem 4 - Taxationapi-3762419100% (2)

- 4.3 Solution To Income From Salary - Class Work & Home Assignment QuestionsDocument39 pages4.3 Solution To Income From Salary - Class Work & Home Assignment QuestionsKASHISH GUPTANo ratings yet

- PAYSLIPDocument1 pagePAYSLIPRama AfandiNo ratings yet

- Salary Structure and Benefits - EClerxDocument5 pagesSalary Structure and Benefits - EClerxBhanuNo ratings yet

- Jul_2023Document2 pagesJul_2023NilanjanNo ratings yet

- MTP_10_17_ANSWERS_1694876511Document11 pagesMTP_10_17_ANSWERS_1694876511luvkumar3532No ratings yet

- CTC BreakupDocument2 pagesCTC BreakupbaluNo ratings yet

- Staff Nurse Job Offer DetailsDocument1 pageStaff Nurse Job Offer DetailsKaren SagunNo ratings yet

- RatuDocument1 pageRatubiswajitnandi611No ratings yet

- Solution SalariesDocument16 pagesSolution SalariesAniket AgrawalNo ratings yet

- Step by Step Procedure To Solve Pension ProblemDocument5 pagesStep by Step Procedure To Solve Pension ProblemgcrajasekaranNo ratings yet

- Payslip 75116420200501Document2 pagesPayslip 75116420200501Rudy IskandarNo ratings yet

- Ganga HO Gullu Ram OSDDocument1 pageGanga HO Gullu Ram OSDTao TmaNo ratings yet

- CTC SCM Operations Asset DesignDocument3 pagesCTC SCM Operations Asset DesignShubham AgarwalNo ratings yet

- Case - 1: Click of Calculator WWW - Taxguru.inDocument3 pagesCase - 1: Click of Calculator WWW - Taxguru.inBilla RockNo ratings yet

- MaxsDocument1 pageMaxssushilkumar708No ratings yet

- Health Insurance Premium ReceiptDocument2 pagesHealth Insurance Premium ReceiptprasathNo ratings yet

- 30 SalaryDocument13 pages30 SalaryBahi Rathan RNo ratings yet

- Harrison Fa Ifrs 11e Ch09 SMDocument107 pagesHarrison Fa Ifrs 11e Ch09 SMAshleyNo ratings yet

- Your-Pay-Advice-for-Pay-Ending-30-09-2022Document2 pagesYour-Pay-Advice-for-Pay-Ending-30-09-2022iqbal.shahid0374No ratings yet

- Questions & Answers - Salary IncomeDocument14 pagesQuestions & Answers - Salary IncomeKiran BendeNo ratings yet

- PayslipWithYTDReport MYS FGV A5Document1 pagePayslipWithYTDReport MYS FGV A5Eyrul SyahNo ratings yet

- Additional Illustration-19Document1 pageAdditional Illustration-19Gulneer LambaNo ratings yet

- Appoinment LetterDocument3 pagesAppoinment LetterPrashant KumarNo ratings yet

- Print This PageDocument1 pagePrint This PageTenali ChandanaNo ratings yet

- Pakistan Institute of Public Finance Accountants: Winter Exam-2020Document3 pagesPakistan Institute of Public Finance Accountants: Winter Exam-2020ArifNo ratings yet

- Relief PackageDocument2 pagesRelief PackageMohammad Imran FarooqiNo ratings yet

- Pension Problem For Kalapaka Guys at Accounts Test 1. Years of Service Calculation (YOS)Document5 pagesPension Problem For Kalapaka Guys at Accounts Test 1. Years of Service Calculation (YOS)Boddu ThirupathiNo ratings yet

- Your-Pay-Advice-for-Pay-Ending-30-06-2022Document2 pagesYour-Pay-Advice-for-Pay-Ending-30-06-2022iqbal.shahid0374No ratings yet

- CTC Breakup For SHIBU P SAM - Sr. Quality Intelligence-SpecialistDocument1 pageCTC Breakup For SHIBU P SAM - Sr. Quality Intelligence-Specialistsavita17julyNo ratings yet

- In Class Exercise - Personal TaxDocument3 pagesIn Class Exercise - Personal TaxNur AsnadirahNo ratings yet

- Lecture 13 PensionDocument11 pagesLecture 13 PensionVikas WadmareNo ratings yet

- F1. FIOO.P December 2020Document6 pagesF1. FIOO.P December 2020Laskar REAZNo ratings yet

- Hydrogeology: Paper Ii. Advances in Geological SciencesDocument5 pagesHydrogeology: Paper Ii. Advances in Geological SciencesThirukumaran VenugopalNo ratings yet

- Exam Cell Automation - AbstractDocument17 pagesExam Cell Automation - AbstractThirukumaran VenugopalNo ratings yet

- Stable and Radiogenic IsotopesDocument6 pagesStable and Radiogenic IsotopesThirukumaran VenugopalNo ratings yet

- P-T-T Paths: (Type Text) (Type Text) (Type Text)Document8 pagesP-T-T Paths: (Type Text) (Type Text) (Type Text)Thirukumaran VenugopalNo ratings yet

- Lecture 8 - GranitesDocument10 pagesLecture 8 - GranitesNguyen tiendungNo ratings yet

- Quality Management Gurus TheoriesDocument6 pagesQuality Management Gurus TheoriesSyafiqah RedzwanNo ratings yet

- 10 1 1 112Document18 pages10 1 1 112Dr-Sarjesh LaishramNo ratings yet

- Lecture 8 - GranitesDocument10 pagesLecture 8 - GranitesNguyen tiendungNo ratings yet

- MetallogenyDocument22 pagesMetallogenyThirukumaran VenugopalNo ratings yet

- Story On Mediation - Management TheoryDocument2 pagesStory On Mediation - Management TheoryThirukumaran VenugopalNo ratings yet

- Department of GeologyDocument1 pageDepartment of GeologyThirukumaran VenugopalNo ratings yet

- Income Tax Form For FY-2014-2015 (AY-2015-2016) Ver 2.0-Excel-2007Document8 pagesIncome Tax Form For FY-2014-2015 (AY-2015-2016) Ver 2.0-Excel-2007Thirukumaran VenugopalNo ratings yet

- Annual ReportDocument4 pagesAnnual ReportThirukumaran VenugopalNo ratings yet

- Natural Resources Mapping - BasicsDocument10 pagesNatural Resources Mapping - BasicsThirukumaran VenugopalNo ratings yet

- Ore-Bearing Fluids - Their Origin & Migration: Meteoric WatersDocument2 pagesOre-Bearing Fluids - Their Origin & Migration: Meteoric WatersThirukumaran VenugopalNo ratings yet

- ApartmentsDocument1 pageApartmentsThirukumaran VenugopalNo ratings yet

- Fluid Inclusion AnalysisDocument4 pagesFluid Inclusion AnalysisThirukumaran VenugopalNo ratings yet

- Company Name GisDocument38 pagesCompany Name GisThirukumaran VenugopalNo ratings yet

- 12 Tamilnadu Battalion NCC Training Programme for October 2010Document7 pages12 Tamilnadu Battalion NCC Training Programme for October 2010Thirukumaran VenugopalNo ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Artwork 2010Document44 pagesArtwork 2010Thirukumaran VenugopalNo ratings yet

- GPPB Reso 27-2012Document3 pagesGPPB Reso 27-2012Ax Scribd100% (1)

- Spouses Aggabao V. Parulan, Jr. and Parulan G.R. No. 165803, (September 1, 2010) Doctrine (S)Document9 pagesSpouses Aggabao V. Parulan, Jr. and Parulan G.R. No. 165803, (September 1, 2010) Doctrine (S)RJNo ratings yet

- Fundamentals of Accounting 2 - PrefinalsDocument3 pagesFundamentals of Accounting 2 - PrefinalsCary JaucianNo ratings yet

- Federal ReserveDocument21 pagesFederal ReserveMsKhan0078No ratings yet

- Thesis Writing FinalDocument34 pagesThesis Writing FinalFriends Law ChamberNo ratings yet

- Joseph Showry MBADocument3 pagesJoseph Showry MBAjosephshowryNo ratings yet

- Cost of CapitalDocument68 pagesCost of CapitalJohn Ervin TalagaNo ratings yet

- FCA PBL (2)Document21 pagesFCA PBL (2)ttanishataNo ratings yet

- Chapter 6Document17 pagesChapter 6MM M83% (6)

- Rentberry Whitepaper enDocument59 pagesRentberry Whitepaper enKen Sidharta0% (1)

- Veneracion v. Mancilla (2006)Document2 pagesVeneracion v. Mancilla (2006)Andre Philippe RamosNo ratings yet

- Aptivaa Model ManagementDocument18 pagesAptivaa Model Managementikhan809No ratings yet

- Hindusthan Microfinance provides loans to Mumbai's poorDocument25 pagesHindusthan Microfinance provides loans to Mumbai's poorsunnyNo ratings yet

- SME Credit Scoring Using Social Media DataDocument82 pagesSME Credit Scoring Using Social Media DatadavidNo ratings yet

- Prosper September 2020 Small Business SurveyDocument17 pagesProsper September 2020 Small Business SurveyStuff NewsroomNo ratings yet

- Zillow 2Q22 Shareholders' LetterDocument17 pagesZillow 2Q22 Shareholders' LetterGeekWireNo ratings yet

- Nava Bharat-2013-2014Document180 pagesNava Bharat-2013-2014SUKHSAGAR1969No ratings yet

- Regression Analysis Application in LitigationDocument23 pagesRegression Analysis Application in Litigationkatie farrellNo ratings yet

- Megaworld Corporation Shelf Registration of Up to P30B Debt SecuritiesDocument117 pagesMegaworld Corporation Shelf Registration of Up to P30B Debt SecuritiesEunji eunNo ratings yet

- Revenue Recognition Guide for Telecom OperatorsDocument27 pagesRevenue Recognition Guide for Telecom OperatorsSaurabh MohanNo ratings yet

- Module 5Document3 pagesModule 5RyuddaenNo ratings yet

- Comparison of Equity Mutual FundsDocument29 pagesComparison of Equity Mutual Fundsabhishekbehal5012No ratings yet

- Atria Convergence Technologies Limited, Due Date: 15/11/2021Document2 pagesAtria Convergence Technologies Limited, Due Date: 15/11/2021NaveenKumar S NNo ratings yet

- Grant Thornton Dealtracker H1 2018Document47 pagesGrant Thornton Dealtracker H1 2018AninditaGoldarDuttaNo ratings yet

- Analyze datesDocument31 pagesAnalyze datesHussain AminNo ratings yet

- Sebi Grade A Exam: Paper 2 Questions With SolutionsDocument34 pagesSebi Grade A Exam: Paper 2 Questions With SolutionsnitinNo ratings yet

- VC Case Study SaaS Valuation MultiplesDocument17 pagesVC Case Study SaaS Valuation MultiplesJohn SmithNo ratings yet

- Overview of Working Capital Management and Cash ManagementDocument48 pagesOverview of Working Capital Management and Cash ManagementChrisNo ratings yet