Professional Documents

Culture Documents

Mimimum Wages Act 1948

Uploaded by

Avinash Hariramani0 ratings0% found this document useful (0 votes)

143 views5 pagesPRESENTATION ON MINIMUM WAGES ACT

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPRESENTATION ON MINIMUM WAGES ACT

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

143 views5 pagesMimimum Wages Act 1948

Uploaded by

Avinash HariramaniPRESENTATION ON MINIMUM WAGES ACT

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

MIMIMUM WAGES ACT 1948

-By Avinash Hariramani

80303160043

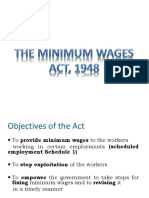

Objectives of the Act

To provide minimum wages to the workers working in

organized sector

To stop exploitation of the workers

To empower the government to take steps for fixing

minimum wages and to revising it in a timely manner

To apply this law on most of the sections in organized

sector (scheduled employment)

Historical Backdrop

The initiative by Shri K.G.R.Choudhary in 1920: set up

boards for determination of wages

The International Labour Conference adopted

convention 26 and 30 in 1928 relating to wage fixing

machinery in trades or parts of trades

A Minimum Wages Bill was introduced in the Central

Legislative Assembly on 11.4.46 and came into force with

effect from 15.3.48

The Committee on Fair Wage was set up in 1948 to

provide guidelines for wage structure

Broad Features of the Act

[Sec 3]: The Act lays down the principles for fixation of

A minimum time rate of wages

A minimum piece rate

A guaranteed time rate

An overtime rate for different occupations, localities

or classes of work and for adults, adolescents, children

and apprentices

[Sec 4]: The minimum wages may consist of

A basic rate of wages and a cost of living of

allowances

A basic rate of wages with or without the cost of

living allowance and the cash value of the concessions

in respect of essential commodities supplied at

concessional rates

Short Title and Extent [Sec. 1]

This Act, the Minimum Wages Act, 1948 extends to the

whole of India

This Act may be called the Minimum Wages Act, 1948

How Does It Going To Benefit

An Act to provide for fixing minimum rates of wages in certain

employments.

WHEREAS it is expedient to provide for fixing minimum rates of

wages in certain employments;

An Act to provide for certain benefits to employees in case of

sickness, maternity and "employment injury" and to make

provision for certain other matters in relation thereto

WHEREAS it is expedient to provide for certain benefits to

employees in case of sickness, maternity and employment injury

and to make provision for certain other matters in relation thereto

The minimum rate of wages may consist of:

a) A basic rate of wages and a cost of living allowance or

b) A basic rate of wages with or without the cost of living

allowance and the cash value of the concessions in respect of

essential commodities supplied at concessional rates.

c) The act lays down that wages shall be paid in cash although it

empowers the appropriate government to authorize the payment

of minimum wages either wholly or partly in kind in particular

cases.

d) It provides that the cost of living allowance and cash value of

the concessions in respect of supplies of essential commodities at

concessional rates shall be computed by component authority at

certain interval.

e) The act empowers the appropriate government to fix the

number of hours of work per day, to provide for a weekly holiday

and the payment of overtime wages of which minimum rates of

wages have been fixed under the act.

f) The act lays down for appointment of inspectors and other

authorities to hear and decide claims arising out of payment of

wages at less than the minimum rates of wages or remuneration

for days of rest of work done on such days or of overtime wages.

g) All establishments covered by the act are required to maintain

registers and office records in the prescribe manner

h) The act provides the procedure for dealing with complaints

arising out of the violation of the provisions of the act and for

imposing penalties for offences under the act.

DEFECTS IN THE LAW

A minimum wage is a legal minimum for workers. It means

workers are guaranteed a certain hourly pay helping to reduce

relative poverty. However, a minimum wage could have potential

defects:

1. Unemployment. If labour markets are competitive a minimum

wage could cause unemployment because firms will demand less

labour, and higher wages may encourage more workers to supply

their labour.

Firms in labour intensive industries will be most affected. For

example, hairdressers and cleaning companies will see a

proportionately bigger increase in their wage bill.

2. Cost Push Inflation. A minimum wages can cause cost push

inflation. This is because firms face an increase in costs which are

likely to be passed on to consumers. This is even more likely if

wage differentials are maintained.

3. Black Market. A minimum wage may increase the number of

people working on the black market so firms can avoid paying the

legal minimum.

4. Poorest dont benefit. A limitation of the minimum wage is

that it doesnt increase the incomes of the lowest income groups.

This is because the poorest have to rely on benefits and are

therefore not affected by minimum wages.

5. Limited Impact on Relative Poverty. Many who benefit

from the minimum wage are second income earners and therefore

the household is unlikely to be below the poverty line. A

household with a single income earner just above the min wage is

likely to be relatively poorer. But, they will not benefit from the

minimum wage.

SUGGESTIONS:

The effect of a min wage on unemployment is uncertain, the

structure of the labour market is very important. E.g. if the labour

market is a monopsony, a minimum wage may not cause

unemployment.

Empirical evidence from the US and the UK suggests that a

moderate increase in the minimum wage doesnt cause a fall in

employment. Therefore the key question is how high the

minimum wage can rise before causing unemployment.

The impact of a minimum wage wage differentials is

important. For example, skilled workers just above the minimum

wage may feel they deserve more. However, increasing the

minimum wage tends to have limited impacts on wage

differentials.

There may be a good case for a regional minimum wage

because actual wages tend to be lower in the north than the

south. In London, very few workers benefit from the minimum

wage and in this region the minimum wage could increase.

You might also like

- FHA Financing AddendumDocument2 pagesFHA Financing AddendumRon SimentonNo ratings yet

- Minimum Wage ActDocument9 pagesMinimum Wage ActJitendra RavalNo ratings yet

- Notes Labour Law IIDocument43 pagesNotes Labour Law IIChaudharybana92% (13)

- Minimum Wages Act 1948Document35 pagesMinimum Wages Act 1948charvinNo ratings yet

- Minimum Wages Act, 1948 PDFDocument18 pagesMinimum Wages Act, 1948 PDFPankaj BhanwraNo ratings yet

- T1 General PDFDocument4 pagesT1 General PDFbatmanbittuNo ratings yet

- Factories Act 1948Document3 pagesFactories Act 1948Sharmila SubramanianNo ratings yet

- Payment of Bonus ActDocument7 pagesPayment of Bonus Actarihant_219160175100% (1)

- Analysis - Code of Wages, 2019Document8 pagesAnalysis - Code of Wages, 2019Nikhil JainNo ratings yet

- What Is Public Choice Theory PDFDocument8 pagesWhat Is Public Choice Theory PDFSita SivalingamNo ratings yet

- Butler Lumber Company: An Analysis On Estimating Funds RequirementsDocument17 pagesButler Lumber Company: An Analysis On Estimating Funds Requirementssi ranNo ratings yet

- Labour Legislation in IndiaDocument61 pagesLabour Legislation in Indiapentahuse5No ratings yet

- Payment of Bonus Act, 1965Document17 pagesPayment of Bonus Act, 1965Milani NarulaNo ratings yet

- Industrial Employment (Standing Orders) Act 1946Document17 pagesIndustrial Employment (Standing Orders) Act 1946supriyanairNo ratings yet

- Labour Laws (Notes For Exam)Document53 pagesLabour Laws (Notes For Exam)Niyati KhullarNo ratings yet

- Uber MarketingDocument23 pagesUber MarketingKavya SathishNo ratings yet

- Minimum Wages Act 1948Document33 pagesMinimum Wages Act 1948Jaison S RozarioNo ratings yet

- Minimum Wages Act, 1948Document4 pagesMinimum Wages Act, 1948RIYA AGRAWAL0% (1)

- The Minimum Wages Act NewDocument8 pagesThe Minimum Wages Act NewMehr MunjalNo ratings yet

- Istinction/ Difference Between Minimum Wages and Fair WagesDocument3 pagesIstinction/ Difference Between Minimum Wages and Fair Wagesnitish kumar twariNo ratings yet

- The Payment of Bonus ActDocument10 pagesThe Payment of Bonus Actshanky631No ratings yet

- A Presentation On The Occupational Safety, Health and Working Conditions Code, 2020 - ImportantDocument12 pagesA Presentation On The Occupational Safety, Health and Working Conditions Code, 2020 - Importantkavyashreemb100% (1)

- Payment of Wages Act 1936Document2 pagesPayment of Wages Act 1936Rajendra Kumar100% (1)

- Social Security in IndiaDocument15 pagesSocial Security in IndiadranshulitrivediNo ratings yet

- The Code On Social SecurityDocument11 pagesThe Code On Social Securityabdul gani khanNo ratings yet

- The Payment of Gratuity Act 1972Document36 pagesThe Payment of Gratuity Act 1972Prema LathaNo ratings yet

- Code On Wage 2019Document27 pagesCode On Wage 2019Kumaar utsav100% (1)

- Social Security System in IndiaDocument28 pagesSocial Security System in Indiavaibhav chauhanNo ratings yet

- Social Security in IndiaDocument38 pagesSocial Security in IndiaSourav BhattacharjeeNo ratings yet

- ILO Impct IndiaDocument28 pagesILO Impct IndiaMahesh KumarNo ratings yet

- Wage ActDocument1 pageWage ActShumayla KhanNo ratings yet

- Provident Fund Act Summary NotesDocument8 pagesProvident Fund Act Summary Notesshanky631No ratings yet

- Code On Social Security, 2020Document11 pagesCode On Social Security, 2020Abdul Hudaif100% (1)

- Dr. Meeta JoshiDocument33 pagesDr. Meeta JoshiKarunya RamasamyNo ratings yet

- Industrial Disputes - AdjudicationDocument19 pagesIndustrial Disputes - AdjudicationMbaStudent56No ratings yet

- Memorandum of AssociationDocument48 pagesMemorandum of AssociationPrabhjot Kaur100% (2)

- The Cyber Regulations Appellate TribunalDocument17 pagesThe Cyber Regulations Appellate TribunalTaher Rangwala100% (2)

- On ESI & PFDocument31 pagesOn ESI & PFvipin H50% (4)

- Labour Notes (Self Made)Document43 pagesLabour Notes (Self Made)ZxyerithNo ratings yet

- Adr AssignmentDocument6 pagesAdr Assignmentrashmi gargNo ratings yet

- The History of The Companies Law in IndiaDocument10 pagesThe History of The Companies Law in Indiaakula11130% (10)

- PF Fund PPT NewDocument25 pagesPF Fund PPT NewTaniya ThakkarNo ratings yet

- A Research Paper On: Arbitration Law in India: Development and Critical AnalysisDocument31 pagesA Research Paper On: Arbitration Law in India: Development and Critical AnalysisMríñålÀryäñNo ratings yet

- LC Legal Feed Annual Edition 2021Document59 pagesLC Legal Feed Annual Edition 2021vishal rajputNo ratings yet

- Module V Social Security ConceptDocument13 pagesModule V Social Security ConceptnikitaNo ratings yet

- On "Employee's State Insurance Act 1948" of India.Document20 pagesOn "Employee's State Insurance Act 1948" of India.Anshu Shekhar SinghNo ratings yet

- Industrial Dispute Act1947Document29 pagesIndustrial Dispute Act1947shanmugapriyaNo ratings yet

- Legality of ObjectDocument23 pagesLegality of Objectrashpinder singhNo ratings yet

- Code of Wages Act 2019Document9 pagesCode of Wages Act 2019Suhasini JNo ratings yet

- The Trade Unions Act, 1926Document3 pagesThe Trade Unions Act, 1926GauriNo ratings yet

- Minimum Wages ActDocument52 pagesMinimum Wages Actanilkanwar111No ratings yet

- CanonsDocument2 pagesCanonsonprocessNo ratings yet

- Industrial Dispute PresentationDocument67 pagesIndustrial Dispute PresentationTanya VermaNo ratings yet

- New Labour Code - Highlights - by Dr. B.GiasuddinDocument13 pagesNew Labour Code - Highlights - by Dr. B.GiasuddinKinanti PurwitasariNo ratings yet

- Social Code in IndiaDocument26 pagesSocial Code in Indiaaslam shaNo ratings yet

- Dissertation On Idr and AdrDocument112 pagesDissertation On Idr and AdrAbhay KumarNo ratings yet

- Employees Provident Fund Act 1952Document43 pagesEmployees Provident Fund Act 1952Manojkumar MohanasundramNo ratings yet

- Types of WagesDocument5 pagesTypes of WagesAhniejhei DhizinueveNo ratings yet

- The Workmen's Compensation Act 1923Document21 pagesThe Workmen's Compensation Act 1923aman26kaurNo ratings yet

- Fair Wage: Meaning and ConceptDocument11 pagesFair Wage: Meaning and ConceptVishal SinghNo ratings yet

- The Code On Wages 2019Document7 pagesThe Code On Wages 2019Astha Ahuja100% (1)

- Code On Wages, 2019Document8 pagesCode On Wages, 2019CHANDA SINGHNo ratings yet

- Trade Secret Protection in IndiaDocument22 pagesTrade Secret Protection in Indiabrainleague100% (1)

- Tax, Taxation& Canon of Taxation (Slide)Document13 pagesTax, Taxation& Canon of Taxation (Slide)isanNo ratings yet

- Coas b1 AcksDocument1 pageCoas b1 AcksSanah KhanNo ratings yet

- Assignment 2-3 ContempDocument2 pagesAssignment 2-3 ContempMARK JAMES BAUTISTANo ratings yet

- Maruti CaseDocument5 pagesMaruti CaseBishwadeep Purkayastha100% (1)

- ESSAY01 - Advantages and Disadvantages of GlobalizationDocument5 pagesESSAY01 - Advantages and Disadvantages of GlobalizationJelo ArtozaNo ratings yet

- Kultura NG TsinaDocument5 pagesKultura NG TsinaJeaniel amponNo ratings yet

- International Management+QuestionsDocument4 pagesInternational Management+QuestionsAli Arnaouti100% (1)

- PMC RFP Document PDFDocument112 pagesPMC RFP Document PDFHarleen SehgalNo ratings yet

- List of FPOs in The State OfTelanganaDocument5 pagesList of FPOs in The State OfTelanganakkk0019No ratings yet

- Atienza v. de CastroDocument3 pagesAtienza v. de CastroAprilMartelNo ratings yet

- DTH IndustryDocument37 pagesDTH IndustrySudip Vyas100% (1)

- Test Bank For Entrepreneurship The Art Science and Process For Success 3rd Edition Charles Bamford Garry BrutonDocument15 pagesTest Bank For Entrepreneurship The Art Science and Process For Success 3rd Edition Charles Bamford Garry Brutonsaleburrock1srNo ratings yet

- List of Important International Organizations and Their Headquarter 2017Document6 pagesList of Important International Organizations and Their Headquarter 2017Kalaivani BaskarNo ratings yet

- Global Strategic Planning: ObjectivesDocument4 pagesGlobal Strategic Planning: ObjectivesHitesh GevariyaNo ratings yet

- Marketing Strategy An OverviewDocument13 pagesMarketing Strategy An OverviewRobin PalanNo ratings yet

- Strategic Plan DRAFTVolunteerDocument85 pagesStrategic Plan DRAFTVolunteerLourdes SusaetaNo ratings yet

- Indian Economic Social History Review-1979-Henningham-53-75Document24 pagesIndian Economic Social History Review-1979-Henningham-53-75Dipankar MishraNo ratings yet

- IET Educational (Xiao-Ping Zhang)Document17 pagesIET Educational (Xiao-Ping Zhang)Mayita ContrerasNo ratings yet

- SCHOOLDocument18 pagesSCHOOLStephani Cris Vallejos Bonite100% (1)

- Answer Sheet Gen Math Mod 9Document6 pagesAnswer Sheet Gen Math Mod 9ahlsy CazopiNo ratings yet

- MNCDocument25 pagesMNCPiyush SoniNo ratings yet

- Boat Bassheads 100 Wired Headset: Grand Total 439.00Document1 pageBoat Bassheads 100 Wired Headset: Grand Total 439.00Somsubhra GangulyNo ratings yet

- Certificate - BG. MARINE POWER 3028 - TB. KIETRANS 23Document3 pagesCertificate - BG. MARINE POWER 3028 - TB. KIETRANS 23Habibie MikhailNo ratings yet

- 19, Cabaltica, Ednalyn A. What Is The Basel Committee?Document3 pages19, Cabaltica, Ednalyn A. What Is The Basel Committee?chenlyNo ratings yet

- Guc 57 56 21578 2022-06-21T23 25 51Document3 pagesGuc 57 56 21578 2022-06-21T23 25 51Mariam MhamoudNo ratings yet

- Foreign Trade: Ricardian ModelDocument11 pagesForeign Trade: Ricardian Modelellenam23No ratings yet