Professional Documents

Culture Documents

Team 10

Uploaded by

api-314570886Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Team 10

Uploaded by

api-314570886Copyright:

Available Formats

Name(s)

Common Data Spreadsheet

ACC 240 Budget Project Spring 2017

You have just been hired as a new management trainee by Tasers, Inc. a wholesaler of tasers selling

only to a variety of law enforcement agencies across the U.S.

In the past, the company has done very little in the way of budgeting and at certain times the year

has experienced a cash shortage.

Because you are well trained in budgeting as a result of your having taken ACC 240 at Nichols College,

you have decided to prepare comprehensive budgets for the upcoming second quarter to show management

the benefits that can be realized from an integrated budgeting program. To this end, you have worked

with accounting and other areas of the company to gather the information presented below.

The company sell many styles of taser but they all currently sell at wholesale for $ 300 each

Actual unit sales for the last three months and budgeted sales for the next six months are:

Units Basis Units Basis

April 20000 actual September 75000 budget

May 18000 actual October 60000 budget

June 15000 actual November 55000 budget

July 75000 budget December 50000 budget

August 80000 budget

Sales pick up after June 30 government agencies' new budget for the fiscal year kicks in.

Sufficient inventory needs to be on hand at the end of each month and that is determined

to be 40% of next month's sales.

The cost of each taser from the manufacturer is $ 150 per unit. Purchases in any month

are paid 50% in the month of purchase and 50% in the following month. All sales are on account

n/30 but experience shows customers on average pay as follows:

Month of sale 30%

Month following sale 60%

Second month following sale 10% Tasers, Inc.

Bad debts are negligible. Balance Sheet

30-Jun-15

Monthly operating expenses are as follows:

Cash 250,000

Variable: Accounts receivable 4,497,900

Sales commissions 4% of sales Inventory 5,100,000

Patents (not amortized) 3,000

Fixed: $ Property and equipment (net) 950,000

Advertising $ 500,000 Total assets 10,800,900

Rent $ 72,000

Salaries $ 1,060,000 plus 10% of sales Accounts payable (for product purchases) 5,220,000

Utilities $ 7,000 Dividends payable 25,000

Insurance $ 10,000 Common Stock 2,000,000

Depreciation $ 14,000 Retained earnings 3,555,900

Total liabilities and stockholders' equity 10,800,900

The company plans to make equipment purchases this year as follows: Other information:

$ The company desires to maintain a minimum cash balance of $ 250,000

August $ 100,000 All borrowings are made at the beginning of the month and repaid at the end of the month.

November $ 100,000 The interest rate charged by the bank is 8% per annum.

Repayments of principal plus accrued interest will occur in the month when the entire amount

The company declares a dividend at the end of each quarter payable in the first month of the owed (plus interest) can be repaid. Any interest unpaid at the end of a quarter must be accrued

of the following quarter of $25,000 and the related expense and liability reported appropriately. Any principal amount owing to

the bank at the end of the quarter will be reported as notes payable on the balance sheet.

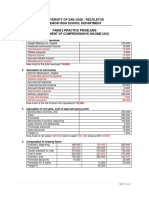

Sales Budget Budgeted Cash Disbursements for Merchandise Purchases

July August September Quarter July August September Quarter

Budgeted unit sales 75,000 80,000 75,000 230,000 Accounts payable $ 5,220,000 5,220,000

Selling price per unit $300 $300 $300 $300 July purchases 5,475,000 5,475,000 10,950,000

Total sales $ 22,500,000 24,000,000 22,500,000 69,000,000 August purchases 5,850,000 5,850,000 11,700,000

September purchases 5,175,000 5,175,000

Schedule of Expected Cash Collections Total cash payments $ 10,695,000 11,325,000 11,025,000 33,045,000

Cash from: July August September Quarter

May sales 5,400,000 $ 540,000 540,000 Cash Budget

June sales 4,500,000 2,700,000 450,000 3,150,000 July August September Quarter

July Sales 6,750,000 13,500,000 2,250,000 22,500,000 Beginning cash balance $ 250,000 250,000 4,966,000 250,000

August sales 7,200,000 14,400,000 21,600,000 Add collections from customers 9,990,000 21,150,000 23,400,000 54,540,000

September sales 6,750,000 6,750,000 Total cash available 10,240,000 21,400,000 28,366,000 54,790,000

Total cash collections $ 9,990,000 21,150,000 23,400,000 54,540,000 Lee: cash disbursements

Merchandise purchases 10,695,000 11,325,000 11,025,000 33,045,000

Merchandise Purchases Budget Advertising 500,000 500,000 500,000 1,500,000

July August September Quarter Rent 72,000 72,000 72,000 216,000

Budgeted unit sales 75,000 80,000 75,000 230,000 Salaries 3,310,000 3,460,000 3,310,000 10,080,000

Add: desired ending inventory 32,000 30,000 24,000 86,000 Commissions 900,000 960,000 900,000 2,760,000

Total needs 107,000 110,000 99,000 316,000 Utilities 7,000 7,000 7,000 21,000

Less: Beginning merchandise inventory 6/30/2015 34,000 32,000 30,000 96,000 Insurance 10,000 10,000 10,000 30,000

Required purchases 73,000 78,000 69,000 220,000 Equipment purchases 100,000 100,000

Unit cost $ 150 150 150 150 Dividends paid 25,000 25,000

Required dollar purchases $ 10,950,000 11,700,000 10,350,000 33,000,000 Total cash disbursements 15,519,000 16,434,000 15,824,000 47,777,000

Excess cash available over disbursements (5,279,000) 4,966,000 12,542,000 7,013,000

Financing:

Borrowings 5,529,000 5,529,000

Repayments (5,529,000) (5,529,000)

Interest (110,580) (110,580)

Total financing 5,529,000 0 (5,639,580) (110,580)

Ending cash balance $ 250,000 4,966,000 6,902,420 6,902,420

Tasers, Inc. Tasers, Inc.

Budgeted Income Statement Balance Sheet

For the quarter ending 9/30/2015 9/30/2015

Sales $ 69,000,000 Assets

Variable expenses:

Cost of goods sold 34,500,000 Cash $ 6,902,420

Salaries 6,900,000 Accounts receivable 18,957,900

Commissions 2,760,000 44,160,000 Inventory 3,600,000

Patents 3,000

Contribution margin 24,840,000 Property and equipment (net) 1,008,000

Fixed expenses: Total assets $ 30,471,320

Advertising 1,500,000

Rent 216,000 Liabilities and Stockholders' Equity

Salaries 10,080,000

Utilities 21,000 Accounts payable (for product purchases) $ 5,175,000

Insurance 30,000 Dividends payable 25,000

Depreciation 42,000 Common Stock 2,000,000

11,889,000 Retained earnings 16,371,320

Net operating income (EBIT) 12,951,000 Total liabilities and stockholders' equity $ 23,571,320

Interest expense (110,580)

Earnings before taxes (EBT) $ 12,840,420

You might also like

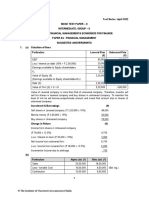

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- Week15 - Fundamentals of AccountingDocument5 pagesWeek15 - Fundamentals of AccountingShiene MedrianoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Installment SalesDocument12 pagesInstallment SalesRusselle Therese DaitolNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Stephensonrealestaterecapitalizationcompiled 130418215434 Phpapp01Document29 pagesStephensonrealestaterecapitalizationcompiled 130418215434 Phpapp01atul parad100% (2)

- Lecture Notes Employee Benefits: Page 1 of 16Document16 pagesLecture Notes Employee Benefits: Page 1 of 16fastslowerNo ratings yet

- Unit 5 - Management AccountingDocument37 pagesUnit 5 - Management Accountingdangthanhhd79100% (4)

- Financial Analysis May Be Used To Test TheDocument8 pagesFinancial Analysis May Be Used To Test TheJohnAllenMarilla100% (1)

- Quiz 2 KeysDocument15 pagesQuiz 2 KeysLeslieCastro100% (1)

- Sample FinancialDocument35 pagesSample Financialhaznawi100% (1)

- Week 6 Module 5 Analysis and Interpretation of Financial StatementsDocument31 pagesWeek 6 Module 5 Analysis and Interpretation of Financial StatementsZed Mercy86% (14)

- Chapter 19 Borrowing CostsDocument22 pagesChapter 19 Borrowing Costsmariel evangelistaNo ratings yet

- Final AccountDocument7 pagesFinal Accountswati100% (3)

- CHAPTER 1-Cash and Cash EquivalentsDocument43 pagesCHAPTER 1-Cash and Cash EquivalentsMarriel Fate CullanoNo ratings yet

- Cory and Tisha Dumont CaseDocument17 pagesCory and Tisha Dumont Caseapi-31457088675% (4)

- Asset ManagementDocument7 pagesAsset ManagementDrims MgNo ratings yet

- Termeni Contabili in EnglezaDocument11 pagesTermeni Contabili in EnglezaCrisan AnamariaNo ratings yet

- FSA Vertical FormatDocument10 pagesFSA Vertical FormatMayank BahetiNo ratings yet

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Jawaban Soal - Vita Nur AryatiDocument4 pagesJawaban Soal - Vita Nur AryatiVita Nur AryatiNo ratings yet

- CBSE Class 12 Accountancy Accounting Ratios WorksheetDocument3 pagesCBSE Class 12 Accountancy Accounting Ratios WorksheetJenneil CarmichaelNo ratings yet

- Problems On Sole PropritersDocument10 pagesProblems On Sole PropritersMouly ChopraNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Corporate Taxes Part 1 (VAT, EWT and Income Tax) CaseDocument4 pagesCorporate Taxes Part 1 (VAT, EWT and Income Tax) CaseMikaela L. RoqueNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- UV0806 North Mountain Nursery, Inc - Statement of Cahs FlowDocument3 pagesUV0806 North Mountain Nursery, Inc - Statement of Cahs Flowpaocvl892No ratings yet

- Budgeting OnlineDocument4 pagesBudgeting OnlineSoumendra RoyNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- 02 Edu91 FM Practice Sheets QuestionsDocument77 pages02 Edu91 FM Practice Sheets Questionsprince soniNo ratings yet

- (C) San Antonio Home Furnishings Company-1Document3 pages(C) San Antonio Home Furnishings Company-1Mark OteroNo ratings yet

- MA Sem-4 2018-2019Document23 pagesMA Sem-4 2018-2019Akki GalaNo ratings yet

- Chapter 5 Amalgamtion of Companies HandoutsDocument7 pagesChapter 5 Amalgamtion of Companies Handoutsvikax90927No ratings yet

- PA Biweekly5 G1Document3 pagesPA Biweekly5 G1Quang NguyenNo ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- Accountancy Answer Key - II Puc Annual Exam March 2019Document8 pagesAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNo ratings yet

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- EC 1 - Acctg Cycle Part 2 Sample ProblemsDocument1 pageEC 1 - Acctg Cycle Part 2 Sample ProblemsChelay EscarezNo ratings yet

- Less: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaDocument16 pagesLess: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaGao YungNo ratings yet

- Paper 1Document19 pagesPaper 1GianNo ratings yet

- Managerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Document5 pagesManagerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Miral AqelNo ratings yet

- CA Inter FM Super 50 Q by Sanjay Saraf SirDocument129 pagesCA Inter FM Super 50 Q by Sanjay Saraf SirSaroj AdhikariNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- 3405 24654 Textbooksolution PDFDocument36 pages3405 24654 Textbooksolution PDFManoharNo ratings yet

- Statement of Profit or Loss For The Year Ended 31 December 2016Document2 pagesStatement of Profit or Loss For The Year Ended 31 December 2016Plawan GhimireNo ratings yet

- 5 6294322980864393322Document10 pages5 6294322980864393322CharlesNo ratings yet

- Accounting 1 - Part 2Document18 pagesAccounting 1 - Part 2Jessica ManuelNo ratings yet

- CSEC Accounting Formats and TemplatesDocument15 pagesCSEC Accounting Formats and TemplatesRealGenius (Carl)No ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Lecture Notes - Financial Statement AnalysisDocument56 pagesLecture Notes - Financial Statement AnalysisRajnishKumarRohatgiNo ratings yet

- Financial PlanningDocument6 pagesFinancial Planningakimasa raizeNo ratings yet

- 162 PresummativeDocument5 pages162 PresummativeMeichigo SwadeeNo ratings yet

- Review of The Accounting ProcessDocument17 pagesReview of The Accounting ProcessLucy UnNo ratings yet

- Chapter # 03 ProblemsDocument99 pagesChapter # 03 Problemsruman mahmoodNo ratings yet

- FABM1 11 Quarter 4 Week 6 Las 3Document4 pagesFABM1 11 Quarter 4 Week 6 Las 3Janna PleteNo ratings yet

- Acc 1 - Financial Accounting and Reporting QUIZ NO. 15 - Accounting Cycle of A Merchandising Business (Application)Document1 pageAcc 1 - Financial Accounting and Reporting QUIZ NO. 15 - Accounting Cycle of A Merchandising Business (Application)nicole bancoroNo ratings yet

- Seatwork 5: Application A. Owner's EquityDocument7 pagesSeatwork 5: Application A. Owner's EquityAngela GarciaNo ratings yet

- DIY LiquidationDocument27 pagesDIY LiquidationJOYCE C ANDADORNo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- AnsweredASS16 AccountingDocument6 pagesAnsweredASS16 Accountingvomawew647No ratings yet

- Completing The Acctg CycleDocument14 pagesCompleting The Acctg CycleHearty Hitutua100% (1)

- Ratio Analysis (Divya Jadi Booti)Document85 pagesRatio Analysis (Divya Jadi Booti)Michael AdhikariNo ratings yet

- Bba 2 Sem Financial and Management Accounting Compulsory 5549 Summer 2019Document5 pagesBba 2 Sem Financial and Management Accounting Compulsory 5549 Summer 2019Nikkie pieNo ratings yet

- Accn 101 Assignment Group WorkDocument8 pagesAccn 101 Assignment Group WorkkumbiraidavidNo ratings yet

- Schedule 3Document8 pagesSchedule 3Hilary GaureaNo ratings yet

- By of 3,750: AccountDocument6 pagesBy of 3,750: AccountAravind ShekharNo ratings yet

- POF Class Activity - 1Document1 pagePOF Class Activity - 1Muhammad MansoorNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisJoy ConsigeneNo ratings yet

- Question Bank - Financial Reporting and AnalysisDocument8 pagesQuestion Bank - Financial Reporting and AnalysisSagar BhandareNo ratings yet

- Brien G. Thompson: ProfileDocument1 pageBrien G. Thompson: Profileapi-314570886No ratings yet

- FinalDocument7 pagesFinalapi-314570886No ratings yet

- Exam 3Document3 pagesExam 3api-314570886No ratings yet

- Business Plan VineethDocument13 pagesBusiness Plan VineethMuhammad Aslam C50% (2)

- Topic 1: Introduction To Business/Corporate FinanceDocument22 pagesTopic 1: Introduction To Business/Corporate FinanceyvonnepangestuNo ratings yet

- MFRS 139 ReceivableDocument62 pagesMFRS 139 ReceivableRAUDAHNo ratings yet

- Case Study 1Document6 pagesCase Study 1Narendra VaidyaNo ratings yet

- Pas 16 - Property, Plant, & Equipment: Conceptual Framework and Accounting StandardsDocument5 pagesPas 16 - Property, Plant, & Equipment: Conceptual Framework and Accounting StandardsMeg sharkNo ratings yet

- Ifrs 8 and Ias 34-Operating Segments & Interim ReportingDocument46 pagesIfrs 8 and Ias 34-Operating Segments & Interim Reportingesulawyer2001No ratings yet

- Valuation of Inventories: Accounting Standard (AS) 2Document8 pagesValuation of Inventories: Accounting Standard (AS) 2psrikanthmbaNo ratings yet

- Accounting System PDFDocument122 pagesAccounting System PDFmanoj100% (1)

- Top 100 Questions of AccountsDocument75 pagesTop 100 Questions of Accountschauhanthakur554No ratings yet

- IntaccDocument13 pagesIntaccMelita CarriedoNo ratings yet

- PFRS 6 Exploration For and Evaluation of Mineral Resources With IllustrationsDocument31 pagesPFRS 6 Exploration For and Evaluation of Mineral Resources With IllustrationsHannah TaduranNo ratings yet

- Reviewer in AccountingDocument22 pagesReviewer in AccountingMIKASANo ratings yet

- MFRS - 116 PpeDocument26 pagesMFRS - 116 PpeJeevajothy Satchithanandan100% (3)

- Financial Report Over 5 Years Of: Vinamilk CompanyDocument30 pagesFinancial Report Over 5 Years Of: Vinamilk CompanyThảo PhạmNo ratings yet

- Accounting For LeassesDocument122 pagesAccounting For LeassesIntan ParamithaNo ratings yet

- Chapter 1 - 4Document27 pagesChapter 1 - 4Joyce Dela CruzNo ratings yet

- Zimplow FY 2012Document2 pagesZimplow FY 2012Kristi DuranNo ratings yet

- AccountsDocument135 pagesAccountsChinnam LalithaNo ratings yet

- 1915103-Accounting For ManagementDocument22 pages1915103-Accounting For Managementmercy santhiyaguNo ratings yet

- MarketingStrategyChapter04 2.4Document48 pagesMarketingStrategyChapter04 2.4Heartowner PrinceNo ratings yet