Professional Documents

Culture Documents

Hydrogen Expense Form

Uploaded by

Tim ClarkeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hydrogen Expense Form

Uploaded by

Tim ClarkeCopyright:

Available Formats

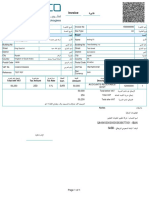

All expenses should be entered net of VAT. The Enter VAT amount.

If price has no VAT

VAT exclusive total should be entered on your included enter 0.

Contractor invoice , with VAT charged on your full invoice

Cost Centre Company Code Month of Claim Year of Claim amount.

Company/Name

Telephone

Email

Dept / Location Number

Other Expenses - Description

Additional No. of

Project Code /

Date of expense Details of cost Reciept no

Activity Code

Company business Subsistence Fares Car Parking Hotel Total VAT Total including VAT

Code miles

1 0.00 0.00 0.00

2 0.00 0.00 0.00

3 0.00 0.00 0.00

4 0.00 0.00 0.00

5 0.00 0.00 0.00

6 0.00 0.00 0.00

7 0.00 0.00 0.00

8 0.00 0.00 0.00

9 0.00 0.00 0.00

10 0.00 0.00 0.00

12 0.00 0.00 0.00

13 0.00 0.00 0.00

14 0.00 0.00 0.00

15 0.00 0.00 0.00

16 0.00 0.00 0.00

17 0.00 0.00 0.00

18 0.00 0.00 0.00

19 0.00 0.00 0.00

20 0.00 0.00 0.00

Rate per mile p Total no. of business miles 0.00 0.00 0.00

Photocopy receipts must be attached Row includes totals from overflow sheet (mileage total inclusive of overflow sheet) 0.00 0.00 0.00 0.00

Private car Note: Contractor Declaration

Please attach copies of invoices / receipts for amounts claimed behind this

Engine Capacity (cc) expense claim form.

Petrol Diesel

Please ensure, once your business expenses are approved, an invoice is

raised for payment of these expenses. Invoices which charge VAT on VAT Claimants Signature Date

will not be processed for payment.

Authorised Signature Date

Print Name Pages authorised for this claim

You might also like

- EDC Rig 62Document1 pageEDC Rig 62Tim ClarkeNo ratings yet

- RETAIL TAX INVOICEDocument2 pagesRETAIL TAX INVOICEshaddy umerNo ratings yet

- EDC Rig 47Document1 pageEDC Rig 47Tim ClarkeNo ratings yet

- EDC Rig 16Document1 pageEDC Rig 16Tim ClarkeNo ratings yet

- EDC Rig 16Document1 pageEDC Rig 16Tim ClarkeNo ratings yet

- DPS Rig 4Document1 pageDPS Rig 4Tim ClarkeNo ratings yet

- EDC Rig 55 drilling rig detailsDocument1 pageEDC Rig 55 drilling rig detailsTim ClarkeNo ratings yet

- Understanding ISO Codes Appearance of Water in Oil: Viscosity Grading SystemsDocument1 pageUnderstanding ISO Codes Appearance of Water in Oil: Viscosity Grading SystemsPorfirioDuarteZarateNo ratings yet

- Bill 774719595 DDocument5 pagesBill 774719595 DKrishnasamy SanjeevanNo ratings yet

- Ccinv 1400503748Document1 pageCcinv 1400503748Farooq HussainNo ratings yet

- Invoice: Your Company NameDocument7 pagesInvoice: Your Company Namesanjeev151No ratings yet

- 1ed82dd0 56051Document1 page1ed82dd0 56051Ahmed ElhawaryNo ratings yet

- Show EBillDocument2 pagesShow EBillcarolinabra485No ratings yet

- Simple Tax Invoice TemplateDocument2 pagesSimple Tax Invoice TemplateTarek El-SayedNo ratings yet

- 2021 App Cse TemplateDocument333 pages2021 App Cse TemplateCHANIELOU MARTINEZNo ratings yet

- APP-CSE 2020" Annual Procurement Plan for Common Supplies and Equipment 2020 FormDocument27 pagesAPP-CSE 2020" Annual Procurement Plan for Common Supplies and Equipment 2020 FormGil Bryan BalotNo ratings yet

- Invoice 2017-04-30 BackupDocument1 pageInvoice 2017-04-30 BackuphesusNo ratings yet

- Klasipayd Carwash & Detailing Job OrderDocument5 pagesKlasipayd Carwash & Detailing Job OrderKlasipayd Carwash and Detailing Klasiko LifestyleNo ratings yet

- Annual Procurement Plan-Common Supplies and Equipment (App-Cse) 2020 FormDocument1 pageAnnual Procurement Plan-Common Supplies and Equipment (App-Cse) 2020 FormalexNo ratings yet

- New Zealand Tax Invoice TemplateDocument2 pagesNew Zealand Tax Invoice Templatemohamed elmakhzniNo ratings yet

- Criticare Airoli Hospital Inv .1.12.21Document1 pageCriticare Airoli Hospital Inv .1.12.21RavindraNo ratings yet

- Quote: Your Company NameDocument3 pagesQuote: Your Company NameNikhilNo ratings yet

- InvoiceDocument3 pagesInvoiceIsrael Alberto SanchezNo ratings yet

- Annual Procurement Plan - Commom-Use Supplies and Equipment (App-Cse) 2022 FormDocument12 pagesAnnual Procurement Plan - Commom-Use Supplies and Equipment (App-Cse) 2022 FormNenbon Natividad100% (3)

- Rhelec Ingeniería Cia., Ltd. RFQ No. Request For Quotation/Solicitud de CotizacionDocument2 pagesRhelec Ingeniería Cia., Ltd. RFQ No. Request For Quotation/Solicitud de CotizacionJose Luis A.No ratings yet

- Invoice Template - Sole Trader VATDocument2 pagesInvoice Template - Sole Trader VATWong JowoNo ratings yet

- Insurance InvoiceDocument1 pageInsurance InvoiceAhmadNo ratings yet

- Anees Alnofous Clinic 2023-06-12 SAR Settlement ReportDocument1 pageAnees Alnofous Clinic 2023-06-12 SAR Settlement ReportmohamdNo ratings yet

- Rep 12 Income Statement AgtDocument3 pagesRep 12 Income Statement AgtShivani raikarNo ratings yet

- IoCl BDDocument3 pagesIoCl BDtyagichemNo ratings yet

- Shangi Material ReportDocument1 pageShangi Material ReportNuraNo ratings yet

- Kanpur Electricity Supply Company Limited Electricity Bill and Disconnection Notice (LMV-1) - (ST-11 Domestic Other Metered (TVM Above10KW) )Document2 pagesKanpur Electricity Supply Company Limited Electricity Bill and Disconnection Notice (LMV-1) - (ST-11 Domestic Other Metered (TVM Above10KW) )Satyam TiwariNo ratings yet

- PR Bull Fy23Document1 pagePR Bull Fy23sofiaouchabaneNo ratings yet

- شركة جوتن السعودية المحدودة CD5024003037Document2 pagesشركة جوتن السعودية المحدودة CD5024003037alrashdydecorationNo ratings yet

- Annexure C Report (12) ICTDocument2 pagesAnnexure C Report (12) ICTSaqib XamNo ratings yet

- Vendor Application Form SummaryDocument2 pagesVendor Application Form Summarykiki adamNo ratings yet

- Sample Format of Laundry BillDocument1 pageSample Format of Laundry BillShiva RajNo ratings yet

- 96325XXXXXencc (1) Postpaid BillDocument3 pages96325XXXXXencc (1) Postpaid BillkarthikNo ratings yet

- Alinma Product and Services StickerDocument1 pageAlinma Product and Services StickerAbdullah S. AbdullahNo ratings yet

- App-Cse Cy Jan 2023Document56 pagesApp-Cse Cy Jan 2023ConnorNo ratings yet

- SCAN & PAY Through Paytm Fill Details & Complete: (Authorised Signatory)Document1 pageSCAN & PAY Through Paytm Fill Details & Complete: (Authorised Signatory)lg100% (1)

- TechnotronicsDocument1 pageTechnotronicsviral patelNo ratings yet

- online-invoicing-sampleDocument4 pagesonline-invoicing-sampleNaveen JhaNo ratings yet

- Noon Doc 80038888Document2 pagesNoon Doc 80038888Hisham HussainNo ratings yet

- Income Tax Return 480.20 (U)Document3 pagesIncome Tax Return 480.20 (U)Alan EscobarNo ratings yet

- Annexure C ReportDocument1 pageAnnexure C ReportMuhammad AslamNo ratings yet

- Annual Procurement Plan-Common Supplies and Equipment (App-Cse) 2020 FormDocument3 pagesAnnual Procurement Plan-Common Supplies and Equipment (App-Cse) 2020 FormEeve YhoungNo ratings yet

- Ets QTN 2022 01460Document1 pageEts QTN 2022 01460SUNIL TPNo ratings yet

- Rep 11 Income Statement BaDocument3 pagesRep 11 Income Statement BaWealthMitra Financial ServicesNo ratings yet

- Supplemental Annual Procurement Plan-Common Supplies and Equipment (App-Cse) 2019 FormDocument2 pagesSupplemental Annual Procurement Plan-Common Supplies and Equipment (App-Cse) 2019 FormMarivic Sabangan DiazNo ratings yet

- Expense Report IIF FileDocument8 pagesExpense Report IIF FileLiz AnNo ratings yet

- Declaration 3966758Document5 pagesDeclaration 3966758mehboob rehmanNo ratings yet

- Tax Acknowledgement SlipDocument2 pagesTax Acknowledgement SlipUmair Jamal IslamianNo ratings yet

- Bengalore: Ree U'sDocument1 pageBengalore: Ree U'sR ChandruNo ratings yet

- Your Company Name: Address City, State, ZIP Phone # Advertising LineDocument1 pageYour Company Name: Address City, State, ZIP Phone # Advertising LineZakaria AlsyaniyNo ratings yet

- Expense Template Non VatDocument2 pagesExpense Template Non Vatzazira19No ratings yet

- JasmalDocument1 pageJasmalmehmoodd43No ratings yet

- Training Invoice: Punjab Institute of TechnologyDocument1 pageTraining Invoice: Punjab Institute of TechnologyQAISAR Aziz SHAHZADNo ratings yet

- BillDocument7 pagesBillstanciucorinaioanaNo ratings yet

- b7169 Shipping Simple Invoice With GST 3 1Document1 pageb7169 Shipping Simple Invoice With GST 3 1vashishthbhai229No ratings yet

- Duplicate: Tax InvoiceDocument1 pageDuplicate: Tax InvoiceMalak NakhlehNo ratings yet

- 26april Food BillDocument1 page26april Food BillRaju VNo ratings yet

- Interest Sheet For Service TaxDocument2 pagesInterest Sheet For Service Taxdilbagsingh009No ratings yet

- GST Part 2Document12 pagesGST Part 2Shanmughadas KGNo ratings yet

- Head Chef CV Sample CV Sample: Professional SummaryDocument1 pageHead Chef CV Sample CV Sample: Professional SummaryTim ClarkeNo ratings yet

- United States Patent (19) : Moggridge Et AlDocument3 pagesUnited States Patent (19) : Moggridge Et AlTim ClarkeNo ratings yet

- Acronyms Used in The Oil & Gas IndustryDocument48 pagesAcronyms Used in The Oil & Gas IndustryharoldalconzNo ratings yet

- Filled in Scorecard Eurovision 2017 FinalDocument1 pageFilled in Scorecard Eurovision 2017 FinalTim ClarkeNo ratings yet

- EDC Rig 19Document1 pageEDC Rig 19Tim ClarkeNo ratings yet

- 1 2 3 4 5 6Document8 pages1 2 3 4 5 6Tim ClarkeNo ratings yet

- Corazon FlyerDocument1 pageCorazon FlyerTim ClarkeNo ratings yet

- Corazon FlyerDocument2 pagesCorazon FlyerTim ClarkeNo ratings yet

- 83 127gDocument20 pages83 127gTim ClarkeNo ratings yet

- EDC Rig 18Document1 pageEDC Rig 18Tim ClarkeNo ratings yet

- Rig 602 - Trinidad Drilling LTDDocument4 pagesRig 602 - Trinidad Drilling LTDTim ClarkeNo ratings yet

- EDC Rig 18Document1 pageEDC Rig 18Tim ClarkeNo ratings yet

- EDC Rig 17 drilling rig detailsDocument1 pageEDC Rig 17 drilling rig detailsTim ClarkeNo ratings yet

- DPS Rig 43Document1 pageDPS Rig 43Tim Clarke100% (1)

- EDC Rig 3Document1 pageEDC Rig 3Tim ClarkeNo ratings yet

- EDC Rig 3Document1 pageEDC Rig 3Tim ClarkeNo ratings yet

- EDC Rig 10Document1 pageEDC Rig 10Tim ClarkeNo ratings yet

- EDC Rig 5Document1 pageEDC Rig 5Tim ClarkeNo ratings yet

- EDC Rig 3Document1 pageEDC Rig 3Tim ClarkeNo ratings yet

- EDC Rig 3Document1 pageEDC Rig 3Tim ClarkeNo ratings yet

- GSF Galaxy I PDFDocument2 pagesGSF Galaxy I PDFTim ClarkeNo ratings yet

- EDC Rig 9 Specs and Equipment DetailsDocument1 pageEDC Rig 9 Specs and Equipment DetailsTim ClarkeNo ratings yet

- EDC Rig 1Document1 pageEDC Rig 1Tim ClarkeNo ratings yet

- Sedco 714 Midwater Semi StorageDocument2 pagesSedco 714 Midwater Semi StorageTim ClarkeNo ratings yet