Professional Documents

Culture Documents

Tax Return Bill

Uploaded by

Jon Campbell0 ratings0% found this document useful (0 votes)

2K views4 pagesSponsored by Assemblyman David Buchwald and Sen. Brad Hoylman.

Original Title

Tax return bill

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSponsored by Assemblyman David Buchwald and Sen. Brad Hoylman.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views4 pagesTax Return Bill

Uploaded by

Jon CampbellSponsored by Assemblyman David Buchwald and Sen. Brad Hoylman.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

Legislative Bill Drafting Commission

11072-06-7

IN SENATE--Introduced by Sen

4 twice and ordered printed,

and when printed to be committed

to the Committee on

Assembly

IN ASSEMBLY-~Introduced by M. of A.

Bochwars

with M, of A. as co-sponsors

~-read once and referred to the

Committee on

*TAxtat

(Requires the disclosure of tax

returns by statewide elected public

officials including the president of

the United stat

Tax. tax return disclosure

aN ACT

to amend the tax law, in relation to

requiring the disclosure of tax

returns by statewide elected public

officials including the president of

the United states

he m of

York, repre in_Senate and

Assembly, do enact as follows:

IN SENATE,

‘ae saetce stat sm ary cheiod Seow lah wo olan Sn ae pemeahip

‘28 sattoe—st8oerraneone 17 tena tS smmary 83 Sine

‘bt smears sit atlanta 2 ser

46 amos tT Peder 60 Remap 5 sort

santa set leaps Hitt ae sn,

16 matey BE ata erngee aD Parte sarah

(0 cate 80 nett os

6 cet att mntng

IN ASSEMBLY.

he ube Of sk Amy so nes art stad Delon tf me Inthe

smietspossrny of eats pepaste

ste mains s27 chane HS Suu Phnre a8 malay 0 hinge

4008 bey 9 ete 838 sete

00 nema ARE ponse a7 Sepa

‘0 narrate mateedete 474 arene

ee ae

‘er sue sote riepeeter a3 urine

(229 umente

‘o tatanat

(9 mages

e csnon tt oamnae a0 nme

ss ent acre ett ue

mes crue 8 weday aT ete

st, senso Aaa erate sgn ee ne aap of tbe BL

clas of M1 a ean of mann Ln gpa (lope howls ot 4 sme

olan of 21 a # copies of moran bn mppere el D

10

1

12

13

ua

4s

16

uw

1s

19

20

21

22

23

24

25

26

27

04/20/17 3 11072-06-7

ex that the folloving information shall be redacted prior to such copies

being posted on the dey tt sit

taxpayer's social

EL ey (AL security number of the ‘6

spouse and _anj Hividuals claimed as dependents e ret A144)

‘any account number reported on the return, (iv) any taxpayer addresses

ne return, y) any additii tion if the commiasi

that the disclosure of such information vill violate federal

C)_ The commissioner shall

£4 ch_post ine rod

his eaph no. than thirty days the effective date of

‘this subsection, and subsequent postings no later than thirty daye after

the president of the United States, the vice president of the United

States, a United states senator representing New York state or a state-

wide elected official takes his or her oath of office.

pb) Statements andi tax returns a department's

bs su 6 in posted _un ch

elected ah feice

Notwithstanding the provisions of subsection (e) of this sect:

AD AS disclosing whether the president of the United States,

the vice president of the United states, a United States senator sepres-

enting New ¥ a statewide elected as that term

in section seventy-three lic officers lav, has filed

New York state income tax returns pursuant to this article on or after

the effective date of this subsection. With respect to uch ret

the commissioner shall include in such statenent the following informa-

tion as ted turn: (1) New York adju goss inc: aa

10

na

13

ua

1s

16

7

18

rT

20

04/20/17 5 111072-06-7

hundred fifty-seven of this article, such ha later

than thirty days after the return is filed with the department.

D) ments and returns posted on ¢! tment 's vebsite at

to this paragraph shall remain posted until such elected official leaves

gffice,

Ifthe commi: yr reda information from sted

want to subsection based on a determinat! disclosure of

such information vould violate federal law, the commissioner shall, at

the time of posting such redacted _retur ¢_on_the de Yt

website a description of the type of ati 2 from

the ceturn and a detailed explanation of the commissioner's determi-

ion that sure of information would constitute « violation

of federal law.

4) 1f 0, sen agraph_or this subsecti

shall _be adjudged by any court wrisdiction to be invali4

ydqment shall not a impair or invalidate the remainder

of, but shall be confined in its operation to the clause, sentence,

Y this subsection directly involved in rover~

in which the judgment shall have bi red.

§ 2. This act shall take effect innediately.

NEW YORK STATE SENATE

INTRODUCER'S MEMORANDUM IN SUPPORT

‘submitted in accordance with Senate Rule VI. Sec 1

BILL NUMBER: A

SPONSOR: Buchwald

TITLE OF BILL:

An act to amend the Tax Law, in relation to requiring the disclosure of tax

eusns by statewide elected public officials including the President of the

United states

SUMMARY OF SIONS:

Section one of the bill adds a new subsection (p) to section 697 of the Tax

fan te require the Conmissioner of the New York State Department of Taxation

and Finance to post on the Department’s website:

— an annual statement disclosing whether the President of the United

bates, vice President, a United States Senator representing New York or

are retewide elected official, has filed New York State incone tax

Securns in any of the inmedistely preceding five taxable years. Included

in such statement shall be up to 16 pieces of New York-specific

{hfermation to provide 2 basic sense of the elected official’s New York

state tax obligations;

= copies of such elected officials’ New York State income tax returns for

She immediately preceding five taxable years, with selected information

redacted, as outlined below:

= An annual statement disclosing whether the President of the United

Btaces, Vice President, a United States Senator representing New York or

2 statewide elected official, has filed New York State income tax

teturne for current years after the effective date of this law. Included

In suen statement shall be up to 16 pieces of New York-specific

internation to provide a basic sense of the elected official’s New York

state tax obligations;

= copies of such elected officials’ New York State income tax returns for

Corrent years after the effective date of this law, with selected

{information redacted, as outlined below

the Connissioner shall redact the following information from tax returns

yee Sing social security numbers of the taxpayer, spouse and any dependents

Qaimed, account numbers, addresses and any additional information the

Conntesioner determines would violate federal law. If any information is

couscred on the basis that ite release would violate federal law, the

Gemmissioner shall, at the time of posting such redacted return, post to the

coneite a description of the type of information redacted and an explanation

rene determination that the information would constitute a violation of

federal law.

You might also like

- Senate Dems Analysis of Lulus Paid To Non-Committee Chairs.Document5 pagesSenate Dems Analysis of Lulus Paid To Non-Committee Chairs.liz_benjamin6490No ratings yet

- Opinion Re Legislative LawDocument4 pagesOpinion Re Legislative LawCasey SeilerNo ratings yet

- Morabito DecisionDocument3 pagesMorabito DecisionJon CampbellNo ratings yet

- FHWA DOT LettersDocument4 pagesFHWA DOT LettersJon CampbellNo ratings yet

- Acacia v. SUNY RF Et AlDocument12 pagesAcacia v. SUNY RF Et AlJon CampbellNo ratings yet

- AttyAffirmation For Omnibus Motion - FinalDocument4 pagesAttyAffirmation For Omnibus Motion - FinalJon CampbellNo ratings yet

- NYS Department of Health Aca Repeal AnalysisDocument2 pagesNYS Department of Health Aca Repeal AnalysisMatthew HamiltonNo ratings yet

- Gaddy SummonsDocument2 pagesGaddy SummonsJon CampbellNo ratings yet

- Sexual Offense Evidence Kit Inventory Report 3-1-17Document26 pagesSexual Offense Evidence Kit Inventory Report 3-1-17Jon Campbell100% (1)

- Chamber of CommerceDocument1 pageChamber of CommerceRyan WhalenNo ratings yet

- Schneiderman Proposed Complaint For ACLU Trump Executive Order LawsuitDocument33 pagesSchneiderman Proposed Complaint For ACLU Trump Executive Order LawsuitMatthew HamiltonNo ratings yet

- Schneiderman Proposed Complaint For ACLU Trump Executive Order LawsuitDocument33 pagesSchneiderman Proposed Complaint For ACLU Trump Executive Order LawsuitMatthew HamiltonNo ratings yet

- Stronger Neighborhoods PAC/SerinoDocument2 pagesStronger Neighborhoods PAC/SerinoJon CampbellNo ratings yet

- US v. Percoco Et Al Indictment - Foreperson SignedDocument36 pagesUS v. Percoco Et Al Indictment - Foreperson SignedNick ReismanNo ratings yet

- US v. Kang and Kelley IndictmentDocument27 pagesUS v. Kang and Kelley IndictmentJon CampbellNo ratings yet

- Trump Foundation Notice of Violation 9-30-16Document2 pagesTrump Foundation Notice of Violation 9-30-16Cristian Farias100% (1)

- FOIA 2017 0037 Response Letter 15 19Document5 pagesFOIA 2017 0037 Response Letter 15 19Jon CampbellNo ratings yet

- Cuomo StatementDocument5 pagesCuomo StatementJon CampbellNo ratings yet

- NY DFS LawsuitDocument77 pagesNY DFS LawsuitJon CampbellNo ratings yet

- FHWA - Presentation - NY SignsDocument112 pagesFHWA - Presentation - NY SignsJon Campbell100% (1)

- Stronger Neighborhoods PAC/SerinoDocument2 pagesStronger Neighborhoods PAC/SerinoJon CampbellNo ratings yet

- FHWA Nov 2016 LetterDocument2 pagesFHWA Nov 2016 LetterJon CampbellNo ratings yet

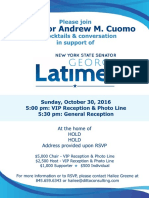

- Stronger Neighborhoods PAC/LatimerDocument2 pagesStronger Neighborhoods PAC/LatimerJon CampbellNo ratings yet

- Orange County CaseDocument42 pagesOrange County CaseJon CampbellNo ratings yet

- Latimer Oct 30 EventDocument2 pagesLatimer Oct 30 EventJon CampbellNo ratings yet

- DiNapoli MTA ReportDocument8 pagesDiNapoli MTA ReportJon CampbellNo ratings yet

- Skelos Opening Brief v17 - SignedDocument70 pagesSkelos Opening Brief v17 - SignedJon CampbellNo ratings yet

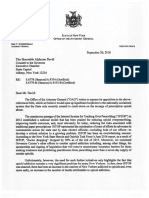

- 2016 9 20 Letter To A David Re ISTOPDocument3 pages2016 9 20 Letter To A David Re ISTOPJon CampbellNo ratings yet

- New York State Offshore Wind BlueprintDocument24 pagesNew York State Offshore Wind BlueprintJon CampbellNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)