Professional Documents

Culture Documents

Corrections To CH 15 and 16 in Agamata

Uploaded by

Julienne AristozaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corrections To CH 15 and 16 in Agamata

Uploaded by

Julienne AristozaCopyright:

Available Formats

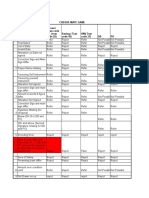

Cash and MS Management

EIR Effective Interest Rate APR Annual Percentage Rate

Compounded interest rate Simple Interest/Year

also known as EAR Net borrowing cost/Net Proceeds

(effective annual rate) Does not take the effect of compounding

Solution to Sample Problem 15.5 on pp 842

Requirement 1 Bank 1 Bank 2 Bank 3

Interest Expense 500,000 500,000 500,000

Less: Income from incremental compensating balance 12,000 - -

Net borrowing cost 488,000 500,000 500,000

Principal 5,000,000 5,000,000 5,000,000

Less: Discounted interest - 500,000 -

Less: Incremental compensating balance 200,000 600,000 -

Net proceeds 4,800,000 3,900,000 5,000,000

APR 10.17% 12.82% 10.00%

Requirement #2

EAR =(1+(0.1017/4))^4-1

10.56%

Solution to Sample Problem 15.4 on pp 843

Wealth Rich Dad

Prime Lending Financing Consortium

Interest Expense 10,000 2,500 2,500

Net Proceeds 100,000 100,000 97,500

Periodic Interest Rate (PEBR) - Req #1 10.000% 2.500% 2.564%

Payment per Month 34,167 33,333

EIR --- using N ratio method (applicable only to add on interest) 15.31% 15.70%

1.28% 1.31%

EIR --- using Excel's rate function 1.24% 1.28%

14.94% 15.32%

Wealth Financing Amortization Proof

Proof >>> using EIR from N-Ratio

Payment Interest Principal Balance

100,000.00

Month 1 34,166.67 1,275.99 32,890.68 67,109.32

Month 1 34,166.67 856.31 33,310.36 33,798.96

Month 1 34,166.67 431.27 33,735.40 63.56 >>> close approximation of the EIR

Proof >>> using EIR from Excel:

Payment Interest Principal Balance

100,000.00

Year 1 34,166.67 1,244.87 32,921.80 67,078.20

Year 2 34,166.67 835.03 33,331.63 33,746.57

Year 3 34,166.67 420.10 33,746.57 0.00

Rich Dad Amortization Proof

Proof >>> using EIR from N-Ratio

Payment Interest Principal Balance

97,500.00

Month 1 33,333.33 1,275.98 32,057.35 65,442.65

Month 1 33,333.33 856.45 32,476.88 32,965.77

Month 1 33,333.33 431.42 32,901.91 63.86 >>> close approximation of the EIR

Proof >>> using EIR from Excel:

Payment Interest Principal Balance

97,500.00

Year 1 33,333.33 1,244.74 32,088.60 65,411.40

Year 2 33,333.33 835.08 32,498.26 32,913.15

Year 3 33,333.33 420.19 32,913.15 0.00

What if the credit term of Wealth Financing and Rich Dad is 3 years instead of three months?

Wealth Rich Dad

Financing Consortium

Interest Expense 30,000 30,000

Net Proceeds 100,000 70,000

Simple Interest Rate over the life if the loan 30.000% 42.857%

Payment per Year 43,333.33 33,333.33

EIR --- using N ratio method 14.24% 19.76%

EIR --- using Excel's rate function 14.360% 20.197%

Wealth Financing Amortization Proof

Proof >>> using EIR from N-Ratio

Payment Interest Principal Balance

100,000.00

Year 1 43,333.33 14,244.19 29,089.15 70,910.85

Year 2 43,333.33 10,100.67 33,232.66 37,678.19

Year 3 43,333.33 5,366.95 37,966.38 - 288.19 >>> close approximation of the EIR

Proof >>> using EIR from Excel:

Payment Interest Principal Balance

100,000.00

Year 1 43,333.33 14,359.67 28,973.67 71,026.33

Year 2 43,333.33 10,199.15 33,134.19 37,892.15

Year 3 43,333.33 5,441.19 37,892.15 -

Wealth Financing Amortization Proof

Proof >>> using EIR from N-Ratio

Payment Interest Principal Balance

70,000.00

Year 1 33,333.33 13,830.65 19,502.69 50,497.31

Year 2 33,333.33 9,977.29 23,356.04 27,141.27

Year 3 33,333.33 5,362.59 27,970.74 - 829.47 >>> close approximation of the EIR

Proof >>> using EIR from Excel:

Payment Interest Principal Balance

70,000.00

Year 1 33,333.33 14,137.91 19,195.42 50,804.58

Year 2 33,333.33 10,261.01 23,072.33 27,732.25

Year 3 33,333.33 5,601.09 27,732.25 -

Receivables Management

pp 868

Credit Effects to

Management

Variables Credit Policy Collection AR balance AR Turnover Collection Period

High (lax) slower increase decrease longer

Credit Cap Low (strict) faster decrease increase shorter

Low risk slower increase decrease longer

Credit Class High Risk faster decrease increase shorter

pp 869

EDR should be 37.34% instead of 36.73%.

Buyer EDR<ROI if money is used Ignore trade discount

Buyer EDR>ROI if money is used Avail of the trade discount

pp 869

Sample Problem 16.1

Doubtful accounts are expected to increase from 1% to 2 1 .75%

For the corrections in the solution table, refer to Neil's slides for TF class.

Corrections are already given to the MTh class.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Mock Recitation-Characteristic of Criminal LawDocument8 pagesMock Recitation-Characteristic of Criminal LawJulienne AristozaNo ratings yet

- John Hay PAC vs. Lim Case DigestDocument2 pagesJohn Hay PAC vs. Lim Case DigestJulienne Aristoza100% (1)

- Speaking Law To PowerDocument2 pagesSpeaking Law To PowerJulienne AristozaNo ratings yet

- Consti 1 Gatmaytan Finals Reviewer PDFDocument130 pagesConsti 1 Gatmaytan Finals Reviewer PDFJulienne AristozaNo ratings yet

- University of The Phillipines College of LawDocument7 pagesUniversity of The Phillipines College of LawNathan MacayananNo ratings yet

- CRIM - San Beda Pre-Week ReviewerDocument19 pagesCRIM - San Beda Pre-Week ReviewerJulienne AristozaNo ratings yet

- Go Vs Dimagiba 499 Phil. 445Document17 pagesGo Vs Dimagiba 499 Phil. 445Julienne AristozaNo ratings yet

- Management of Accounts Receivable Sample ProblemsDocument3 pagesManagement of Accounts Receivable Sample ProblemsJulienne Aristoza100% (7)

- 19th Century PhilippinesDocument18 pages19th Century PhilippinesJulienne Aristoza73% (26)

- Beda Political Law (2017)Document1 pageBeda Political Law (2017)Julienne AristozaNo ratings yet

- Sample OutlineDocument2 pagesSample OutlineKristine Astorga-NgNo ratings yet

- Investments Portofolio PaperDocument6 pagesInvestments Portofolio PaperJulienne AristozaNo ratings yet

- Akwe 2015 Edited Guidelines PDFDocument6 pagesAkwe 2015 Edited Guidelines PDFJulienne AristozaNo ratings yet

- The 1987 Constitution of The Republic of The Philippines: PreambleDocument49 pagesThe 1987 Constitution of The Republic of The Philippines: PreambleJulienne AristozaNo ratings yet

- Strategic Management Ethical CasesDocument5 pagesStrategic Management Ethical CasesJulienne AristozaNo ratings yet

- Receivables ManagementDocument6 pagesReceivables ManagementJulienne AristozaNo ratings yet

- PI 100 First SessionDocument26 pagesPI 100 First SessionJulienne AristozaNo ratings yet

- UP Analysis ExperientialDocument3 pagesUP Analysis ExperientialJulienne AristozaNo ratings yet

- Quality MeasurementsDocument3 pagesQuality MeasurementsJulienne AristozaNo ratings yet

- Chapter 1-Introduction To Cost Management: Learning ObjectivesDocument15 pagesChapter 1-Introduction To Cost Management: Learning Objectivesshineshoujo100% (1)

- Receivables ManagementDocument6 pagesReceivables ManagementJulienne AristozaNo ratings yet

- Batch Vs Real Time ProcessingDocument27 pagesBatch Vs Real Time ProcessingJulienne AristozaNo ratings yet

- 9 Introduction To Variance Analysis and Standard CostsDocument4 pages9 Introduction To Variance Analysis and Standard CostsJulienne AristozaNo ratings yet

- Case Study HBPDocument20 pagesCase Study HBPJulienne AristozaNo ratings yet

- Iloilo As An Investment OpportunityDocument3 pagesIloilo As An Investment OpportunityJulienne AristozaNo ratings yet

- At-030507 - Auditing in A CIS EnvironmentDocument15 pagesAt-030507 - Auditing in A CIS EnvironmentRandy Sioson100% (9)

- Strategic Management (Vision Mission, BOD, Corporate Governance)Document48 pagesStrategic Management (Vision Mission, BOD, Corporate Governance)Julienne AristozaNo ratings yet

- Batch Vs Real Time ProcessingDocument27 pagesBatch Vs Real Time ProcessingJulienne AristozaNo ratings yet

- Case Analysis - PaperDocument9 pagesCase Analysis - PaperJulienne AristozaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cheque Mate Game Current (Tran Code 11) (Tran Code 29) Saving (Tran Code 10) HNI (Tran Code 31)Document1 pageCheque Mate Game Current (Tran Code 11) (Tran Code 29) Saving (Tran Code 10) HNI (Tran Code 31)Nandini JaganNo ratings yet

- A. Methodology: Condominium ActDocument13 pagesA. Methodology: Condominium ActPrei BaltazarNo ratings yet

- Calveta Dining ServicesDocument7 pagesCalveta Dining ServicesSmera Eliza Philip100% (2)

- AYN520 Case Study - Semester 1, 2015 PDFDocument33 pagesAYN520 Case Study - Semester 1, 2015 PDFLinh VuNo ratings yet

- Loan Function of BanksDocument2 pagesLoan Function of BanksKarlo OfracioNo ratings yet

- 9706 s06 QP 2Document16 pages9706 s06 QP 2roukaiya_peerkhanNo ratings yet

- Mock Exam For CFA Level 1Document70 pagesMock Exam For CFA Level 1christyNo ratings yet

- Banks and Money: Pages 124-125Document7 pagesBanks and Money: Pages 124-125ronaldobatista_engNo ratings yet

- Green Finance Study - 2016 - MyanmarDocument27 pagesGreen Finance Study - 2016 - MyanmarTHAN HANNo ratings yet

- Loan Amortization Schedule: Enter Values Loan SummaryDocument1 pageLoan Amortization Schedule: Enter Values Loan Summaryadeelshahzadqureshi8086No ratings yet

- 7.the Hire-Purchase ActDocument66 pages7.the Hire-Purchase Actfenson2006100% (3)

- CSEC Economics June 2007 P1Document10 pagesCSEC Economics June 2007 P1Sachin BahadoorsinghNo ratings yet

- Deed of Partnership Victory Export This Deed of Partnership Executed at Erode OnDocument7 pagesDeed of Partnership Victory Export This Deed of Partnership Executed at Erode OnsamaadhuNo ratings yet

- Citizen Charter of FCI - FinalDocument36 pagesCitizen Charter of FCI - Finalabhay deep singhNo ratings yet

- Oct 17 WS 1 Understanding Credit and How To Improve Your Credit ScoreDocument19 pagesOct 17 WS 1 Understanding Credit and How To Improve Your Credit ScorePîslaru NicoletaNo ratings yet

- FA3PDocument4 pagesFA3PdainokaiNo ratings yet

- Control of The Money Supply PDFDocument2 pagesControl of The Money Supply PDFMario SarayarNo ratings yet

- Arvind SIngh Mahor-10BM60017-Summer Project ReportDocument60 pagesArvind SIngh Mahor-10BM60017-Summer Project ReportAdTheLegendNo ratings yet

- cs25 2013Document3 pagescs25 2013stephin k jNo ratings yet

- Channel Partner AgreementDocument4 pagesChannel Partner AgreementVivek LuckyNo ratings yet

- Complete Information On The Advantages and Disadvantages of Barter SystemDocument6 pagesComplete Information On The Advantages and Disadvantages of Barter SystemTariq MahmoodNo ratings yet

- Cash FlowDocument81 pagesCash FlowRoy Van de SimanjuntakNo ratings yet

- Obtained A Loan From The Bank For Rs. 50 Lakhs: ST ST STDocument5 pagesObtained A Loan From The Bank For Rs. 50 Lakhs: ST ST STSumal kumarNo ratings yet

- Barclays Municipal Research Detroit - Chapter 9 BeginsDocument22 pagesBarclays Municipal Research Detroit - Chapter 9 Beginsabcabc123123xyzxyxNo ratings yet

- SAVING HABITS OF RURAL HOUSEHOLDS C 1236 PDFDocument4 pagesSAVING HABITS OF RURAL HOUSEHOLDS C 1236 PDFEldho BensonNo ratings yet

- 2008 HSBC Annual Report and Accounts EnglishDocument34 pages2008 HSBC Annual Report and Accounts EnglishigharieebNo ratings yet

- Spo Annual Report 2016Document36 pagesSpo Annual Report 2016api-355186637No ratings yet

- Dividend Policy: Saurty Shekyn Das (1310709) BSC (Hons) Finance (Minor: Law) Dfa2002Y (3) Corporate Finance 20 April 2015Document9 pagesDividend Policy: Saurty Shekyn Das (1310709) BSC (Hons) Finance (Minor: Law) Dfa2002Y (3) Corporate Finance 20 April 2015Anonymous H2L7lwBs3No ratings yet

- Duyag vs. Inciong, G.R. No. L-47775, July 5, 1980, 98 SCRA 522Document12 pagesDuyag vs. Inciong, G.R. No. L-47775, July 5, 1980, 98 SCRA 522Colleen Rose GuanteroNo ratings yet

- Public International Law CasesDocument479 pagesPublic International Law CasesMaria Margaret MacasaetNo ratings yet