Professional Documents

Culture Documents

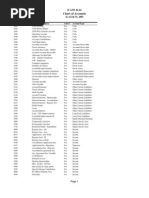

Balance Sheet Chart of Accounts For Small Businesses Numb Er Account Title Balance Sheet Section

Uploaded by

makahiya0 ratings0% found this document useful (0 votes)

82 views5 pagesfinance

Original Title

Accounting

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfinance

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

82 views5 pagesBalance Sheet Chart of Accounts For Small Businesses Numb Er Account Title Balance Sheet Section

Uploaded by

makahiyafinance

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

Balance sheet chart of accounts for small businesses

Numb Account Title Balance Sheet

er Section

100 Cash in Checking Asset

101 Cash in Savings Asset

102 Cash on Hand Asset

103 Accounts Receivable Asset

104 Merchandise Inventory Asset

105 Office Supplies Asset

106 Prepaid Insurance Asset

110 Land Asset

111 Equipment Asset

112 Accumulated Depreciation- Asset

Equipment

113 Building Asset

114 Accumulated Depreciation-Building Asset

115 Leasehold Improvements Asset

116 Accumulated Depreciation- Asset

Leasehold Improvements

117 Furniture and Fixtures Asset

118 Accumulated Depreciation- Asset

Furniture and Fixtures

120 Organization Costs Asset

121 Amortization-Organization Costs Asset

130 Patents Asset

131 Amortization-Patents Asset

200 Accounts Payable Liability

201 Salaries Payable Liability

202 Sales Taxes Payable Liability

203 Unearned Rent Liability

210 Notes Payable Liability

211 Loans Payable-National Bank Liability

212 Credit Card Payable-MasterCard Liability

220 Accrued Expenses Liability

250 Long-term Notes Payable Liability

300 Retained Earnings Equity

310 Capital Equity

311 Drawing Equity

Some accounts explained below:

Cash in Checking: cash used to pay expenses or deposit

revenue

Cash in Savings: cash kept in a depository account

Cash on Hand: cash kept for small expenditures (Petty Cash)

or cash kept in cash registers

Accounts Receivable: sales on credit

Leasehold Improvements: expenses incurred to accommodate

leased space to the business needs

Furniture and Fixtures: desks, chairs, store fixtures

Organization Costs: start-up costs

Capital: initial investment by owners

Drawing: withdrawals by business owners.

A three-digit account code can be sufficient for a small

business as such code would allow creating up to 1,000 accounts.

However, a larger business might need to use a four-digit code

that would allow up to 10,000 accounts.

Balance sheet chart of accounts for corporations

Numb Account Title Balance Sheet

er Section

1000 Cash Asset

1010 Petty Cash Asset

1020 Accounts Receivable Asset

1030 Inventory Asset

1040 Prepaid insurance Asset

1100 Land Asset

1110 Equipment Asset

1111 Accumulated Depreciation- Asset

Equipment

1120 Building Asset

1121 Accumulated Depreciation-Building Asset

1130 Leasehold Improvements Asset

1131 Accumulated Depreciation- Asset

Leasehold Improvements

2000 Accounts Payable Liability

2010 Salaries Payable Liability

2020 Accrued Expenses Liability

2100 Notes Payable Liability

2110 Bonds Payable Liability

3000 Common Stock Equity

3010 Retained Earnings Equity

3020 Dividends Equity

Note that only some numbers within a sequence are assigned. For

instance, Cash and Petty Cash have been assigned the numbers

1000 and 1010, respectively. As no account was assigned a number

within the 1001-1009 range, the company can add more accounts

within that range when the need arises: for instance, 1001: Cash

- X Bank; and 1002: Cash - Y Bank.

Income statement accounts within a chart of accounts

Revenue is an increase in assets (e.g., cash sale) or decrease

in liabilities (e.g., recognition of unearned service revenue as

earned revenue) resulting from operating activities of an

entity. Revenue accounts normally have credit balances. Revenues

are compared to expenses to calculate net income.

Cost of goods sold (cost of sales) is the difference between the

cost of goods available for sale and the cost of goods on hand

at the end of an accounting period. This cost represents the

cost of goods sold by the company during the period.

Expenses are decreases in assets (e.g., rent expenses) or

increases in liabilities (e.g., accrued utility expenses) that

result from operating activities undertaken to generate revenue.

Expense accounts normally have debit balances. Expenses may be

classified as selling, general, and administrative. Note that

the cost of goods sold is also an expense, but it is usually

shown separately from other operating expenses. Expenses are

subtracted from revenues to determine net income.

Other income and expenses represent non-operating income or

expenses and include extraordinary items. Non-operating income

or expenses relate to transactions or events that are not part

of a companys normal operating activity. Examples of non-

operating activities include sales of fixed assets, interest

income/expense (for entities whose operating activity is not

related to earning interest), and miscellaneous income.

Extraordinary items are revenues or expenses that arise from

activities that are not ordinary and not expected to recur

regularly (frequently). Examples of extraordinary items: gain

(loss) on early retirement of debt, natural disaster,

expropriation of property by foreign government, property

condemnation, etc. Extraordinary items are reported net of

taxes.

Chart of accounts with income statement elements

Let us look at a simple chart of accounts with income statement

elements for a merchandising business. The chart of accounts has

the following ranges for income statement accounts:

Numbe Account Title Income Statement

r Section

4000 Sales of Goods Revenue

4010 Sales Discounts Revenue

4020 Sales Returns and Revenue

Allowances

5000 Purchases Cost of goods sold

5010 Purchase Cost of goods sold

Discounts

5020 Purchase Returns Cost of goods sold

and Allowances

5030 Freight Cost of goods sold

6000 Salaries and Expense

Wages

6005 Payroll Taxes Expense

6010 Advertising Expense

6015 Depreciation Expense

6020 Amortization Expense

6025 Bank Services Expense

6030 Rent Expense

6035 Utilities Expense

6040 Insurance Expense

6045 Legal and Expense

Accounting

6050 Postage Expense

6055 Office Expense Expense

6060 Supplies Expense

7010 Interest Income Non-operating income

7020 Interest Expense Non-operating expense

8010 Gain on Sale of Non-operating income

Fixed Assets

8020 Miscellaneous Non-operating expense

Expense

9000 Extraordinary Non-operating income/expense

items

You might also like

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityFrom EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNo ratings yet

- Illustration Sample Chart of AccountsDocument3 pagesIllustration Sample Chart of AccountsJulie R. UgsodNo ratings yet

- Audit Module 1 - Trial Balance Account MappingDocument6 pagesAudit Module 1 - Trial Balance Account MappingGaurav KumarNo ratings yet

- Sample Chart of AccountsDocument12 pagesSample Chart of AccountsjeffryNo ratings yet

- Chart of AccountsDocument4 pagesChart of AccountsmakahiyaNo ratings yet

- Construction Chart of Accounts: Account Type Account No. Account Name Current AssetsDocument10 pagesConstruction Chart of Accounts: Account Type Account No. Account Name Current AssetsTy ChanreaksmeyNo ratings yet

- Chart of Accounts For Small Business Template V 1.0Document3 pagesChart of Accounts For Small Business Template V 1.0Siva Naga Prasad TadipartiNo ratings yet

- Accounting For Non-Accountant HandoutDocument26 pagesAccounting For Non-Accountant HandoutROMMUEL TOLENTINONo ratings yet

- XL JournalSHEET - Accounting System V3.43 - Merchandise - Lite V3Document686 pagesXL JournalSHEET - Accounting System V3.43 - Merchandise - Lite V3Satria ArliandiNo ratings yet

- Descriptive Chart of Accounts Model TemplateDocument17 pagesDescriptive Chart of Accounts Model Templateयशोधन कुलकर्णीNo ratings yet

- Sample Chart of Accounts: Account Name Code Financial Statement Group NormallyDocument2 pagesSample Chart of Accounts: Account Name Code Financial Statement Group NormallyQamar ShahzadNo ratings yet

- Account ListingDocument2 pagesAccount Listingaliko13No ratings yet

- Construction Company COADocument10 pagesConstruction Company COAappiah ernestNo ratings yet

- Chapter 4 - Fundamentals of AccountingDocument75 pagesChapter 4 - Fundamentals of AccountingThuy Tien DinhNo ratings yet

- Accounting Adjustment-Accrued & PrepaidDocument30 pagesAccounting Adjustment-Accrued & PrepaidEida HidayahNo ratings yet

- QuickBooks Online No MC COA Sample FileDocument2 pagesQuickBooks Online No MC COA Sample FilecardiacanesthesiaNo ratings yet

- Accounting For Not-for-Profit Organisation: Business. Normally, TDocument63 pagesAccounting For Not-for-Profit Organisation: Business. Normally, TVinit MathurNo ratings yet

- Bank Statement Reconciliation: What You Need To KnowDocument54 pagesBank Statement Reconciliation: What You Need To Knowmax belirNo ratings yet

- The Financial Accounting Cycle PDFDocument219 pagesThe Financial Accounting Cycle PDFQuadjo Opoku Sarkodie100% (1)

- 25 Chart of AccountsDocument104 pages25 Chart of AccountsFiania WatungNo ratings yet

- Chart of AccountsDocument8 pagesChart of AccountsMariaCarlaMañagoNo ratings yet

- List of Business Transactions (Edited) : The Rose and Flower Owned by Rose GreenDocument2 pagesList of Business Transactions (Edited) : The Rose and Flower Owned by Rose GreenJon DonNo ratings yet

- MYOB - Sample Chart of Accounts (Task 1)Document2 pagesMYOB - Sample Chart of Accounts (Task 1)Tan NguyenNo ratings yet

- Chart of Accounts: Current AssetsDocument8 pagesChart of Accounts: Current Assetsgalatid4u100% (1)

- Chart of Accounts: Account Type Income Tax LineDocument4 pagesChart of Accounts: Account Type Income Tax LineNak VanNo ratings yet

- Tax Calculator FormulaDocument5 pagesTax Calculator FormulaLizaNo ratings yet

- Account Number Account Name Heade R Balance Account Type KeteranganDocument3 pagesAccount Number Account Name Heade R Balance Account Type KeteranganYogga FMNo ratings yet

- Adjusting The AccountsDocument47 pagesAdjusting The AccountsshuvoertizaNo ratings yet

- Standard Chart of AccountsDocument6 pagesStandard Chart of AccountsAArif SShuvrooNo ratings yet

- Unique Share Management LTD.: Chart of AccountsDocument34 pagesUnique Share Management LTD.: Chart of AccountsFarida YesminNo ratings yet

- Standard Chart of AccountsDocument20 pagesStandard Chart of Accountshungryniceties100% (1)

- Chart of Accounts and ReportingDocument35 pagesChart of Accounts and ReportingSafiullah KamawalNo ratings yet

- Accounts Payable Interview QuestionsDocument11 pagesAccounts Payable Interview QuestionsBandita RoutNo ratings yet

- The Uniform Chart of AccountsDocument137 pagesThe Uniform Chart of AccountsElzein Amir ElzeinNo ratings yet

- Recording Transactions: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDDocument34 pagesRecording Transactions: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDShiTheng Love UNo ratings yet

- 4 Chart of AccountsDocument115 pages4 Chart of Accountsresti rahmawatiNo ratings yet

- Icann Chart of Accounts 02aug02Document3 pagesIcann Chart of Accounts 02aug02Namikaze MinatoNo ratings yet

- Basic AccountsDocument51 pagesBasic AccountsNilesh Indikar100% (1)

- Payroll Brochure For Prospective ClientsDocument2 pagesPayroll Brochure For Prospective Clientsanon-414607100% (3)

- Chart of AccountsDocument18 pagesChart of AccountsMargerie FrueldaNo ratings yet

- GST - Hospitality IndustryDocument68 pagesGST - Hospitality IndustrySOPHIA POLYTECHNIC LIBRARYNo ratings yet

- Accounting Assignment 04A 207Document10 pagesAccounting Assignment 04A 207Aniyah's RanticsNo ratings yet

- Chart of Accounts PolicyDocument13 pagesChart of Accounts PolicyMazhar Ali JoyoNo ratings yet

- Adjustment Entries, Income Statement and Balance SheetDocument60 pagesAdjustment Entries, Income Statement and Balance Sheetvaishnavi sharma100% (1)

- ACCOUNTINGDocument31 pagesACCOUNTINGCHARAK RAYNo ratings yet

- Examples of Customized Charts of AccountsDocument33 pagesExamples of Customized Charts of AccountsDennis lugodNo ratings yet

- Excel Skills - Basic Accounting Template: InstructionsDocument39 pagesExcel Skills - Basic Accounting Template: InstructionsStorage BankNo ratings yet

- Restaurant Expense Dictionary ReviewDocument8 pagesRestaurant Expense Dictionary ReviewiMetsu eMailNo ratings yet

- Motor Yacht Laurel: ProceduresDocument3 pagesMotor Yacht Laurel: Proceduresroberto.stepicNo ratings yet

- Adjusting EntryDocument48 pagesAdjusting EntryKentoy Serezo Villanura100% (1)

- Chart of AccountsDocument2 pagesChart of AccountsFiania WatungNo ratings yet

- Accounting Payroll Services 1Document18 pagesAccounting Payroll Services 1Donna MarieNo ratings yet

- Chart of Accounts (Sole Proprietorship) Account No. Account Title AssetsDocument16 pagesChart of Accounts (Sole Proprietorship) Account No. Account Title Assetselaine galvezNo ratings yet

- FAR Module 3Document21 pagesFAR Module 3Michael Angelo DawisNo ratings yet

- A Cpas & Controllers Checklist For Closing Your Books at Year-End Part One: Closing The Books at Year-EndDocument3 pagesA Cpas & Controllers Checklist For Closing Your Books at Year-End Part One: Closing The Books at Year-EndDurbanskiNo ratings yet

- Proposed Disbursement ProcessDocument4 pagesProposed Disbursement ProcessmarvinceledioNo ratings yet

- Payroll Calculator: Period Ending: Company NameDocument1 pagePayroll Calculator: Period Ending: Company NameClement Agyenim-boatengNo ratings yet

- Key Roles & Responsibilities of Accounts Receivable - Finance in Erp and CRMDocument35 pagesKey Roles & Responsibilities of Accounts Receivable - Finance in Erp and CRMABT SuppNo ratings yet

- Principles of Financial ManagementDocument10 pagesPrinciples of Financial ManagementmakahiyaNo ratings yet

- Location and BuildingDocument1 pageLocation and BuildingmakahiyaNo ratings yet

- Finance and Its Legal EnvironmentDocument15 pagesFinance and Its Legal EnvironmentmakahiyaNo ratings yet

- Evolution of Financial ManagementDocument2 pagesEvolution of Financial ManagementmakahiyaNo ratings yet

- General PoliciesDocument1 pageGeneral PoliciesmakahiyaNo ratings yet

- Figure 1Document1 pageFigure 1makahiyaNo ratings yet

- Importance of Legal ResearchDocument2 pagesImportance of Legal ResearchmakahiyaNo ratings yet

- Rome's ContributionDocument9 pagesRome's ContributionmakahiyaNo ratings yet

- Cash Flow Statement AnalysisDocument14 pagesCash Flow Statement AnalysismakahiyaNo ratings yet

- ROMANDocument2 pagesROMANmakahiyaNo ratings yet

- Classification of SportsDocument1 pageClassification of SportsmakahiyaNo ratings yet

- FM100Document8 pagesFM100makahiyaNo ratings yet

- IntroductionDocument1 pageIntroductionmakahiyaNo ratings yet

- ROMANDocument2 pagesROMANmakahiyaNo ratings yet

- SocioDocument3 pagesSociomakahiyaNo ratings yet

- Background History of KFCDocument4 pagesBackground History of KFCmakahiya50% (2)

- IntroductionDocument1 pageIntroductionmakahiyaNo ratings yet

- Rizal LawDocument5 pagesRizal LawMathilda Victoria GomezNo ratings yet

- Rizal LawDocument5 pagesRizal LawMathilda Victoria GomezNo ratings yet

- KFCDocument3 pagesKFCmakahiyaNo ratings yet

- Income StatementsDocument11 pagesIncome StatementsmakahiyaNo ratings yet

- Financial StamentDocument4 pagesFinancial Stamentmakahiya0% (1)

- Financial RatioDocument3 pagesFinancial RatiomakahiyaNo ratings yet

- Social Structure DefinedDocument6 pagesSocial Structure DefinedmakahiyaNo ratings yet

- Financial StamentDocument4 pagesFinancial Stamentmakahiya0% (1)

- HULDocument27 pagesHULAshwini SalianNo ratings yet

- JollibeeDocument3 pagesJollibeeArgel Linard Francisco Mabaga100% (1)

- SAP ResumeDocument4 pagesSAP ResumesriabcNo ratings yet

- Tank+Calibration OP 0113 WebsiteDocument2 pagesTank+Calibration OP 0113 WebsiteMohamed FouadNo ratings yet

- Leonardo Roth, FLDocument2 pagesLeonardo Roth, FLleonardorotharothNo ratings yet

- Uber Final PPT - Targeting and Positioning MissingDocument14 pagesUber Final PPT - Targeting and Positioning MissingAquarius Anum0% (1)

- Terminal Operators LiabilityDocument30 pagesTerminal Operators LiabilityMurat YilmazNo ratings yet

- Practicum ReportDocument30 pagesPracticum ReportCharlie Jhake Gray0% (2)

- Business CombinationDocument20 pagesBusiness CombinationabhaybittuNo ratings yet

- Enhancing Analytical & Creative Thinking Skills PDFDocument2 pagesEnhancing Analytical & Creative Thinking Skills PDFsonypall3339No ratings yet

- Customer Loyalty AttributesDocument25 pagesCustomer Loyalty Attributesmr_gelda6183No ratings yet

- Lessons 1 and 2 Review IBM Coursera TestDocument6 pagesLessons 1 and 2 Review IBM Coursera TestNueNo ratings yet

- Notes On b2b BusinessDocument7 pagesNotes On b2b Businesssneha pathakNo ratings yet

- Anastasia Chandra - .Akuntanis A 2014 - Tugas 6xDocument21 pagesAnastasia Chandra - .Akuntanis A 2014 - Tugas 6xSriNo ratings yet

- Coi D00387Document101 pagesCoi D00387Fazila KhanNo ratings yet

- ACFE Fraud Examination Report (Short)Document8 pagesACFE Fraud Examination Report (Short)Basit Sattar100% (1)

- Corrección Miro - Zrepmir7Document19 pagesCorrección Miro - Zrepmir7miguelruzNo ratings yet

- Cab - BLR Airport To Schneider PDFDocument3 pagesCab - BLR Airport To Schneider PDFVinil KumarNo ratings yet

- Abstract Mini Projects 2016Document91 pagesAbstract Mini Projects 2016Sikkandhar JabbarNo ratings yet

- Coca Cola Porter S Five Forces Analysis and Diverse Value Chain Activities in Different Areas PDFDocument33 pagesCoca Cola Porter S Five Forces Analysis and Diverse Value Chain Activities in Different Areas PDFLouise AncianoNo ratings yet

- Income Tax Banggawan2019 Ch9Document13 pagesIncome Tax Banggawan2019 Ch9Noreen Ledda83% (6)

- Business Plan RealDocument16 pagesBusiness Plan RealAjoy JaucianNo ratings yet

- Investor PDFDocument3 pagesInvestor PDFHAFEZ ALINo ratings yet

- Letter of Intent LOI TemplateDocument4 pagesLetter of Intent LOI Templatew_fib100% (1)

- Introduction To Business-to-Business Marketing: Vitale A ND Gig LieranoDocument18 pagesIntroduction To Business-to-Business Marketing: Vitale A ND Gig LieranoMaria ZakirNo ratings yet

- Real Options and Other Topics in Capital BudgetingDocument24 pagesReal Options and Other Topics in Capital BudgetingAJ100% (1)

- Six Sigma Control PDFDocument74 pagesSix Sigma Control PDFnaacha457No ratings yet

- MKT 460 CH 1 Seh Defining Marketing For The 21st CenturyDocument56 pagesMKT 460 CH 1 Seh Defining Marketing For The 21st CenturyRifat ChowdhuryNo ratings yet

- No Shortchanging ActDocument11 pagesNo Shortchanging ActDesiree Ann GamboaNo ratings yet

- Clementi TownDocument3 pagesClementi TownjuronglakesideNo ratings yet