Professional Documents

Culture Documents

Cheer Fades For Consumer Goods Sector: FMCG Stocks Rise On Lower Tax

Uploaded by

prasadzinjurdeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cheer Fades For Consumer Goods Sector: FMCG Stocks Rise On Lower Tax

Uploaded by

prasadzinjurdeCopyright:

Available Formats

<

PRICESOFTVs, ACs & WASHING AUTO PARTSAREPROPOSED CIGARETTESWILL

MACHINESCOULD GO UP 1.5-4% TO BETAXED AT 28% GST ATTRACT GST RATEOF28%

Cheer fades for consumer goods sector

While staples and FMCG items have got relief,

discretionary goods to become costlier

FMCG stocks rise on lower tax

PAVAN BURUGULA

ARNAB DUTTA said: Keeping with the Digital India objec-

New Delhi, 19 May tives, the ideal GST rate should have been FMCG stocks saw a positive movement on Friday as

five per cent. The additional price burden investors cheered the possibility of consumer goods

T

he initial cheer over lower tax rates will have to be unwillingly passed on to becoming cheaper after the implementation of the

for some mass-consumption consumers, to sustain profitable growth for GST. The BSE index for the FMCG sector gained 1.9%

consumer goods proved to be short- our business. to close at 9,627 even as the benchmark indices

lived. The detailed goods and serv- The rates declared for IT (information closed flat on Thursday. On the other hand, all the

ices tax (GST) rate of 1,211 items that came technology) products seem on the higher other major sectoral indices closed in the red.

late on Thursday night was like the sting in side. Clarity is awaited on GST on differential Among the FMCG companies, shares of Colgate-

the tail, with major consumer goods firms duty on imports and local manufacturing, on Palmolive India soared 3.6% the best by any

expressing concerns that the introduction services and treatment of area-based exemp- company that is a part of the FMCG index. Shares of ITC

of the new tax regime would lead to price tions, said Rajeev Jain, group chief financial and Emami closed 2.8% and 2.4% higher. This rally of

increase of most discretionary items. That officer (CFO), Intex Technologies. ITC shares also helped the benchmarks recover from However, shares of consumer durables witnessed a

includes durables, mobile handsets, aerated Indian Beverage Association said, We the selling in the broader markets. ITC has a weight of fall as the GST rate for the sector is higher than the cur-

drinks and sanitaryware, among others. are extremely disappointed with sweetened around 11.5% in the Sensex. rent tax slab. The BSE Consumer Durables Index lost one

While the rates for most fast moving con- aerated water and flavoured water being Market participants said GST will provide much- per cent to close at 15,475.71. Similarly, the index for

sumer goods items were in line with expec- placed in the highest tax slab rate of 28 per needed impetus for FMCG firms which are yet to Consumer Discretionary Goods & Services also lost one

tations, discretionary spending might be hit cent, combined with an additional cess of recover from the impact of demonetisation. The per cent during the session. Shares of Crompton Greaves

in a market that already faces a slowdown. 12 per cent. The effective tax rate of 40 per BSE FMCG Index has gained little more than 20% in were down 3.8% while shares of Symphony and

Prices of TV sets, refrigerators, washing cent on these products under the GST regime the current calendar. Whirlpool of India lost 1.8% and 1.4%, respectively.

machines and air conditioners might see is against the stated policy of maintaining

price increases of 1.5-4 per cent in the com- parity with the existing weighted average

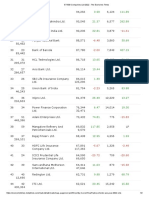

ing days. Effective tax rates for these items tax. This will have a negative ripple effect S&P BSE 15,800 S&P BSE 9,900

have been set at 28 per cent, up from the 24- and hurt the entire eco-system of farmers, CONSUMER 15,637.91 FAST- 9,627.43

26.5 per cent at present. Seniors at major retailers, distributors and bottlers. 15,600 9,750

durables makers say it is imperative that they Coca-Cola India gets a little over DURABLES 15,475.71 MOVING

pass on the additional burden to consumers. 60 per cent of its ~10,200-crore yearly sale 15,400 CONSUMER 9,600

They were, they say, already finding it diffi- from aerated drinks. PepsiCo generates near-

cult to absorb a rise in material costs for TV ly 45 per cent. However, a 12 per cent rate on 15,200

GOODS 9,451.31 9,450

panels and compressors. fruit juices and milk-based drinks is a May 18 2017 May 19 May 18 2017 May 19

Under the new GST tax slab, a price rise breather; the two have been expanding their

of 4 per cent and upwards can be expected portfolio outside of colas for some time. Most CONSUMER DURABLES FAST-MOVING CONSUMER GOODS

for consumer durables. The trade partners staple consumer goods such as dairy prod- BSE price in ~ BSE price in ~

though might have a slight impact due to ucts, meat derivatives, breakfast cereals and

input tax but they can recover by increasing processed vegetables have been kept under May 19,2017 % chg* May 19,2017 % chg*

their selling price, said Manish Sharma, the 18 per cent or lower tax brackets, in line GAINERS GAINERS

president and chief executive at Panasonic with expectations, companies said. Some PC Jeweller 450.35 0.57 Colgate-Palmolive 1,014.55 3.59

India and South Asia. items have been taxed higher. Videocon Ind 100.45 0.40 Tata Coffee 134.10 3.07

At a time when the government is We are disappointed with the decision to LOSERS Jay Shree Tea 103.45 3.04

aggressively pushing for digitisation, where levy 12 per cent GST on ayurvedic medicines

smartphones and value added feature and products, which we feel will be adverse

Crompton Greaves Con Ele 222.70 -3.82 ITC 285.90 2.82

phones are expected to play a central role, the for the category, at a time when the govern- Symphony 1,417.85 -1.84 Emami 1,107.10 2.46

tax on these would increase. The effective ment has been talking about promoting tra- Whirlpool of India 1,174.30 -1.43 LOSERS

rate on such items is presently eight to nine ditional Indian alternative medicine, said TTK Prestige 6,352.65 -1.02 Zydus Wellness 810.40 -3.08

per cent; under GST, this is set to rise up to Lalit Malik, CFO, Dabur India. Rajesh Exports 634.70 -0.67 Gujarat Ambuja Exports 131.55 -3.06

18 per cent. Considering smartphones at Sanitarywares and bathroom products Nilkamal 1,986.45 -0.45 Ess Dee Alum 47.00 -2.99

par with consumer durable items is incor- will be taxed at 28 per cent; the current rate

rect, said Syed Tajuddin, chief executive is 24 per cent. Driving a luxury car and going

Blue Star 646.65 -0.27 Radico Khaitan 125.45 -2.68

officer, Coolpad India. to the toilet will cost you the same, said K E Titan Company 471.10 -0.08 Advanced Enzyme Tech 1,889.50 -2.46

Pardeep Jain, MD at Karbonn Mobiles, Ranganathan, MD, Roca Bathroom Products. *Change over previous close Compiled by BS Research Bureau

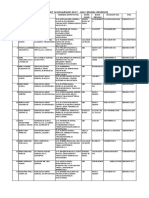

IMPACT OF GST RATES ON VARIOUS SECTORS AND COMPANIES

ITEMS CURRENT GST COMPANIES ITEMS CURRENT GST COMPANIES

EFFECTIVE RATE IMPACTED EFFECTIVE RATE IMPACTED

RATE (%) (%) RATE (%) (%)

AUTOMOBILES BEVERAGES

Two-wheelers 23.7 28 Bajaj Auto, Eicher Motors, Aerated waters containing added sugars 32-36 28 + cess

Hero Motocorp and TVS Motors Fruit pulp or fruit juice-based drinks 6 to 8 12 Dabur, Manpasand Beverages

Small cars 23.7 28 + cess Maruti Suzuki Malted milk (including powders) 11 to 18 18 Nestle, GSKConsumer Healthcare

of 1% for infant use

Mid-sized cars/SUVs 27.1 28 + cess Maruti Suzuki, M&M

of 3% DAIRY PRODUCTS

SUVs and cars over 1,500 cc 28.8 28 + cess Maruti Suzuki, M&M Butter 12.5-15 12 Britannia

of 15% Cheese 12.5 12 Britannia

Commercial vehicles 23.7 28 Ashok Leyland, Bharat Forge, Ghee 5-12.5 12

Eicher Motors, Tata Motors and Wabco Milkand cream Nil Nil Nestle, Britannia

Tractors 11.9 12 M&M Milk food for babies Nil x Nestle

Milk powder/ UHT milk, skimmed milk, 4-6 5 Nestle, Britannia

CEMENT yoghurt

All companies 23-26 28 UltraTech, ACC, Ambuja, Shree Cement

and other mid-cap names OTHER FOOD ITEMS

Chocolates 22-24 28 Nestle

CONSUMER DURABLES

Edible oils 4-6 5 Marico, Agro Tech Foods

Air-conditioners, fans, microwave ovens, 26-30 28 Havells, Voltas, Whirlpool

refrigerators, washing machines Honey 4-6 5 Dabur

Ice cream 16-20 18 Hindustan Unilever

CONSUMER PRODUCTS Pasta 16-20 18 Nestle, ITC

Apparel/garments 6 to 7 NA Arvind, Kewal Kiran, Nandan Denim

Bullion/Jewellery 2 NA Titan, PCJeweller PERSONAL CARE ITEMS

Cigarettes 40-70 NA ITC, VST, Godfrey Phillips Coconut oil 4-6 5 Marico, Dabur

All other FMCG products 16-24 28 All FMCG companies Hair oils (excluding coconut oil) 22-24 18 Marico, Dabur, Bajaj Corp, Emami

Sanitary napkins 4-6 12 P&G Hygiene

BAKERY ITEMS

Pastries and cakes 11-18 18 Britannia BUILDING MATERIALS

Rusks, toasted bread and similar 5-12.5 5 Britannia Paints 22-24 28 All paint companies

toasted products Sanitaryware, faucets, tiles 18-24 28 Cera, HSIL, Kajaraia, Somany

Notes: (a) Current effective rate includes central excise duty and state VAT. (b) Swachh Bharat, Krishi Kalyan and Infrastructure cess to ENTERTAINMENT

be subsumed in GST within one year of implementation. (c) Entertainment tax is 27% on net ticket sales.

Source: CBEC, Kotak Institutional Equities DTH 21.5 18 Dish TV

You might also like

- Presentation by - Hitaksha Gambhir - Archana Ramesh - Kushal Shah - Harshil Bhadra - Suyog KandiDocument25 pagesPresentation by - Hitaksha Gambhir - Archana Ramesh - Kushal Shah - Harshil Bhadra - Suyog KandiKunal ChawlaNo ratings yet

- PDFFile5b432d754ab853 80651823Document7 pagesPDFFile5b432d754ab853 80651823Shagun KumarNo ratings yet

- Industry News Brief 031422Document4 pagesIndustry News Brief 031422Jan Paolo CruzNo ratings yet

- Consumer: GST Rates Broadly in Line With ExpectationsDocument6 pagesConsumer: GST Rates Broadly in Line With ExpectationssameerNo ratings yet

- Surya Nepal Private LimitedDocument31 pagesSurya Nepal Private LimitedSwastika GiriNo ratings yet

- Economics Project: Indrojeet Datta 10 CDocument13 pagesEconomics Project: Indrojeet Datta 10 CKush DattaNo ratings yet

- ITC Press Release Q4 FY2021Document16 pagesITC Press Release Q4 FY2021trash mailNo ratings yet

- Angel Top Picks - July 2017Document20 pagesAngel Top Picks - July 2017Abhijit TripathiNo ratings yet

- Credence Capital GSTDocument6 pagesCredence Capital GSTnitroglyssNo ratings yet

- FMCG Sector Quarterly Update - Dec2010: Volume Growth Intact, Rising Input Costs A Key ConcernDocument12 pagesFMCG Sector Quarterly Update - Dec2010: Volume Growth Intact, Rising Input Costs A Key ConcernRohit GharatNo ratings yet

- Wot Analysis of FMCG Industry - Document TranscriptDocument6 pagesWot Analysis of FMCG Industry - Document TranscriptKarandhina DhinaNo ratings yet

- Impact of COVID-19 On Natural Gas Business in IndiaDocument10 pagesImpact of COVID-19 On Natural Gas Business in IndiaireshaNo ratings yet

- Analysis of The GST Law: Is Your Business Prepared For The Change?Document23 pagesAnalysis of The GST Law: Is Your Business Prepared For The Change?Minecraft ServerNo ratings yet

- Document Project FMCGDocument5 pagesDocument Project FMCGstepstobecomemillionaireNo ratings yet

- Indirect TaxDocument6 pagesIndirect TaxstepstobecomemillionaireNo ratings yet

- FMCG & Retail: Impact of GST on Supply Chain and TaxationDocument10 pagesFMCG & Retail: Impact of GST on Supply Chain and TaxationNitinNo ratings yet

- Impact of GST on Indian FMCG SectorDocument6 pagesImpact of GST on Indian FMCG Sectorsheebakbs5144No ratings yet

- DABUR- KEY HIGHLIGHTS AND STRATEGIESDocument60 pagesDABUR- KEY HIGHLIGHTS AND STRATEGIESSimran JainNo ratings yet

- Bs Nws:1&Tbo U&Sa X&Ei Yrfxtaz 6 KPDPRQF 90 Tnrcg&Ved 0 Cfiqqai&Fp 3 F881 D2 B67 F183 B3Document5 pagesBs Nws:1&Tbo U&Sa X&Ei Yrfxtaz 6 KPDPRQF 90 Tnrcg&Ved 0 Cfiqqai&Fp 3 F881 D2 B67 F183 B3Rohit GharatNo ratings yet

- SWOT of FMCGDocument10 pagesSWOT of FMCGMahmood SadiqNo ratings yet

- Itc 031017Document3 pagesItc 031017Sam SamNo ratings yet

- Chapter 4 5 6 References Appendices Coco VinegarDocument30 pagesChapter 4 5 6 References Appendices Coco VinegarGlenn VergaraNo ratings yet

- Impact of GST on Indian FMCG SectorDocument42 pagesImpact of GST on Indian FMCG SectorManthanNo ratings yet

- ITC Reduces Dependence on Tobacco BusinessDocument6 pagesITC Reduces Dependence on Tobacco BusinessVishakha RathodNo ratings yet

- Surya Nepal Private LimitedDocument14 pagesSurya Nepal Private LimitedSudip DhakalNo ratings yet

- Impact of GST On The Indian Economy: January 2018Document31 pagesImpact of GST On The Indian Economy: January 2018SIDDHARTH MAJHINo ratings yet

- Cost Analysis - Fast Moving Consumer Durables Industry: NOVEMBER 2, 2018Document8 pagesCost Analysis - Fast Moving Consumer Durables Industry: NOVEMBER 2, 2018Saurabh SinghNo ratings yet

- Analyzing the Impact of Freeing Petroleum Prices in IndiaDocument4 pagesAnalyzing the Impact of Freeing Petroleum Prices in IndiaamitgvsNo ratings yet

- 88 1 407 2 10 20170909 PDFDocument13 pages88 1 407 2 10 20170909 PDFJazz JuniorNo ratings yet

- Impact of Budget On FMCG Sector: BY:-Renu Antil Santosh Pathak Prachi Singh Prerna Kapur Shilpa Kumari Nimika GuptaDocument10 pagesImpact of Budget On FMCG Sector: BY:-Renu Antil Santosh Pathak Prachi Singh Prerna Kapur Shilpa Kumari Nimika GuptaPrachi SinghNo ratings yet

- Consumer Sector - Best in ClassDocument30 pagesConsumer Sector - Best in ClassEry IrmansyahNo ratings yet

- Hindustan Unilever: Better Performance in An Uncertain EnvironmentDocument7 pagesHindustan Unilever: Better Performance in An Uncertain EnvironmentUTSAVNo ratings yet

- CMP: INR264 Strong Near-Term Visibility Environment ConduciveDocument14 pagesCMP: INR264 Strong Near-Term Visibility Environment ConducivebradburywillsNo ratings yet

- Idtl Project Ic201128Document36 pagesIdtl Project Ic201128Coc MeniaNo ratings yet

- FMEC PROJECT After GSTDocument45 pagesFMEC PROJECT After GSTdeepankarbiswas456No ratings yet

- ECO_V5_N1_010Document9 pagesECO_V5_N1_010debadattakumbha13No ratings yet

- Consumer: Growing PainsDocument8 pagesConsumer: Growing PainsAndrew BangsatNo ratings yet

- What is GST? A guide to the Goods and Services Tax in India (38Document6 pagesWhat is GST? A guide to the Goods and Services Tax in India (38ShamikaNo ratings yet

- Sanitary MKT ReportDocument38 pagesSanitary MKT ReportsanjnuNo ratings yet

- PLAGIARISM SCAN REPORTDocument3 pagesPLAGIARISM SCAN REPORTMadan ViswanathanNo ratings yet

- JCR 3Document7 pagesJCR 3rupa khannaNo ratings yet

- Consumers Thesis Statement: Under The TRAIN Law, Consumers Are Faced With High Priced Daily Commodities, Due To Additional ExciseDocument3 pagesConsumers Thesis Statement: Under The TRAIN Law, Consumers Are Faced With High Priced Daily Commodities, Due To Additional ExciseDave RectoNo ratings yet

- FMCG Crasher Sep 2023Document1 pageFMCG Crasher Sep 2023mridulrathi4No ratings yet

- Duplichecker Plagiarism ReportDocument3 pagesDuplichecker Plagiarism ReportMadan ViswanathanNo ratings yet

- Good and Services TaxDocument31 pagesGood and Services TaxSixd WaznineNo ratings yet

- March 2018 38Document7 pagesMarch 2018 38Dr Sachin Chitnis M O UPHC AiroliNo ratings yet

- Pre-Budget Expectations of FMCG SectorDocument20 pagesPre-Budget Expectations of FMCG SectorJha YatindraNo ratings yet

- Industry Research PDFDocument14 pagesIndustry Research PDFInfinityNo ratings yet

- 2 5 296 180Document4 pages2 5 296 180Mayur PatilNo ratings yet

- GST IntroductionDocument20 pagesGST IntroductionMayur MalviyaNo ratings yet

- GST and Its Impact On Various Sector: September 2017Document6 pagesGST and Its Impact On Various Sector: September 2017deepak kumar gochhayatNo ratings yet

- FMCG SectorDocument37 pagesFMCG SectorJafar SibtainNo ratings yet

- ITC - Stock Analysis - by Prashanth JanaDocument26 pagesITC - Stock Analysis - by Prashanth JanaD.G.DNo ratings yet

- Jyothy Laboratories LTD Accumulate: Retail Equity ResearchDocument5 pagesJyothy Laboratories LTD Accumulate: Retail Equity Researchkishor_warthi85No ratings yet

- Deregulation of Energy Sector in NigeriaDocument15 pagesDeregulation of Energy Sector in NigeriaWilliam BabigumiraNo ratings yet

- UGC NET Commerce Sample Theory ExplainedDocument12 pagesUGC NET Commerce Sample Theory ExplainedgeddadaarunNo ratings yet

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesFrom EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesNo ratings yet

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesFrom EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNo ratings yet

- An Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipFrom EverandAn Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipNo ratings yet

- SEBI (LODR) Regulation 2015Document20 pagesSEBI (LODR) Regulation 2015prasadzinjurdeNo ratings yet

- Money Tips For New Parents - The Economic Times - Mumbai, 2018-06-04Document14 pagesMoney Tips For New Parents - The Economic Times - Mumbai, 2018-06-04prasadzinjurdeNo ratings yet

- Key Amendments to SS-1Document13 pagesKey Amendments to SS-1prasadzinjurdeNo ratings yet

- Real Estate Marketing Ideas and Materials by Boris GantsevichDocument32 pagesReal Estate Marketing Ideas and Materials by Boris GantsevichBoris GantsevichNo ratings yet

- ComplianceDocument2 pagesComplianceprasadzinjurdeNo ratings yet

- Key Amendments to SS-1Document13 pagesKey Amendments to SS-1prasadzinjurdeNo ratings yet

- Draft Board Resolutions Under Companies Act 2013Document4 pagesDraft Board Resolutions Under Companies Act 2013Ashish Jain0% (1)

- Trademark Registration Process OverviewDocument1 pageTrademark Registration Process OverviewCA Vikas NevatiaNo ratings yet

- User Manual Etrademarkfiling PDFDocument36 pagesUser Manual Etrademarkfiling PDFprasadzinjurdeNo ratings yet

- Listed Public Independent Director: Exemption To Certain Category of CompaniesDocument4 pagesListed Public Independent Director: Exemption To Certain Category of CompaniesprasadzinjurdeNo ratings yet

- Real Estate Regulatory Act (RERA) User ManualDocument29 pagesReal Estate Regulatory Act (RERA) User ManualprasadzinjurdeNo ratings yet

- Rera 1Document95 pagesRera 1prasadzinjurdeNo ratings yet

- Luxury goods concept expands to include paints, chocolates under 28% GSTDocument1 pageLuxury goods concept expands to include paints, chocolates under 28% GSTprasadzinjurdeNo ratings yet

- Car GSTDocument1 pageCar GSTprasadzinjurdeNo ratings yet

- 3Document16 pages3prasadzinjurdeNo ratings yet

- Case Study: PointDocument1 pageCase Study: PointprasadzinjurdeNo ratings yet

- All About ECBDocument7 pagesAll About ECBprasadzinjurdeNo ratings yet

- Travelling GSTDocument1 pageTravelling GSTprasadzinjurdeNo ratings yet

- BASKAR SUBRAMANIAN, Co-Founder of Targeted Advertising Platform Amagi, Tells Sangeeta TanwarDocument1 pageBASKAR SUBRAMANIAN, Co-Founder of Targeted Advertising Platform Amagi, Tells Sangeeta TanwarprasadzinjurdeNo ratings yet

- Checklist For ACSDocument5 pagesChecklist For ACSprasadzinjurdeNo ratings yet

- Booking A 5,000-Plus Hotel Room? Be Ready To Pay More: Shubham ParasharDocument1 pageBooking A 5,000-Plus Hotel Room? Be Ready To Pay More: Shubham ParasharprasadzinjurdeNo ratings yet

- Phone Bills, Insurance and Banking To Cost More: Arup Roychoudhury & Kiran RatheeDocument1 pagePhone Bills, Insurance and Banking To Cost More: Arup Roychoudhury & Kiran RatheeprasadzinjurdeNo ratings yet

- GST Unlikely To Push Up Inflation: Lower Rates Lead To Concerns Over Shortfall in Government Revenue, Say EconomistsDocument1 pageGST Unlikely To Push Up Inflation: Lower Rates Lead To Concerns Over Shortfall in Government Revenue, Say EconomistsprasadzinjurdeNo ratings yet

- Questionnaire ObjectiveDocument9 pagesQuestionnaire Objectiveprasadzinjurde100% (3)

- Ration For ProjectDocument3 pagesRation For ProjectprasadzinjurdeNo ratings yet

- CG SyllabusDocument1 pageCG SyllabusprasadzinjurdeNo ratings yet

- New Microsoft Office Excel WorksheetDocument8 pagesNew Microsoft Office Excel WorksheetprasadzinjurdeNo ratings yet

- Indian EthosDocument9 pagesIndian EthoslinsysanjuNo ratings yet

- StressDocument14 pagesStressprasadzinjurdeNo ratings yet

- Vinay Black Book BSEDocument66 pagesVinay Black Book BSEVinay yadavNo ratings yet

- Jukkal Mandal Farmer Data - Individual DataDocument602 pagesJukkal Mandal Farmer Data - Individual DataBeing iitianNo ratings yet

- Bank details submission letterDocument2 pagesBank details submission letterKarthi Keyan100% (1)

- Amba To PricelistDocument148 pagesAmba To PricelistRishabh MalikNo ratings yet

- SMART 22 Aug 2016Document45 pagesSMART 22 Aug 2016siva kNo ratings yet

- Colliers Report Ipmo4q2010Document20 pagesColliers Report Ipmo4q2010Mukesh ChawdaNo ratings yet

- Project Report On STUDY OF RISK PERCEPTIDocument58 pagesProject Report On STUDY OF RISK PERCEPTIGanesh TiwariNo ratings yet

- Alumni Data 2010 Batch EceDocument9 pagesAlumni Data 2010 Batch EceAbhishek abhishekNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument31 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceTyrion LannisterNo ratings yet

- Ambit - Strategy - ERr GRP - The Rebooting of IndiaDocument25 pagesAmbit - Strategy - ERr GRP - The Rebooting of Indiaomkarb87No ratings yet

- ET 500 Companies List 2022Document2 pagesET 500 Companies List 20220000000000000000No ratings yet

- Bajaj Auto Finance Ltd part of diversified Indian financial sectorDocument3 pagesBajaj Auto Finance Ltd part of diversified Indian financial sectorradhikaNo ratings yet

- Analysis of Consumer Behavior Towards Share Trading andDocument79 pagesAnalysis of Consumer Behavior Towards Share Trading andSagar Paul'g100% (2)

- Sek M Haniph 01042021 Till 31032022Document29 pagesSek M Haniph 01042021 Till 31032022Sujat KhanNo ratings yet

- 9 July TrackerDocument12 pages9 July Trackernayana dhotreNo ratings yet

- Equities in IndiaDocument3 pagesEquities in Indiansrivastav1No ratings yet

- 10 Biggest Falls in The Indian Stock Market HistoryDocument4 pages10 Biggest Falls in The Indian Stock Market HistoryPrashant MauryaNo ratings yet

- Architects GurgaonDocument2 pagesArchitects GurgaonHarsha KumariNo ratings yet

- List of CPIOs and AAs - 23!01!18Document3 pagesList of CPIOs and AAs - 23!01!18Karan Pratap100% (1)

- Fabex Share Price Movement FinalDocument20 pagesFabex Share Price Movement FinalChinmay ShirsatNo ratings yet

- Review of LiteratureDocument38 pagesReview of Literaturesingh.pragati123No ratings yet

- Account Statement: Description DateDocument11 pagesAccount Statement: Description DateBoni MondalNo ratings yet

- V Share Capital Goods Vol-34 - December 2007Document38 pagesV Share Capital Goods Vol-34 - December 2007tarun.mitra19854923No ratings yet

- ABM Weekly Techno-Derivatives Snapshot 13 July 2020Document35 pagesABM Weekly Techno-Derivatives Snapshot 13 July 2020Mukesh GuptaNo ratings yet

- Weekly Technical Analysis 15th July 2013Document27 pagesWeekly Technical Analysis 15th July 2013Kaushaljm PatelNo ratings yet

- HSLC Rural ReserveDocument53 pagesHSLC Rural ReserveHimungshu KashyapaNo ratings yet

- ExportDocument32 pagesExportSumit KumarNo ratings yet

- Research Paper On: Submitted By: Ashish Chanchlani PGDM-07 VesimsrDocument10 pagesResearch Paper On: Submitted By: Ashish Chanchlani PGDM-07 VesimsrAshish chanchlaniNo ratings yet

- New Microsoft Word DocumentDocument5 pagesNew Microsoft Word DocumentMukeshNo ratings yet

- Research Methodology Ca 2Document20 pagesResearch Methodology Ca 2Rohit SharmaNo ratings yet