Professional Documents

Culture Documents

Procedure of Contract Labour Act 1970

Uploaded by

Shravan Kumar0 ratings0% found this document useful (0 votes)

185 views4 pagesprocedure of contract labour act 1970

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentprocedure of contract labour act 1970

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

185 views4 pagesProcedure of Contract Labour Act 1970

Uploaded by

Shravan Kumarprocedure of contract labour act 1970

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Detailed Process flow for applications under Contract

Labour Act.1970

A. Process of Registration of Principal Employer under Contract Labour Act

FlOW CHART

Application by the Principal Employer Registering Officer of the area

in triplicate in Form-I in case of

offline mode alongwith fees (Sec-7 of

C L Act)

Acknowledgement to applicant

Grant of Registration Certificate in

Form II or rejection

Registering Officer of the area

Application for Amendment of Grant of Amended Registration

Registration Certificate, if any, within 30 Certificate

days from the change.

Registration of Establishment

Principal Employer Employing 20 or more worker through the

contractor or contractors has to obtain Registration Certificate.

Check List

1. Application in triplicate in Form- I in case of offline mode

2. Copy of challan according to no of labourers

3. Copy of Pan Card

4. Latest copy of agreement /work order with contractor

Time Line

Maximum Number of Days after complete application is submitted: 30 Days (As

per notified at Sr. No. 227 under Right to Service Act, 2011)

Forms and Fees: -

http://pblabour.gov.in/Content/documents/pdf/Procedures/Forms_of_Registrat

ion_under_Contract_Labour_Act_1970.pdf

B Process of Granting licenses under Contract Labour Act

Application in quadruplicate in Form IV Licensing Officer of the area

in case of offline mode alongwith

Security, fees and Form V

Acknowledgement to applicant

Grant of License in form VI or

Refusal of License after recording

reasons

Application in triplicate in Form VII in

case of offline mode for renewal of Grant of Renewed License

License, original License alongwith Fees

before 30 days of the date on which

license expires

Registering Officer to refund Security

Application for Refund of Security within 60 days

Application for a License

Any contractor engaging 20 or more contract Workers is required to get license.

Check List

1. Application for License in Triplicate in Form IV [Rule 7 (1)] in case offline

mode

2. Principal employer certificate (Form VI) [Refer rule 7 (2)]

3. Security deposit challan

4. License fee challan

5. Work order/Agreement with principal employer/Enlistment copy

6. PAN card copy

7. EPF Number

Time Line

Maximum Number of Days after complete application is submitted: 30 Days

Refund of Security 60 days. (As per notified at Sr. No. 228 and 229 under Right to

Service Act, 2011)

Validity of License

One year from the date of issue

Forms and Fees :-

http://pblabour.gov.in/Content/documents/pdf/Procedures/Forms_of_Registrat

ion_under_Contract_Labour_Act_1970.pdf

Procedure in Detail

CONTRACT LABOUR (REGULATION & ABOLITION) ACT, 1970 & PUNJAB

CONTRACT LABOUR (REGULATION & ABOLITION) RULES 1973

Object: The object of the Act is to regulate the employment of contract labour in

certain establishments and provide for its abolition in certain circumstances and for

matters connected therewith.

Applicability: It is applicable to every establishment (Principal Employer) in which 20

or more workmen are employed or were employed on any day of the preceding 12

months as contract labour. It is also applicable to every contractor who employs or who

employed on any day of the preceding twelve months 20 or more workmen.

Who is the Principal Employer: In the case of an office or the department of

government or the local authority - the head thereof or the specified person; in the case

of a factory, the owner or occupier or the person named as manager thereof; in the case

of other establishments, the person responsible for the supervision and control of the

establishment, is the principal employer under the Act.

Registration of Establishment & its fee: The Principal Employer of an establishment

to whom the Act is applicable is required to get himself registered with the Registering

Officer of the area i.e. the Assistant Labour Commissioner or the Labour-cum-

Conciliation Officer by submitting an application in triplicate in Form-1 in case of

offline mode alongwith the prescribed fee mentioned herein under.

Grant of Registration Certificate

The Registering officer shall issue the Registration Certificate within thirty days of the

receipt of application, if the application is complete in all respect.

Revocation of Registration & its amendment: A Certificate of Registration can be

revoked by the Registering Officer if it is obtained by misrepresentation or suppression

of material facts etc. after affording an opportunity of being heard to the principal

employer. The registration certificate is required to be amended upon the occurrence of

any change in the particulars of establishment and upon the payment balance fee, if any

on the enhancement of number of workers.

Licensing of Contractor: Every contractor to whom this Act is applicable is required

to obtain a License on an application in Form IV in triplicate in case of offline mode,

made to the Licensing Officer of the area i.e. the Assistant Labour Commissioner or the

Labour-cum-Conciliation Officer alongwith the fee mentioned herein under. He is also

required to deposit a security amount @ 1 Rs. 270/- per worker. The contractor is

required to renew the licence by submitting the application in Form VII in triplicate and

deposit of fee for renewal

Grant of License

The Registering officer shall issue the License within thirty days of the receipt of

application, if the application is complete in all respect.

Revocation or Suspension & Amendment of License: A license can be revoked by

the Licensing Officer if it was obtained by misrepresentation or suppression of material

facts or upon the failure of the contractor to comply with the conditions or

contravention of Act or the Rules.

Welfare Measures to be taken by contractor: Where one hundred or more contract

labour is employed one or more canteens are to be provided and maintained; first aid

facilities, rest rooms, drinking water, latrines and washing facilities etc. are to be

provided by the Contractor and upon his failure, to be provided by the Principal

Employer.

Responsibility of contractor for payment of wages: A contract is responsible to pay

timely payment of wages and to ensure the disbursement of wages in the presence of

the authorized representatives of the principal employer. The rates of wages are not to

be less than the prescribed rates of minimum wages by the State Government.

Maintenance of records and submission of returns by Principal Employer:-

Register of contractors in respect of every establishment in Form XII and annual return

in Form XXV in duplicate before 15 th February.

Maintenance of records and submission of returns by Contractor:- Register of

workers for each registered establishment in Form XIII, muster roll and register of

wages in form XVI and Form XVII when combined; register of wage-cum-muster roll

in form XVII where the wage period is fortnightly or less; register of deductions for

damages or loss in Form XX, register of fines in Form XXI; register of advances in

Form XXII, register of overtime in Form XXIII, wage slip in Form XIX; and half-

yearly return in Form XXIV in duplicate within 30 days from the Penalties: For

obstructing the inspector or failing to produce registers etc. three months

imprisonment or fine up to Rs. 500/- or both and for violation of the provisions of the

act or the rules, imprisonment of three months or fine up to Rs. 1000/- and in the case of

continuing contravention, additional fine unto Rs. 100/- per day.

For more information and detail Click on the link below: -

1) http://pblabour.gov.in/Content/documents/pdf/acts_rules/contract_labour_

regulation_and_abolition_act_1970.pdf

2) http://pblabour.gov.in/Content/documents/pdf/acts_rules/contract_labour_punja

b_rules_1973.pdf

You might also like

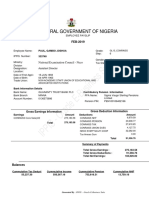

- IPPIS - Oracle E-Business Suite: Federal Government of NigeriaDocument18 pagesIPPIS - Oracle E-Business Suite: Federal Government of Nigeriamustapha kamilu100% (1)

- Anchoring Script For Annual Day CelebrationDocument6 pagesAnchoring Script For Annual Day CelebrationRani Ambrose78% (123)

- EcoDocument15 pagesEcoShravan KumarNo ratings yet

- Port AgentsDocument11 pagesPort AgentstbalaNo ratings yet

- Taxes On Savings: Jonathan Gruber Public Finance and Public PolicyDocument51 pagesTaxes On Savings: Jonathan Gruber Public Finance and Public PolicyGaluh WicaksanaNo ratings yet

- Notes On Contract LabourDocument12 pagesNotes On Contract Labourflower87No ratings yet

- Labour Compliances COLPALDocument17 pagesLabour Compliances COLPALAshu TanejaNo ratings yet

- The Contract Labour Act 1970Document2 pagesThe Contract Labour Act 1970Shawn SriramNo ratings yet

- Clra 1970Document5 pagesClra 1970L. BalajiNo ratings yet

- The Occupational Safety, Health and Working Conditions Code, 2020 - Part IVDocument40 pagesThe Occupational Safety, Health and Working Conditions Code, 2020 - Part IVNikita D'LimaNo ratings yet

- Contract Labour Act 494Document14 pagesContract Labour Act 494Sivaguru ArumugamNo ratings yet

- Gratuity FormsDocument2 pagesGratuity FormsDeeptodip SenNo ratings yet

- Registration of Establishment Under BOCW Act 1996Document7 pagesRegistration of Establishment Under BOCW Act 1996ramuNo ratings yet

- The Inter State Migrant Workmen Act - 1979Document8 pagesThe Inter State Migrant Workmen Act - 1979Shaji Mullookkaaran100% (2)

- Rules 1972Document30 pagesRules 1972venkateshbedhreNo ratings yet

- Abstract of The Contract Labour Act, 1971Document4 pagesAbstract of The Contract Labour Act, 1971Shabir TrambooNo ratings yet

- Altus Employemnt Law TrackerDocument27 pagesAltus Employemnt Law Trackersaransh yadavNo ratings yet

- The Contract LabourDocument18 pagesThe Contract Labour9600663030No ratings yet

- Management of Contract Labour: 1. Object of The ActDocument4 pagesManagement of Contract Labour: 1. Object of The ActdileepgoliNo ratings yet

- Labour Laws Compliance-HaryanaDocument7 pagesLabour Laws Compliance-HaryanaAshok Sharma100% (1)

- Gratuity & PF-Shweta, Pratibha & RohanDocument48 pagesGratuity & PF-Shweta, Pratibha & RohanBhagyashree SondagarNo ratings yet

- Telangana Shops and Establishments Act, 1988Document27 pagesTelangana Shops and Establishments Act, 1988saransh yadavNo ratings yet

- TN Gratuity RulesDocument42 pagesTN Gratuity RulesKAVIYANo ratings yet

- Contract Labour ActDocument18 pagesContract Labour ActSatyam mishraNo ratings yet

- The Factories Act, 1948 and The Karnataka Factories Rules, 1969.Document9 pagesThe Factories Act, 1948 and The Karnataka Factories Rules, 1969.Nithiyakalyanam Punniyakotti50% (2)

- Contract Labour (R&A) Act, 1970 and Ap Rules, 1971Document5 pagesContract Labour (R&A) Act, 1970 and Ap Rules, 1971Palani KumarNo ratings yet

- Audit of Contract LabourDocument18 pagesAudit of Contract LabourRavi Kiran NavuduriNo ratings yet

- Payment of Gratuity Act1972Document29 pagesPayment of Gratuity Act1972Rafunsel PresentationNo ratings yet

- Contract Labour (Regulation & Abolition) Act, 1970 (Amended in 2004) 1.0 ObjectiveDocument4 pagesContract Labour (Regulation & Abolition) Act, 1970 (Amended in 2004) 1.0 ObjectivemdklyaNo ratings yet

- Faq Dish GomhDocument12 pagesFaq Dish Gomhmahesh battuNo ratings yet

- Kerala Shops and Commercial Establishment Act 1960Document4 pagesKerala Shops and Commercial Establishment Act 1960Allenz TomzNo ratings yet

- Cancellation & Revocation of GST RegistrationDocument5 pagesCancellation & Revocation of GST RegistrationshenbhaNo ratings yet

- Cancellation of RegistrationDocument2 pagesCancellation of RegistrationRajdev AssociatesNo ratings yet

- Sales Tax - 03Document6 pagesSales Tax - 03Bilal ShaikhNo ratings yet

- Guide Me MinimumWageActDocument5 pagesGuide Me MinimumWageActSuman DasNo ratings yet

- Forms - Factories Act & Contract Labour ActDocument6 pagesForms - Factories Act & Contract Labour ActRavikant Pandey0% (1)

- Show FileDocument22 pagesShow Filesaumya.bsphcl.prosixNo ratings yet

- Shops and Establishment Act - KeralaDocument4 pagesShops and Establishment Act - KeralaJudie GeorgeNo ratings yet

- A Brief Check List of Labour Laws: Composed by P.B.S. KumarDocument17 pagesA Brief Check List of Labour Laws: Composed by P.B.S. KumarShriya KhannaNo ratings yet

- Contractor License Under ContractLabour ActDocument5 pagesContractor License Under ContractLabour ActAnonymous 3ZvXNhY100% (1)

- Contract Labour (R&A) Act, 1970 and Ap Rules, 1971Document5 pagesContract Labour (R&A) Act, 1970 and Ap Rules, 1971MD IMRAN RAJMOHMADNo ratings yet

- A Brief Check List of Labour Laws: Composed by P.B.S. KumarDocument17 pagesA Brief Check List of Labour Laws: Composed by P.B.S. KumarkamalnetinNo ratings yet

- A Brief Check List of Labour Laws: Composed by P.B.S. KumarDocument18 pagesA Brief Check List of Labour Laws: Composed by P.B.S. KumarvinodroyalraoNo ratings yet

- Published by Labour Law Reporter DelhiDocument1 pagePublished by Labour Law Reporter DelhirawbeansNo ratings yet

- Payment of Wages Act, 1936: FactoriesDocument46 pagesPayment of Wages Act, 1936: FactoriesViraja GuruNo ratings yet

- Contract Labour ActDocument5 pagesContract Labour ActSatyam mishra100% (1)

- Real Estate: (Regulation & Development)Document17 pagesReal Estate: (Regulation & Development)Vivek KumarNo ratings yet

- Checklist Department of Labour LawDocument19 pagesChecklist Department of Labour LawPrateek VermaNo ratings yet

- Payment of Gratuity Punjab RulesDocument7 pagesPayment of Gratuity Punjab RulesSakshi VermaNo ratings yet

- HR Check ListDocument18 pagesHR Check ListenareshkumarNo ratings yet

- Compliances BITS Position-Yes/No Along With Rationale. Key Responsible Person. Apprentices Act, 1961 and Apprenticeship Rules, 1992Document15 pagesCompliances BITS Position-Yes/No Along With Rationale. Key Responsible Person. Apprentices Act, 1961 and Apprenticeship Rules, 1992raviNo ratings yet

- 19 Exhbit-J - Contract Labour Management - GuidelineDocument6 pages19 Exhbit-J - Contract Labour Management - GuidelineSyed Qaisar ImamNo ratings yet

- Contract Labour ActDocument13 pagesContract Labour ActAlok RoutNo ratings yet

- Chapter VDocument35 pagesChapter VBesar VermaNo ratings yet

- A Brief Check List of Labour LawsDocument17 pagesA Brief Check List of Labour LawsfitrianovianiNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- Labor Contract Law of the People's Republic of China (2007)From EverandLabor Contract Law of the People's Republic of China (2007)No ratings yet

- MAMS Hospital Presentation Stress ManagementDocument18 pagesMAMS Hospital Presentation Stress ManagementShravan KumarNo ratings yet

- Contract Labour Terms and ConditionsDocument2 pagesContract Labour Terms and ConditionsShravan KumarNo ratings yet

- Avaliação Do SMETA Best Practice Guidance 4 Pillar 5.0Document72 pagesAvaliação Do SMETA Best Practice Guidance 4 Pillar 5.0RitaCavalcantiNo ratings yet

- Induction ManualDocument17 pagesInduction ManualShravan KumarNo ratings yet

- Constitution English 04 (1) .07.06 Published PDFDocument32 pagesConstitution English 04 (1) .07.06 Published PDFNoemiCiullaNo ratings yet

- Apprentice (Amendment)Document49 pagesApprentice (Amendment)Shravan KumarNo ratings yet

- Job Analysis TemplateDocument1 pageJob Analysis TemplateShravan KumarNo ratings yet

- Splitting of Minimum Wages For PF in AbeyanceDocument1 pageSplitting of Minimum Wages For PF in AbeyanceShravan KumarNo ratings yet

- Lane Community College Job Analysis QuestionnaireDocument16 pagesLane Community College Job Analysis QuestionnaireShravan KumarNo ratings yet

- Form 5 IFDocument4 pagesForm 5 IFsarvansasNo ratings yet

- Judgment: Judgment A.K.SIKRI, JDocument41 pagesJudgment: Judgment A.K.SIKRI, JIrshadAhmedNo ratings yet

- Contract LabourDocument11 pagesContract LabourPrawin SterNo ratings yet

- Curriculum VitaeDocument3 pagesCurriculum VitaeShravan KumarNo ratings yet

- Professional Practice in Real EstateDocument19 pagesProfessional Practice in Real Estatedaniel daher100% (1)

- Southend Sweater Company LimitedDocument120 pagesSouthend Sweater Company LimitedLina Ali Abdul100% (1)

- Contemporary Issues in Managing Human ResourcesDocument13 pagesContemporary Issues in Managing Human ResourcesrudrarajunareshNo ratings yet

- Dressing Sense and Employee MotivationDocument53 pagesDressing Sense and Employee MotivationJnana Ranjan Pati100% (4)

- Enrique Salafranca Vs PhilamlifeDocument1 pageEnrique Salafranca Vs PhilamlifePipoy ReglosNo ratings yet

- Memo in Support of Motion To DismissDocument9 pagesMemo in Support of Motion To Dismissdavid_latNo ratings yet

- Certiorari Filed LateDocument5 pagesCertiorari Filed LateFrancesco Celestial BritanicoNo ratings yet

- Presented By, Neenu.S.K Secm, Fisat 2014-2016Document45 pagesPresented By, Neenu.S.K Secm, Fisat 2014-2016NeenuskNo ratings yet

- Nursing LeadershipDocument6 pagesNursing LeadershipAyanne03No ratings yet

- Board Certified Behavior Analysts ' Supervisory Practices of Trainees: Survey Results and RecommendationsDocument11 pagesBoard Certified Behavior Analysts ' Supervisory Practices of Trainees: Survey Results and RecommendationsNBNo ratings yet

- Cover Letter For Animation InternshipDocument7 pagesCover Letter For Animation Internshipwisaj0jat0l3100% (2)

- 101 Ways Job MarketDocument448 pages101 Ways Job MarketHajji Assamo PadilNo ratings yet

- HRA Module 1 - Lecture SlidesDocument44 pagesHRA Module 1 - Lecture Slidesankit100% (1)

- Ethics Assignment 1Document7 pagesEthics Assignment 1Black FlameNo ratings yet

- Aibea Cir 518.13Document2 pagesAibea Cir 518.13Sai PkNo ratings yet

- Genex Recruitment PolicyDocument9 pagesGenex Recruitment PolicySabuj MondalNo ratings yet

- Duke-Booz ORNreport Exec SummaryDocument9 pagesDuke-Booz ORNreport Exec SummaryStinkyNo ratings yet

- Growth of Bpo Sector and Its Effect On Indian EconomyDocument19 pagesGrowth of Bpo Sector and Its Effect On Indian EconomySwatiBhardwaj75% (4)

- Synopsis of The EMPLOYEES' COMPENSATION ACT 1923Document2 pagesSynopsis of The EMPLOYEES' COMPENSATION ACT 1923Ashish KumarNo ratings yet

- RA ARCHI ZAMBO Jan2019 PDFDocument2 pagesRA ARCHI ZAMBO Jan2019 PDFPhilBoardResultsNo ratings yet

- Mattel Recalls 2007: Communication Implications For Quality Control, Outsourcing, and Consumer RelationsDocument28 pagesMattel Recalls 2007: Communication Implications For Quality Control, Outsourcing, and Consumer RelationsSasha KhalishahNo ratings yet

- FAIR SHIPPING CORP. v. JOSELITO T. MEDELDocument15 pagesFAIR SHIPPING CORP. v. JOSELITO T. MEDELkhate alonzoNo ratings yet

- Topic 2 - Lesson 3 - Measuring Human Resource ContributionDocument8 pagesTopic 2 - Lesson 3 - Measuring Human Resource ContributionLagat ToshNo ratings yet

- Organizational Gap Analysis TemplateDocument3 pagesOrganizational Gap Analysis Templatemhardi cubacubNo ratings yet

- Resume 2016-01-25Document16 pagesResume 2016-01-25api-307102664No ratings yet

- UK Level 3 Award: NEBOSH: International General Certificate in Occupation Health and SafetyDocument3 pagesUK Level 3 Award: NEBOSH: International General Certificate in Occupation Health and SafetyJYD100% (1)

- MRA CUS ASS MVC Form2Document2 pagesMRA CUS ASS MVC Form2Neel BC0% (1)