Professional Documents

Culture Documents

Buscom Doa

Uploaded by

Christian GoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Buscom Doa

Uploaded by

Christian GoCopyright:

Available Formats

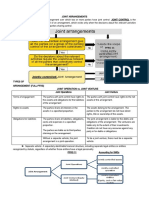

Business Combination

Formulas

1.) Noncontrolling interest

Priority 1 = Fair value of NCI given to the problem but it should not be lower than the NCI - measured at

Non-controlling interest's proportionate share of Subsidairy's identifiable net assets @ Fair Value.

If fair value of NCI given to the problem is lower than NCI measured at proportionate share

of Subsidiary's identifiable net assets use the latter.

Compuation of NCI measured in proportionate share of Subsidiary's identifiable net assets.

Subsidiary net assets at Fair Value xxx

Multiply by: Noncontrolling interest x%

Fair value of NCI proportionate share in Subsidiary identifiable net assets xxx

Priority 2 = If Fair value of NCI is not given or unknown

Acquistion cost xxx

Divided by: Controlling interest x%

Total fair value of business xxx

Multiply by: Noncontrolling interest x%

Fair value of Noncontrolling interest xxx

Note: But again the computed Fair value of Noncontrolling interest should not be lower than

than the fair value of NCI in proportionate share in Subsidiary's identifiable net assets.

Note: We apply whichever is higher rule: Part of the new provision, NCI should not have

an amount that is lower than the fair value of NCI measured in proportionate share in

Subsidiary's identifiable net assets. We use whichever is higher.

2.) Result of acquisition

Acquisition cost (Consideration paid) xxx

FMV of NCI xxx

FMV of old investment in same company acquired ( less than 50%), included xxx

Contingent liabiilty xxx

Total xxx

Less: FMV of Subsidiary Net Assets (100%) xxx

Goodwill/Gain from acquisition xxx

3.) Consolidated total Assets

Parent total assets (book value) xxx

Subsidairy total assets (fair value) exclusive of goodwill, if any xxx

Goodwill - result from acquisition xxx

Payment - taken from the assets of the acquirer (xxx)

Consolidated total assets xxxx

4.) Consolidated retained earnings

Parent retained earnings before acquisition xxx

Add: Gain from acquistion, if any xxx

Total xxx

Less: Expenses (Direct cost, indirect cost) xxx

Consolidated retained earnings xxx

5.) Consolidated common stock

Parent common stock before acqquisition xxx

Add: New issued shares to acquire subsidairy @ Par value xxx

Consolidated Common Stock xxx

6.) Consolidated additional paid in capital

Parent additional paid in capital xxx

Add: New issued share to acquire subsidiay - excess of par xxx

Total xxx

Less: Stock issue cost, if any xxx

Consolidated additional paid in capital xxx

7.) Consolidated stockholders' equity

Consolidated common stock xxx

Consolidated additional paid in capital xxx

Consolidated retained earnings xxx

Noncontrolling interest xxx

Consolidated stockholders' equity xxx

You might also like

- Buscom NotesDocument2 pagesBuscom NotesLiza SoberanoNo ratings yet

- Business CombinationDocument2 pagesBusiness CombinationMarie GonzalesNo ratings yet

- Formulas For Business Combination PDFDocument28 pagesFormulas For Business Combination PDFJulious CaalimNo ratings yet

- Questions in ConsolidatedDocument2 pagesQuestions in ConsolidatedvanessaNo ratings yet

- Consolidated Statement Formula01 PDFDocument2 pagesConsolidated Statement Formula01 PDFNiña Rica PunzalanNo ratings yet

- Consolidated Financial StatementsDocument27 pagesConsolidated Financial StatementsAlyssa CasimiroNo ratings yet

- Consolidated Statement Formula02 PDFDocument3 pagesConsolidated Statement Formula02 PDFNiña Rica PunzalanNo ratings yet

- Consolidated Financial Statements - Notes PDFDocument2 pagesConsolidated Financial Statements - Notes PDFKeanna Denise GonzalesNo ratings yet

- Audit of Shareholders EquityDocument4 pagesAudit of Shareholders EquityVic BalmadridNo ratings yet

- FormulasDocument5 pagesFormulasKezNo ratings yet

- 13 Consolidated Financial StatementDocument5 pages13 Consolidated Financial StatementabcdefgNo ratings yet

- Consolidated Statement of Financial PositionDocument6 pagesConsolidated Statement of Financial PositionRameen FatimaNo ratings yet

- Buscom Subsequent To AcquisitionDocument1 pageBuscom Subsequent To AcquisitionmcespressoblendNo ratings yet

- Intermediate Accounting Second Sem ReviewerDocument7 pagesIntermediate Accounting Second Sem ReviewerchxrlttxNo ratings yet

- Consolidated Financial Statement ExerciseDocument4 pagesConsolidated Financial Statement ExerciseAnonymous OzWtUONo ratings yet

- Consolidated Financial AccountingDocument3 pagesConsolidated Financial AccountingEmma Mariz GarciaNo ratings yet

- Consolidation Subsequent To Date of Acquisitionpdf PDF FreeDocument9 pagesConsolidation Subsequent To Date of Acquisitionpdf PDF FreelixvanterNo ratings yet

- CA. Ranjay Mishra (FCA)Document14 pagesCA. Ranjay Mishra (FCA)ZamanNo ratings yet

- Xintacctg1-Reviewer For Shareholders' EquityDocument5 pagesXintacctg1-Reviewer For Shareholders' Equitymushroompolice100% (2)

- Managerial RemunerationDocument1 pageManagerial RemunerationRakshith S BNo ratings yet

- The Consolidated Statement of Financial Position (Formerly Known As Consolidated Balance Sheet-CBS)Document5 pagesThe Consolidated Statement of Financial Position (Formerly Known As Consolidated Balance Sheet-CBS)illyanaNo ratings yet

- Chapter 2 (Mapping)Document3 pagesChapter 2 (Mapping)Zakirah ZakariaNo ratings yet

- Contractually Agreed Sharing Relevant Activities Unanimous ConsentDocument3 pagesContractually Agreed Sharing Relevant Activities Unanimous ConsentKathleen MarcialNo ratings yet

- ADVACDocument17 pagesADVACHohohoNo ratings yet

- Investments For Investments in Equity Securities (Shares)Document2 pagesInvestments For Investments in Equity Securities (Shares)Carms St ClaireNo ratings yet

- AUDIT OF INVESTMENTS - AssociateDocument4 pagesAUDIT OF INVESTMENTS - AssociateJoshua LisingNo ratings yet

- SadasfDocument1 pageSadasf.No ratings yet

- Investment Decisions NotesDocument2 pagesInvestment Decisions NotesSaumya AllapartiNo ratings yet

- Capital Gains Tax Calculation GuideDocument9 pagesCapital Gains Tax Calculation GuideAffan AliNo ratings yet

- Financial Statements of Sole Trader (Unit-04) PDFDocument3 pagesFinancial Statements of Sole Trader (Unit-04) PDFImadNo ratings yet

- Cfas CR and DR ImportantDocument6 pagesCfas CR and DR ImportantataydeyessaNo ratings yet

- Working Paper EntriesDocument2 pagesWorking Paper EntriesRixer PrietoNo ratings yet

- Introduction To Financial Statement Analysis ReviewwerDocument3 pagesIntroduction To Financial Statement Analysis ReviewwerMatthew PanganNo ratings yet

- Accounting For Corporations Pro-Forma Entries: Memorandum Entry Method Journal Entry MethodDocument5 pagesAccounting For Corporations Pro-Forma Entries: Memorandum Entry Method Journal Entry MethodKent Logarta100% (2)

- Diya 1Document4 pagesDiya 1Vipul I PanchasarNo ratings yet

- Business Combination - Stock AcquisitionDocument6 pagesBusiness Combination - Stock AcquisitionEmma Mariz GarciaNo ratings yet

- Statement of Financial Position: AssetsDocument3 pagesStatement of Financial Position: AssetsMary Quezia AlferezNo ratings yet

- Day 2 Dipifrs Weekend Batch 19022022Document21 pagesDay 2 Dipifrs Weekend Batch 19022022Kathleen De JesusNo ratings yet

- 1-Cash Flow StatementDocument21 pages1-Cash Flow StatementOvais Zia100% (1)

- Chapter 24 - The Consolidated Statement of BalanceDocument3 pagesChapter 24 - The Consolidated Statement of BalanceNazrin HasanzadehNo ratings yet

- Chapter 12 Dealings in PropertiesDocument6 pagesChapter 12 Dealings in PropertiesAlyssa BerangberangNo ratings yet

- CF StatementDocument3 pagesCF StatementSukumarVenkataNo ratings yet

- IAS 1 Presentation of Financial Statements (2021)Document17 pagesIAS 1 Presentation of Financial Statements (2021)Tawanda Tatenda Herbert100% (1)

- 5.consolidated SOCI - AAFRDocument11 pages5.consolidated SOCI - AAFRAli OptimisticNo ratings yet

- AFR Revision - Qns-AnsDocument63 pagesAFR Revision - Qns-AnsDownloder UwambajimanaNo ratings yet

- What Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial Measures, Updated EditionFrom EverandWhat Every Real Estate Investor Needs to Know About Cash Flow... And 36 Other Key Financial Measures, Updated EditionRating: 4.5 out of 5 stars4.5/5 (15)

- Chapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFDocument24 pagesChapter 3 Fundamentals of Corporate Finance 9th Edition Test Bank PDFChristian GoNo ratings yet

- ReportDocument1 pageReportChristian GoNo ratings yet

- Second Term SchedDocument3 pagesSecond Term SchedChristian GoNo ratings yet

- Wai Kit Ow Yeong Our Failure of EmpathyDocument9 pagesWai Kit Ow Yeong Our Failure of EmpathyChristian GoNo ratings yet

- TestbankDocument27 pagesTestbankChristian GoNo ratings yet

- Test Bank - Far2 CparDocument17 pagesTest Bank - Far2 CparChristian Go100% (1)

- STATADocument1 pageSTATAChristian GoNo ratings yet

- Accounting For Partnerships: Chapter OutlineDocument34 pagesAccounting For Partnerships: Chapter Outlineايهاب غزالةNo ratings yet

- A 10 y 11 T 3 Q 3 BDocument2 pagesA 10 y 11 T 3 Q 3 BChristian GoNo ratings yet

- Wrking Cap CLDocument13 pagesWrking Cap CLChristian GoNo ratings yet

- Ifrs10 179Document96 pagesIfrs10 179Christian GoNo ratings yet

- Class Direct Service ExperienceDocument2 pagesClass Direct Service ExperienceChristian GoNo ratings yet

- All The Graded Components Are Itemized Below The Chart: Class Participation Items: Essays: QuizzesDocument3 pagesAll The Graded Components Are Itemized Below The Chart: Class Participation Items: Essays: QuizzesChristian GoNo ratings yet

- Special Production Issues On Lost Units and AccretionDocument47 pagesSpecial Production Issues On Lost Units and AccretionKuroko0% (1)

- Test BankDocument30 pagesTest BankChristian GoNo ratings yet

- All The Graded Components Are Itemized Below The Chart: Class Participation Items: Essays: QuizzesDocument3 pagesAll The Graded Components Are Itemized Below The Chart: Class Participation Items: Essays: QuizzesChristian GoNo ratings yet

- Ifrs3 103Document25 pagesIfrs3 103Christian GoNo ratings yet

- Exercise 1Document1 pageExercise 1Christian GoNo ratings yet

- JapanDocument8 pagesJapanChristian GoNo ratings yet

- Advanced Accounting - SolutionDocument4 pagesAdvanced Accounting - SolutionChristian GoNo ratings yet

- Accounting and The Use of Computers PDFDocument3 pagesAccounting and The Use of Computers PDFChristian GoNo ratings yet

- Kinney8e PPT Ch06Document43 pagesKinney8e PPT Ch06Christian GoNo ratings yet

- A08y09t3q1 PDFDocument2 pagesA08y09t3q1 PDFChristian GoNo ratings yet

- Tredone Tredone Ntropsy Ntropsy: C37 - A702 C37 - A702 C31 - L110 C31 - L110Document1 pageTredone Tredone Ntropsy Ntropsy: C37 - A702 C37 - A702 C31 - L110 C31 - L110Christian GoNo ratings yet

- Present Value of An Annuity: R 10,000 J 12% M 1 T 3 YearsDocument32 pagesPresent Value of An Annuity: R 10,000 J 12% M 1 T 3 YearsChristian GoNo ratings yet

- TemplateDocument1 pageTemplateChristian GoNo ratings yet

- Englres 2Document2 pagesEnglres 2Christian GoNo ratings yet

- Tredone Tredone Ntropsy Ntropsy: C37 - A702 C37 - A702 C31 - L110 C31 - L110Document1 pageTredone Tredone Ntropsy Ntropsy: C37 - A702 C37 - A702 C31 - L110 C31 - L110Christian GoNo ratings yet

- NSTP CWTSDocument2 pagesNSTP CWTSChristian GoNo ratings yet

- DSFGHJKLKJHDocument2 pagesDSFGHJKLKJHdbhnjbgvfcvgbhnjNo ratings yet

- Depreciation of Non Current AssetsDocument27 pagesDepreciation of Non Current Assetskimuli FreddieNo ratings yet

- Initial Measurement: by Default: FVPLDocument7 pagesInitial Measurement: by Default: FVPLRemNo ratings yet

- Advacc 3 Answer Key Set b165 PcsDocument4 pagesAdvacc 3 Answer Key Set b165 PcsPearl Mae De VeasNo ratings yet

- Gross Profit Method CVDocument18 pagesGross Profit Method CVRigine Pobe MorgadezNo ratings yet

- NovemberDocument9 pagesNovemberkaty.haugland2No ratings yet

- GR 12 Notes On Audit Reports Eng AfrDocument2 pagesGR 12 Notes On Audit Reports Eng AfrmvelonhlemsimangoNo ratings yet

- Midterm Quiz 104Document8 pagesMidterm Quiz 104Sky SoronoiNo ratings yet

- Leasing: You Are To Use Your Critical Thinking Skills, Collaboration Techniques, Creative Problem-SolvingDocument2 pagesLeasing: You Are To Use Your Critical Thinking Skills, Collaboration Techniques, Creative Problem-SolvingdanielNo ratings yet

- Corporation and Corporate GovernanceDocument18 pagesCorporation and Corporate GovernanceAlmiraNo ratings yet

- The Feels - TWICE (Revamped)Document77 pagesThe Feels - TWICE (Revamped)Angela SaladoNo ratings yet

- AZODocument9 pagesAZOLegacy Mib100% (5)

- UBS WM - Equity Model Portfolios - What's Changing - June 2019Document3 pagesUBS WM - Equity Model Portfolios - What's Changing - June 2019Blue RunnerNo ratings yet

- Cvcitc: College of Business and Accountancy Department of Accountancy Proof of CashDocument2 pagesCvcitc: College of Business and Accountancy Department of Accountancy Proof of CashTyrelle Dela CruzNo ratings yet

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDocument3 pages(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNo ratings yet

- Thesis Version 1Document80 pagesThesis Version 1deosa villamonteNo ratings yet

- International Financial Management 13 Edition: by Jeff MaduraDocument39 pagesInternational Financial Management 13 Edition: by Jeff MaduraJaime SerranoNo ratings yet

- Cara Menghitung BALANCE SHEETDocument1 pageCara Menghitung BALANCE SHEETIncesNo ratings yet

- Fundamental of Accountancy, Business and Management ReviewerDocument5 pagesFundamental of Accountancy, Business and Management ReviewerMarkDeoAboboto100% (2)

- Cost FlowDocument30 pagesCost FlowAndrea Nicole MASANGKAYNo ratings yet

- TCS ValuationDocument264 pagesTCS ValuationSomil Gupta100% (1)

- Chapter 4 - 5 ActivitiesDocument3 pagesChapter 4 - 5 ActivitiesJane Carla BorromeoNo ratings yet

- Problem 1Document3 pagesProblem 1Nicole Allyson AguantaNo ratings yet

- Question PSPM AA015 1718 by SectionDocument9 pagesQuestion PSPM AA015 1718 by Sectionnur athirahNo ratings yet

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsJustine VeralloNo ratings yet

- Horizontal AnalysisDocument3 pagesHorizontal AnalysisTeofel John Alvizo Pantaleon0% (1)

- FHKHKHDocument1 pageFHKHKHKara BrownNo ratings yet

- FAR-05 Book Value Per ShareDocument2 pagesFAR-05 Book Value Per ShareKim Cristian MaañoNo ratings yet

- Accounting 1 ReviewDocument13 pagesAccounting 1 ReviewAlyssa Lumbao100% (1)

- IAS 1 Preparation of FS PDFDocument12 pagesIAS 1 Preparation of FS PDFJohn Carlo SantianoNo ratings yet