Professional Documents

Culture Documents

RTI Reply From RBI To DR Subramanian Swamy On Islamic Banking

Uploaded by

Sanatan Dharma0 ratings0% found this document useful (0 votes)

69 views26 pagesRTI Reply From RBI to Dr Subramanian Swamy on Islamic Banking

Original Title

RTI Reply From RBI to Dr Subramanian Swamy on Islamic Banking

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRTI Reply From RBI to Dr Subramanian Swamy on Islamic Banking

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

69 views26 pagesRTI Reply From RBI To DR Subramanian Swamy On Islamic Banking

Uploaded by

Sanatan DharmaRTI Reply From RBI to Dr Subramanian Swamy on Islamic Banking

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 26

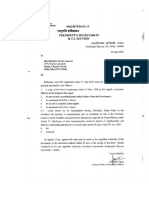

RESERVE BANK OF INDIA-——_—_______

DNBS. (CoR-S) No. 1367/62.27.001/2013-14

Dr. Subramanian Swamy

Minister for Commerce, Law & Justice,

A-77, Nizamuddin (East)

New-Delhi-110 013.

agiea/ugtaat/Dear Sir/Madam,

“vowor sbi org.)

September 13, 2013

aaa ar afeare afafar 2005 /Right to Information Act, 2005

ware aad F srearsy 961/2013-14

Our Ref, RIA 961/2013-14

apr at afirere affrr, 2005 % sieht

saferrr arrarét wint Bq aren Peat 05

amet , 2013 3% va fam wera car

Roar a safe wat oa orp A fo

am @|

2. aft art ea sae % aay Hf afta gear

card at ea oa At oft Ai atta @ 30 Peat

after aredta frag aah germ onfictra

wierd ff wa aeoranf, pide

Fase, i aa oie Peart, arcdir

400 005 ait srfter az ana S|

Thank you for your letter dated

August 19, 2013. seeking certain

information under the Right to

information Act 2005.The replies

pertaining to this Department have

been furnished in the Annex-A

2. For your information, the First

Appellate Authority in Reserve Bank of

India is Shri S.— Karuppasamy,

Executive Director Reserve Bank of

India, Department of — Banking

Supervision, World Trade Centre, Cutfe

Parade Mumbai — 400 005. Appeal, if

any, in respect of the above reply,

should be preferred within 30 days to

the First Appellate Authority

srrémt /Yours faithfully,

in Jem

(ua wa Pararert/N S Vishwanathan)

ars aire aT aferArf/Central Public Information Officer

1 2626, 2218 9131 Fan No

feat arena, garam wera Tee,

Annexure “A”

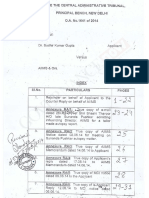

Sl. | Query > Reply

No.

1 Whether it is a fact that the| Reserve Bank of India has not

Reserve Bank of India has granted | granted permission under the RBI

permission under the RBI Act} Act and/or Banking Regulation Act

and/or Banking Regulation Act or | or any other Act to a financial entity

any other Act to a financial entity | in Kerala to establish and run an

in Kerala to establish and run an} Islamic bank according to the

Islamic bank according to the| religious Sharia Code. All entities

religious Sharia Code. registered with the RBI are required

to comply with the provisions of

Reserve Bank of India Act, 1934,

Banking Regulation Act, 1949 or the

applicable Statutes and the

directions issued there under by

RBI.

e If so, a copy of the letter granting} A copy of the Certificate of

permission Registration (CoR) granted to a

NBFC, Cheraman Financial Services

Limited which may have a bearing

on the subject is enclosed

3 All file notings connected with the | Copy of the file noting with respect

same

to the above mentioned CoR is

enclosed.

Information exempted from

disclosure under clauses (e), (d), (j)

and (g) of sub Section 1 of Section 8

of RTI Act, 2005 is severed in terms

of Section 10 of RTI Act, 2005.

&

aredta fier an =

theater tem fram

fanaerayia —apirr raters

RESERVE BANK OF INDIA

DEPARTMENT OF NON: BANKING SUPERVISION

‘THI RUVANANTHAPURAM REGIONAL OFFICE

wi

CERTIFICATE OF REGISTRA’

(sr Bt waraferat irae aes & fee ae Tet)

(Not valid for uecepting Public Deposits)

ie N= 16,00199 |

sed or es safheey, 1934 A omer as a om cee ford dm a ear aft a ria

wae Qa afm ahha Mtns, a

gad wer Sort edt we Sar 8 sprofera eter fe fe thet fata dem ar atan oe

WO / aw & fag ae

WSC TANT TT

ard) ea

In exercise of the powers conferred on the Reserve Bank of India by Section 451A of the

Reserve Bank of India Act, 1934

CHERAUAN FINANCIAL SERVICES LIMITED

ishereby eranted

Certificate of Registration

to commence / carry on the business of non-banking Financial institution without accepting.

public deposits subject to the conditions given on the reverse.

Brena & onion A aoe Bea A ORG g Te at ond frre |

Given under my hand at Thizuvananthapuram

dayof Ady Too Thad Thirteen

a

a >. mf EY k. sharma)

CRETE / SeerRPERIAE)

General Manager / Deputse(Ganasaldenagor [

FA / Conditions

1 Sareea SH afin ately one

Brn sige orci 9 ee ss arafert, erent A,

tt a i, sen at ah

2am art at whee anny aca to Fe

offre, 1934 & srara un ares Arelftr ager

‘weed cea erage) oor Pata srery PA TA at er ont

oat oem ae th

[3 oust ert a te ew ot am sam may,

tah, Reena septeh, are ORLA AL me

aun én

fs ate ome aor ew nar ya far ae |

ae ceria uae & fis sik me ened fad 8 aT a |

fon rea hesen wo se A an eH fa

aR BROT Prd 6a 8 afer Pen or Re

eet oe sacha fort te aterm, 1934 a

‘4s 8% siefa eta fort 4 art ont fete

ea Be sm ont oat

sed fet Ae eet A Fhe gegen ot antara fnte

ema ae Tm Fed Her MT sat SPAR

nit At nel Poh aa ot) rm FRE a ATA eM

aerated A ree ¢ Reh re A tere aE

Reda sean meal etter nt en

1. The Certificate of Registration or a certified copy

thereof shall be kept displayed a the Registered Oitice |

and other offices, brancles, any, of your

omnpany.

The Cenifcate of Repisivaion is waved te you

we te all the:

company sutyect to your continued adhen

conditions and parameters supulated under Chapter IIL

of the Reserve Bank of lucha et, 1944

8 Your company shall be requests comply sith all |

the requirements of the Dureetums, unlelines 1

nstitctinns, ete. issued by the Bank and ay appheable ws

11 your company desires 1 indicate dueetly or

indireetly in any advertisement, ete that the company 1s

having @ Certificate of Ri

Reserve Bank of India, such advertixement should |

istration issued by the

invariably contain a statement as under |

"The ct

Rep

Reserve:

npany is having a valid Certificate of

ration dated MAY 2, 2013

Bank of Indi under Seeten 45 1A ot the

Reserve Bank of In 1. the RBI

does wot accept any responsibility or about the

wssnied by the

Act 1 Howe

te

present position ay to the financial soundness of the

company or for ibe corteciness of any of the statements

of representations made or epinions expressed by the

company and for repayment of deposits / discharge of |

abilities by the company.”

5 comm Het Rosen at sarah ae ae /

He saat a 21

6 amt ae Raia e fawe AE amet

he at ach aie 2 af al ora ae sama

19 ac aR $4 sae torah ae Se

aa} derstha gm oh feet aren a

Foote Get Bots sprefers fore are Prfer

Cates Yen) are te ote ar RE are

at ot fitte opts ra ah ha A a

want ean athe

$@ Your company is not allowed to aceepi / hold public

deposits

6*-Your company must not accept any public deposits |

for the time being. After the company has been in |

operation for a period of two years, if if intends to raise

Public deposits, it may approach the Bank with the

audited Balance Sheets for two years and a credit rating

for fixed deposits fom one of the recognised rating

agencies. Your company will accept public deposits only

after obtaining specific approval from us

7 Ae Rtn Pathe wea wr A aan mi ea a |

arte 2 ty Ft rer Fee ara

on tid Wo, 8 FR ECR TS |

rae ce hee TOT Ae PNT a Ae a ae

fed ty fetter Saat # fan seam oral

ata aR

| * S580 9, 907 a a ae a Feira Te aE

| am

_[ after January 9, 1997

7. The date when your company has commenced

business as a non-banking financial institution may be

advised tothe Bank.

@ Applicable to companies, t0 whom Certieate of

Registration has been issued on the basis of their Board |

Resolution noi to accep! public deposits without prior

written permission of RBI

* Applicable to new companies incorporated on or

DEPARTMENT OF NON-BANKING SUPERVISION

CENTRAL OFFICE

ZONAL MONITORING DIVISION - SOUTH

{Thiruvananthapuram Reglonal Office (TVM RO))}

‘New Company’

Application for Certificate of Registration —

Cheraman Financial Services Limited

Cheraman Financial Services Limited with its Registered Office at Ponnurunni,

Vyttila P.O, Kochi - 682 019, Kerala had submitted an application dated April

30, 2013 for grant of Certificate of Registration (CoR) as a "New" Company for

commencing the business of a Non-Banking Financial Institution (NBFI). As the

documents submitted were incomplete, it was advised by the Regional Office to

submit the same and the company submitted the complete set of documents on

June 5, 2013. The application was processed and forwarded to Central Office

on June 06, 2013. It was received at Central Office on June 11, 2013. The final

clarifications/documents were received in CO on June 20, 2013. The salient

features of the applicant company and its eligibility for grant of CoR are

discussed in the following paragraphs:

|. Profile of the Company

2. The company was incorporated on November 30, 2009 as a public limited

company under the Companies Act 1956 with the name “Al Barakah Financial

Services Limited” (corporate identity number U67110KL2009PLC025082). The

name of the company was later changed to “Cheraman Financial Services

Limited” on October 26, 2012.

and an application for issue of CoR was submitted

to us. The application was subsequently withdrawn as the company had

decided to alter the main ‘object’ clause in the MoA to carry on the business of

rendering corporate financial advisory service and manage portfolio of

securities. The applicant company, in December 2012, decided to alter its main

‘object’ clause to enable it to carry on NBFC activities, namely financial leasing

and equity funding. The company has clarified that though equity funding can

be carried out through venture capital fund, it involves higher transaction cost

he

Application for Certiticate of Registration.

Cheraman Financial Services. Limited

compared to an NBFC as the company is looking to finance major

Government-backed projects involving huge funds. The main objects to be

Pursued by the company are financial leasing and equity funding.

The company has not yet commenced its NBFI activities as per

its certificate dated April 26, 2013,

3. The company was specifically advised that it should not include/ have

any clause in its AoA or MoA, which rolates to interest free transactions,

Participatory finance, profit sharing, sharia, Islamic financing/banking,

either explicitly or implied. The company has altered its MoA and AoA as

advised. As the proposed business model of the company was financial

easing, in order to comply with the Bank's guidelines on FPC, it was

also advised to furnish the detailed methodology adopted by it for

arriving at the IRR, giving details of cost of funds, risk promium, cost of

operations, profit margin and other components. Following the

Clarifications received from the company, it was advised to use the terms

“annualised cost to the borrower” instead of the term “IRR” in its FPC

guidelines. It was also advised to intimate the role of the “Sharla Board”

in its operations and also submit an undertaking that It would not be

accessing public funds and that the entire funding would be through

equity financing and retained earnings. The company has furnished the

undertaking to that effect and has also clarified that the role of the Sharia

Advisory Group is restricted to Providing consultancy for sharia

compliant investments and the opinions expressed by the Sharia

Advisory Group would be subjected to the discretionary powers of the

Board and are not necessarily binding on the Board.

a

Cheraman Financial Services Lit

Source of funds

5. The company had been incorporated with paid up capital of Rs. 350.00 lakh,

raised in full from the promoters of the company

The directors have declared that the source

of funds for making investment in the company belongs to them and no

investment had been made out of borrowed funds. They have also submitted

Application for Gertticate of Registration-

Cheraman Financial Services. Limited

documentary evidence like copies of their bank statements indicating transfer

of funds towards the initial paid up capital of the company.

Foreign Direct Investment (FDI

8. The applicant company has no Foreign Direct Investment as on date as

declared by it and certified by its auditor vide certificate dated May 21, 2013.

Although four of the Directors are NRIs and one a foreign national, the

company has confirmed that all the investments made so far are on non-

fepatriable basis. The company however intends to approach the FIPB for

permission to access funds in the form of FDI after obtaining NBFC licence.

Ill, Management

7. The company is managed by ten directors. The details of their qualifications

and experience as also their association with other companies are given below:

a) Shri A P M Mohammedhanish IAS (44 years) is the Managing Director

of the Company. He is a graduate in Civil Engineering and an officer of the

Indian Administrative Service. He has no NBFC experience

b) Dr.P. Mohamad All (63 years) is the Chairman of the company. He is

an NRI (Sultanate of Oman), holding a diploma in Civil Engineering and his.

line of business is construction and hotel management. He has been

awarded the Pravasi Bharatiya Samman, Oman Civil Order award

Honarary Doctorate in Science from Glasgow Caledonian University UK; V

Gangadharan Memorial Kerala Pravasi Award, Business Man Award 1998

and IOD Distinguished Fellowship Award - 2007. He has no NBFC

experience.

Application for Cortificate of Rogistration-

Cheraman Financial Services Limited

Application for Certificate of Registration-

Cheraman Financial Services Limited

¢) Shri C.K. Menon (63 years) an NRI (Doha-Qatar) is a director of the

company. He is a Law graduate and an industrialist by profession. He is the

recipient of Pravasi Bharatiya Samman, 2006; Padmasree Award, 2009;

DICID Award, 2012, Keralean Award, 2012; P.V. SAMI Memorial Cultural

Award, 2012, He has no NBFC experience

“~&

Application for Cortiticate of Rogistration-

Choraman Financial Services Limited

d) ShriP NC Menon (64 years) is another director of the company. He is

a citizen of Sultanate of Oman, but a person of Indian origin. He is engaged

in real estate and construction business. He had been awarded the Pravasi

Bharatiya Samman Puraskar-2009, Life time achievement Award-2006 and

also Global India Splendor Award, 2007. He has no NBFC experience.

Application for Certificate of Reegistration-

Cheraman Financial Services Limited

e) Shri T Balakrishnan (61 years) is another director of the company. He

is a post graduate in Political Science and International Relations. He has 7

years of NBFC experience

Application for Cortificate of Rogistration-

Choraman Financial Services Limited

f) Dr.P.A. Ibrahimhaji (69 years) an NRI (Dubai) is also a director of the

company. He is a diploma holder in Automobile Engineering and Business

Management. He has been awarded an honorary Doctorate in Philosophy

from American Global International University. He is also engaged in the

field of education, automobiles and textiles. He was awarded the Junior

Chamber International award of Indian Association, Ras Al Khaima, Giants

International Award (Education)- 2010. He has no NBFC experience.

(ec

Application for Certificate of Registration-

Cheraman Financial Services Limited

Application for Cortiticato of Rogistration-

Cheraman Financial Services Limitod

g) Shri P. K. Ahammed (70 years) is one of the directors of the company

He is a matriculate. He has no NBFC experience. He is the recipient of a

Life time achievement Award from the Govt. of Kerala for his invaluable

contribution for industrial development of the State

423:

Application for Certificate of Registration-

Cheraman Financial Services Limited

h) Shri P.A. Siddeek (44 years) an NRI (Kingdom of Saudi Arabia) is also

a director of the company and he has obtained an honorary Doctorate in

Philosophy from Tamil Nadu University. He has one year NBFC experience

Application tor Cortit

Choraman Financial

of Rogistration-

orvicos Limited

He has been awarded the AP. Aslam Award

2012, Pazhassi Raja Business Excellency Award 2011, SION, Award for

Excellence in the field of business and charitable services, Vallapara

Mohammedkunhi Memorial Award.

tae

Application for Certiieat of Registration.

CCheraman Financial Services. Limited

i) Shri P.V. Abdul Wahab (62 years) director is a pre-degree. He has no

NBFC experience. He had been awarded Lions Excellence Award, 1997

J) Shri E M Najeeb (58 years) is a graduate in English Literature and a Post

graduate diploma holder in Journalism and acquired MBA from New Port

University, USA. He has no NBFC experience. He was conferred the Kerala

Business Award, World Malayalee Council Excellence Award in Tourism

Sector and WMC Business Awards.

8. COSMOS database on the names and PAN numbers of the directors

have been verified for confirming whether directors of the applicant company

are associated with other rejected/ cancelled/ vanishing companies and it is

found that the directors are not associated with other rejected/ cancelled/

vanishing companies. Neither the company nor the directors and the

companies with which they are associated appear in the defaulters’/ willful

defaulters’ list of DBOD. The company's name does not figure in the orders

{for Certificate of Registration-

raman Financial Services Limited

Passed by the Company Law Board (CLB) as observed from the Website of

CLB. The names of the applicant company and other group companies do not

figure in the approved/ pending list of companies under CDR mechanism

CIBIL data of the Directors of the company does not show any adverse

observations.

IV. Documents! Declarations

9 The company has submitted certified copies of Board Resolutions dated

March 15, 2013 & April 30, 2013

a) approving the submission of application for CoR;

b) stating that it has not accepted any public deposit as on date and will not

accept any public deposit in future without prior approval of RBI;

©) stating that the company has not conducted/ commenced NBFI business

and will not conducy commence the same without obtaining Certificate of

Registration from the Bank and

¢) adopting the ‘Fair Practices Code! as per the Bank's Circular DNBS. (PD)

No.266/ 03. 10.01/ 2011-12 dated March 26, 2012

10. Mis Krishnamoorthy & Krishnamoorthy, CA, Cochin, Statutory Auditors o?

the company, have also certified in their certificates dated April 19, 2013

a) that the company is not holding public deposits as on date and

) that the company is not carrying on any NBFI activities as on date.

41.

Eyer

Application for Corificate of Registra

‘Cheraman Financial Sorvices Linitod

12. All the directors of the company have furnished declarations stating that

they are not associated with any unincorporated bodies which are accepting

deposits in violation of Section 45S of the Reserve Bank of India Act, 1934 so

as to ensure that the financial concems with which the directors are associated,

have complied with the provisions of Chapter-lIIC of the Act ibid, relating to

acceptance of public deposits.

13. Clause No. Ill (A) of the Memorandum of Association of the applicant

‘company provides for conducting financial business. The company has also

altered the clauses of MoA and AoA accordingly.

14, The RO has confirmed that the company has given an undertaking to the

effect that it will not access public funds, raised either directly or indirectly

through public deposits, commercial paper, debentures, inter corporate

deposits, bank finance and other borrowings and that the entire funding would

be through equity financing and retained earings only.

15. The bankers’ of the company, Union Bank of India, Kochi and Axis Bank,

Kochi vide their certificates dated June 13, 2013 have indicated that the_

conduct of the applicant company’s accounts is satisfactory.

16, The RO has confirmed that satisfactory bankers’ reports have been

received in respect of all the companies in which the directors (including the

foreign national and four NRIs) are having substantial interest

17. The company has two WOS as certified by its Auditors vide certificate

dated April 26, 2013,

Name of tha Group Company Activity Regulated

Cheraman infrastructure Pvi Ltd | infrastructure NA

|__ Development

218:

‘Application or Cortiiests of Registration

(Cheraman Financial Sorvises Lined

1.

Asset Management |

ews)

Cheraman Funds Management Lid

(wos)

SEBI has confirmed that they do not have any supervisory concems against

M/s Cheraman Funds Management Ltd,

18, Business Plan and viability:

The company has been set up with the objective of making effective use of

remittances made by non-resident Keralites, in building infrastructure and

Promoting overall development of the State. The financial resources needed for

the activity of the company are proposed to be mobilized by raising share

capital. The financing and investment activities of the company would be

limited to financial leasing and equity funding. The company would be primarily

focused on the financial lease of durable assets in the areas of

industrial machinery, construction and healthcare equipment. The company

foresees good business prospects over the coming years, in view of the high

value of assets and many of the small and medium players are not in a position

for outright purchase and are, therefore looking for financing and leasing.

Equity funding to Government projects, therefore, assumes significance, in

view of the higher potential for Public Private Partnership (PPP) projects in the

State of Kerala

Financial Products of the Company

Health Care Equipment Financing is one of the untapped business segments

and the company targets this segment. With the growth of medical tourism

especially in Kerala, the company expects that considerable amount of capital

expenditure in the nature of building and sophisticated equipment would be

required

Construction Equipment Lease is another area that the company intends to

target for high volume business. Owing to the thrust given by the State

Government for infrastructure development of the State, the construction

219i

‘Application for Certicae of Registration:

‘Cheraman Financial Services Linites

industry is expected to receive a major flip. The company expects to have a

driven demand for specialized construction equipment including crawler,

wheeled loaders, excavators compaction equipment, various types of cranes,

transit mixtures etc.

Industrial Machinery Lease is yet another field which the company intends to

finance. Various industries like Food Processing, textile, mat and matting,

agricultural harvesting equipment, hardware and software used in IT/ITES

Industry, equipment used by ports, logistics Industry etc. are proposed to be

leased by the company.

The company also proposes to provide equity funding to both Governmental

and Non-Governmental projects. The projects designed on PPP mode, viz

Kochi Metro, Monorail, Personal Rapid Transport System, Vizhinjam

International Sea Port, expansion of Techno Park etc, give much potential for

the company and offers the space for low cost equity funding

The projected business plan submitted by

the company indicates that the business has earning prospects and the

projections are viable and achievable.

19, The company has certified that no prohibitory order was issued in the past

to it or any other NBFC/ RNBC with which the directors! promoters were

associated

Application for Cortfieate of Regl

‘Cheraman Financial Services

20. It'is indicated against item No. 11 of the respective Annexurediil to the

application in respect of all the directors of the applicant company that they

were not prosecuted! convicted for any economic offence either in their

individual capacity or as partners/ directors of any firm/ company. None of the

directors is involved in any criminal case including Section 138 of the

Negotiable Instruments Act, 1881 vide their declarations dated October 8,

2011

24. Most of the Directors are professionally well qualified and two of them have

NBFC experience

All the directors of the company are well-

known figures in the field of business or bureaucracy. They do not suffer from

other infirmities or charges like action by other regulators, arrests by police or

criminality ete. and there are no other adverse remarks against them in our

records during their association with the above-mentioned NOFC. Therefore, it

may be reasonably assumed that the quality of the management is satisfactory

at this point of time.

22. The company has adequate technological infrastructure and capability to

enable it to submit information electronically and achieve on-line connectivity

through internet. The e-mail Id of the applicant company _ is

mail@cheraman.com

23. Keeping in view that (i) the company is new, (ii) there are no adverse

observations against the directors of the company, (ii) the company is not

Permitted to accept deposits and (iv) the Certificate of Registration issued to it

would be subject to review by the Regional Office, after two years, the

recommendation of Thiruvananthapuram Regional Office may be accepted and

the quality of the management may be considered as satisfactory.

‘Application or Certificate of Registration

V. Other Regulators’ comments.

24, The applicant company, as certified by its auditor vide certificate dated April

26, 2013, has two WOS, of which M/s Cheraman Funds Management Ltd has

been registered with SEBI and, therefore, regulated by them

SEBI has confirmed that they do not have any supervisory concerns against

M/s Cheraman Funds Management Ltd

vi.

25.

26. The applicant company has submitted all the relevant documents and the

‘same are in order.

27. Thiruvananthapuram Regional Office has recommended for issue of

Certificate of Registration to the company.

28. As regards the applicant company having a Sharia Advisory Group,

the role of the Advisory Group in the

company might not hinder the regulatory functions of the Bank and as a

precautionary measure, stipulate an additional condition to the usual

conditions.

VII, Proposal

28. We may approve the issue of Certificate of Registration to Cheraman

Financial Services Limited under Section 45-1A (5) of the Reserve Bank of India

Act, 1934, subject to usual terms and conditions as applicable to a ‘New’

company. Further. , We may also put an

S22

‘Application for Carseat of Regictration-

‘Cheramer Financial Services Lined

additional concition thet “the directions, guidelines, orders, circulars ote.

issued thera under by the Reserve Bank shall prevail over tho advices or

opinions of the Advisory Group and the company shall not earry on its

busimegs in such manner as would rondor it unabla to comply with the

provisions of the RBI Act, directions, ete,”

ads

em

we BA ayer” to

a4 PCGM Ue

You might also like

- DR Subramanian Swamy's Letter To Amit Shah in 2015 Regarding Poll PromisesDocument2 pagesDR Subramanian Swamy's Letter To Amit Shah in 2015 Regarding Poll PromisesSanatan DharmaNo ratings yet

- DR Subramanian Swamy S Letter Against Sonia Gandhi To President Abdul Kalam in 2004Document1 pageDR Subramanian Swamy S Letter Against Sonia Gandhi To President Abdul Kalam in 2004Sanatan DharmaNo ratings yet

- Sonia Maino and EvidenceDocument5 pagesSonia Maino and Evidencetxm7793690100% (2)

- Subramanian Swamy's Letter and Documents To PM On Nov 12, 2015 On Rahul Gandhi's British CitizenshipDocument13 pagesSubramanian Swamy's Letter and Documents To PM On Nov 12, 2015 On Rahul Gandhi's British CitizenshipSrini KalyanaramanNo ratings yet

- ENLIGHTENED SECULAR POLITICS AND HINDUSTANI UNITY - DR Subramanian SwamyDocument21 pagesENLIGHTENED SECULAR POLITICS AND HINDUSTANI UNITY - DR Subramanian SwamySanatan DharmaNo ratings yet

- Hidden origins of the Nehru-Gandhi dynastyDocument15 pagesHidden origins of the Nehru-Gandhi dynastyMayank GuptaNo ratings yet

- Subramanian Swamy's Statement and Documents Released On Nov 1, 2012Document26 pagesSubramanian Swamy's Statement and Documents Released On Nov 1, 2012IBTLNo ratings yet

- Subramanian Swamy's Letter and Documents To PM On Nov 12, 2015 On Rahul Gandhi's British CitizenshipDocument13 pagesSubramanian Swamy's Letter and Documents To PM On Nov 12, 2015 On Rahul Gandhi's British CitizenshipSrini KalyanaramanNo ratings yet

- Role of Church and West in Destabilizing Activities in IndiaDocument8 pagesRole of Church and West in Destabilizing Activities in IndiaSanatan DharmaNo ratings yet

- Press Release DR Swamy Feb20-2017Document5 pagesPress Release DR Swamy Feb20-2017PGurus100% (2)

- Subramanian Swamy's Statement and Documents Released On Nov 1, 2012Document26 pagesSubramanian Swamy's Statement and Documents Released On Nov 1, 2012IBTLNo ratings yet

- 2G Money Traced To Chidambaram's Son - Evidence by Dr. Subramanian SwamyDocument25 pages2G Money Traced To Chidambaram's Son - Evidence by Dr. Subramanian Swamydharma nextNo ratings yet

- Scams in IndiaDocument30 pagesScams in IndiaABs Kn0% (1)

- Writ Petition Against DDCADocument56 pagesWrit Petition Against DDCASanatan DharmaNo ratings yet

- Dr. Subramanian Swamy's Meeting With Deng Xiaoping in Beijing, April 1981Document3 pagesDr. Subramanian Swamy's Meeting With Deng Xiaoping in Beijing, April 1981rudragni108100% (1)

- 2G Spectrum Scam Full StoryDocument2 pages2G Spectrum Scam Full StorySanatan DharmaNo ratings yet

- FUNDAMENTALS OF HINDU UNITY AND THE CONCEPT OF HINDUSTAN by Subramanian SwamyDocument94 pagesFUNDAMENTALS OF HINDU UNITY AND THE CONCEPT OF HINDUSTAN by Subramanian SwamySanatan Dharma0% (1)

- Azad Letter To JaitleyDocument6 pagesAzad Letter To JaitleyFirstpostNo ratings yet

- How To Wipe Out Islamic Terror Excellent Article by DR Subramanian Swamy in DNADocument4 pagesHow To Wipe Out Islamic Terror Excellent Article by DR Subramanian Swamy in DNASanatan Dharma100% (1)

- FIR Sunanda PushkarDocument2 pagesFIR Sunanda PushkarFirstpost100% (1)

- Karunanidhi Rule and Family Wealth EstimationDocument17 pagesKarunanidhi Rule and Family Wealth EstimationVaseegaran Scientist100% (1)

- Sunanda Pushkar ReportDocument6 pagesSunanda Pushkar ReportSanatan DharmaNo ratings yet

- True Face of Sonia GandhiDocument36 pagesTrue Face of Sonia GandhiSanatan DharmaNo ratings yet

- DR Swamy's Letter To MMS On JehadDocument1 pageDR Swamy's Letter To MMS On Jehadaroopam1636No ratings yet

- Letter 2 PM On Jana Gana ManaDocument2 pagesLetter 2 PM On Jana Gana ManaPGurus100% (1)

- Corruption in India 2010 and BeforeDocument49 pagesCorruption in India 2010 and BeforeHaindava KeralamNo ratings yet

- Curious Case of Rahul GandhiDocument44 pagesCurious Case of Rahul GandhiSanatan DharmaNo ratings yet

- Subramanian Swamy's Letter To PM On Assets of PC and Family and Karti Cos March 7, 2017Document7 pagesSubramanian Swamy's Letter To PM On Assets of PC and Family and Karti Cos March 7, 2017PGurus86% (7)

- Constitutional Foundation of Secularism by Subramanian SwamyDocument73 pagesConstitutional Foundation of Secularism by Subramanian SwamySanatan DharmaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)