Professional Documents

Culture Documents

Sathya S 8

Uploaded by

Vasumathi SubramanianCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sathya S 8

Uploaded by

Vasumathi SubramanianCopyright:

Available Formats

International Journal of scientific research and management (IJSRM)

||Volume||3||Issue||2||Pages||

\ 2175-2182||2015||

Website: www.ijsrm.in ISSN (e): 2321-3418

A Comparative Study on Equity, Commodity, Currency Derivatives in

India - Evidence from Future Market with special reference to BSE Ltd,

Mumbai

*S.Sathya,

M.Phil Scholar,SNR &Sons college,Coimbatore.

e-mail:sathya160388@gmail.com

Abstract

The study compares the equity, commodity, and currency derivatives in India evidence from future

market. This study focus on the risk and return associated with derivatives used in equity, commodity, and

currency market in India. The average and standard deviation to access the risk and return factor and also

comparative tool for correlation analysis were used to find out relationship among risk and return. It is

found that the risk premium of equity is essentially the same as commodity, equity returns are negatively

correlated with commodity return and currency return and also found that the equity, commodity, and

currency of derivatives are used for hedging purpose

.Key words: Derivatives, Stock market, Risk & Return.

Introduction instruments. Hedging can basically be described

Derivative is a product whose as an attempt to reduce the risk of an underlying

value is derived from the value of one or more transaction by concluding an adverse transaction

basic variables, called bases (underlying asset, in order to offset the risks. New financial

index, or reference rate), in a contractual manner. instruments such as derivatives have been

The underlying asset can be equity, forex, intensively used to hedge these risks. Derivatives

commodity or any other asset. are kinds of financial instruments whose changes

in market value are depending on changes in

Over the last decade the business underlying variables (asset and/or liabilities).

environment has become more and more global, Common examples of underlying variables are

which has led to an increasing level of interest rates, exchange rates, stock prices, stock-

competition but also enabled entities to gain market indices, or prices of commodities. Besides

access to new customers and additional resource hedging risks, derivatives can be used for trading

markets. With a growing diversity of international (speculative) purposes. Though the primary users

business operations an increase in risks naturally of derivatives are financial institutions such as

comes along, especially with risks related to banks, insurance companies, and investment

financial issues such as fluctuating currencies, managers, the usage of derivatives by non-

commodity prices and interest rates. When financial firms is considerable.

companies face those kinds of risks, a common

way to deal with such issue is the usage of hedge

*S.Sathya, IJSRM volume 3 issue 2 Feb 2015 [www.ijsrm.in] Page 2175

This study examines the impact of To Compare the risk and return profile of

introduction of derivative market trading on the Equity, Commodity, Currency Derivatives

Indian stock market. It examines the theme that towards in Future Market in India.

the compare the risk and return profile of equity

derivative, commodity derivative, currency

derivative towards in Future Market in India.

Prices in an organized derivatives market reflect

Scope of the Study

the perception of market participants about the

Derivative is a generic term like

future and lead the price of underlying to the

futures and options on Indian stock markets have

perceived future level.

become important instruments of price discovery,

Statement of the Problem portfolio diversification and risk hedging in recent

times. The study cant be said as totally perfect

Investors are less knowledge

because of any alteration may come. The study

about the derivative market. Investor always

has only made a humble attempt at evaluation

makes investment in expectation of return.

derivatives market only in India context. The

However, return is always subject to the risk

present study has been carried out with the focus

attached. Investors do require a hedging

on future contract. This study is useful for the

mechanism to offset the risk of investing in shares

Advisory agents and the investors to manage the

and debentures. There has been a quest for finding

price risk that prevails in the market. Moreover it

out suitable hedging mechanism. Some of these

is helpful for the investors to hedge their profits

are forward contracts, futures and options. These

through the use of stock exchange. It should be

are collectively called as Derivatives because

extended with consists of investment in all

these contracts derive their value from some

securities of the market.

underlying assets (Stock, index, interest rate,

currency, and commodity). Many Investors are Review of Literature

not aware of the hedging the risk and also cannot

Viral Acharia and Matt Richardson

diversified the risk in various investment option.

(2009) Derivatives The Ultimate Financial

Objective of the Study Innovation: In this article should review that the

derivatives background and the ultimate financial

To analyze the risk and return towards the

innovation of derivatives market. And also the

future trends of Equity Derivatives.

procedures of cost benefit analysis of

To analyze the risk and return towards the derivatives.

future trends of Commodity Derivatives.

Edmund Parker (2008) Overview and

To analyze the risk and return towards the introduction to equity derivatives: This review

future trends of Currency Derivatives. deals with over all Equity derivatives traded in

*S.Sathya, IJSRM volume 3 issue 2 Feb 2015 [www.ijsrm.in] Page 2176

stock exchanges. Size and history of equity rates and is on average 4.87% of firm value. They

derivatives market briefly described the author. also find some evidence consistent with the

They briefly discuss on equity derivatives market hypothesis that hedging causes an increase in firm

constitution, tax benefit, transaction process value.

should be also trading methods on stock market.

Methodology

Gary Gorton and K. Geert Rouwenhorst

Research is simply a scientific search for

(2005) Facts and Fantasies about Commodity

knowledge of new things. Research as a

Futures: This paper review that construct an

systematic investigation, including research

equally-weighted index of commodity futures

development, testing and evaluation, designed to

monthly returns over the period between July of

develop or contribute to generalizable knowledge.

1959 and December of 2004 in order to study

Activities which meet this definition constitute

simple properties of commodity futures as an asset

research for purposes of this policy, whether or

class. Fully-collateralized commodity futures have

not they are conducted or supported under a

historically offered the same return and Sharpe

program which is considered research for other

ratio as equities. While the risk premium on

purposes. For example, some demonstration and

commodity futures is essentially the same as

service programs may include research activities

equities, commodity futures returns are negatively

correlated with equity returns and bond returns. Research Design

The negative correlation between commodity

A research design is purely and simply the

futures and the other asset classes is due, in

framework or plan for a study that guides the

significant part, to different behavior over the

collection and analysis of the data. It is the

business cycle. In addition, commodity futures are

blueprint for finding research objectives and

positively correlated with inflation, unexpected

answering questions. It is a framework for the

inflation, and changes in expected inflation.

collection and analysis of data. The research relies

George Allayannis and James P. Weston mainly on secondary data. However, it still offers

(2001) The Use of Foreign Currency Derivatives thorough and accurate answers to all the research

and Firm Market Value: This article examines questions. The qualitative research methodologies

the use of foreign currency derivatives (FCDs) in would be applied. The reasons why this research

a sample of 720 large U.S. nonfinancial firms method is utilized will be explained later in the

between 1990 and 1995 and its potential impact research method and approach section. The type

on firm value. Using Tobins Q as a proxy for of research under present is an analytical research,

firm value, they find a positive relation between we use facts or information is already available

firm value and the use of FCDs. The hedging and analyzes to makes the critical evaluation of

premium is statistically and economically the project.

significant for firms with exposure to exchange

Data Collection

*S.Sathya, IJSRM volume 3 issue 2 Feb 2015 [www.ijsrm.in] Page 2177

Data Collection is an important aspect of

any type of research study. Inaccurate data variables.

collection can impact the results of a study and

Period of the Study

ultimately lead to invalid results. In this study, the

secondary data has been provided wherever The data for a period 5 years ranging from

required. April 2008 to March 2013 have been collected

and considered for analysis.

Secondary data is the data which is Returns

collected, collated and analyzed by someone other

A major purpose of investment is to set a

than user as opposed to primary data which is

return of income on the funds invested. On a bond

collected directly by researcher. The research

an investor expects to receive interest. On a stock,

method exploited in this study is merely based on

dividends may be anticipated. The investor may

secondary data that has been collected from the

expect capital gains from some investments and

commercial websites on stock exchanges,

rental income from house property.

commodity exchanges, and Reserve Bank of

India. The prominent advantages of this method

are to provide larger database and to guarantee the

Rj,t = Pj,t - Pj,t-1/Pj,t

high level of reliability and accuracy, the first and

Where;

foremost criteria in finance research. Another

Pj,t= The yearly Price of stocks j at the year t;

merit involves far less time consuming and

Pj,t-1 = The yearly price of the stock j at

cheaper cost in searching secondary sources than

the month t-1

in conducting primary data collection.

Standard Deviation

Tools for Data Analysis

1. Return Standard deviation is applied to the annual

rate of return of an investment to measure the

2. Standard Deviation

investment's volatility. Standard deviation is also

3. Correlation known as historical volatility and is used by

Descriptive Statistics investors as a gauge for the amount of expected

volatility. Standard deviation is a statistical

Average and Standard Deviation : To

measurement that sheds light on historical

assess the risk and return factors.

volatility

Inferential Statistics

A measure of the dispersion of a set of

Correlation : An data from its mean. The more spread apart the

analysis of the relationship of two or more data, the higher the deviation. Standard deviation

is calculated as the square root of variance.

*S.Sathya, IJSRM volume 3 issue 2 Feb 2015 [www.ijsrm.in] Page 2178

T-statistic 2.92 2.57 1.77

Sharpe

0.43 0.38 0.26

Correlation (R) ratio

The correlation is one of the most common

and most useful statistics. A correlation is a Single

number that describes the degree of relationship

Inference:

between two variables. The Correlation Co-

efficient measures the nature and extent of It is understood from the table historical

relationship between the stock Market index risk premium of Commodity (5.23) is about equal

Return and the Stock Return in a particular period. to the risk premium of Stocks (5.65), and is more

dxdy than double the risk premium of Currency (2.22).

r = ----------- The t-statistic measures the confidence that the

dx2dy2 average risk premium is different from zero.

Limitations of the Study Comparative Risk Premium of Commodity,

Stock, and Currency Diagram

The study is applicable to derivative

market and focuses on price discovery and The Comparative Return of Commodity, Stock,

risk hedging only. and Currency of the returns on financial returns

often deviate from a normal distribution, display

The time period of research was restricted skewness, and have fat tails.

to 30 days.

Comparative Return of Commodity, Stock, and

The study has covered only three Currency

underlying assets (Equity, Commodity,

and Currency). Commo Currenc

Stocks

dity y

The reliability of the data may not be

dependable. Average 0.89 0.93 0.64

Analysis and Interpretation Standard

3.47 4.27 2.45

Deviation

To examine the risk premium across a variety

of commodity, stock, and currency and the Skewness 0.71 -0.34 0.37

particular time periods

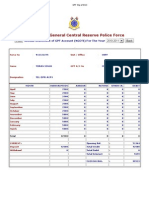

Comparative Risk Premium of Commodity,

Stock, and Currency

Inference:

Commo Currenc

Stocks

dity y It is understood from the table Commodity

Average 5.23 5.65 2.22 (0.89) and Stocks (0.93) have about the nearest

average return, but the currency (0.64) have

Standard

12.1 14.85 8.47 medium return yield. The return distribution of

Deviation

*S.Sathya, IJSRM volume 3 issue 2 Feb 2015 [www.ijsrm.in] Page 2179

equities has negative skewness, while the

Risk Premium

20

Commodit Currenc 15

Stocks

y y

10 Commodity

Monthly 0.05 -0.14 0.01 5

Stocks

0

currency

Quarterly -0.06 -0.27 0.14

1-year -0.10 -0.30 0.29

positive correlation of Currency tends to increase

with the holding period.

5-year -0.42 -0.25 0.45

distribution of commodity and currency returns Correlation of Commodity, Stock, and

has positive skewness. Currency Diagram

Comparative Return of Commodity, Stock, Correlation

and Currency Diagram 0.5

0.4

Returns 0.3

Commodit

0.2

4.5 y

0.1

4 Stocks

0

3.5

-0.1

3 Currency

Average -0.2

2.5

2 -0.3

1.5 Standard -0.4

Deviation

1 -0.5

0.5

0

Commodity Stocks Currency Findings of the Study

The coefficient of correlation is indicates the The study has revealed the following important

strength and direction of statistical relationship findings.

between commodity, stock, and currency. The risk premium of equity (5.65) is

Comparative Correlation of Commodity,

essentially the same as commodity (5.23)

Stock, and Currency

and double the currency (2.22).

Inference: The return of equity (0.93) is essentially

the same as commodity (0.89) and single

It is understood from the table negative

time high in currency (0.64).

correlation of Commodity tends to increase with

holding period. The negative correlation of Stocks Holding period more than five years the

tends to increase with holding period. And the return of equity (-0.25) and commodity (-

*S.Sathya, IJSRM volume 3 issue 2 Feb 2015 [www.ijsrm.in] Page 2180

0.42) is negatively correlated but currency effect from previous studies was probably the

(0.45) is positively correlated. result of including firms that used a multiplicity of

derivatives and then also found results that are

consistent with the use of derivatives for hedging

Suggestions purposes.

The risk premium of equity (5.65) more

Reference

high compare with commodity (5.23) and

currency (2.22) so it is suggested that the Abken .A and shrikhande .M (1997) The

risk avoiders may invest in different Role of Currency Derivatives in Internationally

Diversified Portfolios Federal Reserve Bank of

equity, commodity, and currency Atlanta Economic Review Third Quarter 1997

derivatives combinations.

Ameer and Rashid (2011) A Survey on

the Usage of Derivatives and Their Effect on Cost

The investor should try to make more of Equity Capital Journal of Derivatives; Fall

investment in derivative market since the 2011; 19, 1; ABI/INFORM Global pg. 56

fluctuation is normal for risk and return on Edmund Parker (2008) Overview and

holding period less than one month. introduction to equity derivatives Building the

Global Market, A 4,000-Year History of

Conclusion Derivatives, by Edward J. Swan, p.163

Derivatives are financial contracts whose Gary Gorton and K. Geert Rouwenhorst

(2005) Facts and Fantasies about Commodity

value is derived from some underlying asset. Futures

These assets can include equities and equity

George Allayannis and James P. Weston

indices, bonds, loans, interest rates, exchange (2001) The Use of Foreign Currency Derivatives

rates, commodities. The contracts come in many and Firm Market Value The Review of Financial

Studies Spring 2001 Vol, 14 No.1 PP 243 -276

forms, but the more common ones include

options, forwards/futures and swaps. This study Hina Shahzadi and Muhammad Naveed

Chohan (2010) Impact of Gold Prices on Stock

has been to investor compare among different Exchange: A Case Study of Pakistan

types of derivatives for reducing risk and increase

Jarkko Peltomaki (2010) On derivatives

the return. This is important if one wants to use by equity-specialized hedge funds Journal of

understand the determinants of use of each type of Derivatives & Hedge Funds Vol. 17, 1, 4262

derivatives, due to the fact that investors of Mallikarjunappa.T and Afsal E. M.(2008)

derivatives often use more than one type of The Impact Of Derivatives On Stock Market

Volatility: A Study of The NIFTY INDEX

derivatives. The results shows negatively AAMJAF, Vol. 4, No. 2, 4365, 2008

correlated with equity, commodity, and currency

Dr. G. Malyadri and B. Sudheer Kumar

returns. This study applies to each of the three (2012) A Study on Commodity Market

types of derivatives is not dependent on size, International Journal of Computer Science and

Management Research Vol 1 Issue 5 December

leading us to conclude that the finding of a size 2012

*S.Sathya, IJSRM volume 3 issue 2 Feb 2015 [www.ijsrm.in] Page 2181

Nissar A. Barua and Devajit Mahanta

(2012) Indian Commodity Derivatives Market

and Price Inflation IOSR Journal of Business and

Management (IOSRJBM) ISSN: 2278-487X

Volume 1, Issue 6 (July-Aug. 2012), PP 45-59

Siv Potayya and Wortels Lexus (2010)

Mauritius is revolutionarily inching its way

towards Currency Derivatives, Commodity

Derivatives and Futures contracts

Takeshi INOUE and Shigeyuki HAMORI

(2012) Market Efficiency of Commodity Futures

In India Institute of Developing Economics, IDE

Discussion paper no.370

Viral Acharia and Matt Richardson (2009)

Derivatives The Ultimate Financial

Innovation From Restoring Financial Stability:

How to Repair a Failed System

Yakup Selvi and Asl Turel (2010)

Derivatives Usage in Risk Management by

Turkish Non-Financial Firms and Banks: A

Comparative Study Annales Universitatis

Apulensis Series Oeconomica, 12(2), 2010

Yogesh Maheshwari (2012) Equity

Derivatives Introduction and Stock Market

Efficiency Journal of Management Research Vol.

12, No. 3, December 2012, pp. 141-152

*S.Sathya, IJSRM volume 3 issue 2 Feb 2015 [www.ijsrm.in] Page 2182

You might also like

- Rakesh H M - 8 PDFDocument10 pagesRakesh H M - 8 PDFVasumathi SubramanianNo ratings yet

- Project On Investment in IndiaDocument58 pagesProject On Investment in IndiaRahul MalikNo ratings yet

- A Study On Investors Behaviour in Stock MarketDocument5 pagesA Study On Investors Behaviour in Stock MarketMaddy09061986No ratings yet

- Determination of Factors Affecting Individual Investor BehavioursDocument13 pagesDetermination of Factors Affecting Individual Investor BehavioursSiing LiingNo ratings yet

- Strategy - Kotak - 12th OctDocument38 pagesStrategy - Kotak - 12th OctVasumathi SubramanianNo ratings yet

- Sensitivity of Investors Towards Stock MarketDocument7 pagesSensitivity of Investors Towards Stock MarketVasumathi SubramanianNo ratings yet

- Dr. Suman Chakraborty 3Document12 pagesDr. Suman Chakraborty 3Vasumathi SubramanianNo ratings yet

- Sensitivity of Investors Towards Stock MarketDocument7 pagesSensitivity of Investors Towards Stock MarketVasumathi SubramanianNo ratings yet

- Strategy - Kotak - 12th OctDocument38 pagesStrategy - Kotak - 12th OctVasumathi SubramanianNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bob Marley - SunumDocument5 pagesBob Marley - SunumNaz SakinciNo ratings yet

- Self Concept's Role in Buying BehaviorDocument6 pagesSelf Concept's Role in Buying BehaviorMadhavi GundabattulaNo ratings yet

- Our Common Future, Chapter 2 Towards Sustainable Development - A42427 Annex, CHDocument17 pagesOur Common Future, Chapter 2 Towards Sustainable Development - A42427 Annex, CHShakila PathiranaNo ratings yet

- Charlotte Spencer - Student - SalemMS - Manifest Destiny and Sectionalism Unit PacketDocument9 pagesCharlotte Spencer - Student - SalemMS - Manifest Destiny and Sectionalism Unit Packetcharlotte spencerNo ratings yet

- Availability Dependencies EN XXDocument213 pagesAvailability Dependencies EN XXraobporaveenNo ratings yet

- Math FINALDocument16 pagesMath FINALCecille IdjaoNo ratings yet

- Risk Register 2012Document2 pagesRisk Register 2012Abid SiddIquiNo ratings yet

- United BreweriesDocument14 pagesUnited Breweriesanuj_bangaNo ratings yet

- Mitul IntreprinzatoruluiDocument2 pagesMitul IntreprinzatoruluiOana100% (2)

- SSS Presentation PDFDocument50 pagesSSS Presentation PDFEMMANUEL SSEWANKAMBO100% (2)

- The Seven ValleysDocument17 pagesThe Seven ValleyswarnerNo ratings yet

- Omoluabi Perspectives To Value and Chara PDFDocument11 pagesOmoluabi Perspectives To Value and Chara PDFJuan Daniel Botero JaramilloNo ratings yet

- Humility Bible StudyDocument5 pagesHumility Bible Studyprfsc13No ratings yet

- 2014 10 A Few Good Men Playbill PDFDocument8 pages2014 10 A Few Good Men Playbill PDFhasrat natrajNo ratings yet

- Case Study 2, Domino?s Sizzles With Pizza TrackerDocument3 pagesCase Study 2, Domino?s Sizzles With Pizza TrackerAman GoelNo ratings yet

- The Miracle - Fantasy FictionDocument2 pagesThe Miracle - Fantasy FictionAanya ThakkarNo ratings yet

- Guruswamy Kandaswami Memo A.y-202-23Document2 pagesGuruswamy Kandaswami Memo A.y-202-23S.NATARAJANNo ratings yet

- 79 Fair Empl - Prac.cas. (Bna) 1446, 75 Empl. Prac. Dec. P 45,771, 12 Fla. L. Weekly Fed. C 540 Mashell C. Dees v. Johnson Controls World Services, Inc., 168 F.3d 417, 11th Cir. (1999)Document9 pages79 Fair Empl - Prac.cas. (Bna) 1446, 75 Empl. Prac. Dec. P 45,771, 12 Fla. L. Weekly Fed. C 540 Mashell C. Dees v. Johnson Controls World Services, Inc., 168 F.3d 417, 11th Cir. (1999)Scribd Government DocsNo ratings yet

- EXIDEIND Stock AnalysisDocument9 pagesEXIDEIND Stock AnalysisAadith RamanNo ratings yet

- FAA Airworthiness Directive for Airbus AircraftDocument2 pagesFAA Airworthiness Directive for Airbus AircraftMohamad Hazwan Mohamad JanaiNo ratings yet

- Complete Spanish Grammar 0071763430 Unit 12Document8 pagesComplete Spanish Grammar 0071763430 Unit 12Rafif Aufa NandaNo ratings yet

- RR 7-95 Consolidated VATDocument64 pagesRR 7-95 Consolidated VATjankriezlNo ratings yet

- HSS S6a LatestDocument182 pagesHSS S6a Latestkk lNo ratings yet

- IGNOU Hall Ticket December 2018 Term End ExamDocument1 pageIGNOU Hall Ticket December 2018 Term End ExamZishaan KhanNo ratings yet

- Lawrkhawm: Kum 2014 Branch Kumtir Com-Mittee Neih A NiDocument4 pagesLawrkhawm: Kum 2014 Branch Kumtir Com-Mittee Neih A NibawihpuiapaNo ratings yet

- Purnama RT Sinaga - MB-4D - Developing Skiils Before Graduating From PolmedDocument2 pagesPurnama RT Sinaga - MB-4D - Developing Skiils Before Graduating From PolmedPurnamaNo ratings yet

- Lecture-1 An Introduction To Indian PhilosophyDocument14 pagesLecture-1 An Introduction To Indian PhilosophySravan Kumar Reddy100% (1)

- Annual GPF Statement for NGO TORA N SINGHDocument1 pageAnnual GPF Statement for NGO TORA N SINGHNishan Singh Cheema56% (9)

- Financial Reporting Standards SummaryDocument5 pagesFinancial Reporting Standards SummaryKsenia DroNo ratings yet

- Chapter-10 E-Commerce Digital Markets, Digital GoodsDocument18 pagesChapter-10 E-Commerce Digital Markets, Digital GoodsHASNAT ABULNo ratings yet