Professional Documents

Culture Documents

Control in Divisionalized Organizations Answer To End of Chapter Exercises

Uploaded by

Jay BrockOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Control in Divisionalized Organizations Answer To End of Chapter Exercises

Uploaded by

Jay BrockCopyright:

Available Formats

1

Chapter 10

Control in Divisionalized Organizations

Answer to End of Chapter Exercises

Q 10.1

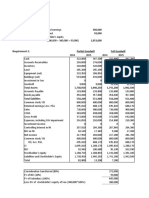

Division A Division B

a) '000 '000

Profit 480 130

CA 280 400

FA 1840 2200

2120 2600

ROI % 22.6% 5.0%

Evaluation of the two project using net present value

Project

X Project Y

Cash Present Cash Present

Year flow value Year flow value

-

0 200,000 1 -200,000 0 -500,000 1 -500,000

1 36,000 0.8696 31,304 1 140,000 0.8696 121,739

2 36,000 0.7561 27,221 2 140,000 0.7561 105,860

3 36,000 0.6575 23,671 3 140,000 0.6575 92,052

4 236,000 0.5718 134,934 4 140,000 0.5718 80,045

5 140,000 0.4972 69,605

17,130 -30,698

Project X delivers a postive net present value of 17,130 and is worthwhile, while project Y

delivers a negative net present value of 30,698 and is not worthwhile.

1) Project X '000 Project Y '000

Contribution from

sales 120 Contribution 140

less advertising 84 less depreciation 100

Additional profit

p.a. 36 Additional profit p.a. 40

Investment 200 Investment 500

ROI % 18% ROI % 8%

Project X provides a positive net present value and so should be accepted but reduces

the overall ROI of the division

Project Y provides a negative net present value and so should be rejected but increases

the overall ROI of the division

b) Head office would accept project X, but not Y. Divisional manager B might be tempted to

progress with project Y.

c) A range of options are available

- Investment decisions could be removed from divisional managers

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

2

- Consider a change in the measurement system. In this chapter the possible use of

residual income as an alternative measure has been introduced. Note that a broader

range of measures are discussed in much greater detail in part 4 of this book.

d) See chapter

Residual income before

e) i) the investment Division A Division B

'000 '000

Net profit 480 130

Interest charge @15% 318 390

162 -260

e) ii) Residual income of investment

Residual income including the investment

Division A Division B

'000 '000

Net profit 516 170

Interest charge @15% 348 465

168 -295

Workings (residual income of projects)

Project X Project Y

'000 '000

Profit from investment 36 40

Interest charge (200,000 @ 15%) 30 500,000@15% 75

Residual income of divisions after the

investments 6 -35

Q 10.2

Fairdoo B division Cheapbuy

Price 90 95 85

contribution from division c 16

additional cost to company 74

a) Cheapest from division A managers viewpoint is Cheapbuy.

b) From Aldo Ltd's perspective the best option is to buy from Fairdoo as the additional cost to the

company is 74. 90 to purchase the component less 16 contribution earned by Division C which

is not operating at full capacity.

c) Could introduce some method for sharing the contribution earned e.g. dual pricing or negotiated price.

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

3

Q 10.3 a) It is necessary to compare the cost of buying in against the cost of making.

i) The quote from Apple Ltd is 7,200, but division C will undertake work for Apple Ltd and will receive a

contribution from this work. Since division C is not operating at full capacity, this contribution should be

taken into consideration

Apple

7,200

less contribution division C (Note 1)* 600

Cost to company 6,600

* (Note 1)calculation of contribution to division C

Sales 2,000

variable cost 1,400

Contribution to division C. 600

ii) If the quote is given to division B, in order to calculate the cost to the company it is necessary to

identify whether the relevant cost of work completed by divisions C and D should be included

at variable cost or at market price.

Division B

Quoted price 9,200

mark-up 2,300

Costs to division B 6,900

less cost of component from division C 2,000

4,900

less cost of work sub-contracted to division D 2,700

Variable cost of division B 2,200

If there is spare capacity in divisions B, C and D then the additional cost to division B is

Variable cost of division B 2,200

Variable cost of division C 1,400

Variable cost of division D** (Note 2) 1,350

4,950

Additional cost to the company of manufacturing in division B if there is spare capacity in those

divisions as well as division C is 4,950.

The cost to the company of buying in from Apple is 6,600. It is therefore in the interests of the organisation

to manufacture the component internally.

Divison D** (Note 2)

Sales 2,700

Variable cost 1,350

Contribution 1,350

b) If there is no spare capcity in division D then there is an opportunity cost of 1,350 i.e.

the relevant cost of using division D is the market price of 2,700. So relevant cost of Division B undertaking

the work is

Variable cost of division B 2,200

Variable cost of division C 1,400

relevant cost of division D 2,700

6,300

The relevant cost of 6,300 is still less than the cost of purchasing from Apple ltd so from a company

perspective it is still better to purchase from Division B

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

4

Q 10.4

a)i) '000 '000

Profit 450

CA 575

FA 525

1100

ROI % 40.9%

aii) - Investment in machine of 240,000.

Machine will provide a saving of 70,000 per annum. Depreciation is 40,000 per

annum so the favourable impact on profit is 30,000 p.a. Net book value at the end

of the year on the asset is 240,000 - 40,000 = 200,000

Original add New

'000 '000 '000

Net

profit 450 30 480

Net capital

employed 1,100 200 1300

R.O.I

% 40.9% 15.0% 36.9%

aii) discount to customers

Original add New

'000 '000 '000

Net

profit 450 -0.96 449.04

Net capital

employed 1,100 -36 1064

R.O.I

% 40.9% 2.7% 42.2%

aii) sell machine

Original add New

'000 '000 '000

Net

profit 450 -20 430

Net capital

employed 1,100 0 1100

R.O.I

% 40.9% 39.1%

b) Decision on investment in new machine

The divisional manager may be against the decision to invest in the new machine

costing240,000 as there is a reduction in the ROI %age in the year. Reviewing the

investment (see table below) there appears to be a substantially positive net present

value generated and accordingly it is likely that head office would welcome the

investment.

Machinery

Year Cash flow Present value

'000 '000

0 -240 1 -240

1 70 0.8772 61

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

5

2 70 0.7695 54

3 70 0.6750 47

4 70 0.5921 41

5 70 0.5194 36

6 70 0.4556 32

Net present value +32

Decision on offering discount

The divisional management may be for the decision as it results in a higher ROI

The interest saving on reduced trade receivables is 36,000 x 14% = 5,040.

The cost reduction is 6,000 so the impact on the profit of the organisation is

adverse.

Decision on sale of machine

The impact of selling the machine now would be to have an adverse impact on ROI.

Selling the asset for 40,000 would result in a loss of 60,000 (sale price of 40,000

- depreciation 100,000).

If the asset was kept the impact would be a loss of 40,000 (contribution 60,000

- depreciation 100,000

Both Head office and divisional managers would be against the decision.

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

6

Q 10.5

Cash Discount

a) Year flow factor Present value

'000 '000

0 -50 1 -50

1 5 0.9091 5

2 10 0.8264 8

3 10 0.7513 8

4 25 0.6830 17

5 25 0.6209 16

Net present value 3

ARR is 10% and in the first year it is 0%. NPV is +ve but

given an ARR less than the target ROI, Jack Jones may not

be keen to undertake the investment.

b) April June 20X8

Total Sales 598,000

Less variable costs:

Labour 211,558

Material 143,240

Controllable contribution 243,202

Less controllable divisional expenses

Fixed Production overhead 132,000

Accounting 35,000

Commercial 23,000

Controllable profit 53,202

Allocation of corporate advertising 20,000

Divisional net profit 33,202

2008 John Wiley & Sons Ltd.

www.wileyeurope.com/college/bowhill

You might also like

- Investment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Document7 pagesInvestment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Sneha DasNo ratings yet

- ACC401-Basic Conso SPLDocument4 pagesACC401-Basic Conso SPLOhene Asare PogastyNo ratings yet

- Prepare SCI for Service and MerchandisingDocument10 pagesPrepare SCI for Service and MerchandisingJessamine Romano AplodNo ratings yet

- Quiz 2 - Income Tax Concepts and ComplianceDocument3 pagesQuiz 2 - Income Tax Concepts and CompliancelcNo ratings yet

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- GUIDE TO DISCOUNTED CASH FLOW ANALYSIS AND PROJECT EVALUATIONDocument6 pagesGUIDE TO DISCOUNTED CASH FLOW ANALYSIS AND PROJECT EVALUATIONDorianne BorgNo ratings yet

- Pa Revision For FinalsDocument9 pagesPa Revision For FinalsKhải Hưng NguyễnNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (60)

- Responsibility AccountingDocument6 pagesResponsibility Accountingrodell pabloNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- Individuals Assign3Document7 pagesIndividuals Assign3jdNo ratings yet

- CH 3 Problem SolutionsDocument9 pagesCH 3 Problem SolutionsFrancisco PradoNo ratings yet

- Corporate Finance JUNE 2022Document7 pagesCorporate Finance JUNE 2022Rajni KumariNo ratings yet

- Statement of Changes in Comprehensive IncomeDocument33 pagesStatement of Changes in Comprehensive Incomeellyzamae quiraoNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- PROBLEM 9 (Net Present Value)Document8 pagesPROBLEM 9 (Net Present Value)Kathlyn TajadaNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- Chapter 13 A-C PDFDocument13 pagesChapter 13 A-C PDFKim Arvin DalisayNo ratings yet

- Section C Answer Student'sDocument7 pagesSection C Answer Student'sAmir ArifNo ratings yet

- Illustrative Questions: Classic TutorsDocument20 pagesIllustrative Questions: Classic TutorsTbabaNo ratings yet

- Quiz 2 - Income Tax Concepts and ComplianceDocument3 pagesQuiz 2 - Income Tax Concepts and ComplianceDela cruz, Hainrich (Hain)No ratings yet

- Anindita SenguptaDocument8 pagesAnindita Senguptandim betaNo ratings yet

- Chapter 08Document10 pagesChapter 08julie anne mae mendozaNo ratings yet

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- MOCK_EXAMDocument4 pagesMOCK_EXAMAna-Maria GhNo ratings yet

- Solution ExercisesDocument7 pagesSolution Exercises280alexNo ratings yet

- Comprehensive Income & NcahsDocument6 pagesComprehensive Income & NcahsNuarin JJ67% (3)

- Ch08 Responsibility Accounting, Segment Evaluation and Transfer Pricing PDFDocument10 pagesCh08 Responsibility Accounting, Segment Evaluation and Transfer Pricing PDFjdiaz_646247No ratings yet

- Option A Option B Location A Location B Million MillionDocument6 pagesOption A Option B Location A Location B Million MillionAkshita ChordiaNo ratings yet

- Lecture 27Document34 pagesLecture 27Riaz Baloch NotezaiNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationDocument10 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Advanced TaxationNarendra KumarNo ratings yet

- Exercise 1Document4 pagesExercise 1Nyster Ann RebenitoNo ratings yet

- Learning Unit 8 - Treatments of Dividends During ConsolidationDocument41 pagesLearning Unit 8 - Treatments of Dividends During ConsolidationThulani NdlovuNo ratings yet

- Equity Method (First Year of Acquisition)Document3 pagesEquity Method (First Year of Acquisition)Angel Chane OstrazNo ratings yet

- Financial Accounting Statement of Cash FlowsDocument4 pagesFinancial Accounting Statement of Cash FlowsPlawan GhimireNo ratings yet

- Fair Value of Identifiable Net Assets Acquired:: Acquisition AnalysisDocument8 pagesFair Value of Identifiable Net Assets Acquired:: Acquisition AnalysiserinNo ratings yet

- Fa2 Module234Document20 pagesFa2 Module234Yanna100% (1)

- Case FileDocument4 pagesCase Fileabeer alamNo ratings yet

- Analyze investment project cash flows and valuationDocument4 pagesAnalyze investment project cash flows and valuationabeer alamNo ratings yet

- Advanced Accounting Chapter 22Document9 pagesAdvanced Accounting Chapter 22LJ AggabaoNo ratings yet

- Case 9-2 Innovative Engineering CoDocument4 pagesCase 9-2 Innovative Engineering CoFaizal PradhanaNo ratings yet

- Addtl Exercises 10 12Document5 pagesAddtl Exercises 10 12John Lester C AlagNo ratings yet

- Midterms MADocument10 pagesMidterms MAJustz LimNo ratings yet

- Responsibility Acctg Transfer Pricing GP AnalysisDocument21 pagesResponsibility Acctg Transfer Pricing GP AnalysisMoon LightNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- Exercise 2589Document5 pagesExercise 2589Marites Amores MercedNo ratings yet

- Advanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)Document1 pageAdvanced Accounting - 2015 (Chapter 17) Multiple Choice Solution (Part I)John Carlos DoringoNo ratings yet

- c38fn2 - Revision Handout (2018)Document6 pagesc38fn2 - Revision Handout (2018)Syaimma Syed AliNo ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- MAS Part II Illustrative Examples (Capital Budgeting)Document2 pagesMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNo ratings yet

- ROI, residual income, and required returnsDocument21 pagesROI, residual income, and required returnsGelyn CruzNo ratings yet

- Taxation Final Pre-Board - SolutionsDocument14 pagesTaxation Final Pre-Board - SolutionsMischievous MaeNo ratings yet

- 1007 (RA, SR and TP)Document6 pages1007 (RA, SR and TP)Neil Ryan CatagaNo ratings yet

- Contribution Margin Analysis and Break Even CalculationDocument8 pagesContribution Margin Analysis and Break Even CalculationVishal SairamNo ratings yet

- Pembahasan Kuiz Indirect HoldingsDocument3 pagesPembahasan Kuiz Indirect HoldingsAdara KiranaNo ratings yet

- PT Cagak financial statement 2020Document9 pagesPT Cagak financial statement 2020Laras sukma nurani tirtawidjajaNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Solution Manual Chapter 9 - Government Accounting: Fund-Based Financial StatementsDocument25 pagesSolution Manual Chapter 9 - Government Accounting: Fund-Based Financial StatementsJay BrockNo ratings yet

- Chapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Document20 pagesChapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Introduction To The Consolidation Process: Learning Objectives - Coverage by QuestionDocument21 pagesIntroduction To The Consolidation Process: Learning Objectives - Coverage by QuestionJay BrockNo ratings yet

- Solution Manual: (Updated Through November 11, 2013)Document55 pagesSolution Manual: (Updated Through November 11, 2013)Jay BrockNo ratings yet

- Chapter 15 Markov Analysis: Quantitative Analysis For Management, 11e (Render)Document18 pagesChapter 15 Markov Analysis: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 13 Waiting Lines and Queuing Theory Models: Quantitative Analysis For Management, 11e (Render)Document34 pagesChapter 13 Waiting Lines and Queuing Theory Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Solution Manual: (Updated Through November 11, 2013)Document23 pagesSolution Manual: (Updated Through November 11, 2013)Jay BrockNo ratings yet

- Chapter 16 Statistical Quality Control: Quantitative Analysis For Management, 11e (Render)Document20 pagesChapter 16 Statistical Quality Control: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Aa2e Hal SM Ch09Document19 pagesAa2e Hal SM Ch09Jay BrockNo ratings yet

- Chapter 4 Regression Models: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 4 Regression Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 9 Transportation and Assignment Models: Quantitative Analysis For Management, 11e (Render)Document30 pagesChapter 9 Transportation and Assignment Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 12 Project Management: Quantitative Analysis For Management, 11e (Render)Document36 pagesChapter 12 Project Management: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Strategy and Control System Design Answer To End of Chapter ExercisesDocument5 pagesStrategy and Control System Design Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Chapter 5 Forecasting: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 5 Forecasting: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 6 Inventory Control Models: Quantitative Analysis For Management, 11e (Render)Document27 pagesChapter 6 Inventory Control Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- CH23 PDFDocument5 pagesCH23 PDFJay BrockNo ratings yet

- Chapter 11 Network Models: Quantitative Analysis For Management, 11e (Render)Document32 pagesChapter 11 Network Models: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Measuring and Improving Internal Business Processes Answer To End of Chapter ExercisesDocument7 pagesMeasuring and Improving Internal Business Processes Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Chapter 2 Probability Concepts and Applications: Quantitative Analysis For Management, 11e (Render)Document34 pagesChapter 2 Probability Concepts and Applications: Quantitative Analysis For Management, 11e (Render)Jay BrockNo ratings yet

- Chapter 1Document12 pagesChapter 1Dennisse M. Vázquez-Casiano IsraelNo ratings yet

- Measuring Shareholder Value Answer To End of Chapter ExercisesDocument5 pagesMeasuring Shareholder Value Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Budgetary Control, Performance Management and Alternative Approaches To Control Answer To End of Chapter ExercisesDocument2 pagesBudgetary Control, Performance Management and Alternative Approaches To Control Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Accounting and Strategic Analysis Answer To End of Chapter ExercisesDocument6 pagesAccounting and Strategic Analysis Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Evaluating Strategies and Writing The Business Plan Answer To End of Chapter ExercisesDocument4 pagesEvaluating Strategies and Writing The Business Plan Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Identifying Suitable Strategic Options Answer To End of Chapter Exercises Siegmund LTDDocument7 pagesIdentifying Suitable Strategic Options Answer To End of Chapter Exercises Siegmund LTDJay BrockNo ratings yet

- Political: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesDocument6 pagesPolitical: Strategic Analysis - The External Environment Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Corporate Social Responsibility: Objectives, Strategy and Influences Answer To End of Chapter ExercisesDocument3 pagesCorporate Social Responsibility: Objectives, Strategy and Influences Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Internal Appraisal of The Organization Answer To End of Chapter ExercisesDocument5 pagesInternal Appraisal of The Organization Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Funding The Business Answer To End of Chapter ExercisesDocument2 pagesFunding The Business Answer To End of Chapter ExercisesJay BrockNo ratings yet

- Standard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesDocument4 pagesStandard Costing and Control Using Accounting Rules Answer To End of Chapter ExercisesJay BrockNo ratings yet

- JapaneseDocument250 pagesJapaneseAlberto VillalbaNo ratings yet

- E-Viva Werkplaatshandboek PDFDocument76 pagesE-Viva Werkplaatshandboek PDFAntónio PedrosaNo ratings yet

- Wall-Mounted King Shell Temperature and Humidity Transmitter User ManualDocument6 pagesWall-Mounted King Shell Temperature and Humidity Transmitter User ManualTrung Trần HữuNo ratings yet

- 05 Allama Ibn e Nujaim or Un Ki Kitab PDFDocument20 pages05 Allama Ibn e Nujaim or Un Ki Kitab PDFFk imaginaryNo ratings yet

- Syllabus For Undergraduate Course in History (Bachelor of Arts Examination)Document26 pagesSyllabus For Undergraduate Course in History (Bachelor of Arts Examination)Rojalin Mishra0% (1)

- Chapter 11Document3 pagesChapter 11JIMENEZ, Hans Rainer C.No ratings yet

- A Critical Analysis of Anchor Spacing in Refractory Lining DesignDocument11 pagesA Critical Analysis of Anchor Spacing in Refractory Lining Designanon_554588463No ratings yet

- LTE eNB L1 API DefinitionDocument106 pagesLTE eNB L1 API Definitioneng_alshimaaNo ratings yet

- CP SanitaryDocument2 pagesCP SanitaryMuthu ManiNo ratings yet

- Literature Study of HospitalDocument18 pagesLiterature Study of HospitalJasleen KaurNo ratings yet

- Modul Push 15A enDocument6 pagesModul Push 15A enUPOTERMNo ratings yet

- AGBT05-18 Guide To Bridge Technology Part 5 Structural DraftingDocument73 pagesAGBT05-18 Guide To Bridge Technology Part 5 Structural DraftingyasNo ratings yet

- FM 200 Datasheet and DesignDocument174 pagesFM 200 Datasheet and DesignRichard Rajkumar0% (1)

- Construction Plans and Strength RequirementsDocument8 pagesConstruction Plans and Strength Requirementsstormriderbh100% (1)

- Bulk Storage SilosDocument5 pagesBulk Storage SilosMiran VidovićNo ratings yet

- Maruti AR2016-17 DLX MediumDocument280 pagesMaruti AR2016-17 DLX MediumGautam MehtaNo ratings yet

- DecayDocument76 pagesDecayBurning EmpireNo ratings yet

- Nature-Based+tourism+and+biodiversity+conservation+in+protected+areas +philippine+contextDocument17 pagesNature-Based+tourism+and+biodiversity+conservation+in+protected+areas +philippine+contextRene John Bulalaque EscalNo ratings yet

- Correlated Subqueries With AliasesDocument5 pagesCorrelated Subqueries With AliasesPretty BellaNo ratings yet

- Accc/Tw Helsinki (160) : Data SheetDocument1 pageAccc/Tw Helsinki (160) : Data SheetkmiqdNo ratings yet

- Stages of Growth and DevelopmentDocument32 pagesStages of Growth and DevelopmentAaron Manuel MunarNo ratings yet

- Advances in Experimental Social Psychology, Volume 52 PDFDocument349 pagesAdvances in Experimental Social Psychology, Volume 52 PDFJose LuisNo ratings yet

- #1 Basic Functions of The Hand-1Document29 pages#1 Basic Functions of The Hand-1Yosep Gustiy PanguestueNo ratings yet

- OHSMS - Questions and AnswersDocument17 pagesOHSMS - Questions and AnswersPrakash PatelNo ratings yet

- Tank Heating DiscussionsDocument26 pagesTank Heating DiscussionsTHERMAX007No ratings yet

- Lesson Plan Financial LiteracyDocument1 pageLesson Plan Financial Literacyapi-438803241No ratings yet

- Action Paper g2 Final OutputDocument67 pagesAction Paper g2 Final Outputjay diazNo ratings yet

- 12 Mounting and LabelingDocument1 page12 Mounting and LabelingEunice AndradeNo ratings yet

- Katalog Optibelt Remenice PDFDocument128 pagesKatalog Optibelt Remenice PDFluky ivanNo ratings yet

- Advancing Social Justice, Promoting Decent WorkDocument29 pagesAdvancing Social Justice, Promoting Decent WorkalnaturamilkaNo ratings yet