Professional Documents

Culture Documents

Gautam Engineers Ltd. Director'S Report: Profit Before Interest, Depreciation & Tax 4606276 4615009

Uploaded by

ravibhartia1978Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gautam Engineers Ltd. Director'S Report: Profit Before Interest, Depreciation & Tax 4606276 4615009

Uploaded by

ravibhartia1978Copyright:

Available Formats

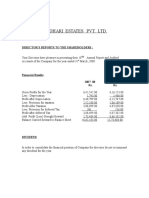

GAUTAM ENGINEERS LTD.

DIRECTORS REPORT

TO THE MEMBERS

Your directors are glad to present the 34th Annual report together with audited statement of accounts for

the year ended 31st March 2009.

SUMMARISED FINANCIAL RESULTS

Current Year Previous Year

(Rs.in lakhs) (Rs.in lakhs)

Income 12593406 11279221

Less: Operating & other expenditure 7987130 6664212

Profit before Interest, Depreciation & tax 4606276 4615009

Less: Interest - -

Depreciation (Including amortizations) 742402 828975

Profit before tax 3863874 3786034

Taxes on income 1316000 1095000

Profit after tax 2447874 2691034

Profit b/f from previous year 9146081 6444847

Add/Less: Prior period adjustments (12791) 10200

Profit carried to balance sheet 11681164 9146081

1. OPERATION

The Board has continued its efforts to search for profitable avenues for business and hopes for

Better results in the coming year.

2. DIVIDEND

In order to fuel growth in its revenues and profits the company needs to conserve its financial

resources to meet critical investment requirements in the near term due to which your directors

regret their inability to declare dividend to members.

3. CONSERVATION OF ENEGRY & TECHNOLOGY ABSORBTION

The issues to conservation of energy and technology absorption are not applicable at present, as

the company has not carried on any such business.

4. FOREIGN EXCHANGE EARNINGS & OUTGO

There has been no foreign exchange earnings and outgo during the year under review.

5. PARTICULARS OF SPECIFIED EMPLOYEES

There are no employees covered under the disclosure requirement of section 217(2A) of the

Company Act 1956 read with the Companies ( Particulars of Employees ) Rules 1975.

6 . SECRETARIAL COMPLIANCE CERTIFICATE

In accordance with section 383A of the Companies Act,1956 and Companies Compliance

certificate Rules 2001, the Company has obtained a certificate from a Secretary in whole time

practice confirm that Company has compiled with all the provisions of the Companies Act,1956.

7 DIRECTORS RESPONSIBILITY STATEMENT

As required U/S 217 of the Company Act 1956, as amended by the Companies (Amendment) Act

2000, the Directors hereby confirm that

a) In the preparation of Annual Account, the applicable Accounting Standards had been followed

along with proper explanation made in the notes annexed to the accounts relating to material

departures

b) the directors had selected such accounting policies and applied them consistently and made

judgment and estimates that are reasonable and prudent so as to give a true and fair view of the

state of affairs of the Company at the end of the financial year and of the profit of the company

for that period .

c) The directors had taken proper and sufficient care for the maintenance of adequate accounting

records in accordance with the provision of this Act for safeguarding the assets of the

Company and for preventing and detecting fraud.

d) The Directors had prepared the Annual Accounts on a going concern basis.

8 DEPOSIT

The Company has not accepted any deposit from the public u/s. 58A of Company Act, 1956.

9. AUDITORS

M/s S.B.Dandeker & Co., Chartered Accountants, auditors of the company retire at the

forthcoming annual general meeting and have conveyed their eligibility and acceptance to be

reappointed.

10. ACKNOWLEDGEMENTS

The board places on record its appreciation for the effort and cooperation of all who have

contributed to the efficient functioning of the company during the year.

For & on behalf of the Board

GAUTAM ENGINEERS LTD.

DIRECTOR

19, R.N. Mukherjee Road,

Place: Kolkata

Date: 1st July,2009

You might also like

- Gautam Engineers Ltd. Director'S Report: Profit Before Interest, Depreciation & Tax 9177020 9769331Document3 pagesGautam Engineers Ltd. Director'S Report: Profit Before Interest, Depreciation & Tax 9177020 9769331Ravi BhartiaNo ratings yet

- Director's Report Highlights Jute Company's 75th Annual FinancialsDocument3 pagesDirector's Report Highlights Jute Company's 75th Annual Financialsravibhartia1978No ratings yet

- Girdhari Estates Director's Report Highlights Financials and Lack of DividendDocument3 pagesGirdhari Estates Director's Report Highlights Financials and Lack of Dividendravibhartia1978No ratings yet

- Annual Report 2019-20Document252 pagesAnnual Report 2019-20sk jhaNo ratings yet

- Annual Report 18-19Document338 pagesAnnual Report 18-19sairaj bhatkarNo ratings yet

- Financial Statements 3Document213 pagesFinancial Statements 3Liliana MNo ratings yet

- Annual Report highlights Caprihans' strong performanceDocument92 pagesAnnual Report highlights Caprihans' strong performancePuneet367No ratings yet

- Unit 12Document200 pagesUnit 12vaghelavijay2205No ratings yet

- Cosmos Appliances FY 2018Document23 pagesCosmos Appliances FY 2018Bhavin SagarNo ratings yet

- Company Annual Report 2017-18Document27 pagesCompany Annual Report 2017-18Elaina fernandoNo ratings yet

- Annual Report 2 0 0 1 - 2 0 0 2: Relaxo Footwears LimitedDocument51 pagesAnnual Report 2 0 0 1 - 2 0 0 2: Relaxo Footwears LimitedSeerat JangdaNo ratings yet

- Reliance Utilities and Power Private Limited: Annual Report 2016-17Document131 pagesReliance Utilities and Power Private Limited: Annual Report 2016-17Debabrata GhoshNo ratings yet

- Ambika Cotton Mills LimitedDocument69 pagesAmbika Cotton Mills LimitedTotmolNo ratings yet

- Annual - Report - 2009-10 Automotive AxcelDocument49 pagesAnnual - Report - 2009-10 Automotive AxcelPuneeNo ratings yet

- Bse 2Document18 pagesBse 2Aashish JainNo ratings yet

- Sme Ar 17675 Avg 2019 2020 09092020023827Document139 pagesSme Ar 17675 Avg 2019 2020 09092020023827Nihit SandNo ratings yet

- Ambika Cotton Mills LimitedDocument68 pagesAmbika Cotton Mills LimitedSriNo ratings yet

- 10th Annual Report 2019-20: Gala Global Products LimitedDocument77 pages10th Annual Report 2019-20: Gala Global Products LimitedApurvAdarshNo ratings yet

- Paramount Polish Processors Private LimitedDocument2 pagesParamount Polish Processors Private LimitedJeremy HoltNo ratings yet

- Gautam Engineers LTD.: Director'S Reports To The ShareholdersDocument5 pagesGautam Engineers LTD.: Director'S Reports To The Shareholdersravibhartia1978No ratings yet

- KDDL LTD DDocument10 pagesKDDL LTD Ds jNo ratings yet

- Annual Report 2022 23Document176 pagesAnnual Report 2022 23Avinash ChauhanNo ratings yet

- Annual Report 2012-13Document155 pagesAnnual Report 2012-13Jr. ScientistNo ratings yet

- CA Sales - Results 2019 PDFDocument2 pagesCA Sales - Results 2019 PDFgarag muniNo ratings yet

- Alisha Snacks Private Limited: CIN: U15549GJ2018PTC100441Document12 pagesAlisha Snacks Private Limited: CIN: U15549GJ2018PTC100441vineminaiNo ratings yet

- Hanuman Estates Ltd Director's ReportDocument5 pagesHanuman Estates Ltd Director's Reportravibhartia1978No ratings yet

- rp2022 23Document24 pagesrp2022 23nihalNo ratings yet

- Audit Account 6ayFRaWgLGNIKooY0xwLsEsyRaxCV12xMHSCZHJpDocument16 pagesAudit Account 6ayFRaWgLGNIKooY0xwLsEsyRaxCV12xMHSCZHJpSamson OlubodeNo ratings yet

- K-One AR2020 - Part 2Document85 pagesK-One AR2020 - Part 2apeachsugaNo ratings yet

- Notice & Director ReportDocument4 pagesNotice & Director ReportJoshua McdowellNo ratings yet

- OptiemusInfa 5301350316Document145 pagesOptiemusInfa 5301350316eepNo ratings yet

- Board's Report Highlights Asian Paints' FY2016-17 PerformanceDocument8 pagesBoard's Report Highlights Asian Paints' FY2016-17 PerformanceChittaNo ratings yet

- Avery India Limited 2012Document10 pagesAvery India Limited 2012Abhisek MukherjeeNo ratings yet

- ATGL interim report analysisDocument11 pagesATGL interim report analysisparidhiNo ratings yet

- Results Dec 2018Document4 pagesResults Dec 2018Mukesh PadwalNo ratings yet

- VITP Private Limited-FSDocument71 pagesVITP Private Limited-FSnarayanvarmaNo ratings yet

- FinolexDocument171 pagesFinolexAkash Nil ChatterjeeNo ratings yet

- Dabur (Uk) Limited: Annual Report For The Financial Year Ended 31St March, 2009Document13 pagesDabur (Uk) Limited: Annual Report For The Financial Year Ended 31St March, 2009rishabhrockNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- IHCL SUBSIDIARY Annual Report 2009 10Document348 pagesIHCL SUBSIDIARY Annual Report 2009 10raman86_netNo ratings yet

- Vadilal Industries LimitedDocument29 pagesVadilal Industries LimitedSubhash YadavNo ratings yet

- Growtech InfraDocument33 pagesGrowtech InfraKhyati SrivastavaNo ratings yet

- TC Travel's Annual Report Summarizes Drop in Revenue, Rise in CostsDocument33 pagesTC Travel's Annual Report Summarizes Drop in Revenue, Rise in CostsRishabh VachharNo ratings yet

- Eclerx Services Private Limited: 7 Annual ReportDocument22 pagesEclerx Services Private Limited: 7 Annual ReportNikhil AroraNo ratings yet

- Atlas & Union Jute Press Co. LTD.: Director'S Report To The ShareholdersDocument5 pagesAtlas & Union Jute Press Co. LTD.: Director'S Report To The Shareholdersravibhartia1978No ratings yet

- Girdhari Estates Pvt. LTD.: Director'S Reports To The ShareholdersDocument5 pagesGirdhari Estates Pvt. LTD.: Director'S Reports To The Shareholdersravibhartia1978No ratings yet

- AnnualReport2018 19Document210 pagesAnnualReport2018 19AnshulNo ratings yet

- Standalone Financial Results, Form B For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form B For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Sme Ar 22026 Rexpipes 2022 2023 17062023160713Document65 pagesSme Ar 22026 Rexpipes 2022 2023 17062023160713awuNo ratings yet

- Annual Report 2017-18: Accord Synergy LimitedDocument55 pagesAnnual Report 2017-18: Accord Synergy Limitedshark123No ratings yet

- Financial Results Q1 August 2018Document13 pagesFinancial Results Q1 August 2018shakeelahmadjsrNo ratings yet

- Annual Report 2017-18Document190 pagesAnnual Report 2017-1823321gauravNo ratings yet

- Kitply Industries Limited WCDocument11 pagesKitply Industries Limited WCZakir HussainNo ratings yet

- Dangote Cement 2018 Financial Statements ReviewDocument79 pagesDangote Cement 2018 Financial Statements ReviewReuben GrahamNo ratings yet

- Malom Foods 2022Document13 pagesMalom Foods 2022Samuel kwateiNo ratings yet

- CFCL Annual Report 2018-19Document195 pagesCFCL Annual Report 2018-19Bharath KumarNo ratings yet

- Annual Report 2021-22 PDFDocument179 pagesAnnual Report 2021-22 PDFMohnish KhianiNo ratings yet

- Voltas 2019 Balance SheetDocument16 pagesVoltas 2019 Balance SheetAbhishekNo ratings yet

- Profit & LossDocument5 pagesProfit & Lossbvs_preethiNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Girdhari Estates PVT - LTD.: NoticeDocument1 pageGirdhari Estates PVT - LTD.: Noticeravibhartia1978No ratings yet

- Letter From MCO To Anirudh Jalan Dated 19-1-2018Document1 pageLetter From MCO To Anirudh Jalan Dated 19-1-2018ravibhartia1978No ratings yet

- Statement of Accounts: OfficeDocument1 pageStatement of Accounts: Officeravibhartia1978No ratings yet

- Gautam Engineers Limited requests cancellation of Airtel Hotspot number due to battery issuesDocument1 pageGautam Engineers Limited requests cancellation of Airtel Hotspot number due to battery issuesravibhartia1978No ratings yet

- U67120WB1981PTC033586Document2 pagesU67120WB1981PTC033586ravibhartia1978No ratings yet

- Statement of Accounts: OfficeDocument1 pageStatement of Accounts: Officeravibhartia1978No ratings yet

- 27a Cala01174f 26Q Q3 201516Document1 page27a Cala01174f 26Q Q3 201516ravibhartia1978No ratings yet

- Commercial CircularDocument1 pageCommercial Circularravibhartia1978No ratings yet

- Manoj Kr. Agarwal - GIRDHARIDocument1 pageManoj Kr. Agarwal - GIRDHARIravibhartia1978No ratings yet

- Hindi Book Prem Chand Aur Subhasit Aur Suktiya PDFDocument196 pagesHindi Book Prem Chand Aur Subhasit Aur Suktiya PDFravibhartia1978No ratings yet

- Gautam Engineers Limited requests cancellation of Airtel Hotspot number due to battery issuesDocument1 pageGautam Engineers Limited requests cancellation of Airtel Hotspot number due to battery issuesravibhartia1978No ratings yet

- 27a Cala01174f 26Q Q2 201516Document1 page27a Cala01174f 26Q Q2 201516ravibhartia1978No ratings yet

- Ministry of Corporate Affairs: Receipt G.A.R.7Document1 pageMinistry of Corporate Affairs: Receipt G.A.R.7ravibhartia1978No ratings yet

- Atlas JuteDocument9 pagesAtlas Juteravibhartia1978No ratings yet

- Atlas Jute - Only Rent CapDocument6 pagesAtlas Jute - Only Rent Capravibhartia1978No ratings yet

- 86Document5 pages86ravibhartia1978No ratings yet

- MINISTRY OF CORPORATE AFFAIRS RECEIPTDocument1 pageMINISTRY OF CORPORATE AFFAIRS RECEIPTravibhartia1978No ratings yet

- Director Report: To The Members of M/S. Bhagwati Devcon Private LimitedDocument2 pagesDirector Report: To The Members of M/S. Bhagwati Devcon Private Limitedravibhartia1978No ratings yet

- Bhagwati Devcon Private LimitedDocument2 pagesBhagwati Devcon Private Limitedravibhartia1978No ratings yet

- Auditor's Report on Bhagwati Devcon Private LimitedDocument3 pagesAuditor's Report on Bhagwati Devcon Private Limitedravibhartia1978No ratings yet

- 85Document2 pages85ravibhartia1978No ratings yet

- Ministry of Corporate Affairs: Receipt G.A.R.7Document1 pageMinistry of Corporate Affairs: Receipt G.A.R.7ravibhartia1978No ratings yet

- Oct 17 News PaperDocument8 pagesOct 17 News Paperravibhartia1978No ratings yet

- GSTR 3B Excel FormatDocument2 pagesGSTR 3B Excel Formatravibhartia1978No ratings yet

- Lli I: LimitedDocument10 pagesLli I: Limitedravibhartia1978No ratings yet

- Balance Sheet Abstract & Company'S General Business Profile: I. Registration DetailsDocument3 pagesBalance Sheet Abstract & Company'S General Business Profile: I. Registration Detailsravibhartia1978No ratings yet

- Useful 1Document15 pagesUseful 1ravibhartia1978No ratings yet

- Accounting Policies and Notes for Hanuman EstatesDocument3 pagesAccounting Policies and Notes for Hanuman Estatesravibhartia1978No ratings yet

- Gautam Engineers LTDDocument1 pageGautam Engineers LTDravibhartia1978No ratings yet

- S.B.Dandeker & CoDocument3 pagesS.B.Dandeker & Coravibhartia1978No ratings yet

- Cleartrip MOMDocument19 pagesCleartrip MOMAlok Mishra100% (3)

- Deductions: Business/Investment Losses and Passive Activity LossesDocument18 pagesDeductions: Business/Investment Losses and Passive Activity LossesBinbin YanNo ratings yet

- UDS GAME Marketing Plan 2016 enDocument14 pagesUDS GAME Marketing Plan 2016 enRazvan Vasiliu100% (1)

- Accounting For Business CombinationsDocument19 pagesAccounting For Business Combinationsvinanovia50% (2)

- Dental Services MarketDocument35 pagesDental Services MarketIndia Business ReportsNo ratings yet

- PACE Sample ExamDocument13 pagesPACE Sample ExamjhouvanNo ratings yet

- CFA Level 1 Fundamentals of Credit AnalysisDocument5 pagesCFA Level 1 Fundamentals of Credit AnalysisAditya BajoriaNo ratings yet

- Stern Stewart - Evaluation PDFDocument8 pagesStern Stewart - Evaluation PDFAntoanela MihăilăNo ratings yet

- Volkswagen A G Situation Analysis Final 2Document19 pagesVolkswagen A G Situation Analysis Final 2HarshitAgrawalNo ratings yet

- Quiz Chapter 7Document2 pagesQuiz Chapter 7PauNo ratings yet

- Ranjit HsDocument4 pagesRanjit HsJeeva JaguarNo ratings yet

- 23 East 4Th Street NEW YORK, NY 10003 Orchard Enterprises Ny, IncDocument2 pages23 East 4Th Street NEW YORK, NY 10003 Orchard Enterprises Ny, IncPamelaNo ratings yet

- Leave PolicyDocument3 pagesLeave PolicyShiva PillaiNo ratings yet

- Term Paper Business FinanceDocument31 pagesTerm Paper Business FinanceJodi LegpitanNo ratings yet

- Small Scale Industries: Characteristics Importance Advantages of Running An SSIDocument5 pagesSmall Scale Industries: Characteristics Importance Advantages of Running An SSIynkamatNo ratings yet

- Strat Sourcing StrategyDocument4 pagesStrat Sourcing StrategySagar DorgeNo ratings yet

- What is a SPAC? Understanding the Alternative to a Traditional IPODocument22 pagesWhat is a SPAC? Understanding the Alternative to a Traditional IPOPolina ChtchelockNo ratings yet

- Goals - Usim.edu - My Moodle Pluginfile - PHP 137457 Mod Resource Content 1 010 096 4thICBER2013 Proceeding p0137Document11 pagesGoals - Usim.edu - My Moodle Pluginfile - PHP 137457 Mod Resource Content 1 010 096 4thICBER2013 Proceeding p0137Syafiqah NajibNo ratings yet

- DATABASEDocument8 pagesDATABASERusheet PadaliaNo ratings yet

- Microeconomics IntroductionDocument126 pagesMicroeconomics Introductionrajvinder deol83% (82)

- THE FINANCIAL PERFORMANCE OF INTEREST (Raw Data)Document5 pagesTHE FINANCIAL PERFORMANCE OF INTEREST (Raw Data)Ahmed Jan DahriNo ratings yet

- Effect of Basel III On Indian BanksDocument52 pagesEffect of Basel III On Indian BanksSargam Mehta50% (2)

- Kochi Investment Scenario Bullish Outlook for IT Fuelled GrowthDocument4 pagesKochi Investment Scenario Bullish Outlook for IT Fuelled GrowthsheizidireesNo ratings yet

- Bajaj Inventory ManagementDocument87 pagesBajaj Inventory ManagementRohit KatariaNo ratings yet

- JK BankDocument38 pagesJK BanksanashoukatNo ratings yet

- International Accounting Standards: IAS 39 Final Instruments Recognition An MeasurementDocument49 pagesInternational Accounting Standards: IAS 39 Final Instruments Recognition An MeasurementMia CasasNo ratings yet

- Nestle India Ratio Analysis and Cash Flow AnalysisDocument2 pagesNestle India Ratio Analysis and Cash Flow AnalysisakshayNo ratings yet

- Life Insurance Product Pricing in Rural OdishaDocument7 pagesLife Insurance Product Pricing in Rural OdishaAbdul LathifNo ratings yet

- Synopsis On Financial DerivativesDocument13 pagesSynopsis On Financial Derivativesgursharan4march67% (3)

- Case S02 01Document5 pagesCase S02 01jnfzNo ratings yet