Professional Documents

Culture Documents

Islamic Economics Is Part of The Islamic Fundamentalist Movement Gaining Ground in Large Parts of The Muslim World

Uploaded by

azreym210 ratings0% found this document useful (0 votes)

41 views6 pagesIslamic economics is part of the Islamic fundamentalist movement gaining ground in large parts of the Muslim world. The rapid growth of Islamic banking in the middle east, North Africa and East Asia has attracted some attention. The impact on economic development of Islamic banking has most likely has been limited.

Original Description:

Original Title

Islamic Economics is Part of the Islamic Fundamentalist Movement Gaining Ground in Large Parts of the Muslim World

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIslamic economics is part of the Islamic fundamentalist movement gaining ground in large parts of the Muslim world. The rapid growth of Islamic banking in the middle east, North Africa and East Asia has attracted some attention. The impact on economic development of Islamic banking has most likely has been limited.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

41 views6 pagesIslamic Economics Is Part of The Islamic Fundamentalist Movement Gaining Ground in Large Parts of The Muslim World

Uploaded by

azreym21Islamic economics is part of the Islamic fundamentalist movement gaining ground in large parts of the Muslim world. The rapid growth of Islamic banking in the middle east, North Africa and East Asia has attracted some attention. The impact on economic development of Islamic banking has most likely has been limited.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 6

SISTEM

EKONOMI

ISLAM

ISLAMIC ECONOMICS AND

ECONOMI DEVELOPMENT

NOOR AZNAIM BT ABD

LATIB

IEH 080049

DR ASMAK BT ABD

RAHMAN

Islamic economics is part of the Islamic fundamentalist movement

gaining ground in large parts of the Muslim world. Many Muslim felt that this

humiliating defeat was caused by Arab turning away from god and embracing

foreign ideologies such as communism and capitalism. This ideology which

are viewed as inherently opposed to Islam and therefore unable to solve the

problem of the Muslim world. The fundamentalist call for a return to Islamic

law, shariah which is believed to offer solution to economic and social

problems of all places. Islamic scholar point to the military and economic

success of early Islamic society to prove that adherence to Islam may bring

about great material achievements. It is claimed that this success was caused

by religious inspiration and high moral standards among people in those early

days of islam.Due to its emphasis on political action, the fundamentalist

movement is sometimes referred to as “political Islam” and its supporters as

Islamists rather than fundamentalist.Islamisation of economic life is certainly

not the most visible expression of Islamic fundamentalist.Still,the rapid growth

Islamic banking in the middle East, North Africa and East Asia has attracted

some attention and is a matter of great prestige to the Islamic movement.

Islamic banking is based on the prohibition against riba, which may be

interpreted as usury but which most Islamic scholars understand as interest.

Islam is not the only religion with a fundamentalist economic agenda. There

are striking similarities between the economic Buddhism and other. Secular

economic is rejected as immoral since market competition is believed to

make people selfish and less concerned with helping those in need. Islamic

banks have not eliminated interest from their operation. From a religious point

of view then the success of Islamic banking has been limited. And precisely

because the transformation of the banking system has been rather superficial.

The impact on economic development of Islamic banking has most likely has

been limited. Focus on the Islamic ban on interest. Such a narrow approach

may be jusfied for three reasons.First, the general Islamic norm of altruism

and honesty are common to most ethical system, religious and non

religious.Secondly, these general norms cannot be expected to influence

economic development in a Muslim country in other ways than they effect

economic development in a non Muslim country. The ban on interest is the

only issue where there is some degree of consensus among Islamic

economists. Third, the interest ban is without comparisons the Islamic

economic issue that has attracted the most attention from both supporters and

observers of Islamic economics. Based on the koranic ban on interest, Islamc

banks have been established in more than 50 counteries, particularly after the

increase in oil prices in the early 1970s and mainly in North Africa, the Middle

East and South Asia. In few countries, interest has been eliminated altogether

from the banking in theory and practice. The source of the Islamic ban on

interest is the quran.Majority of Islamic scholar understands is any

predetermined return on a loan. The ban on usury form part of the more

general Islamic vision of moral economy. The term of credit in the Arabia

Peninsular at the time of Muhammad could be very harsh and suggest why

usury is made the focus of attention several place in the Koran. Taking

advantage of their market power, the commercial elite in Macca frequently

made use of the due.Usurios practices were therefore a visible sign of what

Montgomery Watt describes as a weakening of social solidarity and growth of

individualism in Mecca at the time of Muhammad. At the time of the prophet,

the commercial elite in southern Arabia included a large number of Jews.

Elsewhere in the Koran, God promises e severe punishment for those of the

Jews who break their own prohibition against interest. Islamic scholar explains

the prohibition in the following way. Projects of trade and production generate

an income, but only if he enters into a partnership, the lenders share in the

risk of the enterprise. And by sharing the risk, the lender is directly involve in

the enterprise and may receive a share of profit. This partnership model

should be contrasted with the lender as a creditor, in which case the lender is

not directly involve in the project, and therefore has no right to any share of its

profits.Certainly, the creditor is involved in the project to the degree that he

run the risk of the borrower becoming insolvation.Islamic scholars argue that

this is not sufficiently to justify a return on the money, since the risk of

insolvency can be eliminated by demanding sufficient security for the loan.

Profit and lost sharing or risk sharing if you wish, is therefore essential to

justify compensation to the lander.Loans which do not create any verifiable

value added. Economic development and growing international trade brought

with it an increase in market transaction, such as interest based banking. A

first response this challenge was for the midi eve religious scholar, Christian

as well as Muslim, to insist o the principle of the interest prohibition but allow

interest in practice through a number of legal tricks. The Christian

Reformation attempted to rage the gap between principle and practice and

bought with pragmatic approach to such issues as interest and he right to

private property. Even though Islam has yet to experience its ‘Reformation’

some leading Islamic scholars take a more pragmatic stance on the usury

issue, for instance by accepting interest as long as it is not ‘unreasonably’

high. But majority view amongst Islamic scholar appears to be a clear

rejection of the right to take interest. One may therefore say that today’s

Islamic scholars continue the tradition of the Christian scholastics. They have

developed schemes of interest free banking which have been introduced in

most parts of the world and a least nominally, have been implemented

comprehensively in Iran, Pakistan and the sudan.Beside that, Islamic banking

theory, the Islamic solution to finance without interest is profit and loss sharing

arrangements, that is partnerships where people participate in a project by

sharing profit and risk. According o this risk sharing idea, depositer buy

shares in Islamic banks, while the banks buy shares in other companies. The

two main risk sharing techniques are called mudarabah and

musyarakah.Mudaharabah is an investment fund in which the entrepreneur

contributes to the project with his time and effort only, while musyaraka is a

joint venture agreement in which the entrepreneur also invest some of his own

capital in the project. Consumption loans should be interest free. In addition to

profit and loss sharing, Islamic banks may use mark up techniques such as

service charges and leasing operation.However, these financial methods are

recognized as inferior from a religious point of view since they closely

resemble nterest.But even though these markup techniques very much

resemble interest, Islamic scholar are willing to accept such contracts since

the bank, at least for a limited period of time, own the traded god. It is argued

that period of bank ownership the banks run the risk of the commodities being

lost or damaged in transport, or the risk of the customer changing his mind

and choosing not buy the good after all. This element of risk is what makes

the mark up contract legal according to Islamic law. The fundamentalist ideal

of Islamic banking is to replace interest by profit and lose sharing

contracts.Claerly, since interest is view as country to Islam, the fundamentalist

goal is not only to offer Islamic banking as alternative to interest based

banking, but rather to eliminate interest based banking altogether. In

evaluating Islamic banking in practice, I will therefore mainly deal with the

situation in the three contries,which have attempted to shape their entire

financial system according to islam,namely Iran, Pakistan and the

sudan.Islamic banks reluctant to enter into profit and lose sharing contracts

because asymmetric information between bank and enterprenuer.Consider

the moral hazard problem. Imagine entrepreneur approaching an Islamic

banker applying for funds to finance a project on a profit and loss sharing

basis, for instance on a 50-50 sharing rule. The banker’s problem is that it

may be very difficult and at lest very costly to verify the true profitability of the

various projects. This problem is particularly serious in developing countries

where systematic accounting is rare or where companies for reasons of tax

evasion keep several accounts. There is clearly an incentive on the part of the

entrepreneur to underreport true profits and in this way reduce the transfer to

the bank. This incentive to cheat makes banks reluctant to enter into ventures

with entrepreneurs. Due to the lack of success in implementing risk sharing

financial techniques, Many observers even those sympathetic to the idea of

Islamic banking, point out that Islamic banks are reluctant to invest in long

term projects. These observers argue that by concentrating on financing of

working capital and short term trade in commodities, Islamic banks negatively

discriminate loon term investment projects and therefore reduce the prospects

for economic growth and development.Althought it is true that Islamic banks

mainly, deal with relatively safe short term projects, but do not believe

islamination as such can explain this fact, for two reasons.First,the moral

hazard problem has nothing has to do with islam.In fact, to the extent that

islamisation of society leads to increased awareness of Islamic value such as

honesty, the moral hazard problem should be reduced.Second,we have seen

that interest is eliminated only in name. So no reason to believe that

islamination of he banking sector in practice has had any great impact on

economic performance in general.

Islamic banking may indeed play an important positive role in stimulating

economic development. But in order to play this positive role, the scope of

Islamic banking in the economy should be reduced, relative to the ambitious

plan of Islamic fundamentalism. Rather than attempting to eliminate interest

from the entire financial system, the principle of profit and loss sharing should

be applied to the more traditional, rural areas in the Muslim world. In this way

Islamic banks should play the role of rural development banks. There are

three reasons why banking base on profit and loss sharing is more likely to be

successful in rural areas than in modern cities.Firstly, cheating is likely to be

less of a problem in small, transparent societies such as rural

communities.Secondly, rural people may be more concerned with religion

than urban population.Third, the need for Islamic banking as a means of

improving income distribution may be greater in rural communities. Beside

that, in solidarity networks individual risk of starvation creates a need for co-

operation in order to handle this risk. Co- operation stimulates emotional ties

between members of group which strengthen the informal insurance

agreement. Efficient risk sharing requires flexibility, but flexibility may create

moral hazard problem, that is cheating. In small, closely knit societies, the

chances of getting away worth cheating are small, and the lack of alternative

sources of income are important reasons why solidarity network can survive in

traditional societies. There are at least three reasons why traditional solidarity

networks tend to disintegrate as a result of economic development.First,

economic development is accompanied by greater affluence and therefore a

reduction in the need for comprehensive risk sharing.Secondly, economic

development stimulates migration and urbanization ad therefore increased

privacy. The last reasons is economic development brings with it more varied

income opportunities, such as jobs in manufacturing. In conclusion, Islamic

banking in the rural development in Muslim societies. This pragmatic plan of

Islamic banking also harmonies well with the intention of Islamic usury ban,

namely to help those in need.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Enterprise Information Management (EIM) : by Katlego LeballoDocument9 pagesEnterprise Information Management (EIM) : by Katlego LeballoKatlego LeballoNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- English Vocabulary For MedicineDocument5 pagesEnglish Vocabulary For MedicineDentistryuv 2020100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Compiler Design Lab ManualDocument24 pagesCompiler Design Lab ManualAbhi Kamate29% (7)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Sample Front Desk Receptionist ResumeDocument5 pagesSample Front Desk Receptionist ResumeReyvie FabroNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- New Intelligent AVR Controller Based On Particle Swarm Optimization For Transient Stability EnhancementDocument6 pagesNew Intelligent AVR Controller Based On Particle Swarm Optimization For Transient Stability EnhancementnaghamNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

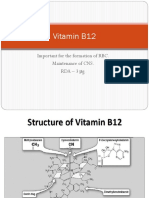

- Vitamin B12: Essential for RBC Formation and CNS MaintenanceDocument19 pagesVitamin B12: Essential for RBC Formation and CNS MaintenanceHari PrasathNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Present Simple Tense ExplainedDocument12 pagesPresent Simple Tense ExplainedRosa Beatriz Cantero DominguezNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Essay A Level Drama and Theatee Studies A LevelDocument2 pagesEssay A Level Drama and Theatee Studies A LevelSofia NietoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- SLE On TeamworkDocument9 pagesSLE On TeamworkAquino Samuel Jr.No ratings yet

- Multiple Choice Test - 66253Document2 pagesMultiple Choice Test - 66253mvjNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- A Case Study On Implementing ITIL in Bus PDFDocument7 pagesA Case Study On Implementing ITIL in Bus PDFsayeeNo ratings yet

- M5-2 CE 2131 Closed Traverse - Interior Angles V2021Document19 pagesM5-2 CE 2131 Closed Traverse - Interior Angles V2021Kiziahlyn Fiona BibayNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Proposal For Funding of Computer Programme (NASS)Document6 pagesProposal For Funding of Computer Programme (NASS)Foster Boateng67% (3)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Community Action and Core Values and Principles of Community-Action InitiativesDocument5 pagesCommunity Action and Core Values and Principles of Community-Action Initiativeskimberson alacyangNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- All Projects Should Be Typed On A4 SheetsDocument3 pagesAll Projects Should Be Typed On A4 SheetsNikita AgrawalNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Unit 11 LeadershipDocument4 pagesUnit 11 LeadershipMarijana DragašNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- As 3778.6.3-1992 Measurement of Water Flow in Open Channels Measuring Devices Instruments and Equipment - CalDocument7 pagesAs 3778.6.3-1992 Measurement of Water Flow in Open Channels Measuring Devices Instruments and Equipment - CalSAI Global - APACNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Giles. Saint Bede, The Complete Works of Venerable Bede. 1843. Vol. 8.Document471 pagesGiles. Saint Bede, The Complete Works of Venerable Bede. 1843. Vol. 8.Patrologia Latina, Graeca et Orientalis100% (1)

- Shaft-Hub Couplings With Polygonal Profiles - Citarella-Gerbino2001Document8 pagesShaft-Hub Couplings With Polygonal Profiles - Citarella-Gerbino2001sosu_sorin3904No ratings yet

- Students Playwriting For Language DevelopmentDocument3 pagesStudents Playwriting For Language DevelopmentSchmetterling TraurigNo ratings yet

- Debate Pro AbortionDocument5 pagesDebate Pro AbortionFirman Dwi CahyoNo ratings yet

- 15Document74 pages15physicsdocs60% (25)

- New GK PDFDocument3 pagesNew GK PDFkbkwebsNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The ADDIE Instructional Design ModelDocument2 pagesThe ADDIE Instructional Design ModelChristopher Pappas100% (1)

- Listening LP1Document6 pagesListening LP1Zee KimNo ratings yet

- Problem Set 12Document5 pagesProblem Set 12Francis Philippe Cruzana CariñoNo ratings yet

- Mpeg-1 11172-1Document46 pagesMpeg-1 11172-1Hana HoubaNo ratings yet

- International Journal of Current Advanced Research International Journal of Current Advanced ResearchDocument4 pagesInternational Journal of Current Advanced Research International Journal of Current Advanced Researchsoumya mahantiNo ratings yet

- Cost-Benefit Analysis of The ATM Automatic DepositDocument14 pagesCost-Benefit Analysis of The ATM Automatic DepositBhanupriyaNo ratings yet

- So Neither or NorDocument2 pagesSo Neither or NorMita KusniasariNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)