Professional Documents

Culture Documents

BB Dashboard Template Solution

Uploaded by

Mavin JeraldCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BB Dashboard Template Solution

Uploaded by

Mavin JeraldCopyright:

Available Formats

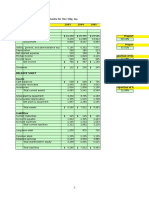

Bubble and Bee Organic - Pro Forma Modeling Template

Assumptions and Decision 2014 2015 2016 2017

Method 1: Revenue Growth Rate 9% <<Modify model to assume constant for all three years

IS Line Items

Marketable Security Interest Rate 1.5% <<Modify IS to reflect interest earned on Marketable Securities

COGS % of Sales 20% 21% 21%

Selling Expense % of Sales 25% 26% 27%

General & Admin Variable Expense % of Sales 5%

General & Admin Fixed Expense $ 675,000 $ 725,000 $ 775,000

Depreciation Expenses:

Existing Equipment $ 95,221 $ 95,221 $ 95,221

New Equipment $ - $ 10,000 $ 10,000

Existing Bank Loan Interest Rate 4%

Tax Rate 0% 0% 0%

Dividends Paid $ 175,000 $ 175,000 $ 175,000

BS Line Items

Working Cash % of Sales 3% 3% 3% <<Modify BS Cash to reflect working capital and Excess Cash as plug

AR% of Sales 2% 2% 2%

Inventory % of Sales 8% 8% 8%

Net Additions to PPE $ 100,000

AP% of Sales 4% 4% 4%

Accrued Liabilities % of Sales 0% 0% 0%

Changes to Existing Bank Loan <<Remove as input and use bank loan as debt plug

Changes to Long Term Liabilities $ - $ - $ -

Changes to Members Equity $ - $ - $ -

Income Statement (in $)

2014 2015 2016 2017

Revenues 1,776,168 1,936,023 2,110,265 2,300,189

Cost of Goods Sold 357,597 387,205 443,156 483,040

Gross Margin 1,418,571 1,548,818 1,667,110 1,817,149

Marketable Security Interest - - 432 <<Interest Earned from Excess Cash

Expenses

Selling 439,512 484,006 548,669 621,051

General & Administrative Variable 82,514 96,801 105,513 115,009

General & Administrative Fixed 572,776 675,000 725,000 775,000

Depreciation 87,221 95,221 105,221 105,221

Total Expenses 1,182,023 1,351,028 1,484,403 1,616,282

EBIT 236,548 197,791 182,706 201,300 <<modified to include MS interest

Net Interest Expense 7,535 4,208 2,131 1,114

Taxable Income 229,013 193,582 180,575 200,185

Taxes - - - -

Net Income 229,013 193,582 180,575 200,185

Dividends Paid 175000 175,000 175,000 175,000

Addition to Retained Earnings 54,013 18,582 5,575 25,185

Balance Sheet

2013 2014 2015 2016 2017

Assets

Current Assets

Excess Cash/MarketSec 0 - - 57,594 << Cash plug as first plug

Working Cash 25,567 43,008 58,080.69 63,307.96 69,005.67 <<Working Capital cash

Receivables 32,375 35,525 38,720 42,205 46,004

Inventories 131,250 143,937 154,882 168,821 184,015

Total Current Assets 189,192 222,470 251,683 274,334 356,619

Fixed Assets

PP&E 395,785 470,185 470,185 570,185 570,185

Less Depreciation 120,221 207,442 302,663 407,884 513,105

Total Fixed Assets 275,564 262,743 167,522 162,301 57,080

Total Assets 464,756 485,213 419,205 436,635 413,699

Liabilities & Shareholder's Equity

Current Liabilities

Accounts Payable 44,625 53,286 77,441 84,411 92,008

Accrued Liabilities - - - - -

Bank Loan 201,796 159,579 50,834 55,719 - <<Bank loan as second plug

Total Current Liabilities 246,421 212,865 128,275 140,130 92,008

Long Term Liabilities - - - - -

Total Liabilities 246,421 212,865 128,275 140,130 92,008

Shareholder's Equity

Member's Equity 150,000 150,000 150,000 150,000 150,000

Retained Earnings 68,335 122,348 140,930 146,506 171,691

Total Shareholder's Equ 218,335 272,348 290,930 296,506 321,691

Total Liabilities and Shareholde 464,756 485,213 419,205 436,635 413,699

Check 1: TA-TLE=0? - - -

Check 2: Change BS MS = CF Stmt net inc Cash? 0 - (0)

TA w/o Excess Cash 419,205 436,635 356,105

TLE w/o ST Bank Loan 368,371 380,916 413,699

Excess Cash(revolver) (50,834) (55,719) 57,594

Cash Flow Statement

Cash Provided (used) by Operations 2014 2015 2016 2017

Net Income 229,013 193,582 180,575 200,185

Plus Depreciation 87,221 95,221 105,221 105,221

Change in Working Capital

Decrease (increase) in Cash (17,441) (15,073) (5,227) (5,698) <<New working Capital CF

Decrease (increase) in Receivables (3,150) (3,195) (3,485) (3,798)

Decrease (increase) in Inventory (12,687) (10,945) (13,939) (15,194)

Increase (decrease) in Accts. Payable 8,661 24,155 6,970 7,597

Increase (decrease) in Accrued Liabilities - - - -

Cash Provided (used) by Operations 291,617 283,745 270,114 288,313

Cash Provided (used) by Investments

Additions to PP&E (74,400) - (100,000) -

Other Investments - -

Cash Provided (used) by Investments (74,400) - (100,000) -

Cash Provided (used) by Financing Activities

Additions (reductions) to Debt (42,217) (108,745) 4,886 (55,719)

Net issues of Stock - - - -

(Dividends - Owner Draws) (175,000) (175,000) (175,000) (175,000)

Cash Provided (used) by Financing Activities (217,217) (283,745) (170,114) (230,719)

Net increase (decrease) in cash - - - 57,594

Ratios 2014 2015 2016 2017

Liquidity

Current Ratio 0.90 1.39 1.96 2.72

Quick Ratio 0.30 0.51 0.75 1.20

Cash Conversion Cycle

Inventory to Sale (DIO or DSI) 140.44 140.84 133.31 133.31

Sale to Cash (DSO) 6.98 7.00 7.00 7.00

Purchase to Payment (DPO) 49.97 61.62 66.65 66.65

Cash Conversion Cycle (in days) 97.45 86.23 73.65 73.65

Leverage Ratios

Total Debt to Assets 0.48 0.38 0.31 0.27

Cash Interest Coverage 42.97 69.63 135.11 275.06

Times Interest Coverage (TIE) 31.39 47.00 85.73 180.64

Financial Leverage Ratio 1.782 1.441 1.473 1.286

Profitability Ratios

Gross Profit Margin 79.9% 80.0% 79.0% 79.0%

Operating Profit Margin 13.3% 10.2% 8.7% 8.8%

Net Profit Margin 12.9% 10.0% 8.6% 8.7%

NOPAT Margin 13.3% 10.2% 8.7% 8.8%

Efficiency & Return Measures

Sales to Total Assets 3.74 4.28 4.93 5.41

Operating Return on Assets 49.8% 43.7% 42.7% 47.3%

Return on Equity 93.3% 68.7% 61.5% 64.8%

Return on Assets 48.2% 42.8% 42.2% 47.1%

Inventory Turnover 2.60 2.59 2.74 2.74

Total Asset Turnover 3.74 4.28 4.93 5.41

Bubble and Bee Organic - Pro Forma Modeling Template

Assumptions and Decision 2014 2015 2016 2017

Method 1: Revenue Growth Rate 9% <<Modify model to assume constant for all three years

IS Line Items

Marketable Security Interest Rate 1.5% <<Modify IS to reflect interest earned on Marketable Securities

COGS % of Sales 20% 21% 21%

Selling Expense % of Sales 25% 26% 27%

General & Admin Variable Expense % of Sales 5%

General & Admin Fixed Expense $ 600,000 $ 650,000 $ 700,000 <<numbers change due to less rent & personnel needed for 3 locations

Depreciation Expenses:

Existing Equipment $ 95,221 $ 95,221 $ 95,221

New Equipment $ - $ 10,000 $ 10,000

Building 30 years $ 36,667 $ 36,667 $ 36,667 <<30 year straight line depreciation of proposed new building

Existing Bank Loan Interest Rate 4%

Tax Rate 0% 0% 0%

Dividends Paid $ 175,000 $ 175,000 $ 175,000

BS Line Items

Working Cash % of Sales 3% 3% 3% <<Modify BS Cash to reflect working capital and Excess Cash as plug

AR% of Sales 2% 2% 2%

Inventory % of Sales 8% 8% 8%

Net Additions to PPE $ 1,100,000 $ 100,000

AP% of Sales 4% 4% 4%

Accrued Liabilities % of Sales 0% 0% 0%

Changes to Existing Bank Loan <<Remove as input and use bank loan as debt plug

Changes to Long Term Liabilities $ 959,292 $ (32,283) $ (33,938) <<Building loan payments seen in row 37 & 38

Changes to Members Equity $ - $ - $ -

Building Loan Purchase Price $ 1,100,000

Percent Down 10%

Loan Amount $ 990,000

Interest Rate 5%

Number years 20

Annual Loan Payment ($79,440.16)

Payment Schedule

Beginning Balance $ 990,000 $ 959,292 $ 927,010

Interest $ 48,732 $ 47,158 $ 45,502

Principal $ 30,708 $ 32,283 $ 33,938

Ending Balance $ 959,292 $ 927,010 $ 893,071

Income Statement (in $)

2014 2015 2016 2017

Revenues 1,776,168 1,936,023 2,110,265 2,300,189

Cost of Goods Sold 357,597 387,205 443,156 483,040

Gross Margin 1,418,571 1,548,818 1,667,110 1,817,149

Marketable Security Interest - - - <<Interest Earned from Excess Cash

Expenses

Selling 439,512 484,006 548,669 621,051

General & Administrative Variable 82,514 96,801 105,513 115,009

General & Administrative Fixed 572,776 600,000 650,000 700,000

Depreciation 87,221 95,221 105,221 105,221

Total Expenses 1,182,023 1,276,028 1,409,403 1,541,282

EBIT 236,548 272,791 257,706 275,868 <<modified to include MS interest

Net Interest Expense 7,535 55,276 54,146 50,686 <<modified to include mortgage interest

Taxable Income 229,013 217,514 203,561 225,182

Taxes - - - -

Net Income 229,013 217,514 203,561 225,182

Dividends Paid 175000 175,000 175,000 175,000

Addition to Retained Earnings 54,013 42,514 28,561 50,182

Balance Sheet

2013 2014 2015 2016 2017

Assets

Current Assets

Excess Cash/MarketSec 0 - - - << Cash plug as first plug

Working Cash 25,567 43,008 58,080.69 63,307.96 69,005.67 <<Working Capital cash

Receivables 32,375 35,525 38,720 42,205 46,004

Inventories 131,250 143,937 154,882 168,821 184,015

Total Current Assets 189,192 222,470 251,683 274,334 299,025

Fixed Assets

PP&E 395,785 470,185 1,570,185 1,670,185 1,670,185

Less Depreciation 120,221 207,442 302,663 407,884 513,105

Total Fixed Assets 275,564 262,743 1,267,522 1,262,301 1,157,080

Total Assets 464,756 485,213 1,519,205 1,536,635 1,456,105

Liabilities & Shareholder's Equity

Current Liabilities

Accounts Payable 44,625 53,286 77,441 84,411 92,008

Accrued Liabilities - - - - -

Bank Loan 201,796 159,579 167,609 181,792 77,421 <<Bank loan as second plug

Total Current Liabilities 246,421 212,865 245,050 266,203 169,428

Long Term Liabilities - - 959,292 927,010 893,071

Total Liabilities 246,421 212,865 1,204,343 1,193,212 1,062,500

Shareholder's Equity

Member's Equity 150,000 150,000 150,000 150,000 150,000

Retained Earnings 68,335 122,348 164,862 193,423 243,605

Total Shareholder's Equ 218,335 272,348 314,862 343,423 393,605

Total Liabilities and Sharehold 464,756 485,213 1,519,205 1,536,635 1,456,105

Check 1: TA-TLE=0? - - -

Check 2: Change BS MS = CF Stmt net inc Cash? 0 - -

TA w/o Excess Cash 1,519,205 1,536,635 1,456,105

TLE w/o ST Bank Loan 1,351,596 1,354,843 1,378,684

Excess Cash(revolver) (167,609) (181,792) (77,421)

Cash Flow Statement

Cash Provided (used) by Operations 2014 2015 2016 2017

Net Income 229,013 217,514 203,561 225,182

Plus Depreciation 87,221 95,221 105,221 105,221

Change in Working Capital

Decrease (increase) in Cash (17,441) (15,073) (5,227) (5,698) <<New working Capital CF

Decrease (increase) in Receivables (3,150) (3,195) (3,485) (3,798)

Decrease (increase) in Inventory (12,687) (10,945) (13,939) (15,194)

Increase (decrease) in Accts. Payable 8,661 24,155 6,970 7,597

Increase (decrease) in Accrued Liabilities - - - -

Cash Provided (used) by Operations 291,617 307,677 293,100 313,309

Cash Provided (used) by Investments

Additions to PP&E (74,400) (1,100,000) (100,000) -

Other Investments - -

Cash Provided (used) by Investments (74,400) (1,100,000) (100,000) -

Cash Provided (used) by Financing Activities

Additions (reductions) to Debt (42,217) 967,323 (18,100) (138,309)

Net issues of Stock - - - -

(Dividends - Owner Draws) (175,000) (175,000) (175,000) (175,000)

Cash Provided (used) by Financing Activities (217,217) 792,323 (193,100) (313,309)

Net increase (decrease) in cash - - - -

Ratios 2014 2015 2016 2017

Liquidity

Current Ratio 0.90 1.04 1.03 1.32

Quick Ratio 0.30 0.38 0.40 0.51

Cash Conversion Cycle

Inventory to Sale (DIO or DSI) 140.44 140.84 133.31 133.31

Sale to Cash (DSO) 6.98 7.00 7.00 7.00

Purchase to Payment (DPO) 49.97 61.62 66.65 66.65

Cash Conversion Cycle (in days) 97.45 86.23 73.65 73.65

Leverage Ratios

Total Debt to Assets 0.48 0.71 0.78 0.75

Cash Interest Coverage 42.97 6.66 6.70 7.52

Times Interest Coverage (TIE) 31.39 4.94 4.76 5.44

Financial Leverage Ratio 1.782 4.825 4.474 3.699

Profitability Ratios

Gross Profit Margin 79.9% 80.0% 79.0% 79.0%

Operating Profit Margin 13.3% 14.1% 12.2% 12.0%

Net Profit Margin 12.9% 11.2% 9.6% 9.8%

NOPAT Margin 13.3% 14.1% 12.2% 12.0%

Efficiency & Return Measures

Sales to Total Assets 3.74 1.93 1.38 1.54

Operating Return on Assets 49.8% 27.2% 16.9% 18.4%

Return on Equity 93.3% 74.1% 61.8% 61.1%

Return on Assets 48.2% 21.7% 13.3% 15.0%

Inventory Turnover 2.60 2.59 2.74 2.74

Total Asset Turnover 3.74 1.93 1.38 1.54

Input Assumptions

Retained

Revenue Growth Rate: 9%

$300,000

2015 Selling Expense % of sales: 25%

$250,000

Decisions:

Retaine Earnings

2015 2016 2017 $200,000

Owner Draw: $ 175,000 $ 175,000 $ 175,000 $150,000

Percent Down on Building: 10% $100,000

$50,000

KPI: $0

2014 20

Year of Interest: 2015

Reta i ned Earni ng

ROE - Rent

Rent Space Buy Building

ST Bank Loan Balance $ 50,834 $ 167,609

Retained Earnings $ 140,930 $ 164,862

Revenues $ 1,936,023 $ 1,936,023

Net Income $ 193,582 $ 217,514

Cash Provided by Operations $ 283,745 $ 307,677

Net Profit Margin 10.0% 11.2%

Return on Equity 68.7% 74.1%

Quick Ratio 0.51 0.38

Times Interest Earned 47.00 4.94

Financial Leverage 1.44 4.82

Retained Earnings versus ROE

$300,000 100.0%

90.0%

$250,000 80.0%

$200,000 70.0%

60.0%

$150,000 50.0%

ROE

40.0%

$100,000 30.0%

$50,000 20.0%

10.0%

$0 0.0%

2014 2015 2016 2017

Reta i ned Earni ngs - Rent Reta i ned Ea ri ngs - Buy

ROE - Rent ROE - Buy

You might also like

- AirThread Valuation MethodsDocument21 pagesAirThread Valuation MethodsSon NguyenNo ratings yet

- Organic Bubble and Bee Pro Forma TemplateDocument2 pagesOrganic Bubble and Bee Pro Forma TemplateMavin JeraldNo ratings yet

- Group 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplDocument13 pagesGroup 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplSarah WuNo ratings yet

- Bubble and Bee Organic - TemplateDocument7 pagesBubble and Bee Organic - TemplateAkanksha SaxenaNo ratings yet

- Solutions For Bubble and BeeDocument12 pagesSolutions For Bubble and BeeMavin Jerald100% (6)

- Bubble and Bee Organic - Historical Financial InformationDocument14 pagesBubble and Bee Organic - Historical Financial Informationapi-28404220080% (5)

- BV - Assignement 2Document7 pagesBV - Assignement 2AkshatAgarwal50% (2)

- Front Valuation Page: Un-Levered Firm ValueDocument61 pagesFront Valuation Page: Un-Levered Firm Valueneelakanta srikar100% (1)

- TN-1 TN-2 Financials Cost CapitalDocument9 pagesTN-1 TN-2 Financials Cost Capitalxcmalsk100% (1)

- Tire City Spreadsheet SolutionDocument7 pagesTire City Spreadsheet SolutionSyed Ali MurtuzaNo ratings yet

- Tire - City AnalysisDocument17 pagesTire - City AnalysisJustin HoNo ratings yet

- Flash Memory Case Study SolutionDocument8 pagesFlash Memory Case Study SolutionRohit Parnerkar57% (7)

- Valuation of Airthread April 2012Document26 pagesValuation of Airthread April 2012Perumalla Pradeep KumarNo ratings yet

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- Flash Memory, Inc.Document2 pagesFlash Memory, Inc.Stella Zukhbaia0% (5)

- Airthread SolutionDocument30 pagesAirthread SolutionSrikanth VasantadaNo ratings yet

- Mercury Athletic FootwearDocument4 pagesMercury Athletic FootwearAbhishek KumarNo ratings yet

- BKI's Capital Structure and Payout PoliciesDocument4 pagesBKI's Capital Structure and Payout Policieschintan MehtaNo ratings yet

- Mercury Athletic CaseDocument3 pagesMercury Athletic Casekrishnakumar rNo ratings yet

- Flash Memory AnalysisDocument25 pagesFlash Memory AnalysisaamirNo ratings yet

- TCI's Financial Performance and Forecasts 1993-1997Document8 pagesTCI's Financial Performance and Forecasts 1993-1997Kyeli TanNo ratings yet

- Finance - WK 4 Assignment TemplateDocument31 pagesFinance - WK 4 Assignment TemplateIsfandyar Junaid50% (2)

- MercuryDocument5 pagesMercuryமுத்துக்குமார் செNo ratings yet

- Cooper Spreadsheet SolutionDocument23 pagesCooper Spreadsheet SolutionSwaraj DharNo ratings yet

- Pacific Spice CompanyDocument15 pagesPacific Spice CompanySubhajit MukherjeeNo ratings yet

- Mercuryathleticfootwera Case AnalysisDocument8 pagesMercuryathleticfootwera Case AnalysisNATOEENo ratings yet

- Probabilities and Deal Terms for Biotech Firm Decision TreeDocument13 pagesProbabilities and Deal Terms for Biotech Firm Decision TreeRegine Marie TalucodNo ratings yet

- Mercury Athletic FootwearDocument9 pagesMercury Athletic FootwearJon BoNo ratings yet

- Netscape Valuation AssumptionsDocument10 pagesNetscape Valuation Assumptionsyosra DridiNo ratings yet

- Flash MemoryDocument9 pagesFlash MemoryJeffery KaoNo ratings yet

- Ocean Carriers MemoDocument2 pagesOcean Carriers MemoAnkush SaraffNo ratings yet

- Financial Modelling Complete Internal Test 4Document6 pagesFinancial Modelling Complete Internal Test 4vaibhav100% (1)

- Case 4 - Tire CityDocument4 pagesCase 4 - Tire Cityfriendsaks100% (1)

- Marvin Co Financial StatementsDocument4 pagesMarvin Co Financial StatementsVaibhav KathjuNo ratings yet

- BurtonsDocument6 pagesBurtonsKritika GoelNo ratings yet

- Ceres+Gardening+Company+Submission Shradha PuroDocument6 pagesCeres+Gardening+Company+Submission Shradha PuroShradha PuroNo ratings yet

- Mercury Athletic Footwear Acquisition AnalysisDocument8 pagesMercury Athletic Footwear Acquisition AnalysisVaidya Chandrasekhar100% (1)

- New Heritage Doll Company Capital Budgeting for ExpansionDocument11 pagesNew Heritage Doll Company Capital Budgeting for ExpansionDeep Dey0% (1)

- Mercury Athletic QuestionsDocument1 pageMercury Athletic QuestionsRazi UllahNo ratings yet

- NHDC Solution EditedDocument5 pagesNHDC Solution EditedShreesh ChandraNo ratings yet

- Clarkson Lumber Cash Flows and Pro FormaDocument6 pagesClarkson Lumber Cash Flows and Pro FormaArmaan ChandnaniNo ratings yet

- ANALYSIS OF ACQUISITION OF MERCURY ATHLETIC BY ACTIVE GEARDocument9 pagesANALYSIS OF ACQUISITION OF MERCURY ATHLETIC BY ACTIVE GEARVedantam GuptaNo ratings yet

- Case 1 Spreadsheet - EI DuPontDocument6 pagesCase 1 Spreadsheet - EI DuPontSamuel BishopNo ratings yet

- New Heritage Doll Company Capital BudgetDocument27 pagesNew Heritage Doll Company Capital BudgetCarlos100% (1)

- FlashMemory SLNDocument6 pagesFlashMemory SLNShubham BhatiaNo ratings yet

- Ocean CarriersDocument17 pagesOcean CarriersMridula Hari33% (3)

- New Heritage Doll Company Capital BudgetDocument5 pagesNew Heritage Doll Company Capital BudgetCarlosNo ratings yet

- UK Gilts CalculationsDocument10 pagesUK Gilts CalculationsAditee100% (1)

- MERCURY ATHLETIC FOOTWEAR COST OF CAPITAL ANALYSISDocument16 pagesMERCURY ATHLETIC FOOTWEAR COST OF CAPITAL ANALYSISBharat KoiralaNo ratings yet

- Varma Capitals - Modeling TestDocument6 pagesVarma Capitals - Modeling TestSuper FreakNo ratings yet

- DCF Valuation-BDocument11 pagesDCF Valuation-BElsaNo ratings yet

- Planning and ForecastingDocument16 pagesPlanning and ForecastingAinun Nisa NNo ratings yet

- Nvda 28092022132137-0001 PDFDocument47 pagesNvda 28092022132137-0001 PDFTey Boon KiatNo ratings yet

- Aldine WestfieldDocument250 pagesAldine WestfieldJafarNo ratings yet

- LGD.2Q11 ResultsDocument18 pagesLGD.2Q11 ResultsSam_Ha_No ratings yet

- ABC Company, Inc. Recapitalization AnalysisDocument10 pagesABC Company, Inc. Recapitalization AnalysisMarcNo ratings yet

- EPL LTD Financial Statements - XDocument16 pagesEPL LTD Financial Statements - XAakashNo ratings yet

- NVDA F3Q23 Investor Presentation FINALDocument62 pagesNVDA F3Q23 Investor Presentation FINALandre.torresNo ratings yet

- Vertical Analysis Vertical Analysis Vertical Analysis: Intl Business Machines Corp Com in Dollar US in ThousandsDocument24 pagesVertical Analysis Vertical Analysis Vertical Analysis: Intl Business Machines Corp Com in Dollar US in ThousandsshaskiaNo ratings yet

- Berger Paints Ratio Analysis Summary 2015Document8 pagesBerger Paints Ratio Analysis Summary 2015KARIMSETTY DURGA NAGA PRAVALLIKANo ratings yet

- Log 082415Document24 pagesLog 082415Mavin JeraldNo ratings yet

- Homophily, Group Size, and The Diffusion of Political Information in Social Networks - Evidence From TwitterDocument16 pagesHomophily, Group Size, and The Diffusion of Political Information in Social Networks - Evidence From TwitterMavin JeraldNo ratings yet

- ImperialismDocument1 pageImperialismMavin JeraldNo ratings yet

- IslamDocument1 pageIslamMavin JeraldNo ratings yet

- Calculate Working Capital Requirements Using Different MethodsDocument18 pagesCalculate Working Capital Requirements Using Different MethodsGaganGabriel0% (1)

- Working Capital Management ProjectDocument88 pagesWorking Capital Management ProjectUlpesh Solanki67% (3)

- 08 Capital Budgeting Cash FlowDocument40 pages08 Capital Budgeting Cash FlowClaire BarbaNo ratings yet

- Bba III Year Finance-Optional-Paper - Working Capital Management 2022Document2 pagesBba III Year Finance-Optional-Paper - Working Capital Management 2022sajal dubeyNo ratings yet

- 132 Studymat FM Nov 2009Document72 pages132 Studymat FM Nov 2009Ashish NarulaNo ratings yet

- SupplyChainOperations 2014 PDFDocument20 pagesSupplyChainOperations 2014 PDFVithaya SuharitdamrongNo ratings yet

- Financial Management Volume - IDocument522 pagesFinancial Management Volume - ISrinivasa Rao Bandlamudi80% (5)

- Working Capital Simulation - Managing Growth - Sunflower Nutraceuticals Harvard Case StudyDocument4 pagesWorking Capital Simulation - Managing Growth - Sunflower Nutraceuticals Harvard Case Studyalka murarka67% (3)

- Project Appraisal - Stages FlowchartDocument6 pagesProject Appraisal - Stages FlowchartAshokNo ratings yet

- Din Textile Limited ProjDocument34 pagesDin Textile Limited ProjTaiba Akhlaq0% (1)

- BTEA Policy PaperDocument38 pagesBTEA Policy PapercrainsnewyorkNo ratings yet

- Financial Statement Analysis (Tenth Edition) Solution For CH - 07 PDFDocument50 pagesFinancial Statement Analysis (Tenth Edition) Solution For CH - 07 PDFPrince Angel75% (20)

- Lakme: Latest Quarterly/Halfyearly As On (Months)Document7 pagesLakme: Latest Quarterly/Halfyearly As On (Months)Vikas UpadhyayNo ratings yet

- Working Capital Management BCLDocument82 pagesWorking Capital Management BCLJag JeetNo ratings yet

- CA Inter FM Short Theory by CA Aaditya Jain For Dec 21 Exam OnlyDocument35 pagesCA Inter FM Short Theory by CA Aaditya Jain For Dec 21 Exam OnlyJiya ChawlaNo ratings yet

- Working Capital Finance NotesDocument84 pagesWorking Capital Finance NotesShveta HastirNo ratings yet

- Liquidity Ratios:: Current Ratio: It Is Used To Test A Company's LiquidityDocument12 pagesLiquidity Ratios:: Current Ratio: It Is Used To Test A Company's LiquidityDinesh RathinamNo ratings yet

- Class 12 Solution AccountDocument45 pagesClass 12 Solution AccountChandan ChaudharyNo ratings yet

- A Comparative Study On Working Capital Management of Selected Cement Companies in IndiaDocument61 pagesA Comparative Study On Working Capital Management of Selected Cement Companies in IndiaSatya Prakash SahuNo ratings yet

- Summer Project ReportDocument55 pagesSummer Project ReportsunilpratihariNo ratings yet

- (505 (B) ) Analysis of Financial Statemnets BB223039 Shirke Kartiki RatnadeepDocument26 pages(505 (B) ) Analysis of Financial Statemnets BB223039 Shirke Kartiki RatnadeepRohan KashidNo ratings yet

- Dudh Saritha (Milk Booth) : 5. Items of Investment and Unit CostDocument7 pagesDudh Saritha (Milk Booth) : 5. Items of Investment and Unit CostnaguficoNo ratings yet

- Bangladesh Development Bank loan application formDocument27 pagesBangladesh Development Bank loan application formJadid HoqueNo ratings yet

- MSN Laboratories PVT Limited, Hyderabad: "A Study On Financial Performance"Document65 pagesMSN Laboratories PVT Limited, Hyderabad: "A Study On Financial Performance"Harish Kumar DaivamNo ratings yet

- Hindalco Working Capital Internship Report PDFDocument81 pagesHindalco Working Capital Internship Report PDFAnkur SharmaNo ratings yet

- 2015 - Valuation of SharesDocument31 pages2015 - Valuation of SharesGhanshyam KhandayathNo ratings yet

- Syllabus - IO2 - Basic FinanceDocument23 pagesSyllabus - IO2 - Basic FinanceJeizel Esolir SumanladNo ratings yet

- Quiz No. 3 - Working Capital Management PDFDocument5 pagesQuiz No. 3 - Working Capital Management PDFNerissa PasambaNo ratings yet

- Business Finance Final TermDocument3 pagesBusiness Finance Final TermClarice TorresNo ratings yet

- A Study of Working Capital Management Efficiency of India Cements LTDDocument4 pagesA Study of Working Capital Management Efficiency of India Cements LTDSumeet N ChaudhariNo ratings yet