Professional Documents

Culture Documents

HHS Memo Ending CSR Payments With AG Legal Opinion

Uploaded by

iggybau0 ratings0% found this document useful (0 votes)

172 views5 pagesOctober 2017

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOctober 2017

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

172 views5 pagesHHS Memo Ending CSR Payments With AG Legal Opinion

Uploaded by

iggybauOctober 2017

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 5

&

SS

To:

From:

Date:

Re:

The Attomey General of the United States has provided the U.S. Department of Health &

Human Services (HHS) and the U.S. Department of the Treasury with the attached legal opinion

regarding CSR payments made to issuers of qualified health plans. In light of that opinion—and

the absence of any other appropriation that could be used to fund CSR payments—CSR

payments to issuers must stop, effective immediately. CSR payments are prohibited unless and

‘THE SECRETARY OF HEALTH AND HUMAN SERVICES.

WASHINGTON, D.C. 20201

Seema Verma, Administrator

Centers for Medicare and Medicaid Services

Eric Hargan 44

Acting Secretary

October 12, 2017

Payments to Issuers for Cost-Sharing Reductions (CSRs)

until a valid appropriation exists

Office of the Attorney General

Washington, B.C 20330

October 11, 2017

The Hon. Steven Mnuchin, Secretary of the Treasury

U.S Department of the Treasury

1500 Pennsylvania Avenue, NW

Washington, DC 20220

Don Wright, M.D., M.P.H., Acting Secretary

U.S. Department of Health & Human Services

200 Independence Avenue, SW

Washington, DC 20201

Dear Secretary Mnuchin and Acting Secretary Wright

You have asked for my legal opinion as to whether the permanent appropriation for

“refunding internal revenue collections,” 31 U.S.C. § 1324, is available to fund the cost-sharing

reduction (CSR) payments authorized by section 1402 of the Affordable Care Act, 42 U.S.C.

§ 18071. As you are aware, the prior administration originally sought an appropriation to fund

CSR payments—suggesting it believed such an appropriation was necessary—but then later

concluded that section 1324”s permanent appropriation was available. The U.S. House of

Representatives sued, contending that Congress had not appropriated funds for CSR payments.

The U.S. District Court for the District of Columbia agreed, holding that section 1324 does not

appropriate funds for CSR payments. U.S. House of Reps. v. Burwell, 185 F. Supp. 3d 165 (D.D.C.

2016). The district court “enjoin{ed] any further reimbursements under Section 1402 until a valid

appropriation is in place,” but “stay{ed] its injunction pending any appeal by the parties.” 1d. at

189. The prior administration appealed that decision, and the D.C. Circuit has held the appeal in

abeyance to allow time for a resolution that would obviate the need for judicial determination of

the appeal, including potential legislative action.

The Department of Justice has consulted with your Departments, as well as the Office of

Management and Budget, all of which have now expressed the view that section 1324 does not

appropriate funds for the CSR program. Although the Department of Justice has previously

defended in court the govemment’s decision to use the permanent appropriation in section 1324

for CSR payments, | have concluded that the best interpretation of the law is that the permanent

appropriation for “refunding internal revenue collections,” 31 U.S.C. § 1324, cannot be used to

fund the CSR payments to insurers authorized by 42 U.S.C. § 18071

First, “[iJf the statutory language is plain,” it must be enforced “according to its terms.”

King v. Burwell, 135 8. Ct. 2480, 2489 (2015). Here, the plain reading of the text is that the ACA

permanently appropriated money for section 1401 premium tax credits, but not for section 1402

CSR payments to insurers. As relevant here, the ACA created two distinet programs that both

have the broad purpose of providing government funding for the cost of health insurance obtained

through ACA exchanges. Section 1401(a) created a program to reduce the health insurance

premiums of qualified individuals by providing those individuals with refundable tax credits

Congress appropriated funds for this program in the ACA by: (1) amending the Internal Revenue

Code to add a new refundable tax credit provision (§ 36B, entitled “Refundable Credit for

Coverage Under a Qualified Health Plan”), see ACA § 1401(a); and (2) amending 31

US.C. § 1324—a preexisting funding provision that provides a permanent appropriation “for

refunding internal revenue collections as provided by law,” id. § 1324(a)—to include the new

Intemal Revenue Code § 36B credit in its list of permanently funded tax credits, see ACA

§ 1401(4)(1). That is, Congress amended the funding provision to provide for payment of “refunds

due ... from section ... 36B.” 31 U.S.C. § 1324(b)(2).

Separately, the ACA created the section 1402 CSR program, which Congress did not

include in the Internal Revenue Code. Section 1402 (1) requires insurers offering policies through

ACA exchanges to reduce co-payments and other out-of-pocket costs for certain policyholders

(reductions referred to in the ACA as “Cost-Sharing Reductions”), see ACA § 1402, codified at

42 U.S.C. § 18071; and (2) authorizes the federal government to make payments directly to

insurers to offset the lost revenue these reductions cause, see ACA § 1412(¢)(3). But unlike with

section 1401’s refundable tax credit, the ACA did not itself provide an appropriation to directly

fund the section 1402 CSR program. The ACA’s amendment to the permanent appropriation in

31 U.S.C. § 1324 refers only to section 1401 tax eredits (i.e., “refunds due ... from [Internal

Revenue Code] section ... 36B”), and makes no reference to section 1402 payments (i.e, 42 U.S.C.

§ 18071 payments). As amended by the ACA, that appropriation provision thus supplies funding

for Internal Revenue Code § 36B tax credits to insureds, but not for 42 U.S.C. § 18071 CSR

payments to insurers.

Second, although the “meaning—or ambiguity—of certain words or phrases may only

become evident when placed in context,” King, 135 S. Ct. at 2489, the statutory context of these

provisions is consistent with their plain meaning. As noted above, while the two payment

provisions appear sequentially within the ACA, only the section 1401 tax credits are included in

the Internal Revenue Code (consistent with their status as tax credits for taxpayers). It is logical

that the permanent appropriation in 31 U.S.C. § 1324—which funds a variety of tax

expenditures—would fund the ACA’s tax credits. But it would make little sense for a provision

that appropriates funds for “refunding internal revenue collections,” 31 U.S.C. § 1324(a), to also

(and without saying so) permanently fund a non-tax program that provides payments to insurers.

The prior administration contended that CSR payments should be deemed “refunds due ,

from section ... 368” on the ground that both types of payments are essentially two parts of a

single program. But the two programs are distinct. Each is authorized by a separate provision in

a separate title of the U.S. Code; each has a different focus (tax credits for premiums, CSR

payments for out-of-pocket costs); each functions differently; and each has a different eligibility

formula. It is true that ACA section 1402(f)(2) provides CSRs are not “allowed ... unless ,., a

credit is allowed to the insured ... under section 36B,” but that provision means only that

individuals who are ineligible for a tax credit are likewise ineligible for CSRs. It does not mean

that CSR payments are the same as tax credits under section 36B—or even that they have the same

eligibility requirements, Compare 26 U.S.C. § 36B(c)(1)(A) (policyholder is eligible for tax

credits if household income is between 100 and 400 percent of the federal poverty level), with 42

ULS.C. § 18071 (complex CSR formula providing for income-based reductions, adjustments to

reductions to maintain actuarial levels, and additional reductions for lower-income insureds); see

also House of Reps., 185 F. Supp. 3d at 176. Indeed, the distinction between the programs is

reflected throughout the ACA, including in the section providing for advance payments of both

tax credits and CSRs to insurers—a provision that bundles the two types of payments together but

nonetheless carefully distinguishes between the two programs. See generally 42 U.S.C. § 18082

The issue here is quite different from the statutory question in King. There, the Supreme

Court held that certain language within the ACA seemed unambiguous in isolation, but did not

make sense in the context of the rest ofthe Act because “the most natural reading of the pertinent

statutory phrase” would have prevented two of the ACA’s “three major” policy changes from

being applicable in certain States—something the Court saw as a “calamitous result that Congress

plainly meant to avoid.” 135 S. Ct. 2493, 2495-96. Here, the two programs in the ACA that

provide government funding for insurance costs function properly when operated according to

their terms. Unlike in King, practical difficulties do not result from any conflict or inconsistency

within the ACA; rather, practical difficulties result, if at all, from Congress's post-ACA decision

to not appropriate money for CSR payments. Nothing in King suggested that the ACA’s plain text

can be ignored in order to override the intentional legislative decisions of subsequent Congresses.

Congress has the power of the purse, and it is up to Congress to decide which programs it,

will and will not fund. See, ¢.g., House of Reps., 185 F. Supp. 3d at 184 (recounting instance when

Congress conferred “permanent authority” on Treasury “to permit prepayment ... to territorial

treasuries of estimates of moneys to be collected” but made “no subsequent appropriation,” such

that “no such money could be spent”). There is no more fundamental power granted to the

Legislative Branch than its exclusive power to appropriate funds. And the Executive Branch

cannot unilaterally spend money that Congress has not appropriated. Congress's repeated choice

to deny funding for CSR payments is thus Congress's prerogative. When Congress refuses to

appropriate money for a program, the Executive is required to respect that decision.

Third, the contemporary evidence is consistent with this straightforward interpretation of

the ACA’s text. The prior administration, in the President's Fiscal Year 2014 Budget of the US.

Government, and in the HHS-submitied House and Senate Justification of Estimates for

Appropriations Committees, sought an appropriation for section 1402 CSR payments. See House

of Reps., 185 F. Supp. 3d at 186. These requests suggest that the prior administration initially

believed that—unlike with section 1401 tax credits—it needed an appropriation from Congress to

fund section 1402 CSR payments to insurers. It was only months after these submissions that the

prior administration adopted an interpretation of the ACA that authorized funding CSR payments

out of the permanent appropriation in 31 U.S.C. § 1324,

Finally, itis not surprising the Congress chose to retain the power of the purse, even for an

important component of the ACA. After all: “Most current appropriations are adopted on an

annual basis and must be re-authorized for each fiscal year. Such appropriations are an integral

part of our constitutional checks and balances, insofar as they tie the Executive Branch to the

Legislative Branch via purse strings.” House of Reps., 185 F. Supp. 3d at 169-70.

In sum, it is my opinion that the best interpretation of the law is that section 1324 does not

appropriate funds for the Affordable Care Act’s Cost-Sharing Reduction program.

io ease

ferson B. Sessions III

Attorney General of the United States

Sincerely,

You might also like

- AAFP Letter To Domestic Policy Council 6-10-2020Document3 pagesAAFP Letter To Domestic Policy Council 6-10-2020iggybauNo ratings yet

- S 3721 COVID-19 Racial and Ethnic Disparities Task ForceDocument11 pagesS 3721 COVID-19 Racial and Ethnic Disparities Task ForceiggybauNo ratings yet

- Bostock v. Clayton County, Georgia DecisionDocument119 pagesBostock v. Clayton County, Georgia DecisionNational Content DeskNo ratings yet

- Boston Mayor Executive Order 6-12-2020Document3 pagesBoston Mayor Executive Order 6-12-2020iggybauNo ratings yet

- HR 6437 Coronavirus Immigrant Families Protection AcfDocument16 pagesHR 6437 Coronavirus Immigrant Families Protection AcfiggybauNo ratings yet

- 7th Circuit Affirming Preliminary Injunction Cook County v. WolfDocument82 pages7th Circuit Affirming Preliminary Injunction Cook County v. WolfiggybauNo ratings yet

- A Bill: in The House of RepresentativesDocument2 pagesA Bill: in The House of RepresentativesiggybauNo ratings yet

- HR 6763 COVID-19 Racial and Ethnic Disparities Task ForceDocument11 pagesHR 6763 COVID-19 Racial and Ethnic Disparities Task ForceiggybauNo ratings yet

- HR 4004 Social Determinants Accelerator ActDocument18 pagesHR 4004 Social Determinants Accelerator ActiggybauNo ratings yet

- NCAPIP Recommendations For Culturally and Linguistically Appropriate Contact Tracing May 2020Document23 pagesNCAPIP Recommendations For Culturally and Linguistically Appropriate Contact Tracing May 2020iggybauNo ratings yet

- S 3609 Coronavirus Immigrant Families Protection ActDocument17 pagesS 3609 Coronavirus Immigrant Families Protection ActiggybauNo ratings yet

- HR 6585 Equitable Data Collection COVID-19Document18 pagesHR 6585 Equitable Data Collection COVID-19iggybauNo ratings yet

- Doe v. Trump Preliminary Injunction Against Proclamation Requiring Private Health InsuranceDocument48 pagesDoe v. Trump Preliminary Injunction Against Proclamation Requiring Private Health InsuranceiggybauNo ratings yet

- Cook County v. Wolf Denial Motion To Dismiss Equal ProtectionDocument30 pagesCook County v. Wolf Denial Motion To Dismiss Equal ProtectioniggybauNo ratings yet

- Doe v. Trump 9th Circuit Denial of Stay of Preliminary InjunctionDocument97 pagesDoe v. Trump 9th Circuit Denial of Stay of Preliminary InjunctioniggybauNo ratings yet

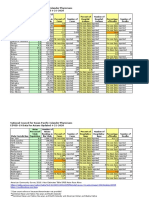

- COVID-19 Data For Native Hawaiians and Pacific Islanders UPDATED 4-21-2020 PDFDocument2 pagesCOVID-19 Data For Native Hawaiians and Pacific Islanders UPDATED 4-21-2020 PDFiggybauNo ratings yet

- Milwaukee Board of Supervisors Ordinance 20-174Document9 pagesMilwaukee Board of Supervisors Ordinance 20-174iggybauNo ratings yet

- Doe v. Trump Denial of All Writs Injunction Against April 2020 Presidential ProclamationDocument9 pagesDoe v. Trump Denial of All Writs Injunction Against April 2020 Presidential ProclamationiggybauNo ratings yet

- COVID 19 FaceCovering 1080x1080 4 SPDocument1 pageCOVID 19 FaceCovering 1080x1080 4 SPiggybauNo ratings yet

- SF StayHome MultiLang Poster 8.5x11 032620Document1 pageSF StayHome MultiLang Poster 8.5x11 032620iggybauNo ratings yet

- Covid-19 Data For Asians Updated 4-21-2020Document2 pagesCovid-19 Data For Asians Updated 4-21-2020iggybauNo ratings yet

- WA v. DHS Order On Motion To CompelDocument21 pagesWA v. DHS Order On Motion To CompeliggybauNo ratings yet

- Physician Association Letter To HHS On Race Ethnicity Language Data and COVID-19Document2 pagesPhysician Association Letter To HHS On Race Ethnicity Language Data and COVID-19iggybauNo ratings yet

- Tri-Caucus Letter To CDC and HHS On Racial and Ethnic DataDocument3 pagesTri-Caucus Letter To CDC and HHS On Racial and Ethnic DataiggybauNo ratings yet

- ND California Order On Motion To CompelDocument31 pagesND California Order On Motion To CompeliggybauNo ratings yet

- Booker-Harris-Warren Letter To HHS Re Racial Disparities in COVID ResponseDocument4 pagesBooker-Harris-Warren Letter To HHS Re Racial Disparities in COVID ResponseStephen LoiaconiNo ratings yet

- MMMR Covid-19 4-8-2020Document7 pagesMMMR Covid-19 4-8-2020iggybauNo ratings yet

- CDC Covid-19 Report FormDocument2 pagesCDC Covid-19 Report FormiggybauNo ratings yet

- Democratic Presidential Candidate Positions On ImmigrationDocument10 pagesDemocratic Presidential Candidate Positions On ImmigrationiggybauNo ratings yet

- Pete Buttigieg Douglass PlanDocument18 pagesPete Buttigieg Douglass PlaniggybauNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)