Professional Documents

Culture Documents

Months Sales Material Wages Overheads: Estimated Sale and Cost

Uploaded by

Garima0 ratings0% found this document useful (0 votes)

9 views1 pageThe document provides estimated sales, costs, credit terms, and other financial details for a company over multiple months. This includes sales forecasts, material costs, wages, overheads, credit sale collection periods, supplier credit terms, payment delays, interest on debentures, expected dividend income, planned machinery purchase, advance tax payment, beginning and target ending cash balances, and instructions to prepare a monthly cash budget from this information for June to September 2012.

Original Description:

uff

Original Title

17743 Home Work

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides estimated sales, costs, credit terms, and other financial details for a company over multiple months. This includes sales forecasts, material costs, wages, overheads, credit sale collection periods, supplier credit terms, payment delays, interest on debentures, expected dividend income, planned machinery purchase, advance tax payment, beginning and target ending cash balances, and instructions to prepare a monthly cash budget from this information for June to September 2012.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageMonths Sales Material Wages Overheads: Estimated Sale and Cost

Uploaded by

GarimaThe document provides estimated sales, costs, credit terms, and other financial details for a company over multiple months. This includes sales forecasts, material costs, wages, overheads, credit sale collection periods, supplier credit terms, payment delays, interest on debentures, expected dividend income, planned machinery purchase, advance tax payment, beginning and target ending cash balances, and instructions to prepare a monthly cash budget from this information for June to September 2012.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

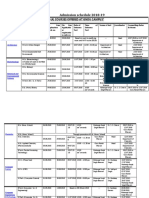

The following details are forecasted by a company for the purpose of effective

cash utilisation and management.

I. Estimated Sale and Cost

Months Sales Material Wages Overheads

April 4,20,000 2,00,000 1,60,000 45,000

May 4,50,000 2,10,000 1,60,000 40,000

June 5,00,000 2,60,000 1,65,000 38,000

July 4,90,000 2,82,000 1,65,000 37,500

August 5,40,000 2,80,000 1,65,000 60,800

Sep 6,10,000 3,10,000 1,70,000 52,000

II. Credit Items

-Sales 20% of sales on cash basis, 50% of the credit sales are collected

next month and balance in the following month.

-Credit allowed by suppliers is 2 months.

-Delay is payment of wages is month and of overhead is one month.

III. Interest on 12% Debentures of Rs. 5,00,000 is paid half yearly in june and

December.

IV. Dividend on investments amounting to Rs. 25,000 is expected to be

received in June 2012.

V. A new machinery will be installed in June 2012 at a cost of Rs. 4,00,000

which is payable in 20 installments from july 2012 onwards.

VI. Advance income tax to be paid in August, 2012 is Rs. 15,000.

VII. Cash balance on 1st June 2012 is expected to be Rs.45,000 and the

company wants to keep it at the end if every month around this figure.

The excess cash (in multiples of Rs. Thousands) is being put in a fixed

deposit.

VIII. Prepare a monthly cash budget for four months starting from June 2012

You might also like

- Cash Management NumericalsDocument5 pagesCash Management NumericalsAnjali Jain100% (1)

- ACCT1003 - Worksheet - 8 - Summer 2016Document5 pagesACCT1003 - Worksheet - 8 - Summer 2016sandrae brownNo ratings yet

- Chapter 10Document27 pagesChapter 10Nayomi_DNo ratings yet

- P2 Financial Management June 2012Document9 pagesP2 Financial Management June 2012Subramaniam KrishnamoorthiNo ratings yet

- SCM310 Chap 14 Fall 2012Document46 pagesSCM310 Chap 14 Fall 2012CfhunSaatNo ratings yet

- of Management ScienceDocument31 pagesof Management ScienceNusa FarhaNo ratings yet

- Financial ManagementDocument144 pagesFinancial ManagementKenadid Ahmed Osman100% (2)

- Cash Budget Excercise: Month Sales (RM 000) Actual SalesDocument4 pagesCash Budget Excercise: Month Sales (RM 000) Actual SalesKhairi IzuanNo ratings yet

- F9 - Mock A - QuestionsDocument15 pagesF9 - Mock A - Questionsshahidmustafa429No ratings yet

- CAT FFM Course Notes PDFDocument251 pagesCAT FFM Course Notes PDFMISS AYIEEN100% (1)

- Capital Budgeting Cash FlowsDocument218 pagesCapital Budgeting Cash FlowsKARL PASCUANo ratings yet

- ACCA F9 Mock Exam GuideDocument10 pagesACCA F9 Mock Exam GuideRaluca PanaitNo ratings yet

- Year Project A Project B: Total PV NPVDocument19 pagesYear Project A Project B: Total PV NPVChin EENo ratings yet

- Multiple Choice Answers and SolutionsDocument11 pagesMultiple Choice Answers and SolutionsLaraNo ratings yet

- Macmillan and Grunski Consulting - Discounted Cash Flow AnalysisDocument18 pagesMacmillan and Grunski Consulting - Discounted Cash Flow AnalysisSuduNo ratings yet

- Fina ManDocument20 pagesFina ManhurtlangNo ratings yet

- Inventory Management (2021)Document8 pagesInventory Management (2021)JustyNo ratings yet

- EOQ & POQ Workshop Operation Management Class Eicea Universidad de La SabanaDocument2 pagesEOQ & POQ Workshop Operation Management Class Eicea Universidad de La SabanaEsteban MurciaNo ratings yet

- Financial Management Questions on Cost of Capital, Investment Appraisal and Working CapitalDocument34 pagesFinancial Management Questions on Cost of Capital, Investment Appraisal and Working CapitalKoketso Mogwe100% (1)

- Describing People Physical Appearance WorksheetDocument2 pagesDescribing People Physical Appearance WorksheetAlifon ConstructoraNo ratings yet

- Huayin Valve Catalogue PDFDocument30 pagesHuayin Valve Catalogue PDFAHMED YOUSEFNo ratings yet

- NotesDocument146 pagesNoteshudaNo ratings yet

- Derivados-Ejercicios Resueltos 1Document8 pagesDerivados-Ejercicios Resueltos 1patriciaNo ratings yet

- Chapter 5 - Pricing Forwards and Futures (S.V.)Document39 pagesChapter 5 - Pricing Forwards and Futures (S.V.)flippy23No ratings yet

- Material and Equipment Standard: IPS-M-EL-136Document14 pagesMaterial and Equipment Standard: IPS-M-EL-136Fatholla SalehiNo ratings yet

- SIMPower-Decision Making Guide-En enDocument37 pagesSIMPower-Decision Making Guide-En enHoang LongNo ratings yet

- Capital BudgetingDocument23 pagesCapital BudgetingchanfunyanNo ratings yet

- Revenue From Contracts With Customers PDFDocument204 pagesRevenue From Contracts With Customers PDFHafeel MohamedNo ratings yet

- NPV ProfileDocument3 pagesNPV ProfileKhan Ahsan HabibNo ratings yet

- Financial Management (Repaired)Document353 pagesFinancial Management (Repaired)Parth PatelNo ratings yet

- ACAD Elec 2011 UserGuideDocument2,464 pagesACAD Elec 2011 UserGuidezvingoNo ratings yet

- AccA P4/3.7 - 2002 - Dec - QDocument12 pagesAccA P4/3.7 - 2002 - Dec - Qroker_m3No ratings yet

- Quantity Discounts For The Eoq ModelDocument13 pagesQuantity Discounts For The Eoq Modelnatalie clyde matesNo ratings yet

- Introduction to Economics DevelopmentDocument38 pagesIntroduction to Economics DevelopmentAngelo TipaneroNo ratings yet

- F4CLENG Revision Question Bank - Sample - D14 J15 PDFDocument82 pagesF4CLENG Revision Question Bank - Sample - D14 J15 PDFMuhib EffendiNo ratings yet

- Capital Budgeting Methods and Cash Flow AnalysisDocument42 pagesCapital Budgeting Methods and Cash Flow AnalysiskornelusNo ratings yet

- Financial Management 2Document248 pagesFinancial Management 2RialeeNo ratings yet

- European Standard Norme Européenne Europäische NormDocument13 pagesEuropean Standard Norme Européenne Europäische NormTsrinivasanTNo ratings yet

- 2017 02 Ifrs 15 Revenue From Contracts With CustomersDocument65 pages2017 02 Ifrs 15 Revenue From Contracts With Customerssuruth242No ratings yet

- Marginal and Absorption CostingDocument8 pagesMarginal and Absorption CostingEniola OgunmonaNo ratings yet

- Chapter 07 - Exercises - Part IIDocument4 pagesChapter 07 - Exercises - Part IIRawan YasserNo ratings yet

- Financial Management September 2011 Exam Paper ICAEWDocument7 pagesFinancial Management September 2011 Exam Paper ICAEWMuhammad Ziaul HaqueNo ratings yet

- UAE Accounting System vs. IFRS Rules.Document6 pagesUAE Accounting System vs. IFRS Rules.Shibam JhaNo ratings yet

- Acca f9 Class Notes 2010 Final 21 JanDocument184 pagesAcca f9 Class Notes 2010 Final 21 JanArshadul Hoque Chowdhury75% (4)

- Engineering Standard: IPS-E-PR-785Document22 pagesEngineering Standard: IPS-E-PR-785Julio Enrique Molina ChirinoNo ratings yet

- My Interpersonal Communication PlanDocument2 pagesMy Interpersonal Communication PlanMariel LunaNo ratings yet

- Assignment SolutionDocument14 pagesAssignment SolutionEfeme SammuelNo ratings yet

- Ias 8 Accounting Policies, Change in Accounting Estimates and ErrorsDocument13 pagesIas 8 Accounting Policies, Change in Accounting Estimates and ErrorsSyed Munib AbdullahNo ratings yet

- VAT Guide Saudi Arabia R3Document43 pagesVAT Guide Saudi Arabia R3Adeel ArsalanNo ratings yet

- Financial Accounting by DrummerDocument48 pagesFinancial Accounting by DrummershabahatanwaraliNo ratings yet

- Calculate China's foreign exchange intervention and sterilizationDocument5 pagesCalculate China's foreign exchange intervention and sterilizationFagbola Oluwatobi OmolajaNo ratings yet

- Acca Performance Management (PM) : Practice & Revision NotesDocument114 pagesAcca Performance Management (PM) : Practice & Revision NotesХалиун Тунгалаг100% (1)

- Feasibility Study ReportDocument41 pagesFeasibility Study ReportGail IbayNo ratings yet

- M5 Management of Cash Pract. ProbDocument5 pagesM5 Management of Cash Pract. ProbAmruta PeriNo ratings yet

- Cash ManagementDocument16 pagesCash ManagementdhruvNo ratings yet

- Cash BudgetDocument4 pagesCash BudgetSANDEEP SINGH0% (1)

- Cash Budget (Problem-2)Document1 pageCash Budget (Problem-2)Aachal hajareNo ratings yet

- Form Ngao Limited to acquire businessDocument6 pagesForm Ngao Limited to acquire businessJames WisleyNo ratings yet

- Answer The Following Questions Very CarefullyDocument2 pagesAnswer The Following Questions Very CarefullyMaham ImtiazNo ratings yet

- Farmville Cash Budget Dec 2019-Mar 2020 Shows Sales, Purchases & OverheadsDocument5 pagesFarmville Cash Budget Dec 2019-Mar 2020 Shows Sales, Purchases & OverheadsMAZLIZA AZUANA ABDULLAHNo ratings yet

- Mandatory GuidelinesDocument8 pagesMandatory GuidelinesGarimaNo ratings yet

- Moot Problem: 2Nd National Moot Court Competition, 2019 Department of Law, University of North BengalDocument5 pagesMoot Problem: 2Nd National Moot Court Competition, 2019 Department of Law, University of North BengalGarimaNo ratings yet

- My Admission ScheduleDocument10 pagesMy Admission Schedulegud2seeu5554No ratings yet

- To ToDocument21 pagesTo ToGarimaNo ratings yet

- Analysis of key provisions of the Essential Commodities ActDocument33 pagesAnalysis of key provisions of the Essential Commodities ActGarimaNo ratings yet

- Legal Framework For Fighting CorruptionDocument37 pagesLegal Framework For Fighting CorruptionGarimaNo ratings yet

- Analysis of key provisions of the Essential Commodities ActDocument33 pagesAnalysis of key provisions of the Essential Commodities ActGarimaNo ratings yet

- Constitution of Central Information Commissions-Section 12Document27 pagesConstitution of Central Information Commissions-Section 12GarimaNo ratings yet

- OkDocument19 pagesOkGarimaNo ratings yet

- AdmissioNotice GNDUcampusDocument2 pagesAdmissioNotice GNDUcampusLavishNo ratings yet

- AfsosDocument45 pagesAfsosGarimaNo ratings yet

- PunjabiDocument2 pagesPunjabiGarimaNo ratings yet

- AaaDocument8 pagesAaaGarimaNo ratings yet

- AfsosDocument45 pagesAfsosGarimaNo ratings yet

- Guru Nanak Dev University, Amritsar (Punjab) PDFDocument1 pageGuru Nanak Dev University, Amritsar (Punjab) PDFGarimaNo ratings yet

- Department of Law Punjabi University, Patiala: Compulsory PapersDocument20 pagesDepartment of Law Punjabi University, Patiala: Compulsory PapersGarimaNo ratings yet

- GaganDocument3 pagesGaganGarimaNo ratings yet

- Reserch Paper GarimaDocument17 pagesReserch Paper GarimaGarimaNo ratings yet

- ScheduleDocument13 pagesScheduleGarimaNo ratings yet

- CA OneDocument1 pageCA OneGarimaNo ratings yet

- Student internship list with company placementsDocument1 pageStudent internship list with company placementsGarimaNo ratings yet

- Student internship list with company placementsDocument1 pageStudent internship list with company placementsGarimaNo ratings yet

- Assignment ACC205Document4 pagesAssignment ACC205GarimaNo ratings yet

- Department of Law Punjabi University, Patiala: Compulsory PapersDocument20 pagesDepartment of Law Punjabi University, Patiala: Compulsory PapersGarimaNo ratings yet

- Months Sales Material Wages Overheads: Estimated Sale and CostDocument1 pageMonths Sales Material Wages Overheads: Estimated Sale and CostGarimaNo ratings yet

- ShimulDocument2 pagesShimulGarimaNo ratings yet

- RPT Ip Print NewDocument14 pagesRPT Ip Print NewGarimaNo ratings yet

- FIN GroupsDocument1 pageFIN GroupsGarimaNo ratings yet

- GaganDocument3 pagesGaganGarimaNo ratings yet