Professional Documents

Culture Documents

D. All of The Above Are Required

Uploaded by

julie anne mae mendozaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

D. All of The Above Are Required

Uploaded by

julie anne mae mendozaCopyright:

Available Formats

Solution to Chapter 23 Example Questions

Multiple Choice Circle the best Answer

1. Which of the following disclosures is NOT required for a change from sum-of-

the-years-digits to straight-line?

a. The cumulative effect on prior years, net of tax, in the current income

statement

b. The justification for the change

c. Pro forma data on income and earnings per share

d. All of the above are required.

2. Which of the following is not considered to be an accounting principle change

under APB Opinion No. 20?

a. A change from FIFO to LIFO for inventory valuation.

b. Using a different method of depreciation for new plant assets.

c. A change from full-cost to successful efforts in the extractive industry.

d. Switching from the direct write-off to the allowance method of accounting for

bad debts (note: the direct write-off method was never acceptable in this

case).

e. Both b and d.

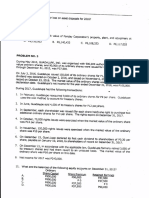

3. Accrued salaries payable of $8,750 were not recorded at Dec. 31, 1993.

Office supplies on hand of $3,750 at Dec. 31, 1994, were erroneously treated

as expense instead of supplies inventory. Neither of these errors was

discovered or corrected. The effect of these two errors would cause

a. 1994 net income to be understated $8,750 December 31, 1994 retained

earnings to be understated $3,750.

b. 1993 net income and December 31, 1993 retained earnings to both be

understated by $8,750 each.

c. 1993 net income to be overstated $8,750 and 1994 net income to be

understated $12,500.

d. 1994 net income and December 31, 1994 retained earnings to both be

understated by $3,750 each.

4. Counterbalancing errors do NOT include

a. errors that correct themselves in two years.

b. errors that correct themselves in three years.

c. an understatement of purchases.

d. an overstatement of unearned revenue.

-Continued on Next Page-

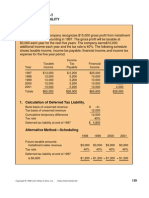

Accounting changes

Osborne Company's net income for its first three years of operations (using

straight-line depreciation method and estimating sales returns at 1% of credit

sales) are presented below:

1999 1998 1997

$160,000 $150,000 $120,000

During 1999, Osborne decided to change from the straight-line method of

depreciating its cement plant to the double-declining balance method and change

its estimate of sales returns to 2% of credit sales, for book purposes only. The

following presents information regarding differences in pre-tax expense and

contra-revenue resulting from these changes:

1999 1998 1997

(DDB Depr. Exp. - St. line Depr Exp.) (5,000) 4,000 12,000

(Sales Returns 2% -Sales Returns 1%) 25,000 N/A N/A

Required:

a. Assuming an income tax rate of 30% for all periods, prepare the necessary

1999 entry to record the past cumulative effect of the depreciation change.

(4pts)

Past cumulative effect of acct. chg. 11,200

Deferred taxes 4,800

Accumulated depreciation 16,000

Complete the following comparative income statement data for the years 1999

and 1998 in accordance with generally accepted accounting principles starting

with income before cumulative effect of accounting changes. (8 pts)

1999 1998

Income before cumulative effect of accounting changes $146,000 $150,000

Cumulative effect on prior years of retroactive

application of new depreciation method, net of tax (11,200) ______0

Net income $134,800 $150,000

Pro-forma Net Income (assuming retroactive application

of new depreciation method): $146,000 $147,200

You might also like

- Taxing Situations Two Cases On Income Taxes - An Accounting Case StudyDocument5 pagesTaxing Situations Two Cases On Income Taxes - An Accounting Case Studyfossaceca80% (5)

- Tax Questions & SolutionsDocument126 pagesTax Questions & SolutionsTawanda Tatenda Herbert100% (8)

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparJoyce Kay Azucena73% (22)

- Ukff3083 Financial Statement AnalysisDocument4 pagesUkff3083 Financial Statement AnalysisChong Jk100% (1)

- Case 2 - Revenue and Expense RecognitionDocument4 pagesCase 2 - Revenue and Expense RecognitionRizwan MushtaqNo ratings yet

- Acctng Error 2Document5 pagesAcctng Error 2Kim FloresNo ratings yet

- Ias 8 Accounting Policies, Change in Accounting Estimates and ErrorsDocument13 pagesIas 8 Accounting Policies, Change in Accounting Estimates and ErrorsSyed Munib AbdullahNo ratings yet

- Assignment 5-2020Document2 pagesAssignment 5-2020Muhammad Hamza0% (4)

- Ps 6Document19 pagesPs 6Da Harlequin GalNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- AutobiographyDocument2 pagesAutobiographyjulie anne mae mendoza83% (6)

- Vikram Rathi - Taxing SituationsDocument2 pagesVikram Rathi - Taxing SituationsVikram RathiNo ratings yet

- Accounting Change Answer KeyDocument4 pagesAccounting Change Answer KeyShielle AzonNo ratings yet

- CH 12Document93 pagesCH 12Saskia SpencerNo ratings yet

- © Mcgraw Hill Companies, Inc., 2000Document19 pages© Mcgraw Hill Companies, Inc., 2000RamadeviChowdaryRayapatiNo ratings yet

- Accounting ErrorssDocument5 pagesAccounting ErrorssJuvilynNo ratings yet

- Topic 6 MFRS 108 Changes in Acc Policies, Estimates, ErrorsDocument30 pagesTopic 6 MFRS 108 Changes in Acc Policies, Estimates, Errorsdini sofiaNo ratings yet

- Accounting ChangesDocument5 pagesAccounting ChangesShielle AzonNo ratings yet

- Soal Test Intermediate 2 MAC 2020Document6 pagesSoal Test Intermediate 2 MAC 2020DikaGustianaNo ratings yet

- IASSS16e Ch16.Ab - AzDocument33 pagesIASSS16e Ch16.Ab - AzLovely DungcaNo ratings yet

- US Internal Revenue Service: f2210f - 1995Document2 pagesUS Internal Revenue Service: f2210f - 1995IRSNo ratings yet

- ENMG602 Week6 HW3Document4 pagesENMG602 Week6 HW3Issam TamerNo ratings yet

- Kolej Universiti Poly-Tech MaraDocument12 pagesKolej Universiti Poly-Tech Maranatasha thaiNo ratings yet

- Fcomprehensiveexam FDocument16 pagesFcomprehensiveexam FDominic SociaNo ratings yet

- Fcomprehensiveexam FDocument16 pagesFcomprehensiveexam FDominic SociaNo ratings yet

- Solution 3G To Accounting Principles Hermanson (CH 19)Document28 pagesSolution 3G To Accounting Principles Hermanson (CH 19)Ahmed IstehadNo ratings yet

- Tax XXXXDocument60 pagesTax XXXXGerald Bowe ResuelloNo ratings yet

- Accounting For Income TaxDocument4 pagesAccounting For Income TaxShaira Bugayong0% (2)

- Chapter 4. Review of AccountingDocument49 pagesChapter 4. Review of AccountingMichenNo ratings yet

- Week 5 TutorialDocument8 pagesWeek 5 TutorialRenee WongNo ratings yet

- Accounting Changes-QUESTIONNAIRESDocument7 pagesAccounting Changes-QUESTIONNAIRESJennifer ArcadioNo ratings yet

- Quiz 2 Solutions...Document34 pagesQuiz 2 Solutions...Esmer AliyevaNo ratings yet

- Accounting For Income Taxes: About This Chapter!Document9 pagesAccounting For Income Taxes: About This Chapter!sabithpaulNo ratings yet

- Answers Quiz Chapter 4Document4 pagesAnswers Quiz Chapter 4Anthony MartinezNo ratings yet

- AccountingDocument8 pagesAccountingGuiamae GuaroNo ratings yet

- Deferred Tax IllustrationDocument8 pagesDeferred Tax IllustrationFaseeh IqbalNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- F1 CIMA Workbook Q PDFDocument169 pagesF1 CIMA Workbook Q PDFKhadija Rampurawala100% (1)

- Unit 5 - Depreciation - Chat Session 8 (Spring 2020)Document5 pagesUnit 5 - Depreciation - Chat Session 8 (Spring 2020)RealGenius (Carl)No ratings yet

- Prism Region 4a-Pnc Cup Far QuestionsDocument16 pagesPrism Region 4a-Pnc Cup Far QuestionsShin YaeNo ratings yet

- RR No. 9-1998Document10 pagesRR No. 9-1998Rhinnell RiveraNo ratings yet

- Week 4 IndividualDocument8 pagesWeek 4 IndividualNatasha BoldonNo ratings yet

- W9. After-Tax Analysis PDFDocument31 pagesW9. After-Tax Analysis PDFCHRISTOPHER ABIMANYUNo ratings yet

- Nur Rokhmat (1701617135) Teori Akun Chapter 6Document10 pagesNur Rokhmat (1701617135) Teori Akun Chapter 6Nur RahmatNo ratings yet

- M09 Berk0821 04 Ism C091Document15 pagesM09 Berk0821 04 Ism C091Linda VoNo ratings yet

- Curve CCC!C CC"#$%C& CCC C''C (CC) CCC:) c11111111111111111cc2 cc11111111111111111111111c "$$3c4cc56"7cccccc CCCCCCCCCCDocument7 pagesCurve CCC!C CC"#$%C& CCC C''C (CC) CCC:) c11111111111111111cc2 cc11111111111111111111111c "$$3c4cc56"7cccccc CCCCCCCCCC037boyNo ratings yet

- CH 011 AIA 5e PDFDocument7 pagesCH 011 AIA 5e PDFfaizthemeNo ratings yet

- Bài tập chủ đề 6Document7 pagesBài tập chủ đề 6thanhtrucNo ratings yet

- Aprelim - Mixed IncomeDocument17 pagesAprelim - Mixed IncomeAshley VasquezNo ratings yet

- Mcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Document14 pagesMcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Vonna TerribleNo ratings yet

- Cost-Based POC MethodDocument5 pagesCost-Based POC Methodkkka TtNo ratings yet

- Income Statement Two Most Common Formats: Single-Step Format Multiple-Step FormatDocument23 pagesIncome Statement Two Most Common Formats: Single-Step Format Multiple-Step Formattribhu1ranaNo ratings yet

- Personal (Or Individual) Income Tax: 1) Domain of ApplicationDocument30 pagesPersonal (Or Individual) Income Tax: 1) Domain of ApplicationChe OmarNo ratings yet

- Day 11 Chap 6 Rev. FI5 Ex PRDocument8 pagesDay 11 Chap 6 Rev. FI5 Ex PRChristian De Leon0% (2)

- RIT IndividualDocument77 pagesRIT IndividualAngelica Pagaduan100% (1)

- This Study Resource Was: Revenue Regulations No. 9-98Document6 pagesThis Study Resource Was: Revenue Regulations No. 9-98Cyruss Xavier Maronilla NepomucenoNo ratings yet

- Osd CorrectionDocument2 pagesOsd CorrectionSai BomNo ratings yet

- Accounting For Income Tax HandoutsDocument4 pagesAccounting For Income Tax HandoutsMichael Bongalonta0% (1)

- Fall10mid1 ProbandsolnDocument8 pagesFall10mid1 Probandsolnivanata72No ratings yet

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Shen YueDocument1 pageShen Yuejulie anne mae mendozaNo ratings yet

- Audit Reporting-At A Glance-Final USE ME PDFDocument12 pagesAudit Reporting-At A Glance-Final USE ME PDFhgcisoNo ratings yet

- New IAR Key Audit MattersDocument4 pagesNew IAR Key Audit Mattersjulie anne mae mendozaNo ratings yet

- BIR EFPS Quick GuideDocument2 pagesBIR EFPS Quick Guidejulie anne mae mendozaNo ratings yet

- Application For Authority To Print Receipts and Invoices: Kawanihan NG Rentas InternasDocument1 pageApplication For Authority To Print Receipts and Invoices: Kawanihan NG Rentas InternasAnnamaAnnamaNo ratings yet

- New Auditor's Report Effective December 15, 2016 - Philippine Accounting UpdatesDocument3 pagesNew Auditor's Report Effective December 15, 2016 - Philippine Accounting UpdatesEricaNo ratings yet

- The New Auditor ReportDocument12 pagesThe New Auditor ReportSanja Noele RBNo ratings yet

- Adminstrative Officer IDocument3 pagesAdminstrative Officer Ijulie anne mae mendozaNo ratings yet

- New IAR DiscussionDocument4 pagesNew IAR Discussionjulie anne mae mendozaNo ratings yet

- Iar - Iaasb vs. PcaobDocument13 pagesIar - Iaasb vs. Pcaobjulie anne mae mendozaNo ratings yet

- Mendoza Written ReportDocument6 pagesMendoza Written Reportjulie anne mae mendozaNo ratings yet

- Administrative and Finance Department Accounting DivisionDocument10 pagesAdministrative and Finance Department Accounting Divisionjulie anne mae mendozaNo ratings yet

- AuditingDocument67 pagesAuditingHengky Jaya95% (19)

- PSA 706 Revised CleanDocument17 pagesPSA 706 Revised CleanRheneir MoraNo ratings yet

- Bus - Strat. ReviewerDocument21 pagesBus - Strat. Reviewerjulie anne mae mendozaNo ratings yet

- Recipe Ham & Cheese Pizza CupcakeDocument3 pagesRecipe Ham & Cheese Pizza Cupcakejulie anne mae mendozaNo ratings yet

- Amunt: Foilows:-FanualyDocument1 pageAmunt: Foilows:-Fanualyjulie anne mae mendozaNo ratings yet

- Chapter 28 PDFDocument19 pagesChapter 28 PDFjulie anne mae mendozaNo ratings yet

- Y 1H"? J:fr?i"k: p6,135,933 p6,140,433 C. p6,10g, 333Document1 pageY 1H"? J:fr?i"k: p6,135,933 p6,140,433 C. p6,10g, 333julie anne mae mendozaNo ratings yet

- Audit Rev 1Document1 pageAudit Rev 1julie anne mae mendozaNo ratings yet

- DramaDocument6 pagesDramajulie anne mae mendozaNo ratings yet

- Work SchedDocument1 pageWork Schedjulie anne mae mendozaNo ratings yet

- Philhealth ER1-Employer FormDocument1 pagePhilhealth ER1-Employer FormAimee F67% (3)

- SSSForms ER Registration PDFDocument2 pagesSSSForms ER Registration PDFjulie anne mae mendozaNo ratings yet

- MusicDocument5 pagesMusicjulie anne mae mendozaNo ratings yet

- DanceDocument3 pagesDancejulie anne mae mendozaNo ratings yet

- Research ReportDocument4 pagesResearch Reportjulie anne mae mendozaNo ratings yet

- Assessment and Returns of IncomeDocument13 pagesAssessment and Returns of IncomeMaster KihimbwaNo ratings yet

- FATCA Cams PDFDocument1 pageFATCA Cams PDFPushpakVanjariNo ratings yet

- Bullet QQR Taxation Law FinalDocument46 pagesBullet QQR Taxation Law FinalPrincess Janine Sy100% (2)

- Customs in India Nature & TypesDocument2 pagesCustoms in India Nature & TypesSaagar Hingorani100% (3)

- Ageasfederal: February 18, 2021Document3 pagesAgeasfederal: February 18, 2021Jayanth RNo ratings yet

- Philippine Geothermal, Inc. vs. Commissioner of Internal Revenue, 465 SCRA 308 (2005)Document2 pagesPhilippine Geothermal, Inc. vs. Commissioner of Internal Revenue, 465 SCRA 308 (2005)VerlynMayThereseCaroNo ratings yet

- Ecojen Holdings LimitedDocument1 pageEcojen Holdings LimitedABOBO 254No ratings yet

- 20220407T115419 - Afq Inv Sa 2022 1586492Document4 pages20220407T115419 - Afq Inv Sa 2022 1586492Hassan ShathakNo ratings yet

- Income TaxDocument11 pagesIncome Taxvikas_thNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceNeha RawatNo ratings yet

- Us-Orl-Or1: Express WorldwideDocument3 pagesUs-Orl-Or1: Express WorldwideAgi AgistriaNo ratings yet

- Information For Canadian Small Businesses: This Guide Is Available Only in Digital FormatDocument36 pagesInformation For Canadian Small Businesses: This Guide Is Available Only in Digital FormatAhmedNo ratings yet

- Emergency Sick PayDocument6 pagesEmergency Sick PayJenNo ratings yet

- Principles of Taxation M. Khalid Petiwala: Income From PropertyDocument8 pagesPrinciples of Taxation M. Khalid Petiwala: Income From PropertyosamaNo ratings yet

- 69 Customs Duty Tariff and Taxes in Ethiopia 1Document3 pages69 Customs Duty Tariff and Taxes in Ethiopia 1Esrom AbebeNo ratings yet

- Chapter 4 SolmanDocument11 pagesChapter 4 SolmanUchayya100% (1)

- Saint Wealth Ltd. v. Bureau of InternalDocument76 pagesSaint Wealth Ltd. v. Bureau of InternalMarj BaquialNo ratings yet

- Livermore Valley Joint Unified School District: 45-Day Budget RevisionDocument2 pagesLivermore Valley Joint Unified School District: 45-Day Budget RevisionLivermoreParentsNo ratings yet

- Aptiv DRodDocument4 pagesAptiv DRodRajesh TipnisNo ratings yet

- Ayon Chatterjee-BQ0049-May 2023-PayslipDocument1 pageAyon Chatterjee-BQ0049-May 2023-Paysliplaxmi kumariNo ratings yet

- 15 - Western Mindanao Power Corporation v. CIRDocument3 pages15 - Western Mindanao Power Corporation v. CIRPaula Marquez MenditaNo ratings yet

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- Porm 27 NDocument11 pagesPorm 27 Njohn paroNo ratings yet

- Q 5Document5 pagesQ 5music3kzNo ratings yet

- RR 1 - 1998Document3 pagesRR 1 - 1998Lady Ann CayananNo ratings yet

- 2307 PDFDocument2 pages2307 PDFAnonymous BVowhxQPNo ratings yet

- Partition DeedDocument2 pagesPartition Deedsanyu1208No ratings yet

- Assignment 3 TAX3702Document3 pagesAssignment 3 TAX3702GenevieveNo ratings yet

- Balancing Act: Managing The Public PurseDocument64 pagesBalancing Act: Managing The Public PurseGamers LKONo ratings yet

- BBP Form 1Document3 pagesBBP Form 1Umalo Libmanan Camarines SurNo ratings yet