Professional Documents

Culture Documents

Final Review Questions

Uploaded by

hatanoloveOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Review Questions

Uploaded by

hatanoloveCopyright:

Available Formats

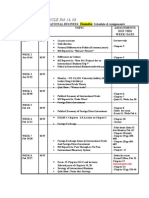

Final Review Questions

1. Which of the following statements is most correct?

a) Yield Degradation is the reduction in the IRR (yield to maturity) below the

contract rate, based on a specified conditional recovery rate.

b) Realized yield is the shortfalls to the lender as a result of default and

foreclosure.

c) Credit loss is the difference between the realized yield and yield

degradation.

d) Realized yield equal to contract yield plus yield degradation.

2. Which of the following statement is incorrect?

a) Yield degradation is conditional based on that default will occur in a

particular year.

b) Yield degradation is conditional based on a specific recovery rate.

c) The conditional yield degradation is greater, the earlier the default occurs

in the life of the loan.

d) The conditional yield degradation is greater, the later the default occurs in

the life of the loan.

3. What is the main factor which can cause the Weighted Average Maturity of

tranch A of a CMBS issue to be lower (shorter) than tranche B?

a) Superior credit quality

b) Prepayment of loans

c) More “weight” attributed to higher quality financial issues

d) Less demand from non-institutional investors

4. Which of the following statement is mostly incorrect?

a) A mortgage pool consisting of loans that have relatively low and

homogeneous LTV ratio will not need as much credit support for a given

credit rating.

b) All other thing equal, a mortgage pool containing loans with diverse LTV

ratio can have higher credit rating than a mortgage pool containing loans

with homogeneous LTV ratio.

c) Greater credit support will result in a higher rating for a given tranche.

d) It is the job of the bond rating agency to evaluate how much credit support

is required for a given credit rating for each tranche in a CMBS issue.

5. What is meant by the term "umbrella partnership REIT" (or "UPREIT")?

a) A REIT that invests primarily in Seattle.

b) A REIT that invests in low-risk properties, saving for a "rainy day".

c) A REIT that owns property equity directly.

d) A REIT that owns property only indirectly, through its holdings in a

partnership.

6. Suppose REIT prices have risen strongly for two consecutive years. It is

reasonable to expect:

a) REIT prices will certainly rise substantially next year.

b) REIT prices will certainly fall substantially next year.

c) Property market prices will probably rise in the upcoming year.

d) Property market prices will probably fall in the upcoming year

7. An "Expense Stop" provision in a lease:

a) Puts a limit on the amount of building operating expenses the tenant must

pay.

b) Puts a limit on the amount of building operating expenses the landlord must

pay.

c) Puts a limit on the amount of building operating expenses the property

manager must pay.

d) Puts a limit on the total operating expenses of a building.

8. All of the following relate most directly to the benefit side of the real estate

development NPV equation, except:

a) The construction and absorption budget.

b) The operating budget.

c) The projected cap rates in the built property market.

d) The rents in the built property market.

9. Suppose a lease has a 75% CPI-Adjustment each year. If last year's rent

was $20/SF and the CPI has increased from 155 to 161, what is the new rent

this year?

a) $20.50

b) $20.58

c) $20.77

d) $21.00

10. A "Step-up" provision in a commercial property lease means:

a) Provides for the tenant to move to a higher floor.

b) Adjusts the rental payments to changes in inflation.

c) Specifies in advance the absolute dollar amounts by which the rental

payments will increase, no matter what happens to inflation.

d) Requires the tenant to pay specified increases in the building's operating

expenses.

You might also like

- CF2 1Document11 pagesCF2 1COPY PAPAGAJKANo ratings yet

- Inv PLNGDocument78 pagesInv PLNGapi-38145570% (1)

- BU393 MidtermDocument12 pagesBU393 MidtermNineowNo ratings yet

- Studocudocument 2Document17 pagesStudocudocument 2Kathleen J. GonzalesNo ratings yet

- Sample of The Fin320 Department Final Exam With SolutionDocument10 pagesSample of The Fin320 Department Final Exam With Solutionnorbi113100% (1)

- Capital Budgeting FM2 AnswersDocument17 pagesCapital Budgeting FM2 AnswersMaria Anne Genette Bañez89% (28)

- Question Bank-MCQ FM&CF (KMBN, KMBA 204)Document27 pagesQuestion Bank-MCQ FM&CF (KMBN, KMBA 204)Amit ThakurNo ratings yet

- Capital Budget IDocument9 pagesCapital Budget Ia100% (1)

- Review Extra CreditDocument8 pagesReview Extra CreditMichelle de GuzmanNo ratings yet

- Investment Planning FINAL PDFDocument84 pagesInvestment Planning FINAL PDFs_hirenNo ratings yet

- CAPITAL BUDGETING DECISIONS—PART II MULTIPLE CHOICEDocument7 pagesCAPITAL BUDGETING DECISIONS—PART II MULTIPLE CHOICEthescorpioNo ratings yet

- Midterm W07 With SolutionsDocument13 pagesMidterm W07 With SolutionsSupri awasthiNo ratings yet

- DYSAS QuestionairesDocument5 pagesDYSAS QuestionairesAngelica Manaois100% (1)

- Fin QuestionsDocument20 pagesFin QuestionsMaria RahmanNo ratings yet

- 261 0701Document17 pages261 0701api-27548664No ratings yet

- Multiple ChoiceDocument11 pagesMultiple ChoiceAnna Carlaine PosadasNo ratings yet

- Multiple Choice Questions on Finance TopicsDocument12 pagesMultiple Choice Questions on Finance TopicsHamid UllahNo ratings yet

- TB ch07Document27 pagesTB ch07carolevangelist4657No ratings yet

- DocxDocument26 pagesDocxMary DenizeNo ratings yet

- Unit 15 Final ExamDocument5 pagesUnit 15 Final ExamTakuriNo ratings yet

- ADM 2350 Final Exam SolnsDocument11 pagesADM 2350 Final Exam SolnsIshan Vashisht100% (1)

- 325 Fa10 Final, Sec2AnswersDocument24 pages325 Fa10 Final, Sec2AnswersDeepannita ChakrabortyNo ratings yet

- 2017 Acf - Revision1Document15 pages2017 Acf - Revision1Leezel100% (1)

- Real Estate Finance & Investments Midterm I Group ADocument8 pagesReal Estate Finance & Investments Midterm I Group AJiayu JinNo ratings yet

- CF Self Assess QuestionsDocument6 pagesCF Self Assess QuestionsLeo Danes100% (1)

- Corporate Finance QuizDocument8 pagesCorporate Finance QuizAditya SinghNo ratings yet

- TB Ch08 Capital Budgetting Decisions Part 2Document13 pagesTB Ch08 Capital Budgetting Decisions Part 2kimberly agravante100% (1)

- Off-Balance Sheet Financing & Financial AnalysisDocument10 pagesOff-Balance Sheet Financing & Financial AnalysisEvan AzizNo ratings yet

- How to maximize firm value by investing in projects with positive NPVDocument4 pagesHow to maximize firm value by investing in projects with positive NPVRose PinkNo ratings yet

- Capital Budgetting Multiple ChoiceDocument24 pagesCapital Budgetting Multiple ChoiceMaryane Angela67% (3)

- Tiong, Gilbert Charles - Decision MakingDocument11 pagesTiong, Gilbert Charles - Decision MakingGilbert TiongNo ratings yet

- Bond Interest Revenue ReportingDocument24 pagesBond Interest Revenue ReportingPatrick WaltersNo ratings yet

- Important Notice:: D. I, III and IV OnlyDocument12 pagesImportant Notice:: D. I, III and IV Onlyjohn183790No ratings yet

- Tiong, Gilbert Charles - Financial Planning and ManagementDocument10 pagesTiong, Gilbert Charles - Financial Planning and ManagementGilbert TiongNo ratings yet

- EFB201 Fixed Income and Equity Markets Part B TutDocument4 pagesEFB201 Fixed Income and Equity Markets Part B Tuthowunfung0705No ratings yet

- Sample Questions 2Document14 pagesSample Questions 2조서현No ratings yet

- Barai Ch. 5Document59 pagesBarai Ch. 5Dinkar GUPTANo ratings yet

- Key MCQ Capital BudgetingDocument4 pagesKey MCQ Capital BudgetingPadyala SriramNo ratings yet

- FXTM - Model Question Paper 2Document37 pagesFXTM - Model Question Paper 2Rajiv WarrierNo ratings yet

- 10 28 QuestionsDocument5 pages10 28 QuestionstikaNo ratings yet

- CPA Review Cost of CapitalDocument12 pagesCPA Review Cost of CapitalCarlito B. BancilNo ratings yet

- Practice Questions 6 SolutionsDocument2 pagesPractice Questions 6 SolutionsNevaeh LeeNo ratings yet

- Mcq. Capital BudgetingdocxDocument4 pagesMcq. Capital BudgetingdocxPadyala SriramNo ratings yet

- ACC 603 Advanced Accounting Theory ExamDocument7 pagesACC 603 Advanced Accounting Theory ExamSteph Stevens0% (1)

- Final ADM 3350Document13 pagesFinal ADM 3350Dan Grimsey100% (1)

- MCQ - Part 01 Students - Intermediate Accounting IIDocument6 pagesMCQ - Part 01 Students - Intermediate Accounting IIAbdulaziz FaisalNo ratings yet

- Financial ManagementDocument16 pagesFinancial ManagementNanaji THANGETINo ratings yet

- Multiple Choice at The End of LectureDocument6 pagesMultiple Choice at The End of LectureOriana LiNo ratings yet

- Callable Bonds ExplainedDocument33 pagesCallable Bonds ExplainedtwinklenoorNo ratings yet

- Q&aDocument70 pagesQ&apaulosejgNo ratings yet

- Capital Budgeting MathsDocument2 pagesCapital Budgeting MathsAli Akand Asif67% (3)

- Financial Analysis Placement TestDocument15 pagesFinancial Analysis Placement TestAbigail SubaNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresFrom EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresNo ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- MoveDocument31 pagesMovehatanolove100% (1)

- State Farm Auto PolicyDocument28 pagesState Farm Auto Policyhatanolove80% (5)

- MoveDocument31 pagesMovehatanolove100% (1)

- Insurance ContractDocument6 pagesInsurance Contracthatanolove100% (1)

- Practice Midterm KeyDocument4 pagesPractice Midterm KeyhatanoloveNo ratings yet

- Tir 08 2 BerggrenDocument19 pagesTir 08 2 BerggrenhatanoloveNo ratings yet

- Risk and InsuranceDocument17 pagesRisk and Insurancehatanolove100% (5)

- Auto InsuranceDocument14 pagesAuto InsurancehatanoloveNo ratings yet

- Revised Schedule MGNT4670 Winter 2008 Section 02Document2 pagesRevised Schedule MGNT4670 Winter 2008 Section 02hatanoloveNo ratings yet

- Supply Side Economics-GwartneyDocument3 pagesSupply Side Economics-GwartneyhatanoloveNo ratings yet

- GNIPCDocument4 pagesGNIPChatanolove100% (2)

- SCF - Practice QDocument3 pagesSCF - Practice QhatanoloveNo ratings yet

- Study Questions For Chapters 14-16-20Document4 pagesStudy Questions For Chapters 14-16-20hatanoloveNo ratings yet

- The Application of Austrian Business Cycle TheoryDocument21 pagesThe Application of Austrian Business Cycle Theoryhatanolove100% (1)

- SHQ Practice QDocument1 pageSHQ Practice QhatanoloveNo ratings yet

- Martha StewartDocument4 pagesMartha Stewarthatanolove100% (3)

- SHQ Practice Q Answer KeyDocument1 pageSHQ Practice Q Answer KeyhatanoloveNo ratings yet

- Sample Questions: Multiple ChoicesDocument4 pagesSample Questions: Multiple ChoiceshatanoloveNo ratings yet

- Income, Life-Satisfaction and Real Consumption InequalityDocument4 pagesIncome, Life-Satisfaction and Real Consumption InequalityhatanoloveNo ratings yet

- Milton FriedmanDocument3 pagesMilton FriedmanhatanoloveNo ratings yet

- Midterm InformationDocument2 pagesMidterm InformationhatanoloveNo ratings yet

- Homework Assignment 6Document1 pageHomework Assignment 6hatanoloveNo ratings yet

- Libby Chap 11 Study NotesDocument16 pagesLibby Chap 11 Study Noteshatanolove100% (4)

- Mgmt3620 Syllabus (S08)Document4 pagesMgmt3620 Syllabus (S08)hatanoloveNo ratings yet

- Management Mistakes That President Bush MadeDocument5 pagesManagement Mistakes That President Bush Madehatanolove100% (2)

- Libby Chapter 6 Study NotesDocument6 pagesLibby Chapter 6 Study NoteshatanoloveNo ratings yet

- Keynes Robert ReichDocument4 pagesKeynes Robert ReichhatanoloveNo ratings yet

- Governor Frederic S. Mishkin: How Should We Respond To Asset Price Bubbles?Document10 pagesGovernor Frederic S. Mishkin: How Should We Respond To Asset Price Bubbles?hatanoloveNo ratings yet

- HW 7 Answer KeyDocument2 pagesHW 7 Answer KeyhatanoloveNo ratings yet

- Governor Frederic S. Mishkin: How Should We Respond To Asset Price Bubbles?Document10 pagesGovernor Frederic S. Mishkin: How Should We Respond To Asset Price Bubbles?hatanoloveNo ratings yet

- IBM - Multiple Choice Questions PDFDocument15 pagesIBM - Multiple Choice Questions PDFsachsanjuNo ratings yet

- Energia Solar en EspañaDocument1 pageEnergia Solar en EspañaCatalin LeusteanNo ratings yet

- KYOTO PROTOCOL EXPLAINED: GLOBAL AGREEMENT TO REDUCE GREENHOUSE GAS EMISSIONSDocument20 pagesKYOTO PROTOCOL EXPLAINED: GLOBAL AGREEMENT TO REDUCE GREENHOUSE GAS EMISSIONSShashikant MishraNo ratings yet

- Lesson 2 Material Adidas To Make Shoes From Ocean GarbageDocument3 pagesLesson 2 Material Adidas To Make Shoes From Ocean GarbageashykynNo ratings yet

- 22 - Intangible Assets - TheoryDocument3 pages22 - Intangible Assets - TheoryralphalonzoNo ratings yet

- Most Important Terms & ConditionsDocument6 pagesMost Important Terms & ConditionsshanmarsNo ratings yet

- Survey highlights deficits facing India's minority districtsDocument75 pagesSurvey highlights deficits facing India's minority districtsAnonymous yCpjZF1rFNo ratings yet

- Analysis Master RoadDocument94 pagesAnalysis Master RoadSachin KumarNo ratings yet

- Chapter One - Part 1Document21 pagesChapter One - Part 1ephremNo ratings yet

- FAR1 ASN01 Balance Sheet and Income Statement PDFDocument1 pageFAR1 ASN01 Balance Sheet and Income Statement PDFira concepcionNo ratings yet

- 12 Jun 2019 PDFDocument12 pages12 Jun 2019 PDFAnonymous dy7g4jzo7No ratings yet

- Unified DCR 37 (1 AA) DT 08 03 2019..Document6 pagesUnified DCR 37 (1 AA) DT 08 03 2019..GokulNo ratings yet

- Fisker Karma Specs V2Document1 pageFisker Karma Specs V2LegacyforliveNo ratings yet

- Solow Growth ModelDocument15 pagesSolow Growth ModelSamuel Elias KayamoNo ratings yet

- NiobiumDocument15 pagesNiobiumAdi TriyonoNo ratings yet

- Inter-regional disparities in industrial growthDocument100 pagesInter-regional disparities in industrial growthrks_rmrctNo ratings yet

- 21936mtp Cptvolu1 Part4Document404 pages21936mtp Cptvolu1 Part4Arun KCNo ratings yet

- Bridge Over Bhagirathi AllotmentDocument6 pagesBridge Over Bhagirathi AllotmentKyle CruzNo ratings yet

- Accounting-ABM WorksheetDocument5 pagesAccounting-ABM WorksheetPrincess AlontoNo ratings yet

- Pengaruh Kualitas Bahan Baku Dan ProsesDocument11 pagesPengaruh Kualitas Bahan Baku Dan Proses039 Trio SukmonoNo ratings yet

- Five Key Sources of Critical Success FactorsDocument2 pagesFive Key Sources of Critical Success FactorsHanako ChinatsuNo ratings yet

- Proposal HydrologyDocument4 pagesProposal HydrologyClint Sunako FlorentinoNo ratings yet

- Sales and Purchases 2021-22Document15 pagesSales and Purchases 2021-22Vamsi ShettyNo ratings yet

- Five Forces Analysis TemplateDocument2 pagesFive Forces Analysis TemplateKedar JoshiNo ratings yet

- Mineral and Energy ResourcesDocument4 pagesMineral and Energy ResourcesJoseph ZotooNo ratings yet

- 5 ABN AMRO Ahmedabad Case StudyDocument3 pages5 ABN AMRO Ahmedabad Case StudyprathsNo ratings yet

- High Capacity Stacker-F1-G1-H1 Safety Guide en - USDocument14 pagesHigh Capacity Stacker-F1-G1-H1 Safety Guide en - UShenry lopezNo ratings yet

- Macroeconomic Analysis of USA: GDP, Inflation & UnemploymentDocument2 pagesMacroeconomic Analysis of USA: GDP, Inflation & UnemploymentVISHAL GOYALNo ratings yet

- 12 Risks With Infinite Impact PDFDocument212 pages12 Risks With Infinite Impact PDFkevin muchungaNo ratings yet

- Talent Corp - Final Report (Abridged) PDFDocument211 pagesTalent Corp - Final Report (Abridged) PDFpersadanusantaraNo ratings yet