Professional Documents

Culture Documents

BIR Form No. 0608 PDF

Uploaded by

Paolo MartinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Form No. 0608 PDF

Uploaded by

Paolo MartinCopyright:

Available Formats

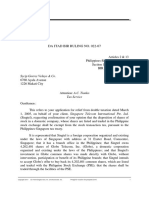

(To be filled up the BIR)

DLN: PSIC: PSOC:

Compromise Settlement BIR Form No.

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Payment Form 0608

(Pursuant to RR No. 7-2001) July 2001

Fill in all applicable spaces. Mark all appropriate boxes with an "X"

1 For the Calendar Fiscal 3 Quarter 4 Application Form No. 5 No. of Sheets 6 ATC

2 Year Ended Attached

M C 0 3 0

( MM / YYYY ) 1st 2nd 3rd 4th

7 Return Period ( MM / DD / YYYY ) 8 Tax Type Code BCS No./Item No. (To be filled up by the BIR)

Part I Background Information

9 Taxpayer Identification No. 10 RDO Code 11 Taxpayer Classification 12 Line of Business/Occupation

I N

13 Taxpayer's (Last Name, First Name, Middle Name for Individuals) / (Registered Name for Non-Individuals) 14 Telephone Number

Name

15 Registered 16 Zip Code

Address

17 Manner of Payment

Others (Specify)

SPF-(Compromise Settlement)

18 Remarks

Part II Computation of Tax

19 Compromise Settlement:

Doubtful Validity of Assessment Financial Incapacity

Amount Payable 19

For Voluntary Payment APPROVED BY: Stamp of Receiving

Office

I declare, under the penalties of perjury, that this document has been made and Date of Receipt

in good faith, verified by me, and to the best of my knowledge and belief, is true

and correct, pursuant to the provisions of the National Internal Revenue Code,

as amended, and the regulations issued under authority thereof.

20A 20B

Signature over Printed Name of Taxpayer /Authorized Representative Title/Position of Signatory Signature over Printed Name of Head of Office

Part III D e t a i l s of P a y m e n t

Particulars Drawee Bank/Agency Number MM DD YYY Amount

21 Cash 21

22 Check 22A 22B 17C 22C 22D

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

Taxpayer Classification: I - Individual N - Non-Individual

TAX TYPE

Code Description Code Description

INCOME TAX

IT WITHHOLDING TAX-BANKS AND OTHER

IMPROPERLY ACCUMULATED EARNINGS TAX WB

CG CAPITAL GAINS TAX - Real Property FINANCIAL INSTITUTIONS

CS CAPITAL GAINS TAX - Stocks WC WITHHOLDING TAX-COMPENSATION

ES ESTATE TAX WE WITHHOLDING TAX-EXPANDED

DN DONOR'S TAX WF WITHHOLDING TAX-FINAL

VT VALUE-ADDED TAX WITHHOLDING TAX - VAT AND OTHER

WG

PT PERCENTAGE TAX PERCENTAGE TAXES

ST PERCENTAGE TAX - STOCKS WITHHOLDING TAX-OTHERS (ONE-TIME TRAN-

SO PERCENTAGE TAX - STOCKS (IPO) WO SACTION NOT SUBJECT TO CAPITAL

SL PERCENTAGE TAX - SPECIAL LAWS GAINS TAX)

DS DOCUMENTARY STAMP TAX WR WITHHOLDING TAX - FRINGE BENEFITS

XS EXCISE - SPECIFIC TAX WITHHOLDING TAX-PERCENTAGE TAX

XV EXCISE TAX - AD VALOREM WW

ON WINNINGS AND PRIZES

XF TOBACCO INSPECTION & MONITORING FEES

You might also like

- ITAD BIR Ruling No. 311-14Document9 pagesITAD BIR Ruling No. 311-14cool_peachNo ratings yet

- HDMF Contributions and Loan PaymentDocument29 pagesHDMF Contributions and Loan PaymentRocelle IndicoNo ratings yet

- Retainer AgreementDocument2 pagesRetainer AgreementJson Galvez100% (1)

- FINAL FOI Request Form - Annex BDocument1 pageFINAL FOI Request Form - Annex BAnnie Bag-ao100% (1)

- Cover Sheet: Month Day Month DayDocument1 pageCover Sheet: Month Day Month DayWilliam S. FeridaNo ratings yet

- BIR Ruling on Informer's RewardDocument4 pagesBIR Ruling on Informer's RewardAnonymous fnlSh4KHIgNo ratings yet

- Letter For LOADocument1 pageLetter For LOAmaeNo ratings yet

- Process For Application To Use LooseleafDocument1 pageProcess For Application To Use LooseleafFrancis MartinNo ratings yet

- 1604-C Jan 2018 Final Annex A PDFDocument1 page1604-C Jan 2018 Final Annex A PDFAs Li NahNo ratings yet

- Bir Ruling Da 192-08Document2 pagesBir Ruling Da 192-08norliza albutraNo ratings yet

- Write - Off Sample CasesDocument16 pagesWrite - Off Sample CasesLiDdy Cebrero BelenNo ratings yet

- BPI - Secretary's Certificate TemplateDocument3 pagesBPI - Secretary's Certificate TemplatemaureenNo ratings yet

- APPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Document7 pagesAPPLICATION FOR REGISTRATION/ACCREDITATION AS AN ECOZONE SERVICE ENTERPRISE (For Customs Broker, Freight Forwarder/Trucker and Security Agency)Albert YsegNo ratings yet

- SPM Permit Application ProcedureDocument11 pagesSPM Permit Application ProcedureMay Ann MeramNo ratings yet

- Secretary's Board Resolution Vghoa - Series 2019Document2 pagesSecretary's Board Resolution Vghoa - Series 2019Janeth Villanueva Montorio WaminalNo ratings yet

- Application for Authority to Print Receipts and InvoicesDocument1 pageApplication for Authority to Print Receipts and InvoicesShane Shane100% (4)

- RMC 69-2020 POS Cancellation New RequirementDocument2 pagesRMC 69-2020 POS Cancellation New RequirementGreyNo ratings yet

- Memo To Suppliers - Invoicing Requirements - 2019Document5 pagesMemo To Suppliers - Invoicing Requirements - 2019Mark MagallanesNo ratings yet

- Efps Letter 009Document1 pageEfps Letter 009ElsieJhadeWandasAmandoNo ratings yet

- Auditor AffidavitDocument4 pagesAuditor Affidavitdaryl canozaNo ratings yet

- Application For Registration: BIR Form NoDocument2 pagesApplication For Registration: BIR Form NoBernardino PacificAceNo ratings yet

- Transfer Estate TIN Special Power of AttorneyDocument1 pageTransfer Estate TIN Special Power of AttorneyHanan KahalanNo ratings yet

- CMPRS Form2 - Secretarys Certificate CMPRS Oct 17 2017Document2 pagesCMPRS Form2 - Secretarys Certificate CMPRS Oct 17 2017Lariyl de VeraNo ratings yet

- TIN Verification SlipDocument21 pagesTIN Verification SlipKate Hazzle Janda100% (1)

- Checklist PcabDocument5 pagesChecklist PcabLyka Amascual ClaridadNo ratings yet

- Sample SMRDocument1 pageSample SMRearl0917No ratings yet

- Letter For Delisting BIRDocument2 pagesLetter For Delisting BIRFreann Sharisse AustriaNo ratings yet

- Affidavit of ParaphernalDocument1 pageAffidavit of ParaphernalKyle MondejarNo ratings yet

- Affidavit of Non-OperationDocument2 pagesAffidavit of Non-OperationkeitoNo ratings yet

- Petition For Dropping LTFRBDocument3 pagesPetition For Dropping LTFRBMegan Camille SanchezNo ratings yet

- Annex C.1Document1 pageAnnex C.1Eric OlayNo ratings yet

- BIR Ruling On How To Compute Book Value If There Is Unpaid SubscriptionDocument3 pagesBIR Ruling On How To Compute Book Value If There Is Unpaid SubscriptionBobby LockNo ratings yet

- Affidavit of No ChangeDocument2 pagesAffidavit of No Changerodel vallartaNo ratings yet

- RR 12-98Document3 pagesRR 12-98matinikki100% (1)

- NEW OMNIBUS SWORN STATEMENT UpdatedDocument2 pagesNEW OMNIBUS SWORN STATEMENT Updatedchedita obiasNo ratings yet

- Closing A Business in The PhilippinesDocument7 pagesClosing A Business in The PhilippinesWen ChiNo ratings yet

- Philippine Shippers Bureau AO No. 06 S. 2005Document22 pagesPhilippine Shippers Bureau AO No. 06 S. 2005PortCalls50% (2)

- Deed Restriction For Carmel Ray Park-1Document14 pagesDeed Restriction For Carmel Ray Park-1Jerome Ilao100% (1)

- Affidavit of Non-Holding of MeetingDocument1 pageAffidavit of Non-Holding of MeetingChanine Mae Cruz100% (1)

- BOC Application Form ImporterDocument3 pagesBOC Application Form Importerlyn121988gmailcom100% (3)

- Statement of ManagementDocument1 pageStatement of ManagementDaisuke InoueNo ratings yet

- Fs - Evilla, E. (Vertam Farms Opc) 2020Document44 pagesFs - Evilla, E. (Vertam Farms Opc) 2020Ma Teresa B. Cerezo100% (2)

- Board Resolution - Business Permit RenewalDocument2 pagesBoard Resolution - Business Permit RenewalBasic Forme Builders100% (1)

- Issuance of Certificate of No Pending CaseDocument4 pagesIssuance of Certificate of No Pending CaseGerry DayananNo ratings yet

- Special power of attorney for death certificate claimDocument1 pageSpecial power of attorney for death certificate claimDC SNo ratings yet

- Contractor's License Amnesty Application RequirementsDocument11 pagesContractor's License Amnesty Application RequirementsArlyn JarabeNo ratings yet

- 1903 January 2018 ENCS FinalDocument4 pages1903 January 2018 ENCS FinalJames E. NogoyNo ratings yet

- Affidavit attesting to accuracy of 2020 sales recordsDocument1 pageAffidavit attesting to accuracy of 2020 sales recordsCha GomezNo ratings yet

- Declaration of Heirship With SPA To Sell The Property AdjudicatedDocument2 pagesDeclaration of Heirship With SPA To Sell The Property AdjudicatedJoemar CalunaNo ratings yet

- CTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceDocument74 pagesCTA 8459 (CADPI) - No DST On Bank Loans, Year-End BalanceJerwin DaveNo ratings yet

- Secretary's Certificate-2018Document1 pageSecretary's Certificate-2018Athena SalasNo ratings yet

- Affidavit of Incident Windshield DamageDocument2 pagesAffidavit of Incident Windshield Damagejc cayananNo ratings yet

- BIR Sworn StatementDocument1 pageBIR Sworn StatementPFMPC SecretaryNo ratings yet

- Sworn Application For Tax Clearance Annex C 1 RufDocument1 pageSworn Application For Tax Clearance Annex C 1 RufellenNo ratings yet

- Philippines Land Affidavit Details Agricultural and Residential PropertiesDocument3 pagesPhilippines Land Affidavit Details Agricultural and Residential PropertiesHarold EstacioNo ratings yet

- Deed of Absolute Sale of MotorcycleDocument1 pageDeed of Absolute Sale of MotorcyclerhvividcreationsNo ratings yet

- 0605version1999 09.02.2022Document2 pages0605version1999 09.02.2022Danel Dave BarbucoNo ratings yet

- BIR Form 0605Document3 pagesBIR Form 0605rafael soriao0% (1)

- PH Bir 0605Document2 pagesPH Bir 0605Anonymous onBMYp9YNo ratings yet

- BIR Form 0605Document4 pagesBIR Form 0605Rudy Bangaan63% (8)

- Schengen ItineraryDocument1 pageSchengen ItineraryPaolo MartinNo ratings yet

- Annual Medical Report Form PDFDocument8 pagesAnnual Medical Report Form PDFDaniel ReyesNo ratings yet

- Jurisprudence On Solidary CreditorsDocument2 pagesJurisprudence On Solidary CreditorsPaolo MartinNo ratings yet

- DA ITAD BIR Ruling No. 022-07 Dated February 9, 2007Document12 pagesDA ITAD BIR Ruling No. 022-07 Dated February 9, 2007Paolo MartinNo ratings yet

- Guide To Composition of Safety CommitteeDocument2 pagesGuide To Composition of Safety Committeeraighnejames1975% (4)

- DamagesDocument1 pageDamagesPaolo MartinNo ratings yet

- MARINA Memorandum Circular No. 2013-01Document11 pagesMARINA Memorandum Circular No. 2013-01Paolo Martin0% (2)

- Rules On Provisional Work Permit PDFDocument3 pagesRules On Provisional Work Permit PDFPaolo MartinNo ratings yet

- MARINA Authority To Acquire Ship - Checklist of Documentary RequirementsDocument1 pageMARINA Authority To Acquire Ship - Checklist of Documentary RequirementsPaolo MartinNo ratings yet

- Passion For JusticeDocument5 pagesPassion For JusticeGab CarasigNo ratings yet

- DamagesDocument1 pageDamagesPaolo MartinNo ratings yet

- Calculate VAT and branch profit taxDocument8 pagesCalculate VAT and branch profit taxjaysonNo ratings yet

- Court rules SMART liable for local franchise taxDocument7 pagesCourt rules SMART liable for local franchise taxDivinoCzarA.AndalesNo ratings yet

- Edited IOS NotesDocument89 pagesEdited IOS NotesBharatNo ratings yet

- Chapter 12 Dealings in PropertiesDocument6 pagesChapter 12 Dealings in PropertiesAlyssa BerangberangNo ratings yet

- Motion To Dismiss (Alonto)Document4 pagesMotion To Dismiss (Alonto)Primo Andreas Yosef PianoNo ratings yet

- Ans: B. National Internal Revenue LawDocument6 pagesAns: B. National Internal Revenue LawBebs Desales VillavicencioNo ratings yet

- NINJA Notes - Individual TaxationDocument26 pagesNINJA Notes - Individual TaxationMahesh Toppae100% (1)

- Principles of Public Finance (Notes For Final Exams by Muhammad Ali)Document27 pagesPrinciples of Public Finance (Notes For Final Exams by Muhammad Ali)Muhammad AliNo ratings yet

- Tax Reviewer MonteroDocument61 pagesTax Reviewer MonteroJan Ceasar ClimacoNo ratings yet

- CIR vs Carrie Realty HoldingsDocument11 pagesCIR vs Carrie Realty HoldingsJV PagunuranNo ratings yet

- Baran-Final Exam TaxDocument3 pagesBaran-Final Exam TaxAlona JeanNo ratings yet

- Direct and Indirect TaxesDocument14 pagesDirect and Indirect Taxeskratika singhNo ratings yet

- BIR Form Inventory2022 Annex A C of RMC No. 57 2015 RMIv1Document1 pageBIR Form Inventory2022 Annex A C of RMC No. 57 2015 RMIv1dvcompliance2024No ratings yet

- Business Tax ReviewerDocument86 pagesBusiness Tax ReviewerJhoren RemolinNo ratings yet

- Sales Judge Adviento BetterDocument27 pagesSales Judge Adviento BetterApple Ke-eNo ratings yet

- 32 Liddell V Collector of Internal RevenueDocument12 pages32 Liddell V Collector of Internal RevenueBULAGAS RafaelNo ratings yet

- Advertising Associates, Inc. vs. Court of Appeals 133 SCRA 765, December 26, 1984Document3 pagesAdvertising Associates, Inc. vs. Court of Appeals 133 SCRA 765, December 26, 1984Francise Mae Montilla MordenoNo ratings yet

- PSALM Vs CIRDocument2 pagesPSALM Vs CIRIshNo ratings yet

- Chapter 2 Value-Added TaxDocument23 pagesChapter 2 Value-Added TaxDudz Matienzo100% (5)

- Payments User Guide - English (2006)Document39 pagesPayments User Guide - English (2006)Gláucia CarvalhoNo ratings yet

- BIR Ruling No. 291-12 Dated 04.25.2012 PDFDocument5 pagesBIR Ruling No. 291-12 Dated 04.25.2012 PDFJerwin DaveNo ratings yet

- Pasinaya Forms March 2022 PDFDocument15 pagesPasinaya Forms March 2022 PDFVicky rederaNo ratings yet

- La Sallian Educational Innovators Foundation Inc, Vs CIR GR No. 202792 February 27, 2019Document4 pagesLa Sallian Educational Innovators Foundation Inc, Vs CIR GR No. 202792 February 27, 2019Junaid DadayanNo ratings yet

- XYZ Water Inc. FAN ProtestDocument16 pagesXYZ Water Inc. FAN ProtestRalf Arthur SilverioNo ratings yet

- ProblemsDocument12 pagesProblemsJohn Carlo J. DominoNo ratings yet

- Commissioner of Internal Revenue vs. Filinvest Development CorporationDocument7 pagesCommissioner of Internal Revenue vs. Filinvest Development Corporationcarl dianneNo ratings yet

- Md. Jehad Uddin Deputy Secretary Financial Institutions Division Ministry of FinanceDocument75 pagesMd. Jehad Uddin Deputy Secretary Financial Institutions Division Ministry of FinanceKhadeeza ShammeeNo ratings yet

- Sec 114Document9 pagesSec 114waqaswaNo ratings yet

- Tax 2 Transfer and Business Taxation Module 2020Document26 pagesTax 2 Transfer and Business Taxation Module 2020freezale roqasNo ratings yet

- Up Taxation Law Reviewer 2017 PDFDocument267 pagesUp Taxation Law Reviewer 2017 PDFManny Aragones100% (3)