Professional Documents

Culture Documents

F 1 F 2

Uploaded by

Rapha John0 ratings0% found this document useful (0 votes)

44 views11 pagestduudy

Original Title

f1f2

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttduudy

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

44 views11 pagesF 1 F 2

Uploaded by

Rapha Johntduudy

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 11

PRE-COMPREHENSIVE EXAMINATION

FINANCIAL ACCOUNTING 1 & 2

$¥.2011-2012

“Theories 1pteach

1

‘The operating cycle ofan entity is that span of time which

‘a. Coincides with an entity's business cycle which runs from one trough ofthe entity's business activity to the

next

Corresponds with ts natural busines yea which runs fram ane rough ofthe particular Firm’ businoss

activity tothe nex.

_lssetby the industry's trade association usualy on an average length of time forall entities which are

‘members ofthe association.

4. Runs rom cash disbursement for items of inventory through thei sale to the realization of eash from sale.

[At the Boginning ofthe current year, an investor acquired 308 ofthe ocdinary shares of another entity Inthe

current year, the investes has net eaings which exceeded dvidends paid. The investor mistakenly recorded

these transactions using the cost method instead ofthe equity method of accounting. What effect would this

have on investment account, net earnings, and retained earnings, respectively?

2 Overstate, overstate, overstate

'b.Overstato, understate, understate

&Understate, overstate, understate

1. Underetate, understate, understate

Ian inventory is transferred to investment property that ist be carried at fir, the remeasurement to flr value

3, Included in equity

by Inchded in profit or loss

© Incuded in retained earings

4. Aecounted fr as revaluation of inventory

Which ofthe fallowing best dscrbos residual value?

4. Theestimated net amount currently obtainable If the asst is at the ond of its useful ie

The present value of estimated future cash lows expected to arise fom the continuing use ofthe asset and

from its timate isposal

The amount at which the asset could be exchanged between knowledgeable and wing partios nan arm's

length transaction

44. The amount of cash or cash equivalents that could curently obtained by sling the asset in an orderly

‘isposat

Which ofthe following statements regarding depreciation struc?

2a. Anassot must be depreciated frm the date ofits purchase the date of sale

b, The annual depreciation charge shal be constant over the feof the asset

The total costs of an asset must eventually be depreciated

44. the carrying amount of an assets less than the residual value, deprecation I not charged

Contingent assets are usualy recognized when

a. Realized

1b. Occurrence is reasonably possible and the amount canbe reliably measured

‘&Oceurrence is probable and the amount can be reliably measured

1d, Theamountcan be reliably measured

Ifthe sale and leaseback transaction results ina finance lease, any exces of sale procoeds over the carrying

amounts

1. Deferred and amortized as income over the lease term

1, Deferred and amortized as income over theif ofthe asset

Recognized in the profit or loss immediately

4. Recognized in other comprehensive income

10.

a

2

13.

14

Uf the present value of 2 note issued In exchange for a property's las than Its face amount, the ifference shall

Amortized as interest expense over the life of the note

“Amortized as interest expense over the lf of the asset

Included in interest expense inthe year of issuance

be

| Included in the costo the asset

b

4

Which ofthe following ienota theoretical basis forthe allocation of expense?

3. Summarization

b. Classification

Profit maximization

immediate recognition

\Which ofthe following would be matched with current revenue ona basis other than association of causeand

effect?

3. Good!

Sales commission

Cost of goods sold

Purchases on account

‘The installation of accounting procedures forthe accumulation of accounting data is known 3s

a. Auditing

. Financlal Accounting

6 Gloctronie data processing

1d. Recounting system

eis a financing agreement thats usually done ona “without recourse, notification basis.

a. Pledge

b. Assignment

Factoring

6. Discounting

Any transtion loss on fist adosting PAS 19 shal be recognized

1. Asexpense immediately

Ik As expense over a maximum ofS years

a. Lonly

b. Monly

Either ort irevocably

44. Either or i revocably

‘Any transition gain on fist adopting PAS 19 shal be

‘8. Recognized as income immediately

b. Deferred and amorszed over a maximum of § years

© Credited to Retained Earrings

4. Credited to Equity

Which one ofthe following lt an adjunctaecount that should not be closed a the end of every accounting

period?

Allowance for doubtful accounts

be Fightin

‘&_Dscount on bonds payable

4

‘Share premium

Which ofthe following should be lnluded in plan assets?

L Assets held by long-term employee benefit fund

N.——Qualiying insurance policy

a tonly

b.tonly

& Bothtandit

Nether | nor

117. How should sales staff commission be dealt with when valuing inventors atthe lower of cost and net realizable

vue?

a. Added tocost

bored

&Deducted in arriving NRV

4. Deducted fram cost

28, These ae spoof principles, bases, conventions, rules and practices applied inthe preparation and presentation

of financial statements.

Accounting polices

Accounting principles

© Accounting standards

4. Accounting concepts

19. The use ofa discount lst account implies that cost ofa purchased inventory item is

| Invoice price

bist price

© Invoice price less the purchase discount taken

‘4, Invoic price less the purchase discount allowable whether or not taken

20. Which ofthe followings not a derivative?

Interest ate swap agreement

Futures contract

© Option

Regular way purchase or sale

Problems 2pts cach

4 During the curent year, Shawn Company incurred the following costs in connection with the issuance of bonds:

Printing and engraving 150,000

Legal fees 800,000

Fees pad to independent accountants

{or registration information 100,000

Commission pai to underwriter 1,500,000

‘what amount should be recorded as bond issue costs to be amortized ver the term ofthe bonds?

1. 2,550,000

». . 2,400,000

© 1500.00

3. 1,050,000

2. Hana Company had 700,000 ordinary shares authorized and 300,000 shares outstanding at January 12010. The

{allowing events occured during 2010

Januaty31 Declared 10% stock dividends

June 30 Purchased 100,000 shares

August Reissued 50,000 shares

November 30 Declared 2-or- stock split

‘On December 31, 2010, how many ordinary shates are outstanding?

a. 560,000

b. 600,000

630,000

4 660,000

(On November 3, 2010, Jessie Company declared a property dividend of equioment payable on March 1, 2011. The

carrying amount ofthe equlpmant 3,000,000 and the flr values 2,500,000 on November 3, 2030.

However, the fal value less costo distribute the equipment s 2,200,000 on December 31, 2010 and 2,000,000 on

‘Mare, 2012

‘what the dividend payable on December 31, 20107

2,500,000

b. 2,200,000

= 3,000,000

ao

‘whats the measurement af the equipment on December 31,2010?

a. 2,500,000

b. 2,200,000

3,000,000

. 2,000,000

\What amount of loss is recognized in profit or loss on March 1, 20117

‘@ 300,000

200,000

‘= 500,000

40

‘on December 28, 2010, Mikee Company purchased goods costing 500,000. The terms were F.0.B. destination, Some

‘ofthe costs Incurred in connection with the sale and delivery ofthe goods were a follows

Packaging for shipments 10,000

Shipping 15,000

Speciathandlings 25,000

“These goods were recelved on December 31,2010. On December 31, 2010, what amount of costs for these

{g00ds shouldbe incused in inventory?

a. 545,000

b. 535,000

© $20,000

4. 500,000

‘On January 1, 2005 5) Company purchased 2 naw building a a cost of 6,000,000. Depreciation was computed on

straight ine baci at 4% per year. On January 2, 2010, the bulling was revalved ata fir value of 8,000,000

laneringincome tax, what the revaluation surplus on January 3, 20107

4,000,000

. 3,200,000

2,000,000

4. 6,400,000

‘What is the depreciation for 2010?

320,000

b. 400,000

© 100,000

4. 240000

9. Whatisthe revaluation surplus on December 31,2010?

a. 3.072,000

1,900,000

& 3,040,000

4 1820,000

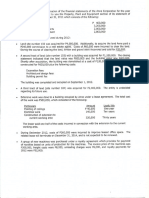

10. On uly, 2032, Maroons Company acquired 3 held to maturity security in Cobra Starship Company's 10-year 12%

bonds with a face value of P5,000,000, for PS 386,300. Interest s payable semi-annually on January 1 aad July 1. The

bonds mature on uly 1, 2016. Bonds effective rate is 10%, On Decemibar 31,2032, Maroons Company soldits debt

Instrument for 5,500,000.

|What amount of goin should Maroons Company recognize asa result of the dsposal?

1M 385 210438

b. a76,604 6. 245,956

ANSWER:

Seling Price 5,500,000.

‘amortized Cost 5.289.566

Gain onsale of investment Bao.ass

Acausition &

interest date Interest Eorned @ 6% rate _Inteestincome Strate Premium Amortization Book Valve

July, 2012 ° © ° 5.386.300

ec. 31, 2011 300,000 269,315 30,585 5,355,515

Duly 2, 2012 300,000, 267,781 32,239, 5)323,396

Dec. 31, 2012 300,000 266,170 33.830, 209.566

11, PLOT has ahalance in the telephone wires account of 1,234,000 on January 1, 2016, During 2016, PLOT installed

new telephone wices a follows:

May August December

Cost of new wires installed 500,000 800.000 400,000,

Cost of ld wires replaced 360,000 300,000,

Proceeds from sale of old wires 40,000 30,000

Using the retirement and replacement methods, whats the amount of depreciation that should be recognized in

2016?

Retirement Replacement

a, 580,000 830,000

6. 580,000 3,630,000

© 660,000 "660,000,

. 660,000 1,630,000

ANSWER: A

Retirerant Method:

Original cst of asses rere (360,000 + 300,000) 60,000

Less Salvage value of assets retired 70,000

Depreciation 390.000

Replacement Method!

Replacement cost of assets (500,000 + 400,000), 300,000

Less: Salvage value of asets retired 79.000

Depreciation eaa0.000

42, Punkrock Company had 600,000 ordinary sharas oustanding on January 2, 2011. During 2011, Punkrockissued right

to acquire one ordinary share at P20 the ratio fone new share for every shares outstanding, The market value

ofthe ordinary share immediately prior to the right issue Is P35. The rghts were exercised on October 1, 2011. The

net income of Punkrock Company forthe year I P8,580,000.

\hat amount should ba reported as basi earnings per share?

ote «as

& deo a Be

swe 8

Teweiaiabiotn «SL

Maret a of share eh on %

Thao a fa :

Morcetonwot hres %

saysmene ar ana

(alnary shares, Jan. 3

‘Ordinary shares issued through right on Oct 2 (600,000/4)

Total ordinary shares, Dec. 33

January 1 600,000 x 35/30x 9/12

October 1: 750,000 3/12

Avorage number of shares

Basie Earnings per share (8,580,000/712,500)

13, The third year ofa construction project began with aF30,000 balance in Construction in Progress. Included in that

figures P5,000 of interest capitalized inthe fist swo years, Construction expenditures during the year were P80,000,

"which were incurred evenly throughout the entre year. The company has had over P300,000 interest-bearing debt

‘outstanding the third year, ata weighted avarage rate of 9 percent, How much is the interest forthe third year is

exptalzed?

a. 3,600 © 9360

b 6300 4. 9.900

ANSWER:

Beginning balance, Construction in Progress 30,000

Current expenditures, incurred evenly (80,000/2), ‘49000

‘Average current expenditures 70,000

‘Weighted average rato —_ 2%

Interest eapialized E30

14, On December 17,2013, an explosion ocurred at Jagger Company plant causing extensive property damage to arco

buildings, Although no claims had yet been asserted against Jagger Company by March 10,2012, Jagger's

management and counsel concluded that itis reasonably possible that Jagger will be cesponsibe for damages, and

‘that P2,500,000 would be reasonable estimate ofits ably. lager’sP10,000,000 comprehensive publ labilty

polly has 500,000 deductible clause.

In Jagger's December 31, 2025 financiat statements, which wore Issued on March 25,2012, how should this item be

reported?

3. Mofootnote or accruals necessary

b. Asa footnote disclosure indicating the possible oss of ®500,000,

© Asan acerved lability of P5C0,000

4. As@ footnote disclosure indicating the possible loss of P2,500,000

ANSWER: B

‘When the loss contingency s only possible and canbe reasonably estimate it requires no accrual, only a

disclosure s necessary indicating the posible loss of 800,000. Based on comprehensive insurance, any damage

in excess of P500,000 to be paid by the insurance company.

415, Nick Minaj Record’ lables at Dacember 31, 2011 were as follows

‘Recounts payable and accrued intrest 2,000,000

v.

18

19.

S.year 10% Notes Payable 5,000,000

Part ofthe loans for Nick Minato appropriate a fixed amount out of its accu lated profits and losses annually

tnt the amount of appropriation has equaled the face ofthe obligation. As of December 31,2033, Nici Mina

cords has yet to comply with the loan agreement.

In ts December 31, 2011 statement of Financial postion, Nik Mina) should report current ables at

2. 2,000,000, 5,000,000

2,500,000 7,000,000

ANSWER:

‘All accounts are cutent

AS 1 pr. 68, hen an entity breaches an undertaking under a long-term loan agreement on or before balance

sheet date and the liability Becomes payable on demand, the lability s classified as current.

(On October 2, 2010 Jet Corporation issued 10,000 shares ofthe 25 par treasury oxdinary share fr a parcel of land to

bbe hel fora future plant site. The treasury share was acquired by Jat at a cost of 30 per share. Jet's ordinary share

had a fir market value of 40 per share on October 1, 2010. Jt recsived $0,000 from the sale of scrap when an

existing structure onthe site was raze.

[Atwhatamount should the land be carro? ponies = 3 ee

a. 250,000 (eee)

300000 =a

350,000 ore

4 400,000

(on May 1, 2010 Red Hood Company issued 2,000,000, 10 yar, 8% bonds at 205 including accrued interest These

bonds are dated January 1, 2010 Interests payable semi-annually on January 1 and Jly 1. Transaction costs of

10,000 were paid by Red Hood.

‘what isthe net cash receipt fom the bond issuance?

ano aee aS

2,100,000 — ss

i zine Bee

; ED

coon ce)

2

[At the end of 2022, Vanity Corparation has one timing ifference that wl roverse and cause taxable amounts 10275,

100 n 2012, 300,000 in 2013 and 300,000 in 2014. Vanity’s pretax financial income for 2011 i 2,500,000 and the tax

rate is 32%. There are na deferred taxes a the beginning of 2011.

Mow much shouldbe the income tx. or 2017 sm oo

+‘ a Cae oR)

20000 Cae oy

428,750 [2eOD80)

& ss0000 Sarre 22. + 200 &00

: =

uo Company i awholstr etd candles. The ctv rem e124 ing ine presented below

ie___Tramactions Unt

fine Ot tnvrybal 6000” 2000

oh puss 9.000 2400

2 Ses iano

19 Puchaws 14400. 2600

2 San ano

29 Purchases ‘4800 27.00

Under the FIFO inventory system, how much the ending inventory of tem #1234 at June 30?

a. 280,800 ce

b. 278,400 (ee ee ee

302,400 eae 290 x 26.00 \ETID

316,800 az By

20, Under the weighted average cost periadic inventory system, how much is the ending inventory of tem #1238 at

June 302 Gao 22D. NO OO

2. 278,400 ee 2A Ze COD

b. 294,720 440 z a

& 302,400 “eae 23 40

oa promo 7ASLx ao =Ay 37

Sem 2

21. draft of Bell Company's 2023 statement of financial position reported total assets of 3,093,750 of which the

following Items were included

“Treasury share of Bell at cost, which

tpoorimats mare leon Decor 31 soon

nae! ptr ooo

Cah sured vale fe nsrarc on cor. exces zs

Tons reserve Det oso

cedars ena ken thera vsDacrr 34,201 cecal ruc

postion! i

meee \ea3s0

b. Losaas0 (20080)

© Loszias ies

16750 ieee

Toss 22

22, Asof June 30, 2010, the bank statement af Marine Trading had an ending balance of 373,612. The following balances

werenpembed nthe coune of ecanling the bak bln :

+ Thebank erroneously credited Marine Trading for 2,150 on June 19

1+ uring the month, the benk charged NSF checks amounting o 2,340 af which 800 had been deposited onthe

24" ofsune

+ Collections for June 30 totaling 10,330 was deposited the following month

+ Checks outstanding as of lune 30 were 30,205,

1+ Notes collected by the bank for Marine Trading were 8,180 and the corresponding bank charges were 50

Whats the adjusted bank balance on June 30,2030?

a. 351587

353927

358,147

6 359,687

23. Mercury Company bought a patent fo 600,000n January 2, 2008, at which time the patent hed an estimated useful

life offen years. On January 2, 2012 was determined thatthe patent’ useful fe would expire atthe end of 2014,

How much should Mercury record as amortization expense for this patent on December 31, 2011?

e000 geo oc0] 07 GOOD

305000 ae

© zaeo Gee)

& ano B10 Cop/a = les ee

24 On anuary 2, 2013, Earth Company bought trademark rom Mars Company for 600,000. Earth retained an

Independent consultant, who estimated the trademark’ remaining life to be 20 years, Is amortized cost on Mats!

ecounting records was 456,000

28.

26.

‘what amount should the trademark be initially recorded?

2. 456,000

b. 570,000

585,000

‘4 600,000

Computer Inc. had 300,000 of ordinary shares ised and outstanding st December 32, 2010, On July 1, 2011, an

additonal 50,000 ordinary shares were isued for eash. Computer aso had unexercsed stock options to purchase

£20,000 ordinary shares at 15 per share outstanding atthe beginning and end of 2011. The average market price of

(Computer's ordinary share was 20 during 2013

‘Whats the numberof shares that should be used in computing diluted earings per share?

a 325,000

b. 335,000

360,000

365,000

ANSWER:

January 1 300,000.12/12= 300,000

July 50,000. 6/12 = 25,000

325,000

erage 325,000,

Share sued for no consideration schedule 1) 10,000

Total umber of shares tobe usec son

Schedule 1

‘Assumed exercised and isue of shares ‘40,000

Les: Assumed shares issued if purchased for market price:

Assume proceeds (4,000 x15) 600,000

+ Average market price 20,000 30,000

‘Shares issued (ree for no consierction 909

‘Bugs Co, sole to Bunny Co, a 200,000, 8% 5-year note that required five equal annual year-end payments. This note

‘was iscounted to yield 9% rate ta Bunny. The present value factors ofan ordinary anuity of PL for S periods areas

Fallows:

Be 3.982

9% 3.890

\what should be the total interest revenue earned by Bunny on this note?

= 59500

b. 55,610

80,000

4. 99,000

ANSWER:

Total futuee payments (50,100% 5) 250,500

Less: PV value of note 194.890

Total interest revenue —S5510

Face value ofthe note 200,000

“Present value annuity 3.992

Required year-end annual payment 50,100

XPV factor of ordinary annuity of for S periods at yet rate _ 3.890

2.

22.

Present Value of note

‘Abe Company, lessor, leases its equipment under an operating ease. Te lease term is S years and the lease

payments are made in advance an January 1 ofeach year as shown inthe fllowing schedule:

January 1, 2009, 1,000,000

January 1, 2020 1,000,000

January 12012, 4,400,000

January 1, 2022 3,700,000,

January 1, 2023, 1,900,000,

(On December 31, 2030, what amount shouldbe recognized as ren receivable?

1,400,000

b. 200.000

& 400,000

4 °

ANSWER:

‘Average annual rental (7,000,000/5) 400,009

Rent income for 2009 and 2010 (1,400,000 2) 2,800,000

Rent recelved for 2008 and 2010 (1,000,000+ 1,000,000} 2,000,000

Rent receivable =s0.000

‘The folloing were taken from the incomplete financial data of Sam Company, a calendar year mefchandlsing

corporation:

Dec.31.2010 Dec. 31,2001

‘Trade Aecounts Recalvable 840,000 760,000

Inventory 3,500,000 2,000,000

‘Accounts Payable 950,000 980,000

‘Accrued general & administrative expenses 130,000 170,000

Prepaid seling expense 150,000, 330,000

Property, plant and equipment 1,750,000 11420,000

Patent 25,000 300,000

Investmentin Associate 550,000 720,000

Investment equity Oc 490,000 520,000

“Te following addtional information were made avaliable: cash payments for seling and administrative expenses

as 900,000, payments for purchases, net of cash clscounts of 70,000 was 1,580,000. Equipment with a book value

oF 200,000 was sold for 250,000. There were no acquisitions of property, plant and equipment and other

transactions affecting net income curing the period. There were no acqustions of investment during 2013. Income

aerate is 22%,

If the company reported comprehensive income of 285,600 net of tax, whats the amount collections on trade

receivables in 20117

a 3,295,000

3,335,000

&3595,000

3.655.000

ANSWER: D

‘Comprehensive income before tax (285/600/68%) 420,000

‘Uncealized gain (520,000-400,000) (220,000)

{Gain fom sale of PPE (250,000 ~ 200,000) (0,000)

Patent amortization (425,000 ~ 300,000) 325,000

PE Depreciation (1,750,000 ~1,420,000 ~ 200,000) 130,000

Selling 2 gen exp. other than depreciation and amortization 960,000

Grats profit, 1,465,000

Cost of Sales 2,330,000

Sales 3,595,000

‘Trade RecoWvabes beginning 40,000

‘Trade Receivables ending 139,000)

Collection of trade receivables 3.885.009

23. Rainbow Company has the following information pertaining to is biological asets forthe yeer 2022: Aherd of 10,

2.yea od animals was held at January 3, 2022. Ten animals aged 25 years were purchased on lly 2, 2012 or 5400,

and ten animals were born on July 1, 2012. No animals were sold or disposed of during the period. Per unit ai

‘vals les estimated point-oFsale costs were as follows

2.0. year old animal at January 1, 2012 5,000

[Newborn animal at July 1, 2012 3,500

25-year old animal a uly 2, 2012 5,400

[Newborn animal at December 31,2032 3,600

(05-year old animal at December 31,2012 4,000

20-year old animal at December 31, 2012 5,250

25-year old animal at December 31,2012 5.550

'30- year old animal at December 31, 2012 5,000

How much ofthe increase inthe fair value ofthe biological assets is due to price change?

b. 25,000,

26500,

4 27500

30. How much ofthe inerease inthe fir value of the asst is due to bilogical change?

a. 75,000

b 79,500

© 110000

4 118500

ANSWER:

Increase in FV less estimated point of sale costs due to price change

300(5,280-$,000) 25,000

3015 550- 5,400), 1,500

3043 600 3500) 4.000

‘otal 22500

ANSWER: D

Increase in FV ess estate point of sale costs due to price change

100(6,000 5,250) 75,000

10(5,000-5,550), 4500

10(4,000- 3,600), 44,000

10% 3500 35005

Total 300

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- ExamAnnouncement03s2018 FOE2018 PDFDocument8 pagesExamAnnouncement03s2018 FOE2018 PDFRapha JohnNo ratings yet

- Room Assignment BCLDocument7 pagesRoom Assignment BCLRapha JohnNo ratings yet

- Ra Cpa Cdo May2018Document11 pagesRa Cpa Cdo May2018Rapha JohnNo ratings yet

- 2017 Pds GuidelinesDocument4 pages2017 Pds GuidelinesManuel J. Degyan75% (4)

- Form 1 BCLTE EOPT Mandatory RegistrantsDocument1 pageForm 1 BCLTE EOPT Mandatory RegistrantsRapha JohnNo ratings yet

- RA CPA CDO May2018 PDFDocument17 pagesRA CPA CDO May2018 PDFPhilBoardResultsNo ratings yet

- 6 - FAQs For FIDELITY BONDINGDocument3 pages6 - FAQs For FIDELITY BONDINGRapha JohnNo ratings yet

- P1 1stpreboard PDFDocument16 pagesP1 1stpreboard PDFRapha JohnNo ratings yet

- Capital Budgeting Practice QuestionsDocument5 pagesCapital Budgeting Practice QuestionsMujtaba A. Siddiqui100% (5)

- #1 Bclte Reviewer 2018Document3 pages#1 Bclte Reviewer 2018jrduronio90% (20)

- MamaDocument1 pageMamaRapha JohnNo ratings yet

- AntonioDocument5 pagesAntonioRapha JohnNo ratings yet

- Answer Key 042016fDocument12 pagesAnswer Key 042016fRapha JohnNo ratings yet

- The John Adair Handbook of Management and Leadership.Document242 pagesThe John Adair Handbook of Management and Leadership.Mapycha100% (1)

- Independent Auditor'S Report: The Board of Directors Philippine Deposit Insurance Corporation Makati CityDocument17 pagesIndependent Auditor'S Report: The Board of Directors Philippine Deposit Insurance Corporation Makati CityRapha JohnNo ratings yet

- Bonds PDFDocument4 pagesBonds PDFRapha JohnNo ratings yet

- Lease PDFDocument4 pagesLease PDFRapha JohnNo ratings yet

- JeeeeeeeffDocument8 pagesJeeeeeeeffRapha JohnNo ratings yet

- Corpo PDFDocument4 pagesCorpo PDFSer CisNo ratings yet

- TF PDFDocument3 pagesTF PDFRapha JohnNo ratings yet

- Capital Budgeting Practice QuestionsDocument5 pagesCapital Budgeting Practice QuestionsMujtaba A. Siddiqui100% (5)

- BLT FinalpreboardDocument5 pagesBLT FinalpreboardRapha JohnNo ratings yet

- 203 Cat Generalbrochure Topnotch 2017 ADocument24 pages203 Cat Generalbrochure Topnotch 2017 ANicolas MercadoNo ratings yet

- AP 5902 LiabilitiesDocument11 pagesAP 5902 LiabilitiesAnonymous Cd5GS3GM100% (1)

- Quiz Bee - Pa1 & Toa - DifficultDocument4 pagesQuiz Bee - Pa1 & Toa - DifficultskylavanderNo ratings yet

- ApDocument6 pagesApRapha JohnNo ratings yet

- AP 5902 LiabilitiesDocument11 pagesAP 5902 LiabilitiesAnonymous Cd5GS3GM100% (1)

- Taxation Law 2 ReviewerDocument54 pagesTaxation Law 2 ReviewerNgan Tuy100% (2)

- 2015 Joint Small Business Credit SurveyDocument13 pages2015 Joint Small Business Credit SurveyRapha JohnNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)