Professional Documents

Culture Documents

Pimentel v. Aguirre, Et Al.

Uploaded by

Noreenesse SantosCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pimentel v. Aguirre, Et Al.

Uploaded by

Noreenesse SantosCopyright:

Available Formats

ADMIN LAW

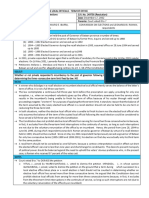

Title: Pimentel v. Aguirre, et al. G.R. No. 132988

Date: July 19, 2000

Ponente: Panganiban, J.

Hon. ALEXANDER AGUIRRE in his capacity as Executive

AQUILINO Q. PIMENTEL JR., Secretary, Hon. EMILIA BONCODIN in her capacity as

petitioner Secretary of the Department of Budget and Management,

respondents

FACTS

On December, 1997, the President issued AO 372 (Adoption of Economy Measures in Government for FY 1998). The

AO provided that (a) 10% of the Internal Revenue allotment to LGUs is withheld. Further it (b) "directs" LGUs to reduce

their expenditures by 25 percent. Subsequently, on December 10, 1998, President Estrada issued AO 43, amending

Section 4 of AO 372, by reducing to five percent (5%) the amount of internal revenue allotment (IRA) to be withheld

from the LGUs.

Petitioner contends that by issuing AO 372, the President exercised the power of control over LGUs in contravention

of law. Moreover, withholding 10% of the IRA is in contravention of Sec 286 LGC and of Sec 6 Article X of the

Constitution, providing for the automatic release to each of these units its share in the national internal revenue.

The Solicitor General, on the other hand, argues that the aforesaid AO was purportedly in order to cope with the

nation’s economic difficulties brought about by the peso depreciation on that said period. Further, he claims that AO

372 was issued merely as an exercise of the President’s power of supervision over LGUs. It allegedly does not violate

local fiscal autonomy, because it merely directs local governments to identify measures that will reduce their total

expenditures for non-personal services by at least 25 percent. Likewise, the withholding of 10 percent of the LGUs’

IRA does not violate the statutory prohibition on the imposition of any lien or holdback on their revenue shares,

because such withholding is "temporary in nature pending the assessment and evaluation by the Development

Coordination Committee of the emerging fiscal situation."

ISSUE/S

1. Whether or not Section 1 of AO 372, insofar as it "directs" LGUs to reduce their expenditures by 25 percent is a valid

exercise of the President's power of general supervision over local governments? YES

2. Whether or not Section 4 of AO 372, which withholds 10 percent of their internal revenue allotments, are valid exercises

of the President's power of general supervision over local governments? NO

RATIO

1. YES.

There are several requisites before the President may interfere in local fiscal matters: (1) an unmanaged public

sector deficit of the national government; (2) consultations with the presiding officers of the Senate and the House

of Representatives and the presidents of the various local leagues; and (3) the corresponding recommendation of

the secretaries of the Department of Finance, Interior and Local Government, and Budget and Management.

Furthermore, any adjustment in the allotment shall in no case be less than thirty percent (30%) of the collection

of national internal revenue taxes of the third fiscal year preceding the current one1.

Petitioner points out that respondents failed to comply with the above requisites before the issuance and the

implementation of AO 372. At the very least, the respondents did not even try to show that the national

government was suffering from an unmanageable public sector deficit. Neither did they claim having conducted

consultations with the different leagues of local governments. Without these requisites, the President has no

authority to adjust, much less to reduce, unilaterally the LGU's internal revenue allotment.

Although the Supreme Court agrees with the Petitioner that the requisites were not complied with, it still holds

that the President’s directive in AO 372 is in conformity with law, and does constitute interference to local

autonomy. There is interference if Section 1 of AO 372 was couched in mandatory or binding language. While the

wordings of Section 1 of AO 3722 have a rather commanding tone, the provision is merely an advisory to prevail

upon local executives to recognize the need for fiscal restraint in a period of economic difficulty. Indeed, all

concerned would do well to heed the President's call to unity, solidarity and teamwork to help alleviate the crisis.

It is understood, however, that no legal sanction may be imposed upon LGUs and their officials who do not follow

such advice.

2. NO.

A basic feature of local fiscal autonomy is the automatic release of the shares of LGUs in the national internal

revenue as mandated by the Constitution. The Local Government Code. specifies further that the release shall be

made directly to the LGU concerned within five (5) days after every quarter of the year and "shall not be subject

to any lien or holdback that may be imposed by the national government for whatever purpose.

The use of the term "shall" shows that the provision is imperative. Therefore, Section 4 of AO 372, which orders

the withholding of 10 percent of the LGUs' IRA "pending the assessment and evaluation by the Development

Budget Coordinating Committee of the emerging fiscal situation" in the country clearly contravenes the

Constitution and the law. Although temporary, it is equivalent to a holdback, which means "something held back

or withheld, often temporarily”. Hence, the "temporary" nature of the retention by the national government does

not matter. Any retention is prohibited. Therefore, the President clearly overstepped the bounds of his lawful

authority when he issued Section 4 of AO 372.

RULING

WHEREFORE, the Petition is GRANTED. Respondents and their successors are hereby permanently PROHIBITED from

implementing Administrative Order Nos. 372 and 43, respectively dated December 27, 1997 and December 10, 1998,

insofar as local government units are concerned.

NOTES

DISSENT: Kapunan

o On the President's power as chief fiscal officer of the country. Justice Kapunan posits that Section 4 of AO 372

conforms with the President's role as chief fiscal officer, who allegedly "is clothed by law with certain powers to

ensure the observance of safeguards and auditing requirements, as well as the legal prerequisites in the release

and use of IRAs, taking into account the constitutional and statutory mandates, citing instances when the

President may lawfully intervene in the fiscal affairs of LGUs.

Section 284 (c) of the Local Government Code

1

o Section 284. Allotment of Internal Revenue Taxes. - Local government units shall have a share in the national

internal revenue taxes based on the collection of the third fiscal year preceding the current fiscal year as follows:

xxx

(c) On the third year and thereafter, forty percent (40%).

xxx

2 The above Section states that (LGUs must) "identify and implement measures x x x that will reduce total

expenditures x x x by at least 25% of authorized regular appropriation."

(SANTOS, 2B 2017-2018)

You might also like

- Manila International Airport Authority v. Court of AppealsDocument2 pagesManila International Airport Authority v. Court of AppealsNoreenesse Santos100% (1)

- Whether or Not The Reduction of Validity by The Court of Appeal Assailed Law Provide Is Proper? - YESDocument9 pagesWhether or Not The Reduction of Validity by The Court of Appeal Assailed Law Provide Is Proper? - YESjeliena-malazarte100% (1)

- XYZ Pvt Ltd Internal Audit Programs & Controls 2008-09Document14 pagesXYZ Pvt Ltd Internal Audit Programs & Controls 2008-09CMA Pankaj JainNo ratings yet

- Alvarez Vs GuingonaDocument3 pagesAlvarez Vs GuingonaRaymond Roque100% (1)

- President's Power of Supervision Over LGUsDocument9 pagesPresident's Power of Supervision Over LGUsLan100% (1)

- Sema v. Commission On ElectionsDocument4 pagesSema v. Commission On ElectionsNoreenesse SantosNo ratings yet

- 01) Boy Scouts of The Philippines V CoaDocument3 pages01) Boy Scouts of The Philippines V CoaAlfonso Miguel LopezNo ratings yet

- Art. X, Sec. 6 – Just share of LGUs includes all national taxesDocument4 pagesArt. X, Sec. 6 – Just share of LGUs includes all national taxesTherese Espinosa83% (12)

- Supreme Court upholds unconstitutionality of Dinagat Islands province creationDocument2 pagesSupreme Court upholds unconstitutionality of Dinagat Islands province creationRaynold delta100% (1)

- Philippine Society For The Prevention of Cruelty To Animals v. Commission On Audit, Et Al.Document2 pagesPhilippine Society For The Prevention of Cruelty To Animals v. Commission On Audit, Et Al.Noreenesse SantosNo ratings yet

- Samahan NG Mga Progresibong Kabataan v. Quezon City PDFDocument4 pagesSamahan NG Mga Progresibong Kabataan v. Quezon City PDFNoreenesse Santos100% (5)

- Panaguiton Digest Pimentelvs AguirreDocument2 pagesPanaguiton Digest Pimentelvs AguirrecpanaguitonNo ratings yet

- Admin Law Creation ExemptionDocument4 pagesAdmin Law Creation ExemptionNoreenesse SantosNo ratings yet

- National Liga Vs Paredes Case DigestDocument3 pagesNational Liga Vs Paredes Case DigestYodh Jamin OngNo ratings yet

- Cordillera Broad Coalition Vs COADocument2 pagesCordillera Broad Coalition Vs COARaymond RoqueNo ratings yet

- Boy Scouts V COADocument3 pagesBoy Scouts V COAattyalanNo ratings yet

- Rivera III v. Commission On ElectionsDocument1 pageRivera III v. Commission On ElectionsNoreenesse SantosNo ratings yet

- SC Rules on Local Officials' SuspensionDocument4 pagesSC Rules on Local Officials' SuspensionNOLLIE CALISING100% (1)

- League of Cities v. COMELEC (G.R. No. 176951)Document3 pagesLeague of Cities v. COMELEC (G.R. No. 176951)Roward100% (1)

- Villafuerte V Robredo DigestDocument2 pagesVillafuerte V Robredo DigestJose Ramon Ampil50% (2)

- Rodolfo Ganzon Suspension CaseDocument2 pagesRodolfo Ganzon Suspension CaseAizaLiza100% (1)

- Miranda V AguirreDocument2 pagesMiranda V AguirreFidela Maglaya100% (1)

- Simple. Effective. Simply Effective.: Jesse Mecham, CPADocument45 pagesSimple. Effective. Simply Effective.: Jesse Mecham, CPADonald B Baker100% (1)

- COMELEC Plebiscite Nullified for New Province CreationDocument2 pagesCOMELEC Plebiscite Nullified for New Province CreationKeilah Arguelles100% (2)

- Miranda vs. Aguirre DigestDocument2 pagesMiranda vs. Aguirre DigestAlfred BryanNo ratings yet

- Mandanas vs. Ochoa DigestDocument6 pagesMandanas vs. Ochoa DigestJamiah Hulipas100% (8)

- Digest of Magtajas v. Pryce Properties Corp. (G.R. No. 111097)Document2 pagesDigest of Magtajas v. Pryce Properties Corp. (G.R. No. 111097)Rafael Pangilinan94% (16)

- Dadole vs. COA, G.R. No. 125350Document4 pagesDadole vs. COA, G.R. No. 125350Roward100% (1)

- Ganzon Vs CADocument3 pagesGanzon Vs CAKeilah Arguelles100% (1)

- Navarro V Ermita PubCorp DigestDocument1 pageNavarro V Ermita PubCorp DigestErika Bianca Paras100% (2)

- Rural Bank of Makati Vs Municipality of MakatiDocument1 pageRural Bank of Makati Vs Municipality of MakatiRenzo JamerNo ratings yet

- Disomangcop Vs DatumanongDocument5 pagesDisomangcop Vs DatumanongRaymond RoqueNo ratings yet

- 37 Distinguish Public Corporations From GOCC - As To Personality Philippine Fisheries Development Authority v. CADocument5 pages37 Distinguish Public Corporations From GOCC - As To Personality Philippine Fisheries Development Authority v. CATootsie GuzmaNo ratings yet

- Pimentel v. Aguirre, Et Al.Document2 pagesPimentel v. Aguirre, Et Al.Noreenesse Santos100% (1)

- Benefits of Federalism and Parliamentary Government for the PhilippinesDocument19 pagesBenefits of Federalism and Parliamentary Government for the PhilippinesfranzgabrielimperialNo ratings yet

- Capital Budgeting Idea For Netflix Inc.Document26 pagesCapital Budgeting Idea For Netflix Inc.PraNo ratings yet

- Talaga v. Commission On ElectionsDocument3 pagesTalaga v. Commission On ElectionsNoreenesse SantosNo ratings yet

- Alvarez V Guingona DigestDocument4 pagesAlvarez V Guingona DigestJamiah Hulipas67% (3)

- Joson V TorresDocument2 pagesJoson V TorresMaureen Co50% (2)

- Pimentel Vs AguirreDocument3 pagesPimentel Vs AguirreKR ReborosoNo ratings yet

- Calculating Overhead VariancesDocument12 pagesCalculating Overhead VariancesKella PradeepNo ratings yet

- Datu Kida Vs SenateDocument3 pagesDatu Kida Vs SenateChikoy Anonuevo100% (1)

- Samson v. AguirreDocument2 pagesSamson v. AguirreNoreenesse SantosNo ratings yet

- The Province of North Cotabato v. The Gov. of The Republic of The Phils. Peace PanelDocument4 pagesThe Province of North Cotabato v. The Gov. of The Republic of The Phils. Peace PanelNoreenesse SantosNo ratings yet

- PublicCorp - Cordillera Broad Coalition Vs COADocument2 pagesPublicCorp - Cordillera Broad Coalition Vs COARhea Mae A. SibalaNo ratings yet

- Mendoza v. Commission On ElectionsDocument2 pagesMendoza v. Commission On ElectionsNoreenesse SantosNo ratings yet

- Social Justice Society v. Atienza, Jr.Document5 pagesSocial Justice Society v. Atienza, Jr.Noreenesse Santos100% (1)

- Digest of Limbona v. Mangelin (G.R. No. 80391)Document3 pagesDigest of Limbona v. Mangelin (G.R. No. 80391)Rafael Pangilinan80% (5)

- CD Acord vs. ZamoraDocument2 pagesCD Acord vs. ZamoraJane Sudario100% (2)

- Sangalang v. Intermediate Appellate CourtDocument4 pagesSangalang v. Intermediate Appellate CourtNoreenesse Santos100% (1)

- Salalima Vs GuingonaDocument2 pagesSalalima Vs GuingonaRaymond Roque100% (1)

- 1081 Camid Vs Op DigestDocument2 pages1081 Camid Vs Op DigestLennart Reyes67% (3)

- Province of Batangas Vs RomuloDocument2 pagesProvince of Batangas Vs RomuloCelinka Chun100% (3)

- Case Digest: Pimentel Vs AguirreDocument1 pageCase Digest: Pimentel Vs AguirreMaria Anna M Legaspi80% (5)

- Digest of Lina v. Paño (G.R. No. 129093)Document1 pageDigest of Lina v. Paño (G.R. No. 129093)Rafael Pangilinan50% (2)

- G.R. No. 195770 Pimentel v. Executive Secretary July 17, 2012Document2 pagesG.R. No. 195770 Pimentel v. Executive Secretary July 17, 2012franzadon100% (2)

- Police Power OverreachDocument3 pagesPolice Power OverreachNoreenesse SantosNo ratings yet

- Basco v. PAGCOR, 197 SCRA 52-DigestDocument1 pageBasco v. PAGCOR, 197 SCRA 52-DigestAlleine Tupaz100% (1)

- Disomangcop Vs DPWH SecretaryDocument2 pagesDisomangcop Vs DPWH SecretaryKhryz Callëja86% (7)

- LGUS Eminent Domain PowersDocument3 pagesLGUS Eminent Domain PowersNoreenesse SantosNo ratings yet

- Tano v. SocratesDocument3 pagesTano v. SocratesNoreenesse SantosNo ratings yet

- Cawaling V COMELEC Digest Issue Pertaining Only To The GR AssignedDocument2 pagesCawaling V COMELEC Digest Issue Pertaining Only To The GR AssignedJamiah HulipasNo ratings yet

- COA ruling on GenSan early retirement programDocument2 pagesCOA ruling on GenSan early retirement programRonnie Garcia Del RosarioNo ratings yet

- Local Officials Eligible for Recall Election After Serving 3 TermsDocument3 pagesLocal Officials Eligible for Recall Election After Serving 3 TermsNoreenesse SantosNo ratings yet

- Province of Batangas v. RomuloDocument4 pagesProvince of Batangas v. RomuloNoreenesse Santos100% (1)

- Atienza v. Villarosa DigestDocument6 pagesAtienza v. Villarosa DigesttinctNo ratings yet

- Digest of Drilon v. Lim (G.R. No. 112497)Document2 pagesDigest of Drilon v. Lim (G.R. No. 112497)Rafael Pangilinan71% (7)

- Cawaling Vs COMELEC DigestDocument2 pagesCawaling Vs COMELEC DigestHaroun Pandapatan67% (3)

- Samson v. AguirreDocument2 pagesSamson v. AguirreCristelle Elaine Collera100% (3)

- Lucena Grand Central Terminal Inc. v. JAC Liner Inc.Document2 pagesLucena Grand Central Terminal Inc. v. JAC Liner Inc.Noreenesse Santos100% (1)

- Batangas Catv Vs CADocument2 pagesBatangas Catv Vs CAAnonymous 5MiN6I78I0100% (1)

- Talaga's service of unexpired term not a full term for term limit purposesDocument2 pagesTalaga's service of unexpired term not a full term for term limit purposesTippy Dos SantosNo ratings yet

- Financial AdministrationDocument322 pagesFinancial AdministrationAbhijit Jadhav91% (57)

- Mariano v. Comelec DigestDocument3 pagesMariano v. Comelec DigestkathrynmaydevezaNo ratings yet

- Pimentel Vs Ochoa DigestedDocument2 pagesPimentel Vs Ochoa DigestedRonnie Garcia Del Rosario100% (1)

- Dadole Vs Coa G.R. No. 125350Document2 pagesDadole Vs Coa G.R. No. 125350Benedict EstrellaNo ratings yet

- Republic v. RambuyongDocument1 pageRepublic v. RambuyongNoreenesse Santos100% (2)

- Bclte Mock Exam IDocument40 pagesBclte Mock Exam IAna Mae SalamanteNo ratings yet

- Garcia v. COMELEC - DigestDocument3 pagesGarcia v. COMELEC - Digestcmv mendoza100% (5)

- Local Officials Term LimitsDocument2 pagesLocal Officials Term LimitsNoreenesse SantosNo ratings yet

- Disomangcop v. DatumanongDocument3 pagesDisomangcop v. DatumanongGRNo ratings yet

- General Welfare Clause Cases SummaryDocument8 pagesGeneral Welfare Clause Cases Summarycrystine jaye senadreNo ratings yet

- Pimentel V OchoaDocument3 pagesPimentel V OchoaAndrea JuarezNo ratings yet

- SC Rules Secretary Can Suspend Mayors Under Supervisory PowerDocument2 pagesSC Rules Secretary Can Suspend Mayors Under Supervisory PowerGeanelleRicanorEsperon100% (5)

- LGU Autonomy vs Presidential PowerDocument1 pageLGU Autonomy vs Presidential PowerMaribeth G. TumaliuanNo ratings yet

- 1 Pimentel v. AguirreDocument3 pages1 Pimentel v. AguirreEmmanuel C. DumayasNo ratings yet

- Two BBL Strategies (Artemio v. Panganiban)Document2 pagesTwo BBL Strategies (Artemio v. Panganiban)Noreenesse SantosNo ratings yet

- Sobejana-Condon v. Commission On ElectionsDocument3 pagesSobejana-Condon v. Commission On ElectionsNoreenesse SantosNo ratings yet

- Tan v. Commission On ElectionsDocument3 pagesTan v. Commission On ElectionsNoreenesse SantosNo ratings yet

- Why A Federalist Is Now An Anti-Federalist (Edmund S. Tayao)Document2 pagesWhy A Federalist Is Now An Anti-Federalist (Edmund S. Tayao)Noreenesse SantosNo ratings yet

- MMDA Lacks Authority to Open Private RoadDocument2 pagesMMDA Lacks Authority to Open Private RoadNoreenesse SantosNo ratings yet

- Philippine Constitutional Framework For Economic Emergency - Expanding The Welfare State, Restricting The National Security (Raul C. Pangalangan)Document16 pagesPhilippine Constitutional Framework For Economic Emergency - Expanding The Welfare State, Restricting The National Security (Raul C. Pangalangan)Noreenesse SantosNo ratings yet

- Kida v. Senate of The PhilippinesDocument2 pagesKida v. Senate of The PhilippinesNoreenesse SantosNo ratings yet

- Disomangcop v. DatumanongDocument3 pagesDisomangcop v. DatumanongNoreenesse SantosNo ratings yet

- Unit 2 - Fundamental Analysis AKTUDocument50 pagesUnit 2 - Fundamental Analysis AKTUharishNo ratings yet

- Jacomille Vs AbayaDocument16 pagesJacomille Vs AbayaHazel-mae LabradaNo ratings yet

- Saudi Arabia A Guide To The Market by HSBCDocument254 pagesSaudi Arabia A Guide To The Market by HSBCsamehrifaatNo ratings yet

- Project Management Manual Ku (2012)Document165 pagesProject Management Manual Ku (2012)alwil144548No ratings yet

- Budget 1980 81 EDocument30 pagesBudget 1980 81 EMonilal SNo ratings yet

- Chapter 1 Basic Concepts & Product Cost SheetDocument72 pagesChapter 1 Basic Concepts & Product Cost SheetRupee Vs DollarNo ratings yet

- Gov Glance 2017Document282 pagesGov Glance 2017CesarNo ratings yet

- EPUB/PDF of Summoned Hero StoryDocument253 pagesEPUB/PDF of Summoned Hero StoryDaniel Walton100% (1)

- Introduction to the LGU Accounting OfficeDocument5 pagesIntroduction to the LGU Accounting Office渡辺正平No ratings yet

- Downloaded From WWW - Dbm.gov - PH WebsiteDocument16 pagesDownloaded From WWW - Dbm.gov - PH WebsiteJean Monique Oabel-TolentinoNo ratings yet

- Tutorial Chapter 8Document3 pagesTutorial Chapter 8fitrieyfiey0% (1)

- ANNEX E - Statement of Comparison of Budget and Actual AmountsDocument2 pagesANNEX E - Statement of Comparison of Budget and Actual Amountswichupinuno100% (1)

- Topic Iv - Local Taxation and Fiscal MattersDocument48 pagesTopic Iv - Local Taxation and Fiscal MattersJean Ashley Napoles AbarcaNo ratings yet

- SITXFIN004 - Student Assessment v2.0Document15 pagesSITXFIN004 - Student Assessment v2.0Heloisa GalesiNo ratings yet

- Analyzing the financial environment and cash management practices of Capital Development Authority (CDADocument11 pagesAnalyzing the financial environment and cash management practices of Capital Development Authority (CDAMuhammad ShabbirNo ratings yet

- An Introduction to Financial Management Principles and ConceptsDocument30 pagesAn Introduction to Financial Management Principles and ConceptsGautami JhingaranNo ratings yet

- OECD Public Spending on Early Childhood Education and CareDocument3 pagesOECD Public Spending on Early Childhood Education and CarefastbankingNo ratings yet

- Selected Exercises in Preparation of Question 1 On BA 6601 (Section 9) Compressive ExamDocument4 pagesSelected Exercises in Preparation of Question 1 On BA 6601 (Section 9) Compressive ExamAdam Khaleel0% (1)

- 100 Tory NHS Failures, Evidence Based With Links To Verify DataDocument14 pages100 Tory NHS Failures, Evidence Based With Links To Verify DataTory Fibs100% (1)

- 60932Document5 pages60932stevan janampa acuache0% (1)

- True FalseDocument2 pagesTrue FalseCarlo ParasNo ratings yet

- Full Download Multinational Financial Management 10th Edition Shapiro Solutions Manual PDF Full ChapterDocument36 pagesFull Download Multinational Financial Management 10th Edition Shapiro Solutions Manual PDF Full Chaptertightlybeak.xwf5100% (16)

- The National DebtDocument3 pagesThe National DebtSai MuttavarapuNo ratings yet

- GST JV Configuration Process 1Document4 pagesGST JV Configuration Process 1Sweta AgrawalNo ratings yet