Professional Documents

Culture Documents

Matrix Law v. Rule PDF

Uploaded by

kook0 ratings0% found this document useful (0 votes)

14 views3 pagesOriginal Title

Matrix Law v. Rule.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views3 pagesMatrix Law v. Rule PDF

Uploaded by

kookCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

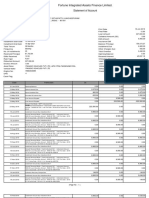

Matrix:

Law vs. Rules (Treatment of Cases – fill-‐in matrix)

Case Where Law Rule Ruling

Manuel v. General p. 103 Cumulative vacation and sick Not cumulative Rule cannot supplement law

Auditing Office leaves

Olsen v. Aldanese p. 104 Promulgate rules on Tobacco of good quality Rule went beyond scope of

classification, marking and exclusively comes from 3 enabling law

packing of tobacco to secure provinces

good quality

Young v. Rafferty p. 105 Authorizes Collector of Confined to two languages Keeping of books in particular

Internal Revenue to specify language not required by law

manner which proper books Any language allowed by law

of accounts shall be kept

Phil. Lawyers Assoc. v. p. 110 Practice of law provided pass Director of Patents required Exams not required by law

Agrava bar practitioners to pass its Practice of law covers

exams appearance before Patent

Office

Lupangco v. CA p. 117 Constitution: right to liberty; Professional Regulation Violates Constitution

academic freedom Commission prohibits Unreasonable despite good aim

examinees from attending

review classes, receiving

hand-‐outs and tips

People v. Maceren p. 122 Law lists offenses + other Secretary added electro-‐ Electro-‐fishing not penalized

violations fishing Not covered under other

violations because penalty for

obnoxious substances under

category 1 is not the same as

for other violations

Case Where Law Rule Ruling

CIR v. Fortune 2011 Revenue Regulations which Not valid

Tobacco provided that the tax due on

cigars and cigarettes starting

on January 1, 2000 shall not

be lower than the tax due on

October 1, 1966

CIR v. Fortune 2008 NIRC mandated a new rate of Increase would be based on Unauthorized administrative

Tobacco excise tax for cigarettes the excise tax actually paid legislation

without regard to whether the prior to January 1, 2000, and

revenue collection may turn shall not be lower than the

out to be lower than that excise tax actually paid prior

collected prior to that date to January 1, 2000

CIR v. San Miguel 2011 Excise tax on fermented Rates should not be lower Nothing in the law authorizes

liquor rates would apply from than the rates prior to the Secretary of Finance to

January 1, 1997 to December January 1, 2000 provide that the new tax rates

31, 1999, but the rates should after January 1, 2000 should

be lower than the tax imposed not be less than the rate before

on October 1, 1996 January 1, 2000

NPC v. Pinatubo 2010 GPRA mandates eligibility Limited the bidders for the Consistent with law

screening purchase of scrap aluminum Not violate competitiveness

conductor steel-‐reinforced to provision of law

partnerships or corporations

which directly use aluminum

as raw materials in producing

finished products

Secretary of Finance 2009 Law not authorize Updated the classification of Reclassification not authorized

v. La Suerte reclassification cigarettes by law

Case Where Law Rule Ruling

Rimonde v. Comelec 2009 Law requires written Penalized those who did not Violate since law not penalize

permission but not penalize secure written permission

those who do not get one

Association of Internal 2008 Duty to regulate pilotage and order directing shipping power necessarily includes the

Shipping Lines v. PPA the conduct of pilots in all companies to withhold the authority to issue rules and

Philippine ports; authority to share of the PPA from the regulations on the manner of

impose fees for services payment for the pilotage collection of the government

rendered by the pilotage services and to remit it share

association directly to the Philippines

Ports Authority

Hazard Pay of SC 2008 Granted public health Health workers of the SC be Rule amended law

workers exposed to high risk paid a uniform hazard pay

hazard pay without regard to the risks to

which they were exposed

Metrobank v. 2007 Set a wage level or a range to Across the board increase to

Wage board exceeded

National Wage which the wage increase shall all employees authority

Commission be added

Pharmaceuticals and 2007 Not prohibit advertising of Prohibited advertising Rule violated law

Health Care v. Duque breastmilk substitutes for

infants and growing children

MCC v. Ssangyong 2007 Electronic Commerce Law Rules included them in Rules went beyond parameters

definition of data message definition of law

did not include electronic data

interchange, electronic mail,

telegram, telex or telecopy

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Public Officers ReviewerDocument203 pagesPublic Officers ReviewerkookNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Preventing MSME Fraud with Due DiligenceDocument16 pagesPreventing MSME Fraud with Due Diligencesidh0987No ratings yet

- Piercing The Corporate VeilDocument31 pagesPiercing The Corporate VeilirishvilllamorNo ratings yet

- Statement of Account for Mohansri ADocument2 pagesStatement of Account for Mohansri ASanthosh SehwagNo ratings yet

- Oriental Assurance V OngDocument2 pagesOriental Assurance V OngClar NapaNo ratings yet

- Medical JurisprudenceDocument100 pagesMedical JurisprudenceAngelique PortaNo ratings yet

- PD 27 of October 21, 1972Document2 pagesPD 27 of October 21, 1972anneNo ratings yet

- Indophil Textile Mill Workers Union PTGWO v. CalicaDocument2 pagesIndophil Textile Mill Workers Union PTGWO v. CalicaBettina Rayos del SolNo ratings yet

- Tax Invoice: de Guzman Randy Sison 64 PUNGGOL WALK #03-31 SINGAPORE 828782 Account No: 3924232952Document2 pagesTax Invoice: de Guzman Randy Sison 64 PUNGGOL WALK #03-31 SINGAPORE 828782 Account No: 3924232952Randy GusmanNo ratings yet

- 213522-2018-Republic v. CoteDocument7 pages213522-2018-Republic v. CotekookNo ratings yet

- 0Document3 pages0kookNo ratings yet

- 0Document4 pages0kookNo ratings yet

- Uson v. Del Rosario (1953)Document5 pagesUson v. Del Rosario (1953)kookNo ratings yet

- RMC No 21-2010Document3 pagesRMC No 21-2010kookNo ratings yet

- LLDocument9 pagesLLkookNo ratings yet

- Petitioner Vs Vs Respondent: Second DivisionDocument17 pagesPetitioner Vs Vs Respondent: Second DivisionkookNo ratings yet

- Padgett v. Babcock - Templeton IncDocument5 pagesPadgett v. Babcock - Templeton InckookNo ratings yet

- NotesDocument46 pagesNoteskookNo ratings yet

- Automated Election LectureDocument4 pagesAutomated Election LecturekookNo ratings yet

- PASAR v. Lim PDFDocument29 pagesPASAR v. Lim PDFkookNo ratings yet

- Term I NologiesDocument3 pagesTerm I NologieskookNo ratings yet

- RA9225Document5 pagesRA9225kookNo ratings yet

- RA9225Document5 pagesRA9225kookNo ratings yet

- Case Key Issue Held/Answer: de Facto Officer de FactoDocument4 pagesCase Key Issue Held/Answer: de Facto Officer de FactokookNo ratings yet

- Reading Assignment For 7 and 14 February 2018Document1 pageReading Assignment For 7 and 14 February 2018kookNo ratings yet

- RA9225Document5 pagesRA9225kookNo ratings yet

- Critical Thinking Test ExplainedDocument46 pagesCritical Thinking Test ExplainedkookNo ratings yet

- Atty. F. Philip A. PinedaDocument6 pagesAtty. F. Philip A. PinedakookNo ratings yet

- Revising Manila Airport AuthorityDocument4 pagesRevising Manila Airport AuthoritykookNo ratings yet

- Term I NologiesDocument3 pagesTerm I NologieskookNo ratings yet

- CIR v. Toledo PDFDocument26 pagesCIR v. Toledo PDFkook100% (1)

- ;Document11 pages;kookNo ratings yet

- Report On Industrial Visit: Visited Professor Visited StudentsDocument10 pagesReport On Industrial Visit: Visited Professor Visited StudentsRishabh MishraNo ratings yet

- Laws Governing Insurance AcceptanceDocument1 pageLaws Governing Insurance AcceptanceCamille BugtasNo ratings yet

- Cost and Benefit Approach To DecisionsDocument12 pagesCost and Benefit Approach To DecisionsAngie LyzNo ratings yet

- Tempest Accounting and AnalysisDocument10 pagesTempest Accounting and AnalysisSIXIAN JIANGNo ratings yet

- Gift Case InvestigationsDocument17 pagesGift Case InvestigationsFaheemAhmadNo ratings yet

- VOL. 344, NOVEMBER 15, 2000 805: Mamburao, Inc. vs. Office of The OmbudsmanDocument18 pagesVOL. 344, NOVEMBER 15, 2000 805: Mamburao, Inc. vs. Office of The OmbudsmanLeizl A. VillapandoNo ratings yet

- BBCF4023 - MTDocument5 pagesBBCF4023 - MTbroken swordNo ratings yet

- Common Transaction SlipDocument1 pageCommon Transaction SlipAmrutaNo ratings yet

- SCMDocument22 pagesSCMPradeep Dubey100% (2)

- Cash Flow StatementDocument16 pagesCash Flow Statementrajesh337masssNo ratings yet

- Government of Andhra Pradesh Backward Classes Welfare DepartmentDocument3 pagesGovernment of Andhra Pradesh Backward Classes Welfare DepartmentDjazz RohanNo ratings yet

- Banta, Edmundo-History of International Trade RelationsDocument16 pagesBanta, Edmundo-History of International Trade RelationsBanta EdmondNo ratings yet

- Financial Ratio AnalysisDocument21 pagesFinancial Ratio AnalysisVaibhav Trivedi0% (1)

- Introduction to Climate Finance Economics of Climate Change Adaptation Training ProgrammeDocument78 pagesIntroduction to Climate Finance Economics of Climate Change Adaptation Training Programmeadinsmaradhana100% (1)

- Solution To Chapter 15Document9 pagesSolution To Chapter 15Ismail WardhanaNo ratings yet

- Sriphala Carbons FinancialsDocument16 pagesSriphala Carbons Financials8442No ratings yet

- Marketing Strategy of Master CardDocument36 pagesMarketing Strategy of Master CardParas GalaNo ratings yet

- GROUP 2 Family Case Wealth ManagementDocument18 pagesGROUP 2 Family Case Wealth ManagementAparna KalaskarNo ratings yet

- HFM PresentationDocument31 pagesHFM PresentationLakshmiNarasimhan RamNo ratings yet

- Ifnotes PDFDocument188 pagesIfnotes PDFmohammed elshazaliNo ratings yet

- Responsibility of DDOs PDFDocument64 pagesResponsibility of DDOs PDFRanga Nayak PaltyaNo ratings yet

- Time Value - Future ValueDocument4 pagesTime Value - Future ValueSCRBDusernmNo ratings yet

- Sample Audit ReportsDocument3 pagesSample Audit Reportsvivek1119100% (1)

- Commercial Real Estate Manager in Los Angeles CA Resume Robert HarrisDocument2 pagesCommercial Real Estate Manager in Los Angeles CA Resume Robert HarrisRobertHarrisNo ratings yet

- PRESENT VALUE TABLE TITLEDocument2 pagesPRESENT VALUE TABLE TITLEChirag KashyapNo ratings yet

- Public Enterprises Law Proclamation NoDocument18 pagesPublic Enterprises Law Proclamation Notderess100% (5)

- Hamilton County Board of Commissioners LetterDocument2 pagesHamilton County Board of Commissioners LetterCincinnatiEnquirerNo ratings yet