Professional Documents

Culture Documents

A Brief On Microfinance: Patni Internal

Uploaded by

shiprathereOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Brief On Microfinance: Patni Internal

Uploaded by

shiprathereCopyright:

Available Formats

A brief on

Microfinance

Patni Internal Page 1

A Fund Accounting Ops., Noida initiative.

Patni Internal Page 2

The most important finding in the last two decades in the world of finance did not come from the world of the

rich or the relatively well-off. More important than the hedge fund or the liquid-yield option note was the

finding that the poor can save, can borrow (can indeed decide on loans to fellow poor), and will certainly repay

loans. This is the world of Microfinance.

“Microfinance refers to small-scale financial services for both credits and deposits — that are provided to

people who farm or fish or herd; operate small or microenterprises where goods are produced, recycled,

repaired, or traded; provide services; work for wages or commissions; gain income from renting out small

amounts of land, vehicles, draft animals, or machinery and tools and to other individuals and local groups in

developing countries, in both rural and urban areas”.

The most well known and cited international example of a microcredit institution is the Grameen Bank in

Bangladesh. But there are numerous others. Even during the Asian financial crisis, Bank Rayat Indonesia not

only survived but thrived; as did BancoSol in Bolivia.

The current scenario….

Estimated that 650 million people live Below Poverty Line

This translates to approximately 130 million households.

Annual credit demand by the poor in the country is estimated to be about Rs. 115,000 crores.

Cumulative disbursements under all microfinance programmes is only about Rs. 9000 crores.(Mar. 08)

Total outstanding of all microfinance initiatives in India estimated to be Rs. 2100 crores. (March 08)

Only about 6.2 % of rural poor have access to microfinance.

Origin of MFIs

Initially, many NGO microfinance institutions (MFIs) were funded by donor support in the form of revolving

funds and operating grants. In recent years (roughly since 1994), development finance institutions such as the

National Bank for Agriculture and Rural Development (NABARD) and the Small Industries Development Bank of

India (SIDBI) and micro-finance promotion organizations such as the Rashtriya Mahila Kosh (RMK—the National

Women’s Fund) have also started to provide bulk loans to MFIs. This has resulted in the MFIs becoming

intermediaries between the largely public sector development finance institutions and retail borrowers

consisting of groups of poor people or individual borrowers living in rural areas or urban slums. In another

model, NABARD refinances commercial bank loans to self-help groups (SHGs) in order to facilitate relationships

between the banks and poor borrowers. Though the (mainly) NGO micro-finance sector has made a start in

providing ‘user friendly’ formal financial services to the poor its outreach is still minuscule in comparison with

the need. Recent compilations of support provided by major financial institutions shows that the microfinance

outstanding of domestic financial institutions (including NGO-MFIs) did not exceed Rs 800 crores (US$170

million) by March 2002 with an outreach to less than 5.5 million families – at best less than 10% of the 60

million poor families in the country. This includes the NABARD scheme for linking self-help groups directly with

banks. The available data indicates that progress and outreach in the scheme was around Rs 650 crores (US$140

million) outstanding.

Types of Microfinancial Programmes

1. Self-help Group (SHG)

The SHG is the dominant microfinance methodology in India. The operations of 15-25 member SHGs are based

on the principle of revolving the members’ own savings.

2. Individual Banking Programmes (IBPs)

IBPs entail the provision by MFIs of financial services to individual clients – though they may sometimes be

organized into joint liability groups, credit and savings cooperatives or even SHGs. The model is increasingly

Patni Internal Page 3

popular for microfinance particularly through cooperatives. In the case of cooperatives, all borrowers are

members of the organization either directly or indirectly by being members of primary cooperatives or

associations which are members of the apex society.

3. Grameen Model

This model was initially promoted by the well known Grameen Bank of Bangladesh. These undertake individual

lending but all borrowers are members of 5-member joint liability groups which, in turn, get together with 7-10

other such groups from the same village or neighborhood to form a centre. Within each group and centre peer

pressure is the key factor in ensuring repayment. Each borrower’s creditworthiness is determined by the

overall creditworthiness of the group.

Bottomline:

Soon after Grameen bank and Mohd. Yunus (of Bangladesh) were awarded the Nobel Prize; the understanding

of microfinance has increased significantly among people. This was exhibited in the union budget of 2008 in

which banks were asked to focus in granting small loans in rural parts of the country. Government and people

understood the need of microfinance and Government invited parties with proven track record in managing

rural and micro finance. This brought a considerable change in the living standard of poor people. Due to this

initiative, govt was able to increase the employment opportunities in the rural India and this eventually

resulted in lesser migration of people in search of employment to the larger cities.

Disclaimer:

The contents are collected and arranged from different websites without any fabrication of data. We however believe that the data

published on these websites are authentic and are good for academic and other reference. Happy reading

Patni Internal Page 4

You might also like

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Micro-Financing and the Economic Health of a NationFrom EverandMicro-Financing and the Economic Health of a NationNo ratings yet

- A Study On Microfinance Sector in KarnatakaDocument84 pagesA Study On Microfinance Sector in KarnatakaPrashanth PB100% (3)

- Women Empowerment through Self-Help GroupsDocument12 pagesWomen Empowerment through Self-Help GroupsunknownNo ratings yet

- 05 Chapter-1 PDFDocument52 pages05 Chapter-1 PDFRohitNo ratings yet

- Role of Self Help Groups in Microfinance in IndiaDocument13 pagesRole of Self Help Groups in Microfinance in IndiaKhaki AudilNo ratings yet

- Report On Micro FinanceDocument55 pagesReport On Micro FinanceSudeepti TanejaNo ratings yet

- Vikas ProjectDocument49 pagesVikas ProjectVinay KhannaNo ratings yet

- Microfinance helps empower the poor and alleviate poverty/TITLEDocument62 pagesMicrofinance helps empower the poor and alleviate poverty/TITLEHarshal SonalNo ratings yet

- Microfinance Report in MaharashtraDocument96 pagesMicrofinance Report in MaharashtraJugal Taneja100% (1)

- Micro-Finance in The India: The Changing Face of Micro-Credit SchemesDocument11 pagesMicro-Finance in The India: The Changing Face of Micro-Credit SchemesMahesh ChavanNo ratings yet

- Microfinance Industry, Tremendously Improving The Lives of People in Rural AreasDocument4 pagesMicrofinance Industry, Tremendously Improving The Lives of People in Rural Areasmrun94No ratings yet

- Submitted To: Submitted By: Ambuj Gupta Sangram Keshari Panigrahi 2k91/BFS/43Document36 pagesSubmitted To: Submitted By: Ambuj Gupta Sangram Keshari Panigrahi 2k91/BFS/43Sangram PanigrahiNo ratings yet

- Report On Micro FinanceDocument54 pagesReport On Micro Financemohsinmalik07100% (1)

- Microfinance Chapter 1Document27 pagesMicrofinance Chapter 1Prakash KumarNo ratings yet

- Micro-Finance Management & Critical Analysis in IndiaDocument72 pagesMicro-Finance Management & Critical Analysis in IndiaAtul MangaleNo ratings yet

- Status of Microfinance and Its Delivery Models in IndiaDocument13 pagesStatus of Microfinance and Its Delivery Models in IndiaSiva Sankari100% (1)

- Micro Finance (BankingDocument35 pagesMicro Finance (BankingAsim Waghu100% (1)

- Microfinance in India: Providing Financial Services to the PoorDocument24 pagesMicrofinance in India: Providing Financial Services to the Pooranuradha9787No ratings yet

- FMI final reportDocument30 pagesFMI final reportVIDUSHINo ratings yet

- The Scenario of Retail Industry in India: Its Growth, Challenges and OpportunitiesDocument11 pagesThe Scenario of Retail Industry in India: Its Growth, Challenges and OpportunitiesSajja VamsidharNo ratings yet

- A Study On Role and Effects of Microfinance Banks in Rural Areas in India 1Document63 pagesA Study On Role and Effects of Microfinance Banks in Rural Areas in India 1Rohit KumarNo ratings yet

- A Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Document55 pagesA Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Rohit KumarNo ratings yet

- Project Report Microfinance PDFDocument8 pagesProject Report Microfinance PDFkhageshNo ratings yet

- Microfinance in India - A Tool For Poverty ReductionDocument20 pagesMicrofinance in India - A Tool For Poverty ReductionVijay KumarNo ratings yet

- Micro FinanceDocument53 pagesMicro Financeamitharia100% (6)

- FSM AssignmentDocument50 pagesFSM AssignmentHardik PatelNo ratings yet

- The Role of Micro Finance in SHGDocument12 pagesThe Role of Micro Finance in SHGijgarph100% (1)

- Mfi Obj.1Document13 pagesMfi Obj.1Anjum MehtabNo ratings yet

- Project Report On "A Critical Analysis of Micro Finance in India"Document55 pagesProject Report On "A Critical Analysis of Micro Finance in India"Om Prakash MishraNo ratings yet

- MFS PPT FinalDocument18 pagesMFS PPT FinalvijaybharvadNo ratings yet

- Micro Finance AssignmentDocument8 pagesMicro Finance Assignment19DM017 .SubhamNo ratings yet

- Role of Microfinance in Fighting Rural PovertyDocument7 pagesRole of Microfinance in Fighting Rural PovertySajijul IslamNo ratings yet

- Assignment ON Micro-FinanceDocument24 pagesAssignment ON Micro-FinancerakeshpataelNo ratings yet

- Micro-Finance Builds Rural India's Social and Economic StatusDocument9 pagesMicro-Finance Builds Rural India's Social and Economic StatusChauhan NeelamNo ratings yet

- Term Paper of Banking & Insurance: Topic: Micro Finance Development Overview and ChallengesDocument18 pagesTerm Paper of Banking & Insurance: Topic: Micro Finance Development Overview and ChallengesSumit SinghNo ratings yet

- SMART PUSHNOTE - An Agent Based Intelligent Push Notification System 2017-18Document60 pagesSMART PUSHNOTE - An Agent Based Intelligent Push Notification System 2017-18sachin mohanNo ratings yet

- Report On Micro FinanceDocument12 pagesReport On Micro FinanceNawaz GodilNo ratings yet

- Role of NGO SectorDocument14 pagesRole of NGO SectorriyasoniyaNo ratings yet

- Session 1 - Grameen BankDocument5 pagesSession 1 - Grameen BankagyeyaNo ratings yet

- 2014-VII-1&2 NilimaDocument13 pages2014-VII-1&2 NilimaAPOORVA GUPTANo ratings yet

- Microfinance Scope & Future in IndiaDocument4 pagesMicrofinance Scope & Future in IndiamijjinNo ratings yet

- First and ForemostDocument7 pagesFirst and ForemostZakeyo Dala ChabingaNo ratings yet

- Microfinance Regulation in India. Microfinance ManagementDocument5 pagesMicrofinance Regulation in India. Microfinance ManagementRavindra SalviNo ratings yet

- A Study of The Performance of Microfinance Institutions in India in Present Era - A Tool For Poverty AlleviationDocument10 pagesA Study of The Performance of Microfinance Institutions in India in Present Era - A Tool For Poverty AlleviationjyotivermaNo ratings yet

- Growth of MFIs and Microfinance in IndiaDocument5 pagesGrowth of MFIs and Microfinance in IndiaSiva KumarNo ratings yet

- A Study of Micro Finance Facilities and Analyzing The PDFDocument16 pagesA Study of Micro Finance Facilities and Analyzing The PDFkeenu23No ratings yet

- Role of Microfinance in Financial Inclusion in Bihar-A Case StudyDocument10 pagesRole of Microfinance in Financial Inclusion in Bihar-A Case Studyfida mohammadNo ratings yet

- A Critical Analysis of Micro Finance in IndiaDocument54 pagesA Critical Analysis of Micro Finance in IndiaArchana MehraNo ratings yet

- Microfinance in India: A Critique by Rajarshi GhoshDocument9 pagesMicrofinance in India: A Critique by Rajarshi Ghoshpraveen_jha_9No ratings yet

- Microfinace Reading PDFDocument9 pagesMicrofinace Reading PDFCharles GarrettNo ratings yet

- Micro Finance - Keys & Challenges:-A Review Mohit RewariDocument13 pagesMicro Finance - Keys & Challenges:-A Review Mohit Rewarisonia khuranaNo ratings yet

- MFAssignmentDocument15 pagesMFAssignmentRiturajNo ratings yet

- Microfinance Reduces Poverty in IndiaDocument28 pagesMicrofinance Reduces Poverty in IndiaRatul ChandelNo ratings yet

- Role of Microfinance and Growth of UNACCO FINANCIAL SERVICES in ManipurDocument21 pagesRole of Microfinance and Growth of UNACCO FINANCIAL SERVICES in ManipurOmita ChanuNo ratings yet

- Sustainability of MFI's in India After Y.H.Malegam CommitteeDocument18 pagesSustainability of MFI's in India After Y.H.Malegam CommitteeAnup BmNo ratings yet

- Microfinance in India - Growth and Present StatusDocument16 pagesMicrofinance in India - Growth and Present StatusIJOPAAR JOURNALNo ratings yet

- MicrofinanceDocument58 pagesMicrofinanceSamuel Davis100% (1)

- Significance of Microfinance in Indian EconomyDocument13 pagesSignificance of Microfinance in Indian Economyrajshree2005No ratings yet

- Inclusive Business in Financing: Where Commercial Opportunity and Sustainability ConvergeFrom EverandInclusive Business in Financing: Where Commercial Opportunity and Sustainability ConvergeNo ratings yet

- How To Become A Mortgage AdvisorDocument8 pagesHow To Become A Mortgage Advisorshivam markanNo ratings yet

- MBA Project Report On Financial AnalysisDocument73 pagesMBA Project Report On Financial AnalysisShainaDhiman79% (24)

- Final Accounts QuestionsDocument6 pagesFinal Accounts QuestionsGandharva Shankara Murthy100% (1)

- Examen de Entrada Tecnico IiiDocument3 pagesExamen de Entrada Tecnico IiiKarem Ochochoque SánchezNo ratings yet

- Rbi 1Document27 pagesRbi 1Nishant ShahNo ratings yet

- FDI in Indian Banking SectorDocument38 pagesFDI in Indian Banking SectorSumedhAmaneNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument11 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Accounting For LeaseDocument75 pagesAccounting For LeaseRonnie Salazar53% (15)

- Toyota Shaw IncDocument2 pagesToyota Shaw IncBrains SagaNo ratings yet

- Playing The REITs GameDocument2 pagesPlaying The REITs Gameonlylf28311No ratings yet

- 4th SemDocument6 pages4th SemSijo JacobNo ratings yet

- Ioi Corporation Berhad 2015 - ArDocument280 pagesIoi Corporation Berhad 2015 - ArmohdkhidirNo ratings yet

- Home Office Agency and Branch FinancialsDocument11 pagesHome Office Agency and Branch FinancialsRaraj100% (1)

- Landlord Tenant Handbok Montgomery County MDDocument80 pagesLandlord Tenant Handbok Montgomery County MDkitty_chan_19No ratings yet

- Mil Resources Acquires Option To Purchase 100% of Amazon Bay Iron Sands ProjectDocument4 pagesMil Resources Acquires Option To Purchase 100% of Amazon Bay Iron Sands ProjectLiNo ratings yet

- Tutorial 1 - SolutionDocument3 pagesTutorial 1 - SolutionSuganti100% (1)

- Sale Deed - SampleDocument6 pagesSale Deed - SampleManikandan NVNo ratings yet

- GBL Reporting NotesDocument6 pagesGBL Reporting NotesKarla Marie TumulakNo ratings yet

- Presented By: URVI SINGH Research Scholar Enrollment Number: 2014PHDCOM003 Supervisor: Dr. RUCHITA VERMA Assistant ProfessorDocument18 pagesPresented By: URVI SINGH Research Scholar Enrollment Number: 2014PHDCOM003 Supervisor: Dr. RUCHITA VERMA Assistant ProfessorHari KrishnaNo ratings yet

- Green BankingDocument33 pagesGreen BankingTonu Sarkar100% (3)

- ADM 2350 N Syllabus Winter 2016Document10 pagesADM 2350 N Syllabus Winter 2016saadNo ratings yet

- Budget Worksheet: Monthly Net IncomeDocument1 pageBudget Worksheet: Monthly Net IncomeErnestKalamboNo ratings yet

- CommScope2016 Brochure FinalDocument8 pagesCommScope2016 Brochure FinalsteveNo ratings yet

- A Study On Taxation, Auditing Services Provided by A Chartered Accountant FirmDocument69 pagesA Study On Taxation, Auditing Services Provided by A Chartered Accountant FirmYash Bajaj100% (2)

- 12e Continuing ProblemDocument14 pages12e Continuing ProblemsoundjunkiesNo ratings yet

- Guide To: Credit Rating EssentialsDocument19 pagesGuide To: Credit Rating EssentialseduardohfariasNo ratings yet

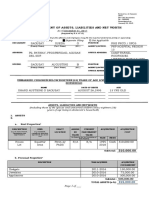

- Revised SWORN Statement of Assets, Liabilities and Net WorthDocument10 pagesRevised SWORN Statement of Assets, Liabilities and Net WorthJeanrichel Quillo LlenaresNo ratings yet

- Chap 009Document57 pagesChap 009palak32100% (3)

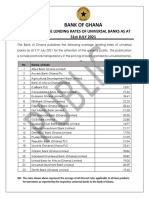

- Average Lending Rates As at July 2021Document1 pageAverage Lending Rates As at July 2021Fuaad DodooNo ratings yet

- TB ch07Document27 pagesTB ch07carolevangelist4657No ratings yet