Professional Documents

Culture Documents

F 8302

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

F 8302

Uploaded by

IRSCopyright:

Available Formats

Form 8302

(Rev. October 2003)

Electronic Deposit of Tax Refund of $1 Million or More OMB No. 1545-1763

䊳 Attach to your income tax return (other than Forms 1040, 1120, 1120-A, or

Department of the Treasury

Internal Revenue Service 1120S), Form 1045, or Form 1139.

Name(s) shown on income tax return Identifying number

Name and location (City, State) of bank Taxpayer’s phone number

( )

1 Method of deposit (one box must be checked) Direct Deposit Fedwire

2 Routing number (must be nine digits). The first two digits must be between 01 and 12 or 21 through 32.

3 Account number (include hyphens but omit spaces and special symbols): 4 Type of account (one

box must be checked):

Checking Savings

General Instructions Conditions Resulting in a in the instructions for the form with

which the Form 8302 is filed. For Forms

Refund by Check 1045 or 1139, attach a separate Form

Purpose of Form If the IRS is unable to process this 8302 for each carryback year.

File Form 8302 to request that the IRS request for an electronic deposit, a

electronically deposit a tax refund of $1 refund by check will be generated.

million or more directly into an account Reasons for not processing a request

Specific Instructions

at any U.S. bank or other financial include: Identifying number. Enter the employer

institution (such as a mutual fund, credit identification number or social security

● The name on the tax return does not

union, or brokerage firm) that accepts number shown on the tax return to

match the name on the account.

electronic deposits. which Form 8302 is attached.

● You fail to indicate the method of

The benefits of an electronic deposit Line 1. Direct deposit is an electronic

deposit to be used (i.e., direct deposit or

include a faster refund, the added payment alternative that uses the

Fedwire).

security of a paperless payment, and the Automated Clearing House (ACH)

savings of tax dollars associated with ● The financial institution rejects the system. Fedwire is a

the reduced processing costs. electronic deposit because of an transaction-by-transaction processing

incorrect routing or account number. system designed for items that must be

Who May File ● You fail to indicate the type of account received by payees the same day as

Form 8302 may be filed with any tax the deposit is to be made to (i.e., originated by the IRS.

return other than Form 1040, 1120, checking or savings). Line 2. Enter the financial institution’s

1120-A, or 1120S to request an ● There is an outstanding liability the routing number and verify that the

electronic deposit of a refund of $1 offset of which reduces the refund to institution will accept the type of

million or more. You are not eligible to less than $1 million. electronic deposit requested. See the

request an electronic deposit if: Sample Check below for an example of

● The receiving financial institution is a

How To File where the routing number may be

foreign bank or a foreign branch of a Attach Form 8302 to the applicable shown.

U.S. bank or return or application for refund. To

ensure that your tax return is correctly Check with your financial

● You have applied for an employer

identification number but are filing your

tax return before receiving one.

processed, see Assembling the Return

!

CAUTION

institution, if necessary, to

verify the routing number

entered on line 2 is correct.

If Form 8302 is filed with Form 1045,

Application for Tentative Refund, or

Form 1139, Corporation Application for

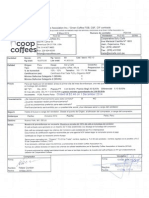

Tentative Refund, both of which allow for Sample Check

more than one year’s reporting,

electronic deposits may be made only ABC Corporation

for a year for which the refund is at least 123 Main Street

1234

䊱

Anyplace, NJ 07000 15-0000/0000

$1 million.

E

Note. Filers of Form 1040 must request

PL

a direct deposit of refund by completing PAY TO THE

ORDER OF $

M

the account information on that for m.

Routing Account

SA

Filers of Forms 1120, 1120-A, or 1120S number number DOLLARS

must request a direct deposit of a refund (line 2) (line 3)

using Form 8050, Direct Deposit of ANYTOWN BANK

Do not include

Corporate Tax Refund. This includes a Anytown, MD 20000

the check number.

request for a refund of $1 million or For

more.

䊱

|:250250025 |:202020 .

"’86" 1234

Note. The routing and account numbers may be in different places on your check.

Cat. No. 62280S Form 8302 (Rev. 10-2003)

Form 8302 (10-2003) Page 2

For accounts payable through a Our authority to ask for information is governments to carry out their tax laws.

financial institution other than the one at sections 6001, 6011, and 6012(a) and We may also disclose this information to

which the account is located, check with their regulations, which require you to Federal, state, or local agencies that

your financial institution for the correct file a return or statement with us for any investigate or respond to acts or threats

routing number. Do not use a deposit tax for which you are liable. Your of terrorism or participate in intelligence

slip to verify the routing number. response is mandatory under these or counterintelligence activities

Line 3. Enter the taxpayer’s account sections. Section 6109 requires that you concerning terrorism.

number. Enter the number from left to provide your social security number or Please keep this notice with your

right and leave any unused boxes blank. employer identification number on what records. It may help you if we ask you

See the Sample Check below for an you file. This is so we know who you for other information. If you have any

example of where the account number are, and can process your return and questions about the rules for filing and

may be shown. other papers. You must fill in all parts of giving information, please call or visit

the tax form that apply to you. any Internal Revenue Service office.

You are not required to provide the The time needed to complete and file

Privacy Act and information requested on a form that is this form will vary depending on

Paperwork Reduction subject to the Paperwork Reduction Act individual circumstances. The estimated

unless the form displays a valid OMB average times are: Recordkeeping, 1

Act Notice control number. Books or records hr., 40 minutes; Learning about the law

We ask for the information on this form relating to a form or its instructions must or the form, 30 minutes; Preparing,

to carry out the Internal Revenue laws of be retained as long as their contents copying, assembling, and sending the

the United States. You are required to may become material in the form to the IRS, 33 minutes.

give us the information. We need it to administration of any Internal Revenue If you have comments concerning the

ensure that you are complying with law. Generally, tax returns and return accuracy of these time estimates or

these laws and to allow us to figure and information are confidential, as required suggestions for making this form

collect the right amount of tax. by section 6103. However, section 6103 simpler, we would be happy to hear from

In addition, the Privacy Act requires allows or requires the Internal Revenue you. You can write to the IRS at the

that when we ask you for information we Service to disclose or give the address listed in the instructions of the

must first tell you our legal right to ask information shown on your tax return to tax return with which this form is filed.

for the information, why we are asking other as described in the Code. For

for it, and how it will be used. We must example, we may disclose your tax

also tell you what could happen if we do information to the Department of Justice

not receive it and whether your response to enforce the tax laws, both civil and

is voluntary, required to obtain a benefit, criminal, and to cities, states, the District

or mandatory under the law. of Columbia, U.S. commonwealths or

possessions, and certain foreign

You might also like

- Nonprofit Law for Religious Organizations: Essential Questions & AnswersFrom EverandNonprofit Law for Religious Organizations: Essential Questions & AnswersRating: 5 out of 5 stars5/5 (1)

- DT 2008 990Document53 pagesDT 2008 990shimeralumNo ratings yet

- Copyright Notice and Registration (BitLaw)Document3 pagesCopyright Notice and Registration (BitLaw)Rit100% (1)

- Return of Organization Exempt From Income Tax: Open To Public InspectionDocument12 pagesReturn of Organization Exempt From Income Tax: Open To Public InspectionYarod ELNo ratings yet

- Ucc 4Document66 pagesUcc 4Glenn Augenstein67% (3)

- Sav1455 PDFDocument6 pagesSav1455 PDFTed100% (1)

- Blakely Amended Motion For Bond Pending SentencingDocument2 pagesBlakely Amended Motion For Bond Pending SentencingFOX54 News HuntsvilleNo ratings yet

- TRP Change Ownership FormDocument2 pagesTRP Change Ownership Formambasyapare1100% (1)

- Instructions for IRS Forms W-8Document15 pagesInstructions for IRS Forms W-8KrisdenNo ratings yet

- 07 Securities LawDocument41 pages07 Securities LawChristy Amor P. LofrancoNo ratings yet

- ps1583 PDFDocument3 pagesps1583 PDFowen tsangNo ratings yet

- Securities and Exchange Commission (SEC) - Formn-8b-2Document19 pagesSecurities and Exchange Commission (SEC) - Formn-8b-2highfinanceNo ratings yet

- 1-3 Power of Attorney - RDW09221985POA0001Document2 pages1-3 Power of Attorney - RDW09221985POA0001RICHARDDWASHINGTONNo ratings yet

- Form 3: United States Securities and Exchange Commission Initial Statement of Beneficial Ownership of SecuritiesDocument1 pageForm 3: United States Securities and Exchange Commission Initial Statement of Beneficial Ownership of SecuritiesJesus Velazquez JrNo ratings yet

- Bank and Financial Institution Act 2073 2017 PDFDocument101 pagesBank and Financial Institution Act 2073 2017 PDFNisha RaiNo ratings yet

- IRS identity theft affidavit formDocument2 pagesIRS identity theft affidavit formMARSHA MAINES100% (1)

- ForeigntrustDocument1 pageForeigntrustIRSNo ratings yet

- Resolution For Transactions Involving Treasury SecuritiesDocument4 pagesResolution For Transactions Involving Treasury SecuritiesYisrael Ezekiel Yahweh's100% (2)

- SSN PaperworkDocument2 pagesSSN PaperworkNashieta JohnsonNo ratings yet

- Ghana's Banks and Deposit ActDocument138 pagesGhana's Banks and Deposit ActOneNationNo ratings yet

- Transfer and Conveyance StandardsDocument10 pagesTransfer and Conveyance Standardsab boNo ratings yet

- Affidavit of Title: CategoriesDocument2 pagesAffidavit of Title: CategoriesRon FerlingereNo ratings yet

- SS FormDocument2 pagesSS Formblueocean8888100% (1)

- Mount Holyoke College travel waiver and release formDocument1 pageMount Holyoke College travel waiver and release formidkthisusernameNo ratings yet

- How To Open Letter of CreditDocument2 pagesHow To Open Letter of Credit✬ SHANZA MALIK ✬No ratings yet

- Beneficiary Designation: Policy InformationDocument2 pagesBeneficiary Designation: Policy Informationjaniceseto1No ratings yet

- General Durable Power of Attorney Effective Upon ExecutionDocument5 pagesGeneral Durable Power of Attorney Effective Upon Executionsable1234No ratings yet

- IRS Publication Form 706Document4 pagesIRS Publication Form 706Francis Wolfgang UrbanNo ratings yet

- UCC Article 8 DefinitionsDocument2 pagesUCC Article 8 DefinitionsLaLa Banks100% (1)

- Kadir Izaah Amir Wisdom ® 2023Document1 pageKadir Izaah Amir Wisdom ® 2023KayNo ratings yet

- Updated Simpler Process of Securing and AcknowledgementDocument2 pagesUpdated Simpler Process of Securing and AcknowledgementdkkhairstonNo ratings yet

- Death ClaimDocument29 pagesDeath Claimparikshit purohitNo ratings yet

- Personal WillDocument4 pagesPersonal WillDavid NowakowskiNo ratings yet

- Monthly Tax Return For Wagers: (Section 4401 of The Internal Revenue Code)Document4 pagesMonthly Tax Return For Wagers: (Section 4401 of The Internal Revenue Code)IRSNo ratings yet

- 00 Affidavit of Fact - COVER LETTER - DECLARATION OF TRUSTDocument2 pages00 Affidavit of Fact - COVER LETTER - DECLARATION OF TRUSTLuna BeyNo ratings yet

- Official attested copy of court documentsDocument3 pagesOfficial attested copy of court documentsBashir AbdulleNo ratings yet

- Purchase OrderDocument2 pagesPurchase OrderNicole LomasangNo ratings yet

- BLANK Trust FOR BANKSDocument7 pagesBLANK Trust FOR BANKSGeraldNo ratings yet

- Judicial Qualifications Complaint FormDocument5 pagesJudicial Qualifications Complaint FormDomestic Violence by ProxyNo ratings yet

- Aa Denial of StatusDocument2 pagesAa Denial of StatusBrian SmileyNo ratings yet

- Laws and Accounts of Bankruptcy Executorship and Trusteeship (Acc 409)Document8 pagesLaws and Accounts of Bankruptcy Executorship and Trusteeship (Acc 409)Samson Mide FolorunshoNo ratings yet

- Terms and Conditions for Escrow AccountsDocument6 pagesTerms and Conditions for Escrow AccountsYogesh SamatNo ratings yet

- Administration of Estates Act 66 of 1965Document50 pagesAdministration of Estates Act 66 of 1965André Le RouxNo ratings yet

- Negotiable Insutruments Act 1881: 5.1 Definition of A Negotiable InstrumentDocument12 pagesNegotiable Insutruments Act 1881: 5.1 Definition of A Negotiable InstrumentAshrafNo ratings yet

- Acceptance Letter of Credit PDFDocument5 pagesAcceptance Letter of Credit PDFmackjblNo ratings yet

- Chicago Offering DocumentsDocument280 pagesChicago Offering DocumentsThe Daily LineNo ratings yet

- Negotiable Instruments Act 1881: by K M ChandrakanthDocument41 pagesNegotiable Instruments Act 1881: by K M Chandrakanthsurya kiranNo ratings yet

- Mechanics LienDocument3 pagesMechanics LienjdNo ratings yet

- Process of Registering An Instrument Affecting Land and BuildingDocument3 pagesProcess of Registering An Instrument Affecting Land and BuildingDilhara PinnaduwageNo ratings yet

- Partial/Final Waiver of Lien to Date TemplateDocument1 pagePartial/Final Waiver of Lien to Date TemplateJannett FlotteNo ratings yet

- William H. Brine, JR., Administrator DBN of The Estate of Francis H. Swift v. Paine Webber, Jackson & Curtis, Incorporated, 745 F.2d 100, 1st Cir. (1984)Document8 pagesWilliam H. Brine, JR., Administrator DBN of The Estate of Francis H. Swift v. Paine Webber, Jackson & Curtis, Incorporated, 745 F.2d 100, 1st Cir. (1984)Scribd Government DocsNo ratings yet

- Ship Mortgage Decree provisions explainedDocument25 pagesShip Mortgage Decree provisions explainedKaira CarlosNo ratings yet

- Harbor Funds Letter InstructionDocument1 pageHarbor Funds Letter Instructioncsmith9100% (1)

- Affidavit of TitleDocument2 pagesAffidavit of TitleFindLegalFormsNo ratings yet

- Formation of Charitable TrustDocument36 pagesFormation of Charitable TrusteBook ManisNo ratings yet

- Imilo: 4jestDocument19 pagesImilo: 4jestMikhael Yah-Shah Dean: VeilourNo ratings yet

- Glossary of Important Business TermsDocument44 pagesGlossary of Important Business TermsJkNo ratings yet

- The Negotiable Instruments LawDocument3 pagesThe Negotiable Instruments LawTinny Flores-LlorenNo ratings yet

- Constitution of the State of Minnesota — 1876 VersionFrom EverandConstitution of the State of Minnesota — 1876 VersionNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Application of Game TheoryDocument65 pagesApplication of Game Theorymithunsraj@gmail.com100% (2)

- Delhi Bank 2Document56 pagesDelhi Bank 2doon devbhoomi realtorsNo ratings yet

- Cases in Civil ProcedureDocument3 pagesCases in Civil ProcedureJaayNo ratings yet

- Take RisksDocument3 pagesTake RisksRENJITH RNo ratings yet

- ACCOUNTING CONTROL ACCOUNTSDocument8 pagesACCOUNTING CONTROL ACCOUNTSMehereen AubdoollahNo ratings yet

- CE462-CE562 Principles of Health and Safety-Birleştirildi PDFDocument663 pagesCE462-CE562 Principles of Health and Safety-Birleştirildi PDFAnonymous MnNFIYB2No ratings yet

- Module 5 NotesDocument20 pagesModule 5 NotesHarshith AgarwalNo ratings yet

- 01-9 QCS 2014Document8 pages01-9 QCS 2014Raja Ahmed HassanNo ratings yet

- Refunds Maceda Law and PD957Document2 pagesRefunds Maceda Law and PD957QUINTO CRISTINA MAENo ratings yet

- The Builder's Project Manager - Eli Jairus Madrid PDFDocument20 pagesThe Builder's Project Manager - Eli Jairus Madrid PDFJairus MadridNo ratings yet

- PEA144Document4 pagesPEA144coffeepathNo ratings yet

- Assignment 2 - IPhonesDocument6 pagesAssignment 2 - IPhonesLa FlâneurNo ratings yet

- Sri Ganesh Engg - ProfileDocument19 pagesSri Ganesh Engg - Profileshikharc100% (1)

- PWC High Frequency Trading Dark PoolsDocument12 pagesPWC High Frequency Trading Dark PoolsAnish TimsinaNo ratings yet

- Chapter 4 - Fire InsuranceDocument8 pagesChapter 4 - Fire InsuranceKhandoker Mahmudul HasanNo ratings yet

- GA3-240202501-AA2. Presentar Funciones de Su OcupaciónDocument2 pagesGA3-240202501-AA2. Presentar Funciones de Su OcupaciónDidier Andres Núñez OrdóñezNo ratings yet

- G.R. No. 161759, July 02, 2014Document9 pagesG.R. No. 161759, July 02, 2014Elaine Villafuerte AchayNo ratings yet

- Notices, Circulars and MemoDocument11 pagesNotices, Circulars and MemoSaloni doshiNo ratings yet

- Settlement Rule in Cost Object Controlling (CO-PC-OBJ) - ERP Financials - SCN Wiki PDFDocument4 pagesSettlement Rule in Cost Object Controlling (CO-PC-OBJ) - ERP Financials - SCN Wiki PDFkkka TtNo ratings yet

- IB Economics Notes - Macroeconomic Goals Low Unemployment (Part 1)Document11 pagesIB Economics Notes - Macroeconomic Goals Low Unemployment (Part 1)Pablo TorrecillaNo ratings yet

- Corpo Bar QsDocument37 pagesCorpo Bar QsDee LM100% (1)

- Filipino Terminologies For Accountancy ADocument27 pagesFilipino Terminologies For Accountancy ABy SommerholderNo ratings yet

- Cash Flow Statement - QuestionDocument27 pagesCash Flow Statement - Questionhamza khanNo ratings yet

- CF Wacc Project 2211092Document34 pagesCF Wacc Project 2211092Dipty NarnoliNo ratings yet

- Ctpat Prog Benefits GuideDocument4 pagesCtpat Prog Benefits Guidenilantha_bNo ratings yet

- Operations ManagementDocument300 pagesOperations Managementsrcool100% (1)

- EMPLOYEE PARTICIPATION: A STRATEGIC PROCESS FOR TURNAROUND - K. K. VermaDocument17 pagesEMPLOYEE PARTICIPATION: A STRATEGIC PROCESS FOR TURNAROUND - K. K. VermaRaktim PaulNo ratings yet

- 3m Fence DUPADocument4 pages3m Fence DUPAxipotNo ratings yet

- Zong Presentation1Document18 pagesZong Presentation1shaddyxp2000No ratings yet

- TCS Connected Universe Platform - 060918Document4 pagesTCS Connected Universe Platform - 060918abhishek tripathyNo ratings yet