Professional Documents

Culture Documents

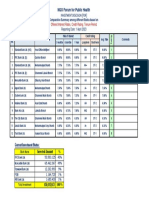

Base Rates, Base Lending/Financing Rates and Indicative Effective Lending Rates

Uploaded by

piscesguy78Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Base Rates, Base Lending/Financing Rates and Indicative Effective Lending Rates

Uploaded by

piscesguy78Copyright:

Available Formats

Base Rates, Base Lending/Financing Rates and Indicative Effective Lending Rates

No. Financial Institution Base Rate (%) Base Lending Indicative Effective

Rate (%) Lending Rate* (%)

1 Affin Bank 3.74 6.60 4.65

2. Alliance Bank 3.82 6.67 5.10

3 AmBank 3.80 6.65 4.50

4 Bank of China (Malaysia) Berhad 3.80 6.60 4.85

5 CIMB Bank Berhad 3.90 6.75 4.65

6 Citibank Berhad 3.65 6.80 4.55

7 Hong Leong Bank Malaysia Berhad 3.69 6.70 4.75

8 HSBC Bank Malaysia Berhad 3.50 6.60 4.60

9 Industrial and Commercial Bank of China 3.77 6.70 4.75

(Malaysia) Berhad

10 Malayan Banking Berhad 3.00 6.65 4.35

11 OCBC Bank (Malaysia) Berhad 3.72 6.65 4.80

12 Public Bank Berhad 3.52 6.72 4.35

13 RHB Bank Berhad 3.65 6.60 4.65

14 Standard Chartered Bank Malaysia Berhad 3.52 6.70 4.52

No. Financial Institution Base Rate (%) Base Lending Indicative Effective

Rate (%) Lending Rate* (%)

15 United Overseas Bank (Malaysia) Bhd. 3.85 6.81 4.75

No. Islamic Financial Institution Base Rate (%) Base Financing Indicative Effective

Rate (%) Lending Rate (%)

1 Affin Islamic Bank Berhad 3.74 6.60 4.65

2 Al Rajhi Banking & Investment Corporation 4.10 7.00 4.70

(Malaysia) Berhad

3 Alliance Islamic Bank Berhad 3.82 6.67 5.10

4 AmIslamic Bank Berhad 3.80 6.65 4.50

5 Asian Finance Bank Berhad 3.77 6.60 5.10

6 Bank Islam Malaysia Berhad 3.65 6.60 4.20

7 Bank Muamalat Malaysia Berhad 3.75 6.75 5.05

8 CIMB Islamic Bank Berhad 3.90 6.75 4.65

9 Hong Leong Islamic Bank Berhad 3.69 6.70 4.60

10 HSBC Amanah Malaysia Berhad 3.50 6.60 4.60

11 Kuwait Finance House (Malaysia) Berhad 3.10 6.99 4.59

12 Maybank Islamic Berhad 3.00 6.65 4.35

No. Islamic Financial Institution Base Rate (%) Base Financing Indicative Effective

Rate (%) Lending Rate (%)

13 OCBC Al-Amin Bank Berhad 3.72 6.65 4.80

14 Public Islamic Bank Berhad 3.52 6.72 4.35

15 RHB Islamic Bank Berhad 3.65 6.60 4.65

16 Standard Chartered Saadiq Berhad 3.52 6.70 4.52

No. Development Financial Institution Base Rate (%) Base Financing Indicative Effective

Rate (%) Lending Rate (%)

1 Bank Kerjasama Rakyat Malaysia Berhad 3.85 6.83 4.65

2 Agrobank 3.60 6.75 -

3 Bank Simpanan Nasional 3.95 6.70 4.40

Note:

* Indicative effective lending rate refers to the indicative annual effective lending rate for a standard 30-year housing loan/home

financing product with financing amount of RM350k and has no lock-in period.

As at 1 December 2016

Bank Negara Malaysia

You might also like

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- BR Table For BNM Website 14062019Document3 pagesBR Table For BNM Website 14062019Sundararaju NarayanasamyNo ratings yet

- BR Table For BNM Website (18.01.19) PDFDocument3 pagesBR Table For BNM Website (18.01.19) PDFJarul ZahariNo ratings yet

- HDFC StrongestBankDocument2 pagesHDFC StrongestBankjalalisumanNo ratings yet

- Bank Interest Rate CalcultationDocument2 pagesBank Interest Rate CalcultationNprantoNo ratings yet

- CS FDRDocument1 pageCS FDRRONINo ratings yet

- Security Bank P2Document9 pagesSecurity Bank P2jancat_06100% (2)

- Assured ReturnsDocument11 pagesAssured ReturnsTheMoneyMitraNo ratings yet

- FIN 101 AssignmentDocument12 pagesFIN 101 AssignmentNasrullah Khan AbidNo ratings yet

- Interest Rate SpreadDocument6 pagesInterest Rate SpreadJannat TaqwaNo ratings yet

- Bank RD Interest Rates (General Public) Senior Citizen RD RatesDocument3 pagesBank RD Interest Rates (General Public) Senior Citizen RD RatesKushal MpvsNo ratings yet

- Banking Theory and Practice: Digital Assignment 1Document5 pagesBanking Theory and Practice: Digital Assignment 1muthu kumaranNo ratings yet

- Credit Risk Management 2017Document31 pagesCredit Risk Management 2017nazmulhossain01011997No ratings yet

- Business Template 0001Document12 pagesBusiness Template 0001Ashif AliNo ratings yet

- Padma Bank: Doomed From Day One: Course InformationDocument8 pagesPadma Bank: Doomed From Day One: Course InformationIrfan Qadir 2035029660No ratings yet

- FD Vs Debt Mutal Fund ModelDocument5 pagesFD Vs Debt Mutal Fund ModeltestNo ratings yet

- Maths Assignment 2022-23 NewDocument10 pagesMaths Assignment 2022-23 NewLokesh gowdaNo ratings yet

- Determinants of Interest Rate Spread in The Banking Sector of Bangladesh: An Econometric AnalysisDocument17 pagesDeterminants of Interest Rate Spread in The Banking Sector of Bangladesh: An Econometric AnalysisAJHSSR JournalNo ratings yet

- Chapter 3 NabinDocument15 pagesChapter 3 NabinNabin AdNo ratings yet

- 2.financial Institutions and Markets PresentationDocument23 pages2.financial Institutions and Markets PresentationSabiha ShantaNo ratings yet

- Bank Analysis WorkingDocument21 pagesBank Analysis WorkingNajmus SakibNo ratings yet

- SL. NO. Name of The Bank Type of Bank Input Variables Public / Privat Fixed Assets Labour Borrowing FundsDocument10 pagesSL. NO. Name of The Bank Type of Bank Input Variables Public / Privat Fixed Assets Labour Borrowing Fundsdip16aniNo ratings yet

- Non-Performing AssetsDocument20 pagesNon-Performing AssetsSagar PawarNo ratings yet

- FD Vs Debt FundDocument6 pagesFD Vs Debt FundGowardhan TamirisaNo ratings yet

- A Summer Internship ReportDocument85 pagesA Summer Internship ReportAbhi PatelNo ratings yet

- Bank LendingingDocument268 pagesBank LendingingAbhay Mathur100% (1)

- FinalReport DevangParab 45163Document24 pagesFinalReport DevangParab 45163Devang ParabNo ratings yet

- Thesis ReportDocument79 pagesThesis ReportHumayra SalsabilNo ratings yet

- Economics AssignmentDocument11 pagesEconomics AssignmentRAJVINo ratings yet

- Maths ProjectDocument15 pagesMaths Projecttmbcreditdummy50% (2)

- Numan Intership Final Report MCB2022Document23 pagesNuman Intership Final Report MCB2022Muhammad ImranNo ratings yet

- Meth ProjectDocument3 pagesMeth Projectjha.smritiNo ratings yet

- Fixed Deposit Interest Rates - Compare Latest FD Interest Rates 2023 PDFDocument11 pagesFixed Deposit Interest Rates - Compare Latest FD Interest Rates 2023 PDFomkar kothuleNo ratings yet

- Symbiosis LawsReleatedtoBankingDocument372 pagesSymbiosis LawsReleatedtoBankingPravindra Singh100% (1)

- Customers' Satisfaction in Commercial Banks of Nepal: Dr. Jitendra Prasad UpadhyayDocument7 pagesCustomers' Satisfaction in Commercial Banks of Nepal: Dr. Jitendra Prasad Upadhyayrezina pokhrelNo ratings yet

- Islamic Final PrjoectDocument12 pagesIslamic Final PrjoectSarah FawazNo ratings yet

- Training Report On Loan and Credit Facility at Cooperative BankDocument86 pagesTraining Report On Loan and Credit Facility at Cooperative BanksumanNo ratings yet

- Repot On SBIDocument76 pagesRepot On SBIPrasad SawantNo ratings yet

- Fixed Deposit Interest Rates - Best FD Rates of Top Banks in India 2022Document12 pagesFixed Deposit Interest Rates - Best FD Rates of Top Banks in India 2022pitax31866No ratings yet

- Internship Report MCB Bank LTDDocument100 pagesInternship Report MCB Bank LTDSajidp78663% (16)

- Customers Preference Towards Islamic Banking - Religious Belief or Influence of Economic FactorsDocument28 pagesCustomers Preference Towards Islamic Banking - Religious Belief or Influence of Economic FactorsIbrahim HossainNo ratings yet

- M2021082 - CORE - Fundamental Analysis of Banking CompaniesDocument72 pagesM2021082 - CORE - Fundamental Analysis of Banking CompaniesSuraj RathodNo ratings yet

- 4.1.1 Ratio of Interest Income To Total Assets: 4.1 AnalysisDocument8 pages4.1.1 Ratio of Interest Income To Total Assets: 4.1 AnalysisGolam Samdanee TaneemNo ratings yet

- Bfsi Project-San CollegeDocument29 pagesBfsi Project-San Collegesuji98998No ratings yet

- Project Report On "Credit Risk Management in State Bank of India"Document22 pagesProject Report On "Credit Risk Management in State Bank of India"Sandeep YadavNo ratings yet

- PNB Project Sahil Khurana-1Document67 pagesPNB Project Sahil Khurana-1PraveenNo ratings yet

- Sip Finance Dipali SanapDocument30 pagesSip Finance Dipali SanapSomnath KhandagaleNo ratings yet

- Sana Shoukat ReportDocument27 pagesSana Shoukat ReportUme Haider100% (1)

- CREDIT RISK MANAGEMENT IN BANK OF INDIA Final WorkingDocument154 pagesCREDIT RISK MANAGEMENT IN BANK OF INDIA Final Workingsanitjaitpal27_28710No ratings yet

- AFS PJCTDocument47 pagesAFS PJCTAbdul BasitNo ratings yet

- Risk Management BlackbookDocument80 pagesRisk Management Blackbookjaueshmahale1234No ratings yet

- Short Term InvestmentDocument16 pagesShort Term Investmentluckey racerNo ratings yet

- Camel 01Document8 pagesCamel 01Pooja PawarNo ratings yet

- Money & Credit: A. Introduction - How Bank FunctionsDocument5 pagesMoney & Credit: A. Introduction - How Bank FunctionsSharvari BurdeNo ratings yet

- Boi ProjectDocument133 pagesBoi ProjectrupalijaiswalNo ratings yet

- Current Scenario of Loans and Advances of Bank Asia Ltd. Moghbazar BranchDocument74 pagesCurrent Scenario of Loans and Advances of Bank Asia Ltd. Moghbazar BranchSumaiya AmrinNo ratings yet

- Comparing Finacial Performances of DCB Bank & Lakshmi Vilas BankDocument25 pagesComparing Finacial Performances of DCB Bank & Lakshmi Vilas BankDaniel Mathew VibyNo ratings yet

- Comparative Study of BanksDocument8 pagesComparative Study of BanksSaurabh RajNo ratings yet

- Financial Institutions and BankingDocument276 pagesFinancial Institutions and BankingWhatsapp stuts100% (1)

- Anoop Mohanty - "Social Obligation vs. Profitability" - System Paradox.Document7 pagesAnoop Mohanty - "Social Obligation vs. Profitability" - System Paradox.AasthaNo ratings yet

- PVC 2 PDFDocument1 pagePVC 2 PDFpiscesguy78No ratings yet

- Cu / PVC Insulated Cable: Conductor Insulation Colour of CoresDocument1 pageCu / PVC Insulated Cable: Conductor Insulation Colour of Corespiscesguy78No ratings yet

- PVC Insulated CablesDocument1 pagePVC Insulated Cablespiscesguy78No ratings yet

- Leader-PVC 3Document1 pageLeader-PVC 3piscesguy78No ratings yet

- PVC 2 PDFDocument1 pagePVC 2 PDFpiscesguy78No ratings yet

- PVC Insulated, PVC Sheathed Unarmoured Cable: Conductors Insulation Colour of CoresDocument1 pagePVC Insulated, PVC Sheathed Unarmoured Cable: Conductors Insulation Colour of Corespiscesguy78No ratings yet

- PVC Insulated, PVC Sheathed Unarmoured Cable (2-Core)Document1 pagePVC Insulated, PVC Sheathed Unarmoured Cable (2-Core)piscesguy78No ratings yet

- Pages From hager-CE240B-2Document1 pagePages From hager-CE240B-2piscesguy78No ratings yet

- Pages From Jotun Hardtop BrochureDocument1 pagePages From Jotun Hardtop Brochurepiscesguy78No ratings yet

- Guideline Temporary Construction Workers Amenities AccommodationDocument1 pageGuideline Temporary Construction Workers Amenities Accommodationpiscesguy78No ratings yet

- Pages From hager-CE240B-3Document1 pagePages From hager-CE240B-3piscesguy78No ratings yet

- Product Family Datasheet: Smartlux T5 HeDocument5 pagesProduct Family Datasheet: Smartlux T5 Hepiscesguy78No ratings yet

- Pages From hager-CE240BDocument1 pagePages From hager-CE240Bpiscesguy78No ratings yet

- Corrosion: BimetallicDocument1 pageCorrosion: Bimetallicpiscesguy78No ratings yet

- HAP - Best Practice Catalog - Francis TurbineDocument1 pageHAP - Best Practice Catalog - Francis Turbinepiscesguy78No ratings yet

- Section A - Preliminaries and General Conditions 1. Scope of WorksDocument1 pageSection A - Preliminaries and General Conditions 1. Scope of Workspiscesguy78No ratings yet

- Bimetallic 1Document1 pageBimetallic 1piscesguy78No ratings yet

- Ral BSDocument1 pageRal BSpiscesguy78No ratings yet

- System 7 System 9: NORSOK M-501: Frequently Asked Questions NORSOK M-501: Frequently Asked QuestionsDocument1 pageSystem 7 System 9: NORSOK M-501: Frequently Asked Questions NORSOK M-501: Frequently Asked Questionspiscesguy78No ratings yet

- BM 3Document1 pageBM 3piscesguy78No ratings yet

- 1.2.2Reliability/Operations & Maintenance - Oriented Best PracticesDocument1 page1.2.2Reliability/Operations & Maintenance - Oriented Best Practicespiscesguy78No ratings yet

- 1.0 Scope and Purpose: HAP - Best Practice Catalog - Francis TurbineDocument1 page1.0 Scope and Purpose: HAP - Best Practice Catalog - Francis Turbinepiscesguy78No ratings yet

- HAP - Best Practice Catalog - Francis TurbineDocument1 pageHAP - Best Practice Catalog - Francis Turbinepiscesguy78No ratings yet

- FAQ Brochure - 29042016 8 PDFDocument1 pageFAQ Brochure - 29042016 8 PDFpiscesguy78No ratings yet

- System 1: NORSOK M-501: Frequently Asked Questions NORSOK M-501: Frequently Asked QuestionsDocument1 pageSystem 1: NORSOK M-501: Frequently Asked Questions NORSOK M-501: Frequently Asked Questionspiscesguy78No ratings yet

- NORSOK M-501: Frequently Asked QuestionsDocument1 pageNORSOK M-501: Frequently Asked Questionspiscesguy78No ratings yet

- FAQ Brochure - 29042016 6Document1 pageFAQ Brochure - 29042016 6piscesguy78No ratings yet

- System 2: NORSOK M-501: Frequently Asked QuestionsDocument1 pageSystem 2: NORSOK M-501: Frequently Asked Questionspiscesguy78No ratings yet

- Hempel NORSOK Coating Systems: NORSOK M-501: Frequently Asked QuestionsDocument1 pageHempel NORSOK Coating Systems: NORSOK M-501: Frequently Asked Questionspiscesguy78No ratings yet

- Manual Transmissions, Double-Clutch Transmissions and Automatic Transmissions For Cars List of Lubricants TE-ML 11Document1 pageManual Transmissions, Double-Clutch Transmissions and Automatic Transmissions For Cars List of Lubricants TE-ML 11piscesguy78No ratings yet

- TElenor GroupDocument168 pagesTElenor Groupbangbang63100% (1)

- Inventux VoordelenDocument2 pagesInventux VoordelenJohan BeijertNo ratings yet

- Blink Press - Financial Times - Start-Ups Seek To Cut Cost of Private Jet Travel in EuropeDocument6 pagesBlink Press - Financial Times - Start-Ups Seek To Cut Cost of Private Jet Travel in EuropeBlinkNo ratings yet

- Financial System of SwitzerlandDocument66 pagesFinancial System of Switzerlandmizan5150% (2)

- SpyderDocument3 pagesSpyderHello100% (1)

- PWC Vietnam Ifrs Vas PDFDocument99 pagesPWC Vietnam Ifrs Vas PDFminhNo ratings yet

- Economics Example Answers Paper 1Document2 pagesEconomics Example Answers Paper 1mohdportmanNo ratings yet

- Intellectual Property Issues in Pharmaceutical Industries in Merger and Acqisitin - A Critical AnalysisDocument17 pagesIntellectual Property Issues in Pharmaceutical Industries in Merger and Acqisitin - A Critical AnalysisDevvrat garhwalNo ratings yet

- AppppDocument3 pagesAppppMaria Regina JavierNo ratings yet

- BP Amoco Pre Zen Tare PPT ModificatDocument37 pagesBP Amoco Pre Zen Tare PPT ModificatSergiu DraganNo ratings yet

- Discounted Measure of Cost and Benefit and Preparation of Cash FlowDocument43 pagesDiscounted Measure of Cost and Benefit and Preparation of Cash FlowHassan GilaniNo ratings yet

- 4.1 Debt and Equity FinancingDocument13 pages4.1 Debt and Equity FinancingAliza UrtalNo ratings yet

- BUS 485 Final ReportDocument30 pagesBUS 485 Final ReportShahida HaqueNo ratings yet

- Case Analysis - Real MadridDocument7 pagesCase Analysis - Real MadridLaurence Janvier67% (3)

- BAV Model To Measure Brand EquityDocument4 pagesBAV Model To Measure Brand EquityElla StevensNo ratings yet

- About Nestle IndiaDocument5 pagesAbout Nestle IndiaSAMBHAVI SINGH 1827653No ratings yet

- Jpso 061915Document8 pagesJpso 061915theadvocate.comNo ratings yet

- Benefits of Franolaxy Consulting ServiceDocument1 pageBenefits of Franolaxy Consulting ServiceVikramNo ratings yet

- ch01 The Role of Financial ManagementDocument25 pagesch01 The Role of Financial ManagementBagusranu Wahyudi PutraNo ratings yet

- AuditingDocument19 pagesAuditingUsman Khalid100% (1)

- Europe by Easyjet: Executive SummaryDocument10 pagesEurope by Easyjet: Executive SummaryAmal HameedNo ratings yet

- Soal-Soal Chap 017 Understasnding Accounting and Information SystemDocument52 pagesSoal-Soal Chap 017 Understasnding Accounting and Information SystemNurhayati SitorusNo ratings yet

- Annual Report: Registered OfficeDocument312 pagesAnnual Report: Registered OfficeDNo ratings yet

- Protocols For Economic Collapse in America by Al MartinDocument12 pagesProtocols For Economic Collapse in America by Al Martininformationawareness100% (1)

- Home Work Ch. 1Document2 pagesHome Work Ch. 1score08No ratings yet

- Option SellingDocument5 pagesOption SellingSathishNo ratings yet

- Nature and Importance of Entrepreneurs-2Document19 pagesNature and Importance of Entrepreneurs-2sandychawatNo ratings yet

- Matapang Computer Repairs Journal Entries For The Month Ended February 29,2016 Date Account Title & Explanation Debit CreditDocument4 pagesMatapang Computer Repairs Journal Entries For The Month Ended February 29,2016 Date Account Title & Explanation Debit CreditAaroneZulueta50% (4)

- Research Scientist IBM Research Africa DR - Charity Wayua EaseofDoingBusinessReport ConnectedEA2015 1-04-15Document28 pagesResearch Scientist IBM Research Africa DR - Charity Wayua EaseofDoingBusinessReport ConnectedEA2015 1-04-15ICT AUTHORITYNo ratings yet

- Irc CRMDocument43 pagesIrc CRMsureshv23No ratings yet