Professional Documents

Culture Documents

CAT Review Qs PDF

Uploaded by

Suy YanghearOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CAT Review Qs PDF

Uploaded by

Suy YanghearCopyright:

Available Formats

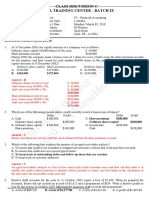

CAT Review Qs

Sunday, July 23, 2017 9:50 AM

FA2 Managing Financial Records

Chap 1 Practice Questions

Lecturer: Christine Colon, ACCA

Name:

Group: Date:

1 A sole trader had opening capital of $10,000 and closing capital of $4,500. During the

period, the owner introduced capital of $4,000 and withdrew $8,000 for her own use.

What was her profit or loss during the period?

A $9,500 loss

B $1,500 loss

C $7,500 profit

D $17,500 profit

2 Arthur had net assets of $19,000 at 30 April 20X7. During the year to 30 April 20X7, he

introduced $9,800 additional capital into the business. Profits were $8,000, of which he

withdrew $4,200.

accounting equation exercise Page 1

withdrew $4,200.

What was the balance on Arthur’s capital account at 1 May 20X6?

A $5,400

B $13,000

C $16,600

D $32,600

3 The following transactions relate to Max's business:

1 May Purchase of goods for resale on credit $300

2 May Max injects long term capital into the business $1,400

3 May Payment of rent made $750

5 May Max withdraws cash from the business $400

7 May Sales made on credit (goods originally cost $600) $1,200

At the start of the week, the assets of the business were $15,700 and liabilities

amounted to $11,200.

At the end of the week, what is the amount of Max's capital?

A $5,350

B $1,400

C $850

D $1,000

4 A business borrowed $1,700 from its bank and used the cash to buy a new computer.

How is the accounting equation affected by these transactions?

Assets Liabilities

A Unchanged Decreased

accounting equation exercise Page 2

Assets Liabilities

A Unchanged Decreased

B Unchanged Increased

C Increased Increased

D Increased Decreased

5 Andrea started a taxi business by transferring her car, worth $5,000 into the business.

What are the accounting entries required to record this?

A Dr Capital $5,000

Cr Car $5,000

B Dr Car $5,000

Cr Drawings $5,000

C Dr Car $5,000

Cr Capital $5,000

D Dr Car $5,000

Cr Bank $5,000

6. A sole trader had opening capital of $12,000 and closing capital of $14,500. During the

period, the owner made a loss of $13,000 withdrew $7,500 for his own use.

What was capital introduced into the business during the year?

A. $6,000

B. $8,000

C. $23,000

D. $18,000

accounting equation exercise Page 3

accounting equation exercise Page 4

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- FA2 Accruals and PrepaymentsDocument4 pagesFA2 Accruals and Prepaymentsamna zamanNo ratings yet

- Chapter 6 Bank Recon Practice QHDocument3 pagesChapter 6 Bank Recon Practice QHSuy Yanghear100% (1)

- Examiner's Report - FA2 PDFDocument40 pagesExaminer's Report - FA2 PDFSuy YanghearNo ratings yet

- F3 Mock1 Ans PDFDocument9 pagesF3 Mock1 Ans PDFhayarpiNo ratings yet

- f3 Mock TestDocument11 pagesf3 Mock TestSai SandhyaNo ratings yet

- f3 Specimen j14 PDFDocument21 pagesf3 Specimen j14 PDFBestNo ratings yet

- Fa2 Mock Test 2Document7 pagesFa2 Mock Test 2Sayed Zain ShahNo ratings yet

- FA1 MOCK EXAM CHAPTER 1 To 5Document6 pagesFA1 MOCK EXAM CHAPTER 1 To 5Haris AhnedNo ratings yet

- Irrecoverable Debts ReviewDocument11 pagesIrrecoverable Debts ReviewThidarothNo ratings yet

- Mock Test 2Document9 pagesMock Test 2Toàn ĐứcNo ratings yet

- FA2 Mock 3 ExamDocument12 pagesFA2 Mock 3 ExamRameen ChNo ratings yet

- AccountingDocument7 pagesAccountingHà PhươngNo ratings yet

- Mock 2Document13 pagesMock 2Angie Nguyen0% (1)

- Fa1 4&BRSDocument5 pagesFa1 4&BRSShahab ShafiNo ratings yet

- Assets, Liabilities and The Accounting Equation 36 MinsDocument9 pagesAssets, Liabilities and The Accounting Equation 36 MinsKhánh Ly50% (2)

- ACCA ExerciseDocument23 pagesACCA ExerciseIndriyanti Krisdiana100% (1)

- Skans School of Accoutancy Subject Ma1 Test Teacher Shahab Name Batch Obtained Marks Total Marks 30Document4 pagesSkans School of Accoutancy Subject Ma1 Test Teacher Shahab Name Batch Obtained Marks Total Marks 30shahabNo ratings yet

- Kaplan Chapter 2: IAS 16 Property, Plant and EquipmentDocument11 pagesKaplan Chapter 2: IAS 16 Property, Plant and EquipmentRaihan SirNo ratings yet

- Chapter - 1 Introduction To AccountingDocument3 pagesChapter - 1 Introduction To AccountingAnna Olivia MarieNo ratings yet

- FA1 Basic MCQsDocument8 pagesFA1 Basic MCQsamir100% (3)

- FIA FA1 Course Exam 2 QuestionsDocument16 pagesFIA FA1 Course Exam 2 Questionsmarlynrich3652No ratings yet

- Revision Question BankDocument134 pagesRevision Question Bankgohasap_303011511No ratings yet

- Chapter 6 Suspense Practice Q HDocument5 pagesChapter 6 Suspense Practice Q HSuy YanghearNo ratings yet

- Sales Tax: Calculation of Sales Tax Double Entries Ledger Accounts of Sales Tax Practice Questions Answer BankDocument10 pagesSales Tax: Calculation of Sales Tax Double Entries Ledger Accounts of Sales Tax Practice Questions Answer BankUmar SageerNo ratings yet

- F3 CBE Mock ExamDocument21 pagesF3 CBE Mock ExamMaja Jareno GomezNo ratings yet

- Chapter 03Document12 pagesChapter 03Asim NazirNo ratings yet

- Cash Budget . Feb 2020: Q 1 Calgon ProductsDocument11 pagesCash Budget . Feb 2020: Q 1 Calgon Products신두No ratings yet

- P1 Kaplan Q PDFDocument76 pagesP1 Kaplan Q PDFLidiya KhadjibayevaNo ratings yet

- Objective Test Questions: Section 1Document8 pagesObjective Test Questions: Section 1Renato WilsonNo ratings yet

- Kpmg-Entrance-Test 21.22Document13 pagesKpmg-Entrance-Test 21.22Vũ Tăng ThếNo ratings yet

- MCQ FA1 TenDocument12 pagesMCQ FA1 TenZeeshan BakaliNo ratings yet

- Accounting EQB Chapter 15 QsDocument41 pagesAccounting EQB Chapter 15 Qsnatalia hariniNo ratings yet

- CAT Paper FA2Document16 pagesCAT Paper FA2Asra Javed100% (1)

- This Study Resource Was: Multiple Choice QuestionsDocument8 pagesThis Study Resource Was: Multiple Choice QuestionsPamela SantosNo ratings yet

- F2 Mock 5Document9 pagesF2 Mock 5deepakNo ratings yet

- 6 AnsDocument9 pages6 AnsAj PotXzs Ü100% (1)

- Icaew Cfab Asr 2019 Sample ExamDocument28 pagesIcaew Cfab Asr 2019 Sample ExamAnonymous ulFku1v100% (1)

- ACCA F3 - Final Mocks - AnswersDocument12 pagesACCA F3 - Final Mocks - AnswersbunipatNo ratings yet

- Ffa/F3 Financial AccountingDocument16 pagesFfa/F3 Financial AccountingArt and Fashion galleryNo ratings yet

- Accacat Paper t3 Maintaining Financial ReDocument32 pagesAccacat Paper t3 Maintaining Financial ReKian Yen0% (1)

- Mock 1Document12 pagesMock 1Mohsena MunnaNo ratings yet

- Bank Reconciliation Statement-2 MCQSFFDDocument11 pagesBank Reconciliation Statement-2 MCQSFFDAbdul Ahad YousafNo ratings yet

- Chapter 21Document4 pagesChapter 21Rahila RafiqNo ratings yet

- (SAPP) F2 ACCA Mock Exam With AnswerDocument16 pages(SAPP) F2 ACCA Mock Exam With AnswerCherLloydNguyen100% (1)

- F3 Mock1 QuestDocument18 pagesF3 Mock1 QuestKiran Batool86% (7)

- Toaz - Info Acca f3 LRP Questions PRDocument64 pagesToaz - Info Acca f3 LRP Questions PRArt and Fashion galleryNo ratings yet

- ACCA FFA Test 1Document6 pagesACCA FFA Test 1Monjurul AhsanNo ratings yet

- Chuẩn mực KTQTDocument24 pagesChuẩn mực KTQTChi PhươngNo ratings yet

- Sales Tax Test - SolutionDocument4 pagesSales Tax Test - SolutionBilal GouriNo ratings yet

- Cfs Direct Method - IaDocument35 pagesCfs Direct Method - IaCanny TrầnNo ratings yet

- ACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesDocument40 pagesACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesMuhammad AzamNo ratings yet

- TN Cô Cho ThêmDocument3 pagesTN Cô Cho ThêmDĩm MiNo ratings yet

- PACE Sample ExamDocument13 pagesPACE Sample ExamjhouvanNo ratings yet

- PA Sample MCQs 2Document15 pagesPA Sample MCQs 2ANH PHẠM QUỲNHNo ratings yet

- Quiz ch1 2Document5 pagesQuiz ch1 2loveshareNo ratings yet

- Double Entry Book Keeping Rules Chapter - 03Document10 pagesDouble Entry Book Keeping Rules Chapter - 03Ramainne RonquilloNo ratings yet

- 2010 Yr 9 POA AnsDocument67 pages2010 Yr 9 POA AnsMuhammad SamhanNo ratings yet

- Accounting AssignmentDocument16 pagesAccounting AssignmentAarya SharmaNo ratings yet

- Pilot TestDocument4 pagesPilot TestTrang Nguyễn QuỳnhNo ratings yet

- Practice Qs Chap 13HDocument4 pagesPractice Qs Chap 13HSuy YanghearNo ratings yet

- Chapter 6 Suspense Practice Q HDocument5 pagesChapter 6 Suspense Practice Q HSuy YanghearNo ratings yet

- Incomplete Records - ActivitiesHDocument10 pagesIncomplete Records - ActivitiesHSuy YanghearNo ratings yet

- Name: Group: Date:: Chap 1 Practice Questions Lecturer: Christine Colon, ACCADocument3 pagesName: Group: Date:: Chap 1 Practice Questions Lecturer: Christine Colon, ACCASuy YanghearNo ratings yet

- Name: Group: Date:: FA2 Managing Financial RecordsDocument2 pagesName: Group: Date:: FA2 Managing Financial RecordsSuy YanghearNo ratings yet

- Chapter 6a QUIZ GDocument3 pagesChapter 6a QUIZ GSuy YanghearNo ratings yet

- Name: Group: Date:: FA2 Managing Financial RecordsDocument4 pagesName: Group: Date:: FA2 Managing Financial RecordsSuy Yanghear100% (1)

- Name: Group: Date: Chapter Exercise 1 - Preparation of Statement of Profit or Loss From General Ledger AccountsDocument5 pagesName: Group: Date: Chapter Exercise 1 - Preparation of Statement of Profit or Loss From General Ledger AccountsSuy YanghearNo ratings yet

- Bank Reconciliations - Activities Blyth CDocument4 pagesBank Reconciliations - Activities Blyth CSuy YanghearNo ratings yet

- Bank Reconciliations C1 - Activities CDocument8 pagesBank Reconciliations C1 - Activities CSuy YanghearNo ratings yet

- Activity 1 - Journal EntriesDocument5 pagesActivity 1 - Journal EntriesSuy YanghearNo ratings yet

- Bank Reconciliations C1 - Activities CDocument8 pagesBank Reconciliations C1 - Activities CSuy YanghearNo ratings yet

- C Rita Blake PDFDocument4 pagesC Rita Blake PDFSuy Yanghear100% (1)

- CAT Capex Opex Exercise 1Document1 pageCAT Capex Opex Exercise 1Suy YanghearNo ratings yet

- Chapter 14 Developing Pricing Strategies and ProgramsDocument40 pagesChapter 14 Developing Pricing Strategies and ProgramsA_Students100% (1)

- Factors Effecting Fiscal PolicyDocument24 pagesFactors Effecting Fiscal PolicyFaizan Sheikh100% (2)

- Mba 4 Sem Banking and Insurance 2 849905 Summer 2013Document1 pageMba 4 Sem Banking and Insurance 2 849905 Summer 2013Hansa PrajapatiNo ratings yet

- SG NRE Open FormDocument2 pagesSG NRE Open FormRanjith PNo ratings yet

- Hostile Takeovers and Their DefensesDocument20 pagesHostile Takeovers and Their DefensesatulgoelafNo ratings yet

- QAd Cex HKC MP 88 P UgDocument3 pagesQAd Cex HKC MP 88 P Ugrozy kumariNo ratings yet

- International Debt and Equity FinancingDocument38 pagesInternational Debt and Equity FinancingNGA HUYNH THI THUNo ratings yet

- LINda Fox BudgetDocument3 pagesLINda Fox Budgettoneyjacoby1No ratings yet

- 1 Case Studies. 2nd SemDocument20 pages1 Case Studies. 2nd SemNeha SinglaNo ratings yet

- 81601CP575Notice 1692149599160Document3 pages81601CP575Notice 1692149599160FGHJJ FDJFHDNo ratings yet

- Challan Form PDFDocument2 pagesChallan Form PDFaccountsmcc islamabadNo ratings yet

- Cali Lesson Notes For PropertyDocument2 pagesCali Lesson Notes For PropertyShannon Robinson0% (1)

- A Case Study of Barclays LoansDocument64 pagesA Case Study of Barclays Loansaditya_naluNo ratings yet

- ACCT557 Week 7 Quiz SolutionsDocument7 pagesACCT557 Week 7 Quiz SolutionsDominickdad100% (2)

- IFRS Differences in Accounting 17Document7 pagesIFRS Differences in Accounting 17Silvia alfonsNo ratings yet

- GenMath11 Q2 Mod-6Document20 pagesGenMath11 Q2 Mod-6Nico Paolo L. BaltazarNo ratings yet

- 4FINALDocument5 pages4FINALAlice Kingsleigh100% (2)

- 05 Aashirwad Medical Agency - Blplup05-05.01.15Document10,153 pages05 Aashirwad Medical Agency - Blplup05-05.01.15Suraj RajbharNo ratings yet

- 0453 Development Studies: MARK SCHEME For The October/November 2012 SeriesDocument9 pages0453 Development Studies: MARK SCHEME For The October/November 2012 SeriesTee SiNo ratings yet

- Kai Garden Residences Hinoki Building Unit and Parking Slot Computation (January 2020 Reservations)Document10 pagesKai Garden Residences Hinoki Building Unit and Parking Slot Computation (January 2020 Reservations)Lem MikeeNo ratings yet

- Credit Card Transaction FlowDocument7 pagesCredit Card Transaction Flowranjith123456No ratings yet

- Duvf - U QHN (: LT Nisarahmed Akbarali AnsariDocument2 pagesDuvf - U QHN (: LT Nisarahmed Akbarali AnsariArman MalikNo ratings yet

- Nego First DayDocument4 pagesNego First DayJackie CanlasNo ratings yet

- Article SearchDocument75 pagesArticle SearchilyaskureshiNo ratings yet

- Public Finance Class PresentationDocument45 pagesPublic Finance Class PresentationnaimaNo ratings yet

- Whbc06 FinalDocument72 pagesWhbc06 Finalmunnicod64No ratings yet

- Chapter 3Document17 pagesChapter 3Siti Khadijah Mohd NoorNo ratings yet

- Indusind Bank InternshipDocument5 pagesIndusind Bank InternshipHarsh ChaitanyaNo ratings yet