Professional Documents

Culture Documents

Measurement issues for auditors

Uploaded by

naega nuguOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Measurement issues for auditors

Uploaded by

naega nuguCopyright:

Available Formats

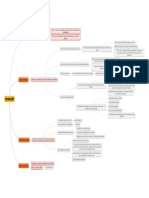

possible for several different but reasonable

measurements and impairment losses to be

recognised by management Stevens: measurement is

assignment of numerals to objects

or events according to rules.

determine whether management

has made appropriate and

reasonable valuations Campbell: Measurement is the assignment of

numerals to represent properties of material

systems other than numbers

fair value approach should be

adopted as the working Involves linking formal

measurement principle Capital number system to

Measurement objects/events (semantic

issues for auditors rules).

Importance of

Measurement

Measurement in In accounting we

assigning a value to capital

accounting measure profit by

Profit calculating profit as the change in

linked to timely capital over the period

recognition

Interval scale Celcius temperature scale, standard cost accounting

Reliability

repeatable or

reproducible Numbering footbalers, classification of

Nominal scale

asset and liabilities into different classes

precision Reliability and accuracy Measurement Theory Scales

Ordinal scale Tallest to shortest person, investment

Proven consistency rank according to NPV

Ratio scale

Accuracy Measurement of length, use of dollar to

measure asset & liabilities

how close the measurement is to

the ‘true value’ of the attribute Permissible

measure - representation operations of

Types of measurement scales

Interval scale: addition

and subtraction

Derived measurement

depends on the measurement of two

or more other quantities Fiat measurement Nominal and ordinal scales: no

Fundamental arthmetic operations

measurement

Ratio scale: all

arithmetic operations

the measurement of profit Numerous ways in which scales can be

depends on the measurement of constructed

both income and expenses Numbers are assigned by reference to

natural laws

there are hundreds of

Length, number, volume ways to measure profit

You might also like

- Ratio AnalysisDocument2 pagesRatio AnalysisMehak RakhechaNo ratings yet

- Costing-ICAI Canotes PDFDocument21 pagesCosting-ICAI Canotes PDFVenkataRajuNo ratings yet

- Costing-ICAI Canotes PDFDocument21 pagesCosting-ICAI Canotes PDFVenkataRajuNo ratings yet

- Ringkasan Pertemuan 12 Adityo RE Prayudi & Gilang KusumabangsaDocument12 pagesRingkasan Pertemuan 12 Adityo RE Prayudi & Gilang KusumabangsagilangNo ratings yet

- Management Accounting Provides Internal InsightsDocument1 pageManagement Accounting Provides Internal InsightsCathlene TitoNo ratings yet

- Analyzing key cost terminology and frameworksDocument1 pageAnalyzing key cost terminology and frameworksIsna Fauziah Biljannah0% (1)

- 2nd Meeting - Mind Map C. 2 - Introduction To Cost Terms and Cost Purposes - A3 PDFDocument1 page2nd Meeting - Mind Map C. 2 - Introduction To Cost Terms and Cost Purposes - A3 PDFIsna Fauziah BiljannahNo ratings yet

- Overview of AccountingDocument7 pagesOverview of AccountingLovenia M. FerrerNo ratings yet

- Chapter 2 - Audit Strategy, Planning and ProgrammingDocument1 pageChapter 2 - Audit Strategy, Planning and Programmingthuzh007No ratings yet

- Cost AccountingDocument6 pagesCost AccountingMelka BelmonteNo ratings yet

- COST ACCOUNTINGDocument6 pagesCOST ACCOUNTINGMelka BelmonteNo ratings yet

- Tema Accounting Policies and StandardsDocument1 pageTema Accounting Policies and Standardsadriana albuNo ratings yet

- Bus103 Endofperiodadjustments PDFDocument5 pagesBus103 Endofperiodadjustments PDFYssa SadjiNo ratings yet

- Appendix 6 - KPI and Supplier Performance Scorecard: ContextDocument4 pagesAppendix 6 - KPI and Supplier Performance Scorecard: ContextDewala KutaNo ratings yet

- Management Advisory Services Concept MapDocument1 pageManagement Advisory Services Concept MapCathlene TitoNo ratings yet

- Costing ChartbookDocument29 pagesCosting ChartbookSHRAVANNo ratings yet

- Nature of Accounting Mind MapDocument12 pagesNature of Accounting Mind MapJared 03No ratings yet

- CA IPCC Costing & FM Quick Revision NotesDocument21 pagesCA IPCC Costing & FM Quick Revision NotesChandreshNo ratings yet

- Recasting FSDocument1 pageRecasting FSCapung SolehNo ratings yet

- Operational Systems ExampleDocument3 pagesOperational Systems ExampleShahid RasheedNo ratings yet

- Managerial Accounting Chapter 1 Lecture on Cost FundamentalsDocument10 pagesManagerial Accounting Chapter 1 Lecture on Cost Fundamentalsrajeshaisdu009No ratings yet

- LRTIDocument12 pagesLRTIWellington Bismark Leon GarciaNo ratings yet

- Printable File - AcounBM2 - Knowledge Explorations - Learning Matrix TableDocument4 pagesPrintable File - AcounBM2 - Knowledge Explorations - Learning Matrix TableMa. Beatriz PatronNo ratings yet

- (HRM-DH45ISB-1) Nguyễn Minh Thảo - Mindmap Session 9 (Performance Management) - 31191022307Document1 page(HRM-DH45ISB-1) Nguyễn Minh Thảo - Mindmap Session 9 (Performance Management) - 31191022307Ng. Minh ThảoNo ratings yet

- 59904bos48773interp3 PDFDocument57 pages59904bos48773interp3 PDFswetha reddyNo ratings yet

- Future economic benefits: potential measures and recognitionDocument1 pageFuture economic benefits: potential measures and recognitionnaega nuguNo ratings yet

- FAR1 - Accounting FrameworksDocument5 pagesFAR1 - Accounting FrameworksMarielle ReyesNo ratings yet

- Case Study SMDocument100 pagesCase Study SMMeet DalalNo ratings yet

- Introduction To AccountingDocument32 pagesIntroduction To AccountingAkp Wewen GensayaNo ratings yet

- Then Do A Pictionary of The Jobs That You Can See in The PuzzleDocument7 pagesThen Do A Pictionary of The Jobs That You Can See in The PuzzleDayana VegaNo ratings yet

- Case Study: After Studying This Chapter, You Will Be Able ToDocument87 pagesCase Study: After Studying This Chapter, You Will Be Able ToYASH PATILNo ratings yet

- Uk FintechDocument1 pageUk FintechcoloradoresourcesNo ratings yet

- Forensic Investigation - ReportDocument6 pagesForensic Investigation - Reportjhon DavidNo ratings yet

- Improving Flowmeter Calibration - Control EngineeringDocument3 pagesImproving Flowmeter Calibration - Control EngineeringGregg JamesNo ratings yet

- Module 1 ACCTDocument26 pagesModule 1 ACCTFathimath NoohaNo ratings yet

- Financial vs Managerial Accounting: Key DifferencesDocument3 pagesFinancial vs Managerial Accounting: Key DifferencesGamuchirai Michael DereraNo ratings yet

- POA Book NotesDocument66 pagesPOA Book Notesshaneka100% (1)

- Chapter 1 Introduction To Cost Accounting - PDF PDFDocument27 pagesChapter 1 Introduction To Cost Accounting - PDF PDFAyushi GuptaNo ratings yet

- Generally Accepted Accounting Principles.Document4 pagesGenerally Accepted Accounting Principles.carmen viquezNo ratings yet

- Icds ChartDocument2 pagesIcds ChartRadhika McNo ratings yet

- BUS254 - Variance Analysis - 4slidesper PageDocument14 pagesBUS254 - Variance Analysis - 4slidesper PageyuviNo ratings yet

- Topic3 ActivityDocument7 pagesTopic3 ActivityCassie HowardNo ratings yet

- Sr. No - Key Audit Matter Our ResponseDocument1 pageSr. No - Key Audit Matter Our Responsegs randhawaNo ratings yet

- Project Metrics DefinitionsDocument8 pagesProject Metrics DefinitionsSudharsana100% (6)

- L2_Property Plant and EquipmentDocument28 pagesL2_Property Plant and EquipmentFallen LeavesNo ratings yet

- Q.1 Define Cost Accounting. State Its Functions. Ans. DefinitionDocument16 pagesQ.1 Define Cost Accounting. State Its Functions. Ans. DefinitionHardik PatelNo ratings yet

- LawDocument29 pagesLawMichael ArciagaNo ratings yet

- STRACOSMAN - Chapter 1Document2 pagesSTRACOSMAN - Chapter 1Rae WorksNo ratings yet

- Valuation HandbookDocument1 pageValuation HandbookbaronfgfNo ratings yet

- Classroom Instruction Delivery Alignment Map (CIDAM) : Core Subject DescriptionDocument11 pagesClassroom Instruction Delivery Alignment Map (CIDAM) : Core Subject DescriptionGlenn Valero Redrendo100% (1)

- IMS - PR.09 Measurement & MonitoringDocument3 pagesIMS - PR.09 Measurement & MonitoringmuneerpmhNo ratings yet

- Job Order Costing Exercises-Solved Problems-Home Work SolutionDocument20 pagesJob Order Costing Exercises-Solved Problems-Home Work SolutionBasanta K Sahu100% (6)

- Cost Classification and BehaviorDocument5 pagesCost Classification and BehaviorShannonNo ratings yet

- Eric Melse explores momentum accounting as part of economic accounting frameworkDocument15 pagesEric Melse explores momentum accounting as part of economic accounting frameworkRafael Gregorio Aguilar GómezNo ratings yet

- Lean AccountingDocument5 pagesLean AccountingAli NadafNo ratings yet

- Referencer For Quick Revision: Intermediate Course Paper-3: Cost and Management AccountingDocument49 pagesReferencer For Quick Revision: Intermediate Course Paper-3: Cost and Management Accountingsunil1287No ratings yet

- Performance - A Guide To Developing Performance Measurement Using The Balanced ScorecardDocument36 pagesPerformance - A Guide To Developing Performance Measurement Using The Balanced Scorecardapi-3820836100% (1)

- Cost Recovery: Turning Your Accounts Payable Department into a Profit CenterFrom EverandCost Recovery: Turning Your Accounts Payable Department into a Profit CenterNo ratings yet

- Sedang Prestige Resort Apologizes for Poor ServiceDocument7 pagesSedang Prestige Resort Apologizes for Poor Servicenaega nuguNo ratings yet

- Analyzing Firm Distress and Credit SourcesDocument4 pagesAnalyzing Firm Distress and Credit Sourcesnaega nuguNo ratings yet

- Pertemuan 9 - The Risk Management Framework in The Implementing Good Corporate GovernanceDocument100 pagesPertemuan 9 - The Risk Management Framework in The Implementing Good Corporate Governancenaega nuguNo ratings yet

- Accounting For GoodwillDocument5 pagesAccounting For Goodwillnaega nuguNo ratings yet

- Measurement issues for auditorsDocument1 pageMeasurement issues for auditorsnaega nuguNo ratings yet

- Value relevance of asset revaluation reserves across countriesDocument1 pageValue relevance of asset revaluation reserves across countriesnaega nuguNo ratings yet

- Classification of Financial Instruments With Characteristic of Both Debt and Equity - Evidence Concerning Convertible RDocument1 pageClassification of Financial Instruments With Characteristic of Both Debt and Equity - Evidence Concerning Convertible Rnaega nuguNo ratings yet

- Liabilities and Owner's EquityDocument1 pageLiabilities and Owner's Equitynaega nuguNo ratings yet

- Classification of Financial Instruments With Characteristic of Both Debt and Equity - Evidence Concerning Convertible RDocument1 pageClassification of Financial Instruments With Characteristic of Both Debt and Equity - Evidence Concerning Convertible Rnaega nuguNo ratings yet

- Conceptual FrameworkDocument1 pageConceptual Frameworknaega nuguNo ratings yet

- Liabilities and Owner's EquityDocument1 pageLiabilities and Owner's Equitynaega nuguNo ratings yet

- Future economic benefits: potential measures and recognitionDocument1 pageFuture economic benefits: potential measures and recognitionnaega nuguNo ratings yet

- SL Physics Lab 2: Air ResistanceDocument6 pagesSL Physics Lab 2: Air ResistanceGennadyNo ratings yet

- Assignment1 ThermodynamicsDocument4 pagesAssignment1 ThermodynamicsThejas SeetharamuNo ratings yet

- Structures Lab ReportDocument18 pagesStructures Lab Reportedk5035No ratings yet

- Karnaugh Map: Engr. Pablo B. Asi Engr. Leni A. Bulan Engr. Liza R. MaderazoDocument18 pagesKarnaugh Map: Engr. Pablo B. Asi Engr. Leni A. Bulan Engr. Liza R. MaderazoDexter DoteNo ratings yet

- Verification and ValidationDocument22 pagesVerification and Validationapi-3806986No ratings yet

- Java Course Notes CS3114 - 09212011Document344 pagesJava Course Notes CS3114 - 09212011Manuel SosaetaNo ratings yet

- Algorithmic Differentiation in Finance Explained-Henrard, Marc, Palgrave Macmillan (2017) PDFDocument112 pagesAlgorithmic Differentiation in Finance Explained-Henrard, Marc, Palgrave Macmillan (2017) PDFdata100% (3)

- Drawing Circles using Midpoint AlgorithmDocument2 pagesDrawing Circles using Midpoint AlgorithmMATTHEW JALOWE MACARANASNo ratings yet

- 2021 Amc Junior W So LnsDocument15 pages2021 Amc Junior W So LnsCharles Jiaquan CUINo ratings yet

- UT Dallas Syllabus For Math1326.502.07s Taught by Raj Seekri (Seekri)Document5 pagesUT Dallas Syllabus For Math1326.502.07s Taught by Raj Seekri (Seekri)UT Dallas Provost's Technology GroupNo ratings yet

- Q-Learning Based Link Adaptation in 5GDocument6 pagesQ-Learning Based Link Adaptation in 5Gkalyank1No ratings yet

- ME Course Content Guide for AY2011/2012 IntakeDocument4 pagesME Course Content Guide for AY2011/2012 IntakedavidwongbxNo ratings yet

- Kotval Mullin Fiscal ImpactDocument44 pagesKotval Mullin Fiscal ImpactMarkWeberNo ratings yet

- (Signal Processing and Communications 13) Hu, Yu Hen - Programmable Digital Signal Processors - Architecture, Programming, and App PDFDocument386 pages(Signal Processing and Communications 13) Hu, Yu Hen - Programmable Digital Signal Processors - Architecture, Programming, and App PDFGururaj BandaNo ratings yet

- Reservoir Engineers Competency Matrix - Society of Petroleum EngineersDocument5 pagesReservoir Engineers Competency Matrix - Society of Petroleum Engineersbillal_m_aslamNo ratings yet

- Algebraic Factorization and Remainder TheoremsDocument5 pagesAlgebraic Factorization and Remainder TheoremsNisheli Amani PereraNo ratings yet

- Transient Stability Analysis With PowerWorld SimulatorDocument32 pagesTransient Stability Analysis With PowerWorld SimulatorvitaxeNo ratings yet

- INTRODUCTION To Construction RatesDocument91 pagesINTRODUCTION To Construction RatesIzo SeremNo ratings yet

- Maximum Efficiency and Output of Class-F Power AmplifiersDocument5 pagesMaximum Efficiency and Output of Class-F Power AmplifierscemshitNo ratings yet

- Números Cardinales y OrdinalesDocument5 pagesNúmeros Cardinales y OrdinalesHeffer Rueda EspinosaNo ratings yet

- Correlation Coefficient DefinitionDocument8 pagesCorrelation Coefficient DefinitionStatistics and Entertainment100% (1)

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers TheDocument13 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers TheaaxdhpNo ratings yet

- HBMT 2103 MeiDocument20 pagesHBMT 2103 MeiNick AnsohNo ratings yet

- Green FunctionDocument15 pagesGreen Functionjitendra25252No ratings yet

- PIAR ExampleDocument7 pagesPIAR ExampleScribdTranslationsNo ratings yet

- Math-6 Demo-LPDocument4 pagesMath-6 Demo-LPREZANo ratings yet

- Correlation AnalysisDocument17 pagesCorrelation AnalysisNabil MarufNo ratings yet

- Basic Programming LogicDocument18 pagesBasic Programming LogicSuvarchala DeviNo ratings yet

- PHYSICS Engineering (BTech/BE) 1st First Year Notes, Books, Ebook - Free PDF DownloadDocument205 pagesPHYSICS Engineering (BTech/BE) 1st First Year Notes, Books, Ebook - Free PDF DownloadVinnie Singh100% (2)