Professional Documents

Culture Documents

PenServROff PDF

Uploaded by

Sanjeev Kumar0 ratings0% found this document useful (0 votes)

8 views2 pagesOriginal Title

PenServROff.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesPenServROff PDF

Uploaded by

Sanjeev KumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

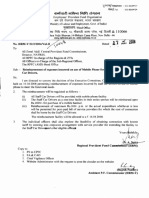

watardt afer Pritt worcr

(CO se, sIRA ee)

Employees’ Provident Fund Organisation

(Ministry of Labour, Govt. Of India)

yon aa” Head Office

te fa mete, 94 ROO ea Re, (Re 99008

Bhavishys Nidhi Bhawan, 14-Bhikaji Cama Place, New Delhi-110066

No. Pension./A&C/1/2000/PIC/Vol.VI Gore Dated:

Te e -

‘0 4 .

ct

19 Fes 207

All Regional Provident Fund Commissioners

Incharge of the Regions,

Alll Officers-in-Charge of Sub Regional Offices.

Sub: Determination of eligible service under para 9 of EPS,1995 —

Rounding off of past service and actual service

Ref:- This office circular No.Pension-A&C/1/2000/PIC/54483 dated

2.11.2001.

Sir,

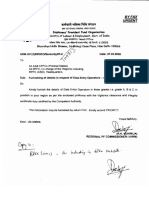

(On a plain reading of para 9 of EPS,1995 it is ve

off of service is possible only for determining the eligi

too only once i.e. either rounding off of actual service for the new entrants OR

rounding off of past service for the existing members. In other words, the

rounding off of actual service is not available for existing members. Further, it

also means that the rounding-off is not available for calculating pension but

restricted only for determining the eligibility of 10 years or more. To sum up, the

facility of rounding-off of service is available under EPS-1995 only for eligible

service and that too only in the following situations.

i, Rounding-off of actual service only for new entrants for the

purpose of determining the eligible service

ii, Rounding-off of past service only for existing members for the

purpose of determining the eligible service

However, the field offices separately round-off both past service and

actual service for the purpose of determining the eligibility as stipulated vide

Para 6.2.14 of MAP Vol.III though this is not backed by the Scheme provision as

seen above. Therefore, this provision of MAP which contradicts the provisions

contained in para 9 of EPS,1995 has no force and can be considered to be

withdrawn as the Scheme provisions shall prevail over the above Manual

provisions to avoid unintended overpayments. Therefore, the rounding off of

past service or actual service has to be carried out only once for determining

the eligible service ie. only past service in respect of existing members and

only actual service in respect of new entrants and not both.

All the cases referred to Head Office in this regard can be considered

as rejected as they do not have an eligible service of 10 years or more.

Yours faithfully,

aye

sO

(K.C. PANDEY)

Additional Central Provident Fund Commissioner (Pension)

1. PS to CPFC

2. PS toFA & CAO

3. All Addl. CPFCs ZonegHead Office

4, Director NATRSS

5. Director/Deputy Director(Audit)

6. Director/Deputy Director(Vig.)

7. All Zonal Training Institutes

8. All Zonal Audit Offices

9. Director(IS) — With request to webcast the above circula:

10. All Officers of Head Office.

Rl,

(RAMAN DHANASEKAR)

Assistant Provident Fund Commissioner(Pension)

You might also like

- Pension LCRC PDFDocument3 pagesPension LCRC PDFSanjeev KumarNo ratings yet

- StaffQtrs CompAllot PDFDocument1 pageStaffQtrs CompAllot PDFSanjeev KumarNo ratings yet

- November 2019Document93 pagesNovember 2019Pratyusha ReddyNo ratings yet

- Posting ProfileDocument2 pagesPosting ProfileSanjeev KumarNo ratings yet

- Notification Schemes PDFDocument10 pagesNotification Schemes PDFSanjeev KumarNo ratings yet

- OneDayPay PDFDocument1 pageOneDayPay PDFSanjeev KumarNo ratings yet

- PensionCalculationMadeEasy PDFDocument2 pagesPensionCalculationMadeEasy PDFzigzagzodiacNo ratings yet

- IntWorker PDFDocument3 pagesIntWorker PDFSanjeev KumarNo ratings yet

- HarraWomenWP PDFDocument2 pagesHarraWomenWP PDFSanjeev KumarNo ratings yet

- OfficersDBF PDFDocument2 pagesOfficersDBF PDFSanjeev KumarNo ratings yet

- NFMS PDFDocument2 pagesNFMS PDFSanjeev KumarNo ratings yet

- Natrss TRGCLR PDFDocument5 pagesNatrss TRGCLR PDFSanjeev KumarNo ratings yet

- Particulars For Grant of Relaxation PDFDocument7 pagesParticulars For Grant of Relaxation PDFSanjeev KumarNo ratings yet

- MobStaffCarDrivr PDFDocument1 pageMobStaffCarDrivr PDFSanjeev KumarNo ratings yet

- NATRSS TrgCal2008 PDFDocument4 pagesNATRSS TrgCal2008 PDFSanjeev KumarNo ratings yet

- IT Act Changes PDFDocument7 pagesIT Act Changes PDFSanjeev KumarNo ratings yet

- List PDFDocument11 pagesList PDFSanjeev KumarNo ratings yet

- orilt: (Ministry of Labour, Go/!I. of India)Document2 pagesorilt: (Ministry of Labour, Go/!I. of India)Sanjeev KumarNo ratings yet

- IntProc Cover PDFDocument2 pagesIntProc Cover PDFSanjeev KumarNo ratings yet

- FWD BelatCredit PDFDocument2 pagesFWD BelatCredit PDFSanjeev KumarNo ratings yet

- Higher Wages PDFDocument3 pagesHigher Wages PDFSanjeev KumarNo ratings yet

- HRM DEO Hire PDFDocument1 pageHRM DEO Hire PDFSanjeev KumarNo ratings yet

- Employees Providen Und Organisation: If FRRRDocument2 pagesEmployees Providen Und Organisation: If FRRRSanjeev KumarNo ratings yet

- DelePower IT PDFDocument5 pagesDelePower IT PDFSanjeev KumarNo ratings yet

- DateofBirth PDFDocument7 pagesDateofBirth PDFSanjeev KumarNo ratings yet

- FileSLP PDFDocument2 pagesFileSLP PDFSanjeev KumarNo ratings yet

- GenLetters PDFDocument1 pageGenLetters PDFSanjeev KumarNo ratings yet

- EarlyPen Calri PDFDocument1 pageEarlyPen Calri PDFSanjeev KumarNo ratings yet

- DetailsDEO PDFDocument1 pageDetailsDEO PDFSanjeev KumarNo ratings yet

- Details DEO PDFDocument2 pagesDetails DEO PDFSanjeev KumarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)