Professional Documents

Culture Documents

Car 2017

Uploaded by

Christine ErnoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Car 2017

Uploaded by

Christine ErnoCopyright:

Available Formats

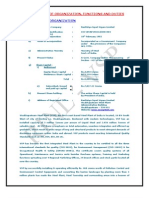

Third Quarter 2017

Cordillera Administrative Region

ASSESSMENT OF LEADING ECONOMIC

INDICATORS

CONTENTS

Leading economic indicators showed a mix picture of

the regional economy for the quarter. Compared to Page

the same period in 2016, improvements were

achieved in terms of agricultural crops production

except for palay and fisheries, PEZA exports, private I. Assessment 1

building, revenue collection, energy consumption,

employment, and prices and inflation. However, A. Agricultural Production 1

there were setbacks in the performance of mineral

production and exports, non-PEZA exports, B. Mineral Production 4

investments, and tourism arrivals.

C. Metallic Mineral Exports 5

More corn, vegetables, fruits, livestock and poultry D. PEZA & Non-PEZA Exports 6

were produced while palay and fisheries production

declined. Production and value of both metallic and E. Investments 6

non-metallic minerals also declined leading to lesser

mineral exports. Also, the value of PEZA exports F. Tourism 8

increased but non-PEZA exports decreased

significantly. Tourism arrivals also declined. G. Private Building Construction 9

H. BIR Revenue Collection 9

Private and MSME investments declined leading to

lesser employment generation and retrenchment of I. Energy Consumption 10

some workers. These might affect the employment

scenario in the succeeding quarters but as of this J. Employment 11

period, employment rate improved coupled by

reduced unemployment and underemployment K. Prices and Inflation 11

rates.

L. Motor Vehicle Registration 12

Prices of goods improved with a lower inflation rate

compared to the previous year. Energy consumption

increased and this might even increase with the II. Challenges and Prospects 13

construction of 309 new private buildings during the

quarter. Revenue collection also increased.

CAR Regional Economic Situationer | 1

A. AGRICULTURAL PRODUCTION

Palay Production Figure 1. Palay Production (MT) and Area

Harvested (Ha), CAR: Q3 2016, Q2 2017, Q3 2017

Contrary to national performance, the 160,000 35,000

region’s palay production contracted to 140,000 30,000

120,000 25,000

58, 958 metric tons, one percent lower 100,000

20,000

80,000

than the production in 2016 and 61 60,000

15,000

percent lower than the previous quarter. 40,000 10,000

20,000 5,000

0 0

Q3 Q2 Q3

The lower palay production is due to the 2016 2017 2017

decrease in areas harvested and palay Palay Production

59,577 152,099 58,958

(MT)

yield. Average area harvested was at 17, Area Harvested

17,873 31,877 17,550

550 hectares during the quarter, a 1.8 (Ha)

percent decrease from 2016 and almost

45 percent decrease from the previous

quarter. On the other hand, palay yield Figure 2. Palay Yield/Hectare, CAR: Q3

2016, Q2 2017, Q3 2017

posted a minimal 0.78 percent annual

6

increase but posted an almost 30

5

percent decline from the preceding

4

quarter.

3

2

Ifugao posted the highest palay

1

production producing 16,697 metric

0

tons (MT) followed by Kalinga with 16, Q3 2016 Q2 2017 Q3 2017

290 MT production. Yield/Hectare 3.33 4.77 3.36

Corn Production Figure 3. Corn Production (in MT), CAR: Q3 2016, Q2 2017, Q3

2017

Corn production was at an

average of 97, 849 MT, 120,000

a 13 percent year-on-year 100,000

increase and a 137 percent 80,000

increase from the second 60,000

quarter. 40,000

20,000

The Provinces of Ifugao and -

Mt.

Kalinga are still the top CAR Abra Apayao Benguet Ifugao Kalinga

Province

producers in the region with Q3 2016 86,486 13,458 1,663 26 48,411 17,184 5,744

production of 49, 409 MT Q2 2017 41,172 - 18,671 5 7,099 11,015 4,382

Q3 2017 97,849 13,629 1,665 26 49,409 24,995 8,125

and 24,995 MT respectively.

CAR Regional Economic Situationer | 2

Vegetable and Fruit Production

A four percent year-on-year increase was achieved but quarter-on-quarter comparisons

show a 6.3 percent decrease. Potato, cabbage, petchay and carrots were the top produce

of the region in terms of volume during the quarter. The five percent increase in the

production of major crops (cabbage, eggplant, tomato, camote, monggo) propelled the

annual increase. However, production of priority vegetable crops which includes potato,

radish, gabi, carrots, pepper, ginger, squash fruit, okra, string beans, ampalaya fruit,

pechay, lettuce, cauliflower, broccoli, banana blossom and habitchuelas decreased by

three percent.

Figure 4. Vegetable Production Figure 5. Fruit Production (MT),

(MT), CAR: Q3 2016, Q2 2017, Q3 CAR: Q3 2016, Q2 2017, Q3 2017

2017

10,000

35,000 9,000

30,000 8,000

25,000 7,000

20,000 6,000

15,000 5,000

4,000

10,000 3,000

5,000 2,000

- 1,000

Major Priority -

Crops Crops Major Crops Priority Crops

Q3 2016 24,183 33,179 Q3 2016 8,742 610

Q2 2017 33,058 28,421 Q2 2017 7,997 1,011

Q3 2017 25,398 32,216 Q3 2017 8,859 554

Total fruit production for the quarter amounting to 9,414 MT is greater than last year’s

and the previous quarter’s production. Banana, pineapple, papaya and orange tops the

quarters production in terms of volume.

Livestock and Poultry

The livestock and poultry industry of the region managed to increase production in spite

of the bird flu outbreak in August 2017 which did not affect the region. The production of

chicken and duck eggs posted a 7.7 percent increase year on year while poultry production

increased by 16 percent quarter on quarter.

Table 1. Livestock and Poultry Production (in MT), CAR: Q3 2016, Q2 2017, Q3 2017

Q3 Q2 2017 Q3 2017 Year-on- Quarter-

2016 year % on-quarter

Change % Change

Livestock 8,181 7,624 8,346 2.0 9.5

Poultry 2,199 1,923 2,228 1.3 15.9

Chicken & Duck Eggs 1,003 1,054 1,080 7.7 2.5

CAR Regional Economic Situationer | 3

Fisheries

A total of 809.86 MT fisheries were produced during the quarter which is lesser by 3.7

percent compared to last year and by 34 percent compared to the previous quarter. The

decline was expected for there has been the "traditional" drop in the performance of

fisheries every 3rd quarter.

B. Mineral Production

Gold, silver and copper concentrate production contracted compared to last year’s

production. Gold production decreased by 30 percent, silver by 23 percent, and copper

concentrate by 20 percent. The reduction is a result of lower head grades and subsequent

power outages in the production areas.

Figure 6. Gold (Large-scale) & Silver Production (in kilograms) and Value (in Pesos)

CAR: Q3 2016, Q2 2017, Q3 2017

Gold Silver

1,400 1,256 3,000,000,000 1,400.00 1,271.00 50,000,000

1,200 2,500,000,000 1,200.00

979.39 40,000,000

1,000 900 884 1,000.00 837.39

2,000,000,000

800 800.00 30,000,000

1,500,000,000

600 600.00 20,000,000

400 1,000,000,000 400.00

500,000,000 10,000,000

200 200.00

- - - -

Q3 2016 Q2 2017 Q3 2017 Q3 2016 Q2 2017 Q3 2017

Quantity (in Kg) Value (in PhP) Quantity (in Kg) Value (in PhP)

Figure 7. Copper Concentrate Production (in Dry Metric Tons) and Value (in Pesos)

CAR: Q3 2016, Q2 2017, Q3 2017

25,000 1,150,000,000

20,000 1,100,000,000

15,000

1,050,000,000

10,000

5,000 1,000,000,000

- 950,000,000

Q3 2016 Q2 2017 Q3 2017

Quantity (in DMT) 20,383 15,703 16,273

Value (in PhP) 1,009,270,942 1,071,773,202 1,112,286,696

However, the value of copper grew by 10.21 percent. Experts attributes this to the stronger

demand from China’s infrastructure and manufacturing sectors. This was reinforced by

the supply disruptions from the world’s key copper mines.

CAR Regional Economic Situationer | 4

On, non-metallic mineral production, reduction in terms of quantity and value were

recorded for slakelime, limestone, and sand and gravel. Only quicklime production

increased in terms of quantity and value.

Table 2. Non-metallic Minerals Production and Value

CAR: Q3 2016, Q2 2017, Q3 2017

Mineral Quantity Value (in PhP)

Q3 Q2 Q3 Q3 2016 Q2 2017 Q3 2017

2016 2017 2017

Quicklime (MT) 1,736.91 2,427.75 2,392.75 13,580,442 19,368,439 18,277,634

Slakelime (MT) 13.91 24.69 7.28 76,004.24 147,225.84 44,550.72

Limestone (MT) - 1,532.02 1,399,346.9 - 684,812.94

3,130.53 1

Sand and Gravel (cu.m.) 286,313 326,608 187,062 78,477,802 278,883,740 74,824,952

C. Metallic Mineral Exports

With the decline in production, quantity and value of mineral exports also declined for

the quarter. Gold exports declined by 38 percent, silver by 47 percent, and copper by 25

percent.

Figure 8. Gold Exports (Kg) & Figure 9. Silver Exports (Kg) &

Value (BillionPhP), CAR: Q3 2016, Value (Million PhP), CAR: Q3

Q2 2017, Q3 2017 2016, Q2 2017, Q3 2017

1,200 2.500 1,400 40.000

1,000 2.000 1,200 35.000

800 1,000 30.000

1.500 25.000

600 800

400 1.000 600

20.000

0.500 15.000

200 400 10.000

- - 200 5.000

Q3 Q2 Q3 - -

2016 2017 2017 Q3 Q2 Q3

Quantity 2016 2017 2017

1,116 922 692 Silver (Kg) 1,263 183 671

(Kg)

Value (in Value (in

2.263 1.861 1.425 37.992 22.899 17.954

Billion PhP) Million PhP)

Figure 10. Copper Concentrate (Dry Metric Tons) & Value (Million

PhP), CAR: Q3 2016, Q2 2017, Q3 2017

25,000 1050

20,000 1000

15,000 950

10,000 900

5,000 850

0 800

Q3 2016 Q2 2017 Q3 2017

Copper (DMT) 20,044 15,037 15,039

Copper (Million PhP) 999 893 959

CAR Regional Economic Situationer | 5

D. PEZA and Non-PEZA Exports

The value of PEZA exports picked up by 41 percent from last year but dipped by 37 percent

compared to the previous quarter. Almost 98 percent of it came from the Baguio City

Economic Zone (BCEZ), 1.5 percent from the John Hay Special Tourism Economic Zone

(JHSTEZ), 0.76 percent from the SM Baguio Cyber zone, and 0.04 percent from the

Neutrinus IT Center.

Radio, Television and

Figure 11. PEZA Exports (in US $) and Communication Equipment

Employment Generated, CAR: Q3 2016,

exports account for 69.7 percent of

Q2 2017, Q3 2017

the total PEZA exports for the

1,000,000,000.00 15,500

quarter, followed by Fabricated

900,000,000.00 15,450

Metal Products that accounted for

800,000,000.00 15,400

almost 26 percent. Call centers

700,000,000.00 15,350 posted a 4 percent share while

600,000,000.00 15,300 textile, wearing apparel, rubber

500,000,000.00 15,250 and plastic products share the rest.

400,000,000.00 15,200

300,000,000.00 15,150 On employment generation, the

200,000,000.00 15,100 PEZA was able to generate a total

100,000,000.00 15,050 of 15, 285 jobs during the quarter,

- 15,000 117 jobs more than the previous

Q3 Q2 Q3

20 20 20 year but 151 lesser than the

16 17 17 previous quarter. Of the total

PEZA Exports

408,013 924,278 575,819

employment generated by PEZA,

(in US $) the BCEZ employs 70 percent

Employment while in terms of industry, call

15,168 15,436 15,285

Generated

centers employ over 59 percent.

On the other hand, non-PEZA exports during the quarter amounted to 410,000 pesos

which is 81 percent lower than the 2.140 million pesos worth of exports in the previous

year. The significant decline is because only the sales of the direct MSME exporters are

reported and that targeted activities to generate exports are scheduled in the following

quarter.

E. Investments

The value of SEC-registered investments decreased by six percent from the same quarter

last year. This is due to the 21 percent decrease in the volume of investments of stock

corporations. There were more investors registered and the volume of investments of

partnership organizations increased but were not enough to offset the decline of stock

corporation investments.

CAR Regional Economic Situationer | 6

Table 3. SEC-Registered Investments (In PhP) & Number of Registrants

CAR: Q3 2016, Q2 2017, Q3 2017

Q3 2016 Q2 2017 Q3 2017

34,834,625 53,861,850 32,862,250

SEC-Registered (In pesos)

Stock Corporation

Volume of Investment 30,099,625 48,803,850 23,819,750

Number of Registrants 30 41 36

Partnership

Volume of Investment 4,735,000 5,058,000 9,042,500

Number of Registrants 14 20 20

DTI-registered investments also posted a 47 percent annual decline from the 567.6

million in 2016 to 300.4 million during the quarter. All provinces experienced a decline

in investments with Ifugao having a 98 percent decrease.

Such decline in investments resulted to a 32 percent decrease of employment generated

by MSMEs from the 6,404 jobs generated during the third quarter of 2016 to 4,364 jobs

of the current quarter.

Figure 12. DTI -Registered Investments by Province (in Million Pesos)

CAR: Q3 2016, Q2 2017, Q3 2017

140.000

120.000

100.000

80.000

60.000

40.000

20.000

0.000

Mountain

Abra Apayao Baguio Benguet Ifugao Kalinga

Province

Q3 2016 90.050 78.820 95.470 106.440 15.550 52.930 128.320

Q2 2017 111.830 97.542 38.940 85.750 14.410 23.668 66.987

Q3 20172 77.402 53.510 32.990 52.340 0.319 24.280 59.530

The decline is primarily due to project implementation delays or even non-

implementation with the persisting challenge of non-submission of Bottom-up Budgeting

(BuB) project liquidation reports by LGUs. Also, reforms promoting ease of doing

business such as the simplification of BPLS needs to be complemented with efficient

support infrastructure such as road networks and telecommunication facilities.

CAR Regional Economic Situationer | 7

F. Tourism

For the tourism industry, arrivals decreased by 14 percent from last year and by 40

percent from the previous quarter. Majority of the provinces posted a decrease for the

quarter except for Baguio City and Ifugao. The 81 percent annual decline of tourist

arrivals in Kalinga is a result of their adoption and compliance to the Standard Local

Tourism Statistics Systems (SLTSS) where data is correctly disaggregated into same-day

visitors and overnight visitors.

However, the regional decline will narrow down with the finalization of data reporting

and the submission of Abra and Mountain Province.

Figure 13. Tourist Arrivals

CAR: Q3 2016, Q2 2017, Q3 2017

500,000

450,000

400,000

350,000

300,000

250,000

200,000

150,000

100,000

50,000

-

Q3 2016 Q2 2017 Q3 2017

CAR 328,839 471,700 282,289

Abra 197

Apayao 883 519 644

Baguio City 241,277 360,811 252,328

Benguet 19,412 23,209 12,143

Ifugao 11,153 15,282 11,164

Kalinga 32,635 23,042 6,010

Mt. Province 23,479 48,640 48,640

Table 4. Tourist Arrivals by Type of Tourists

CAR: Q3 2016, Q2 2017, Q3 2017 By type of tourists, decline in the number

of both foreigner (45 % annual and 47 %

Type of tourists Q3 2016 Q2 2017 Q3 2017

quarter on quarter) and local tourists

Philippine 307,965 449,548 269,945 (12 % annual and 40% quarter on

Residents quarter) can be observed. On the bright

Non-Philippine 20,788 21,802 11,509 side, the number of Overseas Filipinos

Residents

visiting the region multiplied by 871

Overseas 86 350 835 times compared to last year and by 139

Filipinos

percent compared to last quarter.

CAR Regional Economic Situationer | 8

G. Private Building Construction

The private sector increased its investment in building constructions with a total of 309

buildings and total floor area of 61,655 square meters built within the quarter. Of these

new buildings, residential buildings comprise around 75 percent.

Figure 14. Private Building Figure 15. New Construction by

Construction, CAR: Type, CAR: Q3 2016, Q2 2017, Q3

Q3 2016, Q2 2017, Q3 2017 2017

320 234 231

250 215

310 200

300

290 150

280 100

270 23 24 26 16 18 24

50 2 4 1

260

250 0

Q3 Q2 Q3 Residential Commercial Industrial Others

2016 2017 2017

Number 274 316 309 Q3 2016 Q2 2017 Q3 20172

H. BIR Revenue Collection

Tax collections in the region increased by around 21 percent compared to the same period

last year with a total of 1.655 billion pesos. The increase is due to the increased tax

collections from all types of tax except for those under other taxes (one time transactions,

registration fees, and other default taxes) which posted a 1.6 percent decline.

Table 5. BIR Revenue Collection, CAR: Q3 2016, Q2 2017, Q3 2017

Indicator Quarter 3 2016 Quarter 2 2017 Quarter 3 2017

Total 1,373,062,228 1,709,025,364 1,655,692,145

Tax on Income and Profit 823,537,342 1,127,878,200 1,036,169,753

Value-Added Tax 414,429,834 385,221,630 453,927,744

Excise Tax 3,395,981 4,238,440 4,970,838

Percentage Tax 77,733,170 138,392,422 107,527,966

Other Taxes 53,965,899 53,294,670 53,095,841

CAR Regional Economic Situationer | 9

I. Energy Consumption

Energy consumption in the region reached 380,159 KWH for the quarter, which is 0.2

percent higher than energy consumption in 2016 and 46 percent higher than the previous

quarter.

Table 6. Energy Consumption (KWH) by Type of

Use, CAR: Q3 2016, Q2 2017, Q3 2017

The annual increase in energy Type of Use Q3 2016 Q2 2017 Q3 2017

consumption is driven by commercial

consumption and other uses of energy Total 379,280 260,037 380,159

while energy consumption for Residential 209,254 142,633 207,010

residential, industrial and public Commercial 129,352 89,881 133,812

Industrial 8,256 5,007 6,411

buildings posted significant decrease. Public Buildings 22,678 15,383 22,393

The 22 percent decline in industrial Others 9,740 7,133 10,533

energy consumption can be related to

the subsequent power outages Figure 16. Energy Consumption by

experienced in the mineral production Type of Use, CAR: Q3 2017

areas.

Residential

Commercial

Residential consumption accounted

Industrial

for 54 percent of the total

consumption followed by commercial Public Buildings

use accounting for 35 percent.

Benguet Electric Cooperative, Inc. (BENECO) utilized 80 percent of the total energy

consumption while the remaining 20 percent by the other cooperatives. Compared to the

same period last year, energy consumption of Ifugao Electric Cooperative, Inc. declined

by seven percent while Abra Electric Cooperative Inc. by 33 percent. The other electric

cooperatives consumed more compared to the previous year.

Figure 17. Energy Consumption by Electric Cooperative

CAR: Q3 2016, Q2, 2017, Q3 2017

400,000

350,000

300,000

250,000

200,000

150,000

100,000

50,000

-

Q3 2016 Q2 2017 Q3 2017

Mountain Province Electric

13,684 9,405 14,290

Cooperative

Kalinga-Apayao Electric

24,281 15,425 24,985

Cooperative

Ifugao Electric Cooperative, Inc. 14,784 10,002 13,749

Benguet Electric Cooperative Inc 292,196 202,297 304,226

Abra Electric Cooperative Inc 34,335 22,908 22,908

CAR Regional Economic Situationer | 10

J. Employment

Labor Force Participation dipped to 64.5

percent this quarter, lower by 0.8 percent Figure 18. Unemployment and

compared to the same period last year but Underemployment Rate, CAR:

Q3 2016, Q2 2017, Q3 2017

increased by 2.5 percent compared to the

previous quarter. 30.0

25.0 24.6

Employment rate increased from 95 percent

last year to 96.6 percent this quarter, even 20.0

higher than the 95.9 percent of the previous 15.0 15.7

14.6

quarter. Contributing to this is the 45,110 job

applicants placed by the Department of Labor 10.0

and Employment (DOLE)-CAR for the 5.0 5.0 4.1 3.4

quarter.

0.0

Q3 2016 Q2 2017 Q3 2017

Unemployment also decreased from five

percent of July 2016 to 3.4 percent. However, Unemployment Rate

there were 266 retrenched workers for the Underemployment Rate

quarter who might be unemployed for the

succeeding months.

Underemployment also declined from 24.6 in July 2016 to 14.6 during the quarter, still

lower than the 15.7 percent in April 2017. This means that fewer workers are looking for

additional work aside from their current occupations.

K. Prices and Inflation

Regional average inflation rate for the quarter was at 1.8 percent, lower than the 1.9

percent of third quarter 2016 and the 3.1 percent national inflation rate for the same

quarter. The decrease was due to the 1.2 percent slowdown in food and non-alcoholic

beverages prices.

However, quarter-on-quarter Figure 19. Regional Inflation Rate, CAR:

Q3 2016, Q2 2017, Q3 2017,

comparisons show a slight

9

increase from the 1.6 percent of 8

the previous quarter with higher 7

6

prices of alcoholic beverages, 5

tobacco and non-food items. 4

3

2

For non-food commodities, year- 1

on-year price hike were highest 0

All Items Food & Non- Alcoholic Non-Food

for transport (1.7%) and 1.5 Alcoholic Beverages Beverages, Tobacco

percent for housing, water, Q3 2016 Q2 2017 Q3 2017

electricity, gas & other fuels.

CAR Regional Economic Situationer | 11

Provincial comparisons show that Ifugao had the highest inflation rate (3.4%) since the

first to third quarter of 2017. However, Consumer Price Index (CPI) shows that Mountain

Province have the highest price of goods in average with CPI of 156 for all items followed

by Ifugao with 152.

Table 7. Inflation Rate by Province (in percent): Q3 2016, Q2 2017, Q3 2017

Province Q3 2016 Q2 2017 Q3 2017

Abra 2.4 1.3 1.9

Apayao 1.1 0.8 0.5

Benguet 0.9 1.1 1.1

Ifugao 3.4 3.7 3.4

Kalinga 3.3 2.5 2.6

Mountain Province 3.9 2.1 3.1

L. Motor Vehicle Registration

There were 45, 335 registered

Figure 20. Motor Vehicle Registration per

motor vehicles in the region Province/City, CAR: Q3 2017

during the quarter. Of these, 86

percent are private motor

vehicles, 13 percent are for hire

6%

and 1 percent are government 6% 16% Abra

vehicles. There were 5,484 motor 6% Apayao

vehicles that were newly 6% Baguio City

registered while the rest are for

Benguet

renewal.

27% Ifugao

Among provinces/city, Baguio

Kalinga

City accounts for 33 percent of the 33%

total regional MV registrations Mountain Province

followed by Benguet with 27

percent, Abra with 16 percent

while the rest of the provinces

have six percent share each.

CAR Regional Economic Situationer | 12

CHALLENGES AND DEVELOPMENT PROSPECTS

On increasing investments, the establishment of 14 additional Negosyo Centers for the

fourth quarter of 2017 is targeted. Assistance to LGUs with problematic implementation

of BUB projects will also be rendered. The Department of Trade and Industry (DTI) will

also be implementing OTOP Next Gen and Pondo Para sa Pagbabago at Pag-asenso (P3),

new MSME development projects though improving quality of products and providing

micro finance services to micro enterprises with low interest rate. Another new project is

the Trabaho, Negosyo, Kabuhayan, a convergence project of DOLE and DTI.

Towards the improvement of data collection and data reporting of tourism arrivals,

Tourism Establishments’ Forum will be conducted for accommodation establishments

who are the sources of data. The forum is aimed at capacitating the private sector in

tourism data recording and reporting to improve the Local Tourism Statistics System.

Regular conduct of Tourism Officers’ Meeting will also be sustained to closely monitor

tourism data submission, benchmark on tourism issues, concerns, and tourism programs

as well as extend support to LGUs.

The Bureau of Internal Revenue (BIR) aims to improve revenue collection through

enhanced taxpayer voluntary compliance, improved legal tax policy advice services, and

through efficient collection and assessment.

The implementation of the Tax Reform for Acceleration and Inclusion (TRAIN) which

aims to limit the Value Added Tax (VAT)-zero rating to direct importers and thereby

remove VAT exception of local suppliers of PEZA might decrease PEZA local purchases

amounting to 250 billion pesos annually as PEZA-registered enterprises will opt to shift

to import goods (e.g raw materials) which are duty-free and tax-exempt.

PEZA investments are also projected to increase with the increasing investment pledges

but the potential will only be fully realized if the national government will expedite the

approval of economic zone development. As of the quarter, P72.3 billion worth of special

economic zones are still awaiting presidential proclamation.

Prospects for mineral production include assistance to small scale miners specifically in

their application for Minahang Bayan areas in the region. Also, the revised Implementing

Rules and Regulation of Republic Act 7076 otherwise known as People’s Small Scale

Mining Act requires the establishments of centralized custom mills within Minahang

Bayan areas. Assistance in the establishment of these custom mills will then be provided

to mineral processing operators and extractive metallurgy of gold.

CAR Regional Economic Situationer | 13

We would like to acknowledge the contribution of the following RES Task Force members:

Agency Head of Office TWG Representatives

Benguet Electric Cooperative Gerardo Verzosa Juliet D. Alciso

General Manager Olive O. Bete

Bureau of Internal Revenue Teresita M. Dizon Barnabas B. Akilit

Regional Director Juliefer B. Balaoag

Department of Environment and Natural Fay W. Apil Vivian T. Romero

Resources Regional Director

Department of Labor and Employment Exequiel Ronie A. Guzman Myrene A. Bosleng

Regional Director

Department of Tourism Marie Venus Q. Tan Jovy Ganongan

Regional Director

Department of Trade and Industry Myrna P. Pablo Karen M. Lising

Regional Director

Department of Transportation Jose Eduardo L. Natividad Ma. Theresa G. Yatar

Regional Director

National Electrification Administration Edgardo R. Masongsong Leilani L. Rico

Administrator

National Economic and Development Milagros A. Rimando Dolores J. Molintas

Authority Regional Director Antonette A. Anaban

Philippine Export Zone Authority Rene Joey S. Mipa Modesto L. Agyao, Jr.

Zone Administrator

Securities and Exchange Commission Regina May M. Cajucom Edward R. Garcia

OIC-Regional Director Clarence R. Rillota

Philippine Statistics Authority Villafe P. Alibuyog Federico R. Bahit, Jr.

Regional Director

CAR Regional Economic Situationer | 14

You might also like

- Hacienda Bigaa Vs Chavez 2Document5 pagesHacienda Bigaa Vs Chavez 2Christine ErnoNo ratings yet

- RTC Ruling on Service of Summons on Defendant Temporarily AbroadDocument10 pagesRTC Ruling on Service of Summons on Defendant Temporarily AbroadChristine ErnoNo ratings yet

- Varela Vs RevalezDocument8 pagesVarela Vs RevalezChristine ErnoNo ratings yet

- A Critical Look of K To 12 ProgramDocument2 pagesA Critical Look of K To 12 ProgramChristine ErnoNo ratings yet

- Psa Age StatsDocument48 pagesPsa Age StatsChristine ErnoNo ratings yet

- Republic Vs ColbrineDocument4 pagesRepublic Vs ColbrineChristine ErnoNo ratings yet

- Nocum Vs TanDocument11 pagesNocum Vs TanChristine ErnoNo ratings yet

- Marbury Vs Madison 5 US 137 (1803)Document10 pagesMarbury Vs Madison 5 US 137 (1803)Christine ErnoNo ratings yet

- GSIS Vs CaballeroDocument4 pagesGSIS Vs CaballeroChristine ErnoNo ratings yet

- Civ Pro CaseDocument9 pagesCiv Pro CaseChristine ErnoNo ratings yet

- Agdeppa vs. Heirs of Ignacio BoneteDocument5 pagesAgdeppa vs. Heirs of Ignacio BoneteChristine ErnoNo ratings yet

- Calang Vs PeopleDocument2 pagesCalang Vs PeopleChristine ErnoNo ratings yet

- Unenforceable Contracts - JuradoDocument3 pagesUnenforceable Contracts - JuradoChristine ErnoNo ratings yet

- Assignment 2 - DigestsDocument17 pagesAssignment 2 - DigestsChristine ErnoNo ratings yet

- PRC POSITION PAPER As of September 3, 2018 For Senate Hearing On September 4, 2018Document4 pagesPRC POSITION PAPER As of September 3, 2018 For Senate Hearing On September 4, 2018Christine ErnoNo ratings yet

- Avelino Vs CADocument2 pagesAvelino Vs CAChristine ErnoNo ratings yet

- Table1 8Document2 pagesTable1 8Fredd De PilNo ratings yet

- Digests in Corpo LawDocument5 pagesDigests in Corpo LawChristine ErnoNo ratings yet

- Psi Vs AganaDocument8 pagesPsi Vs AganaChristine Erno0% (1)

- Everything You Need to Know About Maternity Leave BenefitsDocument3 pagesEverything You Need to Know About Maternity Leave BenefitsChristine ErnoNo ratings yet

- Cinco Vs CanonoyDocument5 pagesCinco Vs CanonoyChristine ErnoNo ratings yet

- CSC - Omnibus Rules On Leave PDFDocument11 pagesCSC - Omnibus Rules On Leave PDFbongrico92% (13)

- Executive Judge Abused Discretion in Refusing Payment of Filing Fees on Per Case BasisDocument2 pagesExecutive Judge Abused Discretion in Refusing Payment of Filing Fees on Per Case BasisChristine ErnoNo ratings yet

- Digest - Alaban Vs CADocument2 pagesDigest - Alaban Vs CAChristine ErnoNo ratings yet

- Corporate Officer Held Liable for Bouncing Checks Under B.P. Blg. 22Document4 pagesCorporate Officer Held Liable for Bouncing Checks Under B.P. Blg. 22Christine ErnoNo ratings yet

- Apanese Occupation of The PhilippinesDocument10 pagesApanese Occupation of The PhilippinesChristine ErnoNo ratings yet

- The Medical Act of 1959Document17 pagesThe Medical Act of 1959Daley CatugdaNo ratings yet

- Baguio City Population, Households, Density and Poverty DataDocument28 pagesBaguio City Population, Households, Density and Poverty DataChristine ErnoNo ratings yet

- A Critical Look of K To 12 ProgramDocument2 pagesA Critical Look of K To 12 ProgramChristine ErnoNo ratings yet

- Estate Settlement Dispute Over Deceased Woman's PropertyDocument3 pagesEstate Settlement Dispute Over Deceased Woman's PropertyChristine ErnoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Extraction Copper PDFDocument2 pagesExtraction Copper PDFWilliamNo ratings yet

- Met Coal MethodDocument20 pagesMet Coal MethodTjandra LiemNo ratings yet

- Dawnus Presentation FINALDocument32 pagesDawnus Presentation FINALMarina AvalinNo ratings yet

- Case Study On Hindalco Acquire NovelisDocument13 pagesCase Study On Hindalco Acquire Novelissahilagl23_121905585No ratings yet

- Mar 2012Document40 pagesMar 2012Daneshwer VermaNo ratings yet

- Universalcoal Annual Report 2017Document128 pagesUniversalcoal Annual Report 2017satyr01No ratings yet

- G&V - Final Basic Assessment Report and Environmental Management Program ReportDocument311 pagesG&V - Final Basic Assessment Report and Environmental Management Program ReportFrancois GreeffNo ratings yet

- Royalty 3Document16 pagesRoyalty 3Gamers 4 lyfNo ratings yet

- Mining For Non Miners 2Document20 pagesMining For Non Miners 2Mohammad Fahry Aladjai100% (1)

- 6 Development of RailwaysDocument6 pages6 Development of RailwaysPrantik MitraNo ratings yet

- Ali Raza Muhammad Murad CVDocument1 pageAli Raza Muhammad Murad CVAli RazaNo ratings yet

- Kci Kendilo ProfileDocument1 pageKci Kendilo Profileapi-167631790No ratings yet

- Habibillah Energi Adidaya Statement of QualificationsDocument56 pagesHabibillah Energi Adidaya Statement of QualificationsjakalegawaNo ratings yet

- Micmar Company Profile A4 Spreads v.5 PrintDocument20 pagesMicmar Company Profile A4 Spreads v.5 PrintKapolesa LimandeNo ratings yet

- Proposal For Monitoring Agent: SP AdvisoryDocument11 pagesProposal For Monitoring Agent: SP AdvisoryHary AntoNo ratings yet

- Auriferous Placer Sampling and Dimensioning Caychive River AreaDocument88 pagesAuriferous Placer Sampling and Dimensioning Caychive River AreaIsantixMontaliPeraltaNo ratings yet

- Vizag PDFDocument25 pagesVizag PDFRana PrathapNo ratings yet

- MECO - 420: Mineral Economics - 4210Document35 pagesMECO - 420: Mineral Economics - 4210Martin ChikumbeniNo ratings yet

- Noise Surveys in India and AbroadDocument51 pagesNoise Surveys in India and AbroadAbhijeet DuttaNo ratings yet

- Review of The In-Pit Crushing and Conveying Case Study Cooper IndustryDocument16 pagesReview of The In-Pit Crushing and Conveying Case Study Cooper IndustryYorka SánchezNo ratings yet

- Dos AmigosDocument17 pagesDos AmigosAlonso Patricio Herrera GuzmanNo ratings yet

- SiduDocument136 pagesSiduSiddharth MehtaNo ratings yet

- 1 - Gaite Vs FonacierDocument2 pages1 - Gaite Vs FonacierPauPau Abut100% (1)

- Cut-Off Grade PDFDocument11 pagesCut-Off Grade PDFjuan100% (2)

- Differentiate IM Terms Records Fields TablesDocument12 pagesDifferentiate IM Terms Records Fields TablesDrake Wells0% (1)

- INVENTORY OF COAL RESERVES IN INDIADocument16 pagesINVENTORY OF COAL RESERVES IN INDIAJack NandanNo ratings yet

- Hazemag HFB en DD LowDocument4 pagesHazemag HFB en DD LowKuya Fabio VidalNo ratings yet

- Banda Conveyor PDFDocument38 pagesBanda Conveyor PDFJorge Rios RNo ratings yet

- Using Bench Grinder (WS)Document7 pagesUsing Bench Grinder (WS)John KalvinNo ratings yet

- Ancient Jewelry GuideDocument516 pagesAncient Jewelry Guidegiselin_aaNo ratings yet