Professional Documents

Culture Documents

Gebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018

Uploaded by

Abhijeet SahuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018

Uploaded by

Abhijeet SahuCopyright:

Available Formats

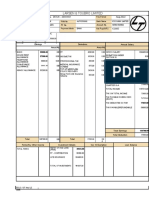

GEBR. PFEIFFER ( INDIA ) PVT. LTD.

FN-1B,1001B,TENTHFLOOR,VISHWA DEEP,DISTRICT CENTRE,JANAKPURI, NEW DELHI - 110058

Pay Slip for the month of February 2018 Print Date : 01/03/2018 04:38:25PM

Code : APT147 Location : DELHI

Name : ABHIJEET SAHU Bank/MICR : DEUTSCHE BANK

Department : ENGINEERING Bank A/c No. : 400033816750019

Designation : ENGINEER - PROJECT ENGINEERING PAN : EXTPS3889F

DOB : 23/01/1991 PF No. : DL/24249/139

DOJ : 18/12/2017 Payable Days : 28.00 UANNO : 100603025233

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic 15,200 15,200 15,200 PROV. FUND 1,824

HRA 9,120 9,120 9,120

Conv Allow 7,000 7,000 7,000

GROSS PAY 31,320 31,320 GROSS DEDUCTION 1,824

Net Pay : 29496.00 (RUPEES TWENTY-NINE THOUSAND FOUR HUNDRED NINETY-SIX)

Income Tax Worksheet for the Period December 2017 - March 2018

Description Gross Exempt Taxable Deduction Under Chapter VI-A HRA Calculation

Basic 52,465 52,465 Investments u/s 80C Rent Paid 28648.00

HRA 31,479 23,402 8,077 PF+VPF 5,252 From 18/12/2017

Conv Allow 24,161 5,523 18,638 P P F 30,300 To 31/03/2018

PRV EMP SAL 254,121 L I P 22,883 1. Actual HRA 31,479

Previous Employer PF 7,154 2. 40% or 50% of Basic 26,233

3. Rent > 10% Basic 23,402

Least of above is exempt 23,402

Taxable HRA 8,077

Gross Salary 362,226 28,925 333,301 Total of Investment u/s 80C 65,589

Deduction U/S 80C 65,589

Previous Employer Professional Tax

Professional Tax

Under Chapter VI-A 65,589

Any Other Income

Taxable Income 267,720

Total Tax 886

Tax Rebate 886

Surcharge

Tax Due

Educational Cess 0

Net Tax 0

Tax Deducted (Previous Employer) Leave Balances

Tax Deducted Till Date Type Closing

Tax to be Deducted

CL 0.50

Tax / Month Total of Ded Under Chapter VI-A 65,589

EL 0.00

Tax on Non-Recurring Earnings

Tax Deduction for this month Interest on Housing Loan

Personal Note :

General Note :As per Circular No 08/2013 dated October 10, 2013, If annual Rent paid by the employee exceeds Rs 100000 per Annum, it is

mandatory for the employee to report PAN of the landlord to the employer. In case the landlord doesn’t have the PAN, a declaration to this

effect from the landlord along with the name and address of the landlord should be filed by the employee

You might also like

- Beginners Guide To SalesDocument19 pagesBeginners Guide To SalesJoannaCamyNo ratings yet

- 315 - 4 - 2017 - P5585 - Kuldeep Manibhai Kothiya PDFDocument1 page315 - 4 - 2017 - P5585 - Kuldeep Manibhai Kothiya PDFKuldeep KothiyaNo ratings yet

- 2013 Deutsche Bank Operational Due Diligence SurveyDocument48 pages2013 Deutsche Bank Operational Due Diligence SurveyRajat CNo ratings yet

- Pooja Singh PDFDocument2 pagesPooja Singh PDFAbhay SinghNo ratings yet

- Is 813Document4 pagesIs 813Abhijeet SahuNo ratings yet

- HL Business Management Course Outline - FinalDocument14 pagesHL Business Management Course Outline - FinalAnthony QuanNo ratings yet

- Capstone - Upgrad - Himani SoniDocument21 pagesCapstone - Upgrad - Himani Sonihimani soni100% (1)

- Salary Slip For The Month Of: JUN 2018: Principle Security and Allied Services PVT LTDDocument2 pagesSalary Slip For The Month Of: JUN 2018: Principle Security and Allied Services PVT LTDBalram Singh JadounNo ratings yet

- Netflix Activity MapDocument6 pagesNetflix Activity Mapbharath_ndNo ratings yet

- August 2022Document1 pageAugust 2022amitdesai92No ratings yet

- Web Payslip 266675 202304Document2 pagesWeb Payslip 266675 202304prabhat.finnproNo ratings yet

- Cash Memo BillDocument1 pageCash Memo BillSonet HosainNo ratings yet

- BJCPK1678J 2018-19Document2 pagesBJCPK1678J 2018-19AnbarasanNo ratings yet

- Payslip For The Month of Nov 2022Document1 pagePayslip For The Month of Nov 2022Natural HealthCare IdeasNo ratings yet

- Ldnov - Dec18551371124 2Document1 pageLdnov - Dec18551371124 2p_panchal82No ratings yet

- FORENSIC ACC Details 1Document42 pagesFORENSIC ACC Details 1angelNo ratings yet

- Employee Pay SlipDocument1 pageEmployee Pay SlipTiyyagura RoofusreddyNo ratings yet

- Booking Request ID: Visiting Purpose: Booking Confirmed On: SubjectDocument2 pagesBooking Request ID: Visiting Purpose: Booking Confirmed On: SubjectManoj GoyalNo ratings yet

- Parle Agro PVT Ltd-46Document1 pageParle Agro PVT Ltd-46QASWA ENGINEERING PVT LTDNo ratings yet

- 2 Old Evaps LB and ELB Series PDFDocument28 pages2 Old Evaps LB and ELB Series PDFPreeti gulatiNo ratings yet

- BD - 65 Dozer Service ScheduleDocument1 pageBD - 65 Dozer Service SchedulePankajkumarsinghsingh SinghNo ratings yet

- PAYSLIPDocument11 pagesPAYSLIPSaran ManiNo ratings yet

- Accretive Health Services Private Limited: Pay Slip For The Month of July 2022Document1 pageAccretive Health Services Private Limited: Pay Slip For The Month of July 2022Santosh Kumar GuptaNo ratings yet

- External PressureDocument22 pagesExternal PressureAbhijeet SahuNo ratings yet

- 6500016884Document7 pages6500016884hfewkorbaNo ratings yet

- CH.5 Strategic Analysis of Ben and JerryDocument9 pagesCH.5 Strategic Analysis of Ben and JerryJackie100% (1)

- Praveen KumarDocument3 pagesPraveen Kumarvidhi09No ratings yet

- Salary Slip OctDocument1 pageSalary Slip OctBhavesh MishraNo ratings yet

- QuotationDocument4 pagesQuotationم.فرج العماميNo ratings yet

- Water in Air Calculator - Version 3Document7 pagesWater in Air Calculator - Version 3Neelakandan DNo ratings yet

- 24 X 7 KOEL CARE Helpdesk: 8806334433/18002333344: Quotation Parts Quotation DetailsDocument1 page24 X 7 KOEL CARE Helpdesk: 8806334433/18002333344: Quotation Parts Quotation DetailsKalpavriksha SocietyNo ratings yet

- Form 16 FY 19-20Document6 pagesForm 16 FY 19-20Anurag SharmaNo ratings yet

- Government of Tamil Nadu: District Officer, Fire and RescueDocument2 pagesGovernment of Tamil Nadu: District Officer, Fire and RescueDhanushya SargunanNo ratings yet

- Feb2017Document2 pagesFeb2017Kalai SelvanNo ratings yet

- Model CTC Calculation 420000 Heads %age P.A. (RS.) P.M. (RS.) Fixed or VariableDocument2 pagesModel CTC Calculation 420000 Heads %age P.A. (RS.) P.M. (RS.) Fixed or Variableranjana sharmaNo ratings yet

- Air Oil Separator Datasheet Rev C1Document2 pagesAir Oil Separator Datasheet Rev C1Anonymous a4Jwz14WNo ratings yet

- PDFReports PDFDocument1 pagePDFReports PDFTuhin ChakrabortyNo ratings yet

- Robotics Lab ManualDocument26 pagesRobotics Lab ManualAbhijeet Sahu100% (3)

- Partes Compresor Gar 5Document6 pagesPartes Compresor Gar 5rolando mora zapataNo ratings yet

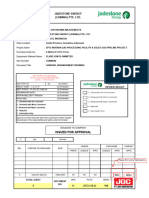

- Jadestone Energy (Lemang) Pte. LTD.: Epci Akatara Gas Processing Facility & Sales Gas Pipeline ProjectDocument5 pagesJadestone Energy (Lemang) Pte. LTD.: Epci Akatara Gas Processing Facility & Sales Gas Pipeline ProjectFirmansyah SiregarNo ratings yet

- Air Division: Parts List For Portable EnglishDocument94 pagesAir Division: Parts List For Portable EnglishMohamed AhteewishNo ratings yet

- Account Statement From 11 Dec 2017 To 11 Jun 2018Document6 pagesAccount Statement From 11 Dec 2017 To 11 Jun 2018Abhijeet SahuNo ratings yet

- Salary Slip NewDocument1 pageSalary Slip Newbindu mathaiNo ratings yet

- Pantawid Pamilyang Pilipino ProgramDocument3 pagesPantawid Pamilyang Pilipino ProgramGercel Therese SerafinoNo ratings yet

- Aeries Technology Group Private Limited: Full and Final Settlement - December 2018Document3 pagesAeries Technology Group Private Limited: Full and Final Settlement - December 2018तेजस्विनी रंजनNo ratings yet

- September AthenaDocument1 pageSeptember AthenaSathyavathi PyNo ratings yet

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument1 pageSalary Calculation Yearly & Monthly Break Up of Gross SalarySRS ENTERPRISESNo ratings yet

- New NXT Mechine Servicing SecduleDocument111 pagesNew NXT Mechine Servicing SecduleDiwash ShahNo ratings yet

- Advanced Financial Accounting and Reporting (Partnership)Document5 pagesAdvanced Financial Accounting and Reporting (Partnership)Mike C Buceta100% (1)

- Approved H1B 2017 Employers 3.2.18 Top Salary Companies LisstttDocument1,351 pagesApproved H1B 2017 Employers 3.2.18 Top Salary Companies Lisstttsaran50% (2)

- Deep Industries Limited: Pay Slip For The Month of SEPTEMBER - 2018Document2 pagesDeep Industries Limited: Pay Slip For The Month of SEPTEMBER - 2018Ankush SehgalNo ratings yet

- Technical Data Sheet EG75-10 BarDocument1 pageTechnical Data Sheet EG75-10 Barabdur rohmanNo ratings yet

- Repsol Merak VDL PDFDocument1 pageRepsol Merak VDL PDFrandiNo ratings yet

- Pay Slip For September 2020: Thermax LTDDocument1 pagePay Slip For September 2020: Thermax LTDER Gautam GauravNo ratings yet

- Job Card Retail - Tax InvoiceDocument2 pagesJob Card Retail - Tax InvoiceazharNo ratings yet

- Fenner Engineering Products Price List PDFDocument29 pagesFenner Engineering Products Price List PDFMohammed Sariya50% (2)

- Condenser Remote Rack TFJ (G600.2QN)Document3 pagesCondenser Remote Rack TFJ (G600.2QN)Wawan NuryanaNo ratings yet

- E75-NC Intake Valve - Lista de Peças Airmaster L1Document26 pagesE75-NC Intake Valve - Lista de Peças Airmaster L1dononoNo ratings yet

- BALENODocument1 pageBALENOazharNo ratings yet

- Teamlease Services LimitedDocument1 pageTeamlease Services LimitedMimin khsNo ratings yet

- Pay Pay Slip For The Month of AUGUST-2018: Deep Industries LimitedDocument1 pagePay Pay Slip For The Month of AUGUST-2018: Deep Industries LimitedAnkush SehgalNo ratings yet

- Salary Slip, Oct - 19 - EIPL - 109Document1 pageSalary Slip, Oct - 19 - EIPL - 109akhilesh singhNo ratings yet

- 5c X-Tend FG Filter InstallationDocument1 page5c X-Tend FG Filter Installationfmk342112100% (1)

- Lajja Ram 3Document4 pagesLajja Ram 3Hutendra poniaNo ratings yet

- Donaldson LF Series PDFDocument8 pagesDonaldson LF Series PDFSebastian GanciNo ratings yet

- Eshwar Tradesr..Document1 pageEshwar Tradesr..ANAND KAGALENo ratings yet

- Hafele DabaspeteDocument3 pagesHafele DabaspeteDipak BagadeNo ratings yet

- Oct2022Document2 pagesOct2022Rishi KumarNo ratings yet

- Salary Slip 03 PDFDocument1 pageSalary Slip 03 PDFSandeep SoniNo ratings yet

- Invoice# INV2122/10638: Invoice Date: Sale Order: Purchase Order NoDocument1 pageInvoice# INV2122/10638: Invoice Date: Sale Order: Purchase Order NoBinode SarkarNo ratings yet

- India Infoline LTD.: Earnings Actual Arrears Earned Deductions AmountDocument1 pageIndia Infoline LTD.: Earnings Actual Arrears Earned Deductions AmountAshish Agarwal100% (1)

- OctDocument1 pageOctRamPrasadNo ratings yet

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Document1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNo ratings yet

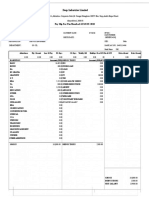

- Indo Bright Petroleum Bottling Plant, Karnal, Haryana: Packing List of Dispatched CylindersDocument1 pageIndo Bright Petroleum Bottling Plant, Karnal, Haryana: Packing List of Dispatched CylindersAbhijeet SahuNo ratings yet

- Elevation Side View: N1 N3 N1 N1 N1 N3Document1 pageElevation Side View: N1 N3 N1 N1 N1 N3Abhijeet SahuNo ratings yet

- LEAD CatalogueDocument12 pagesLEAD CatalogueAbhijeet SahuNo ratings yet

- DistillationColumnDrawingAutoCAD PDFDocument3 pagesDistillationColumnDrawingAutoCAD PDFAbhijeet SahuNo ratings yet

- No Cavitate Orifice PlateDocument2 pagesNo Cavitate Orifice PlateAbhijeet SahuNo ratings yet

- ZZDocument5 pagesZZAbhijeet SahuNo ratings yet

- Is 813 PDFDocument29 pagesIs 813 PDFAbhijeet Sahu100% (1)

- Challan Office Copy Challan Candidate'SDocument1 pageChallan Office Copy Challan Candidate'SAbhijeet SahuNo ratings yet

- Https - WWW - Irctc.co - in - Eticketing - Printticket Raju-2 PDFDocument2 pagesHttps - WWW - Irctc.co - in - Eticketing - Printticket Raju-2 PDFAbhijeet SahuNo ratings yet

- Monu 1Document2 pagesMonu 1Abhijeet SahuNo ratings yet

- Https - WWW - Irctc.co - in - Eticketing - Printticket Raju-2 PDFDocument2 pagesHttps - WWW - Irctc.co - in - Eticketing - Printticket Raju-2 PDFAbhijeet SahuNo ratings yet

- Sumit Soam UpDocument3 pagesSumit Soam UpAbhijeet SahuNo ratings yet

- 06 PPC Ch6 Capacity PlanningDocument20 pages06 PPC Ch6 Capacity PlanningziadatzNo ratings yet

- Quiz 3 SolutionsDocument6 pagesQuiz 3 SolutionsNgsNo ratings yet

- Bank Exam Question Papers - Bank of IndiaDocument34 pagesBank Exam Question Papers - Bank of IndiaGomathi NayagamNo ratings yet

- Cashinfinity EuroDocument2 pagesCashinfinity EuroAna CarvalhoNo ratings yet

- INTL 3003 Module 9 Inventory ManagementDocument68 pagesINTL 3003 Module 9 Inventory ManagementManish SadhuNo ratings yet

- Practice Questions # 4 Internal Control and Cash With AnswersDocument9 pagesPractice Questions # 4 Internal Control and Cash With AnswersIzzahIkramIllahiNo ratings yet

- Sagar Suresh Gupta: Career ObjectiveDocument3 pagesSagar Suresh Gupta: Career ObjectiveakashniranjaneNo ratings yet

- Executive SummaryDocument56 pagesExecutive Summarybooksstrategy100% (1)

- Coca Cola Company PresentationDocument29 pagesCoca Cola Company PresentationVibhuti GoelNo ratings yet

- WG O1 Culinarian Cookware Case SubmissionDocument7 pagesWG O1 Culinarian Cookware Case SubmissionAnand JanardhananNo ratings yet

- Ao239 1 PDFDocument5 pagesAo239 1 PDFAnonymous wqT95XZ5No ratings yet

- Problem 2Document3 pagesProblem 2Mohammed Al ArmaliNo ratings yet

- Qms PPT FinalDocument13 pagesQms PPT FinalHaaMid RaSheedNo ratings yet

- EduHubSpot ITTOs CheatSheetDocument29 pagesEduHubSpot ITTOs CheatSheetVamshisirNo ratings yet

- Tax Case StudyDocument6 pagesTax Case StudyAditi GuptaNo ratings yet

- MATRIX Hervás-Oliver, J. L., Parrilli, M. D., Rodríguez-Pose, A., & Sempere-Ripoll, F. (2021)Document7 pagesMATRIX Hervás-Oliver, J. L., Parrilli, M. D., Rodríguez-Pose, A., & Sempere-Ripoll, F. (2021)Wan LinaNo ratings yet

- Ameritrade History of Transactions From 2002 To April 3, 2010Document16 pagesAmeritrade History of Transactions From 2002 To April 3, 2010Stan J. CaterboneNo ratings yet

- Industry Analysis FinalDocument18 pagesIndustry Analysis FinalManaf BasheerNo ratings yet

- Verification of InvestmentsDocument3 pagesVerification of InvestmentsAshab HashmiNo ratings yet

- Projects Evaluation MethodsDocument87 pagesProjects Evaluation MethodsEmmanuel PatrickNo ratings yet

- EMS Project On SARBDocument2 pagesEMS Project On SARBMichael-John ReelerNo ratings yet