Professional Documents

Culture Documents

PNB Report: Corporate Mission

Uploaded by

gaurav0 ratings0% found this document useful (0 votes)

7 views2 pagesbanking

Original Title

Pnb Details

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentbanking

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesPNB Report: Corporate Mission

Uploaded by

gauravbanking

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

PNB REPORT

Corporate Mission

Mission

Creating Value for all its customers. Investors and Employees for being the first

choice for all stakeholders.

Vision

To position PNB as the ‘Most Preferred Bank’ for customers, the ‘Best Place to

Work In ‘for employees and a ‘Benchmark of Excellence ‘for the industry”.

Organization chart

Board of directors

General Managers

Zonal Manager

Circle office

Branches

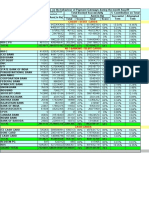

Shareholding Pattern - Punjab National Bank

Holder's Name No of Shares % Share Holding

Promoters 1383459223 57.04%

Financial Institutions 400848896 16.53%

Foreign Institutions 304672972 12.56%

Banks Mutual Funds 212555908 8.76%

General Public 86575982 3.57%

Others 37164524 1.53%

Central Govt. 309800 0.01%

COMPETITOR ANALYSIS

Name Last Market Net Net Total

Price Cap. Interest Profit Assets

(Rs.cr.) Income

SBI 244.75 211,269.52 175,518.24 10,484.10 2,705,966.30

Bank of 140.25 32,404.06 42,199.93 1,383.13 694,875.41

Baroda

PNB 95.30 23,115.85 47,275.99 1,324.80 720,330.55

IDBI Bank 71.85 18,986.30 27,791.37 -5,158.14 361,767.90

Canara Bank 267.45 15,974.53 41,387.64 1,121.92 583,519.45

Central Bank 74.95 14,748.28 24,661.41 -2,439.10 333,401.95

Indian Bank 291.75 14,012.51 16,039.75 1,405.68 218,233.15

Bank of India 101.60 12,034.99 39,290.87 -1,558.34 626,309.27

Union Bank 90.60 7,753.13 32,659.99 555.21 452,704.45

Syndicate 55.90 5,820.84 23,003.79 358.95 299,073.34

Bank

You might also like

- ASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014From EverandASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014No ratings yet

- Andhra Bank: Welcomes Press MeetDocument23 pagesAndhra Bank: Welcomes Press Meetrahul3678No ratings yet

- Press Meet 31 March 2006Document23 pagesPress Meet 31 March 2006pranav_pk88No ratings yet

- 120113-DCCBs in Maharashtra by SunilDocument7 pages120113-DCCBs in Maharashtra by SunilGauresh NaikNo ratings yet

- LGW (G Ptyfg N3'Ljq Ljqlo +:yf Lnld6) 8Sf) T) - F) Q) DFDocument7 pagesLGW (G Ptyfg N3'Ljq Ljqlo +:yf Lnld6) 8Sf) T) - F) Q) DFNaresh Prasad SapkotaNo ratings yet

- Nurani Dyeing and Sweater LTDDocument22 pagesNurani Dyeing and Sweater LTDSM AzaharNo ratings yet

- Kyb 2023Document10 pagesKyb 2023RudraNo ratings yet

- Project Prepared and Presented By:: Jinia Biswas Sruti Jain Vibhav KaushalDocument19 pagesProject Prepared and Presented By:: Jinia Biswas Sruti Jain Vibhav Kaushalmanisha sonawaneNo ratings yet

- Stock Cues: Amara Raja Batteries Ltd. Company Report Card-StandaloneDocument3 pagesStock Cues: Amara Raja Batteries Ltd. Company Report Card-StandalonekukkujiNo ratings yet

- Iqra University: TO Business Finance / Finance FOR ManagersDocument9 pagesIqra University: TO Business Finance / Finance FOR ManagersKanwal NaazNo ratings yet

- Bank of BarodaDocument4 pagesBank of BarodaSololoNo ratings yet

- Amrut An JanDocument112 pagesAmrut An JanTotmolNo ratings yet

- HDFC Bank AnnualReport 2012 13Document180 pagesHDFC Bank AnnualReport 2012 13Rohan BahriNo ratings yet

- Peer Comparison: Company Mcap (In CR.) P/B P/E EPS Roe%Document9 pagesPeer Comparison: Company Mcap (In CR.) P/B P/E EPS Roe%100GOD DOG001No ratings yet

- DM22118 - Dinakaran SDocument11 pagesDM22118 - Dinakaran SDinakaranNo ratings yet

- Mellon ExcelDocument18 pagesMellon ExcelJaydeep SheteNo ratings yet

- Orient CementDocument7 pagesOrient CementManasvi Kushwaha ( B -Arch 21-26)No ratings yet

- A Comparative Study of Loan Performance SandraDocument23 pagesA Comparative Study of Loan Performance SandraSandra DennyNo ratings yet

- Company Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Document5 pagesCompany Current Price (RS) % Change Equity Face Value Market Cap (Rs CR)Nikesh BeradiyaNo ratings yet

- Kbank enDocument356 pagesKbank enchead_nithiNo ratings yet

- PPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)Document13 pagesPPFAS Mutual Fund: Name of The Scheme: Parag Parikh Long Term Equity Fund (An Open Ended Equity Scheme)TunirNo ratings yet

- BanksDocument1 pageBankssourcenaturals665No ratings yet

- BF1 Package Ratios ForecastingDocument16 pagesBF1 Package Ratios ForecastingBilal Javed JafraniNo ratings yet

- 2018 AR Alkyl AminesDocument166 pages2018 AR Alkyl AminesSameep KasbekarNo ratings yet

- By Rajesh NarayananDocument22 pagesBy Rajesh NarayananTusharNo ratings yet

- By Rajesh NarayananDocument22 pagesBy Rajesh NarayananTusharNo ratings yet

- Yes BankDocument43 pagesYes BankSumit SaurabhNo ratings yet

- Im GRP AssignmentDocument5 pagesIm GRP AssignmentRishu GargNo ratings yet

- EquityDocument277 pagesEquityhidulfiNo ratings yet

- Axis BankDocument123 pagesAxis BankKajal HeerNo ratings yet

- Oil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)Document16 pagesOil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)ravi198522No ratings yet

- DCB Bank Announces First Quarter Results FY 2023 24 Mumbai July 28 2023Document2 pagesDCB Bank Announces First Quarter Results FY 2023 24 Mumbai July 28 2023Ishaan SanehiNo ratings yet

- Banks Reports AugDocument5 pagesBanks Reports Auganimeshnathcer06No ratings yet

- Public Sector Banks Comparative Analysis 3QFY24Document10 pagesPublic Sector Banks Comparative Analysis 3QFY24Sujay AnanthakrishnaNo ratings yet

- L Name Price PAT Dividend (5YA) Div - Pay DY.5A DY.CDocument5 pagesL Name Price PAT Dividend (5YA) Div - Pay DY.5A DY.CdineshNo ratings yet

- Share Sansar Samachar of 27th November' 2011Document3 pagesShare Sansar Samachar of 27th November' 2011sharesansarNo ratings yet

- Punjab and Sind BankDocument13 pagesPunjab and Sind Banksimran jeetNo ratings yet

- CRB Assignment Rajatpreet DeepayanDocument3 pagesCRB Assignment Rajatpreet DeepayanashishNo ratings yet

- Session 1 2021 SharedDocument44 pagesSession 1 2021 SharedPuneet MeenaNo ratings yet

- HDFC Bank Equity Research ReportDocument9 pagesHDFC Bank Equity Research ReportShreyo ChakrabortyNo ratings yet

- Types of Mutual Fund 1Document14 pagesTypes of Mutual Fund 1Sneha BhuwalkaNo ratings yet

- FinancialAnalisys - NWT 05032011 FinalDocument9 pagesFinancialAnalisys - NWT 05032011 FinalPeter EropkinNo ratings yet

- PSU Banks Comparative Analysis FY21Document10 pagesPSU Banks Comparative Analysis FY21Ganesh V0% (1)

- SubrosDocument31 pagesSubrossumit3902No ratings yet

- KFI Poush 20791 PDFDocument1 pageKFI Poush 20791 PDFRajendra NeupaneNo ratings yet

- Ratio Analysis 2023Document25 pagesRatio Analysis 2023mishantlilareNo ratings yet

- Treasury Management - Assignment No. 1 - Rohit AggarwalDocument2 pagesTreasury Management - Assignment No. 1 - Rohit AggarwalRohit AggarwalNo ratings yet

- Cost of Capital of ITCDocument24 pagesCost of Capital of ITCAyeesha K.s.No ratings yet

- Samsung Electronics: Earnings Release Q2 2016Document8 pagesSamsung Electronics: Earnings Release Q2 2016Syed Mohd AliNo ratings yet

- Sbi Annual Report 2012 13Document190 pagesSbi Annual Report 2012 13udit_mca_blyNo ratings yet

- Our TopicDocument17 pagesOur Topicadil siddiqyuiNo ratings yet

- School of LAW Name of The Faculty Member LIPIKA DHINGRADocument10 pagesSchool of LAW Name of The Faculty Member LIPIKA DHINGRAKathuria AmanNo ratings yet

- Board of DirectorsDocument94 pagesBoard of Directorschauhan_sanketNo ratings yet

- Mangalore Refinery and Petrochemicals LimitedDocument16 pagesMangalore Refinery and Petrochemicals Limitedsheetal ghugareNo ratings yet

- Bajaj Finserv LTD: General OverviewDocument9 pagesBajaj Finserv LTD: General Overviewakanksha morghadeNo ratings yet

- Fin402 AssignmentDocument8 pagesFin402 AssignmentAl MamunNo ratings yet

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngNo ratings yet

- Sriram Transport FinanceDocument6 pagesSriram Transport FinanceSohrab Ali ChoudharyNo ratings yet

- Tables Bond MarketDocument4 pagesTables Bond MarketIshwar ChhedaNo ratings yet

- Share Sansar Samachar of 14th November' 2011Document4 pagesShare Sansar Samachar of 14th November' 2011sharesansarNo ratings yet