Professional Documents

Culture Documents

Audit Checklist For Goods and Services Tax

Uploaded by

mani1970%(1)0% found this document useful (1 vote)

59 views4 pagescheck

Original Title

Audit Checklist for Goods and Services Tax

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcheck

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0%(1)0% found this document useful (1 vote)

59 views4 pagesAudit Checklist For Goods and Services Tax

Uploaded by

mani197check

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Illustrative Audit Checklist for Goods and

Services Tax

C A Mangala Hampasagar, Hospet.

The checklist for auditors is only illustrative in nature. Members are

expected to exercise their professional judgment while using the checklist

depending upon facts and circumstances of each case.

Whether the registered person has properly availed the Input Tax Credit of

the GST paid on the input services, input, capital goods as the case may

be?

Whether GST have been properly charged by the head office, regional

offices, zonal offices in case of inter unit / branch transactions?

Whether the registered person have filed the applicable returns on timely

basis as notified by the Government?

Whether the registered person has made the payment of GST on timely

basis?

Whether the head office has not availed depreciation u/s 32 of the Income

Tax Act, 1961 on the amount of GST on the capital goods on which input

tax credit has been availed?

Whether GST have been paid on reverse charge basis on the services

procured from supplier in terms of Section 9(3) of the CGST Act?

Whether GST have been paid on reverse charge basis on the

goods/services procured from the unregistered supplier in terms of Section

9(4) of the CGST/SGST Act, for the period July 1,2017 till October 12,

2017, if aggregate value of supplies of goods or services or both received

by a registered person from any or all the suppliers, who is or are not

registered, exceeds Rs. 5000/- in a day?

Similarly, whether GST has been paid, in respect of each GST-registered

location, on reverse charge basis on inter-State inward supplies from

unregistered suppliers for the period July 1, 2017 till October 12, 2017?

Whether sale or lease of vehicles procured prior to 1st July, 2017 and on

which any Input Tax Credit has not been availed of Central Excise duty,

VAT or any other taxes paid on such motor vehicles be subject to 65% of

applicable GST rate?Whether IGST have been paid at the point of

importation in case of high seas sales?

Whether GST have been paid on advances paid by the banks to the

unregistered persons under section 9(4) of the CGST Act till 12th October,

2017?

Whether GST have been paid on advances paid by the banks to the

specified registered persons under section 9(3) of the CGST Act such as

sponsorship services, GTA services, etc.?

Whether all inward supplies (whether creditable or not) flow into the books

of the bank through the GSTR-1 of any registered supplier? If not, have

such supplies been reported in GSTR-2 under section 9(3) of CGST Act /

5(4) of IGST Act, even if no tax is payable from 13th October, 2017?

Whether in respect of each inward supply where no tax has been paid, is

there is a clear disclosure made to the auditors as to the reasons for the

tax position taken in each case? Auditor may examine, if the tax position

taken requires to be reported in the audit report or other communication?

Whether IGST has been paid on ‘import of services’?

Whether the GTA amount have been capitalised under the head Fixed

Assets?

Whether the bank has taken the CENVAT Credit in respect of input and

capital goods on the basis of proper duty paying documents, containing all

particulars as prescribed by CGST Rules read with section 31 of the CGST

Act, 2017, i.e., serially numbered invoice / bill not exceeding sixteen

characters, containing the requisite information like, Name, address and

GST Number of Bank, Name, address and Goods and Services Tax No. of

recipient, date of issue, HSN Code of goods, etc.?

Similarly, whether the bank has taken the CENVAT Credit in respect of

services on the basis of proper duty paying documents, containing all

particulars as prescribed by CGST Rules read with section 31 of the CGST

Act, 2017, i.e., serially numbered invoice / bill not exceeding sixteen

characters, containing the requisite information like, Name, address and

GST Number of Bank, date of issue, amount of the credit distributed, etc.?

Whether an amount equal to the input tax credit availed by the recipient

added to output tax liability of supplier along with interest, where the

recipient fails to pay supplier of goods or services an amount towards the

value of supply along with tax payable within 180 days from the date of

issue of invoice by the supplier?

Whether the credit taken in respect of services covered under reverse

charge mechanism is taken only after making payment of GST?

Whether the banking company or a financial institution including a non-

banking financial company has either availed of, every month, an amount

equal to 50%. of the eligible input tax credit on inputs, capital goods and

input services in that month OR has availed the amount of the input tax

credit attributable to the taxable supplies including zero-rated supplies?

Whether the banks have taken the Registration of GST within 30 days from

the date on which he becomes liable to registration or the date of start of

business of the branch, whichever is later?

Whether the banks (HO/ZO/RO) have sought registration as input service

distributor under CGST Rules, 2017 or whether the supplies centrally

procured have been treated as outward supply from HO/ZO/RO to

respective branches? Unlike earlier laws, GST permits registration as input

service distributor to an office that does not have any outward supplies and

is one that merely receives invoices for such supplies and distributes credit

to recipient branches.

In either case, auditor shall ensure that the returns are being regularly

filed. Auditor shall also ensure that if the respective office is registered as

‘input service distributor’, whether invoice is issued for distributing the

Input Tax Credit as per Rule 54 of the CGST Rules, 2017?

Whether the branches have taken the appropriate credit on the

invoice/challan/bill or any other documents issued by the head office,

regional office, zonal office as an input service distributor?

Whether the branches have mentioned their GST number on the

statement, challan, bill, invoice or any other documents issued to the

customer for the services rendered by the Bank?

Whether bank maintains the records specified by Rule 56 of the CGST

Rules, 2017?

Whether the branches have made arrangements to ensure that GST is

not collected on the interest amount?

You might also like

- GST STeps To File ReturnDocument22 pagesGST STeps To File ReturnAnnu KashyapNo ratings yet

- Vision Collage of Management Kanpur Submitted To, Miss Keerti Tiwari Submitted By, M/S. Anam FatimaDocument24 pagesVision Collage of Management Kanpur Submitted To, Miss Keerti Tiwari Submitted By, M/S. Anam FatimaAnam FatimaNo ratings yet

- GST Itc DetailDocument8 pagesGST Itc DetailAnonymous ikQZphNo ratings yet

- E-Way BillDocument8 pagesE-Way BillJanhvi BhardwajNo ratings yet

- 8 July-Absent - Kavya's Notes 9 JulyDocument57 pages8 July-Absent - Kavya's Notes 9 JulyAnurag SinghNo ratings yet

- E-Book On GST by CA. (DR.) G. S. Grewal - 2020Document58 pagesE-Book On GST by CA. (DR.) G. S. Grewal - 2020Aarav DhingraNo ratings yet

- Impact of GST On Warehousing and Supply ChainDocument39 pagesImpact of GST On Warehousing and Supply ChainSundaravaradhan Iyengar100% (6)

- GST in India - Objectives, Concerns and ChallengesDocument44 pagesGST in India - Objectives, Concerns and Challengesakhilca87% (15)

- Guidance Note On GST AuditDocument128 pagesGuidance Note On GST Auditbalaji0% (1)

- 6 ItcDocument114 pages6 ItcRAUNAQ SHARMANo ratings yet

- CS Professional Programme Tax NotesDocument47 pagesCS Professional Programme Tax NotesRajey Jain100% (2)

- Topic: Page NoDocument21 pagesTopic: Page NoAcchu BajajNo ratings yet

- Public Awareness of TaxDocument12 pagesPublic Awareness of TaxDilli Raj PandeyNo ratings yet

- GST Impact On The Supply ChainDocument8 pagesGST Impact On The Supply ChainAamiTataiNo ratings yet

- Chapter 5 GST - ProblemsDocument10 pagesChapter 5 GST - Problemsbalaji RNo ratings yet

- CA Final GST and Customs Flow Charts Nov 2018Document173 pagesCA Final GST and Customs Flow Charts Nov 2018Amar ShahNo ratings yet

- GST - A Game Changer: 2. Review of LiteratureDocument3 pagesGST - A Game Changer: 2. Review of LiteratureMoumita Mishra100% (1)

- GST Input Tax Credit NotesDocument13 pagesGST Input Tax Credit Notesa_bc691973No ratings yet

- Advance TaxDocument11 pagesAdvance TaxAdv Aastha MakkarNo ratings yet

- Direct Tax Vs Indirect TaxDocument44 pagesDirect Tax Vs Indirect TaxShuchi BhatiaNo ratings yet

- Guide To CGST, SGST and IGST: Inter-State Vs Intra-StateDocument6 pagesGuide To CGST, SGST and IGST: Inter-State Vs Intra-StateSuman IndiaNo ratings yet

- GST Impact On Distribution NetworkDocument17 pagesGST Impact On Distribution NetworkrahulNo ratings yet

- Impact of GST On Agricultural Sector PDFDocument3 pagesImpact of GST On Agricultural Sector PDFSiddardha Kumar NelapudiNo ratings yet

- TCS - in Income TaxDocument8 pagesTCS - in Income TaxrpsinghsikarwarNo ratings yet

- GST ON RestaurantDocument3 pagesGST ON RestaurantjdonNo ratings yet

- GST - Notes For BU IV Sem PDFDocument149 pagesGST - Notes For BU IV Sem PDFSpring BaharNo ratings yet

- Indirect and Customs ActDocument95 pagesIndirect and Customs ActAyushi TiwariNo ratings yet

- Comparision Between Pre GST and Post Gst....Document26 pagesComparision Between Pre GST and Post Gst....Yash MalhotraNo ratings yet

- TDSDocument18 pagesTDSPratik NaikNo ratings yet

- Indian Tax SystemDocument17 pagesIndian Tax SystemSachin RanaNo ratings yet

- AX Educted at Ource - I: KPPM & AssociatesDocument67 pagesAX Educted at Ource - I: KPPM & AssociatesSaksham JoshiNo ratings yet

- Goods & Services Tax (GST) - (One Nation One Tax)Document40 pagesGoods & Services Tax (GST) - (One Nation One Tax)sumukh0% (1)

- Task 8Document23 pagesTask 8Anooja SajeevNo ratings yet

- Indirect Impact of GST On Income TaxDocument14 pagesIndirect Impact of GST On Income TaxNAMAN KANSALNo ratings yet

- Impacts of GSTDocument3 pagesImpacts of GSTNikhil100% (1)

- Income From SalaryDocument54 pagesIncome From SalaryMohsin ShaikhNo ratings yet

- Balance of PaymentDocument4 pagesBalance of PaymentAMALA ANo ratings yet

- Presentation For Viva: Siddhesh Dhotre HPGD/JL20/1852Document16 pagesPresentation For Viva: Siddhesh Dhotre HPGD/JL20/1852SIDDHESHNo ratings yet

- Prof. Ashish R. Chourasiya: Goods & Service Tax: IntroductionDocument36 pagesProf. Ashish R. Chourasiya: Goods & Service Tax: IntroductionAJAY PHENOMNo ratings yet

- E-Filing of Income Tax Return: SUBMITTED BY: Nisha Ghodake Roll No: 17019. (Functional Project)Document7 pagesE-Filing of Income Tax Return: SUBMITTED BY: Nisha Ghodake Roll No: 17019. (Functional Project)NISHA GHODAKENo ratings yet

- Simplified Goods & Services Tax (GST) For Hotels & RestaurantsDocument14 pagesSimplified Goods & Services Tax (GST) For Hotels & Restaurantsvishaljain_caNo ratings yet

- Central ExciseDocument22 pagesCentral ExcisesadathnooriNo ratings yet

- Arms Length PrincipleDocument18 pagesArms Length PrincipleMARY IRUNGUNo ratings yet

- Transport Rules GSTDocument19 pagesTransport Rules GSTSudhir KumarNo ratings yet

- Introduction of GSTDocument9 pagesIntroduction of GSTdevika7575No ratings yet

- Income From Other SourcesDocument27 pagesIncome From Other Sourcesanilchavan100% (1)

- Internship ReportDocument49 pagesInternship ReportSwathi PrasadNo ratings yet

- Project LaikaDocument77 pagesProject LaikaManju JhurianiNo ratings yet

- INCOME TAX AND GST. JURAZ-Module 3Document11 pagesINCOME TAX AND GST. JURAZ-Module 3hisanashanutty2004100% (1)

- IPCC - FAST TRACK MATERIAL - 35e PDFDocument69 pagesIPCC - FAST TRACK MATERIAL - 35e PDFKunalKumarNo ratings yet

- TdsDocument22 pagesTdsFRANCIS JOSEPHNo ratings yet

- GST - ReturnsDocument30 pagesGST - ReturnsAniket Rastogi100% (2)

- GST Returns: What Is GST Return??Document11 pagesGST Returns: What Is GST Return??Yukta AgrawalNo ratings yet

- Capital and Revenue ExpendituereDocument30 pagesCapital and Revenue ExpendituereDheeraj Seth0% (1)

- Basics of TaxationDocument25 pagesBasics of TaxationAnupam BaliNo ratings yet

- Introduction To Custom Law: Prepared by DR Renu AggarwalDocument13 pagesIntroduction To Custom Law: Prepared by DR Renu AggarwalPramod PrabhasNo ratings yet

- GST Provision, Taxes and Tax Rates Applicable Before and After GSTDocument3 pagesGST Provision, Taxes and Tax Rates Applicable Before and After GSTsaket kumarNo ratings yet

- GST Registration NotesDocument13 pagesGST Registration NotesNagashree RANo ratings yet

- 27122018-UPDATED - FAQs ON BANKING, INSURANCE AND STOCK BROKERSDocument34 pages27122018-UPDATED - FAQs ON BANKING, INSURANCE AND STOCK BROKERSHimanshu PanchpalNo ratings yet

- GST Faq by CSDocument6 pagesGST Faq by CSyashj91No ratings yet

- Bar Basics PDFDocument10 pagesBar Basics PDFsrikanth_krishnamu_3100% (1)

- Form 49 BDocument5 pagesForm 49 Bkborah100% (9)

- Sample Size CalculationDocument3 pagesSample Size Calculationmani197No ratings yet

- I General: Internal Audit ChecklistDocument32 pagesI General: Internal Audit Checklistlaltamater83% (12)

- Primary School TIME TABLE MAY 6TH 2020 TO MAY 29TH 20201588140010Document5 pagesPrimary School TIME TABLE MAY 6TH 2020 TO MAY 29TH 20201588140010mani197No ratings yet

- Brain Stuff PDFDocument18 pagesBrain Stuff PDFKrish Veni100% (1)

- Audit Planning Memo - SampleDocument11 pagesAudit Planning Memo - SampleAsh100% (1)

- SAP Sales Business Objectives Risk & Control MatrixDocument4 pagesSAP Sales Business Objectives Risk & Control Matrixmani197100% (3)

- Healey Puzzle PDFDocument76 pagesHealey Puzzle PDFRaden RoyishNo ratings yet

- Poem Copyright FormDocument2 pagesPoem Copyright Formmani197No ratings yet

- Auditors+Practice+Manual-2nd+edn ,+2011Document2 pagesAuditors+Practice+Manual-2nd+edn ,+2011mani197No ratings yet

- Drafting Legal Cover Letters PDFDocument8 pagesDrafting Legal Cover Letters PDFEmina Z. PintarićNo ratings yet

- SAP Audit and Control PointsDocument9 pagesSAP Audit and Control Pointsmani197No ratings yet

- Acknowledge OrderDocument1 pageAcknowledge Orderjairaghavan89100% (1)

- Sample Size CalculationDocument3 pagesSample Size Calculationmani197No ratings yet

- Delivery Method Error RefundDocument1 pageDelivery Method Error Refundjairaghavan89No ratings yet

- 2 Way Lookup FormulasDocument3 pages2 Way Lookup Formulasmani197No ratings yet

- Pillai / Achokmr: Galileo Reference: MGGR2O Passenger(s)Document2 pagesPillai / Achokmr: Galileo Reference: MGGR2O Passenger(s)mani197No ratings yet

- MCE Sample SQL QuestionsDocument4 pagesMCE Sample SQL Questionsmani197No ratings yet

- Notice of Rent Increase To Tenants of Rented PremisesDocument5 pagesNotice of Rent Increase To Tenants of Rented Premisesmani197No ratings yet

- F&B Revenue CycleDocument4 pagesF&B Revenue Cycleericlim1010100% (1)

- Fraud Case StudiesDocument14 pagesFraud Case Studiesmani197No ratings yet

- SAP Audit and Control PointsDocument9 pagesSAP Audit and Control Pointsmani197No ratings yet

- DM Design DataMapping STG To DM v02Document11 pagesDM Design DataMapping STG To DM v02mani197No ratings yet

- Tax Holidays and Other Incentives: Determining The Right Accounting ModelDocument4 pagesTax Holidays and Other Incentives: Determining The Right Accounting Modelmani197No ratings yet

- Income Taxes (Examples) 1199Document4 pagesIncome Taxes (Examples) 1199mani197No ratings yet

- How To Predict The Outcome of A DashaDocument25 pagesHow To Predict The Outcome of A DashaKALSHUBH100% (4)

- Extracting Numbers From Text: Text Num Start Length NumberDocument2 pagesExtracting Numbers From Text: Text Num Start Length Numbermani197No ratings yet

- Tax Holidays and Other Incentives: Determining The Right Accounting ModelDocument4 pagesTax Holidays and Other Incentives: Determining The Right Accounting Modelmani197No ratings yet

- Adobe Scan 01 Sep 2022Document1 pageAdobe Scan 01 Sep 2022Tanuja MehtaNo ratings yet

- 606-Texto Del Artículo-2677-1-10-20190704Document25 pages606-Texto Del Artículo-2677-1-10-20190704jorgeNo ratings yet

- Reaction Paper On Train LawDocument4 pagesReaction Paper On Train LawHannah Cesaree Mae Tadeo100% (1)

- AT - T COMMUNICATIONS SERVICES PHILIPPINES, INC., Vs CIR G.R. No. 182364 August 3, 2010Document4 pagesAT - T COMMUNICATIONS SERVICES PHILIPPINES, INC., Vs CIR G.R. No. 182364 August 3, 2010Francise Mae Montilla MordenoNo ratings yet

- SKMK Impex PVT - LTD.: Original/Duplicate/TriplicateDocument1 pageSKMK Impex PVT - LTD.: Original/Duplicate/TriplicateabdcNo ratings yet

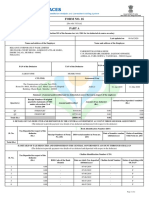

- Form No. 16: Part ADocument8 pagesForm No. 16: Part AParikshit ModiNo ratings yet

- Ip CameraDocument2 pagesIp CameraRaghavendar Reddy BobbalaNo ratings yet

- Latest Updates in GSTDocument6 pagesLatest Updates in GSTprathNo ratings yet

- Press Release Template 01Document2 pagesPress Release Template 01mkb07No ratings yet

- CIR Vs Fortune TobaccoDocument3 pagesCIR Vs Fortune TobaccoAzrael Cassiel100% (2)

- CIR v. Wyeth Suaco - CTADocument3 pagesCIR v. Wyeth Suaco - CTADaLe AparejadoNo ratings yet

- Lecture Notes - Deductions From Gross IncomeDocument18 pagesLecture Notes - Deductions From Gross IncomeRad IsnaniNo ratings yet

- K Discussion Questions (3 Points Each)Document16 pagesK Discussion Questions (3 Points Each)Team BEENo ratings yet

- National Pension System One Pager V2Document2 pagesNational Pension System One Pager V2ramboNo ratings yet

- FNF 02 I33514 Ankit ShuklaDocument3 pagesFNF 02 I33514 Ankit ShuklaAnkit ShuklaNo ratings yet

- Origin Original AL: InvoiceDocument1 pageOrigin Original AL: InvoiceMelike MichelleNo ratings yet

- No. Account Account Name Header Balance Account Type Aset Current AsetDocument2 pagesNo. Account Account Name Header Balance Account Type Aset Current Asetwndy rdvlvtNo ratings yet

- Example of Financial ReportDocument4 pagesExample of Financial Reportaufar syehanNo ratings yet

- Republic V GonzalesDocument2 pagesRepublic V GonzalesSocNo ratings yet

- Carnea, Iqcal, Best QF, Chiromax, Furb XT TmaDocument10 pagesCarnea, Iqcal, Best QF, Chiromax, Furb XT Tmakamlesh singhNo ratings yet

- PF1 Chapter 3 SlidesDocument98 pagesPF1 Chapter 3 SlidesNamie NamieNo ratings yet

- Normal Acc BalanceDocument1 pageNormal Acc BalanceRavi Shankar SNo ratings yet

- Payroll PDFDocument7 pagesPayroll PDFtylerNo ratings yet

- Tax3701 TL 102Document80 pagesTax3701 TL 102Jerome ChettyNo ratings yet

- 8.1 Assignment - Regular Income TaxDocument3 pages8.1 Assignment - Regular Income TaxCharles Mateo0% (1)

- Return of Organization Exempt From Income TaxDocument31 pagesReturn of Organization Exempt From Income TaxRBJNo ratings yet

- Full Income Tax Fundamentals 2018 36Th Edition Whittenburg Solutions Manual PDFDocument54 pagesFull Income Tax Fundamentals 2018 36Th Edition Whittenburg Solutions Manual PDFstephen.crawford258100% (14)

- Federal Income Tax - OutlineDocument28 pagesFederal Income Tax - OutlineMohammed Al-Bidhawi100% (3)

- Pay Slip For July 2021Document1 pagePay Slip For July 2021THE TECHNOSNo ratings yet

- ServiceTaxobjective QuestionsDocument14 pagesServiceTaxobjective QuestionsJitendra VernekarNo ratings yet