Professional Documents

Culture Documents

Spinning The Mills

Uploaded by

Anirudh KashyapOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Spinning The Mills

Uploaded by

Anirudh KashyapCopyright:

Available Formats

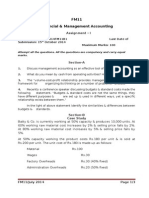

BUS IN ES S

BRIEFIN G

SPINNING THE MILLS

MILL LAND REDEVELOPMENT IN MUMBAI

Au gust 20 1 0 | A C&W Indi a Pu b l i c ati on

CONTENTS EXECUTIVE SUMMARY

1 Executive Summary With an unrelenting global population shift from rural to urban

3 Mumbai’s Textile Mills: Their Rise, Fall areas, sustainable development of our cities is of vital importance

& Redevelopment

for the present as well as future generations. Issues of urban

5 Key Pull Factor Driving Mill Land development, such as creation of adequate infrastructure, public

Redevelopment

utilities, mass housing, public spaces and commercial real estate are

7 Staggered Supply: High Cost

matters of grave concern, particularly, for emerging economies. To

7 Changing Paradigm in Mill Land

Redevelopment stay on course of achieving its development objectives, while

9 New Address for Residential Space ensuring the greatest good for its citizens, India too needs to focus

10 Widening Gap between Supply and

on rejuvenation of its cities and urban spaces.

Demand

POSSIBLE LAND RELEASE SOURCES FOR URBAN REDEVELOPMENT IN MUMBAI

11 Shift in Axis for Office Space

Mill Land Port Trust Land Salt Pan Land

12 Bottlenecks to Reinvention of Mill Approx. 600 acres in the Approx. 1,800 acres along Approx. 5,000 acres in

Lands heart of Mumbai the estern waterfront the city’s suburbs

13 Outlook

15 About Cushman & Wakefield India, Best Option Challenges Challenges

In the light of the lLack of clear lDelicate eco-zone

Research & Business Analytics Group challenges faced by other ownership lCoastal Regulation

areas, the mill lands are the lLack of proper Zone norms

most viable options for planning & vision lCity’s last defence

redevelopment – that too lEnvironmental against floods

For more information please contact: in the heart of the city. concerns

Kaustuv Roy

First Floor, Mafatlal House

Padma Bhushan H. T. Parekh Marg

Churchgate, Mumbai 400 020 Mumbai, with nearly half of its population residing in slums

Tel : 91 22 6657 5555

Fax : 91 22 2202 5165

and urban sprawls, is in dire need of a long-term urban

Email: kaustuv.roy@ap.cushwake.com redevelopment project. The realty values of this financial capital are

already marked by sky-high trends, making it one of the costliest commercial destination in the world. Ever-

increasing demand for real estate across asset classes, coupled with near lack of free space, further adds to this

deadlock. In such a scenario, the only possible solution seems to be sustainable redevelopment projects

involving time-bound release of surplus land.

Mumbai's post-industrial areas include the land belonging to the Mumbai Port Trust (MbPT) and to its

erstwhile textile mills. While the MbPT has approximately 1800 acres of mostly derelict land and underutilized

buildings along the eastern waterfront, the mill lands account for some 600 acres in the heart of Mumbai.

INDIA REPORT | AUGUST 2010 1

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

Despite being nearly thrice the total mill lands area, MbPT land development appears to be

untenable owing to various compelling reasons, including policy issues, environmental concerns,

Coastal Regulation Zone (CRZ) norms, etc.

On the other hand, Mumbai's saltpans, admeasuring approximately 5,000 acres, are nearly eight

times the size of its defunct mill lands. Though the state government and municipal authorities have

been considering these protected areas for mass housing and commercial development,

environmental considerations need to be adequately addressed for this to happen. This, therefore,

leaves Mumbai's mill lands as the sole viable option for reclaiming land for public use.

Non-operational textile mills are also present in cities like Kolkata, Pune and Ahmedabad; but

unlike Mumbai's mills, most of these are located in the peripheral zones, and these land parcels are

therefore not as lucrative as those standing in the heart of Mumbai. And neither do any of these

other cities face as acute a space shortage as Mumbai, which is sea-locked on three sides. The

protracted controversy over these mill lands, however, continues — threatening to turn into a lost

opportunity, unless acted upon with some immediacy.

INDIA REPORT | AUGUST 2010 2

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

MUMBAI’s TEXTILE MILLS: THEIR RISE, FALL & REDEVELOPMENT

The growth of the textile industry in India began in the 1860s to cater to the increasing demand for

cotton in colonial Britain's world market. Large scale cultivation of cotton in Maharashtra and

neighbouring states, coupled with the added geographic advantage of trading with Europe, made

the city an ideal location for the growth of the textile industry. Mumbai's (earlier known as Bombay)

th

supremacy in the textile industry lasted well into the latter part of the 20 Century. As a result,

within a span of about 50 years of the first mill beginning operations, the city witnessed the

establishment of over 80 mills (textile and allied businesses).

By the end of the 20th Century, however, most mills in the city were faced with global

competition, increasing labour unrest and declining profitability. As a result several textile mills shut

down operations, freezing almost 600 acres of prime land in the centre of the city.

The emergence of Mumbai as a prime business centre in the 1990s attracted various foreign

firms to set up base in the city. The eventual evolution of Mumbai as a major global financial hub

over the last two decades, together with its growing population base and changes in regulatory

policies, gave mill owners an opportunity to encash into the vast potential of these mill lands. It was

widely recognised that these defunct industrial areas, if redeveloped, would make available

substantial real estate for commercial and other public usage, while providing better amenities,

infrastructure and modern architecture for its citizens. The redevelopment of the mill lands was

also expected to result in the decongestion of South Mumbai, while controlling surging capital

values in these locations by increasing supply near South Mumbai. Kamala Mills and Phoenix Mills

were among the earliest players to commercialise textile mill lands in Mumbai.

PROGRESSION IN MILL LAND REDEVELOPMENT

Growth Decline Redevelopment Way Forward

1854 - 1925 1926 - 1990 1991 - 2009 2010 - 2015

l First Indian cotton mill l Emergence of new In 1991, Mumbai land

l By 2015, mill lands in

l

starts operations. global players (eg. regulation laws are Mumbai are likely to

Japan) and slowdown amended to allow for witness office space

l Increasing exports

in demand leads to the development of development of about

fuels growth of textile

drop in profitability. closed mill lands. 8.25 million sq.ft.

industry in Mumbai.

l By 1953 only about 53 The State

l A significant number of

l

l Over 80 mills are set

textile mills remain government amends housing units are

up in the city by 1915

operational in the city. Development expected to be

to service the

Control Regulations developed in a phased

increasing demand for l The prolonged strike

(DCR) allowing manner on various mill

textile exports. of 1982 leads to

commercial lands over the next 2

closure of many more

redevelopment of to 3 years.

mills.

mill land.

In June 2005, the first

l

mill land is auctioned

by the National

Textile Corporation

in central Mumbai.

Source: Cushman & Wakefield Research

INDIA REPORT | AUGUST 2010 3

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

To free land for physical and social development of the city, the state government of

Maharashtra amended the Development Control Regulations (DCR) and other rules/regulations

related to existing sick mills.

Some of the major amendments in the DCR and their impact on mill land development:

AMENDMENTS AND IMPACT OF DCR ON MILL LAND DEVELOPMENT

Amendments Impact

1991

l The Maharashtra State Government amended The amendment was expected to free about 400

l

land regulation laws, allowing redevelopment acres of land in the city centre for the

of mill land parcels. DCR 58 introduced. development of open spaces, parks and low cost

affordable housing for mill workers.

l Regulation 58 – popularly known as “one-third

formula” – was framed, allowing mill owners As only a fraction of the land (one-third) was

l

to sell/develop one-third of their land for available for commercial use, most of the mill

commercial use, and provide one-third to the owners stayed away from undertaking any kind

BMC for creating public amenities like open of redevelopment projects.

spaces. The remaining land was to be given to

MHADA for the development of public

housing.

2001

l DCR 58 was amended to DCR 58 (I) which With more area available for commercial use,

l

stated that only vacant land on mill premises the amendment resulted in sale and

with no built-up structure would be divided by development of mill lands. However, only

the “one-third” formula. marginal land was left for public amenities and

housing.

Also resulted in National Textile Corporation

l

(NTC) auctioning off five mills with a total land

area of 50 acres in Central Mumbai.

2005 - 2006

l Mumbai high court puts a stay on mill land Development of mill lands finally begins in the

l

redevelopment projects. city. This resulted in significant new supply in

Central Mumbai, altering the skyline of this

l Supreme Court stays high court order, asks micro market.

buyers to submit their development plans to

BMC in accordance with amended regulation

DCR 58 (I).

INDIA REPORT | AUGUST 2010 4

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

KEY PULL FACTOR DRIVING MILL LAND REDEVELOPMENT

The redevelopment of mill lands in Mumbai is driven by several key factors, such as constrained

availability of land, strategic mill locations and the availability of support infrastructure. Some of

these key factors are analysed here in detail:

Constrained Availability of Developable Land

Mumbai's inability to expand, while keeping the CBD the centre of activities, has always been a

major concern. In spite of being one of the most densely populated cities in the world, real estate

development in Mumbai has been largely restricted. Development has only been towards the

northern and peripheral locations – further away from the CBD. Additionally, several regulatory

limitations like Coastal Regulation Zone (CRZ) norms and Floor Space Index (FSI) restrictions

have further curtailed the real estate development of the city. Located between the CBD and the

growing suburbs, these unused large parcels of mill land in the centre of the city are lucrative for

future development.

Strategic Location

Most mill lands in the city are located in and around Central Mumbai; in locations like Lower Parel,

Parel, Worli, Mahalaxmi and Dadar. Given their strategic location and availability of sound

infrastructure, Cental Mumbai is often

MUMBAI MILL LAND MICRO MARKETS

viewed as Mumbai's extended CBD. MILL LAND LOCATIONS

Lower Parel/

With almost all existing as well as Others

13% Parel

32%

upcoming precincts of the city Lalbaug

13%

providing good connectivity to Elphinstone

4%

Central Mumbai through road and rail

Prabhadevi

networks, mill lands in Mumbai enjoy 5% Dadar Mahalaxmi

Worli

10% 13%

10%

the following location advantages:

Source: Cushman & Wakefield Research

l Close proximity to established

commercial hubs like Churchgate

MILL LAND LOCATIONS

and Bandra Kurla Complex

Andheri

l Good connectivity to existing and Metro Rail Powai

Bandra Kurla Complex

emerging residential corridors Ghatkopar-

Chembur

Bandra

Wadala

l Accessibility to suburban and Dadar

Central Lower Parel

Wadala - Chembur

Monorail

Mumbai

peripheral locations like Ghatkopar, Bandra Worli Sea link

Fort Fountain

CST

Worli

Chembur, Mulund, Thane and Navi 5KM

Churchgate

Breach Candy CBD

Mumbai through eastern Pedder Rd. 10KM

Colaba

Nariman Point

15KM

expressway and central railways 20KM

Major Residential Hubs Major Commercial Hubs

l Availability of retail, entertainment Major Retail Hubs Major Train Station

Major Flyover / Bridges Major Infrastructure Project

and leisure facilities in the Airport Underway

Source – Corres, 1996 immediate vicinity Source: Cushman & Wakefield Research

INDIA REPORT | AUGUST 2010 5

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

l Presence of several educational institutes, hotels and hospitals, offering sound social

infrastructure.

Comparatively Lower Rental & Capital Values

In spite of its strategic location, real estate values in Central Mumbai are comparatively lower than

some of the other prominent micro markets in the city. As a result, these precincts are becoming

increasingly attractive for both commercial and residential end users.

COMPARATIVE ANALYSIS

Zone Commercial Office Residential - Mid Range

Rental Values Capital Values Capital Values

(INR/sq.ft./month) (INR/sq.ft.) (INR/sq.ft.)

Central Mumbai 190-200 17,000 - 22,000 16,000 - 30,000

South Mumbai 250-300 28,000 - 30,000 30,000 - 50,000

North Mumbai (BKC) 225-275 25,000 - 30,000 18,000 - 26,000

Source: Cushman & Wakefield Research

INDIA REPORT | AUGUST 2010 6

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

STAGGERED SUPPLY: HIGH COST

With many mill lands being under litigation or debt ridden, the availability of these land parcels for

redevelopment has been staggered. While their unlocking was expected to bring a gross

rationalisation of values in the region, the actual costs have been remarkably higher due to the large

gap between demand and limited availability. Given the potential of mill land development,

developers have been compelled to pay high land prices for them. Mill land auctions by NTC were

also viewed as an excellent opportunity for well capitalized developers to create high value land

banks. As a result, the average values in these locations began to appreciate at a higher rate than

Staggered release

expected.

of mill land has

led to slower Some significant mill land transactions:

supply and higher

cost. SIGNIFICANT MILL LAND DEAL IN MUMBAI

Name of the Mill Year Micro Market Acquirer Area Deal Price

(Acres) (INR Million)

Mumbai Textile Mills 2005 Lower Parel Jawala Real Estate 16.63 7,022

(Sakserja Mills) (DLF Group)

Elphinstone Mills 2005 Elphinstone Road Indiabulls Real Estate 8.08 4,410

Kohinoor Mills No. 3 2005 Dadar Matoshree Realtors 4.91 4,210

and Kohinoor Group

Jupiter Mills 2005 Elphinstone Road Indiabulls Real Estate 11.13 2,760

Apollo Mills 2005 Parel Lodha Group 7.33 1,800

Dawn Mills 2006 Lower Parel Peninsula Land 6.50 1,200

Poddar Mills 2010 Worli Indiabulls Real Estate 2.39 4,740

Bharat Mills 2010 Woril Indiabulls Real Estate 8.38 15,050

Source: Complied by Cushman & Wakefield Research based on publicly available information through media and other sources

CHANGING PARADIGM IN MILL LAND REDEVELOPMENT

Driven by recent improvements in demand for MILL LAND REDEVELOPMENT IN MUMBAI

residential and commercial space in the city, many 350

developers are expected to aggressively pursue 300

250 146.83

Area (Acres)

opportunities to create new land banks. With 200

217.88

almost 60% of privately held mill lands already 150

106.44

100

developed or currently under development, 50

39.06 80.84

10.92

upcoming mill lands for auction are expected to 0

Public Ownership Private Ownership

generate significant interest from developers. Developed Under Development To be Developed

Source: Cushman & Wakefield Research

INDIA REPORT | AUGUST 2010 7

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

Soaring demand for mill lands can be gauged from the fact that “Reserve Selling Price” of

upcoming mill lands for auction is almost two to three times higher than the “Selling Price” of mill lands

a few years ago.

Mill lands redevelopment in the city has witnessed a paradigm shift in recent years. In 2006-07,

Mumbai's real estate was characterised by all-time high rental and capital values, increasing demand

for office space and limited Grade A supply. Additionally, the city also witnessed steep retail real

estate growth and the entry of several new brands. As a result, most mill lands were envisaged to be

redeveloped as high end commercial projects catering to office and retail sectors.

However, the global economic crisis of 2008, which severely impacted the Indian real estate

sector, altered the nature of mill land development in the city. Low demand, plummeting rental

values and large upcoming supply, raised concerns on financial feasibility of office and retail

developments over mill lands. As a result, many mill land projects, most of which were still at a

planning stage, were converted into residential projects.

Impact of Recent High-Value Mill Land Auctions

The recent auction sales of the adjacent mill lands of NTC's Poddar Mill and the Bharat Mill,

bought by Indiabulls Real Estate (IBRE), works out to approximately INR 2,000 million/acre.

IBREL now has a sizeable land parcel of approximately 11 acres in land-scarce South Mumbai, with

clear title. Additionally, IBRE might be given construction rights on these lands in exchange for a

government-approved multi-storied public parking lot, for which IBRE might be awarded an extra

floor space index (FSI) as high as 4 in the free sale component. It is most likely that these lands will

be utilised for high end residential projects that will be sold in the range of INR 27,000 - 45,000 per

sq.ft. With a typical 3 BHK apartment being sold in the INR 5 crore bracket, these residential units

will largely stay out of the reach of ordinary Mumbaikars. While a public multi-storey car park

(MLCP) might be a bonus for space-starved citizens, but with the municipality already having

sanctioned over 25,000 parking slots in the Worli-Parel-Sewri micro market, the need for yet

another MLCP is debatable.

CAPITAL VALUE MOVEMENT ACROSS MAJOR RESIDENTIAL KAY FACTORS DRIVING HOUSING DEMAND IN

PROJECT ON MILL LANDS CENTRAL MUMBAI

70000

Limited

l opportunity for new residential developments in

South and South Central Mumbai

Average Capital Values

60000

50000

With

l capital values in South and South Central Mumbai

(INR/sq.ft.)

40000

being among the highest in the country, there is

30000

20000

increasing demand for residential apartments near South

10000

Mumbai with better amenities.

0 Lower

l capital and rental values in Central Mumbai as

Planet Godrej Ashok Towers Beaumonde

compared to its counterparts in South and South

Launch Price 2Q 2009 2Q 2010 Central Mumbai.

Source: Cushman & Wakefield Research

INDIA REPORT | AUGUST 2010 8

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

NEW ADDRESS FOR RESIDENTIAL SPACE

Changing lifestyles and an increasing demand KEY DRIVING FACTORS FOR PREMIUM HOUSING

LAUNCHES IN CENTRAL MUMBAI

for apartments with the latest amenities and

l Buoyant demand for premium housing from HNIs

architecture has resulted in a growing demand and NRIs

for premium housing projects. With l Growing demand for apartments with better

opportunity for any new development in amenities and modern architecture

South and South Central Mumbai having l Higher profit margins in the premium housing

segment

become largely exhausted, Central Mumbai is

fast emerging as the preferred location for

new residential space in the city. Besides, most of the existing housing stock in South Mumbai is

dated and lack the latest modern amenities and services.

MAJOR UPCOMING RESIDENTIAL PROJECTS ON MILL LANDS IN MUMBAI

Mill Land Name of Developers Name of Project Approx. Units

Mumbai Textile Mills DLF NA 1,000

(Sakserja Mills)

Pidilite Industries D B Realty Orchid Heights 640

Swan Mills Peninsula Land Ashok Gardens 600

Hindustan Mills K. Raheja Corp Vivarea 492

Crown Mills D B Realty Orchid Crown 342

Srinivas Mills Lodha Group World One 300

Apollo Mills Lodha Group Lodha Bellissimo 267

Elphinstone Mills Indiabulls Real Estate Indiabulls Sky Suites 215

Apollo Mills Lodha Group Lodha Primero 180

Spring Mills Bombay Dyeing NA 160

Sri Ram Mills Sri Ram Urban Infrastructure Palais Royale 120

Jupiter Mills Indiabulls Real Estate Indiabulls Sky 102

Jupiter Mills Indiabulls Real Estate Indiabulls Sky Forest NA

Khatau Mills Marathon Nextgen and NA NA

Adani Infrastructure

Compiled by Cushman & Wakefield Research

INDIA REPORT | AUGUST 2010 9

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

OTHER MAJOR RESIDENTIAL PROJECTS IN CENTRAL MUMBAI

Name of Developers Name of Project Location Approx. Units

Unitech The Residences Parel 250

Unitech Woodside & Ascot Dadar 240

Kumar Builders Kumar Echlon Worli 200

DB Realty Orchid Enclave – II Mumbai Central 188

Orbit Group Orbit Terraces Lower Parel 108

Apartments with

a unit size of Orbit Group Orbit Grand Lower Parel 88

1,200 to 1,500 Rupji Constructions Rupji Arena Lower Parel 88

sq.ft., within the

Ahuja Group Ahuja Towers Worli NA

price range of

INR 30 to 50 Compiled by Cushman & Wakefield Research

million will

witness high

absorption rates. WIDENING GAP BETWEEN SUPPLY AND DEMAND

Over the next three to four years, Central Mumbai UPCOMING RESIDENTIAL UNITS IN CENTRAL MUMBAI

is expected to witness a residential supply of 3000

No of Upcoming Apartments

approximately 7,000 apartment units. 2500

Interestingly, out of this total upcoming supply, 2000

1500

nearly 4,400 apartment units are coming up on 1000

mill lands. 500

0

2010 2011 2012 2013

With an estimated demand of approximately

Source: Cushman & Wakefield Research

2,300 to 2,600 residential units over the next three

years, Central Mumbai will be faced with a significant supply/demand gap. With supply

significantly outstripping demand, capital values in Central Mumbai would witness downward

pressure. Moreover, availability of mill lands through auctions in the near future would lead to

additional supply in this precinct. With locations like Worli and Prabhadevi being the preferred

choice for buyers, taking into account better infrastructure facilities, the residential segment of

Lower Parel will witness correction in the near future.

Right pricing is the most critical component driving demand in these upcoming residential

projects on the mill lands of Lower Parel and Parel. Majority of upcoming apartments are being

priced over INR 70 million; and demand is being driven solely by the high income segment. With

transportation issues and existing congestion levels emerging as the key drawbacks, capital values in

Lower Parel should be lower than that of Worli and Prabhadevi which provide better social and

physical infrastructure facilities. Moreover, apartments with smaller unit sizes of 1,200 to 1,500

sq.ft., with price levels in the range of INR 30 to 45 million, will lead to higher absorption rates.

INDIA REPORT | AUGUST 2010 10

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

SHIFT IN AXIS FOR OFFICE SPACE

Mumbai's CBD (comprising Churchgate and Nariman Point) and Bandra Kurla Complex (BKC)

have been the commercial office space hub till the recent past. However, with mill lands being

redeveloped into Grade A office space, Central Mumbai has currently emerged as an extended

CBD for Mumbai. Central Mumbai is also being preferred by large Indian and multinational

corporate houses as an alternative to the CBD. Larger floor plates with better amenities,

comparatively lower rentals, good connectivity to other micro markets, proximity to residential

precincts, etc., have all worked in favour of mill land redevelopment in Central Mumbai.

Migration of

multinationals to

COMPARATIVE ANALYSIS OF THREE MAJOR MICRO MARKETS OF MUMBAI

central and

suburban micro Central Mumbai CBD Bandra Kurla Complex

markets, along Average Base Rent

with fewer Upcoming Supply

opportunities for

Amenities

new development,

Infrastructure & Connectivity

will reduce the

importance of High Moderate Low

Mumbai's CBD in Source: Cushman & Wakefield Research

the foreseeable

future. Availability of mill lands for redevelopment has altered the dynamics of commercial office space in

the city. Central Mumbai's share of total office stock is expected to rise from 5% in 2000 to 14% by

2012. The emergence of Central Mumbai as a major commercial office hub has been further aided by

continued migration of several large multinationals from the CBD to Central Mumbai and other

suburban locations like BKC and Andheri. As a result, the CBD is expected to witness reduced

importance as a major commercial hub in the near future.

INCREASING NON-CBD SUPPLY

CBD CBD Lower

36 % Worli Lower 20% Lower CBD Parel

Worli Parel

12 % Parel

8% Worli 14 %

5% 6% 7% 4%

2000 2006 2012

Source: Cushman & Wakefield Research

Central Mumbai, which has an existing office stock of 4 million sq. ft., will add about 8 million

sq.ft. by 2013; the majority of which will cater to the IT/ITeS sector. In spite of recent demand

improvements, the upcoming office space supply in Central Mumbai is significantly higher than the

anticipated demand. Additionally, with availabilities of low cost alternatives catering to the IT/ITeS

sector in locations like Andheri, Malad and Thane, Lower Parel is expected to witness downward

pressure on capital and rental values in the short to medium term.

INDIA REPORT | AUGUST 2010 11

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

MAJOR COMMERCIAL PROJECTS ON MILL LANDS IN MUMBAI

Mill Land Name of Project Area (million sq.ft.) Current Status

Jupiter Mills One Indiabulls Centre 1.43 Operational

Elphinstone Mills Indiabulls Finance Centre 1.67 Under Construction

Ruby Mills The Ruby 0.85 Under Construction

Jalan Mills NA 1.35 Under Construction

Apollo Mills Lodha Excelus 0.38 Operational

Upcoming

IT/ITeS-specific Dawn Mills Peninsula Business Park 1.20 Under Construction

commercial office Century Mills NA 2.00 Under Construction

supply in Central

Mumbai is Source: Cushman & Wakefield Research

expected to

outstrip demand,

BOTTLENECKS TO REINVENTION OF MILL LANDS

pressurising rental

and capital values

While mill land redevelopment has transformed the landscape of Central Mumbai considerably, it

in the long term.

has also unearthed some critical hindrances that the micro market could face in the near future.

Limited Infrastructure Development

Despite large scale real estate development (both commercial and residential), there is a

conspicuous absence of infrastructure development in the micro market. This location has

extremely constricted roads that are likely to come under severe pressure with increased traffic flow

expected to be generated by the growing number of commercial office space and residential spaces.

The Bandra-Worli Sea Link as well as the proposed Metro Rail project are expected to have very

limited impact on easing heavy traffic flows here.

Rationalisation of Values

Even after the mill lands were initially opened up for redevelopment, only a fraction of the

estimated supply was actually made available for public use. Thus the impact that this additional

supply was expected to have in terms of rental and capital values, stood largely negated. With a

large part of mill land tracts being either involved in legal tussles, heavily indebted or already

mortgaged, the prospect of any new mill lands becoming available for development in the near

future is quite doubtful. Value rationalisation, therefore, will probably have to take a backseat for the

time being.

Downward Pressure on Financials

While this central micro market is expected to witness substantial upcoming office supply, demand

for office space may not increase proportionately enough. Even in a scenario where the IT/ITeS

sector – one of the principal growth drivers for commercial office space in the city – regains its

historical growth rate, demand would remain focussed on low cost micro markets like Navi Mumbai

INDIA REPORT | AUGUST 2010 12

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

and Thane. As a result, rental values in these micro markets are likely to come under pressure. This

downward pressure on rental and capital values could, consequently, force investors to give such

projects a miss.

POSSIBLE IMPACT OF INCREASED LAND SUPPLY IN CENTRAL MUMBAI

Infrastructure Development Changing Lifestyle Real Estate Impact

l Large scale redevelopment of l Better planned projects to l Surplus supply will help

mill lands will strain civic suit modern living stabilize exorbitant land rates

infrastructure amenities like

l Better lifestyle amenities like l Increased housing supply will

road transportation, water

parking space, recreation & cause cap value correction in

supply, etc., in Central

sports areas, security Central Mumbai

Mumbai.

provisions, etc.

l Commercial office market

l The fast paced real estate

l Better design & architecture might witness strong

construction will compel

over older generation supply competition from upcoming

development of support

supply in Central Mumbai and

infrastructure in Central

other locations like Andheri,

Mumbai.

Thane, Navi Mumbai, etc.

OUTLOOK

There is an urgent need for a time bound redevelopment policy for the city at present. The absence

of any such policy towards the redevelopment of mill lands has resulted in inconsistent and

sporadic development of these land parcels. As a result, the task of moderating surging capital

values in Mumbai, which was one of the primary objectives of redeveloping mill lands, has not yet

seen much success.

Cushman & Wakefield Research is of the opinion that a time bound, development plan

spanning approximately 10 years for mill lands could add significant supply across both residential

and office sectors. Such a planned policy is expected to lead to the development of approximately

17,000 to 22,000 residential units, and nearly 20 million sq.ft. of office space supply, over the next

10 years. Moreover, a stable upcoming supply trend is expected to help moderate residential capital

values across both Central and South Mumbai, while influencing values in other parts of the city.

CONSISTENT AVAILABILITY OF MILL LAND FOR DEVELOPMENT WILL HELP MODERATE RENTAL AND CAPITAL VALUES ACROSS

RESIDENTIAL AND OFFICE SECTOR

RESIDENTIAL SECTOR OFFICE SECTOR

80 4000 6

70 3500

5

Area (Million sq.ft.)

60 3000

50 2500 4

40 2000 3

30 1500

2

20 1000

1

10 500

0 0 0

2010 2012 2014 2016 2018 2020 2010 2012 2014 2016 2018 2020

Supply - Residential Demand - Residential Mill Land Release Supply - Office

Source: Cushman & Wakefield Research

INDIA REPORT | AUGUST 2010 13

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

Mill lands in Mumbai, which have been a driver for growth and employment till the 1990s have yet

again emerged on the centre stage, providing huge potential for development activity in the city. Mill

land redevelopment on other hand, given its geographic and economic benefits, is an ideal and

opportune case for urbanisation, focussing on the social, economic and financial benefits of all

stakeholders. The city, however, has failed to reap the anticipated benefits from the redevelopment

of these land parcels due to the sporadic and slow development pace over the years. The real

challenge towards mill land redevelopment lies in the creation of a holistic approach that should

focus on some of the following aspects:

Regulatory Regime

Regulatory policies governing mill land have largely been reactionary. These policy changes related

to mill lands have undergone frequent changes resulting in the slow development of mill land.

Going forward these policies will have to be reoriented such that not only do they pace up the

process of bringing mill lands into the property market, but also cater to the interest of various

stakeholders (mill owners, current occupiers, environment groups, state government, etc.).

Efficient Land Utilisation

A balance in development on mill land (e.g. commercial, residential, retail, public utility) needs to be

brought in. A planned and guided usage of mill lands will not only ensure a balanced

supply/demand equation, but also moderate price movements curbing artificial shortage of supply.

The release of large supply of mill land at preferred locations would create a surplus, leading to

stabilisation of values.

Infrastructure Development

In order to transform the micro market into a successful real estate destination, a collective

approach of developing infrastructure (i.e. improved transportation and better utility services) is of

paramount importance. The longstanding stalemate on redevelopment of mill lands seems to be

ending, with many mill lands expected to undergo redevelopment in the coming months. As many

developers are keeping a close watch on these last large available land parcels in the city, the skyline

of Central Mumbai is poised for a significant change.

INDIA REPORT | AUGUST 2010 14

Spinning the Mills - Mill Land Redevelopment in Mumbai

A C & W I N D I A P U B L I C AT I O N

About Research & Business Analytics Group Cushman & Wakefield is the world's largest Authors of the report:

Cushman & Wakefield is committed to collation of high privately held commercial real estate services firm. Satish Tiwari

quality base data and assembling detailed statistics for Founded in 1917, it has 231 offices in 58 countries Research & Business Analytics Group

the major India markets on a regular basis. This and more than 15,000 employees. The firm satish.tiwari@ap.cushwake.com

commitment to quality research provides a strong represents a diverse customer base ranging from

foundation for all of our services. Customized, small businesses to Fortune 500 companies. Saon Bhattacharya

analytical reports are also developed to meet the Research & Business Analytics Group

specific research needs of owners, occupiers, and It offers a complete range of services within four saon.bhattacharya@ap.cushwake.com

investors. primary disciplines: Transaction Services, including

tenant and landlord representation in office, Megha Maan

Through the delivery of timely, accurate, high quality industrial and retail real estate; Capital Markets, Research & Business Analytics Group

research reports on the leading trends, markets and including property sales, investment management, megha.maan@ap.cushwake.com

business issues of the day, we aim to assist our clients in valuation services, investment banking, debt and

making pertinent and competitive property decisions. equity financing; Client Solutions, including

integrated real estate strategies for large Published by Corporate Communication.

In addition to producing regular reports such as global

corporations and property owners; and Consulting For more market intelligence and research

rankings and local quarterly updates available on a

Services, including business and real estate reports, visit Cushman & Wakefield’s

regular basis, Cushman & Wakefield also provides

consulting. Knowledge Center at

customized studies to meet specific information needs

www.cushmanwakefield.com

of owners, occupiers and investors. A recognised leader in global real estate research,

the firm publishes a broad array of proprietary

For more information:

Tanuja Rai Pradhan reports available on its online Knowledge Center

National Head - India at cushmanwakefield.com/knowledge.

©2010 Cushman & Wakefield

Research & Business Analytics Group All Rights Reserved

+(91 124) 469 5555

tanuja.pradhan@ap.cushwake.com

Disclaimer

This report has been prepared solely for information purposes. It does not purport to be a complete description of the markets or developments contained in this material. The

information on which this report is based has been obtained from sources we believe to be reliable, but we have not independently verified such information and we do not

guarantee that the information is accurate or complete.

INDIA REPORT | AUGUST 2010 15

www.cushmanwakefield.com

For industry-leading intelligence to support your real estate

and business decisions, go to Cushman & Wakefield's

Knowledge Center at www.cushmanwakefield.com/knowledge

©2010 Cushman & Wakefield

All Rights Reserved

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Speech by Ms - Tong Guili, Deputy Mayor of HangzhouDocument14 pagesSpeech by Ms - Tong Guili, Deputy Mayor of HangzhouAnirudh KashyapNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Invest Hangzhou Information Technology 201104Document28 pagesInvest Hangzhou Information Technology 201104Anirudh KashyapNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Gemini Survey ChinaDocument25 pagesGemini Survey ChinaAnirudh KashyapNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Karnataka Industrial Policy 2009-14Document54 pagesKarnataka Industrial Policy 2009-14Anirudh KashyapNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 2011 India Attractiveness SurveyDocument60 pages2011 India Attractiveness SurveyAnirudh KashyapNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Constituation WiseDocument10 pagesConstituation WiseAnirudh KashyapNo ratings yet

- Delhi - City Demographic ProfileDocument10 pagesDelhi - City Demographic ProfileAnirudh KashyapNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Model Questions - 2018 - Macroeconomics FinalDocument9 pagesModel Questions - 2018 - Macroeconomics FinalSomidu ChandimalNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- India China Starch Sector Analysis September 2010Document12 pagesIndia China Starch Sector Analysis September 2010girishnarangNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Production of Bioplastic Products. Biodegradable and Bio-Plastics Products Manufacturing Business. Glasses, Plates and Bags Manufacturing Project.-207549 PDFDocument71 pagesProduction of Bioplastic Products. Biodegradable and Bio-Plastics Products Manufacturing Business. Glasses, Plates and Bags Manufacturing Project.-207549 PDFPravin DixitNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- SMC Project FinalDocument53 pagesSMC Project FinalSahil KhannaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Channel Conflict ManagementDocument18 pagesChannel Conflict ManagementUmang MehraNo ratings yet

- Fin333 Secondmt04w Sample QuestionsDocument10 pagesFin333 Secondmt04w Sample QuestionsSara NasNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Nagarjuna LTDDocument6 pagesNagarjuna LTDkiranNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Profit and Loss - 1604512744369Document31 pagesProfit and Loss - 1604512744369Gunjan RawatNo ratings yet

- Chapter 6 - Market StructureDocument58 pagesChapter 6 - Market StructureClarisse Joyce Nava AbregosoNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 8 BMCDocument17 pages8 BMCSiddhesh GandhiNo ratings yet

- Girl Scouts Cookies Marketing Online Case StudyDocument2 pagesGirl Scouts Cookies Marketing Online Case Studyg_rayNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Air India: Directors' ReportDocument8 pagesAir India: Directors' ReportSachin NarayankarNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Managing A Stock Portfolio A Worldwide Issue Chapter 11Document20 pagesManaging A Stock Portfolio A Worldwide Issue Chapter 11HafizUmarArshadNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The General EnvironmentDocument5 pagesThe General EnvironmentLawal Idris AdesholaNo ratings yet

- Economics Notes From IGCSE AIDDocument50 pagesEconomics Notes From IGCSE AIDAejaz MohamedNo ratings yet

- Kpo BpoDocument18 pagesKpo BpoSakshi AroraNo ratings yet

- Walmart Write UpDocument5 pagesWalmart Write UpKumar RaviNo ratings yet

- Weis - Final ReportDocument32 pagesWeis - Final Reportapi-253140895No ratings yet

- Real Options Exercis - WeGig-2Document17 pagesReal Options Exercis - WeGig-2Anirudh SinghNo ratings yet

- Case 1 - Computations of GW or IFADocument3 pagesCase 1 - Computations of GW or IFAJem Valmonte0% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Problem Set 7Document2 pagesProblem Set 7Luka JanjalashviliNo ratings yet

- Wensha Voucher 3 PDFDocument1 pageWensha Voucher 3 PDFJulia Shane BarriosNo ratings yet

- The Value and Price of Food: An Excerpt From Terra Madre by Carlo PetriniDocument7 pagesThe Value and Price of Food: An Excerpt From Terra Madre by Carlo PetriniChelsea Green Publishing100% (1)

- Rent Income: Dividend Income Other IncomeDocument1 pageRent Income: Dividend Income Other IncomeLhorene Hope DueñasNo ratings yet

- Decline of Spain (16th Century)Document8 pagesDecline of Spain (16th Century)adarsh aryanNo ratings yet

- Expansion of Opium Production in TurkeyDocument22 pagesExpansion of Opium Production in TurkeyCarla CruzeñaNo ratings yet

- FM11 - Financial & Management AccountingDocument3 pagesFM11 - Financial & Management AccountingA Kaur MarwahNo ratings yet

- CGQS BrochureDocument1 pageCGQS BrochureCathal GuineyNo ratings yet

- From Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETDocument6 pagesFrom Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETMarco Regunayan100% (1)

- Multi Bintang Indonesia TBK.: Company Report: January 2017 As of 31 January 2017Document3 pagesMulti Bintang Indonesia TBK.: Company Report: January 2017 As of 31 January 2017Solihul HadiNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)