Professional Documents

Culture Documents

The Problems of Mergers and Acquisitions: Herbert M. Sancianco

Uploaded by

Business Expert PressOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Problems of Mergers and Acquisitions: Herbert M. Sancianco

Uploaded by

Business Expert PressCopyright:

Available Formats

The Problems of Mergers

and Acquisitions

Herbert M. Sancianco

Abstract: There is always a company out there regard-

less of its size and/or business age that is planning to

or has an intention of selling its business lock, stock,

and barrel to whoever will be interested in buying

it for a good price that is mutually acceptable. There

are numerous reasons for the business exit. Some

companies who plan to grow their business portfolio

needs additional working capital to satisfy their expan-

sion goals over a forecasted timeline. Usually such a

company with this intention will look for medium term

equity investors. But before a successful transaction

can be achieved between buyer and seller in either sce-

nario, there are a variety of p

roblems that need to be

recognized and anticipated, as these are key concerns

in achieving the desired win-win deal. Moreover, there

are other problems that can plague the merger or acqui-

sition after the memorandum of agreement is signed,

and as the third party enters the business it bought or

invested as a working capitalist.

Keywords: consultant intervention, financial health,

Herbert M. Sancianco a Philippine- investment payback, legal liabilities, longevity,

based professional marketer honed as

a business educator, soft-skills trainer,

organization, product relevance, professional

market researcher, brand strategist, competence, retirement

and a corporate rehabilitator with

over 40 years of experience. He is an The journey begins with the reasons why a company

author of three business books on

would like to divest or seek additional working capi-

sales promotion, customer service,

and corporate rehabilitation. He just tal. In like manner, why would another company want

finished writing a fourth book on sales to acquire another company that may have a busi-

and trade management for FMCG ness synergy to it or where an attractive opportunity

products. He can be contacted at presents i tself which can increase the acquirer’s business

marketingpilosopo@yahoo.com.

portfolio in its operating market or be an entry point for

an international business presence?

There have been cases where the acquirer buys

another company for its philanthropic reasons or where

that targeted acquisition will be an image booster for the

acquirer’s company or product brand.

© Business Expert Press 978-1-94897-622-0 (2018) Expert Insights

1

www.businessexpertpress.com

The Problems of Mergers and Acquisitions

The Selling Reasons After all, most parents would say that

Companies that would like to partially or they built the business for their children.

totally sell themselves for a good price are By observation through the years, the

due to the following: second generation continuity is rare or

very few. Getting the next generation to

■■ The key shareholders are getting old voluntarily agree and commit to continue

and want to retire the business largely depends on how the

This is the most prevalent reason for a parents got the children to love the business

company, particularly for those operating they started and nurtured and motivated

for 20 years or more. The founding fathers them to continue the family legacy.

have reached an emotional point where I have often asked my students in gradu-

they feel it is time to go and enjoy the ate school who are taking up their master’s

fruits of their hard work through the years. degree and who are children of a family-

Only a few of those with this reason owned business if they are studying to take

know how much their company is worth over their parent’s company, and with that,

as they may have financial consultants share some reasons for or against the idea.

in this regard. I have learned from them the following:

For those with just an indicative selling a. Six out of 10 will take over the family

price in mind, which is usually from a business because, as a first reason, it has

“gut-feel,” they will establish a range of been there for decades and is rich in a

prices for the interested buying party to tradition which they feel they should

mull over and affirm a commitment after continue (e.g., bakery business, food

corporate due diligence work is completed. service restaurant, retailing, hotels,

■■ There isn’t an anointed one to carry food manufacturing). They feel it is

on the business their destiny to do so.

This is very much associated with the first The second reason is that they

reason since no one among the senior can identify with the business model

management staff is seen and favored as and “love” the products it produces

an eligible candidate to take over the busi- (e.g., fashion design, furniture design)

ness as a shareholder and partner. or the service it renders to its target

This is a tragedy because the aging customers (e.g., food s ervice catering,

owners never went out of their way to commercial transportation). They

adequately prepare for that day when have very bright ideas on how to

they would like to retire from the busi- improve on the products or services

ness, particularly if the business remains and make a big difference in upgrad-

viable and profitable. ing the company’s operating system

In fact, the company has no continu- and profitability.

ity protocol program to address an issue The third and perhaps paramount

like this. reason is that they want to be their

■■ The next generation is not interested own boss, make very good money for

or partially interested to continue the themselves, and be counted among

family business the rich and famous.

Family-owned and operated businesses b. For those who will not continue the

have this either as the first or second r eason family business, they say and feel it is

for divestment. Somehow the second gen- not their calling in life—they want to

eration (their children) did not show any pursue a different career path or blaze

interest in continuing the family business their own trail and make a name for

despite the best efforts of their parents to themselves. For others, they don’t want

woo them into the fold. to experience the unhappy life they led

2 © Business Expert Press 978-1-94897-622-0 (2018) Expert Insights

www.businessexpertpress.com

The Problems of Mergers and Acquisitions

while growing up because their parents as these acquisitions were key marketing

often argued about their business issues interests in expanding its beverage busi-

in front them thereby causing them to ness. It also acquired the Frito-Lay com-

be emotionally affected—sometimes pany that produces snack foods.

scarred for life. ■■ Reduce the competitive threat

■■ Time to cut while the company is at Companies who are the market leaders in

its business peak their product or service category will do this

Some sellers have this next reason since to a competitor who they see as a threat to

they have this pragmatic view that they their market dominance at a future time.

built the company with very little capital Conversely, companies who aspire to be

and grew it where the value of the business the market leader will likely acquire either

and share value is at least 10 times more a competitor who is one rank higher than

from where they first started. They have them or one rank lower so that their com-

the so-called build and sell attitude, which bined business ownership will be a force

is usually a very rewarding proposition. to reckon with by the market leader—the

■■ There is an unsolicited offer company they aspire to overtake in the

There are instances where a third party marketplace at a future time.

will walk up to a company and express ■■ Improve the corporate bottom line

their intent to buy that company at a Companies with several subsidiaries which

price that may be too good to be true. The were acquired or started years earlier may

buying party has many reasons for such be dragging down the corporate bottom line.

an intention. There are at least two reasons for doing so.

The owners of the targeted company The first reason may be related to coun-

will always express a big surprise over the try economics. A weak economy may be

buying interest and sometimes be taken negatively affecting that poor perform-

aback. Unless the buying party’s timing ing company due to its product which

is just right, some of these targeted com- may have demand issues that may be

panies may not go for the offer relative related to its price and where a downward

to their emotional attachment they have adjustment may not deliver the aspired

to the company which to begin with is results in terms of increased demand and

doing very well and is a very good income profitability.

provider for the shareholders. Likewise, it may not make further sense

If the timing is right however, where for to continue its manufacturing facility in

example, the company is facing a financial an area whose cost of doing business is no

stress for some time, the targeted owners longer feasible nor profitable due to the

will gladly sell at a drop of a hat. updated national or local government poli-

cies related to reduced tax incentives or

The Buying Reasons rising labor cost to name a few concerns.

■■ Business synergy Product obsolescence can be the next

There are companies who will buy another reason as competition may have a more

if the targeted firm has a fit in its overall attractive product offer, for example, g eneric

business model and paradigm. medicines that offer the same relief as the

For example, a dominant quick service branded version but sold at a far cheaper

restaurant (QSR) selling burgers, shakes, price. This may not be matched by the

and fries will buy another QSR selling product concerned.

pizzas and pastas. ■■ Build a conglomerate

In a complementing move PepsiCo Inter- There are businesses that have done so

national bought in the old millennium the well for themselves such that they have

Pizza Hut, Taco Bell, and KFC companies earned very hefty profits over time.

© Business Expert Press 978-1-94897-622-0 (2018) Expert Insights

3

www.businessexpertpress.com

You might also like

- Innocent Words That Make Her HornyDocument14 pagesInnocent Words That Make Her HornyH69% (13)

- Grua Grove 530e 2 Manual de PartesDocument713 pagesGrua Grove 530e 2 Manual de PartesGustavo100% (7)

- Instruction For Nantucket NectarsDocument4 pagesInstruction For Nantucket NectarsTanaporn SuwanchaiyongNo ratings yet

- A Detailed Lesson PlanDocument5 pagesA Detailed Lesson PlanIsaac-elmar Agtarap74% (23)

- The Seven Pitfalls of A Mom and Pop Operation: Herbert M. SanciancoDocument3 pagesThe Seven Pitfalls of A Mom and Pop Operation: Herbert M. SanciancoBusiness Expert PressNo ratings yet

- Case1 Mama BearDocument9 pagesCase1 Mama BearAngelo FerrerNo ratings yet

- Entrep ReviewerDocument6 pagesEntrep ReviewerAirah VillaruzNo ratings yet

- Entrepreneurship Ass1 Prosper PhiriDocument10 pagesEntrepreneurship Ass1 Prosper PhiriProsper PhiriNo ratings yet

- ENT300 05 Business FormationDocument23 pagesENT300 05 Business FormationHalimah YusoffNo ratings yet

- Stakeholders Analysis A. Identification: Software Developer Specialist / CompanyDocument17 pagesStakeholders Analysis A. Identification: Software Developer Specialist / CompanyTălmaciu BiancaNo ratings yet

- Developing A Business Plan VIABILITYDocument43 pagesDeveloping A Business Plan VIABILITYDawn AranadorNo ratings yet

- Final 5 - Strategies For GrowthDocument21 pagesFinal 5 - Strategies For Growthnusrat islamNo ratings yet

- Entrepreneurship and Effective Small Business Management 11th Edition Scarborough Solutions Manual 1Document36 pagesEntrepreneurship and Effective Small Business Management 11th Edition Scarborough Solutions Manual 1samuelmckaymdqyaioswk100% (24)

- Running Head: Franchising Essay 1Document13 pagesRunning Head: Franchising Essay 1broookNo ratings yet

- Understanding Your Financing Options 1583093898Document1 pageUnderstanding Your Financing Options 1583093898JacobNo ratings yet

- Entrepreneurship in IndiaDocument21 pagesEntrepreneurship in Indiaadityakashyap123No ratings yet

- Assignment - 2 (5 Marks)Document4 pagesAssignment - 2 (5 Marks)Ãshrąf ShorbajiNo ratings yet

- McKinsey - M & A As Competitive AdvantageDocument5 pagesMcKinsey - M & A As Competitive AdvantagevenkatsteelNo ratings yet

- MACR-03 - Drivers For M&ADocument6 pagesMACR-03 - Drivers For M&AVivek KuchhalNo ratings yet

- Business Ethics BookDocument15 pagesBusiness Ethics BookLOKI MATENo ratings yet

- Chapter 3Document7 pagesChapter 3Adnan SurzoNo ratings yet

- ENT131 Chapter 5 and 6Document21 pagesENT131 Chapter 5 and 6Classic KachereNo ratings yet

- Chapter 5Document5 pagesChapter 5Adnan SurzoNo ratings yet

- BUS 393 - Exam 2 - Chapter 4-9Document13 pagesBUS 393 - Exam 2 - Chapter 4-9Nerdy Notes Inc.No ratings yet

- Starting and Operating A BusinessDocument3 pagesStarting and Operating A BusinessloriemiepNo ratings yet

- Franchise & ConcesionsDocument3 pagesFranchise & ConcesionsMax TorresNo ratings yet

- Merger and AcqucitionDocument8 pagesMerger and AcqucitionSher Zaman BhuttoNo ratings yet

- Bautista, Dhoz Ahsram Balboa - Day 1 EntrepDocument4 pagesBautista, Dhoz Ahsram Balboa - Day 1 EntrepNamerah GoteNo ratings yet

- Ed 2Document19 pagesEd 2Sumatthi Devi ChigurupatiNo ratings yet

- Chapter 7 emDocument9 pagesChapter 7 emkristhelcolegioNo ratings yet

- For Entrep ADocument51 pagesFor Entrep AJose Jeirl Esula ArellanoNo ratings yet

- Strategic Management CHAPTER 5 & 6Document28 pagesStrategic Management CHAPTER 5 & 6Taessa Kim100% (1)

- HGI Passnote Mergers WebDocument4 pagesHGI Passnote Mergers WebIvan MoreiraNo ratings yet

- Ch01 fm202 Finance Small Business EnterpriseDocument9 pagesCh01 fm202 Finance Small Business Enterprisepratik_483No ratings yet

- ENT300 - Module5 - BUSINESS FORMATIONDocument24 pagesENT300 - Module5 - BUSINESS FORMATIONillya amyraNo ratings yet

- 5-Sarah Magdy - Group 4S8-Bus Ethics - FINAL EXAMDocument6 pages5-Sarah Magdy - Group 4S8-Bus Ethics - FINAL EXAMsarah MagdyNo ratings yet

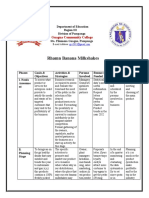

- Rhamn Banana Milkshake Action PlanDocument4 pagesRhamn Banana Milkshake Action PlanNiño SantiagoNo ratings yet

- Ed 2Document12 pagesEd 2Vineetha VNo ratings yet

- Ed 2Document5 pagesEd 2Vineetha VNo ratings yet

- Going For IPODocument31 pagesGoing For IPOpavan718149No ratings yet

- Note Intro BsDocument15 pagesNote Intro Bs徐渼姗No ratings yet

- Enterprise Planning and Risk ManagementDocument46 pagesEnterprise Planning and Risk ManagementkarandeepNo ratings yet

- Ib Da4Document13 pagesIb Da4Abhay KumarNo ratings yet

- Value Creation Private EquityDocument6 pagesValue Creation Private EquityRobes BaimaNo ratings yet

- Difference Between Indigo and Chapter, Growth Strategy, Customers You Want To FireDocument15 pagesDifference Between Indigo and Chapter, Growth Strategy, Customers You Want To FireHasan ShahriarNo ratings yet

- Bus-101 Chapter 5: Structuring Contemporary Business: Instructor: Shegofta ShabnomDocument9 pagesBus-101 Chapter 5: Structuring Contemporary Business: Instructor: Shegofta ShabnomRoynok Khan BadhonNo ratings yet

- Motivation Ent DevelpmentDocument4 pagesMotivation Ent DevelpmentMujahadatun_linafsihNo ratings yet

- Unit 4Document12 pagesUnit 4iamamayNo ratings yet

- TN Smart Start Up GuideDocument82 pagesTN Smart Start Up GuideGold SunriseNo ratings yet

- BrandingDocument15 pagesBrandingSimona Pop100% (4)

- Form 4 POB Growth and Linkage IndustryDocument3 pagesForm 4 POB Growth and Linkage IndustryJaci PaigeNo ratings yet

- Lesson 4 - Setting Up A Business - Next Steps 061021Document17 pagesLesson 4 - Setting Up A Business - Next Steps 061021senejaNo ratings yet

- Business Life CycleDocument4 pagesBusiness Life Cyclenurfarhana6789No ratings yet

- SDocument12 pagesSjoe blowNo ratings yet

- 12 Things To KnowDocument11 pages12 Things To KnowVicWoodsNo ratings yet

- Reflection Paper # 8Document2 pagesReflection Paper # 8Erika VillanuevaNo ratings yet

- Unit 1 - Introduction To Marketing ManagementDocument7 pagesUnit 1 - Introduction To Marketing ManagementJudithNo ratings yet

- Entrepreneurship AssignmentDocument7 pagesEntrepreneurship AssignmentMazhar ArfinNo ratings yet

- Mergers & AcquisitionsDocument62 pagesMergers & AcquisitionsJermaine Weiss100% (1)

- Credit and LendingDocument8 pagesCredit and LendingAbdulkarim Hamisi KufakunogaNo ratings yet

- Dual Pane Company: A Case StudyDocument8 pagesDual Pane Company: A Case StudyKristelle Brooke Dianne JarabeloNo ratings yet

- Lexande I: Lexander Anguage ChoolsDocument3 pagesLexande I: Lexander Anguage ChoolsAlexander InternationalNo ratings yet

- CFO's Guide To The Romanian Banking System: Cristi Spulbar and Ramona BirauDocument3 pagesCFO's Guide To The Romanian Banking System: Cristi Spulbar and Ramona BirauBusiness Expert PressNo ratings yet

- Guideline 1Document22 pagesGuideline 1Sheri DeanNo ratings yet

- Understanding The Indian Economy From The Post-Reforms of 1991Document29 pagesUnderstanding The Indian Economy From The Post-Reforms of 1991Business Expert PressNo ratings yet

- Chapter 1 - III PDFDocument51 pagesChapter 1 - III PDFBusiness Expert PressNo ratings yet

- Endorsement For The NextGen Book - BEP Website - 6 May 2019 FINALDocument14 pagesEndorsement For The NextGen Book - BEP Website - 6 May 2019 FINALBusiness Expert PressNo ratings yet

- Why Quality Is Important and How It Applies in Diverse Business and Social Environments, Volume IDocument29 pagesWhy Quality Is Important and How It Applies in Diverse Business and Social Environments, Volume IBusiness Expert PressNo ratings yet

- Doing Business in Hong Kong: Belinda WongDocument3 pagesDoing Business in Hong Kong: Belinda WongBusiness Expert PressNo ratings yet

- The Importance of Statutory Regulation: S. ChatterjeeDocument3 pagesThe Importance of Statutory Regulation: S. ChatterjeeBusiness Expert PressNo ratings yet

- Growth Strategies For Subscription-Based Businesses: Robbie Kellman BaxterDocument3 pagesGrowth Strategies For Subscription-Based Businesses: Robbie Kellman BaxterBusiness Expert PressNo ratings yet

- How To Close The Talent Gap in The Blockchain Industry: Jamil HasanDocument3 pagesHow To Close The Talent Gap in The Blockchain Industry: Jamil HasanBusiness Expert PressNo ratings yet

- 9781949443301Document3 pages9781949443301Business Expert PressNo ratings yet

- 9781948976305Document3 pages9781948976305Business Expert PressNo ratings yet

- 9781948580458Document3 pages9781948580458Business Expert PressNo ratings yet

- Partnering With EducatorsDocument14 pagesPartnering With EducatorsBusiness Expert PressNo ratings yet

- 9781948580137Document3 pages9781948580137Business Expert PressNo ratings yet

- 9781949443080Document3 pages9781949443080Business Expert PressNo ratings yet

- 9781948976008Document3 pages9781948976008Business Expert PressNo ratings yet

- 9781948580588Document3 pages9781948580588Business Expert PressNo ratings yet

- 9781948580441Document3 pages9781948580441Business Expert PressNo ratings yet

- The Power of Human Emphasis: A Management Framework Disciplined With Neuroscience AgilityDocument3 pagesThe Power of Human Emphasis: A Management Framework Disciplined With Neuroscience AgilityBusiness Expert PressNo ratings yet

- 9781631577352Document3 pages9781631577352Business Expert PressNo ratings yet

- Using Word To Create Great-Looking Reports: Abstract: This Article Gives Step-By-Step Instructions OnDocument3 pagesUsing Word To Create Great-Looking Reports: Abstract: This Article Gives Step-By-Step Instructions OnBusiness Expert PressNo ratings yet

- How To Create Great Reports in Excel: Anne WalshDocument3 pagesHow To Create Great Reports in Excel: Anne WalshBusiness Expert PressNo ratings yet

- Bitcoin and Blockchain: Jayanth R. VarmaDocument3 pagesBitcoin and Blockchain: Jayanth R. VarmaBusiness Expert PressNo ratings yet

- Accounting Information Systems and The U.S. Health Care IndustryDocument3 pagesAccounting Information Systems and The U.S. Health Care IndustryBusiness Expert PressNo ratings yet

- The Role of Corporate Executives in Business Journalism and Corporate CommunicationsDocument3 pagesThe Role of Corporate Executives in Business Journalism and Corporate CommunicationsBusiness Expert PressNo ratings yet

- E-Business and Accounting Information Systems: David M. ShapiroDocument3 pagesE-Business and Accounting Information Systems: David M. ShapiroBusiness Expert PressNo ratings yet

- Employer Productivity Considerations For Managing Cannabis in The WorkplaceDocument3 pagesEmployer Productivity Considerations For Managing Cannabis in The WorkplaceBusiness Expert PressNo ratings yet

- Big Data in The Cybersecurity Operations Center: Thomas M. MitchellDocument3 pagesBig Data in The Cybersecurity Operations Center: Thomas M. MitchellBusiness Expert PressNo ratings yet

- 9781948580595Document3 pages9781948580595Business Expert PressNo ratings yet

- Week 3 Alds 2202Document13 pagesWeek 3 Alds 2202lauren michaelsNo ratings yet

- RS-All Digital PET 2022 FlyerDocument25 pagesRS-All Digital PET 2022 FlyerromanNo ratings yet

- Batron: 29 5 MM Character Height LCD Modules 29Document1 pageBatron: 29 5 MM Character Height LCD Modules 29Diego OliveiraNo ratings yet

- Pipe Freezing StudyDocument8 pagesPipe Freezing StudymirekwaznyNo ratings yet

- MC4 CoCU 6 - Welding Records and Report DocumentationDocument8 pagesMC4 CoCU 6 - Welding Records and Report Documentationnizam1372100% (1)

- Antenatal Care (ANC)Document77 pagesAntenatal Care (ANC)tareNo ratings yet

- Details Philippine Qualifications FrameworkDocument6 pagesDetails Philippine Qualifications FrameworkCeline Pascual-RamosNo ratings yet

- Department of Education: Republic of The PhilippinesDocument2 pagesDepartment of Education: Republic of The PhilippinesISMAEL KRIS DELA CRUZNo ratings yet

- Anykycaccount Com Product Payoneer Bank Account PDFDocument2 pagesAnykycaccount Com Product Payoneer Bank Account PDFAnykycaccountNo ratings yet

- Panera Bread Case StudyDocument28 pagesPanera Bread Case Studyapi-459978037No ratings yet

- Speaking RubricDocument1 pageSpeaking RubricxespejoNo ratings yet

- A Vocabulary of Latin Nouns and AdnounsDocument129 pagesA Vocabulary of Latin Nouns and Adnounsthersitesslaughter-1No ratings yet

- World of Self, Family and Friends UNIT 4 - Lunchtime Speaking 37 Wednesday Friendship LanguageDocument11 pagesWorld of Self, Family and Friends UNIT 4 - Lunchtime Speaking 37 Wednesday Friendship LanguageAin NawwarNo ratings yet

- Final Quiz 2 - Attempt ReviewDocument6 pagesFinal Quiz 2 - Attempt Reviewkoraijohnson7No ratings yet

- Iso 22301 2019 en PDFDocument11 pagesIso 22301 2019 en PDFImam Saleh100% (3)

- Storage-Tanks Titik Berat PDFDocument72 pagesStorage-Tanks Titik Berat PDF'viki Art100% (1)

- LAB REPORT - MGCLDocument5 pagesLAB REPORT - MGCLKali stringsNo ratings yet

- 2017LR72 - SUMMARY REPORT Final 03052020Document72 pages2017LR72 - SUMMARY REPORT Final 03052020Dung PhamNo ratings yet

- Effects of Corneal Scars and Their Treatment With Rigid Contact Lenses On Quality of VisionDocument5 pagesEffects of Corneal Scars and Their Treatment With Rigid Contact Lenses On Quality of VisionJasmine EffendiNo ratings yet

- Sousa2019 PDFDocument38 pagesSousa2019 PDFWilly PurbaNo ratings yet

- Chapter 3 Extension - Game Theory-StDocument25 pagesChapter 3 Extension - Game Theory-StQuynh Chau TranNo ratings yet

- Chemical & Biological Depopulation (By Water Floridation and Food Additives or Preservatives) PDFDocument178 pagesChemical & Biological Depopulation (By Water Floridation and Food Additives or Preservatives) PDFsogunmola100% (2)

- Dragons ScaleDocument13 pagesDragons ScaleGuilherme De FariasNo ratings yet

- DADTCO Presentation PDFDocument34 pagesDADTCO Presentation PDFIngeniería Industrias Alimentarias Itsm100% (1)

- Chain: SRB Series (With Insulation Grip)Document1 pageChain: SRB Series (With Insulation Grip)shankarNo ratings yet

- Defining The Standards For Medical Grade Honey PDFDocument12 pagesDefining The Standards For Medical Grade Honey PDFLuis Alberto GarcíaNo ratings yet

- ENSC1001 Unit Outline 2014Document12 pagesENSC1001 Unit Outline 2014TheColonel999No ratings yet