Professional Documents

Culture Documents

Atlantic Yards DBNA Foundation Tax Year 2014

Uploaded by

Norman Oder0 ratings0% found this document useful (0 votes)

33 views15 pagesAtlantic Yards DBNA Foundation Tax Year 2014

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAtlantic Yards DBNA Foundation Tax Year 2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views15 pagesAtlantic Yards DBNA Foundation Tax Year 2014

Uploaded by

Norman OderAtlantic Yards DBNA Foundation Tax Year 2014

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 15

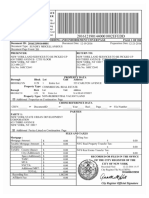

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491256000025]

som 990-PF pre no 1545-0052

Sete 2014

nena Revere Sauce Crs

een

Return of Private Foundation

or Section 4947(a)(1) Trust Treated as Private Foundation

> Donot enter social security numbers on this form as it may be made public.

> Information about Form 990-PF and its instructions fs at www.irs.gov/formS90pf.

For calendar year 2014, or tax year beginning 02-01-2014 and ending 01-31-2015

TS TF EnpToyarTESTTGRION HORST

a B Telephone number (426 wetracons)

Themoreon conten 230 or (238) 923.8400

SH ET PO SURAT SN POTS J rexempton apieaton pening, check hee T

Scmeckaiet ean” Tinweleeton [innate afafemeraiieaarty | 94. oman ptm ch ow or

Final return Amended return

2. Foregnaganaions mestng ne 85%

Fnddress change [name change fen thcthoe aya stacncompuaten

Wicheck type oferganization Section 503(eX3) exempt prvate foundation [iene

F section 4947(a)(1)nonexempt chantable trust Other taxable pnvate foundation

Fair market value ofall assets at end | 3Agcounting method cash M™ Accrual | F sri fundstonam. 6O:month temnmaton

tyeur (om Part IT 2! (0), Totnes tepectt) tnerscion SOO) e) owe

ineiome 0 (tare ctu (0) ust BoA ET DTD

‘Analysis of Revenue and Expenses (7% | (a) nevenc am (8) Dabursements

aac tee Oh eh ead ahaa ee tmyscveme at Toy nec vesinent | crated net | “roca

mecca ol hs aoa ka) (a ce ‘scare ‘ae vases

enc) (costae on)

7 Contributions, oiRs,arants, ete recewe (atach

schedule)

2 check [tthe foundations nat required to attach

seh @

3 Interest on savings end temporary cesh investments

4 Dividends and interest om secuntis

Sa Gross rente

bb Net rental income or (oss)

| 6a Net oainor (oss) rom sale of assets not on ne 10

3 gainer oss)

3 | © ross cates price forall arsete on ine 62

| 7 Capital gain net income (from Part iV, line 2) «

8 Net shortterm capital gain

9 Income madiicatons «

on Gross sales lees retums and

bb Lees Cost of goods colt

€ Gross profit or (loss) (attach schedule)

lst otherincome (attach schedule)

liz Total-Ace lines 2 ehrough 2. we se z

15 Compensation officers, directors, ustees, ete

14 other employee salenes and woges

B ]a5 Pension plans, employee benefits -

© | 6a Legal fees (attach schedule).

3 |b Accounting fees (attach schedule).

ST © otner professional fes (attach schedule)

B |17 interest

& | taxes attach schedule) (cee structions)

% | 19 oepreciaton (attach schedule) and depletion

E |20 occupancy

3 [21 travet,conterences, and meetings.

E ]22 Prinung and pubtieations .

S [23 omerexpenses (attach senedule)

E | 24 Total operating and administrative expenses.

ae Cpe re ° °

2

& |2s contnbutions, gi, rants para 3

25 Total expences and dlebursements. Add hes 24 and

3 ° 0

BY subtract ine 26 fom ne 12

Excess of revenue over expenses and dsbursements q

bb Net lavestment income (ifnegatve, enter -0-) 7

€ Adjusted net income (Fnegative, enter -0-)

For Paperwork Reduction Act Notice, see instructions, Cat No 1285K Form 990-PF (2014)

Form 990-PF (2014)

Page 2

DENTE sotance sheets Siti nee ental wear anus ony See vats ) a) book vale TB ae Ce Fa Rat ae

a =

2° Savings andtemporarycash investments | ss vt vse

Accounts recevable

Lest allovance for dou acounts®

4 Pledges receivable

Less allowance or doubit accounts

6 Recevvabes due from oficers, directors, tustes, and other

disquatiied persons (attach schedule) (see instructions)

7 Other notes and loans receeble attach schedule)

Less allovance or doubt accounts >

te

B| 9 presen expenses and deeredeneres sos sss

|10a_Investments—U S and state government obligations (attach schedule)

Investments—corpomte sock attach schedule) ow. ss

Investmants—corporate bonds (attach schedule), vv sss

12. Investinante—fand, buldinge and equipmant baste

Less accumulated depreciation (attach schedule)

12 _tnwestments—tmertgege lone

13 _avestments—ther (attach schedule}

14 Land, budings, and equpment basis

Less accumulates éepreciation (attach schedule)

15. otherassets(desenbe® >

16 Total ansets (tobe completed by al erases the

instructions Als, seepage 1 tem) d q °

17 Accounts payable and accrued expenses 7S

ee

Se mie

| 20 Loans rom otcers, directors, trustees, and other disqualiied persons

Bax merasges and othernoespayebi atach shes)

22 Otherliniites (describe )

23 _ Total abilities (043 ines 17 rough 2) q

Foundations that fllow SFAS 117, check ewe PF

3] antcomplte tines 24 through 2 and tines 30 and 3.

Blas unrestneted 2.

Glas Tempormnyresincted vs eed

Sa ine

| oundstion that do not follow SFAS 137, check here Pe [-

| and complete ines 27 trough 3.

[27 ceptal stock, tt pnepa or curent finds

| 2m Paitin or capa! surplus, erlang, bldg, and equipment tnd

220 Retained earings, accumulated ncome, endowment, or ether funds

$5] 20 Tote net anets ot fund balances (see instructions) J

31 Total abities and mat ansts/fund balances (see structions) 7 J

EEE Analysis of changes in Net Assets or Fund Balances

1 Total net assets a fund balances at begining af year—Part Il columa (a) ine 30 (must agree

wth and-ot-yeer gure reported onpnoryenrs tum) sv re ree ee ee LB

A CR a

3 oOtherinreases not included nine 2 (itemize) 3

S Decreases not netuded in tine 2 (temze) 5

6 __Totalnet assets orfund balances t end of year ine minus Ine S)-PanTcolumm(@ ine 30_| 6 o

Farm 990-PF (2014)

Form 990-PF (2014) Page 3

Capital Gains and Losses for Tax on Investment Income

(a) List and desenbe the kin(s) of property sold (eg, realestate, eHow acaures] ey pate acqures] (4) Date sla

story brek warenause, orcommon stock, 200 shs MLC CO) Erpurchase [mo davey') | (mo ,€ey, v0)

i

Th Depreciation slowed] (a) Cost orather bane Gi) Gan orowsy

|e {or allowable) plus expense of sale (e) plus (f) minus (9)

»

oy

Complete only fr evvata shoving gin n column (i) and owned bythe foundation on Z/ATIES (Goins (Gal (gen mine

Adjusted basis k) Excess ofol (3) 01 (kl, but not less then -0-) or

Cem os oft2s31/09 nett) CCuerest Uh fany esses trom coh)

»

‘

Troan also entero Part) ne?

2 Capital gain nt mcome or (et capital loss) itflossyemersocmnPer fine? }

3 Net short-term capital gain or (loss) a8 detned in sections 1222(5) and (6)

Ignn, sso enterin Part line 8, column (6) see instructions) IF (loss), enter I

invari ine 8

ication Under Sect

‘Qual in 4940(e) for Reduced Tax on Net Investment Income,

(For optional use by domestic private foundations subyect to the section 4940(e) tax on net investment income )

TH section 4940(4)(2) applies, leave ths part blank

‘Was the foundation liable for the section 4942 tax on the distributable amount of any year inthe bese period? I ves F to

1f"¥95," the foundation does not qualify under section 4940(e) Do not complete this part

11 Enter the appropriate amount in each column for each year, see instructions before making any entries

nse onod Jers Cloner (0 9, Detrbioon ato

buspenot years calender | paused quatiyng dstnbunons | Net vaie of nontamtable-use assets Ce TE, oa)

2013

2012

20n1

2 Total ofine i, column (a). 2

9 Average cistrbution ao forthe 5-year base period die the ttl on ne 2by 8, orby

the number of years the foundation hes been in existence ifless than 5 years 3

4 Enter the net value of noncharttable-use assets for 2014 from Part X, me 5. 4

5 Multiply ine 4 by line 3 5

6 Enter 1% of net investment income (1% of Par I, line 27). 6

7 Addiines 5 and 6. Poe oe a 7

8 Enterqualifying distributions fomParXiLjtined. ee 2 2 ee Do

If tine 81s equal to or greater then line 7, check the box in Pert VI, line 1b, and complete that part using @ 1% taxrate See

the Part Viimetructions

Form 990-PF (2014)

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Atlantic Yards Final SEIS Chapter 4D - Operational - TransportationDocument144 pagesAtlantic Yards Final SEIS Chapter 4D - Operational - TransportationNorman OderNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Pacific Park Conservancy Registration and Board MembersDocument6 pagesPacific Park Conservancy Registration and Board MembersNorman OderNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- NYC Commission On Property Tax Reform Preliminary ReportDocument72 pagesNYC Commission On Property Tax Reform Preliminary ReportNorman OderNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Atlantic Yards/Pacific Park Construction Alert 2.3.2020 and 2.10.2020Document2 pagesAtlantic Yards/Pacific Park Construction Alert 2.3.2020 and 2.10.2020Norman OderNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Pacific Park Conservancy BylawsDocument21 pagesPacific Park Conservancy BylawsNorman OderNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Greenland Metropolis Press Release 12.17.19Document1 pageGreenland Metropolis Press Release 12.17.19Norman OderNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Atlantic Yards/Pacific Park Construction Alert 12.23.19 and 12.30.19Document2 pagesAtlantic Yards/Pacific Park Construction Alert 12.23.19 and 12.30.19Norman OderNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Atlantic Yards FEIS Chapter 12 Traffic ParkingDocument94 pagesAtlantic Yards FEIS Chapter 12 Traffic ParkingNorman OderNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Atlantic Yards/Pacific Park Brooklyn Construction Alert 1.20.2020 and 1.27.20Document2 pagesAtlantic Yards/Pacific Park Brooklyn Construction Alert 1.20.2020 and 1.27.20Norman OderNo ratings yet

- Atlantic Yards Pacific Park Quality of Life Meeting Notes 11/19/19 From ESDDocument4 pagesAtlantic Yards Pacific Park Quality of Life Meeting Notes 11/19/19 From ESDNorman OderNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- SLA Cancellation Order WoodlandDocument2 pagesSLA Cancellation Order WoodlandNorman OderNo ratings yet

- Pacific Park Owners Association (Minus Exhibit K, Design Guidelines)Document93 pagesPacific Park Owners Association (Minus Exhibit K, Design Guidelines)Norman OderNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Woodland Case ALJ Decision, Part of SLA Defense To Second SuitDocument112 pagesWoodland Case ALJ Decision, Part of SLA Defense To Second SuitNorman OderNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Atlantic Yards/Pacific Park Construction Alert 12.23.19 and 12.30.19Document2 pagesAtlantic Yards/Pacific Park Construction Alert 12.23.19 and 12.30.19Norman OderNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Pacific Park Owners Association (Minus Exhibit K, Design Guidelines)Document93 pagesPacific Park Owners Association (Minus Exhibit K, Design Guidelines)Norman OderNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Atlantic Yards/Pacific Park Brooklyn Construction Alert Weeks of 9/2/19 + 9/9/19Document2 pagesAtlantic Yards/Pacific Park Brooklyn Construction Alert Weeks of 9/2/19 + 9/9/19Norman OderNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- 648 Pacific Street Firehouse Appraisal Atlantic YardsDocument53 pages648 Pacific Street Firehouse Appraisal Atlantic YardsNorman OderNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Pacific Park Conservancy IRS FilingDocument40 pagesPacific Park Conservancy IRS FilingNorman OderNo ratings yet

- Pacific Street Between Carlton and Vanderbilt Appraisal Atlantic YardsDocument26 pagesPacific Street Between Carlton and Vanderbilt Appraisal Atlantic YardsNorman OderNo ratings yet

- Block 1118 Lot 6 Appraisal Atlantic YardsDocument14 pagesBlock 1118 Lot 6 Appraisal Atlantic YardsNorman OderNo ratings yet

- MTA Appraisal Vanderbilt YardDocument3 pagesMTA Appraisal Vanderbilt YardNorman OderNo ratings yet

- Pacific Street Fifth To Sixth Avenue AppraisalDocument24 pagesPacific Street Fifth To Sixth Avenue AppraisalNorman OderNo ratings yet

- Fifth Avenue Between Atlantic and Pacific Appraisal Atlantic YardsDocument24 pagesFifth Avenue Between Atlantic and Pacific Appraisal Atlantic YardsNorman OderNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Site 5 Amazon FOIL ResponseDocument4 pagesSite 5 Amazon FOIL ResponseNorman OderNo ratings yet

- Forest City Block 927, Severance of Lot 1 Into Lots 1 and 16, 1998Document3 pagesForest City Block 927, Severance of Lot 1 Into Lots 1 and 16, 1998Norman OderNo ratings yet

- Block 927, Forest City Sale of Parcel To P.C. Richard 1998Document5 pagesBlock 927, Forest City Sale of Parcel To P.C. Richard 1998Norman OderNo ratings yet

- P.C. Richard Mortgage Site 5 Block 927Document20 pagesP.C. Richard Mortgage Site 5 Block 927Norman OderNo ratings yet

- Forest City Modell's Block 927 Second Mortgage Oct. 14, 1997Document56 pagesForest City Modell's Block 927 Second Mortgage Oct. 14, 1997Norman OderNo ratings yet

- Forest City Modell's Block 927 First Mortgage Oct. 14, 1997Document57 pagesForest City Modell's Block 927 First Mortgage Oct. 14, 1997Norman OderNo ratings yet

- Atlantic Yards/Pacific Park Brooklyn Construction Alert Weeks of 9/2/19 + 9/9/19Document2 pagesAtlantic Yards/Pacific Park Brooklyn Construction Alert Weeks of 9/2/19 + 9/9/19Norman OderNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)