Professional Documents

Culture Documents

Effective Spending Management Boosts Performance Oxford Economics 2017

Uploaded by

Jesus Black MillmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Effective Spending Management Boosts Performance Oxford Economics 2017

Uploaded by

Jesus Black MillmanCopyright:

Available Formats

How Finance Leadership Pays Off

Effective Spending Management Boosts Performance

In an increasingly competitive global economy, finance teams are working When the finance function is proactive in these six areas, it pays off. Finance Leaders are

harder than ever before. CFOs today are expected to drive long-term almost twice as likely as non-Leaders to report market share growth over the past year.

growth and performance, and most are involved in strategic decision- They have a significantly tighter grip on costs. And they make the most of technology

making outside finance. In many industries, too, finance must help innovations, including tools that automate routine tasks to improve efficiency.

determine where the organization should invest in new technologies to stay

in step with digital transformation. Fig. 1: How Finance Leaders

Yet alongside these strategic responsibilities, optimizing working capital, boost performance

controlling costs, and forecasting future spending needs are central to

the finance function’s mandate. Fast-growing, highly profitable companies

Drive strategic Collaborate regularly

excel at cost control. Furthermore, they are more likely than slow-growth with other business

growth

organizations to make use of technology that helps them track and analyze units

initiatives

spending, including travel and entertainment (T&E) expenses.

These findings are among the results from a global survey of 1,500

finance executives across a broad range of industries, conducted by Leaders:

Oxford Economics and SAP in March and April 2017. To explore what the 173 respondents

top-performing companies do differently from the rest of the pack, we (11.5% of sample)

Are well equipped Are very effective

identified six traits that make a Finance Leader, including a high degree of

to handle regulatory at core finance

effectiveness in core finance processes. Only a select 11.5% of our survey change processes

respondents qualified as Leaders. Yet our survey results show these six

practices enhance business performance; efficiency; and governance, risk

management, and compliance (GRC) across the organization.

Finance Leaders: Have strong

Improve efficiency influence beyond

1. Have strong influence beyond the finance function with automation the finance

2. Drive strategic growth initiatives function

3. Improve efficiency with automation

4. Are very effective at core finance processes

Companies with 5.1%–10% revenue growth are twice as likely as slower-growing

5. Collaborate regularly with business units across the entire company

companies to strongly agree that automation improves finance function efficiency.

6. Work closely with GRC and are well equipped to handle regulatory change

How Finance Leadership Pays Off: Effective Spending Management

Spending analytics can spur growth

While correlation does not necessarily prove causality, our survey results Fig. 3: Optimizing working capital remains a top priority

suggest that strong profitability and revenue growth are tied to effective cost What are the finance function’s most important business goals? Top three ranked

control—a cornerstone of organizational efficiency. For example, companies responses

with profit margin growth of 5.1% to 10% over the past year are more than

Optimizing risk management and

twice as likely as less profitable companies to rate themselves “very effective”

compliance 68%

at T&E expense management. They’re also significantly more likely to consider

themselves “very effective” at working capital optimization.

Optimizing working capital 57%

Finance Leaders understand the link between superior financial performance and

Improving efficiency across

cost control. They are more likely than non-Leaders to use analytics to understand

their organization’s spending trends in T&E, procurement, and supply chain

the organization 52%

(Fig. 2). Perhaps as a direct result, our survey found that fewer than half (42%) of

Finance Leaders name rising costs and wages as a top business risk facing their

Driving strategic growth initiatives 31%

organization in the next two years, compared with 60% of non-Leaders.

Improving finance’s responsiveness to

and collaboration with business units 31%

Fig. 2: Finance Leaders see value in analytics

Evaluating the financial viability of

Please rate the usefulness to the finance function of the following data and

strategic growth initiatives 29%

information sources. “Useful” and “extremely useful” responses

82% Leaders All others Optimizing procurement 20%

70% 69% Managing supply chain

11%

58% performance and risk

50% Managing T&E costs 3%

39%

The efficiency advantage

T&E (travel and49%

expenses) 49%

Procurement 49%

Supply chain analytics While the correlation between superior cost control and corporate performance

spending analytics spending analytics may shock no one, it’s worth remembering that as the CFO’s mandate expands,

traditional finance activities still play a starring role in corporate performance.

Our research found that the most profitable companies are the most likely to use

Finance executives are well aware of this: Among our survey respondents,

analytics. According to our survey, 82% of companies with profit margin growth

optimizing working capital and improving efficiency across the organization are

above 5% find T&E spending analytics extremely or very useful, compared with

considered two of the top three most important business goals, trailing only

67% of those with lower profit margin growth. Highly profitable companies are

optimizing risk management and compliance (Fig. 3).

also more likely to find supply chain analytics useful.

How Finance Leadership Pays Off: Effective Spending Management

We made automation-enabled efficiency a criterion of team to focus on more value-added tasks. “Automation takes dreary,

Finance Leadership because, as all CFOs understand, repetitive work away from staff,

“Automation delivers better service to the customer,” said David

an inefficient business is like a bucket with a hole at the

Craig, CFO of Commonwealth Bank of Australia. “It takes and the shareholder benefits

bottom, leaking productivity and profits. Finance executives

dreary, repetitive work away from staff. And the shareholder because the organization is

everywhere try to plug that hole, both in their own function

benefits because the organization is more efficient.” more efficient.”

and in other business units. And at many companies,

spending management—be it in T&E, procurement, or Finance Leaders see the finance function as an internal David Craig, CFO, Commonwealth

supply chain—is a prime candidate for streamlining and service within their organization, and they look for tools Bank of Australia

automating, as reporting and analysis must be repeated to help them serve all its different parts. For example,

period after period. Besides saving money, improving 95% of Leaders consider cloud-based applications

efficiency in these areas can free up time for the finance critically or very important to the finance function’s

Fig. 4: Cloud apps and Big Data help optimize working capital

Please rate the usefulness of these technologies to the finance function in the following areas. “Extremely useful” and “very

useful” responses*

Cloud-based applications Big Data

95% Optimizing working capital 96%

94% Driving strategic growth initiatives 96%

Optimizing risk management and

92% compliance 95%

Evaluating the financial viability of

94% startegic growth initiatives 93%

Improving efficiency across

93% the organization 91%

91% Improving finance’s responsiveness to

and collaboration with business units 89%

88% Managing T&E costs 91%

81% Optimizing procurement 80%

Managing supply chain

70% performance and risk 65%

*Respondents who ranked this technology as “critical” to the finance function’s performance today.

How Finance Leadership Pays Off: Effective Spending Management

successful performance today, compared with 70% of Calls to Action OXFORD: +44 (0)1865 268900

non-Leaders. They are also much more likely than non- LONDON: +44 (0)203 910 8000

■ Determine how well your finance team analyzes

Leaders to say the same of Big Data, mobile technology,

spending at your organization, and consider whether BELFAST: + 44 (0)2892 635400

and real-time and predictive analytics.

you need to improve expense tracking and reporting.

DUBAI: +971 56 396 7998

Our survey also demonstrates that cloud and Big Data ■ Diagnose where your expense management processes

applications can be especially useful for managing T&E could be more efficient. Could automating routine tasks FRANKFURT: +49 69 96 758 658

costs (Fig. 4). Among respondents who use cloud-based give your team more time for value-added activities? MILAN: +3902 9406 10

apps, 88% say they are extremely or very useful for

■ Leverage Big Data to convert the massive volumes of PARIS: +33 (0)1 78 91 50 52

managing T&E costs. And among those who use Big Data

expense information the finance function receives into

analytics, nearly all—91%—say they help manage T&E PAARL: +27(0)21 863-6200

actionable insights.

expenses. CFOs recognize that the right tools can help

■ Assess whether analytics might help the finance NEW YORK: +1 (646) 786 1879

them manage costs today, and unearth new efficiencies as

they analyze ever larger streams of data. function anticipate and optimize spending. BOSTON: +1 (617) 206 6112

“Automation of reporting can be about efficiency first, but Read the full study at www.sap.com/CFO. CHICAGO: +1 (773) 867-8140

then, more importantly, it’s about getting a better quality of FLORIDA: +1 (954) 916 5373

information,” says Julian Whitehead, CFO of Airbus Defence

LOS ANGELES: +1 (424) 238-4331

and Space. Developing higher-quality data, in turn, leads

to “a better discussion around the value proposition, how to MEXICO CITY: +52 155 5419-4173

actually drive value for the business,” he notes. PHILADELPHIA: +1 (646) 786 1879

SAN FRANCISCO: +1 (415) 214 3939

TORONTO: +1 (905) 361 6573

SINGAPORE: +65 6850 0110

HONG KONG: +852 3103 1097

MELBOURNE: +61 (0)3 8679 7300

SYDNEY: +61 (0)2 8458 4200

TOKYO: +81 3 6870 7175

Email:

mailbox@oxfordeconomics.com

Website:

www.oxfordeconomics.com

You might also like

- Deloitte Insightful Management ReportingDocument20 pagesDeloitte Insightful Management ReportingДавид АрноNo ratings yet

- Finance Effectiveness Benchmark 2017Document72 pagesFinance Effectiveness Benchmark 2017aditya mishraNo ratings yet

- Beyond Boundaries: A New Role For Finance in Driving Business CollaborationDocument27 pagesBeyond Boundaries: A New Role For Finance in Driving Business CollaborationJORGEB.MORENONo ratings yet

- Global Competitiveness Financial Manager's Leadership Role in Knowledge CreationDocument10 pagesGlobal Competitiveness Financial Manager's Leadership Role in Knowledge CreationEon LinNo ratings yet

- Role of Chief Finance Officer in Firm ManagementDocument19 pagesRole of Chief Finance Officer in Firm ManagementSamNo ratings yet

- Plugin Finance Rising To ChallengeDocument18 pagesPlugin Finance Rising To ChallengeAlvin YunantoNo ratings yet

- Murray - Lindo ControllershipDocument27 pagesMurray - Lindo ControllershipMichella ManlapigNo ratings yet

- Sap BPC 091207 Pass 1 RickardDocument22 pagesSap BPC 091207 Pass 1 RickardKittikorn PattNo ratings yet

- Accenture CFO As Architecture of Business ValueDocument60 pagesAccenture CFO As Architecture of Business ValueCollieMazhNo ratings yet

- The One Task The CFO Should Not Delegate: Integrations: Strategy & Corporate Finance PracticeDocument6 pagesThe One Task The CFO Should Not Delegate: Integrations: Strategy & Corporate Finance PracticeUsman SiddiquiNo ratings yet

- Optimized Financial Reporting in A Dynamic WorldDocument12 pagesOptimized Financial Reporting in A Dynamic Worldkalina hNo ratings yet

- LOS 2021 Execution InsightsDocument22 pagesLOS 2021 Execution InsightsOluwaseun AlausaNo ratings yet

- Deloitte Uk Finance Business PartneringDocument16 pagesDeloitte Uk Finance Business PartneringrubenrealperezNo ratings yet

- Building World-Class Finance and Performance Management CapabilitiesDocument8 pagesBuilding World-Class Finance and Performance Management CapabilitiesChung Chee YuenNo ratings yet

- Justifying Investment in Performance Management Systems: It's Not Just Smoke and Mirrors!Document6 pagesJustifying Investment in Performance Management Systems: It's Not Just Smoke and Mirrors!Ranjith KumarNo ratings yet

- BC Resources Benchmarking Report 2022Document24 pagesBC Resources Benchmarking Report 2022Rafael GuessNo ratings yet

- K04046 Building A Best-in-Class Finance Function (Best Practices Report) 20121112 PDFDocument106 pagesK04046 Building A Best-in-Class Finance Function (Best Practices Report) 20121112 PDFinfosahay100% (1)

- Getting It Right With GrowthDocument36 pagesGetting It Right With GrowthPatrick KariukiNo ratings yet

- The Business Impact of OutsourcingDocument8 pagesThe Business Impact of OutsourcingIBM_Explore_CSuiteNo ratings yet

- Transform Finance with 5 StepsDocument8 pagesTransform Finance with 5 StepsManikantan NatarajanNo ratings yet

- Mobilizing For Excellence in Supply ManagementDocument12 pagesMobilizing For Excellence in Supply ManagementfdgfdgfdsgdfgNo ratings yet

- The Impact of Employee Engagement On PerformanceDocument20 pagesThe Impact of Employee Engagement On PerformanceRajan RahiNo ratings yet

- Evolving Role of Finance FinalDocument12 pagesEvolving Role of Finance FinalVinod HindujaNo ratings yet

- Boosting-Performance-Through-Organization-DesignDocument7 pagesBoosting-Performance-Through-Organization-DesignAyoub AroucheNo ratings yet

- 2019 Finance Trends Report: Microsoft Dynamics 365Document65 pages2019 Finance Trends Report: Microsoft Dynamics 365Acevagner_StonedAceFrehleyNo ratings yet

- Best Practices in Creating A Strategic Finance Function: Sap InsightDocument16 pagesBest Practices in Creating A Strategic Finance Function: Sap Insightaramaky2001No ratings yet

- Chief Growth Officer - A New Role For Todays CFODocument10 pagesChief Growth Officer - A New Role For Todays CFOMuhammed ShahzadNo ratings yet

- New CFO HorizonsDocument16 pagesNew CFO Horizonskinz7879No ratings yet

- Finance TransformationDocument16 pagesFinance Transformationzavalase100% (1)

- Being The Best Thriving Not Just SurvivingDocument8 pagesBeing The Best Thriving Not Just SurvivingBrazil offshore jobsNo ratings yet

- Role of Technology in Management FunctionsDocument3 pagesRole of Technology in Management FunctionsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 4 Strategies To Unlock Performance Management Constraints HFMDocument6 pages4 Strategies To Unlock Performance Management Constraints HFMajay kumarNo ratings yet

- CFO Insights Future of ControllingDocument5 pagesCFO Insights Future of ControllingFelix Peralta LalaneNo ratings yet

- Term Paper On Value Based ManagementDocument19 pagesTerm Paper On Value Based Managementrajiv gupta407100% (1)

- The BEST PAPER CPM 26086235 A Palladium Group White PaperDocument24 pagesThe BEST PAPER CPM 26086235 A Palladium Group White PaperColiveira_brNo ratings yet

- Slender 2003Document15 pagesSlender 2003S.m.HasibRezaNo ratings yet

- Ceo Research BriefDocument10 pagesCeo Research BriefigangNo ratings yet

- Complete Chapter PagesDocument123 pagesComplete Chapter PagesZen1No ratings yet

- Succession Management Positioning Your Organizaton Leadership For Business SuccessDocument9 pagesSuccession Management Positioning Your Organizaton Leadership For Business SuccessRight ManagementNo ratings yet

- Private Company Governance: The Call For Sharper FocusDocument18 pagesPrivate Company Governance: The Call For Sharper Focusfairuz nabilahNo ratings yet

- Introduction To Managerial Accounting: Discussion QuestionsDocument5 pagesIntroduction To Managerial Accounting: Discussion QuestionsParth GandhiNo ratings yet

- Whitepaper ISO 41001: 2018 Facility Management - Management SystemsDocument14 pagesWhitepaper ISO 41001: 2018 Facility Management - Management SystemsIan van der Pool100% (1)

- Enterprise Agility: Buzz or Business Impact?Document19 pagesEnterprise Agility: Buzz or Business Impact?Melissa Salaverry CamposNo ratings yet

- E-Finance: The Foundation For A High Performance Corporate Finance OrganizationDocument13 pagesE-Finance: The Foundation For A High Performance Corporate Finance OrganizationalbusvijayNo ratings yet

- CFO2 WP NagelDocument3 pagesCFO2 WP NagelBSCBRASILNo ratings yet

- Future FinanceDocument2 pagesFuture FinancedakshaykumarNo ratings yet

- Lecture9 STRAT OrganizingForAction TNeparidzeDocument29 pagesLecture9 STRAT OrganizingForAction TNeparidzeDemonSideNo ratings yet

- Integrated Performance ManagementDocument60 pagesIntegrated Performance ManagementShayanNo ratings yet

- Corporate Governance Using Balanced ScorecardDocument11 pagesCorporate Governance Using Balanced Scorecardapi-3820836100% (2)

- Accenture Next Generation FinanceDocument8 pagesAccenture Next Generation FinanceIam DonNo ratings yet

- GARTNER New-Autonomous-Operating-Model PapersDocument15 pagesGARTNER New-Autonomous-Operating-Model PapersEduardo SifontesNo ratings yet

- Linking Business Intelligence To Strategy: Helps Cfos Stag RelevantDocument5 pagesLinking Business Intelligence To Strategy: Helps Cfos Stag RelevantMahima SuneethNo ratings yet

- A Comprehensive Approach To Application Portfolio Rationalization PDFDocument8 pagesA Comprehensive Approach To Application Portfolio Rationalization PDFAditya TrivediNo ratings yet

- Chapter 1 - Cost Management StrategyDocument35 pagesChapter 1 - Cost Management StrategyHaniedar NadifaNo ratings yet

- BAIN BRIEF Strategic Planning That Produces Real StrategyDocument8 pagesBAIN BRIEF Strategic Planning That Produces Real StrategyHoanabc123No ratings yet

- 2175-Article Text-11123-1-10-20210626Document5 pages2175-Article Text-11123-1-10-20210626rajib royNo ratings yet

- Ratingless Performance Management: Innovative Change to Minimize Human Behavior RoadblocksFrom EverandRatingless Performance Management: Innovative Change to Minimize Human Behavior RoadblocksNo ratings yet

- Business Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldFrom EverandBusiness Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldNo ratings yet

- Balanced Scorecard for Performance MeasurementFrom EverandBalanced Scorecard for Performance MeasurementRating: 3 out of 5 stars3/5 (2)

- Coronavirus Cases, Confirmed and Suspected - WHO - March 4Document8 pagesCoronavirus Cases, Confirmed and Suspected - WHO - March 4CityNewsTorontoNo ratings yet

- Finanzas 1ra Edicion Zvi Bodie Robert C MertonDocument459 pagesFinanzas 1ra Edicion Zvi Bodie Robert C MertonFrank LopezNo ratings yet

- Transport Efficiency Successes FailuresDocument37 pagesTransport Efficiency Successes FailuresJesus Black MillmanNo ratings yet

- Wold Economic and Energy MetricsDocument58 pagesWold Economic and Energy MetricsJesus Black MillmanNo ratings yet

- Optimal Control Model of Technology Transition Donald A. HansonDocument24 pagesOptimal Control Model of Technology Transition Donald A. HansonJesus Black MillmanNo ratings yet

- Energy Vision 2013: Energy Transitions: Past and FutureDocument52 pagesEnergy Vision 2013: Energy Transitions: Past and FutureJesus Black MillmanNo ratings yet

- 0353-01 1978v1 EBk v5Document200 pages0353-01 1978v1 EBk v5Jesus Black MillmanNo ratings yet

- Debraj Cap1Document4 pagesDebraj Cap1Jesus Black MillmanNo ratings yet

- Turnabout AirportDocument100 pagesTurnabout AirportBogdan ProfirNo ratings yet

- Lawyer Disciplinary CaseDocument8 pagesLawyer Disciplinary CaseRose De JesusNo ratings yet

- Karnataka State Nursing Council: Nrts (Nurses Registration and Tracking SystemDocument6 pagesKarnataka State Nursing Council: Nrts (Nurses Registration and Tracking Systemhoqueanarul10hNo ratings yet

- Airline Operation - Alpha Hawks AirportDocument9 pagesAirline Operation - Alpha Hawks Airportrose ann liolioNo ratings yet

- Virgin Atlantic Strategic Management (The Branson Effect and Employee Positioning)Document23 pagesVirgin Atlantic Strategic Management (The Branson Effect and Employee Positioning)Enoch ObatundeNo ratings yet

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- Rhetorical AnalysisDocument4 pagesRhetorical Analysisapi-495296714No ratings yet

- Proforma Invoice5Document2 pagesProforma Invoice5Akansha ChauhanNo ratings yet

- Altar Server GuideDocument10 pagesAltar Server GuideRichard ArozaNo ratings yet

- Civil Air Patrol News - Mar 2007Document60 pagesCivil Air Patrol News - Mar 2007CAP History LibraryNo ratings yet

- Exercise of Caution: Read The Text To Answer Questions 3 and 4Document3 pagesExercise of Caution: Read The Text To Answer Questions 3 and 4Shantie Susan WijayaNo ratings yet

- Jffii - Google SearchDocument2 pagesJffii - Google SearchHAMMAD SHAHNo ratings yet

- Corporate Provisional Voter ListDocument28 pagesCorporate Provisional Voter ListtrueoflifeNo ratings yet

- English For Informatics EngineeringDocument32 pagesEnglish For Informatics EngineeringDiana Urian100% (1)

- HRM-4211 Chapter 4Document10 pagesHRM-4211 Chapter 4Saif HassanNo ratings yet

- Managing The Law The Legal Aspects of Doing Business 3rd Edition Mcinnes Test BankDocument19 pagesManaging The Law The Legal Aspects of Doing Business 3rd Edition Mcinnes Test Banksoutacheayen9ljj100% (22)

- MC71206A Practices of The Culture IndustryDocument24 pagesMC71206A Practices of The Culture IndustrykxNo ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- Pta Constitution and Bylaws FinalDocument14 pagesPta Constitution and Bylaws FinalRomnick Portillano100% (8)

- Cross Culture Management & Negotiation IBC201 Essay TestDocument2 pagesCross Culture Management & Negotiation IBC201 Essay TestVu Thi Thanh Tam (K16HL)No ratings yet

- Schedule of Rates for LGED ProjectsDocument858 pagesSchedule of Rates for LGED ProjectsRahul Sarker40% (5)

- Document 6Document32 pagesDocument 6Pw LectureNo ratings yet

- Nursing PhilosophyDocument3 pagesNursing Philosophyapi-509420416No ratings yet

- Role of Education in The Empowerment of Women in IndiaDocument5 pagesRole of Education in The Empowerment of Women in Indiasethulakshmi P RNo ratings yet

- Final Project Taxation Law IDocument28 pagesFinal Project Taxation Law IKhushil ShahNo ratings yet

- Stores & Purchase SopDocument130 pagesStores & Purchase SopRoshni Nathan100% (4)

- The Human Person As An Embodied SpiritDocument8 pagesThe Human Person As An Embodied SpiritDrew TamposNo ratings yet

- 1964 Letter From El-Hajj Malik El-ShabazzDocument2 pages1964 Letter From El-Hajj Malik El-Shabazzkyo_9No ratings yet

- Pakistan Money MarketDocument2 pagesPakistan Money MarketOvais AdenwallaNo ratings yet

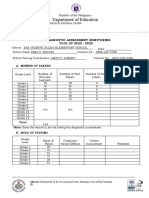

- Regional Diagnostic Assessment Report SY 2022-2023Document3 pagesRegional Diagnostic Assessment Report SY 2022-2023Dina BacaniNo ratings yet