Professional Documents

Culture Documents

Jan18 PDF

Uploaded by

omkassOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jan18 PDF

Uploaded by

omkassCopyright:

Available Formats

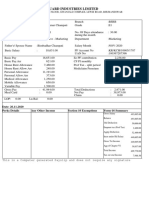

Infinx Services Pvt Ltd

Pay Slip for the month of January-2018

Employee Code : INFX01554 Payable Days : 30.00

Name : Mr. Amit Kasare LWP : 1.00

Department : Pre-Authorization Mahape Arrear Days : 0.00

Designation : Trainee Bank Ac No. : '309002560056 (RATNAKAR BANK LIMITED)

PAN : CATPK0572L PF No. : MH/42842/4388

Esi No. : 3413433433 UAN No. : 100931033955

Date Of Joining : 12 Sep 2016 Old Employee Id : N1045

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Consolidated Salary 9056.00 8764.00 0.00 8764.00 PF 1052.00

HRA 453.00 438.00 0.00 438.00 ESI 267.00

Education Allowance 200.00 194.00 0.00 194.00 PROF. TAX 200.00

Conveyance Allowance 1600.00 1548.00 0.00 1548.00

PLVP 2250.00 0.00 2250.00

Medical Reimbursement 1250.00 1210.00 0.00 1210.00

Special Allowance 2096.00 2028.00 0.00 2028.00

GROSS EARNINGS 14655.00 16432.00 0.00 16432.00 GROSS DEDUCTIONS 1519.00

Net Pay : 14,913.00

Net Pay in words : INR Fourteen Thousand Nine Hundred Thirteen Only

Income Tax Worksheet for the Period April 2017 - March 2018(Proposed Investments)

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation(NON-METRO)

Consolidated Salary 95363.00 0.00 95363.00 Investments u/s 80C Exempted Qualifying Rent Paid 0.00

HRA 7529.00 0.00 7529.00 PROVIDENT FUND 11445.44 150000.00 From 01/04/2017

Education Allowance 2312.00 0.00 2312.00 To 31/03/2018

Conveyance Allowance 18490.00 18489.00 1.00 1. Actual HRA 7529.00

Bonus 4888.00 0.00 4888.00 2. 40% or 50% of Basic 38145.00

PLVP 21000.00 0.00 21000.00 3. Rent - 10% Basic 0.00

Overtime 500.00 0.00 500.00 Least of above is exempt 0.00

Special Allowance 27124.00 0.00 27124.00 Taxable HRA 7529.00

Variable 2519.00 0.00 2519.00

Shift Allowance 4300.00 0.00 4300.00

Canteen Allowance 1703.00 0.00 1703.00 TDS Deducted Monthly

Month Amount

April-2017 0.00

May-2017 0.00

Gross 185728.00 18489.00 167239.00 Total of Investments u/s 80C 11445.44 150000.00 June-2017 0.00

Deductions 80D 0.00 50000.00 July-2017 0.00

Previous Employer Taxable Income 0.00 U/S 80C 11445.44 150000.00 August-2017 0.00

Professional Tax 2500.00 Total of Ded Under Chapter VI-A 11445.44 200000.00 September-2017 0.00

Under Chapter VI-A 11445.44 October-2017 0.00

Any Other Income 0.00 November-2017 0.00

Taxable Income 153290.00 December-2017 0.00

Total Tax 0.00 January-2018 0.00

Marginal Relief 0.00 Tax Deducted on Perq. 0.00

Tax Rebate 0.00 Total 0.00

Surcharge 0.00

Tax Due 0.00

Educational Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 0.00

Tax to be Deducted 0.00

Tax/Month 0.00 Total of Any Other Income 0.00

Tax on Non-Recurring Earnings 0.00

Tax Credit Amount (87A) 0.00

Tax Deduction for this month 0.00

..................................................... Cut Here .....................................................

Personal Note: This is a system generated payslip, does not require any signature.

You might also like

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Judge Kaplan's Ruling in Lehman Brothers LitigationDocument110 pagesJudge Kaplan's Ruling in Lehman Brothers LitigationDealBookNo ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Accounting Diversity PDFDocument13 pagesAccounting Diversity PDFNico AfrizelaNo ratings yet

- India Payslip January 2022Document1 pageIndia Payslip January 2022Mir KazimNo ratings yet

- Salary SlipDocument1 pageSalary SlipAnkit SinghNo ratings yet

- Unknown PDFDocument2 pagesUnknown PDFbijoytvknrNo ratings yet

- PayslipSalary Slips - 9-2020 PDFDocument1 pagePayslipSalary Slips - 9-2020 PDFSukant ChampatiNo ratings yet

- Mar18 PDFDocument1 pageMar18 PDFomkassNo ratings yet

- SRL Limited: Payslip For The Month of JANUARY 2019Document1 pageSRL Limited: Payslip For The Month of JANUARY 2019Giri PriyaNo ratings yet

- Payslip For BeginnerDocument1 pagePayslip For BeginnerKhan SahbNo ratings yet

- Salary Slip - February 2023 - Gurjeet Singh SainiDocument1 pageSalary Slip - February 2023 - Gurjeet Singh SainiGurjeet SainiNo ratings yet

- 187 Chetan Pramod Dagwar Salary 2020-04Document1 page187 Chetan Pramod Dagwar Salary 2020-04chetan pramod dagwarNo ratings yet

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocument1 page175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020No ratings yet

- Dec07 PDFDocument1 pageDec07 PDFomkassNo ratings yet

- Yogesh August PayslipDocument1 pageYogesh August Payslipशिवभक्त बाळासाहेब मोरेNo ratings yet

- Kirandeep September SalaryDocument1 pageKirandeep September Salaryprince.gill07No ratings yet

- Payslip March 2023Document1 pagePayslip March 2023kaushalNo ratings yet

- Payslip For MarchDocument1 pagePayslip For Marchomkass100% (1)

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Document1 pageEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerNo ratings yet

- Sandy Jan PayslipDocument1 pageSandy Jan PayslipJoginderNo ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Encyclopaedia Britannica vs. NLRCDocument1 pageEncyclopaedia Britannica vs. NLRCYsabel PadillaNo ratings yet

- PDF 472850270150723Document1 pagePDF 472850270150723Pijush SinhaNo ratings yet

- Pay Slip BSNLDocument1 pagePay Slip BSNLJohn FernendiceNo ratings yet

- Anuja Tejinkar3Document1 pageAnuja Tejinkar3javed9890No ratings yet

- April2018 PDFDocument1 pageApril2018 PDFomkassNo ratings yet

- Jan 2023 PDFDocument1 pageJan 2023 PDFSANJAY KUMARNo ratings yet

- Sarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageSarguja Rail Corridor Private Limited: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDeeptimayee SahooNo ratings yet

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- TarunDocument1 pageTarunUbed QureshiNo ratings yet

- Payslip For The Month of September-2021: Personal InformationDocument1 pagePayslip For The Month of September-2021: Personal InformationDeep KoleyNo ratings yet

- SalarySlipwithTaxDetails 2021 MayDocument1 pageSalarySlipwithTaxDetails 2021 MaySameer KulkarniNo ratings yet

- March Salary PDFDocument1 pageMarch Salary PDFomkassNo ratings yet

- PaysliP SaDocument1 pagePaysliP SagokulvaratharajanNo ratings yet

- MCQ On Marketing ManagementDocument39 pagesMCQ On Marketing ManagementtusharNo ratings yet

- May Salary PDFDocument1 pageMay Salary PDFomkassNo ratings yet

- Fe96beed 7a5b 4d7b A5cc C38eecd2b38dDocument1 pageFe96beed 7a5b 4d7b A5cc C38eecd2b38dChandan ShahNo ratings yet

- SalarySlip 5876095Document1 pageSalarySlip 5876095Larry WackoffNo ratings yet

- Feb-2023Document1 pageFeb-2023Rny buriaNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- PayslipDocument1 pagePayslipSk Samim AhamedNo ratings yet

- Servlet ControllerDocument1 pageServlet ControllerYashasvi GuptaNo ratings yet

- SalarySlipwithTaxDetails PDFDocument1 pageSalarySlipwithTaxDetails PDFRahul mishraNo ratings yet

- DDICGDIAP72DINOV22Document1 pageDDICGDIAP72DINOV22raghav bharadwajNo ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsN Quinton SinghNo ratings yet

- Centillion Networks PVT LTD: Pay Slip For The Month March 2019Document1 pageCentillion Networks PVT LTD: Pay Slip For The Month March 2019Pruthvi RajuNo ratings yet

- Vistaar Financial Services Private Limited: Payslip For The Month of February 2018Document1 pageVistaar Financial Services Private Limited: Payslip For The Month of February 2018AlleoungddghNo ratings yet

- Kelly PayslipDocument1 pageKelly PayslipadtyshkhrNo ratings yet

- Caltex Phils. Vs Palomar (18 SCRA 247)Document6 pagesCaltex Phils. Vs Palomar (18 SCRA 247)Doris Moriel Tampis100% (1)

- SRS Business Solutions (India) PVT - LTD: Attendance Details ValueDocument1 pageSRS Business Solutions (India) PVT - LTD: Attendance Details ValueraghavaNo ratings yet

- Allcloud Enterprise Solutions Private Limited: Payslip For The Month of June 2019Document1 pageAllcloud Enterprise Solutions Private Limited: Payslip For The Month of June 2019Shaik IrfanNo ratings yet

- Teleperformance Global Services Private Limited: Full and Final Settlement - December 2023Document3 pagesTeleperformance Global Services Private Limited: Full and Final Settlement - December 2023vishal.upadhyay9279No ratings yet

- PayslipSalary Slips - 11-2020-1 PDFDocument1 pagePayslipSalary Slips - 11-2020-1 PDFSukant ChampatiNo ratings yet

- Investment AppraisalDocument24 pagesInvestment AppraisalDeepankumar AthiyannanNo ratings yet

- Final Lego CaseDocument20 pagesFinal Lego CaseJoseOctavioGonzalez100% (1)

- Government of Tamil Nadu: D.M.High - SchoolDocument1 pageGovernment of Tamil Nadu: D.M.High - SchoolKAMAKOTINo ratings yet

- Payslip For The Month of January 2018: Earnings DeductionsDocument1 pagePayslip For The Month of January 2018: Earnings DeductionsDevmalya ChandaNo ratings yet

- Devops Case StudiesDocument46 pagesDevops Case StudiesAlok Shankar100% (1)

- Types of Risk of An EntrepreneurDocument15 pagesTypes of Risk of An Entrepreneurvinayhn0783% (24)

- Nov PayslipDocument1 pageNov Payslipsachikant swainNo ratings yet

- Manchala Sirisha PDFDocument1 pageManchala Sirisha PDFSirisha SiyatonNo ratings yet

- Payslip 5 2021Document1 pagePayslip 5 2021Mehraj PashaNo ratings yet

- May 2020 PDFDocument1 pageMay 2020 PDFshaklainNo ratings yet

- Zamil Information Technology Global Private Limited Pay Slip For The Month of SEP-2018Document1 pageZamil Information Technology Global Private Limited Pay Slip For The Month of SEP-2018vishalNo ratings yet

- PayslipDocument1 pagePayslipBalu PedapudiNo ratings yet

- Randstad India Private Limited: Payslip For The Month of January 2017Document1 pageRandstad India Private Limited: Payslip For The Month of January 2017fashion flowNo ratings yet

- January Salary SlipDocument1 pageJanuary Salary Slipapi-3846919100% (1)

- July 2017Document1 pageJuly 2017omkass100% (1)

- Nov 2017Document1 pageNov 2017omkassNo ratings yet

- Pay Slip For The Month of December-2017Document1 pagePay Slip For The Month of December-2017omkassNo ratings yet

- Pay Slip For The Month of October-2017Document1 pagePay Slip For The Month of October-2017omkassNo ratings yet

- July 2017Document1 pageJuly 2017omkass100% (1)

- Nov 2017Document1 pageNov 2017omkassNo ratings yet

- April 2017Document1 pageApril 2017omkassNo ratings yet

- Pay Slip For The Month of December-2017Document1 pagePay Slip For The Month of December-2017omkassNo ratings yet

- Management Concepts - The Four Functions of ManagementDocument13 pagesManagement Concepts - The Four Functions of ManagementsanketNo ratings yet

- Audit & Reporting ProvisionsDocument6 pagesAudit & Reporting Provisionsdmk.murthyNo ratings yet

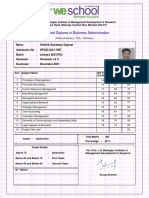

- Advanced Diploma in Business Administration: Hrithik Sandeep GajmalDocument1 pageAdvanced Diploma in Business Administration: Hrithik Sandeep GajmalNandanNo ratings yet

- Intramuros Adminstration - Exec Summary 06Document9 pagesIntramuros Adminstration - Exec Summary 06Anonymous p47liBNo ratings yet

- Case OverviewDocument9 pagesCase Overviewmayer_oferNo ratings yet

- Do CC CadburyDocument42 pagesDo CC CadburySaahil LedwaniNo ratings yet

- Lesson 5 - UNDERSTANDING BASIC ACCOUNTING PRINCIPLEDocument6 pagesLesson 5 - UNDERSTANDING BASIC ACCOUNTING PRINCIPLEMayeng MonayNo ratings yet

- Business Research MethodsDocument3 pagesBusiness Research MethodsSarthak GuptaNo ratings yet

- Case SummaryDocument3 pagesCase SummaryWilliam WeilieNo ratings yet

- Baker Commodities Agreement 2016 - 2019 PDFDocument27 pagesBaker Commodities Agreement 2016 - 2019 PDFUFCW770No ratings yet

- 2 AILS StudyDocument48 pages2 AILS StudyRashid Nisar DarogeNo ratings yet

- MphasisJD - T2 - 2020F PDFDocument1 pageMphasisJD - T2 - 2020F PDFDeepthi DeepuNo ratings yet

- National IP Policy Final 1EDocument11 pagesNational IP Policy Final 1EsandeepNo ratings yet

- Retail BankingDocument11 pagesRetail Banking8095844822No ratings yet

- HBO Jieliang Home PhoneDocument6 pagesHBO Jieliang Home PhoneAshish BhalotiaNo ratings yet

- Interesting Cases HbsDocument12 pagesInteresting Cases Hbshus2020No ratings yet

- T&D March 2011Document118 pagesT&D March 2011refherreraNo ratings yet

- Presented By:: Pranav V Shenoy Gairik Chatterjee Kripa Shankar JhaDocument20 pagesPresented By:: Pranav V Shenoy Gairik Chatterjee Kripa Shankar JhaPranav ShenoyNo ratings yet

- Oval Private Clients BrochureDocument4 pagesOval Private Clients Brochuremark_leyland1907No ratings yet

- Test Pattern Changed For Promotion To MMGS-II & IIIDocument3 pagesTest Pattern Changed For Promotion To MMGS-II & IIIsamuelkishNo ratings yet

- The Demand Curve Facing A Competitive Firm The ...Document3 pagesThe Demand Curve Facing A Competitive Firm The ...BLESSEDNo ratings yet