Professional Documents

Culture Documents

BDO Nomura Daily Report March 9 2018 PDF

Uploaded by

Jeremeil MencianoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BDO Nomura Daily Report March 9 2018 PDF

Uploaded by

Jeremeil MencianoCopyright:

Available Formats

March 9, 2018

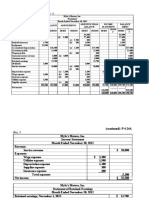

Market Summary Philippines Value Points % Change

The Philippine Stock Exchange index (PSEi) slipped back to negative territory on

Thursday, as investors absorbed data from the US Federal Reserve’s Beige Book.

USD/PHP 52.030 0.05 0.10

The main index went down 0.27% or 22.84 points to close at 8,381.85 today, PSEi 8,381.85 (22.84) (0.27)

March 8, failing to sustain gains seen in the previous session.The broader all-

shares index, meanwhile, rose 0.19% or 9.61 points to 5,065.48. All 5,065.48 9.61 0.19

Four sectors were down today, led by financials which dipped 0.89% or 19.84 Financials 2,186.40 (19.84) (0.90)

points to close at 2,186.40. Industrials followed with a decrease of 0.74% or 85.92 Holding Firms 8,394.30 (9.57) (0.11)

points to 11,442.52; property gave up 0.20% or 7.71 points to 3,747.23; while

holding firms lost 0.11% or 9.57 points to 8,394.30.Services on the other hand Industrial 11,442.52 (85.92) (0.75)

jumped by 1.03% or 18.08 points to 1,762.28, while mining and oil added 0.10% or

11.66 points to 11,538.19. Mining & Oil 11,538.19 11.66 0.10

(Business World) Property 3,747.23 (7.71) (0.21)

Company Brief Services 1,762.28 18.08 1.04

US

PLDT, Inc. (TEL) Last Price: 1,560

DJIA 24,895.21 93.85 0.38

PLDT, Inc. (TEL) expects a better year after earnings took a hit in 2017 from

accelerated depreciation costs, with the dominant telco mulling the sale of its stake S&P 500 2,738.97 12.17 0.45

in German start-up Rocket Internet AG to finance its record capital expenditure

(capex) program. NASDAQ 7,427.95 31.30 0.42

COMMODITIES

In a briefing in Makati City on Thursday, TEL Chairman Manuel V. Pangilinan said

recurring core income will grow to as much as P24 billion this year from the P22.3 Dubai Crude 60.66 (0.84) (1.37)

billion registered last year, slightly ahead of its P22-billion target for the entire

2017. Oil (WTI) 60.12 (1.03) (1.68)

Gold 1,321.97 (3.55) (0.27)

The profit guidance is supported by an anticipated 4% growth in service revenues

that will reverse the 3% drop seen in 2017, Mr. Pangilinan said, anchored on the Nickel 13,213.50 (320.50) (2.37)

double-digit expansion of the home and enterprise segments and the “flattish if not

Prices as of: March 8, 2018 Source: Bloomberg

slight improvement” in the wireless business.

Talking Points

Shares in TEL added P35 or 2.3% to end at P1,560 apiece on Thursday, bucking

the 0.27% slide in the Philippine Stock Exchange index. PLDT Chief Revenue The greenback and Treasuries rallied as traders awaited President

Officer Ernesto R. Alberto said the telco has arrested the decline in service Donald Trump’s tariff announcement Thursday. The Canadian

revenues through 2017, posting three quarters of modest sequential increases dollar and Mexican peso both posted late session rallies amid

starting in the second quarter. reports the nations will be indefinitely exempted from metals

duties. The dollar built on early gains spurred by the European

“Things are beginning to look up for the group. I am not saying we are completely Central Bank, which unexpectedly dropped its easing bias but

out of the woods, but we are getting there,” Mr. Pangilinan said. cautioned that its asset-purchasing program will continue until

(Business World) inflation is solidly on the path to the bank’s target. Treasuries

climbed across the curve, backed by heavy futures volume

World Highlights The dollar gained as much as 0.6%, rising against most of its G-10

peers. EUR/USD slumped 0.8%, while USD/JPY rose 0.2%.

US: The three major U.S. stock indexes closed higher on Thursday after President

USD/CAD and USD/MXN reversed gains after the tariff news

Donald Trump appeared to soften his stance on trade tariffs, easing trade war

fears that had had the market on edge for a week.

Treasuries rallied, with the belly leading gains. U.S. 10Y yield

narrowed 1.3 bps to 2.8699%

The Dow Jones Industrial Average rose 93.85 points, or 0.38%, to close at

24,895.21, the S&P 500 gained 12.17 points, or 0.45%, to 2,738.97 and the

Currency Outlook

Nasdaq Composite added 31.30 points, or 0.42%, to 7,427.95.

USD/PHP at 52.03 implies consolidation within 51.90/52.10 range

could persist. But a break the 51.70 levels is needed to support

COMMODITIES: Oil prices fell on Thursday, headed for a second straight weekly

further appreciation. Otherwise, risk of a move back to 52.25/52.50

drop on a stronger dollar, signs of an inventory build at the U.S. storage hub in

levels could arise.

Cushing, Oklahoma, surging U.S. crude production and investor jitters about a

potential trade war.

Expect currency to range with the 51.90/52.10 levels.

U.S. crude at 60.12. Gold is at 1,321.97.

(Reuters)

DISCLAIMER: This document is based on information obtained from sources believed to be reliable, but we do not make any representations as to its accuracy, completeness or correctness. Opinion

expressed are subject to change without prior notice. Any recommendation contained in this document does not have regard to specific investment objectives, financial situation and the particular needs of

any addressee. This document is for the information of the addressees only and is not to be taken on substitution for the exercise of judgment by the addressees. BDO Unibank. Inc. accepts no liability

whatsoever for and direct or consequential loss arising from any use of this publication. This document is not to be construed as an offer or solicitation of an offer to buy or sell securities. In the course of our

regular business, we may have a position in the securities mentioned and may make purchases and/or sales of them from time to time in the open market.

You might also like

- The First Orange-Nassau: BredaDocument2 pagesThe First Orange-Nassau: BredaJeremeil MencianoNo ratings yet

- Rembrandt's Social Network: 1 February - 19 May 2019Document1 pageRembrandt's Social Network: 1 February - 19 May 2019Jeremeil MencianoNo ratings yet

- Big Names in Art: Kasteel Het NijenhuisDocument1 pageBig Names in Art: Kasteel Het NijenhuisJeremeil MencianoNo ratings yet

- Entry No. Date Time Incident Events Disposition 2018-001 10-13-18 00200H Case Still GoingDocument1 pageEntry No. Date Time Incident Events Disposition 2018-001 10-13-18 00200H Case Still GoingJeremeil MencianoNo ratings yet

- Cases Digest 2Document8 pagesCases Digest 2Jeremeil MencianoNo ratings yet

- Republic of The Philippines Municipality of TagbilaranDocument1 pageRepublic of The Philippines Municipality of TagbilaranJeremeil MencianoNo ratings yet

- Riskcalculator 1Document1 pageRiskcalculator 1Jeremeil MencianoNo ratings yet

- Improvident PleaDocument2 pagesImprovident PleaJeremeil Menciano0% (1)

- Customary Law RulesDocument16 pagesCustomary Law RulesJeremeil MencianoNo ratings yet

- Pampanga Electric Coop Vs NLRC - Pag Allot Sa Lang Og 2 Pages Kay Wala Pa Ko Kasearch AniDocument3 pagesPampanga Electric Coop Vs NLRC - Pag Allot Sa Lang Og 2 Pages Kay Wala Pa Ko Kasearch AniJeremeil MencianoNo ratings yet

- Gold City Integrated Port Services, Inc. (Inport), Petitioner, vs. The Honorable National Labor Relations Commission (NLRC) and Jose L. BacalsoDocument10 pagesGold City Integrated Port Services, Inc. (Inport), Petitioner, vs. The Honorable National Labor Relations Commission (NLRC) and Jose L. BacalsoJeremeil MencianoNo ratings yet

- Cebu Philippines Festivals 2Document3 pagesCebu Philippines Festivals 2Jeremeil Menciano100% (1)

- Commercial Cooking: ExploratoryDocument1 pageCommercial Cooking: ExploratoryJeremeil MencianoNo ratings yet

- Philippine Association of Service Exporters Vs Drilon GR 81958 30 June 1988Document2 pagesPhilippine Association of Service Exporters Vs Drilon GR 81958 30 June 1988Jeremeil MencianoNo ratings yet

- Bohol FiestaDocument3 pagesBohol FiestaJeremeil MencianoNo ratings yet

- Cebu Philippines FestivalsDocument3 pagesCebu Philippines FestivalsJeremeil MencianoNo ratings yet

- For Town FiestaDocument2 pagesFor Town FiestaJeremeil Menciano100% (1)

- Traders' Takedown: Stories For The DayDocument7 pagesTraders' Takedown: Stories For The DayJeremeil MencianoNo ratings yet

- Philippine Geothermal, Inc. vs. Na Tional Labor Relations Commissi On and Edilberto M. Alvarez G.R. No. 106370, September 8, 1994Document3 pagesPhilippine Geothermal, Inc. vs. Na Tional Labor Relations Commissi On and Edilberto M. Alvarez G.R. No. 106370, September 8, 1994Jeremeil MencianoNo ratings yet

- HDMF Es09Document4 pagesHDMF Es09Jeremeil MencianoNo ratings yet

- AsivDocument15 pagesAsivJeremeil MencianoNo ratings yet

- Seismic Waves Are Waves of Energy That: Waves (For ''Primary'' Waves) Whereas The TransverseDocument4 pagesSeismic Waves Are Waves of Energy That: Waves (For ''Primary'' Waves) Whereas The TransverseJeremeil MencianoNo ratings yet

- Exam ASIVDocument1 pageExam ASIVJeremeil MencianoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PBC V Basic PolyprintersDocument4 pagesPBC V Basic PolyprintersArellano AureNo ratings yet

- Accounting Chapter 4 SolutionsDocument14 pagesAccounting Chapter 4 Solutionsali sherNo ratings yet

- Islamic Investment FundsDocument16 pagesIslamic Investment FundsFaisal khanNo ratings yet

- Balance Sheet ActivityDocument3 pagesBalance Sheet ActivityLai Kee KongNo ratings yet

- Maxis Market ShareDocument4 pagesMaxis Market Sharenur atiq0% (1)

- Volatility Index CBOE (VIX)Document19 pagesVolatility Index CBOE (VIX)AVNo ratings yet

- Financial Management - I (Practical Problems)Document9 pagesFinancial Management - I (Practical Problems)sameer_kini100% (1)

- Chapter 2 Basic Financial StatementsDocument34 pagesChapter 2 Basic Financial StatementsAddisalem Mesfin100% (6)

- Investment ProposalDocument10 pagesInvestment ProposalEJTY0% (1)

- Chicken Karahi Costing-IBFDocument14 pagesChicken Karahi Costing-IBFjaffar17No ratings yet

- Copies of Exercises Per TopicDocument10 pagesCopies of Exercises Per TopicRolan PalquiranNo ratings yet

- CTM 0310Document40 pagesCTM 0310ist0100% (1)

- The Healthcare Diagnostics Value GameDocument28 pagesThe Healthcare Diagnostics Value Gamekoolyogesh1No ratings yet

- What Is Property, Plant, and Equipment - PP&E?: EquityDocument2 pagesWhat Is Property, Plant, and Equipment - PP&E?: EquityDarlene SarcinoNo ratings yet

- Four P'sDocument2 pagesFour P'sankitagupNo ratings yet

- Model Questionnaire 14-03-T20 PDFDocument12 pagesModel Questionnaire 14-03-T20 PDFMADHAN KUMAR PARAMESWARANNo ratings yet

- Funds Flow StatementDocument101 pagesFunds Flow StatementSakhamuri Ram'sNo ratings yet

- FCP Business Plan Draft Dated April 16Document19 pagesFCP Business Plan Draft Dated April 16api-252010520No ratings yet

- A Study of Challenges Faced by Equity Investors Investing in Stock MarketDocument33 pagesA Study of Challenges Faced by Equity Investors Investing in Stock MarketPratikJain100% (1)

- Consolidated FS Subsequent To Date of AcquisitionDocument50 pagesConsolidated FS Subsequent To Date of AcquisitionJasmine Marie Ng Cheong60% (5)

- Insights Gree Shoots in Luxury and Office Properties PDFDocument299 pagesInsights Gree Shoots in Luxury and Office Properties PDFKurnia PrawestiNo ratings yet

- Baljekar SystemDocument38 pagesBaljekar SystemRahulNo ratings yet

- PAMI Asia Balanced Fund Product Primer v3 Intro TextDocument1 pagePAMI Asia Balanced Fund Product Primer v3 Intro Textgenie1970No ratings yet

- Chuck LeBeau - Trailing Stops - Chandelier StrategyDocument2 pagesChuck LeBeau - Trailing Stops - Chandelier Strategyasvc8536No ratings yet

- John J MurphyDocument4 pagesJohn J Murphyapi-383140450% (2)

- Chapter 11 - Sources of CapitalDocument21 pagesChapter 11 - Sources of CapitalArman100% (1)

- Financial ManagementDocument145 pagesFinancial Managementmanuj_uniyal89No ratings yet

- Candlestick PatternsDocument30 pagesCandlestick PatternsDavid100% (5)

- ACC04 - Quiz08 - Chap21-22 - BSA 3-1tDocument3 pagesACC04 - Quiz08 - Chap21-22 - BSA 3-1tMaketh.Man100% (1)

- Corporate Governance ComparisionDocument29 pagesCorporate Governance ComparisionShwetha SiddaramuNo ratings yet