Professional Documents

Culture Documents

Part Iii. Structured Learning Exercises: Job Costing Involves The Following

Uploaded by

Lenaryle Dela Cerna RamosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Part Iii. Structured Learning Exercises: Job Costing Involves The Following

Uploaded by

Lenaryle Dela Cerna RamosCopyright:

Available Formats

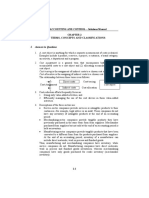

Part III.

STRUCTURED LEARNING

EXERCISES

Activity 1: This activity focuses on Type Job costing involves the following

of Costing System accounting activities: Materials. It

accumulates thecost of components and then

assigns these costs to a product or project

once the components are used. Labor.

Employees charge their time to specific jobs,

which are then assigned to the jobs based on

the labor cost of the employees. Give an oral

report of this exercise in the class.

Activity 2: This activity focuses on Controlling manufacturing overhead is

Factory Overhead Costing especially important for a small business.

Also known as indirect costs or factory

overhead, manufacturing overhead is

everything of a support nature that is needed

to help make the product. It is not the direct

materials and direct labor required to make

the actual product. Manufacturing is a highly

competitive industry, and uncontrolled

overhead expenses can eat away at profits

and increase costs. Small-business owners

can use cost accounting as a way of tracking

and reducing their manufacturing overhead

expenses. Explain the different costs under

Factory Overhead. Explain to your group

mates.

Activity 3: This activity focuses on Cost Assume that as an investor, you are

Volume Practice Analysis. planning to enter the construction industry as

a panel formwork supplier. The potential

number of forthcoming projects, you

forecasted that within two years, your fixed

cost for producing formworks is Rs. 300,000.

The variable unit cost for making one panel is

Rs. 15. The sale price for each panel will be

Rs. 25. If you charge Rs. 25 for each panel,

how many panels you need to sell in total, in

order to start making money?

You might also like

- Chapter 2 - Cost Concepts and Design EconomicsDocument21 pagesChapter 2 - Cost Concepts and Design EconomicsChristine ParkNo ratings yet

- Activity Based CostingDocument30 pagesActivity Based Costinghardik1302No ratings yet

- Lecture 6 - Money in The Organization Part 2Document24 pagesLecture 6 - Money in The Organization Part 2Nihal JannounNo ratings yet

- Pma1113 Chapter 3Document19 pagesPma1113 Chapter 3MOHAMAD SYAHIDAN JAMALUDDIN (IPH)No ratings yet

- Caie Igcse Business Studies 0450 Theory v1Document47 pagesCaie Igcse Business Studies 0450 Theory v1smNo ratings yet

- Cost Terms, Concepts, and Classifications: Solutions To QuestionsDocument14 pagesCost Terms, Concepts, and Classifications: Solutions To QuestionsTrishia OliverosNo ratings yet

- Cost Reduction in A Manufacturing Business - BEDocument3 pagesCost Reduction in A Manufacturing Business - BEsonali sonalNo ratings yet

- Business Studies Production Year 11Document35 pagesBusiness Studies Production Year 11Juliser DublasNo ratings yet

- Managerial Accounting Creating Value in A Dynamic Business Environment 10th Edition Hilton Solutions ManualDocument13 pagesManagerial Accounting Creating Value in A Dynamic Business Environment 10th Edition Hilton Solutions ManualKennethSparkskqgmr100% (14)

- Product and Service CostingDocument25 pagesProduct and Service Costingnshamsundar7929No ratings yet

- 25885110Document21 pages25885110Llyana paula SuyuNo ratings yet

- Introduction To Cost AccountingDocument3 pagesIntroduction To Cost Accountingwalshes walshNo ratings yet

- I. Answers To Questions: Cost Accounting and Control - Solutions Manual Cost Terms, Concepts and ClassificationsDocument18 pagesI. Answers To Questions: Cost Accounting and Control - Solutions Manual Cost Terms, Concepts and ClassificationsYannah HidalgoNo ratings yet

- Chapter 2Document48 pagesChapter 2Shruthi ShettyNo ratings yet

- Chap 002Document47 pagesChap 002Sheennah Lee LimNo ratings yet

- Garrison Lecture Chapter 2Document61 pagesGarrison Lecture Chapter 2Ahmad Tawfiq Darabseh100% (2)

- Cost Sheet 2Document13 pagesCost Sheet 2Nandan Kumar JenaNo ratings yet

- Cost Accounting Reviewer Chapter 1-4Document10 pagesCost Accounting Reviewer Chapter 1-4hanaNo ratings yet

- Managerial Accounting and Cost Concepts: Solutions To QuestionsDocument13 pagesManagerial Accounting and Cost Concepts: Solutions To QuestionsGera MatsNo ratings yet

- Accounting For Decision Making Week 3 Lecture (Seminar 4 - The Nature of Costs)Document51 pagesAccounting For Decision Making Week 3 Lecture (Seminar 4 - The Nature of Costs)nwcbenny337No ratings yet

- Chapter-2-Answer Cost AccountingDocument18 pagesChapter-2-Answer Cost AccountingJuline Ashley A Carballo100% (1)

- Manufacturing Operations Costs and Inventory AccountsDocument7 pagesManufacturing Operations Costs and Inventory AccountsJoy RadaNo ratings yet

- Product Cost Flows and Business OrganizationsDocument48 pagesProduct Cost Flows and Business OrganizationsGaluh Boga KuswaraNo ratings yet

- Introduction To Managerial Accounting Canadian 5th Edition Brewer Solutions ManualDocument25 pagesIntroduction To Managerial Accounting Canadian 5th Edition Brewer Solutions ManualMaryJohnsonsmni100% (57)

- Chapter 2 Hilton 10th Instructor NotesDocument10 pagesChapter 2 Hilton 10th Instructor NotesKD MV100% (1)

- Cost Concepts HandoutsDocument13 pagesCost Concepts HandoutsTushar DuaNo ratings yet

- Cost Accounting Solutions Chapter 2Document19 pagesCost Accounting Solutions Chapter 2Cris VillarNo ratings yet

- CH-4 Chapter ManufDocument14 pagesCH-4 Chapter Manufጌታ እኮ ነውNo ratings yet

- Microeconomics Definitions 1Document1 pageMicroeconomics Definitions 1070_tomNo ratings yet

- Fima PrelimDocument9 pagesFima PrelimCharles IldefonsoNo ratings yet

- NotesDocument155 pagesNotesZainab Syeda100% (1)

- Chapter 02 - Cost Term and Concepts FinalDocument60 pagesChapter 02 - Cost Term and Concepts FinalAminaMatinNo ratings yet

- Lecture 1Document7 pagesLecture 1HarusiNo ratings yet

- Cost Reduction Study at Ultra Tech CementsDocument76 pagesCost Reduction Study at Ultra Tech CementsChethan.sNo ratings yet

- Chapter#1: Introduction To Cost AccountingDocument1 pageChapter#1: Introduction To Cost AccountingSoria Sophia AnnNo ratings yet

- Chapter-2 Answer KeyDocument18 pagesChapter-2 Answer KeyKylie sheena MendezNo ratings yet

- Part III-Managerial AccountingDocument91 pagesPart III-Managerial AccountingGebreNo ratings yet

- Costing NotesDocument48 pagesCosting NotesOckouri BarnesNo ratings yet

- Chapter 3 Cost IDocument64 pagesChapter 3 Cost IBikila MalasaNo ratings yet

- Management Accounting, 4th Edition (PG 225 253)Document29 pagesManagement Accounting, 4th Edition (PG 225 253)Uncle MattNo ratings yet

- Log-In Group 1: Understanding CostsDocument20 pagesLog-In Group 1: Understanding Costschristina may bautistaNo ratings yet

- Managerial Accounting Discussion Set 1Document17 pagesManagerial Accounting Discussion Set 1julsmlarkNo ratings yet

- MODULE 1 ACCT W AnswersDocument14 pagesMODULE 1 ACCT W AnswersLIANNE GEMIMA GIPANo ratings yet

- Session 9 Introduction To Management AccountingDocument52 pagesSession 9 Introduction To Management Accounting靳雪娇No ratings yet

- Cost AccountingDocument11 pagesCost AccountingWilbert Cunanan CapatiNo ratings yet

- c1 - Introduction To Cost AccountingDocument2 pagesc1 - Introduction To Cost AccountingAndrea Camille AquinoNo ratings yet

- 10632m Lecture 6 - Full Costing i [Full Version]Document53 pages10632m Lecture 6 - Full Costing i [Full Version]kammiefan215No ratings yet

- Full Download Managerial Accounting For Managers 2nd Edition Noreen Solutions ManualDocument35 pagesFull Download Managerial Accounting For Managers 2nd Edition Noreen Solutions Manuallinderleafeulah100% (33)

- COST Accounting AND EstimationDocument38 pagesCOST Accounting AND EstimationMollaNo ratings yet

- Cost Terms, Concepts, and ClassificationsDocument45 pagesCost Terms, Concepts, and ClassificationsMountaha0% (1)

- 1 Abulencia Asuncion Dulang Lapiz MocaDocument45 pages1 Abulencia Asuncion Dulang Lapiz MocaMariael PinasoNo ratings yet

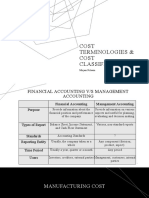

- Cost Terminologies & Cost Classification: Mirjam NilssonDocument13 pagesCost Terminologies & Cost Classification: Mirjam NilssonHitesh JainNo ratings yet

- 6un44rh0q - Cost Accounting and ControlDocument75 pages6un44rh0q - Cost Accounting and ControlJustine Marie BalderasNo ratings yet

- Cost Terms, Concepts, and Classifications: Solution To Discussion CaseDocument48 pagesCost Terms, Concepts, and Classifications: Solution To Discussion Casekasad jdnfrnasNo ratings yet

- Accounting 2Document5 pagesAccounting 2jessicaong2403No ratings yet

- Chapter 1 IntroductionDocument46 pagesChapter 1 IntroductionIrzam ZairyNo ratings yet

- AS Business Unit 4 Production HandoutDocument19 pagesAS Business Unit 4 Production HandoutUrafa NoamanNo ratings yet

- Unit Ii: Basic Cost Management Concepts: Learning ObjectivesDocument25 pagesUnit Ii: Basic Cost Management Concepts: Learning ObjectivesCajalne Carlo C.No ratings yet

- Cost Accounting Concepts ExplainedDocument6 pagesCost Accounting Concepts ExplainedLIGAWAD, MELODY P.No ratings yet

- 06 GapDocument12 pages06 GapLenaryle Dela Cerna RamosNo ratings yet

- 4.-Bir Train Tot Briefing VatDocument32 pages4.-Bir Train Tot Briefing VatLenaryle Dela Cerna RamosNo ratings yet

- MC QuizDocument3 pagesMC QuizLenaryle Dela Cerna RamosNo ratings yet

- Briefing On RA 10963: Tax Reform For Acceleration and Inclusion (TRAIN)Document14 pagesBriefing On RA 10963: Tax Reform For Acceleration and Inclusion (TRAIN)Lenaryle Dela Cerna RamosNo ratings yet

- Causes and Effects of PovertyDocument5 pagesCauses and Effects of PovertyLenaryle Dela Cerna RamosNo ratings yet

- Accountancy Departmen12452Document1 pageAccountancy Departmen12452Lenaryle Dela Cerna RamosNo ratings yet

- Accountancy DepartmentDocument1 pageAccountancy DepartmentLenaryle Dela Cerna RamosNo ratings yet

- The Following Senators Are Elected On May 2013 and Will Serve Until June 30Document4 pagesThe Following Senators Are Elected On May 2013 and Will Serve Until June 30Lenaryle Dela Cerna RamosNo ratings yet

- Mandarin Report!Document12 pagesMandarin Report!Lenaryle Dela Cerna RamosNo ratings yet

- Panama Papers Expose Offshore SecretsDocument6 pagesPanama Papers Expose Offshore SecretsLenaryle Dela Cerna RamosNo ratings yet

- DTRwith ACTDocument2 pagesDTRwith ACTLenaryle Dela Cerna RamosNo ratings yet

- AuditDocument3 pagesAuditLenaryle Dela Cerna RamosNo ratings yet

- Resource, Project, Risk, and Change Management: Describe Your Abilities atDocument4 pagesResource, Project, Risk, and Change Management: Describe Your Abilities atLenaryle Dela Cerna RamosNo ratings yet

- DerivativesDocument48 pagesDerivativesJayant JoshiNo ratings yet

- Technology AnnualDocument84 pagesTechnology AnnualSecurities Lending TimesNo ratings yet

- PSE Rule - Additional Listing of SecuritiesDocument24 pagesPSE Rule - Additional Listing of SecuritiesArcie SercadoNo ratings yet

- Overview of Digital MarketingDocument4 pagesOverview of Digital MarketingSUJIT SONAWANENo ratings yet

- Gmail - Exciting Roles Available at One Finserv Careers!Document8 pagesGmail - Exciting Roles Available at One Finserv Careers!Arif KhanNo ratings yet

- MOB Unit-3Document32 pagesMOB Unit-3Balijepalli Srinivasa RavichandraNo ratings yet

- EPS Practice ProblemsDocument8 pagesEPS Practice ProblemsmikeNo ratings yet

- Jewelry Business Plan ToolkitDocument19 pagesJewelry Business Plan ToolkitPilar AndreoNo ratings yet

- Research Report Sample Format EditedDocument13 pagesResearch Report Sample Format EditedRajveer KumarNo ratings yet

- Adani's Holistic Approach for India's FutureDocument26 pagesAdani's Holistic Approach for India's FutureRow Arya'nNo ratings yet

- Observation Commercial Banks PDFDocument52 pagesObservation Commercial Banks PDFyash_dalal123No ratings yet

- Sustaining Competitive AdvantageDocument4 pagesSustaining Competitive AdvantagensucopyNo ratings yet

- IA3 Statement of Financial PositionDocument36 pagesIA3 Statement of Financial PositionHello HiNo ratings yet

- Vocabulary Words in Araling Panlipunan Grade 7Document3 pagesVocabulary Words in Araling Panlipunan Grade 7Sonia50% (2)

- 5 Principles of Event PlanningDocument2 pages5 Principles of Event PlanningJe ĻenaNo ratings yet

- 9708 w14 Ms 21 PDFDocument7 pages9708 w14 Ms 21 PDFTan Chen Wui0% (1)

- AUD QuizesDocument9 pagesAUD QuizesDanielNo ratings yet

- Pricing and Output Decisions: Monopolistic Competition and OligopolyDocument25 pagesPricing and Output Decisions: Monopolistic Competition and OligopolyKiran MishraNo ratings yet

- Event Guide: CGT Asset Disposal and Other EventsDocument8 pagesEvent Guide: CGT Asset Disposal and Other EventsVMRONo ratings yet

- Chapter 1 ReviewerDocument7 pagesChapter 1 ReviewerClariña VirataNo ratings yet

- ALL Quiz Ia 3Document29 pagesALL Quiz Ia 3julia4razoNo ratings yet

- Copyright Acknowledgement Booklet January 2012 PDFDocument87 pagesCopyright Acknowledgement Booklet January 2012 PDFShajahan AliNo ratings yet

- 18MEC207T - Unit 5 - Rev - W13Document52 pages18MEC207T - Unit 5 - Rev - W13Asvath GuruNo ratings yet

- CAPE Management of Business 2008 U2 P2Document4 pagesCAPE Management of Business 2008 U2 P2Sherlock LangevineNo ratings yet

- Introduction To Strategic IntelligenceDocument10 pagesIntroduction To Strategic IntelligenceJorge Humberto Fernandes100% (6)

- Iso 14001Document8 pagesIso 14001jacobpm2010No ratings yet

- Mcgraw-Hill/Irwin: Levy/Weitz: Retailing Management, 4/EDocument19 pagesMcgraw-Hill/Irwin: Levy/Weitz: Retailing Management, 4/ESatprit HanspalNo ratings yet

- Surendra Trading Company: Buyer NameDocument1 pageSurendra Trading Company: Buyer Nameashish.asati1No ratings yet

- UGRDDocument9 pagesUGRDscattyNo ratings yet

- Evaly PR Plan by PDFDocument20 pagesEvaly PR Plan by PDFAl-Rafi Ahmed100% (1)

- Sports TourismDocument14 pagesSports TourismJaipurnetNo ratings yet

![10632m Lecture 6 - Full Costing i [Full Version]](https://imgv2-1-f.scribdassets.com/img/document/725199452/149x198/3aa5a38357/1713709431?v=1)