Professional Documents

Culture Documents

Gsis V Ca

Uploaded by

jolly verbatim0 ratings0% found this document useful (0 votes)

15 views2 pagesgsis

Original Title

2. gsis v ca

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentgsis

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views2 pagesGsis V Ca

Uploaded by

jolly verbatimgsis

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

G.R. No.

L-40824 February 23, 1989 sufficient notice to them as required either as to

their delinquency in the payment of amortization or

as to the subsequent foreclosure of the mortgage

GOVERNMENT SERVICE INSURANCE SYSTEM, petitioner,

by reason of any default in such payment. The

vs.

notice published in the newspaper, 'Daily Record

COURT OF APPEALS and MR. & MRS. ISABELO R.

(Exh. 12) and posted pursuant to Sec 3 of Act

RACHO, respondents.

3135 is not the notice to which the mortgagor is

entitled upon the application being made for an

The Government Corporate Counsel for petitioner. extrajudicial foreclosure. ... 10

Lorenzo A. Sales for private respondents. On the foregoing findings, the respondent court consequently decreed

that-

In view of all the foregoing, the judgment appealed

from is hereby reversed, and another one entered

REGALADO , J.:

(1) declaring the foreclosure of the mortgage void

insofar as it affects the share of the appellants; (2)

Private respondents, Mr. and Mrs. Isabelo R. Racho, together with the directing the GSIS to reconvey to appellants their

spouses Mr. and Mrs Flaviano Lagasca, executed a deed of mortgage, share of the mortgaged property, or the value

dated November 13, 1957, in favor of petitioner Government Service thereof if already sold to third party, in the sum of

Insurance System (hereinafter referred to as GSIS) and subsequently, P 35,000.00, and (3) ordering the appellees

another deed of mortgage, dated April 14, 1958, in connection with two Flaviano Lagasca and Esther Lagasca to pay the

loans granted by the latter in the sums of P 11,500.00 and P 3,000.00, appellants the sum of P 10,00.00 as moral

respectively. 1 A parcel of land covered by Transfer Certificate of Title damages, P 5,000.00 as attorney's fees, and

No. 38989 of the Register of Deed of Quezon City, co-owned by said costs. 11

mortgagor spouses, was given as security under the aforesaid two

deeds. 2 They also executed a 'promissory note" which states in part: The case is now before us in this petition for review.

... for value received, we the undersigned ...

In submitting their case to this Court, both parties relied on the

JOINTLY, SEVERALLY and SOLIDARILY, provisions of Section 29 of Act No. 2031, otherwise known as the

promise to pay the GOVERNMENT SERVICE Negotiable Instruments Law, which provide that an accommodation

INSURANCE SYSTEM the sum of . . . (P party is one who has signed an instrument as maker, drawer, acceptor

11,500.00) Philippine Currency, with interest at the of indorser without receiving value therefor, but is held liable on the

rate of six (6%) per centum compounded monthly instrument to a holder for value although the latter knew him to be only

payable in . . . (120)equal monthly installments of . an accommodation party.

. . (P 127.65) each. 3

This approach of both parties appears to be misdirected and their

On July 11, 1961, the Lagasca spouses executed an instrument reliance misplaced. The promissory note hereinbefore quoted, as well

denominated "Assumption of Mortgage" under which they obligated as the mortgage deeds subject of this case, are clearly not negotiable

themselves to assume the aforesaid obligation to the GSIS and to

instruments. These documents do not comply with the fourth requisite

secure the release of the mortgage covering that portion of the land to be considered as such under Section 1 of Act No. 2031 because

belonging to herein private respondents and which was mortgaged to they are neither payable to order nor to bearer. The note is payable to

the GSIS. 4 This undertaking was not fulfilled. 5

a specified party, the GSIS. Absent the aforesaid requisite, the

provisions of Act No. 2031 would not apply; governance shall be

Upon failure of the mortgagors to comply with the conditions of the afforded, instead, by the provisions of the Civil Code and special laws

mortgage, particularly the payment of the amortizations due, GSIS on mortgages.

extrajudicially foreclosed the mortgage and caused the mortgaged

property to be sold at public auction on December 3, 1962. 6 As earlier indicated, the factual findings of respondent court are that

private respondents signed the documents "only to give their consent

More than two years thereafter, or on August 23, 1965, herein private to the mortgage as required by GSIS", with the latter having full

respondents filed a complaint against the petitioner and the Lagasca knowledge that the loans secured thereby were solely for the benefit of

spouses in the former Court of the Lagasca spouses. 12 This appears to be duly supported by

sufficient evidence on record. Indeed, it would be unusual for the GSIS

to arrange for and deduct the monthly amortizations on the loans from

First Instance of Quezon City, 7 praying that the extrajudicial the salary as an army officer of Flaviano Lagasca without likewise

foreclosure "made on, their property and all other documents executed affecting deductions from the salary of Isabelo Racho who was also an

in relation thereto in favor of the Government Service Insurance army sergeant. Then there is also the undisputed fact, as already

System" be declared null and void. It was further prayed that they be stated, that the Lagasca spouses executed a so-called "Assumption of

allowed to recover said property, and/or the GSIS be ordered to pay Mortgage" promising to exclude private respondents and their share of

them the value thereof, and/or they be allowed to repurchase the land. the mortgaged property from liability to the mortgagee. There is no

Additionally, they asked for actual and moral damages and attorney's intimation that the former executed such instrument for a

fees. consideration, thus confirming that they did so pursuant to their original

agreement.

In their aforesaid complaint, private respondents alleged that they

signed the mortgage contracts not as sureties or guarantors for the The parol evidence rule 13 cannot be used by petitioner as a shield in

Lagasca spouses but they merely gave their common property to the this case for it is clear that there was no objection in the court below

said co-owners who were solely benefited by the loans from the GSIS. regarding the admissibility of the testimony and documents that were

presented to prove that the private respondents signed the mortgage

The trial court rendered judgment on February 25, 1968 dismissing the papers just to accommodate their co-owners, the Lagasca spouses.

complaint for failure to establish a cause of action. 8 Besides, the introduction of such evidence falls under the exception to

said rule, there being allegations in the complaint of private

respondents in the court below regarding the failure of the mortgage

Said decision was reversed by the respondent Court of contracts to express the true agreement of the parties. 14

Appeals 9 which held that:

However, contrary to the holding of the respondent court, it cannot be

... although formally they are co-mortgagors, they said that private respondents are without liability under the aforesaid

are so only for accomodation (sic) in that the GSIS mortgage contracts. The factual context of this case is precisely what

required their consent to the mortgage of the is contemplated in the last paragraph of Article 2085 of the Civil Code

entire parcel of land which was covered with only to the effect that third persons who are not parties to the principal

one certificate of title, with full knowledge that the obligation may secure the latter by pledging or mortgaging their own

loans secured thereby were solely for the benefit property

of the appellant (sic) spouses who alone applied

for the loan.

So long as valid consent was given, the fact that the loans were solely

for the benefit of the Lagasca spouses would not invalidate the

xxxx mortgage with respect to private respondents' share in the property. In

consenting thereto, even assuming that private respondents may not

'It is, therefore, clear that as against the GSIS, be assuming personal liability for the debt, their share in the property

appellants have a valid cause for having shall nevertheless secure and respond for the performance of the

foreclosed the mortgage without having given principal obligation. The parties to the mortgage could not have

intended that the same would apply only to the aliquot portion of the

Lagasca spouses in the property, otherwise the consent of the private

respondents would not have been required.

The supposed requirement of prior demand on the private respondents

would not be in point here since the mortgage contracts created

obligations with specific terms for the compliance thereof. The facts

further show that the private respondents expressly bound themselves

as solidary debtors in the promissory note hereinbefore quoted.

Coming now to the extrajudicial foreclosure effected by GSIS, We

cannot agree with the ruling of respondent court that lack of notice to

the private respondents of the extrajudicial foreclosure sale impairs the

validity thereof. In Bonnevie, et al. vs. Court of appeals, et al., 15 the

Court ruled that Act No. 3135, as amended, does not require personal

notice on the mortgagor, quoting the requirement on notice in such

cases as follows:

Section 3. Notice shall be given by posting notices

of sale for not less than twenty days in at least

three public places of the municipality where the

property is situated, and if such property is worth

more than four hundred pesos, such notice shall

also be published once a week for at least three

consecutive weeks in a newspaper of general

circulation in the municipality or city.

There is no showing that the foregoing requirement on notice was not

complied with in the foreclosure sale complained of .

The respondent court, therefore, erred in annulling the mortgage

insofar as it affected the share of private respondents or in directing

reconveyance of their property or the payment of the value thereof

Indubitably, whether or not private respondents herein benefited from

the loan, the mortgage and the extrajudicial foreclosure proceedings

were valid.

WHEREFORE, judgment is hereby rendered REVERSING the

decision of the respondent Court of Appeals and REINSTATING the

decision of the court a quo in Civil Case No. Q-9418 thereof.

SO ORDERED.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 4th MAILING - Validation Letter - SampleDocument6 pages4th MAILING - Validation Letter - SampleJeromeKmt100% (20)

- Doctrines of Cases in Securities Regulation CodeDocument1 pageDoctrines of Cases in Securities Regulation Codejolly verbatimNo ratings yet

- Dead Man Walking Worksheet PDFDocument5 pagesDead Man Walking Worksheet PDFCarola BergaminiNo ratings yet

- Anatolia Cultural FoundationDocument110 pagesAnatolia Cultural FoundationStewart Bell100% (3)

- No ConciliationDocument1 pageNo Conciliationjolly verbatimNo ratings yet

- Khan V SimbilloDocument2 pagesKhan V SimbilloSusan KadilNo ratings yet

- Thru Mail RequirementsDocument3 pagesThru Mail Requirementsjolly verbatimNo ratings yet

- Crisostomo vs. SEC (1989)Document11 pagesCrisostomo vs. SEC (1989)JM SisonNo ratings yet

- Director V BayotDocument1 pageDirector V Bayotjolly verbatimNo ratings yet

- PENALTIES OwnDocument2 pagesPENALTIES Ownjolly verbatimNo ratings yet

- People of The Philippines, Plaintiff-Appellee, vs. Farhad Hatani y AbolhassanDocument7 pagesPeople of The Philippines, Plaintiff-Appellee, vs. Farhad Hatani y AbolhassanJumen Gamaru TamayoNo ratings yet

- No ConciliationDocument1 pageNo Conciliationjolly verbatimNo ratings yet

- McGuire Vs Province of Samar, GR L-8155, Oct. 23, 1956 CaseDocument2 pagesMcGuire Vs Province of Samar, GR L-8155, Oct. 23, 1956 Casejolly verbatimNo ratings yet

- Salas Vs CADocument4 pagesSalas Vs CAjolly verbatimNo ratings yet

- Negotiable Instruments Case Digest: Bataan Cigar V. CA (1994) Full Case ResearchDocument4 pagesNegotiable Instruments Case Digest: Bataan Cigar V. CA (1994) Full Case Researchjolly verbatimNo ratings yet

- McGuire Vs Province of Samar, GR L-8155, Oct. 23, 1956 Full CaseDocument2 pagesMcGuire Vs Province of Samar, GR L-8155, Oct. 23, 1956 Full Casejolly verbatimNo ratings yet

- Wong vs. Court of Appeals (GR 117857, 2 February 2001) The Full Case ResearchDocument6 pagesWong vs. Court of Appeals (GR 117857, 2 February 2001) The Full Case Researchjolly verbatimNo ratings yet

- Grounds For ObjectionDocument3 pagesGrounds For Objectionjolly verbatimNo ratings yet

- 1.metropolitan Bank & Trust Company vs. TondaDocument4 pages1.metropolitan Bank & Trust Company vs. Tondajolly verbatimNo ratings yet

- BANCO DE ORO V EquitableDocument6 pagesBANCO DE ORO V Equitablejolly verbatimNo ratings yet

- People of The Philippines Plaintiff-Appellee Vs Rolando Araneta y Abella Botong and Marilou Santos y Tantay Malou Accused-AppeellantsDocument12 pagesPeople of The Philippines Plaintiff-Appellee Vs Rolando Araneta y Abella Botong and Marilou Santos y Tantay Malou Accused-AppeellantsEdenFielNo ratings yet

- G.R. No. 178876 June 27, 2008Document10 pagesG.R. No. 178876 June 27, 2008jolly verbatimNo ratings yet

- G.R. No. 191064 October 20, 2010Document5 pagesG.R. No. 191064 October 20, 2010jolly verbatimNo ratings yet

- Today Is Friday, February 17, 2017: Supreme CourtDocument6 pagesToday Is Friday, February 17, 2017: Supreme Courtjolly verbatimNo ratings yet

- 1Document3 pages1jolly verbatimNo ratings yet

- Lee vs. Court of AppealsDocument6 pagesLee vs. Court of Appealsjolly verbatimNo ratings yet

- Colinares vs. Court of AppealsDocument8 pagesColinares vs. Court of Appealsjolly verbatimNo ratings yet

- PenaltyDocument1 pagePenaltyjolly verbatimNo ratings yet

- This Is For The Isl FilDocument1 pageThis Is For The Isl Filjolly verbatimNo ratings yet

- Negative ListDocument3 pagesNegative Listjolly verbatimNo ratings yet

- Catindig NotesDocument196 pagesCatindig Notesjolly verbatimNo ratings yet

- Get Unlimied Downloads Thhis Is For The BondDocument1 pageGet Unlimied Downloads Thhis Is For The Bondjolly verbatimNo ratings yet

- COM670 Chapter 5Document19 pagesCOM670 Chapter 5aakapsNo ratings yet

- Association of Mutual Funds in India: Application Form For Renewal of Arn/ EuinDocument5 pagesAssociation of Mutual Funds in India: Application Form For Renewal of Arn/ EuinPiyushJainNo ratings yet

- In This Chapter : Me, ShankarDocument20 pagesIn This Chapter : Me, ShankarPied AvocetNo ratings yet

- Install HelpDocument318 pagesInstall HelpHenry Daniel VerdugoNo ratings yet

- Delo Protecion CATERPILLARDocument1 pageDelo Protecion CATERPILLARjohnNo ratings yet

- Corod DWR Regular Strength 29feb12Document3 pagesCorod DWR Regular Strength 29feb12Ronald LlerenaNo ratings yet

- IEEE Guide For Power System Protection TestingDocument124 pagesIEEE Guide For Power System Protection TestingStedroy Roache100% (15)

- 2023 Peruvian Citrus Operations ManualDocument30 pages2023 Peruvian Citrus Operations ManualDamarys Leyva SalinasNo ratings yet

- MSDS - Dispersant SP-27001 - 20200224Document4 pagesMSDS - Dispersant SP-27001 - 20200224pratikbuttepatil52No ratings yet

- Approach To Hackiing in Cameroon:Overview and Mitigation TechniquesDocument14 pagesApproach To Hackiing in Cameroon:Overview and Mitigation TechniquesWilly NibaNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument4 pagesMobile Services: Your Account Summary This Month'S Chargeskumar JNo ratings yet

- PEER PRESSURE - The Other "Made" Do ItDocument2 pagesPEER PRESSURE - The Other "Made" Do ItMyrrh PasquinNo ratings yet

- Original PDF Accounting For Corporate Combinations and Associations 8th PDFDocument42 pagesOriginal PDF Accounting For Corporate Combinations and Associations 8th PDFmarth.fuller529100% (41)

- WWRPL Oct-19Document12 pagesWWRPL Oct-19Sanjay KumarNo ratings yet

- Judaism: Pre-Test Directions: Fill in The Blank With The Correct AnswerDocument9 pagesJudaism: Pre-Test Directions: Fill in The Blank With The Correct AnswerShineeljay TumipadNo ratings yet

- Cases CrimproDocument139 pagesCases CrimproApril GonzagaNo ratings yet

- Aff of Admission of Paternity GalacioDocument1 pageAff of Admission of Paternity GalacioAlfie OmegaNo ratings yet

- Imm5786 2-V1V20ZRDocument1 pageImm5786 2-V1V20ZRmichel fogueNo ratings yet

- Business Ethics Session 5Document9 pagesBusiness Ethics Session 5EliaQazilbashNo ratings yet

- Prom 2015: The Great GatsbyDocument14 pagesProm 2015: The Great GatsbyMaple Lake MessengerNo ratings yet

- Read The Five Text Items 1 - 5. Then Read The Headlines A - J. Decide Which Headline A - J Goes Best With Which TextDocument9 pagesRead The Five Text Items 1 - 5. Then Read The Headlines A - J. Decide Which Headline A - J Goes Best With Which TextVeronika HuszárNo ratings yet

- The People Who Matter Most: P. SainathDocument9 pagesThe People Who Matter Most: P. SainathkannadiparambaNo ratings yet

- Ron Matusalem & Matusa of Florida, Inc., a Florida Corporation, Plaintiff-Counterdefendant v. Ron Matusalem, Inc., a Corporation of the Commonwealth of Puerto Rico, and United Liquors Corporation, a Florida Corporation, Defendants-Counterplaintiffs, Manuel A. Guarch, Jr. And Luisa Alvarez Soriano, Counterdefendants, 872 F.2d 1547, 11th Cir. (1989)Document13 pagesRon Matusalem & Matusa of Florida, Inc., a Florida Corporation, Plaintiff-Counterdefendant v. Ron Matusalem, Inc., a Corporation of the Commonwealth of Puerto Rico, and United Liquors Corporation, a Florida Corporation, Defendants-Counterplaintiffs, Manuel A. Guarch, Jr. And Luisa Alvarez Soriano, Counterdefendants, 872 F.2d 1547, 11th Cir. (1989)Scribd Government DocsNo ratings yet

- Polo Pantaleon V American ExpressDocument10 pagesPolo Pantaleon V American ExpressLyleThereseNo ratings yet

- House ReceiptDocument1 pageHouse ReceiptArunNo ratings yet

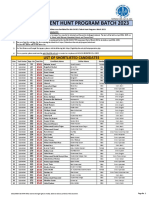

- Iba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesDocument30 pagesIba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesSomil KumarNo ratings yet

- SATIP-Q-001-04rev4 (Structural Precast-Prestressed Conc.) PDFDocument2 pagesSATIP-Q-001-04rev4 (Structural Precast-Prestressed Conc.) PDFRamziAhmedNo ratings yet