Professional Documents

Culture Documents

Work Sheet 4A2

Uploaded by

SohailAKramCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Work Sheet 4A2

Uploaded by

SohailAKramCopyright:

Available Formats

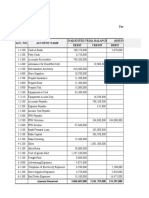

LAW OFFICE OF PAT HAMILTON

WORK SHEET

FOR THE MONTH ENDED APRIL 30, 1994

Trail Balance Adjustments Adjusted Trail Balance Income Statement Balance Sheet

Dr Cr Dr Cr Dr Cr Dr Cr Dr Cr

Balance Sheet Accounts:

Cash 10,060 10,060 - 10,060

Legal fees Receivable 2,780 2,780 - 2,780

Unexpired Insurance 3,000 500 2,500 - 2,500

Prepaid office rent 4,800 1,600 3,200 - 3,200

Office Supplies 1,460 660 800 - 800

Office Equipment 26,400 26,400 - 26,400

Accumulated depreciation: Office Equipment 220 - 220 220

Notes Payable 16,000 - 16,000 16,000

Interest Payable 200 - 200 200

Salaries Payable 970 - 970 970

Unearned retainer fees 15,020 4,700 - 10,320 10,320

Pat Hamilton, Capital 20,000 - 20,000 20,000

Pat Hamilton, Drawing 3,000 3,000 - 3,000

Income Statement Accounts: - -

1,580 4,700 -

Legal fees earned 9,060 9,060

2,780

Salaries expense 2,680 970 3,650 - 3,650

Miscellaneous Expense 1,200 1,200 - 1,200

Office rent Expense 1,600 1,600 - 1,600

Office Supplies Expense 660 660 - 660

depreciation Expense: Office Equipment 220 220 - 220

Interest Expense 200 200 - 200

Insurance Expense 500 500 - 500

Total 52,600 52,600 11,630 11,630 56,770 56,770 8,030 9,060 48,740 47,710

Net Income 1,030 1,030

9,060 9,060 48,740 48,740

Sohail Akram (EMBA) Page 1 of 1 Chapter 4 (4A-1 to 4A-2)

You might also like

- A Framework of Supply Chain Management LiteratureDocument10 pagesA Framework of Supply Chain Management LiteratureyrperdanaNo ratings yet

- Metal Casting Process - 3Document11 pagesMetal Casting Process - 3kiran_wakchaureNo ratings yet

- 110 KG CastingsDocument4 pages110 KG CastingsGurudutta MishraNo ratings yet

- Induction Furnace Cooling Systems: One Foundry's ExperiencesDocument8 pagesInduction Furnace Cooling Systems: One Foundry's ExperiencesAlejandro Martinez RNo ratings yet

- Operation Manual HLJDocument45 pagesOperation Manual HLJjoegrantosNo ratings yet

- (2015) A Review of Tactical Optimization Models For Integrated Production and Transport Routing Planning Decisions PDFDocument18 pages(2015) A Review of Tactical Optimization Models For Integrated Production and Transport Routing Planning Decisions PDFJota Mike Mike100% (1)

- Ciencia, Tecnología y Educación Al Servicio Del PaísDocument3 pagesCiencia, Tecnología y Educación Al Servicio Del PaísAdrian JácomeNo ratings yet

- Alliance Mining Corporation Company ProfileDocument16 pagesAlliance Mining Corporation Company ProfileFanus van Straten0% (1)

- Cost SheetDocument20 pagesCost SheetKeshviNo ratings yet

- Formulae To Formulate The "Head Office Overheads"Document2 pagesFormulae To Formulate The "Head Office Overheads"hotalamNo ratings yet

- Welding Cost Formula For Different ProcessesDocument2 pagesWelding Cost Formula For Different ProcessesmekoxxxNo ratings yet

- Operation Manual For Automatic Girth Welder Model Agw-1Document29 pagesOperation Manual For Automatic Girth Welder Model Agw-1mdk50No ratings yet

- AE 2253 Production Technology Lesson Plan for Aeronautical Engineering Sem IVDocument2 pagesAE 2253 Production Technology Lesson Plan for Aeronautical Engineering Sem IVGiridharan SharmaNo ratings yet

- Daily Program Dec-2011Document21 pagesDaily Program Dec-2011Mahibul HasanNo ratings yet

- Implementing The Theory of Constraints (TOC) : A Guide ToDocument20 pagesImplementing The Theory of Constraints (TOC) : A Guide TorohitbaggaNo ratings yet

- A Small Report On The Steel Melting Shop at Bokaro Steel PlantDocument4 pagesA Small Report On The Steel Melting Shop at Bokaro Steel PlantSrikant Mahapatra0% (1)

- IntroductionDocument114 pagesIntroductionBahish VadakkanNo ratings yet

- Diaphragm Elimination Using Taper-Lok - NPRADocument11 pagesDiaphragm Elimination Using Taper-Lok - NPRAAntonio PerezNo ratings yet

- Effects of Root Gap and Bevel AngelDocument74 pagesEffects of Root Gap and Bevel AngeldaimaheshNo ratings yet

- Supplier Cost Increase1Document3 pagesSupplier Cost Increase1prasad_kcpNo ratings yet

- BS AssignmentDocument6 pagesBS AssignmentCall DutyNo ratings yet

- Methods of CostingDocument21 pagesMethods of CostingsweetashusNo ratings yet

- Standard Costing ExamplesDocument63 pagesStandard Costing ExamplesMuhammad azeemNo ratings yet

- East West University: Methods of Wastage AnalysisDocument7 pagesEast West University: Methods of Wastage AnalysisAshik YousufNo ratings yet

- Cost Accounting Notes Fall 19-1Document11 pagesCost Accounting Notes Fall 19-1AnoshiaNo ratings yet

- Creating A Lean Finance OrganizationDocument2 pagesCreating A Lean Finance OrganizationStephen G. LynchNo ratings yet

- TNEB - Consumer Guidance - Procedure For HT Serivce ConnectionDocument2 pagesTNEB - Consumer Guidance - Procedure For HT Serivce Connectionmksamy2021No ratings yet

- Prepare Cost SheetDocument17 pagesPrepare Cost SheetRajuSharmiNo ratings yet

- Lecture-7 Overhead (Part 5) PDFDocument10 pagesLecture-7 Overhead (Part 5) PDFNazmul-Hassan Sumon100% (5)

- Cost Accounting Fundamentals for Manufacturing BusinessesDocument21 pagesCost Accounting Fundamentals for Manufacturing Businessesabdullah_0o0No ratings yet

- Raw Material Calculation for 3 Ply PouchDocument4 pagesRaw Material Calculation for 3 Ply PouchMd Ali RazuNo ratings yet

- Cost Accounting Finals - GONZALESDocument21 pagesCost Accounting Finals - GONZALESAdolph Christian GonzalesNo ratings yet

- PROJECT:0.654.0303.00-CMR162-3 DATE: February/2015 APPROVED BY: Leman Özgüler/Quality Manager Revision: 0 Total Page: 1/1Document1 pagePROJECT:0.654.0303.00-CMR162-3 DATE: February/2015 APPROVED BY: Leman Özgüler/Quality Manager Revision: 0 Total Page: 1/1Metin DemirciogluNo ratings yet

- American Box Company Case AnalysisDocument9 pagesAmerican Box Company Case AnalysisPranav JainNo ratings yet

- Break Even Analysis CalculatorDocument5 pagesBreak Even Analysis CalculatorSasikumar R NairNo ratings yet

- Manufacturers Price Sheet Direct Material Direct Labor Overhead ProfitDocument1 pageManufacturers Price Sheet Direct Material Direct Labor Overhead ProfitXTNNo ratings yet

- Machine Hour RateDocument9 pagesMachine Hour RateSoumya Ranjan SahooNo ratings yet

- Contract CostingDocument27 pagesContract CostingNishit BaralNo ratings yet

- Contract CostingDocument22 pagesContract Costingrikesh radheNo ratings yet

- Sample CostDocument6 pagesSample Costnath81No ratings yet

- HPs Innovative Buy-Sell Process Manages Outsourcing ChallengesDocument19 pagesHPs Innovative Buy-Sell Process Manages Outsourcing ChallengesAnshul GargNo ratings yet

- Casting ModuleDocument113 pagesCasting ModuleAshok KhannaNo ratings yet

- Enter Data:: MM M Weld Size (Leg) Unit Weld LengthDocument8 pagesEnter Data:: MM M Weld Size (Leg) Unit Weld LengthBassamOmarFarghlNo ratings yet

- Process Costing and Hybrid Product-Costing Systems: Mcgraw-Hill/IrwinDocument44 pagesProcess Costing and Hybrid Product-Costing Systems: Mcgraw-Hill/Irwinsunanda mNo ratings yet

- A Finite Element Method Based Analysis of Casting Solidification Onpermanent Metallic ModelsDocument10 pagesA Finite Element Method Based Analysis of Casting Solidification Onpermanent Metallic ModelsseenisitNo ratings yet

- Inventory ModelsDocument45 pagesInventory ModelsBishawjit Talukder ArnabNo ratings yet

- Workshop Welding ShopDocument80 pagesWorkshop Welding ShopBhaskar KandpalNo ratings yet

- Chapter - 2 Cost TermsDocument23 pagesChapter - 2 Cost TermsZubair Chowdhury0% (1)

- 1.1 1.2 Mechanical Items 1.3 Seal Tanks 1.4 Mechnical Equipments (Pumps +pipe Line + Fittings Etc)Document14 pages1.1 1.2 Mechanical Items 1.3 Seal Tanks 1.4 Mechnical Equipments (Pumps +pipe Line + Fittings Etc)yv singlaNo ratings yet

- 10-Column Worksheet FormDocument1 page10-Column Worksheet Formobrie diazNo ratings yet

- POADocument7 pagesPOAjohnnyNo ratings yet

- Accounting Equation Journal Ledger (T Accounts) Trial Balance Statement of Profit and Loss Balance SheetDocument17 pagesAccounting Equation Journal Ledger (T Accounts) Trial Balance Statement of Profit and Loss Balance SheetVharshinee SridharNo ratings yet

- Jupiter Store - Soln - Completing The Accounting CycleDocument10 pagesJupiter Store - Soln - Completing The Accounting CycleMariella Olympia PanuncialesNo ratings yet

- Managing book journal entries for PT. Kharisma DigitalDocument32 pagesManaging book journal entries for PT. Kharisma DigitalNirdila KrismawatiNo ratings yet

- Accounting AssignmentDocument2 pagesAccounting Assignmentjannatulnisha78No ratings yet

- WorkshitDocument12 pagesWorkshitLukman ArimartaNo ratings yet

- BEA1007 Tutorial 2 SolutionsDocument12 pagesBEA1007 Tutorial 2 SolutionsBecca CrossNo ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- Total 23,500 23,500Document3 pagesTotal 23,500 23,500Vania DNo ratings yet

- Ud Buana Work Sheet: For Month Ended December 31, 2019Document12 pagesUd Buana Work Sheet: For Month Ended December 31, 2019fitryna99No ratings yet

- Darson Securities clients transactions summaryDocument1 pageDarson Securities clients transactions summarySohailAKramNo ratings yet

- Hands-On Exercise No. 2 Batch-06 Quickbooks Total Marks: 10 Due Date: 02/04/2020Document3 pagesHands-On Exercise No. 2 Batch-06 Quickbooks Total Marks: 10 Due Date: 02/04/2020SohailAKramNo ratings yet

- Diesel Generator Set KTA50 Series Engine: Power GenerationDocument4 pagesDiesel Generator Set KTA50 Series Engine: Power GenerationsdasdNo ratings yet

- Adam Securities Limited: Leading Financial Brokerage FirmDocument22 pagesAdam Securities Limited: Leading Financial Brokerage FirmSohailAKram100% (1)

- QuickBooks Hands-On ExerciseDocument4 pagesQuickBooks Hands-On ExerciseMuhammad TaimoorNo ratings yet

- Hands-On Exercise No. 3 Batch-06 Quickbooks Total Marks: 10 Due Date: 16/04/2020Document4 pagesHands-On Exercise No. 3 Batch-06 Quickbooks Total Marks: 10 Due Date: 16/04/2020SohailAKramNo ratings yet

- Jenbacher Type 3: Efficient, Durable, Reliable Reference InstallationsDocument2 pagesJenbacher Type 3: Efficient, Durable, Reliable Reference InstallationsSohailAKramNo ratings yet

- Hands-On Exercise No. 3 Batch-06 Quickbooks Total Marks: 10 Due Date: 16/04/2020Document3 pagesHands-On Exercise No. 3 Batch-06 Quickbooks Total Marks: 10 Due Date: 16/04/2020SohailAKramNo ratings yet

- Hands-On Exercise No. 4 Batch-06 Quickbooks Total Marks: 10 Due Date: 05/05/2020Document4 pagesHands-On Exercise No. 4 Batch-06 Quickbooks Total Marks: 10 Due Date: 05/05/2020SohailAKramNo ratings yet

- Hands-On Exercise No. 4 Batch-06 Quickbooks Total Marks: 10 Due Date: 30/04/2020Document3 pagesHands-On Exercise No. 4 Batch-06 Quickbooks Total Marks: 10 Due Date: 30/04/2020SohailAKramNo ratings yet

- Alternator Data Sheet of 1250kVA Prime Cummins DG SetDocument8 pagesAlternator Data Sheet of 1250kVA Prime Cummins DG SetSohailAKram100% (1)

- Title: 18 - Ads Creation Learning ObjectivesDocument1 pageTitle: 18 - Ads Creation Learning ObjectivesSohailAKramNo ratings yet

- Chapter 2 Integration and The Key Elements of Organizational StrategyDocument30 pagesChapter 2 Integration and The Key Elements of Organizational StrategySohailAKramNo ratings yet

- Fuel Consumption Sheet of 1250kVA Prime Cummins DG SetDocument3 pagesFuel Consumption Sheet of 1250kVA Prime Cummins DG SetSohailAKramNo ratings yet

- Financial Accounting - Chapter 1Document44 pagesFinancial Accounting - Chapter 1SohailAKramNo ratings yet

- 2019-Jyoti & Rani-Role of Burnout and Mentoring Between High Performance Work SystemDocument11 pages2019-Jyoti & Rani-Role of Burnout and Mentoring Between High Performance Work SystemSohailAKramNo ratings yet

- A Grounded Theory Examination of Project Managers' AccountabilityDocument9 pagesA Grounded Theory Examination of Project Managers' AccountabilitySohailAKramNo ratings yet

- Financial Accounting - Chapter 3Document42 pagesFinancial Accounting - Chapter 3SohailAKramNo ratings yet

- Title: 13 - Negotiating With Clients Learning ObjectivesDocument1 pageTitle: 13 - Negotiating With Clients Learning ObjectivesAbdulrehmanNo ratings yet

- 18 AdsCreationDocument1 page18 AdsCreationSohailAKramNo ratings yet

- Mr. Mohsin Tariq 03525 - 96463Document4 pagesMr. Mohsin Tariq 03525 - 96463SohailAKramNo ratings yet

- Instagram Story Exercise - Switch Profile to Business, Create Stories with Polls & FeaturesDocument3 pagesInstagram Story Exercise - Switch Profile to Business, Create Stories with Polls & FeaturesArbaz khanNo ratings yet

- Financial Accounting - Chapter 2Document24 pagesFinancial Accounting - Chapter 2SohailAKramNo ratings yet

- Bachon Ko Zimmedari Kesay SikhainDocument241 pagesBachon Ko Zimmedari Kesay SikhainSohailAKramNo ratings yet

- Guide To InvestorsDocument50 pagesGuide To Investorsshirazz_anwar6011No ratings yet

- Location StrategyDocument21 pagesLocation StrategySohailAKramNo ratings yet

- A Concise History of SufismDocument9 pagesA Concise History of SufismSohailAKramNo ratings yet

- Financial Accounting CH# 4Document21 pagesFinancial Accounting CH# 4SohailAKramNo ratings yet

- Abu Hubairah Basri: Early Sufi Saint of Chishti OrderDocument1 pageAbu Hubairah Basri: Early Sufi Saint of Chishti OrderSohailAKramNo ratings yet

- More Practice For The Final Exam - Adjusting Entries - KeyDocument3 pagesMore Practice For The Final Exam - Adjusting Entries - KeyleyuuhhNo ratings yet

- Competency Government AccountingDocument2 pagesCompetency Government AccountingAlyssa Paula Altaya100% (1)

- Notes On Correction of Errors With AnswerDocument12 pagesNotes On Correction of Errors With AnswerprelandgNo ratings yet

- Chapter 6 - Profits and Gains From Business or Profession - NotesDocument66 pagesChapter 6 - Profits and Gains From Business or Profession - NotesMuskan Jha100% (1)

- 9706 Accounting: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of TeachersDocument5 pages9706 Accounting: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of TeachersSaad MansoorNo ratings yet

- 2010-10-26 233008 SmayerDocument6 pages2010-10-26 233008 Smayernicemann21No ratings yet

- Introduction To Governmental and Not For Profit Accounting 7th Edition Ives Test BankDocument26 pagesIntroduction To Governmental and Not For Profit Accounting 7th Edition Ives Test BankBrianHunterfeqs100% (48)

- V I P - Industries - 13022020Document7 pagesV I P - Industries - 13022020Sriram RanganathanNo ratings yet

- CFA Level 1 corporate finance questions on weighted average cost of capital and cost of debtDocument2 pagesCFA Level 1 corporate finance questions on weighted average cost of capital and cost of debtOpe Olomo100% (1)

- Comparative Financial Analysis of National Foods and Shezan FoodsDocument13 pagesComparative Financial Analysis of National Foods and Shezan Foodsabdullah akhtarNo ratings yet

- Joint Arrangements (IFRS 3)Document12 pagesJoint Arrangements (IFRS 3)Kim Cristian Maaño100% (1)

- Management Accounting - Assignment - Iv (Unit-Iv)Document13 pagesManagement Accounting - Assignment - Iv (Unit-Iv)Ujwal KhanapurkarNo ratings yet

- Is It Fair To Blame Fair Value Accounting For The Financial Crisis - PDFDocument13 pagesIs It Fair To Blame Fair Value Accounting For The Financial Crisis - PDFAndrea ChewNo ratings yet

- Inventory valuation methods and calculationsDocument31 pagesInventory valuation methods and calculationsNela Nafaza100% (1)

- ExamView - 7e Homework Ch. 3Document6 pagesExamView - 7e Homework Ch. 3Brooke LevertonNo ratings yet

- Acctg 111 - TPDocument4 pagesAcctg 111 - TPElizabeth Espinosa ManilagNo ratings yet

- Analyzing Financial Statement of Vinamilk Group 2Document24 pagesAnalyzing Financial Statement of Vinamilk Group 2Phan Thị Hương TrâmNo ratings yet

- Financial Management 1 0Document80 pagesFinancial Management 1 0Awoke mulugetaNo ratings yet

- CA Final Quick Revision Notes On Advanced Management CNEICL0GDocument24 pagesCA Final Quick Revision Notes On Advanced Management CNEICL0GDobu Kolobingo100% (1)

- Exercise #1: Transactions of Bud's Computer Are As FollowsDocument19 pagesExercise #1: Transactions of Bud's Computer Are As FollowsMejias, Janrey80% (10)

- LeverageDocument16 pagesLeverageMohammed AwolNo ratings yet

- Project RAR IntegerationDocument25 pagesProject RAR IntegerationAl-Mahad International School100% (1)

- Accounting QuestionsDocument2 pagesAccounting QuestionsEdward BellNo ratings yet

- BS Goyal Sons 180122Document66 pagesBS Goyal Sons 180122SANJIT CHAKMANo ratings yet

- Assignment Comparative Ratio Analysis ofDocument16 pagesAssignment Comparative Ratio Analysis ofAbhishekDey162b BBANo ratings yet

- Finance Case Study SolutionDocument4 pagesFinance Case Study SolutionOmar MosalamNo ratings yet

- Thunderbird Partnership Short VerDocument3 pagesThunderbird Partnership Short VerElle100% (1)

- Principles of AccountsDocument38 pagesPrinciples of AccountsRAMZAN TNo ratings yet

- Model 7 Assgn 8Document22 pagesModel 7 Assgn 820-22 Ayush GargNo ratings yet

- Integrated Accounting: Financial Accounting & Reporting (P1) Integrated Accounting - Far (P1) Module 4: LiabilitiesDocument10 pagesIntegrated Accounting: Financial Accounting & Reporting (P1) Integrated Accounting - Far (P1) Module 4: LiabilitiesKamyll VidadNo ratings yet