Professional Documents

Culture Documents

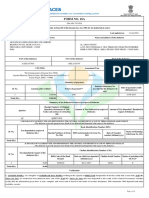

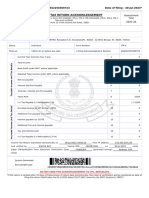

Taxpayer's GSTIN Legal Name Trade Name, If Any Date of ARN Date of Generation

Uploaded by

UmeshOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxpayer's GSTIN Legal Name Trade Name, If Any Date of ARN Date of Generation

Uploaded by

UmeshCopyright:

Available Formats

Taxpayer's GSTIN

Legal name

Trade name, if any

Date of ARN

Date of generation

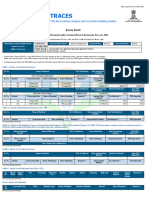

GSTR 7 TABLE WISE SUMMARY

Amount paid to deductee on which

No. of GSTN's tax is deducted

TDS

11 18,437,600.00

TDSA

0 0.00

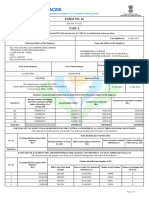

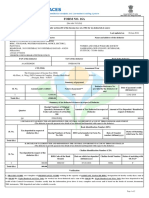

GSTR-7 Data Entry Instructi

Worksheet Name GSTR-7 Table Reference

TDS Details of tax deducted at source

Amendments to details of tax

TDSA deducted at source

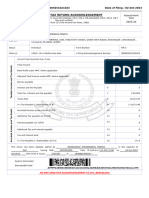

29BLRO00861A1DY Tax period

BESCOM Financial year

Return status

10/12/2018 ARN

10/12/2018

GSTR 7 TABLE WISE SUMMARY

Total Integrated Tax Total Central Tax

TDS

0.00 184,376.00

TDSA

0.00 0.00

GSTR-7 Data Entry Instructions

Field Name Help Instruction

GSTIN of Deductee/Supplier GSTIN of Deductee/Supplier

Trade/Legal name of supplier Trade name of the supplier will be displayed. If trade name is not

supplier

Amount paid to deductee on which tax is deducted Total amount paid to deductee during the tax period on which tax

Integrated Tax Integrated tax amount

Central Tax Central tax amount

State/UT Tax State/UT tax amount

Tax period original GSTR 7(Original details) Tax period in which tax is collected previously

GSTIN of Deductee/supplier(Original details) GSTIN of Supplier

Trade/Legal name of Deductee/supplier(Original details) Trade name of the supplier will be displayed. If trade name is not

supplier

Amount paid to deductee on which tax is deducted(Original Total amount paid to deductee during the tax period on which tax

details)

Type Rejected by supplier: If TDS details rejected by supplier then thos

type as 'Rejected by supplier'.

Uploaded by Deductor: If you amended TDS details which are not

supplier then those details will be displayed with type as 'Upload

GSTIN of Supplier GSTIN of Deductee/Supplier

Trade/Legal name of supplier Trade name of the supplier will be displayed. If trade name is not

supplier

Amount paid to deductee on which tax is deducted Total amount paid to deductee during the tax period on which tax

Integrated Tax Integrated tax amount

Central Tax Central tax amount

State/UT Tax State/UT tax amount

November

2018-19

Filed

AA291118192673S

Total State / UT Tax

184,376.00

0.00

Help Instruction

upplier

pplier will be displayed. If trade name is not available then legal name of the

deductee during the tax period on which tax is deducted

t

x is collected previously

pplier will be displayed. If trade name is not available then legal name of the

deductee during the tax period on which tax is deducted

If TDS details rejected by supplier then those details will be displayed with

upplier'.

r: If you amended TDS details which are not rejected or no action taken by

etails will be displayed with type as 'Uploaded by Deductor'

upplier

pplier will be displayed. If trade name is not available then legal name of the

deductee during the tax period on which tax is deducted

t

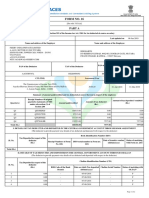

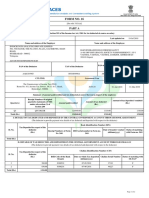

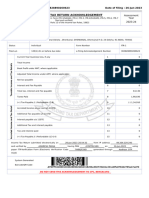

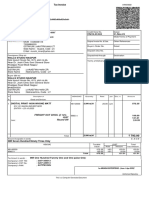

Goods and Services Tax - Form GSTR-7

Details of tax deduction at source

GSTIN 29BLRO00861A1DY Legal name BESCOM

Financial year 2018-19 Return period November

Date of ARN 10/12/2018 ARN AA291118192673S

GSTIN of the Trade/Legal name of the Amount paid to deductee on

S.No

Deductee/Supplier Deductee/Supplier which tax is deducted

1 29AACCI0076K1ZF IDEA INFINITY IT SOLUTI 2,918,200.00

2 29AAEFU4736F1ZZ UTTHAM TRAVELS 21,300.00

3 29AAFCK8154M1ZV KSF-9 CORPORATE SERVI 18,200.00

4 29AAMCA5692B1ZG AN ROYAL ENGINEERING 1.51759E7

5 29AGEPC8450E1ZJ SNS TRAVELS 32,000.00

6 29AHOPR2422C1ZC SRI RANGANATHA ELECT 36,000.00

7 29AKJPR5433K1ZK SREE RAGHAVENDRA TO 68,000.00

8 29ANKPA3949B1Z4 SRI BYRAVESHWARA TOU 32,000.00

9 29AOHPK2341B2ZA TANISHKA TOURS AND T 32,000.00

10 29AOYPG1026J2ZK GAYATHRI TRAVELS 32,000.00

11 29AYEPD9071C2ZH SRI NANJUNDESHWARA T 72,000.00

Tax - Form GSTR-7

ction at source

Trade name, if any

Return status Filed

Date of generation 10/12/2018

Amount of tax deducted at source

Integrated tax Central tax State/UT tax

0.00 29,182.00 29,182.00

0.00 213.00 213.00

0.00 182.00 182.00

0.00 151,759.00 151,759.00

0.00 320.00 320.00

0.00 360.00 360.00

0.00 680.00 680.00

0.00 320.00 320.00

0.00 320.00 320.00

0.00 320.00 320.00

0.00 720.00 720.00

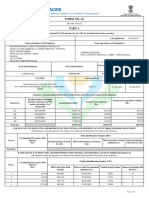

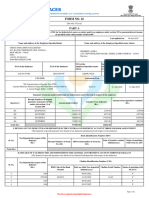

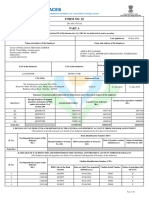

Goods and Services Tax - Form GSTR

Amendments to details of tax deducted at source

GSTIN 29BLRO00861A1DY Legal name BESCOM

ARN Date 10/12/2018 ARN Number AA291118192673S

Original details

S.No Tax period of Original GSTIN of the Trade/Legal name of the

GSTR-7 deductee/supplier deductee/supplier

Tax - Form GSTR-7

ted at source

Trade name, if any Financial year

Return status Filed Date of generation

Re

Amount paid to deductee on

Type GSTIN of the deductee/supplier

which tax is deducted

2018-19 Return period November

10/12/2018

Revised details

Trade/Legal name of the Amount paid to deductee on Amount paid to deductee on which tax is deducted

deductee/supplier which tax is deducted Integrated Tax Central Tax

on which tax is deducted

State/UT Tax

You might also like

- Revised PSID ON SALARY FMO MAY 2023Document1 pageRevised PSID ON SALARY FMO MAY 2023Arshad SadeequeNo ratings yet

- Form 16Document2 pagesForm 16Narendra Nath TripathiNo ratings yet

- 110773Document6 pages110773asheesh kumarNo ratings yet

- Form 16 - 2020-21 - Part A and B - FY 2020 - 2021 3Document10 pagesForm 16 - 2020-21 - Part A and B - FY 2020 - 2021 3kamalkarki03No ratings yet

- Salary Jan 2001Document2 pagesSalary Jan 2001Kharde HrishikeshNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Final Bill FormatDocument4 pagesFinal Bill FormatpujadagaNo ratings yet

- Acope8800c 2020Document4 pagesAcope8800c 2020Asif EbrahimNo ratings yet

- Form16 Fiserv 2018-19Document8 pagesForm16 Fiserv 2018-19SiddharthNo ratings yet

- Tahir Hussain Shah 236 K 12000Document1 pageTahir Hussain Shah 236 K 12000mazharehsan08No ratings yet

- Form16 PDFDocument9 pagesForm16 PDFHarish KumarNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Firoz AminNo ratings yet

- Attpp2455j 2021-22Document2 pagesAttpp2455j 2021-22Aditya PLNo ratings yet

- Basha Form 16Document6 pagesBasha Form 16BakiarajNo ratings yet

- Nandigam Chandrasekhar Anspc5216h Fy202223 SignedDocument6 pagesNandigam Chandrasekhar Anspc5216h Fy202223 SignedChandrasekhar NandigamNo ratings yet

- It 000147088862 2024 12Document1 pageIt 000147088862 2024 12Revenue sectionNo ratings yet

- Form 16: Signature Not VerifiedDocument6 pagesForm 16: Signature Not VerifiedPritha DasNo ratings yet

- TCL BillDocument3 pagesTCL BillYoginder SinghNo ratings yet

- Form16-2018-19 Part ADocument2 pagesForm16-2018-19 Part AMANJUNATH GOWDANo ratings yet

- Aikpd4798c 2019-20Document2 pagesAikpd4798c 2019-20Satyanarayana Sharma ValluriNo ratings yet

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocument2 pagesAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNo ratings yet

- Form16 Parta AQLPK9881A 2018-19Document2 pagesForm16 Parta AQLPK9881A 2018-19Rakesh KumarNo ratings yet

- FORM16Document11 pagesFORM16ganeshPVRMNo ratings yet

- Form No. 16 Part A (2020)Document2 pagesForm No. 16 Part A (2020)Dharmendra ParmarNo ratings yet

- Alasian Craft Aaufa3568m Fy201718Document2 pagesAlasian Craft Aaufa3568m Fy201718SUDHIRNo ratings yet

- Mumtaz Khan 236 K 6000Document1 pageMumtaz Khan 236 K 6000mazharehsan08No ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- GSTR7 37vpne00462a1d1 102018Document2 pagesGSTR7 37vpne00462a1d1 102018A Prabhakar RaoNo ratings yet

- Akshay - Dev@vedanta - Co.in F16Document10 pagesAkshay - Dev@vedanta - Co.in F16Akshay DevNo ratings yet

- Form ADocument2 pagesForm Asky2flyboy@gmail.comNo ratings yet

- Akapr2160g 2019-20Document2 pagesAkapr2160g 2019-20Satyanarayana Sharma ValluriNo ratings yet

- Annual 3683form16Document9 pagesAnnual 3683form16modi jiNo ratings yet

- 26 AsDocument4 pages26 AsAnkrut VaghasiyaNo ratings yet

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- DirectTaxesPaymentPSID UpdateNatureDocument1 pageDirectTaxesPaymentPSID UpdateNatureSkjhkjhkjhNo ratings yet

- It 000126799893 2023 08Document1 pageIt 000126799893 2023 08Anas KhanNo ratings yet

- It 000142262613 2024 09Document1 pageIt 000142262613 2024 09MUHAMMAD TABRAIZNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- It 000129964508 2022 11Document1 pageIt 000129964508 2022 11SkjhkjhkjhNo ratings yet

- Form 16: TLG India Private LimitedDocument9 pagesForm 16: TLG India Private LimitedcagopalofficebackupNo ratings yet

- Mushtaq & IshfaqDocument1 pageMushtaq & IshfaqAʌĸʌsʜ AƴʌŋNo ratings yet

- Eshita Roy Itr MergedDocument2 pagesEshita Roy Itr Mergeddeepghosh260897No ratings yet

- It 000147087234 2024 12Document1 pageIt 000147087234 2024 12Revenue sectionNo ratings yet

- Aoapk6856n 2019-20 PDFDocument2 pagesAoapk6856n 2019-20 PDFSiva Kumar KNo ratings yet

- Form 16 PDFDocument3 pagesForm 16 PDFkk_mishaNo ratings yet

- Abdul Ghaffar 14-10-19 PDFDocument1 pageAbdul Ghaffar 14-10-19 PDFAyan BNo ratings yet

- Tax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Document1 pageTax Invoice: Chennai-600059 Gstin/Uin: 33BMOPM1236R1ZJ State Name: Tamil Nadu, Code: 33Abhinaya JoNo ratings yet

- Ack CKLPR7420J 2022-23 366437070310722Document1 pageAck CKLPR7420J 2022-23 366437070310722manishranjan82710No ratings yet

- It 000132223866 2023 01Document1 pageIt 000132223866 2023 01mazharehsan08No ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:380069251021023 Date of Filing: 02-Oct-2023Document78 pagesIndian Income Tax Return Acknowledgement: Acknowledgement Number:380069251021023 Date of Filing: 02-Oct-2023Mohit DuhanNo ratings yet

- Income Tax Payment Challan: PSID #: 48471182Document1 pageIncome Tax Payment Challan: PSID #: 48471182Haseeb RazaNo ratings yet

- It 000144914729 2024 11Document1 pageIt 000144914729 2024 11MUHAMMAD TABRAIZNo ratings yet

- Income Tax Payment Challan: PSID #: 43320237Document1 pageIncome Tax Payment Challan: PSID #: 43320237gandapur khanNo ratings yet

- ACK302828890260623Document1 pageACK302828890260623Jaswanth KumarNo ratings yet

- Form 16Document2 pagesForm 16Kushal MalhotraNo ratings yet

- Income Tax Payment Challan: PSID #: 146916470Document1 pageIncome Tax Payment Challan: PSID #: 146916470Madiah abcNo ratings yet

- Form16 ANNPM2039F 40000516 PDFDocument8 pagesForm16 ANNPM2039F 40000516 PDFDr. Pankaj MishraNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Cir Vs Central LuzonDocument1 pageCir Vs Central LuzonJf ManejaNo ratings yet

- Agreeya Solutions (India) Private Limited: Earnings DeductionsDocument1 pageAgreeya Solutions (India) Private Limited: Earnings DeductionsGirnar studioNo ratings yet

- Tax Invoice: AB Cartridge Private LimitedDocument1 pageTax Invoice: AB Cartridge Private LimitedSunil PatelNo ratings yet

- Tax Invoice / Bill of SupplyDocument1 pageTax Invoice / Bill of SupplySanvi KalraNo ratings yet

- Ss Ahuja Comp PDFDocument2 pagesSs Ahuja Comp PDFSwaran AhujaNo ratings yet

- Earnings: Hourly Cctips Mealper Prempay RetailcomDocument1 pageEarnings: Hourly Cctips Mealper Prempay Retailcomalfredo velezNo ratings yet

- Egov Urban Portal-Water Tax PDFDocument2 pagesEgov Urban Portal-Water Tax PDFPadmavathi Putra LokeshNo ratings yet

- 1022 2021Document15 pages1022 2021nfk roeNo ratings yet

- Form 16 ADocument2 pagesForm 16 ANitya NarayananNo ratings yet

- TI-046 - Rasman H.O.Document4 pagesTI-046 - Rasman H.O.Uttam kumarNo ratings yet

- CN 282Document1 pageCN 282f4m0uqb2riNo ratings yet

- Itf 12CDocument3 pagesItf 12CLovemore Chigwanda40% (5)

- HRA at Capital CostDocument1 pageHRA at Capital Costsudhir mishraNo ratings yet

- Pacquiao Scores Another Victory - This Time in Tax Court Vs BIRDocument3 pagesPacquiao Scores Another Victory - This Time in Tax Court Vs BIRHayrah LawiNo ratings yet

- GST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormDocument3 pagesGST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormkotisanampudiNo ratings yet

- 0661682135166102122021Document2 pages0661682135166102122021Shivam YadavNo ratings yet

- Module 7 - Tax ExercisesDocument3 pagesModule 7 - Tax ExercisesjessafesalazarNo ratings yet

- Tirumala Tirupati Devasthanams (Official Booking Portal)Document1 pageTirumala Tirupati Devasthanams (Official Booking Portal)Chb RamasasthryNo ratings yet

- Form No. Requirement Deadline For Manual FilersDocument1 pageForm No. Requirement Deadline For Manual FilersLhyraNo ratings yet

- Q2 Taxation Review Income Taxation FundamentalsDocument8 pagesQ2 Taxation Review Income Taxation Fundamentalsdaenielle reyesNo ratings yet

- Shri Mahaveer Enterprises GST Invoice: Daughter CosmeticsDocument1 pageShri Mahaveer Enterprises GST Invoice: Daughter CosmeticsDonNo ratings yet

- Tax Code of BangladeshDocument5 pagesTax Code of Bangladeshsouravsam100% (2)

- REVENUE MEMORANDUM CIRCULAR NO. 64-2020 Issued On June 24, 2020 CircularizesDocument2 pagesREVENUE MEMORANDUM CIRCULAR NO. 64-2020 Issued On June 24, 2020 CircularizesAceGun'nerNo ratings yet

- Laws of Taxation in TanzaniaDocument508 pagesLaws of Taxation in TanzaniaRuhuro tetere100% (3)

- Rate+Sheet+and+Examples 2Document3 pagesRate+Sheet+and+Examples 2mayordrillNo ratings yet

- 1.0 David and Lynette Landry 2021 1040 - Draft PDFDocument33 pages1.0 David and Lynette Landry 2021 1040 - Draft PDFDavid LandryNo ratings yet

- RMC No. 5-2009Document1 pageRMC No. 5-2009CROCS Acctg & Audit Dep'tNo ratings yet

- Payroll ProjectDocument16 pagesPayroll ProjectKatrina Rardon-Swoboda68% (25)

- Order Details: SalesDocument3 pagesOrder Details: SalesAhmad RamiNo ratings yet

- Hotel Bills OCRDocument1 pageHotel Bills OCRNishantNo ratings yet