Professional Documents

Culture Documents

India Consumer Fund Portfolio

Uploaded by

Nitish KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

India Consumer Fund Portfolio

Uploaded by

Nitish KumarCopyright:

Available Formats

Tata India Consumer Fund

(An open ended equity scheme investing in Consumption Oriented Sector)

As on 30th November 2018

PORTFOLIO

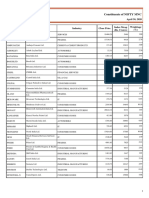

INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of

Primarily focuses on investment in at least 80% of its net Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets

assets in equity/equity related instruments of the Equity & Equity Related Total 133577.02 93.45 Media & Entertainment

companies in the Consumption Oriented sectors in India.

Auto Zee Entertainment Enterprises Ltd. 772410 3774.00 2.64

INVESTMENT OBJECTIVE

Maruti Suzuki India Ltd. 121200 9285.86 6.50 Sun Tv Network Ltd. 455000 2691.55 1.88

The investment objective of the scheme is to seek long

Bajaj Auto Ltd. 158500 4351.93 3.04 Retailing

term capital appreciation by investing atleast 80% of its

assets in equity/equity related instruments of the Mahindra & Mahindra Ltd. 500000 3954.50 2.77 Future Retail Ltd. 1270000 6678.93 4.67

companies in the Consumption Oriented sectors in Eicher Motors Ltd. 9800 2293.72 1.60 Future Consumer Ltd. 8795000 4023.71 2.81

India.However, there is no assurance or guarantee that

the investment objective of the Scheme will be Ashok Leyland Ltd. 1460000 1640.31 1.15 Trent Ltd. 508000 1702.05 1.19

achieved.The Scheme does not assure or guarantee any Auto Ancillaries Textile Products

returns.

MRF Ltd. 6000 4039.92 2.83 Page Industries Ltd. 13700 3715.04 2.60

DATE OF ALLOTMENT Consumer Durables Raymond Ltd. 198500 1606.86 1.12

December 28, 2015 Bata India Ltd. 730000 7616.09 5.33

FUND MANAGER Havells India Ltd. 660000 4519.02 3.16 Other Equities^ 3623.53 2.53

Sonam Udasi (Managing Since 1-Apr-16 and overall Whirlpool Of India Ltd. 122050 1707.36 1.19 Repo 9601.20 6.72

experience of 21 years) Greenply Industries Ltd. 1255000 1672.29 1.17 Portfolio Total 143178.22 100.17

ASSISTANT FUND MANAGER Consumer Non Durables Net Current Liabilities -232.09 -0.17

Ennettee Fernandes (Managing Since 18-Jun-18 and Hindustan Unilever Ltd. 870000 15259.80 10.68 Net Assets 142946.13 100.00

overall experience of 9 years)

ITC Ltd. 5175000 14790.15 10.35

BENCHMARK ^ Exposure less than 1% has been clubbed under Other Equities

Dabur India Ltd. 1675000 6852.43 4.79

Nifty India Consumption TRI

Glaxo Smithkline Con Healthcar Ltd. 79800 5800.02 4.06

NAV Nestle India Ltd. 41000 4413.59 3.09

Direct - Dividend : 18.4697 Jubilant Foodworks Ltd. 347000 4365.43 3.05

Direct - Growth : 18.4697

Regular - Dividend : 16.1605

Britannia Industries Ltd. 135400 4291.84 3.00

Regular - Growth : 17.5696 Asian Paints (India) Ltd. 280000 3768.66 2.64

FUND SIZE Radico Khaitan Ltd. 864895 3591.91 2.51

Rs. 1429.46 (Rs. in Cr.) United Spirits Ltd. 230000 1546.52 1.08

MONTHLY AVERAGE AUM

Rs. 1380.15 (Rs. in Cr.)

TURN OVER SIP - If you had invested INR 10000 every month

Portfolio Turnover (Total) 18.20%

Portfolio Turnover (Equity component only) 18.20% 1 Year 3 Year 5 Year 7 Year 10 Year Since Inception

Total Amount Invested (Rs.) 1,20,000 NA NA NA NA 3,50,000

EXPENSE RATIO**

Total Value as on Nov 30, 2018 (Rs.) 1,18,863 NA NA NA NA 4,64,821

Direct 0.71

Regular 2.39 Returns -1.75% NA NA NA NA 19.93%

**Note: The rates specified are actual month end expenses charged Total Value of B: Nifty India Consumption TRI 1,20,190 NA NA NA NA 4,19,371

as on Nov 30, 2018. The above ratio includes the Service tax on

Investment Management Fees. The above ratio excludes, B: Nifty India Consumption TRI 0.29% NA NA NA NA 12.47%

proportionate charge (out of maximum 30 bps on daily average net

assets allowed) in respect sales beyond T-30 cities assets, wherever Total Value of AB: Nifty 50 TRI 1,22,898 NA NA NA NA 4,18,965

applicable.

AB: Nifty 50 TRI 4.52% NA NA NA NA 12.40%

VOLATILITY MEASURES^ FUND BENCHMARK (Inception date :28-Dec-2015) (First Installment date : 01-Jan-2016)

Std. Dev (Annualised) 17.56 15.87 Past performance may or may not be sustained in the future. Returns greater than 1 year period are compounded annualized. Dividends are assumed to be reinvested

Sharpe Ratio 0.23 0.13 and bonus is adjusted. Load is not taken in to consideration. For SIP returns, monthly investment of equal amounts invested on the 1st day of every month has been

Portfolio Beta 0.96 1.00 considered.

R Squared 0.78 1.00

For scheme performance refer pages 38 - 49.

Treynor 1.22 0.61

*B: Benchmark, AB: Additional Benchmark

Jenson 0.59 NA

^Risk-free rate based on the FBIL Overnight MIBOR rate of 6.55% as

Source: MFI Explorer

on Nov 30, 2018

For calculation methodology please refer to Pg 49

Top 10 Holdings Equity Industry Allocation

MINIMUM INVESTMENT /

MULTIPLES FOR NEW INVESTMENT Issuer Name % to NAV

Consumer Non Durables 46.20%

Hindustan Unilever Ltd. 10.68

Rs. 5,000/- and in multiples of Re. 1/- thereafter.

ITC Ltd. 10.35 Auto 15.06%

ADDITIONAL INVESTMENT/ Maruti Suzuki India Ltd. 6.50

Consumer Durables 10.85%

MULTIPLES FOR EXISTING INVESTORS Bata India Ltd. 5.33

Rs. 1,000/- and in multiples of Re. 1/- thereafter. Dabur India Ltd. 4.79 Retailing 9.43%

Future Retail Ltd. 4.67

LOAD STRUCTURE Media & Entertainment 4.52%

Glaxo Smithkline Con Healthcar Ltd. 4.06

Entry Load : Not Applicable Havells India Ltd. 3.16 Textile Products 3.72%

Exit Load : 1% if redeemed on or before 18 months

Nestle India Ltd. 3.09 Auto Ancillaries 3.66%

from the date of allotment. Jubilant Foodworks Ltd. 3.05

Total 55.68 0.00% 10.00% 20.00% 30.00% 40.00% 50.00%

Please refer to our Tata Mutual Fund website for

fundamental changes, wherever applicable

Market Capitalisation wise Exposure NAV Movement

Large Cap 66.29% Tata India Consumer Fund - Reg - Growth

200 Nifty India Consumption TRI

Mid Cap 20.96% 176

152

Small Cap 12.75% 128

104

80

Market Capitalisation is as per list provided by AMFI.

Dec-15 Dec-16 Dec-17 Nov-18

www.tatamutualfund.com TATA MUTUAL FUND 19

You might also like

- Mid Cap Growth FundDocument1 pageMid Cap Growth FundChromoNo ratings yet

- Small Cap Fun7Document1 pageSmall Cap Fun7kumarsaurabhprincyNo ratings yet

- Ethical Fun9Document1 pageEthical Fun9Nitish KumarNo ratings yet

- 4614 A Fact SheetDocument1 page4614 A Fact SheetAatish TNo ratings yet

- Small Cap FundDocument1 pageSmall Cap Fundshailendra.goswamiNo ratings yet

- Tata Quant PortfolioDocument1 pageTata Quant PortfolioDeepanshu SatijaNo ratings yet

- CyientDLMAnchor Allocation IntimationDocument3 pagesCyientDLMAnchor Allocation IntimationSaurav Kumar SinghNo ratings yet

- UlipDocument1 pageUlipsanu091No ratings yet

- Portfolio Creation With Indian StocksDocument24 pagesPortfolio Creation With Indian StocksTILAK PAI 1827731No ratings yet

- Fiscf Franklin India Smaller Companies Fund: PortfolioDocument1 pageFiscf Franklin India Smaller Companies Fund: PortfolioRtsu PtNo ratings yet

- NIFTY Midcap Liquid 15 Apr2020Document1 pageNIFTY Midcap Liquid 15 Apr2020amitNo ratings yet

- April 30, 2020: Constituents of NIFTY India ConsumptionDocument2 pagesApril 30, 2020: Constituents of NIFTY India ConsumptionamitNo ratings yet

- JM Midcap Oct 30Document1 pageJM Midcap Oct 30yugendhar janjiralaNo ratings yet

- SAPM Assignment 2Document10 pagesSAPM Assignment 2jhilikNo ratings yet

- Digital India FundDocument1 pageDigital India Fundcoinage capitalNo ratings yet

- NIFTY Next 50 Apr2020Document2 pagesNIFTY Next 50 Apr2020amitNo ratings yet

- April 30, 2020: Constituents of NIFTY MNCDocument2 pagesApril 30, 2020: Constituents of NIFTY MNCamitNo ratings yet

- NIFTY100 Liquid 15 Apr2020Document1 pageNIFTY100 Liquid 15 Apr2020amitNo ratings yet

- Model Portfolio Performance - 15th May 2020Document4 pagesModel Portfolio Performance - 15th May 2020FACTS- WORLDNo ratings yet

- MFIN Q2 FY20 Investor PresentationDocument68 pagesMFIN Q2 FY20 Investor PresentationNikunj AgrawallaNo ratings yet

- Nifty India Digital Exchange Traded Fun7Document1 pageNifty India Digital Exchange Traded Fun7Henna KadyanNo ratings yet

- Annual Return: Form No. Mgt-7Document19 pagesAnnual Return: Form No. Mgt-7Shivani KelvalkarNo ratings yet

- NIFTY Next 50 Nov2020Document2 pagesNIFTY Next 50 Nov2020Games ZoneNo ratings yet

- Model Portfolio Performance - 03rd July 2020Document4 pagesModel Portfolio Performance - 03rd July 2020Sandipan DasNo ratings yet

- Hybrid Equity FundDocument1 pageHybrid Equity FundPARAVTHIPURAM SI SUBDIVISIONNo ratings yet

- Fra - Project - Group No.1 - Sec BDocument105 pagesFra - Project - Group No.1 - Sec BAkshita PaulNo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- NIFTY Growth Sectors 15 Apr2020Document1 pageNIFTY Growth Sectors 15 Apr2020amitNo ratings yet

- Nippon India Multicap FundDocument2 pagesNippon India Multicap FundScribbydooNo ratings yet

- Value Product Note October-20Document2 pagesValue Product Note October-20Swades DNo ratings yet

- Trident Ltd18 Jan 2019Document3 pagesTrident Ltd18 Jan 2019darshanmaldeNo ratings yet

- MFIN Q2 FY21 Investor PresentationDocument74 pagesMFIN Q2 FY21 Investor PresentationANJALI MADANANNo ratings yet

- Salient Features of The Financial Statements of Subsidiaries Joint Ventures and Associates Aoc 1Document5 pagesSalient Features of The Financial Statements of Subsidiaries Joint Ventures and Associates Aoc 1Subrahmanya ShastryNo ratings yet

- The Company: Vodafone Idea Limited Is An Indian Telecom OperatorDocument6 pagesThe Company: Vodafone Idea Limited Is An Indian Telecom OperatorSaurabh SinghNo ratings yet

- Annual Report 2022 23Document176 pagesAnnual Report 2022 23Avinash ChauhanNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- 590784414monthly Communique March, 2022Document12 pages590784414monthly Communique March, 2022Dhairya BuchNo ratings yet

- NIFTY Dividend Opportunities 50 Apr2020Document2 pagesNIFTY Dividend Opportunities 50 Apr2020amitNo ratings yet

- Nifty Next 50 Jan2022Document2 pagesNifty Next 50 Jan2022Arati DubeyNo ratings yet

- Cost &: A Project Adani Enterprises LTDDocument12 pagesCost &: A Project Adani Enterprises LTDkarthikNo ratings yet

- Universal Cables LTDDocument3 pagesUniversal Cables LTDRavi TamrakarNo ratings yet

- April 30, 2020: Constituents of NIFTY Services SectorDocument2 pagesApril 30, 2020: Constituents of NIFTY Services SectoramitNo ratings yet

- Tracing Missing ShareholdersDocument19 pagesTracing Missing Shareholdersmrpatel121152No ratings yet

- TopDividendYieldStocks 15march2023Document4 pagesTopDividendYieldStocks 15march2023Dwaipayan MojumderNo ratings yet

- NIFTY 50 Nov2020Document2 pagesNIFTY 50 Nov2020Games ZoneNo ratings yet

- Equity 2019-2020Document1 pageEquity 2019-2020Sandeep SharmaNo ratings yet

- Motilal Oswal Asset Management Company Limited: Half-Yearly Portfolio Statement As On March 31, 2019Document22 pagesMotilal Oswal Asset Management Company Limited: Half-Yearly Portfolio Statement As On March 31, 2019Jennifer NievesNo ratings yet

- 205@CA2Document22 pages205@CA2Rahul GuptaNo ratings yet

- UTIFLEXICAPFUNDDocument2 pagesUTIFLEXICAPFUNDmeghaNo ratings yet

- 2020756102monthly Communique June, 2022Document13 pages2020756102monthly Communique June, 2022Dhairya BuchNo ratings yet

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDocument1 pageSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNo ratings yet

- Nifty FMCG Jan2022Document1 pageNifty FMCG Jan2022Arati DubeyNo ratings yet

- June 29, 2018: Portfolio Characteristics StatisticsDocument2 pagesJune 29, 2018: Portfolio Characteristics StatisticsVicky VickyNo ratings yet

- YNM 231117 enDocument43 pagesYNM 231117 enmahmoud yarahmadiNo ratings yet

- Utiniftyindexfund 12820200210 213216Document2 pagesUtiniftyindexfund 12820200210 213216VarathavasuNo ratings yet

- Research:: Company:: Munjal Showa LTD.: 06 January, 2010Document7 pagesResearch:: Company:: Munjal Showa LTD.: 06 January, 2010tanishaj86No ratings yet

- 8ccff Pms Communique August 22Document13 pages8ccff Pms Communique August 22pradeep kumarNo ratings yet

- Report On Demerger - Tube Investment India LimitedDocument8 pagesReport On Demerger - Tube Investment India LimitedMithil DoshiNo ratings yet

- Mba-Ii Section - A Week 10 Report (7 April To 14 April) : Annaam Bin Muhammad Haris Amir Hira Naeem Muggo Kinza AdnanDocument11 pagesMba-Ii Section - A Week 10 Report (7 April To 14 April) : Annaam Bin Muhammad Haris Amir Hira Naeem Muggo Kinza AdnanHaris AmirNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Analysis of Axial & Centrifugal Compressors: To Be Selected As Per Specific Speed of ApplicationsDocument31 pagesAnalysis of Axial & Centrifugal Compressors: To Be Selected As Per Specific Speed of ApplicationsNitish KumarNo ratings yet

- Generalized Theory of Electrical MachinesDocument16 pagesGeneralized Theory of Electrical MachinesNitish KumarNo ratings yet

- Main Turbine Lub. Oil System: Prepared byDocument44 pagesMain Turbine Lub. Oil System: Prepared byNitish Kumar100% (1)

- CompressorDocument37 pagesCompressorNitish Kumar100% (1)

- Hazards When Purging Hydrogen Gas-Cooled Electric GeneratorsDocument5 pagesHazards When Purging Hydrogen Gas-Cooled Electric GeneratorsNitish KumarNo ratings yet

- TR TASC Unit Selection GuideDocument6 pagesTR TASC Unit Selection GuideNitish Kumar0% (1)

- ABB - 52kV To 550kV - OIP Bushing (En)Document12 pagesABB - 52kV To 550kV - OIP Bushing (En)Nitish KumarNo ratings yet

- Transformer BushingDocument6 pagesTransformer BushingNitish KumarNo ratings yet

- Notice Inviting Open Tender (Through E-Tendering Process Only)Document41 pagesNotice Inviting Open Tender (Through E-Tendering Process Only)Nitish KumarNo ratings yet

- Inuence of External Factors on Results of Bushing tan δ and Capacitance MeasurementsDocument5 pagesInuence of External Factors on Results of Bushing tan δ and Capacitance MeasurementsNitish KumarNo ratings yet

- Flyash: Characteristics, Problems and Possible Utilization Rupnarayan SettDocument19 pagesFlyash: Characteristics, Problems and Possible Utilization Rupnarayan SettNitish KumarNo ratings yet

- Inspection For Low WB DP For Unit 5Document1 pageInspection For Low WB DP For Unit 5Nitish KumarNo ratings yet

- Emhp Bu01 0518 Lo ResDocument4 pagesEmhp Bu01 0518 Lo ResNitish KumarNo ratings yet

- CAT Paper 1994Document23 pagesCAT Paper 1994Nitish KumarNo ratings yet

- Behaviour Based SafetyDocument67 pagesBehaviour Based SafetyNitish KumarNo ratings yet

- Importance of Venture Capital Financing (Development of Economy)Document2 pagesImportance of Venture Capital Financing (Development of Economy)RaviNo ratings yet

- R30 Discounted Dividend Valuation Q Bank PDFDocument9 pagesR30 Discounted Dividend Valuation Q Bank PDFZidane KhanNo ratings yet

- Q4 2022 PitchBook Analyst Note 2023 US Private Equity OutlookDocument14 pagesQ4 2022 PitchBook Analyst Note 2023 US Private Equity Outlookmayowa odukoyaNo ratings yet

- Chapter 19 - OptionsDocument23 pagesChapter 19 - OptionsSehrish Atta0% (1)

- Anchored VWAP-Take Your Swing Trading To The Next LevelDocument7 pagesAnchored VWAP-Take Your Swing Trading To The Next Leveldjoiner45No ratings yet

- Chapter 13 The Marketing Mix PriceDocument19 pagesChapter 13 The Marketing Mix PriceENG ZI QINGNo ratings yet

- Coffee Brand Name IdeasDocument2 pagesCoffee Brand Name IdeasAeron Kyle DiestaNo ratings yet

- A REVIEW OF CAPITAL STRUCTURE THEORIES EditeDocument8 pagesA REVIEW OF CAPITAL STRUCTURE THEORIES EditeMega capitalmarketNo ratings yet

- Strategy Name Number of Option Legs Direction: Bear Call Spread Two Moderatly BearishDocument4 pagesStrategy Name Number of Option Legs Direction: Bear Call Spread Two Moderatly BearishAnish Tirkey 1910125No ratings yet

- Unit # 2 Capital and Mony MarketDocument9 pagesUnit # 2 Capital and Mony MarketDija Awan100% (1)

- Aguilan: Question No. 1 Answer BDocument82 pagesAguilan: Question No. 1 Answer BAnn Margarette Boco75% (4)

- Asahimas Flat Glass TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesAsahimas Flat Glass TBK.: Company Report: January 2019 As of 31 January 2019Abdur RohmanNo ratings yet

- Indonesian Unicorn Xendit To Acquire Two Local Multi-Finance FirmsDocument3 pagesIndonesian Unicorn Xendit To Acquire Two Local Multi-Finance FirmsAnthony RezaNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument5 pagesHSL Weekly Insight: Retail ResearchumaganNo ratings yet

- PPT W5Document30 pagesPPT W5Hilda mayang sariNo ratings yet

- Ratio Analysis NBPDocument16 pagesRatio Analysis NBPArshad M Yar100% (1)

- Customer Acquisition and Retention CostsDocument17 pagesCustomer Acquisition and Retention CostsAkshit AgnihotriNo ratings yet

- Learning CAN SLIM Education Resources: Lee TannerDocument43 pagesLearning CAN SLIM Education Resources: Lee Tannerneagucosmin67% (3)

- Pertemuan 11 - EkuitasDocument34 pagesPertemuan 11 - EkuitasCristian Kumara PutraNo ratings yet

- Advance Sniper Trading Strategy PDFDocument30 pagesAdvance Sniper Trading Strategy PDFHarminder Suman100% (1)

- How To Design A Decision-Making TreeDocument11 pagesHow To Design A Decision-Making Treedross_14014No ratings yet

- 2014 Blackstone Investor DayDocument128 pages2014 Blackstone Investor Day魏xxxapple100% (1)

- Life Cycle of A Trade: Training AcademyDocument98 pagesLife Cycle of A Trade: Training AcademyPavan Patil75% (4)

- Agreement of Program TermsDocument144 pagesAgreement of Program TermsAnil BatraNo ratings yet

- Prospectus Msinvf EnluDocument238 pagesProspectus Msinvf EnluDesaulus swtorNo ratings yet

- Trimegah FN 20240126 Consumer - When Bansos Comes To AidDocument6 pagesTrimegah FN 20240126 Consumer - When Bansos Comes To AidAlexander MargaronisNo ratings yet

- SPX 1-4 DTE 6 Delta Strategy What Strikes To Target?: Part 3 of This SeriesDocument2 pagesSPX 1-4 DTE 6 Delta Strategy What Strikes To Target?: Part 3 of This SeriesloveofprofitNo ratings yet

- I.L.L. Research Paper by Thy and MariyaDocument9 pagesI.L.L. Research Paper by Thy and MariyaPrem ChopraNo ratings yet

- Brealey. Myers. Allen Chapter 17 SolutionDocument10 pagesBrealey. Myers. Allen Chapter 17 Solutionbharath_rath_2100% (1)

- About Parag Parikh Flexi Cap Fund: (Please Visit Page 2)Document14 pagesAbout Parag Parikh Flexi Cap Fund: (Please Visit Page 2)Dr. Mukesh JindalNo ratings yet