Professional Documents

Culture Documents

A 02 18

Uploaded by

metadimitriosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A 02 18

Uploaded by

metadimitriosCopyright:

Available Formats

Part IV

Items of General Interest

Frequent Flyer Miles Attributable to Business or Official Travel

Announcement 2002-18

Most major airlines offer frequent flyer programs under which passengers

accumulate miles for each flight. Individuals may also earn frequent flyer miles

or other promotional benefits, for example, through rental cars or hotels. These

promotional benefits may generally be exchanged for upgraded seating, free

travel, discounted travel, travel-related services, or other services or benefits.

Questions have been raised concerning the taxability of frequent flyer miles or

other promotional items that are received as the result of business travel and

used for personal purposes. There are numerous technical and administrative

issues relating to these benefits on which no official guidance has been provided,

including issues relating to the timing and valuation of income inclusions and the

basis for identifying personal use benefits attributable to business (or official)

expenditures versus those attributable to personal expenditures. Because of

these unresolved issues, the IRS has not pursued a tax enforcement program

with respect to promotional benefits such as frequent flyer miles.

Consistent with prior practice, the IRS will not assert that any taxpayer has

understated his federal tax liability by reason of the receipt or personal use of

frequent flyer miles or other in-kind promotional benefits attributable to the

taxpayer’s business or official travel. Any future guidance on the taxability of

these benefits will be applied prospectively.

This relief does not apply to travel or other promotional benefits that are

converted to cash, to compensation that is paid in the form of travel or other

promotional benefits, or in other circumstances where these benefits are used for

tax avoidance purposes.

For information regarding this announcement, call (202) 622-4606 (not a toll-free

number). Alternatively, taxpayers may transmit comments electronically via the

following e-mail address: Notice.Comments@irscounsel.treas.gov. Please

include “Announcement 2002-18" in the subject line of any electronic

communications.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- How Not To Predict ElectionsDocument7 pagesHow Not To Predict ElectionsmetadimitriosNo ratings yet

- The Mystery Man of The Arms Business A Year in The Arctic: SEPTEMBER 15, 1934Document2 pagesThe Mystery Man of The Arms Business A Year in The Arctic: SEPTEMBER 15, 1934metadimitriosNo ratings yet

- Ann18 10 AmendedDocument7 pagesAnn18 10 AmendedmetadimitriosNo ratings yet

- DownloadedDocument16 pagesDownloadedmetadimitriosNo ratings yet

- IlioDocument1 pageIliometadimitriosNo ratings yet

- Dy M Class PricesDocument7 pagesDy M Class PricesmetadimitriosNo ratings yet

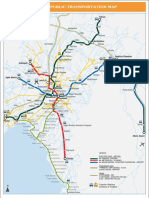

- Diktyo Astikon Sygkinonion Athinon enDocument1 pageDiktyo Astikon Sygkinonion Athinon enmetadimitriosNo ratings yet

- Link To Publication in University of Groningen/UMCG Research DatabaseDocument5 pagesLink To Publication in University of Groningen/UMCG Research DatabasemetadimitriosNo ratings yet

- Atrologia Rientalis: AtabaseDocument2 pagesAtrologia Rientalis: AtabasemetadimitriosNo ratings yet

- Department: of The Parliamentary LibraryDocument50 pagesDepartment: of The Parliamentary LibrarymaviogluNo ratings yet

- Link To Publication in University of Groningen/UMCG Research DatabaseDocument5 pagesLink To Publication in University of Groningen/UMCG Research DatabasemetadimitriosNo ratings yet

- Gmip96 FosterDocument24 pagesGmip96 FostermetadimitriosNo ratings yet

- Eos Eol Notice c51 740521Document4 pagesEos Eol Notice c51 740521metadimitriosNo ratings yet

- Sarrail GreenhalghDocument3 pagesSarrail GreenhalghmetadimitriosNo ratings yet

- Partnerships and Development Policies For Small-Medium Enterprises in Greece: A CFA ApproachDocument28 pagesPartnerships and Development Policies For Small-Medium Enterprises in Greece: A CFA ApproachmetadimitriosNo ratings yet

- Paper2010118 PDFDocument44 pagesPaper2010118 PDFLokchan SopheakNo ratings yet

- En CallGerman African InnovationIncentiveAwardDocument15 pagesEn CallGerman African InnovationIncentiveAwardmetadimitriosNo ratings yet

- PR 2018080264 CoenDocument4 pagesPR 2018080264 CoenmetadimitriosNo ratings yet

- Treasury Offering AnnouncementDocument1 pageTreasury Offering AnnouncementmetadimitriosNo ratings yet

- ITC181115 eDocument1 pageITC181115 emetadimitriosNo ratings yet

- Form Departmental Defense AnnouncementDocument1 pageForm Departmental Defense AnnouncementmetadimitriosNo ratings yet

- Ebs Suite 12 2 Announcement 5172019Document2 pagesEbs Suite 12 2 Announcement 5172019metadimitriosNo ratings yet

- 2019 FSO AnnouncementDocument1 page2019 FSO AnnouncementmetadimitriosNo ratings yet

- 2019 FSO Announcement PDFDocument6 pages2019 FSO Announcement PDFJunave BermudoNo ratings yet

- Announcement Letter 2016Document2 pagesAnnouncement Letter 2016metadimitriosNo ratings yet

- Test Announcement PDF - 0Document1 pageTest Announcement PDF - 0metadimitriosNo ratings yet

- Writing: An Announcement An Announcement: Petr NovotnýDocument8 pagesWriting: An Announcement An Announcement: Petr Novotnýmetadimitrios100% (1)

- Athina GRDocument8 pagesAthina GRaajjaaNo ratings yet

- Tickets and Travel CardsDocument7 pagesTickets and Travel CardsBogdan CatrinescuNo ratings yet